Beruflich Dokumente

Kultur Dokumente

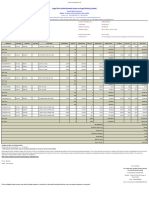

Revenue Regulation No 13 and 14 99-00

Hochgeladen von

Joyce VillanuevaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Revenue Regulation No 13 and 14 99-00

Hochgeladen von

Joyce VillanuevaCopyright:

Verfügbare Formate

Revenue Regulation No.

14-2000

Issued December 29, 2000 amends Sections 3(2), 3 and 6 of RR No. 13-99 relative to the sale, exchange or disposition by a natural person of his "principal residence". The residential address shown in the latest income tax return filed by the vendor/transferor immediately preceding the date of sale of said real property shall be treated, for purposes of these Regulations, as a conclusive presumption about his true residential address, the certification of the Barangay Chairman, or Building Administrator (in case of condominium unit), to the contrary notwithstanding, in accordance with the doctrine of admission against interest or the principle of estoppel. The seller/transferor's compliance with the preliminary conditions for exemption from the 6% capital gains tax under Sec. 3(1) and (2) of the Regulations will be sufficient basis for the RDO to approve and issue the Certificate Authorizing Registration (CAR) or Tax Clearance Certificate (TCC) of the principal residence sold, exchanged or disposed by the aforesaid taxpayer. Said CAR or TCC shall state that the said sale, exchange or disposition of the taxpayer's principal residence is exempt from capital gains tax pursuant to Sec. 24 (D)(2) of the Tax Code, but subject to compliance with the post-reporting requirements imposed under Sec. 3(3) of the Regulations.

Revenue Regulation No. 13-99 Issued September 14, 1999 prescribes the regulations for the exemption of a citizen or a resident alien individual from the payment of the 6% Capital Gains Tax on the sale, exchange or disposition of his principal residence. In order for a person to be exempted from the payment of the tax, he should submit, together with the required documents, a Sworn Declaration of his intent to avail of the tax exemption to the Revenue District Office having jurisdiction over the location of his principal residence within (30) days from the date of the sale, exchange or disposition of the principal residence. The proceeds from the sale, exchange or disposition of the principal residence must be fully utilized in acquiring or constructing the new principal residence within eighteen (18) calendar months from the date of the sale, exchange or disposition. In case the entire proceeds of the sale is not utilized for the purchase or construction of a new principal residence, the Capital Gains Tax will be computed based on the formula specified in the Regulations. If the seller fails to utilize the proceeds of sale or disposition in full or in part within the 18-month reglementary period, his right of exemption from the Capital Gains Tax did not arise on the extent of the unutilized amount, in which event, the tax due thereon will immediately become due and demandable on the 31st day after the date of the sale, exchange or disposition of the principal residence. If the individual taxpayer's principal residence is disposed in exchange for a condominium unit, the disposition of the taxpayer's principal residence will not be subjected to the Capital Gains Tax herein prescribed, provided that the said condominium unit received in the exchange will be used by the taxpayer-transferor as his new principal residence.

Das könnte Ihnen auch gefallen

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionVon EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNoch keine Bewertungen

- Red Mafiya: How The Russian Mob Has Invaded America - Robert I. FriedmanDokument289 SeitenRed Mafiya: How The Russian Mob Has Invaded America - Robert I. FriedmanMarcelo Carreiro80% (5)

- Getting Past Sexual ResistanceDokument6 SeitenGetting Past Sexual ResistanceNuqman Tehuti ElNoch keine Bewertungen

- RR 2-98 (As Amended)Dokument74 SeitenRR 2-98 (As Amended)Mariano RentomesNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- 14-2001 - Requirements For Tax ExemptionDokument7 Seiten14-2001 - Requirements For Tax ExemptionArjam B. BonsucanNoch keine Bewertungen

- Bir Forms 1706 (99) Capital Gains Tax ReturnDokument5 SeitenBir Forms 1706 (99) Capital Gains Tax ReturnArnel Melgar100% (2)

- Common Law - Definition, Examples, Cases, ProcessesDokument6 SeitenCommon Law - Definition, Examples, Cases, ProcessesAbd Aziz MohamedNoch keine Bewertungen

