Beruflich Dokumente

Kultur Dokumente

HDFC Life Sanchay(Spl) Policy Illustration

Hochgeladen von

Ankur Mittal100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

555 Ansichten2 SeitenThe document is an illustration of future benefits for an HDFC Life Sanchay(Spl) insurance policy. It provides details of the policyholder such as name and age. It then lists the policy details including commencement date, term, premium paying term, frequency and amount. The document illustrates potential maturity benefits, death benefits, and surrender values depending on assumed future investment returns of 4% or 8% annually. All benefits are shown in Indian Rupees. Upon receipt of benefits, the policy terminates.

Originalbeschreibung:

n

Originaltitel

HDFC Life Sanchay(Spl) Illustration (1)

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document is an illustration of future benefits for an HDFC Life Sanchay(Spl) insurance policy. It provides details of the policyholder such as name and age. It then lists the policy details including commencement date, term, premium paying term, frequency and amount. The document illustrates potential maturity benefits, death benefits, and surrender values depending on assumed future investment returns of 4% or 8% annually. All benefits are shown in Indian Rupees. Upon receipt of benefits, the policy terminates.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

555 Ansichten2 SeitenHDFC Life Sanchay(Spl) Policy Illustration

Hochgeladen von

Ankur MittalThe document is an illustration of future benefits for an HDFC Life Sanchay(Spl) insurance policy. It provides details of the policyholder such as name and age. It then lists the policy details including commencement date, term, premium paying term, frequency and amount. The document illustrates potential maturity benefits, death benefits, and surrender values depending on assumed future investment returns of 4% or 8% annually. All benefits are shown in Indian Rupees. Upon receipt of benefits, the policy terminates.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

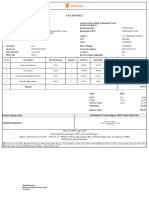

on 25 January 2014

Age is taken as on last birthday

PREMIUM AND BENEFIT DETAILS

ILLUSTRATION OF FUTURE BENEFITS

This illustration has been produced by HDFC Standard Life Insurance Company Limited to help you understand the benefits of your HDFC Life Sanchay(Spl). These illustrations must be

read in conjunction with the sales literature, which describes the features of this product.

The values shown are for illustration only. What you actually receive will depend on what happens over the future lifetime of your policy.

The assumed rate of investment return is usually particularly important as benefits may differ depending on the investment return. However, in this product, the Death Benefit and the

Maturity Benefit do not vary with changing investment returns. The Illustration shows what you could get back using two assumed rates of investment return.These rates have been

specified by the Life Insurance Council.

Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your life insurance company. If your policy offers guaranteed returns then

these will be clearly marked "guaranteed" in the illustration table on this page.

If your policy offers variable returns then the illustrations on this page will show two different rates of assumed investment returns. These assumed rates of return are not guaranteed and

they are not upper or lower limits of what you might get back as the value of your policy is dependent on a number of factors including future investment performance.

Guaranteed benefits are available provided all premiums are paid, when they are due. The illustrative benefits below assume that all premiums that are due have been paid.

All amounts are in Indian Rupees.

Illustrative Benefits on Maturity

On the survival of the Life Assured until the Maturity date, the illustrative Maturity benefits are as shown below.

Upon this payment, the policy terminates and no further benefit becomes payable.

Illustrative Benefits on Death

On the death of the Life Assured before the Maturity date the illustrative benefits are as shown below.

Upon this payment, the policy terminates and no further benefit is payable.

The benefits shown above are at the end of the year.

Ver: 30(19)d-30.19-30 25-Jan-2014 - 23:26:14 Page 1

This is the official illustration issued by HDFC Standard Life Insurance Company Limited. Illustration of any other type is not supported by the company.

