Beruflich Dokumente

Kultur Dokumente

Judgment W.P.No.4971 of 2009

Hochgeladen von

Faisal EmonOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Judgment W.P.No.4971 of 2009

Hochgeladen von

Faisal EmonCopyright:

Verfügbare Formate

1

Present: Ms. Justice Nazmun Ara Sultana and Mr. Justice Md. Ruhul Quddus

Writ Petition No.4971 of 2009 Nasim Anwar Hossain ... Petitioner -VsBangladesh Bank and others ... Respondents

Mr. M. Moksadul Islam with Mr. Asaduzzaman Siddiqui, Advocates ... for the petitioner Mr. Md. Mizanur Rahman appearing for Mr. Ziaul Hassan, Advocate ... for the respondents Heard on 2.12. 2010 Judgment on 7.12. 2010

Md. Ruhul Quddus, J: This Rule Nisi, at the instance of the writ petitioner Nasim Anwar Hossain, share holder of a private limited company, was issued calling in question the inclusion of her name in the report published and circulated by the Credit Information Bureau (in brief CIB) of Bangladesh Bank showing her name as related with Ben-Lub Pte Ltd., a defaulting borrower company against borrower code No.56421.

The petitioners case in short is that she is a share holder to the extent of 15% in the said Ben-Lub Pte Ltd. In course of its business,

the said company took loan from two banks namely Dhaka Bank Ltd. and Bank Asia Ltd. The petitioner was also a personal guarantor against the said loans. Due to financial strain the company defaulted in payment of the loan within the stipulated time, for which the said banks reported to Bangladesh Bank (respondent No.1) describing the said company as a defaulting borrower. Although the petitioner did not take the loan in her personal capacity and having only 15% shares in the borrower company, still her name appeared in the report of CIB. Such inclusion in the CIB report had disqualified her to enjoy credit facilities from any other bank or financial institutions, hence she was aggrieved. In order to substantiate her contention, the petitioner annexed certified copy of the Memorandum and Article of Association of Ben-Lub Pte Ltd. (vide annexe-A to the writ petition) showing her shares to the extent of only 15% therein.

Mr. M. Moksadul Islam, the learned Advocate for the petitioner submitted that according to section 5 (GaGa) of the Bank Companies Act, 1991 the petitioner does not come within the definition of defaulting borrower inasmuch she did not take loan in person and her shares in the company do not exceed 20% of the total shares and as such she is not a person having interest in the company. The Company being a juristic person is a separate entity, which took loan from the banks for which a share holder of it, having less than 20% of its shares, cannot be included in the CIB report. She is neither a

defaulting borrower nor a person having interest in the company and therefore the respondent banks are not supposed to report the petitioners name to Bangladesh Bank describing her as a defaulting borrower within the scope of section 27 KaKa of the Bank Companies Act, 1991.

The learned Advocate further submits that the writ petitioner being a personal guarantor, is only a debtor and not a defaulting borrower, and therefore her name cannot be included in CIB report. In support of his submission the learned Advocate made reliance on the cases of Major Monjur Quader (Rtd) Vs- Bangladesh Bank and others reported in 59 DLR, 451; Mahmudur Rahman and another VsBangladesh Bank and others in same DLR at page 540, and the case of Md. Mostafa Kamal and others Vs- Bangaldesh Bank and others reported in 11 MLR, 377.

On the other hand, Mr. Md. Mizanur Rahman, learned Advocate appearing for the respondent-banks opposed the Rule and without filing any affidavit-in-opposition, submitted that since the writ petitioner is a guarantor against the loan taken by the defaulting borrower company, there is nothing wrong in inclusion of her name in the CIB report and as such, the Rule is liable to be discharged. However, the learned Advocate for the respondents did not deny the writ petitioner as a share holder in the borrower company to the extent of 15% of its total shares. He also positively affirmed the authenticity of the

Memorandum and Article of Association of Ben-Lub Pte Ltd., that has been annexed with the writ petition.