- Capitol Medical Center Vs TrajanoDokument3 SeitenCapitol Medical Center Vs TrajanoJoyce VillanuevaNoch keine Bewertungen

- Commissioner of Internal Revenue Vs TMX Sales Inc Et Al 205 SCRA 184 PDFDokument6 SeitenCommissioner of Internal Revenue Vs TMX Sales Inc Et Al 205 SCRA 184 PDFTAU MU OFFICIALNoch keine Bewertungen

- 2014-03-12 - G.R. No. 150326: First Division Decision Bersamin, J.Dokument12 Seiten2014-03-12 - G.R. No. 150326: First Division Decision Bersamin, J.Nunugom SonNoch keine Bewertungen

- (BIR Form 1706) Capital Gains Tax ReturmDokument2 Seiten(BIR Form 1706) Capital Gains Tax Returmjongsn70057% (7)

- Cathay Pacific Steel Corporation vs. CADokument2 SeitenCathay Pacific Steel Corporation vs. CAJoyce VillanuevaNoch keine Bewertungen

- Session 16 EtiquettesDokument56 SeitenSession 16 EtiquettesISMCSistersCircleNoch keine Bewertungen

- Philsec Investment Et. Al. vs. Court of Appeals DIGESTDokument4 SeitenPhilsec Investment Et. Al. vs. Court of Appeals DIGESTJacquelyn AlegriaNoch keine Bewertungen

- RR No. 18-2013 (Digest)Dokument3 SeitenRR No. 18-2013 (Digest)Alisa FitzpatrickNoch keine Bewertungen

- Ejercito Vs ComelecDokument7 SeitenEjercito Vs ComelecTammy YahNoch keine Bewertungen

- RR 8-98Dokument3 SeitenRR 8-98matinikkiNoch keine Bewertungen

- RR 4-99Dokument3 SeitenRR 4-99matinikkiNoch keine Bewertungen

- Judicial Affidavit - SampleDokument5 SeitenJudicial Affidavit - SampleNori Lola100% (4)

- MR Holdings, LTD., vs. BajarDokument2 SeitenMR Holdings, LTD., vs. BajarJoyce Villanueva100% (1)

- Persons and Family Relations: San Beda College of LawDokument3 SeitenPersons and Family Relations: San Beda College of LawstrgrlNoch keine Bewertungen

- 1706Dokument2 Seiten1706Anonymous WeDQhtcmUNoch keine Bewertungen

- Republic of The Philippines vs. Kawashima Textile Mfg.Dokument2 SeitenRepublic of The Philippines vs. Kawashima Textile Mfg.Joyce Villanueva100% (1)

- Cir vs. PhilamlifeDokument2 SeitenCir vs. PhilamlifeAnny YanongNoch keine Bewertungen

- The Menstrual CycleDokument14 SeitenThe Menstrual Cycleapi-383924091% (11)

- Microsoft vs. Best DealDokument4 SeitenMicrosoft vs. Best DealJoyce VillanuevaNoch keine Bewertungen

- Revenue Regulations No. 14-00Dokument7 SeitenRevenue Regulations No. 14-00Peggy SalazarNoch keine Bewertungen

- Supreme Transliner v. BPIDokument1 SeiteSupreme Transliner v. BPIWhere Did Macky GallegoNoch keine Bewertungen

- BIR RR 14-00 and 13-99Dokument22 SeitenBIR RR 14-00 and 13-99Sophia Martinez100% (1)

- RR 13-99Dokument10 SeitenRR 13-99matinikkiNoch keine Bewertungen

- Rulings2000 DigestDokument21 SeitenRulings2000 DigestArriane MartinezNoch keine Bewertungen

- Amigable vs. Cuenca GR No. L-26400 February 29, 1972Dokument6 SeitenAmigable vs. Cuenca GR No. L-26400 February 29, 1972Joyce VillanuevaNoch keine Bewertungen

- Digest RR 12-2018Dokument5 SeitenDigest RR 12-2018Jesi CarlosNoch keine Bewertungen

- People of The Philippines vs. Joel BaluyaDokument3 SeitenPeople of The Philippines vs. Joel BaluyaJoyce Villanueva0% (1)