Illustration for HDFC Life Sanchay(Spl) (UIN : 101N097V01)

PERSONAL DETAILS

Name Age Gender

Life 1 ankur mittal 26 M

POLICY DETAILS

Date of Policy Commencement: 25-Jan-2014

Policy Term: 21 year(s)

Premium Paying Term: 10 year(s)

Premium Frequency: Annual

Benefit Name

Sum Assured

(in Rs.)

Benefit Term (years)

Premium Paying

Term (years)

Premium

(in Rs.)

Taxes as

applicable*#

(in Rs.)

Total Premium

Main Benefit 1,824,920 21 10 240,000 7,416 247,416

Total Premium payable per Frequency: 240,000 7,416 247,416

Next premium Due Date 25-Jan-2015

* General Sales Tax (GST) in case of Jammu and Kashmir and Service Tax (including Education Cess) in all other cases.

#The Service Tax & Education Cess on the Main Benefit premium for year two and subsequent years will be Rs.3720/-.

Guaranteed Benefit Non-Guaranteed Benefit Total Maturity Benefit

Assumed Investment Return Assumed Investment Return

Date of Maturity Sanchay (Spl) 4% p.a. 8% p.a. 4% p.a. 8% p.a.

25-Jan-2035 5,274,042 0 0 5,274,042 5,274,042

Guaranteed Benefits Non-Guaranteed Benefit Total Death Benefit

Benefit on Valid Claim Assumed Investment Return Assumed Investment Return Assumed Investment Return

Policy Year 4% p.a. 8% p.a. 4% p.a. 8% p.a. 4% p.a. 8% p.a.

1 2,564,243 2,564,243 0 0 2,564,243 2,564,243

2 2,728,486 2,728,486 0 0 2,728,486 2,728,486

3 2,892,730 2,892,730 0 0 2,892,730 2,892,730

4 3,056,974 3,056,974 0 0 3,056,974 3,056,974

5 3,221,218 3,221,218 0 0 3,221,218 3,221,218

6 3,385,462 3,385,462 0 0 3,385,462 3,385,462

7 3,549,706 3,549,706 0 0 3,549,706 3,549,706

8 3,713,950 3,713,950 0 0 3,713,950 3,713,950

9 3,878,194 3,878,194 0 0 3,878,194 3,878,194

10 4,162,438 4,162,438 0 0 4,162,438 4,162,438

11 4,326,682 4,326,682 0 0 4,326,682 4,326,682

12 4,490,926 4,490,926 0 0 4,490,926 4,490,926

13 4,655,170 4,655,170 0 0 4,655,170 4,655,170

14 4,819,414 4,819,414 0 0 4,819,414 4,819,414

15 4,983,658 4,983,658 0 0 4,983,658 4,983,658

16 5,147,902 5,147,902 0 0 5,147,902 5,147,902

17 5,312,146 5,312,146 0 0 5,312,146 5,312,146

18 5,476,390 5,476,390 0 0 5,476,390 5,476,390

19 5,640,634 5,640,634 0 0 5,640,634 5,640,634

20 5,804,878 5,804,878 0 0 5,804,878 5,804,878

Illustrative Benefits on Surrender

This contract is designed for long term savings and is not designed for short term investment. Should you need to surrender your policy in the short term, any surrender benefits may be

less than the premium(s) you have paid.

A policy may be surrendered after it acquires a guaranteed surrender value. Hence, Surrender Values are shown from year 3 onwards.

Upon this payment, the policy terminates and no further benefit becomes payable.

The values shown are for illustration only.

What you actually receive will depend on what happens over the future lifetime of the policy.

Depending on the prevailing market conditions, the surrender value may be revised.

Benefits shown above are at the end of the year.

If you would like help to understand this illustration, please speak to your Financial Consultant / Relationship Manager.

TERMS AND CONDITIONS

1. The Premium and the Sum Assured stated above is based on the information provided. They may vary as a result of underwriting.

