Beruflich Dokumente

Kultur Dokumente

108 QP 1102

Hochgeladen von

Rewa ShankarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

108 QP 1102

Hochgeladen von

Rewa ShankarCopyright:

Verfügbare Formate

Actuarial Society of India EXAMINATIONS

16th November 2002 (am)

Subject 108 Finance and Financial Reporting

Time allowed: Three Hours INSTRUCTIONS TO THE CANDIDATE 1. Do not write your name anywhere on the answer scripts. You have only to write your Candidates Number on each answer script. 2. Mark allocations are shown in brackets. 3. Attempt all 22 questions, beginning your answer to each question on a separate sheet. 4. In addition to this paper you should have available graph paper, Actuarial Tables and an electronic calculator.

AT THE END OF THE EXAMINATION Hand in BOTH your answer booklet and this question paper

S-108

Page 1 of 6

Q.1 A. B. C. D.

Which of the following changes in working capital will result in an outflow of cash? Decrease in debtors Decrease in stocks Increase in current liabilities None of the above [2]

Q.2 A. B. C. D.

As a rule of thumb, the minimum acceptable asset cover and income cover for an unsecured loan stock would be: 4 x for asset cover, 2.5 x for income cover 2.5 x for both asset cover and income cover 2.5 x for asset cover, 4 x for income cover 4 x for both income cover and asset cover [2]

Q.3 A. B. C. D.

A listed company has recently announced a three for one scrip issue. In the absence of any other new information, investors should expect. Both the earnings per share and stock price to remain unchanged from the pre announcement levels Earnings per share to fall but the stock price to remain the same as what it was before the announcement Both the earnings per share and the stock price to fall after the announcement. Stock price will fall but earnings per share to remain the same as what it was before the announcement [2]

Q.4 A. B. C. D.

Which of the following forms of capital should prove the cheapest for a company to finance in the long term? 11% secured debentures maturing in 2012 12.5% unsecured loan stock to be redeemed in 2008 9% cumulative convertible preference shares Equity shares with a net dividend yield of 4% pa Note: Assume that financial markets can allocate capital efficiently. [2] Questions (5) and (6) relate to the following information about MidWest Industries. MidWest Industries is a well-diversified company where one can assume that the systematic risk of the asset portfolio of the company is the same as that of a diversified portfolio of risky assets. The return required by investors investing in a risk free investment is 7% pa and the return required by investors investing in a diversified portfolio of risky assets is 12% pa. Companies like MidWest Industries pays corporate tax at the rate of 30% on profits after deduction of interest.

S-108

Page 2 of 6

Q.5 A. B. C. D.

If Midwest Industries is entirely financed by equity, its weighted average cost of capital will be: 9.5% 13.57% 12% 17.14% [2]

Q.6 A. B. C. D.

If MidWest Industries is financed by a 1:1 mix of risk free debt and equity, the weighted coverage cost of capital is: 10.2% 8.45% 8.40% None of the above [2]

Q.7

In times of high inflation, profits of a company tend to be overstated because: I The nominal (money) value of the stocks will increase faster than their real value II The depreciation charge is based on the historic cost of the assets III The real value of the assets will increase and will be understated in the accounts

A. B. C. D.

Which of the aforesaid reasons are correct? I and II only are correct I and III only are correct I only is correct I, II and III are correct [2]

Q.8

A. B. C. D.

A company is about to embark on a project, which will take 5 years to complete. It will involve the company borrowing at regular intervals for the first two years. Which of the following strategies using futures contract is appropriate? Buy short interest rate futures contract Sell short interest rate futures contract Sell the long bond futures contract Buy the long bond futures contract [2]

Q.9

Which of the following statements is true? I No amount of diversification can remove the systematic risk involved in a project. II A well-diversified portfolio of projects should have little or no unsystematic risk. III The cash flows of a project, which entails a large amount of systematic risk, must be valued using a discount rate that appropriately reflects the risk. I and II only I and III only

A. B.

S-108

Page 3 of 6

C. D.

II and III only I, II and III [2]

Q.10

Which of the following investors in the derivatives market may find that the contract (they have entered into) is a liability at expiry? I Buyer of a call option II III

A. B. C. D.

Writer of a put option Seller of an index futures contract

I only II only III only II and III [2]

Q.11 A. B. C.

Distinguish between Operating lease and finance lease Invoice discounting and non recourse factoring Bill of exchange and commercial paper [6]

Q.12

Briefly explain the term double taxation relief. [2]

Q.13

Some investors have shied away from equity investment s on the ground that Equity shares are the most risky form of investment; so a prudent investor should avoid investing in them. Comment on this viewpoint. [3]

Q.14

From the standpoint of an issuing company, briefly discuss the advantages and disadvantages of raising debt capital by issuing secured redeemable debentures to the public. [5]

Q.15

During the current financial year, a manufacturing company is considering a scrip (bonus) issue of shares for its shareholders. Discuss the effects on its financials due to the scrip issue as against cash dividends for the year [5]

Q.16

What are derivatives? List the main forms of derivative instruments and their uses for a non- financial company [5]

S-108

Page 4 of 6

Q.17

A company must choose between two mutually exclusive investment projects: A and B. Project A has a higher net present value (NPV) than project B, but project B has a higher internal rate of return (IRR) than Project A. Explain which of the two measures (NPV or IRR) is more reliable in the above case and explain whether the company should choose project A or B. [5]

Q.18

Explain how goodwill can arise on consolidation and how it would be treated in the accounts of the consolidated company. [5]

Q.19

Given below is an extract from the financial statements of Company X and Company Y.

