Beruflich Dokumente

Kultur Dokumente

GoGo Class Action

Hochgeladen von

jeff_roberts881Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GoGo Class Action

Hochgeladen von

jeff_roberts881Copyright:

Verfügbare Formate

U

n

i

t

e

d

S

t

a

t

e

s

D

i

s

t

r

i

c

t

C

o

u

r

t

F

o

r

t

h

e

N

o

r

t

h

e

r

n

D

i

s

t

r

i

c

t

o

f

C

a

l

i

f

o

r

n

i

a

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

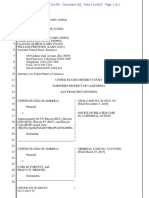

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF CALIFORNIA

JAMES STEWART, et al.,

Plaintiffs,

v.

GOGO, INC.,

Defendant.

___________________________________/

No. C-12-5164 EMC

ORDER DENYING DEFENDANTS

MOTION TO DISMISS SECOND

AMENDED COMPLAINT

(Docket No. 64)

Defendant Gogo, Inc. is a company that provides broadband internet access to passengers on

commercial aircraft. See SAC 11. Plaintiffs James Stewart, Joel Milne, and Joseph Strazullo have

filed a class action against Gogo, asserting that it has violated, inter alia, federal antitrust law

because it has an unlawful monopoly in the market for inflight internet access services on domestic

commercial airline flights within the continental United States. SAC 12. Currently pending

before the Court is Gogos motion to dismiss the second amended complaint (SAC).

Having considered the parties briefs and accompanying submissions, as well as the oral

argument of counsel, the Court hereby DENIES the motion to dismiss.

As before, the critical question for purposes of resolving the instant motion is whether

Plaintiffs complaint contains sufficient allegations that make an illegal exclusive dealing

arrangement between Gogo and the airlines plausible. See Ashcroft v. Iqbal, 129 S. Ct. 1937, 1949

(2009) (stating that [a] claim has facial plausibility when the plaintiff pleads factual content that

allows the court to draw the reasonable inference that the defendant is liable for the misconduct

alleged); see also Bell Atl. Corp. v. Twombly, 550 U.S. 544, 556 (2007). An exclusive dealing

Case3:l2-cv-05l64-EMC Document8l Filed0l/29/l4 Pagel of 4

U

n

i

t

e

d

S

t

a

t

e

s

D

i

s

t

r

i

c

t

C

o

u

r

t

F

o

r

t

h

e

N

o

r

t

h

e

r

n

D

i

s

t

r

i

c

t

o

f

C

a

l

i

f

o

r

n

i

a

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

2

arrangement is a problem only where its effect is to foreclose competition in a substantial share of

the line of commerce affected. Allied Orthopedic Appliances, Inc. v. Tyco Health Care Group LP,

592 F.3d 991, 996 (9th Cir. 2010).

Here, Plaintiffs maintain that there is substantial market foreclosure because Gogo and a

majority of the airlines providing commercial, domestic travel have entered into long-term,

exclusive contracts which locked up either the airlines entire fleet or near entire fleet of airplanes.

See SAC 22 (alleging that Gogo has entered into long-term exclusive agreements with most

domestic carriers pursuant to which Gogo is the exclusive provider permitted to provide internet

service for these carriers [sic] entire or near entire fleet). Plaintiffs specifically allege that Gogo

possesses 85% of the relevant market share. This specific and factual allegation is backed by

additional more specific factual allegations. Plaintiff allege facts about the numbers of aircraft and

airlines covered by Gogos exclusive dealing contracts. To support the allegations, Plaintiffs have

also submitted copies of many of the contracts Gogo had with the airlines along with other evidence

such as press releases, websites, etc.

Accordingly, Plaintiffs have done more than assert conclusory allegations of law or ultimate

facts. Cf. Allen v. Dairy Farmers of Am., Inc., 748 F. Supp. 2d 323, 340 (D. Vt. 2010) (stating that

[d]ismissals for insufficient pleading of market power are rare pre-discovery and are generally

reserved for complaints bereft of factual allegations or which contain market share or market power

allegations that are purely conclusory); see also Sun Microsys., Inc. v. Versata Enters., 630 F.

Supp. 2d 395, 403 (D. Del. 2009) (stating that Versata did not allege facts pertaining to Suns share

of the relevant market, instead relying on conclusory assertions that Suns conduct has achieved,

or has a dangerous probability of achieving monopoly power, and that there is a dangerous

probability of Sun achieving monopoly power in the relevant market). Hence, the issue is not

specificity, but plausibility of Plaintiffs claims.