- RR 14-2000Dokument10 SeitenRR 14-2000LouNoch keine Bewertungen

- Bukluran NG Manggagawa vs. CADokument5 SeitenBukluran NG Manggagawa vs. CAJoyce VillanuevaNoch keine Bewertungen

- Uson Vs Del RosarioDokument2 SeitenUson Vs Del RosarioNic NalpenNoch keine Bewertungen

- A. Soriano Aviation vs. Employees AssociationDokument4 SeitenA. Soriano Aviation vs. Employees AssociationJoyce VillanuevaNoch keine Bewertungen

- BasicBuddhism Vasala SuttaDokument4 SeitenBasicBuddhism Vasala Suttanuwan01Noch keine Bewertungen

- Updated RR 2-98 Sec 2.57.1 (A) (6) Individual CGT On Real PropertyDokument2 SeitenUpdated RR 2-98 Sec 2.57.1 (A) (6) Individual CGT On Real PropertyJaymar DetoitoNoch keine Bewertungen

- REVENUE REGULATIONS NO. 14-2000 Issued December 29, 2000 Amends Sections 3 (2), 3 and 6 of RR NoDokument1 SeiteREVENUE REGULATIONS NO. 14-2000 Issued December 29, 2000 Amends Sections 3 (2), 3 and 6 of RR NoDessa Ruth ReyesNoch keine Bewertungen

- BIR EscrowDokument20 SeitenBIR Escrowlorkan19Noch keine Bewertungen

- Revenue Regulations No. 14-00Dokument6 SeitenRevenue Regulations No. 14-00Ben DhekenzNoch keine Bewertungen

- RR 17-03Dokument15 SeitenRR 17-03firstdummyNoch keine Bewertungen

- Amendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFDokument12 SeitenAmendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFRomer LesondatoNoch keine Bewertungen

- RR 13 99Dokument10 SeitenRR 13 99aloevera1994Noch keine Bewertungen

- Revenue Regulation No. 14-2000Dokument10 SeitenRevenue Regulation No. 14-2000Nombs NomNoch keine Bewertungen

- Revenue Regulations No. 13-99Dokument11 SeitenRevenue Regulations No. 13-99Karen Mae ServanNoch keine Bewertungen

- What Would Be The Tax Implications of Buying The Property?Dokument2 SeitenWhat Would Be The Tax Implications of Buying The Property?MariaHannahKristenRamirezNoch keine Bewertungen

- Capital Gains Tax Exemption (Philippines Taxation)Dokument1 SeiteCapital Gains Tax Exemption (Philippines Taxation)jnbs07Noch keine Bewertungen

- 1706Dokument2 Seiten1706May Chan Cuyos100% (1)

- Cancellation & Revocation of GST RegistrationDokument5 SeitenCancellation & Revocation of GST RegistrationshenbhaNoch keine Bewertungen

- RR 2-98 - Withholding TaxesDokument99 SeitenRR 2-98 - Withholding TaxesbiklatNoch keine Bewertungen

- BIR Ruling No. 634-19Dokument5 SeitenBIR Ruling No. 634-19SGNoch keine Bewertungen

- Revenue Regulation 2-99Dokument5 SeitenRevenue Regulation 2-99Joanna MandapNoch keine Bewertungen

- BIR Ruling 27-2002 July 3, 2002Dokument5 SeitenBIR Ruling 27-2002 July 3, 2002Raiya AngelaNoch keine Bewertungen

- Properties Exempted From CGTDokument5 SeitenProperties Exempted From CGTD GNoch keine Bewertungen

- Updated RR 2-98 Sec 2.57.1 (A) Individual Passive Income in GeneralDokument4 SeitenUpdated RR 2-98 Sec 2.57.1 (A) Individual Passive Income in GeneralJaymar DetoitoNoch keine Bewertungen

- Procedures For Filing of ESTATE TAXDokument2 SeitenProcedures For Filing of ESTATE TAXJennylyn Biltz AlbanoNoch keine Bewertungen

- Rr99 04 DigestDokument1 SeiteRr99 04 DigestCinNoch keine Bewertungen

- RR 2000Dokument76 SeitenRR 2000Maisie Rose VilladolidNoch keine Bewertungen

- RR 2 - 98 As AmendedDokument130 SeitenRR 2 - 98 As AmendedHB AldNoch keine Bewertungen