The points of controversy in the present writ petition are whether the name of a person having 15% share in a defaulting borrower company, and a personal guarantor against a loan, can be included in the CIB report. We have perused the writ petition and the papers submitted therewith, considered the submissions of the learned Advocates for both the parties, and carefully examined the law and decisions cited by the learned Advocate for the petitioner. Section 5 (GaGa) of the Bank Companies Act, 1991 defines defaulting borrower with provisos, as follows:

5(MM) Ljvcx FY hvnvi wbRi AMxg, FY ev ev MnxZv A_ Kvb ew ev cwZvb, c` my`

mv_ Dnvi

mswk Ask

cwZvbi ev

AbyKzj AwRZ

Dnvi Dci

evsjv`k

evsK

KZK

RvixKZ

msv

Abyhvqx

gqv`vxY nIqvi 6 (Qq) gvm AwZevwnZ nBqvQ t

Ze

kZ

_vK h, Ljvcx cwiPvjK

FY MnxZv Kvb bv nBj 25%

cvewjK D bv

wjwgUW Kvvbxi KvvbxZ nBj D

A_ev AwaK

Zvnvi kqvii cvewjK

Ask

Gi

wjwgUW Kvvbx

mv_

mswk

cwZvb ewjqv MY nBe bv t

Aviv Ab

kZ Kvb

_vK h, cvewjK cwZvb FY

wjwgUW Kvvbx

eZxZ AbwaK

MnxZvi kqvii Ask

20%

nBj

cwZvb

GB

`dvi

Aaxb

mv_,

mswk cwZvb ewjqv MY nBe bv|

Section 27 KaKa of the said Act provides that every creditor bank or financial institution shall send a list of its defaulting borrowers to Bangladesh Bank from time to time, upon which the latter bank will prepare a list of the said defaulting borrowers and send it to all banks and financial institutions, so that they refrain from extending credit facilities to them (defaulting borrowers).

In 59 DLR, 451 the petitioner being share holder Managing Director of a private limited company having less than 20% shares in the defaulting borrower company, and also a personal guarantor against the loan received by the company, challenged inclusion of his name in the CIB report on the ground that the definition of defaulting borrower as given in the statute was not attracted in his case, since he had only 2.5% share, and that he had merely provided personal guarantee to the creditor bank to repay the loan money which at best could made him a guarantor and not a defaulting borrower. The High Court Division, after exhaustive hearing and on examination of the relevant sections/articles respectively in the Bank Companies Act, 1991; Bangladesh Bank Order, 1972 and Artha Rin Adalat Ain, 2003, held:

22. ... The petitioners name, even if he is indebted to one of the respondents as a guarantor, cannot be included in the CIB list. It

should however, be noted that the respondent creditor bank is at liberty to file case against the petitioner in the Artha Rin Adalat for recovery of the unpaid loan amount as per terms of the personal guarantee provided by the petitioner

The same view was upheld in the case of Mahmudur Rahman and another Vs- Bangladesh Bank and others reported in the same DLR at page 540, where a share holder director of a defaulting borrower company had already transferred his shares, but

subsequently was included in the CIB report in capacity of personal guarantor.

In 11 MLR, 377 under similar facts and circumstances, another bench of the High Court Division held:

17. The underlying purpose for including the names of the

defaulting borrower companies or individual defaulting borrowers in the report of the Credit Information Bureau of Bangladesh Bank is to inform the financial institutions and the bank companies about the defaulting borrowers so that the financial institutions and banks do not make any loan or financial accommodation to them as envisaged under section 27 KaKa (3) of the Bank Companies Act, 1991. In view of the aforesaid legal position, the names of the aforesaid three defaulting borrower companies were only liable to be included in the report of the Credit Information Bureau of Bangladesh Bank and not the names of the petitioners. In other words, the names of the

petitioners were not liable to be included in the report of the Credit Information Bureau of Bangladesh Bank.

We also find the case of Quazi Nasibul Hasan (Sunnu) VsBangladesh Bank and others reported in 61 DLR, 96, where on conflicting decisions between two benches, a larger bench of the High Court Division was constituted to resolve the issue: whether the petitioner (Quazi Nasibul Hasan), as a guarantor of loan liability of the borrower company, covered by his personal guarantee in force, not having any subsisting interest in such borrower company can be termed as borrower and, for that matter, in case of default in repayment of such loan liabilities by the borrower-company such guarantor can be termed as a default-borrower having regard to the provisions of sections 5 GaGa and 27 KaKa of the Bank Company Act, 1991, as amended, read with Articles 42, 43, 44 and 46 of the Bangladesh Bank Order, 1972 as amended. The larger bench in a comprehensive judgment resolved the issue as under:

20. Considering the aforesaid provisions of sections 5 GaGa, 5 (Chha) and 27 KaKa of the Bank Company Act, 1991, quoted hereinbefore, and Article 42 (a) and (b) of the Bangladesh Bank Order, 1972, quoted herein above, we are of the view that the word guarantor cannot be tagged with the definition of borrower, and particularly having regard to the definition of defaulter-borrower (Ljvcx FY MnxZv) as per section 5 GaGa of the Act, and that the requirement for sending the information of defaulter-borrowers to the

Bangladesh Bank has been detailed in section 27 KaKa of the Act, on the basis of which the CIB list is prepared. The impugned inclusion of name of the petitioner, not being a defaulting borrower, as per the definition of section 5 GaGa of the Act, in the CIB report in reference is illegal and arbitrary and an act of negligence and non-application of mind and has caused loss and injury to the petitioner

In view of the above discussion and long line of decisions as referred hereinbefore, the petitioner in the present writ petition, does not appear to be a defaulting borrower or a person having interest in the defaulting borrower company for the purpose of inclusion of her name in the CIB report, and as such we find substance in the Rule. Accordingly, the Rule is made absolute and the inclusion of the petitioners name in report dated 31.7.2008 published and circulated by the Credit Information Bureau of Bangladesh Bank as related with Ben-Lub Pte Ltd., a defaulting borrower company against borrower code No.56421 (evident from annexe-B to the writ petition) is hereby declared to have been done without lawful authority and is of no legal effect.

Nazmun Ara Sultana, J: I agree.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- All Kinds of Diplomatic NoteDokument90 SeitenAll Kinds of Diplomatic NoteMarius C. Mitrea60% (5)

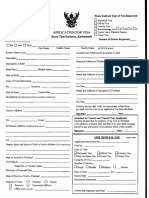

- Thailand VISA Application Form PDFDokument2 SeitenThailand VISA Application Form PDFnimesh gautam0% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Importance of Governance and Development and Its Interrelationship (Written Report)Dokument6 SeitenThe Importance of Governance and Development and Its Interrelationship (Written Report)Ghudz Ernest Tambis100% (3)

- Appointment Details: For Test TakersDokument1 SeiteAppointment Details: For Test TakersFaisal EmonNoch keine Bewertungen

- HasibDokument2 SeitenHasibFaisal EmonNoch keine Bewertungen

- GP Selection Process FullDokument18 SeitenGP Selection Process FullFaisal EmonNoch keine Bewertungen

- New Microsoft Word DocumentDokument2 SeitenNew Microsoft Word DocumentFaisal EmonNoch keine Bewertungen

- Executive Summary: Sales Forecast, Profit Margin, Break Even Analysis, Expense ForecastDokument33 SeitenExecutive Summary: Sales Forecast, Profit Margin, Break Even Analysis, Expense ForecastFaisal EmonNoch keine Bewertungen

- BD FoodsDokument16 SeitenBD FoodsFaisal Emon100% (1)

- Service: BlueprintDokument3 SeitenService: BlueprintFaisal EmonNoch keine Bewertungen

- Independent University, Bangladesh Lfe-201 Report: Submitted To: Submitted byDokument1 SeiteIndependent University, Bangladesh Lfe-201 Report: Submitted To: Submitted byFaisal EmonNoch keine Bewertungen

- Freedom Fighters Job Quota Extends To Their Grandchildren: Priyo - NewsDokument1 SeiteFreedom Fighters Job Quota Extends To Their Grandchildren: Priyo - NewsFaisal EmonNoch keine Bewertungen

- LFE Dairy: (Part A)Dokument2 SeitenLFE Dairy: (Part A)Faisal EmonNoch keine Bewertungen

- KetchupDokument12 SeitenKetchupFaisal EmonNoch keine Bewertungen

- Topic: Role of Livestock in Supplying Household Protein Demand: Case of KarimnagarDokument1 SeiteTopic: Role of Livestock in Supplying Household Protein Demand: Case of KarimnagarFaisal EmonNoch keine Bewertungen

- Gu Gu Jari paraDokument6 SeitenGu Gu Jari paraFaisal EmonNoch keine Bewertungen

- History:: Prepaid ServicesDokument9 SeitenHistory:: Prepaid ServicesFaisal EmonNoch keine Bewertungen

- Barmax Mpre Study Guide: X. Communications About Legal Services (4% To 10%)Dokument2 SeitenBarmax Mpre Study Guide: X. Communications About Legal Services (4% To 10%)TestMaxIncNoch keine Bewertungen