Company X Ltd

Fixed assets Net current assets

(Rs in lakhs)

480 120 600 450 100 50 600

Ordinary shares of Rs 10 Reserves Preference shares of Rs 200

Company Y Ltd

Fixed assets Net current assets

(Rs in lakhs)

240 190 430 60 250 120 430

Ordinary shares of Rs 10 Reserves Unsecured loan stocks of Rs 100

Market values indicate a 400% premium for Xs share, 250% premium for Ys share, par value for the preference share, and 10% discount for the unsecured loan stock. Company X takes over company Y. The terms of offer are: 3 ordinary shares in X + 2 preference shares in X + Rs 90 cash, for every 9 shares of Y. Prepare the consolidated balance sheet clearly showing your workings. State assumptions, if any. S-108 Page 5 of 6

[10]

Q.20

Explain the limitations of financial ratio analysis in the interpretation of the financial statements of a manufacturing company. [10]

Q.21

The Board of Directors of K2 Technologies is evaluating the quantum of equity dividend to be declared for the accounting year ended March 31, 2002. The following financial information is available about the company Year Ended 31 March (figures in Rs. lakhs) Profit after Tax Equity Dividend Declared Number of outstanding shares (in lakhs)

A.

2000 1500 1200 300

2001 3300 1500 333

2002 1200 ? 350

B.

Calculate the dividend per share and dividend cover for the years ended 31 March 2000 and 2001; and comment on these values. Can the company maintain the level of dividend that was declared in 2001? Briefly discuss the factors that must be taken into account when deciding upon the dividend per share announcement for the year ended March 2002.

[4] [6]

Q.22

A. B. C.

You have been approached (in your role as a financial consultant) by Transit Engineering a medium sized company manufacturing cutting tools to review its financial position and performance. The companys credit rating has fallen recently because of fears that it has borrowed too much and that it may not be generating sufficient cash from its operations to survive the next twelve months. You have been provided with a copy of the most recent balance sheet, profit and loss account and the cash flow statement for the past twelve months. List and define three key ratios you would calculate using the balance sheet and profit and loss account. Briefly explain the reasons for calculating these ratios. Briefly explain how you would use the cash flow statement in your analysis If you reach the conclusion that the company is having an acute cash flow problem (and it might not survive the next 12 months) list the steps you would recommend for improving the situation.

[6] [4]

[4]

*************

S-108

Page 6 of 6

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- New Heritage DollDokument26 SeitenNew Heritage DollJITESH GUPTANoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Exercise Answers - IfRS 5 - Discontinued OperationsDokument3 SeitenExercise Answers - IfRS 5 - Discontinued OperationsJohn Philip L Concepcion100% (1)

- Solution - Cash Flow Projection - FinalDokument51 SeitenSolution - Cash Flow Projection - Finalanon_355962815100% (1)

- Cima F2 Questions Answers Exam PDF Dumps With 100% Passing GuaranteeDokument23 SeitenCima F2 Questions Answers Exam PDF Dumps With 100% Passing GuaranteePamela LillyNoch keine Bewertungen

- The 2011 Hays Salary Guide: Sharing Our ExpertiseDokument58 SeitenThe 2011 Hays Salary Guide: Sharing Our ExpertiseTristan YeNoch keine Bewertungen

- Om 2012Dokument356 SeitenOm 2012Rewa ShankarNoch keine Bewertungen

- The Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisDokument22 SeitenThe Complete Guide To Forex: Chapter 1: Introduction To Forex Chapter 3: Introduction To Technical AnalysisRewa Shankar100% (2)

- OrientationDokument23 SeitenOrientationRewa ShankarNoch keine Bewertungen

- 5 Marks Will Be Awarded For The Home Work and Added in Final MarksDokument1 Seite5 Marks Will Be Awarded For The Home Work and Added in Final MarksRewa ShankarNoch keine Bewertungen

- Subject 108 (Finance and Financial Reporting) Indicative SolutionDokument4 SeitenSubject 108 (Finance and Financial Reporting) Indicative SolutionRewa ShankarNoch keine Bewertungen

- Actuarial Society of India: ExaminationsDokument8 SeitenActuarial Society of India: ExaminationsRewa ShankarNoch keine Bewertungen

- 108QP 1101Dokument7 Seiten108QP 1101Rewa ShankarNoch keine Bewertungen

- Covering LetterDokument1 SeiteCovering LetterRewa ShankarNoch keine Bewertungen