2. For details of the above benefits, please read the sales literature provided.

3. Any statutory levy or charges (such as Service Tax & Education Cess) including any indirect tax may be charged to the Policyholder either now or in future by the Company and such

amount so charged shall become due and payable and shall be subject to the same terms and conditions as applicable to payment of premium.

4. UIN for HDFC Life Sanchay(Spl) - 101N097V01

Guaranteed Benefit Non-Guaranteed Benefit Total Surrender Benefit

Assumed Investment Return Assumed Investment Return

Policy Year Guaranteed Surrender Value 4% p.a. 8% p.a. 4% p.a. 8% p.a.

3 227,924 107,504 107,504 335,428 335,428

4 498,330 0 0 498,330 498,330

5 626,361 37,902 37,902 664,263 664,263

6 756,364 112,267 112,267 868,631 868,631

7 888,748 215,842 215,842 1,104,590 1,104,590

8 1,083,641 292,667 292,667 1,376,308 1,376,308

9 1,296,847 390,575 390,575 1,687,422 1,687,422

10 1,526,737 516,945 516,945 2,043,682 2,043,682

11 1,629,256 598,490 598,490 2,227,746 2,227,746

12 1,737,720 690,438 690,438 2,428,158 2,428,158

13 1,853,460 793,570 793,570 2,647,030 2,647,030

14 1,975,374 909,514 909,514 2,884,888 2,884,888

15 2,109,936 1,034,961 1,034,961 3,144,897 3,144,897

16 2,256,883 1,170,702 1,170,702 3,427,585 3,427,585

17 2,418,053 1,318,062 1,318,062 3,736,115 3,736,115

18 2,594,496 1,478,101 1,478,101 4,072,597 4,072,597

19 2,793,360 1,645,782 1,645,782 4,439,142 4,439,142

20 3,017,025 1,821,360 1,821,360 4,838,385 4,838,385

Financial Consultant's Signature: Customer's Signature:

Financial Consultant's Name: Date:

Financial Consultant's Code : Place:

Business Development Manager's Name:

Das könnte Ihnen auch gefallen

- Pay To The Order of Puerto Rico-Part IDokument102 SeitenPay To The Order of Puerto Rico-Part IJavier Arvelo-Cruz-SantanaNoch keine Bewertungen

- PE Ratio Factors Book vs Market ValueDokument28 SeitenPE Ratio Factors Book vs Market Valuebeyonce0% (1)

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Von EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Noch keine Bewertungen

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionVon EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNoch keine Bewertungen

- CIR Vs PrimetownDokument2 SeitenCIR Vs PrimetownTJ MerinNoch keine Bewertungen

- Ps AIA Guaranteed For Life 58964 20190112184147Dokument6 SeitenPs AIA Guaranteed For Life 58964 20190112184147karthikNoch keine Bewertungen

- Philippine Health Providers Tax LiabilityDokument3 SeitenPhilippine Health Providers Tax Liabilityana ortizNoch keine Bewertungen

- Seasons 100 ProposalDokument3 SeitenSeasons 100 ProposalAlvin Dela Cruz100% (1)

- Packaged Drinking Water ProductionDokument6 SeitenPackaged Drinking Water ProductionismaiaaNoch keine Bewertungen

- Vidya DharDokument2 SeitenVidya DharKatie PerryNoch keine Bewertungen

- HDFC Life Super Savings Plan (SPL) IllustrationDokument2 SeitenHDFC Life Super Savings Plan (SPL) IllustrationBrandon WarrenNoch keine Bewertungen

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDokument3 SeitenHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNoch keine Bewertungen

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDokument0 SeitenHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNoch keine Bewertungen

- Illustration PDFDokument3 SeitenIllustration PDFrahulNoch keine Bewertungen

- IllustrationDokument3 SeitenIllustrationDevender Singh RautelaNoch keine Bewertungen

- ICICI Benefit IllustrationDokument4 SeitenICICI Benefit Illustrationudupiganesh3069Noch keine Bewertungen