- Letter of Congratulations To Newly Appointed Ex Governor of Kano StateDokument1 SeiteLetter of Congratulations To Newly Appointed Ex Governor of Kano StateA&A CYBER CAFE LIMITEDNoch keine Bewertungen

- Anaya Cruz Rec ReconsideracDokument6 SeitenAnaya Cruz Rec ReconsideracElkins Guivar OrtizNoch keine Bewertungen

- Fundamental Right and Fundamental Duties Complement Each OtherDokument16 SeitenFundamental Right and Fundamental Duties Complement Each OtherKeshav SachdevaNoch keine Bewertungen

- Limanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)Dokument7 SeitenLimanch-O Hotel Vs City of Olongapo GR No. 185121 (2010)braindead_91Noch keine Bewertungen

- Fimreite-Laegreid 2007 Sepcialization and Coordination - Multilevel SystemDokument31 SeitenFimreite-Laegreid 2007 Sepcialization and Coordination - Multilevel SystemargosmexicanoNoch keine Bewertungen

- Form16PartA Unhale ABFPU8256Q 2019-2020Dokument2 SeitenForm16PartA Unhale ABFPU8256Q 2019-2020Milind UnhaleNoch keine Bewertungen

- In The Supreme Court of Pakistan: Petitioner(s)Dokument8 SeitenIn The Supreme Court of Pakistan: Petitioner(s)Khawaja Burhan100% (6)

- CIR V Petron CorpDokument15 SeitenCIR V Petron CorpChristiane Marie BajadaNoch keine Bewertungen

- Rules of Procedure For Environmental CasesDokument8 SeitenRules of Procedure For Environmental CasesGada AbdulcaderNoch keine Bewertungen

- Case Digest: Cralaw Virtua1aw LibraryDokument4 SeitenCase Digest: Cralaw Virtua1aw LibraryGret HueNoch keine Bewertungen

- CD Acord vs. ZamoraDokument2 SeitenCD Acord vs. ZamoraJane Sudario100% (2)

- Ontario Eviction Notice EXAMPLE 1Dokument1 SeiteOntario Eviction Notice EXAMPLE 1Jonathan AlphonsoNoch keine Bewertungen

- Admin CasesDokument14 SeitenAdmin CasesJessica Joyce PenalosaNoch keine Bewertungen

- Amgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 779Dokument3 SeitenAmgen Inc. v. F. Hoffmann-LaRoche LTD Et Al - Document No. 779Justia.comNoch keine Bewertungen

- International Human Rights ProjectDokument17 SeitenInternational Human Rights ProjectBaksh Mohindra100% (1)

- Interpretation of Stautes XXDokument20 SeitenInterpretation of Stautes XXsaurav prasadNoch keine Bewertungen

- Case Digest JursdictionDokument29 SeitenCase Digest JursdictionPhrexilyn PajarilloNoch keine Bewertungen

- Baguio Midland Carrier v. CADokument12 SeitenBaguio Midland Carrier v. CAKPPNoch keine Bewertungen

- Ra 7691Dokument23 SeitenRa 7691Elenita OrdaNoch keine Bewertungen

- Case-Digest-MMDA-vs-Concerned-Residents PDFDokument2 SeitenCase-Digest-MMDA-vs-Concerned-Residents PDFsayyedNoch keine Bewertungen

- Preliminary Injunction CASESDokument11 SeitenPreliminary Injunction CASESCarl MontemayorNoch keine Bewertungen

- Llda v. CA DigestDokument4 SeitenLlda v. CA DigestkathrynmaydevezaNoch keine Bewertungen

- 9 Go V Colegio de San Juan de LetranDokument9 Seiten9 Go V Colegio de San Juan de LetranDebbie YrreverreNoch keine Bewertungen

- Important Provisions Under RA 9139Dokument2 SeitenImportant Provisions Under RA 9139Myn Mirafuentes Sta Ana0% (1)

- How To Write A Good Position Paper For MUNDokument7 SeitenHow To Write A Good Position Paper For MUNAhmet Yildirim100% (2)

- Deklerck Jasmien Laurette Thesis Human Rights CitiesDokument107 SeitenDeklerck Jasmien Laurette Thesis Human Rights CitiesHenri SitorusNoch keine Bewertungen