- 108 QP 1100Dokument4 Seiten108 QP 1100Rewa ShankarNoch keine Bewertungen

- Actuarial Society of India: ExaminationsDokument6 SeitenActuarial Society of India: ExaminationsRewa ShankarNoch keine Bewertungen

- Amity University Rajasthan: Amity School of EngineeringDokument15 SeitenAmity University Rajasthan: Amity School of EngineeringRewa ShankarNoch keine Bewertungen

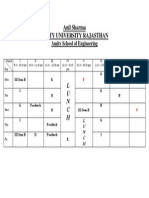

- Anil Sharma Amity University Rajasthan: L U N C HDokument1 SeiteAnil Sharma Amity University Rajasthan: L U N C HRewa ShankarNoch keine Bewertungen

- ARIMA GARCH Spectral AnalysisDokument32 SeitenARIMA GARCH Spectral AnalysisRewa ShankarNoch keine Bewertungen

- GateDokument1 SeiteGateRewa ShankarNoch keine Bewertungen

- Dịch 1Dokument2 SeitenDịch 1Dung Phạm Hồ ThùyNoch keine Bewertungen

- Ranjani-211420631111 RemovedDokument91 SeitenRanjani-211420631111 RemovedSangeethaNoch keine Bewertungen

- International Financial Reporting Standards (IFRS) : A Seminar Presentation SubmittedDokument4 SeitenInternational Financial Reporting Standards (IFRS) : A Seminar Presentation SubmittedPankajNoch keine Bewertungen

- Solved Exercises 2Dokument10 SeitenSolved Exercises 2ScribdTranslationsNoch keine Bewertungen

- FA1Dokument289 SeitenFA1Abhishek BhatnagarNoch keine Bewertungen

- Segmental AnalysisDokument2 SeitenSegmental AnalysisEsmeldo MicasNoch keine Bewertungen

- Common Stock ValuationDokument34 SeitenCommon Stock ValuationSatria DeniNoch keine Bewertungen

- Raizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1Dokument4 SeitenRaizabcanillas: Page1of3 Fd228Pinesparkbalili 9 4 8 9 - 2 4 8 5 - 8 9 Latrinidad Benguetla 2 6 0 1RAIZA CANILLASNoch keine Bewertungen

- Campbell + Snyder'sTranscriptsDokument12 SeitenCampbell + Snyder'sTranscriptsYashJainNoch keine Bewertungen

- Michael J Mauboussin Security Analysis 07Dokument5 SeitenMichael J Mauboussin Security Analysis 07YOG RAJANINoch keine Bewertungen

- FIN 448 Midterm ProblemsDokument6 SeitenFIN 448 Midterm Problemsgilli1trNoch keine Bewertungen

- Consolidations: Chapter-6Dokument54 SeitenConsolidations: Chapter-6Ram KumarNoch keine Bewertungen

- BrillyBrown CH 11 2019Dokument31 SeitenBrillyBrown CH 11 2019Aaron HoardNoch keine Bewertungen

- ACES - Annual Report 2019Dokument32 SeitenACES - Annual Report 2019Ashfina HardianaNoch keine Bewertungen

- Prospectus 2Dokument18 SeitenProspectus 2GUNGUN GUPTANoch keine Bewertungen

- Basic Finance Module Materials List of Modules: No. Module Title CodeDokument49 SeitenBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNoch keine Bewertungen

- What Broke Paytm? - FrontlineDokument9 SeitenWhat Broke Paytm? - Frontlinebaapuu5695Noch keine Bewertungen

- 50726b-624b876dcb855a000f5ca0a0-1649117080-Week 1-3 - ULOe - Practice ProblemDokument3 Seiten50726b-624b876dcb855a000f5ca0a0-1649117080-Week 1-3 - ULOe - Practice ProblemEagle OrtegaNoch keine Bewertungen

- Getting Smarter Series Hhi IndexDokument6 SeitenGetting Smarter Series Hhi Indexkishore13Noch keine Bewertungen

- Pwerm and Hybrid Methods For Allocation of ValuationDokument4 SeitenPwerm and Hybrid Methods For Allocation of ValuationShelly Pratiwi NingsihNoch keine Bewertungen

- Rasmala Global Sukuk Fund Factsheet June 2023Dokument2 SeitenRasmala Global Sukuk Fund Factsheet June 2023Syed Abdul HafeezNoch keine Bewertungen

- Fsa Solved ProblemsDokument27 SeitenFsa Solved ProblemsKumarVelivela100% (1)

- Excel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 2 of 8Dokument4 SeitenExcel Workbook For In-Class Demonstrations and Self-Practice With Solutions - Chapter 9 Part 2 of 8Dante CardonaNoch keine Bewertungen

- Tax 301 - Vat-Subject TransactionsDokument10 SeitenTax 301 - Vat-Subject TransactionsiBEAYNoch keine Bewertungen

- 9706 w17 QP 11Dokument11 Seiten9706 w17 QP 11Vinetha KarunanithiNoch keine Bewertungen