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationBullish Guy100% (1)

- HDFC Life ProGrowth Plus IllustrationDokument3 SeitenHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNoch keine Bewertungen

- Illustration of GSIPDokument3 SeitenIllustration of GSIPAjinkya ChalkeNoch keine Bewertungen

- HDFC Life YoungStar Udaan IllustrationDokument2 SeitenHDFC Life YoungStar Udaan IllustrationSuraj RajbharNoch keine Bewertungen

- HDFC LifeDokument1 SeiteHDFC LifefacebookorkutNoch keine Bewertungen

- Future Benefits and Charges DetailsDokument0 SeitenFuture Benefits and Charges DetailsAnkur MittalNoch keine Bewertungen

- ENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueDokument3 SeitenENDOWMENT PLAN - (Table No. 14) Benefit Illustration: Guaranteed Surrender ValueGBKNoch keine Bewertungen

- IllustrationForm S000000502723Dokument1 SeiteIllustrationForm S000000502723anand_guruwarNoch keine Bewertungen

- Reating Lif: Child Protection Money Back PlanDokument2 SeitenReating Lif: Child Protection Money Back PlanSanjay Ku AgrawalNoch keine Bewertungen

- ICICI Pru Assure WealthDokument2 SeitenICICI Pru Assure WealthPavan Kumar RanguduNoch keine Bewertungen

- Illustration PDFDokument0 SeitenIllustration PDFbpshuNoch keine Bewertungen

- Lakshya Plus v1Dokument10 SeitenLakshya Plus v1Mahadevan VenkatesanNoch keine Bewertungen

- HDFC Life Crest IllustrationDokument0 SeitenHDFC Life Crest IllustrationAnkur SrivastavNoch keine Bewertungen

- MONEY BACK PLAN - (Table No. 75) Benefit IllustrationDokument4 SeitenMONEY BACK PLAN - (Table No. 75) Benefit IllustrationVinayak DhotreNoch keine Bewertungen

- ICICI Pru LifeTime Super: A regular premium unit-linked planDokument3 SeitenICICI Pru LifeTime Super: A regular premium unit-linked planmniarunNoch keine Bewertungen

- ICICI Prudential Retirement Income SolutionDokument4 SeitenICICI Prudential Retirement Income Solutionram_webNoch keine Bewertungen

- Variable Life Insurance Proposal: 0PROP.07.4Dokument4 SeitenVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNoch keine Bewertungen

- rm4800 550kDokument28 Seitenrm4800 550kDwayne OngNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNoch keine Bewertungen

- Gsip For 15 YrsDokument3 SeitenGsip For 15 YrsJoni SanchezNoch keine Bewertungen

- IllustrationDokument1 SeiteIllustrationshalinimani19Noch keine Bewertungen

- IDBI Federal Incomesurance Plan BenefitsDokument3 SeitenIDBI Federal Incomesurance Plan BenefitsVipul KhandelwalNoch keine Bewertungen

- Miss Soo QTNDokument41 SeitenMiss Soo QTNHong Siong ShinNoch keine Bewertungen

- Whole Life Surance Savings Plan 116414681443669413Dokument2 SeitenWhole Life Surance Savings Plan 116414681443669413msneha1Noch keine Bewertungen

- Illustration RapDokument1 SeiteIllustration RapShub KumarNoch keine Bewertungen

- HDFC Life Super Income Plan SHAREDokument6 SeitenHDFC Life Super Income Plan SHARESandeep MookerjeeNoch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect PlusBalachandar SathananthanNoch keine Bewertungen

- HDFC Life Annuity Plan BenefitsDokument1 SeiteHDFC Life Annuity Plan BenefitsSrikanthNoch keine Bewertungen

- Premium 25000Dokument3 SeitenPremium 25000psatya432Noch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument2 SeitenIllustration For Your HDFC Life Click 2 Protect Plus0001212vivekchauhanNoch keine Bewertungen