- Remedies: Procedural Requirements Related To DelinquencyDokument13 SeitenRemedies: Procedural Requirements Related To DelinquencyMarielle SantiagoNoch keine Bewertungen

- GST - Demand and RecoveryDokument32 SeitenGST - Demand and Recoverydhruv MahajanNoch keine Bewertungen

- CIR vs. PhilamlifeDokument2 SeitenCIR vs. PhilamlifeluckyNoch keine Bewertungen

- Republic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Dokument18 SeitenRepublic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Jopan SJNoch keine Bewertungen

- Section 228. Protesting of Assessment. - When The Commissioner or His Duly Authorized Representative FindsDokument2 SeitenSection 228. Protesting of Assessment. - When The Commissioner or His Duly Authorized Representative FindsRaphael FormosoNoch keine Bewertungen

- Presentation 3 Real Property Gains TaxDokument29 SeitenPresentation 3 Real Property Gains TaxAimi AzemiNoch keine Bewertungen

- Source: Revenue Regulations 2-2003Dokument3 SeitenSource: Revenue Regulations 2-2003Jennylyn Biltz AlbanoNoch keine Bewertungen

- Capital Gains Taxation v.1Dokument24 SeitenCapital Gains Taxation v.1shie ramirezNoch keine Bewertungen

- PROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-231Dokument3 SeitenPROTESTING AN ASSESSMENT As Per Tax Code Sec. 228-2312022107419Noch keine Bewertungen

- Taxpayer Revised FlowchartDokument6 SeitenTaxpayer Revised FlowchartRab Thomas BartolomeNoch keine Bewertungen

- 43E - CIR vs. Philippine American LIfe InsuranceDokument3 Seiten43E - CIR vs. Philippine American LIfe InsuranceDannaIngaranNoch keine Bewertungen

- rr7 2003Dokument6 Seitenrr7 2003James Estrada CastroNoch keine Bewertungen

- Rationale For The Imposition of TaxesDokument5 SeitenRationale For The Imposition of TaxesBurnok SupolNoch keine Bewertungen

- RR 05-09 (Sale of RP)Dokument7 SeitenRR 05-09 (Sale of RP)joefieNoch keine Bewertungen

- Documentary Requirements: Estate TaxDokument19 SeitenDocumentary Requirements: Estate TaxAubrey CaballeroNoch keine Bewertungen

- Updated RR 2-98 Sec 2.57.1 (J) Individual Real Property - Ordinary AssetDokument4 SeitenUpdated RR 2-98 Sec 2.57.1 (J) Individual Real Property - Ordinary AssetJaymar DetoitoNoch keine Bewertungen

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsVon EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNoch keine Bewertungen

- Bank of America v. CADokument8 SeitenBank of America v. CAMari DesNoch keine Bewertungen

- Lim vs. ContinentalDokument7 SeitenLim vs. ContinentalJoyce VillanuevaNoch keine Bewertungen

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDokument4 SeitenBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledJoyce VillanuevaNoch keine Bewertungen

- Villareal vs. CADokument2 SeitenVillareal vs. CAJoyce VillanuevaNoch keine Bewertungen

- REVENUE REGULATIONS NO. 9-98 Issued September 2, 1998 PrescribesDokument1 SeiteREVENUE REGULATIONS NO. 9-98 Issued September 2, 1998 PrescribesJoyce VillanuevaNoch keine Bewertungen

- United States v. EduaveDokument2 SeitenUnited States v. EduaveJoyce VillanuevaNoch keine Bewertungen

- People of The Philippines v. OritaDokument6 SeitenPeople of The Philippines v. OritaJoyce VillanuevaNoch keine Bewertungen

- People of The Philippines v. CampuhanDokument6 SeitenPeople of The Philippines v. CampuhanJoyce VillanuevaNoch keine Bewertungen

- Hacienda Luisita vs. Presidential Agrarian Reform CouncilDokument74 SeitenHacienda Luisita vs. Presidential Agrarian Reform CouncilJoyce VillanuevaNoch keine Bewertungen

- POLI DIGEST - Principles & State PoliciesDokument50 SeitenPOLI DIGEST - Principles & State PoliciesJoyce VillanuevaNoch keine Bewertungen