- IllustrationFormat PrashantDokument8 SeitenIllustrationFormat PrashantBhavesh ShuklaNoch keine Bewertungen

- Met Smart Plus BrochureDokument5 SeitenMet Smart Plus BrochurenivasiNoch keine Bewertungen

- Sales Brochure 91Dokument3 SeitenSales Brochure 91prudhvi rajNoch keine Bewertungen

- Reliance's Guaranteed Money Back PlanDokument2 SeitenReliance's Guaranteed Money Back PlantrskaranNoch keine Bewertungen

- HDFC SL CrestDokument4 SeitenHDFC SL CrestPreetinder Singh BrarNoch keine Bewertungen

- MM AssignmentDokument16 SeitenMM AssignmentRahul ParasharNoch keine Bewertungen

- IllustrationDokument1 SeiteIllustrationmon.rohithNoch keine Bewertungen

- Bajaj Future Gain Web PDFDokument17 SeitenBajaj Future Gain Web PDFPhanindra YellapragadaNoch keine Bewertungen

- Edelweiss Tokio Life Pension Plan GuideDokument12 SeitenEdelweiss Tokio Life Pension Plan Guidedeepraj1983Noch keine Bewertungen

- Life Link Pension SP LeafletDokument2 SeitenLife Link Pension SP LeafletSarvesh MishraNoch keine Bewertungen

- LIC's New Endowment Plan AnalysisDokument6 SeitenLIC's New Endowment Plan AnalysisVikrant SinghNoch keine Bewertungen

- Exide Life Secured Income Insurance RPDokument10 SeitenExide Life Secured Income Insurance RPrahul sarmaNoch keine Bewertungen

- IllustrationForm S000045685006Dokument2 SeitenIllustrationForm S000045685006Prachi JainNoch keine Bewertungen

- APIP BrochureDokument2 SeitenAPIP Brochurearpitnigam21Noch keine Bewertungen

- Illustration For Your HDFC Life Click 2 Protect PlusDokument1 SeiteIllustration For Your HDFC Life Click 2 Protect PlusKiran MesaNoch keine Bewertungen

- Fulfil dreams with HDFC Life Super Income PlanDokument8 SeitenFulfil dreams with HDFC Life Super Income PlanSajeed ShaikhNoch keine Bewertungen

- Learn More About Your Participating PolicyDokument6 SeitenLearn More About Your Participating PolicyJessamine LeeNoch keine Bewertungen

- Edelweiss Tokio Life Edu Save PlanDokument11 SeitenEdelweiss Tokio Life Edu Save Planbilu4uNoch keine Bewertungen

- Uttar Pradesh 2012 Election ReportDokument663 SeitenUttar Pradesh 2012 Election ReportAnkur MittalNoch keine Bewertungen

- HDFC Life Sanchay(Spl) Policy IllustrationDokument2 SeitenHDFC Life Sanchay(Spl) Policy IllustrationAnkur Mittal100% (1)

- Indian MFTrackerDokument1.597 SeitenIndian MFTrackerAnkur Mittal100% (1)

- Packaged Water Industry in IndiaDokument14 SeitenPackaged Water Industry in IndiaAnkur MittalNoch keine Bewertungen

- Indian MFTrackerDokument1.597 SeitenIndian MFTrackerAnkur Mittal100% (1)

- Future Benefits and Charges DetailsDokument0 SeitenFuture Benefits and Charges DetailsAnkur MittalNoch keine Bewertungen

- MIT MSL PizzamodelDokument37 SeitenMIT MSL PizzamodelAnkur MittalNoch keine Bewertungen

- Price WirerodDokument1 SeitePrice WirerodAnkur MittalNoch keine Bewertungen

- ReadmeDokument1 SeiteReadmeAnkur MittalNoch keine Bewertungen

- Read President Trump's Fiscal Year 2019 BudgetDokument160 SeitenRead President Trump's Fiscal Year 2019 Budgetkballuck1100% (6)

- Draft Preventive Manual Vol IDokument654 SeitenDraft Preventive Manual Vol Ipooram001Noch keine Bewertungen

- GST invoice summary reportDokument28 SeitenGST invoice summary reportHarinath HnNoch keine Bewertungen

- Bir Rao 01 03Dokument3 SeitenBir Rao 01 03Benedict Jonathan BermudezNoch keine Bewertungen

- Defining quality in IT training invoiceDokument1 SeiteDefining quality in IT training invoicendoriNoch keine Bewertungen

- Kubatana Newsletter 210817Dokument85 SeitenKubatana Newsletter 210817Wendy ZongeNoch keine Bewertungen

- Municipalities & Cities Reclaim Foreshore LandsDokument2 SeitenMunicipalities & Cities Reclaim Foreshore LandsIELTSNoch keine Bewertungen

- KMC Property Tax FormDokument13 SeitenKMC Property Tax FormbitunmouNoch keine Bewertungen

- Assessment in Income TaxDokument3 SeitenAssessment in Income Taxayush sikkewalNoch keine Bewertungen

- Bir Ruling No. 013-05Dokument3 SeitenBir Ruling No. 013-05Anonymous gyYqhBhCvsNoch keine Bewertungen

- Farley Development Company Adjusting Entries Per 31 December 1981 NO Description REF Debet KreditDokument5 SeitenFarley Development Company Adjusting Entries Per 31 December 1981 NO Description REF Debet KreditMelani NasutionNoch keine Bewertungen

- Chapter 13 - ADokument3 SeitenChapter 13 - ARena Jocelle NalzaroNoch keine Bewertungen

- Atrill Capital Structure SlidesDokument8 SeitenAtrill Capital Structure SlidesEYmran RExa XaYdiNoch keine Bewertungen

- Herald 1st Sem Issue School Year 2013-2014Dokument20 SeitenHerald 1st Sem Issue School Year 2013-2014Anabel Quinto Sta CruzNoch keine Bewertungen

- Media Regulation (Lesson 2-5)Dokument22 SeitenMedia Regulation (Lesson 2-5)Mariell PahinagNoch keine Bewertungen

- Export Tax InvoiceDokument1 SeiteExport Tax InvoiceNavin RaviNoch keine Bewertungen

- Euwhoiswho Com enDokument154 SeitenEuwhoiswho Com enexperteugreenNoch keine Bewertungen

- Od 116572688556921000Dokument1 SeiteOd 116572688556921000Shubham guptaNoch keine Bewertungen

- Work Opportunity Tax Credit Package: Employee InstructionsDokument3 SeitenWork Opportunity Tax Credit Package: Employee InstructionsAnonymous K8H1CRR2mNoch keine Bewertungen

- Taco 0088166061500044Dokument1 SeiteTaco 0088166061500044Sourav ChakrabortyNoch keine Bewertungen

- TAX 42 - Exempt Sales GuideDokument10 SeitenTAX 42 - Exempt Sales GuideEJ EduqueNoch keine Bewertungen

- Confidential Payslip DetailsDokument1 SeiteConfidential Payslip DetailsDPD NASDEM Kab. BogorNoch keine Bewertungen

- Tax Invoice for Mobile Protection Plan and HandsetDokument2 SeitenTax Invoice for Mobile Protection Plan and HandsetMuhammed Jabis KNoch keine Bewertungen

- PD 2026Dokument2 SeitenPD 2026Lv AvvaNoch keine Bewertungen

- 2023 Harmony Residential Rebate App PacketDokument2 Seiten2023 Harmony Residential Rebate App PacketSanta Teresa SumapazNoch keine Bewertungen

- Chandra Enterprises CRN-3Dokument1 SeiteChandra Enterprises CRN-3Aarvee FoodNoch keine Bewertungen