- Rev. Fr. Casimiro Lladoc vs. CirDokument5 SeitenRev. Fr. Casimiro Lladoc vs. CirJoyce VillanuevaNoch keine Bewertungen

- Bureau of Printing vs. Bureau of Printing Employees Assoc. GR No. L-15751 January 28, 1961Dokument5 SeitenBureau of Printing vs. Bureau of Printing Employees Assoc. GR No. L-15751 January 28, 1961Joyce Villanueva0% (1)

- Estepa vs. SandiganbayanDokument3 SeitenEstepa vs. SandiganbayanJoyce VillanuevaNoch keine Bewertungen

- City of Caloocan vs. Judge Allarde GR No. 107271 September 10, 2003Dokument18 SeitenCity of Caloocan vs. Judge Allarde GR No. 107271 September 10, 2003Joyce VillanuevaNoch keine Bewertungen

- Significance of Black History MonthDokument6 SeitenSignificance of Black History MonthRedemptah Mutheu MutuaNoch keine Bewertungen

- Constitutional Law IDokument5 SeitenConstitutional Law IMasoom RezaNoch keine Bewertungen

- Twilight (TwilDokument3 SeitenTwilight (TwilAnn RamosNoch keine Bewertungen

- United States Court of Appeals For The Third CircuitDokument22 SeitenUnited States Court of Appeals For The Third CircuitScribd Government DocsNoch keine Bewertungen

- Race Ethnicity Gender and Class The Sociology of Group Conflict Change Ebook PDF VersionDokument62 SeitenRace Ethnicity Gender and Class The Sociology of Group Conflict Change Ebook PDF Versionjames.jones106100% (39)

- The Post-Standard's Argument To Make OCC Settlement PublicDokument23 SeitenThe Post-Standard's Argument To Make OCC Settlement PublicDouglass DowtyNoch keine Bewertungen

- Topic-Act of God As A General Defence: Presented To - Dr. Jaswinder Kaur Presented by - Pulkit GeraDokument8 SeitenTopic-Act of God As A General Defence: Presented To - Dr. Jaswinder Kaur Presented by - Pulkit GeraPulkit GeraNoch keine Bewertungen

- The Most Expensive Ring in The ShopDokument3 SeitenThe Most Expensive Ring in The ShopgratielageorgianastoicaNoch keine Bewertungen

- Us Vs PagaduanDokument5 SeitenUs Vs PagaduanRon AceNoch keine Bewertungen

- Angel One Limited (Formerly Known As Angel Broking Limited) : (Capital Market Segment)Dokument1 SeiteAngel One Limited (Formerly Known As Angel Broking Limited) : (Capital Market Segment)Kirti Kant SrivastavaNoch keine Bewertungen

- PNP Arrest and Booking SheetDokument2 SeitenPNP Arrest and Booking SheetBagong SilangNoch keine Bewertungen

- AML Assignment 2Dokument6 SeitenAML Assignment 2Viraj JoshiNoch keine Bewertungen

- Types of WritsDokument4 SeitenTypes of WritsAnuj KumarNoch keine Bewertungen

- Nehru Report & Jinnah 14 PointsDokument14 SeitenNehru Report & Jinnah 14 Pointskanwal hafeezNoch keine Bewertungen

- S. M. G. M.: Strategic Mind Game ManualDokument34 SeitenS. M. G. M.: Strategic Mind Game ManualJohn KonstantaropoulosNoch keine Bewertungen

- 9 Raisin in The Sun Reading Questions Act I Scene 1Dokument3 Seiten9 Raisin in The Sun Reading Questions Act I Scene 1api-550307076Noch keine Bewertungen

- Fotos Proteccion Con Malla CambiosDokument8 SeitenFotos Proteccion Con Malla CambiosRosemberg Reyes RamírezNoch keine Bewertungen

- The Dog - Otto WeiningerDokument4 SeitenThe Dog - Otto WeiningerstojanjovanovicNoch keine Bewertungen

- Romans Bible Study 32: Christian Liberty 2 - Romans 14:14-23Dokument4 SeitenRomans Bible Study 32: Christian Liberty 2 - Romans 14:14-23Kevin MatthewsNoch keine Bewertungen