Gogo argues that the alleged facts are erroneous and incomplete: that because Plaintiffs fail

to explain the 85% figure (given there is only incomplete information about the numerator and no

information about the denominator in reaching the 85% ratio), they have failed to allege a plausible

claim for relief. However, the level of justification and factual detail Gogo demands exceeds that

Case3:l2-cv-05l64-EMC Document8l Filed0l/29/l4 Page2 of 4

U

n

i

t

e

d

S

t

a

t

e

s

D

i

s

t

r

i

c

t

C

o

u

r

t

F

o

r

t

h

e

N

o

r

t

h

e

r

n

D

i

s

t

r

i

c

t

o

f

C

a

l

i

f

o

r

n

i

a

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

1

See e.g., SAC 53 (pointing to the high cost of infrastructure required to build a network

capable of offering inflight internet connectivity and restrictive legal and regulatory hurdles (e.g.,

[f]or land-based systems, such as Gogos ATG network, the [FCC] must provide and approved the

required frequency spectrum for such transmissions to take place).

3

required in the context of a Rule 12(b)(6) motion. These are matters appropriately left for discovery.

If Gogo believes the 85% is erroneous, it can seek permission to file an early motion for summary

adjudication and limit initial discovery accordingly. If it believes Plaintiffs had no good faith basis

for their allegations, Gogo can move for relief under Rule 11. In short, there are other case

management tools to address Gogos concerns besides Rule 12.

To be sure, the Court is cognizant that there may be problems with some of Plaintiffs

allegations. Gogo never had a contract with Southwest and its contract with United contained terms

indicating that the entirety (or near entirety) of Uniteds fleet was not locked up for a significant

period of time (contrary to Plaintiffs representation). The Court is also cognizant of the fact that

Southwest and United are two of the biggest providers of commercial, domestic airline travel a

point that neither party disputes. These facts legitimately put into question Plaintiffs assertion that

Gogo possesses at least an 85% market share of all commercial aircraft servicing flights within the

continental United States. SAC 22.

Nevertheless, even if the 85% figure is not correct, Plaintiffs allege with specificity other

major airlines including American, Delta, and US Air whose fleets in their entirety or near

entirety are or were locked up by Gogos contract. Thus, it is plausible that even if not a 85%

market share, Gogo has a substantial enough market share such that, together with the allegations in

Plaintiffs complaint that there are high barriers to entry,

1

a substantial share of the market has been

foreclosed. See Theme Promotions, Inc. v. News Am. Mktg. FSI, 546 F.3d 991, 1002-03 (9th Cir.

2008) (noting that a 45-70% market share may be enough to establish a substantial share of the

relevant market where it is accompanied by other factors like fragmentation of competition and high

entry barriers).

The Court it is not persuaded by Gogos argument that there is no substantial market

foreclosure because it is relatively easy for airlines to get out of the contracts. Plaintiffs allege

Gogos contracts with the airlines largely provide that they may not be terminated except in limited

Case3:l2-cv-05l64-EMC Document8l Filed0l/29/l4 Page3 of 4

U

n

i

t

e

d

S

t

a

t

e

s

D

i

s

t

r

i

c

t

C

o

u

r

t

F

o

r

t

h

e

N

o

r

t

h

e

r

n

D

i

s

t

r

i

c

t

o

f

C

a

l

i

f

o

r

n

i

a

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

4

circumstances e.g., unless the airline would suffer competitive harm from not using a competitors

superior services. To the extent Gogo argues that agreements are in fact easy to terminate because

AirTran recently terminated its agreement (and moved to competitor Row 44 after Southwest and

AirTran merged), see Mot. at 5, it should be noted that, in an SEC filing, Gogo specifically stated:

[W]e believe that AirTrans connectivity agreement does not permit it to deinstall our equipment

from these aircraft under these circumstances. Docket No. 26 (Abye Decl., Ex. B at 36) (emphasis

added). In fact, Gogo initiated a lawsuit in Illinois state court, asking for a preliminary injunction to

bar AirTran from installing Gogos equipment in violation of their contract. See Docket No. 26

(Abye Decl., Ex. B at 36). While Gogo ultimately did not succeed, the fact that it took significant

litigation and an attempted appeal to resolve the matter (see Docket No. 66 (Abye Decl., Ex. B at

64)), suggests the agreements are not easily terminated. In any event, for purposes of Rule 12(b)(6),

Plaintiffs have sufficiently alleged a plausible claim that the contracts are not easily terminable.

Accordingly, the Court concludes that Plaintiffs have alleged plausible antitrust claims for

purposes of Rule 12(b)(6) and denies Gogos motion to dismiss. Gogo shall respond to the operative

complaint within thirty (30) days from the date of this order.

This order disposes of Docket No. 64.

IT IS SO ORDERED.

Dated: January 29, 2014

_________________________

EDWARD M. CHEN

United States District Judge

Case3:l2-cv-05l64-EMC Document8l Filed0l/29/l4 Page4 of 4

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- FOIA LetterDokument6 SeitenFOIA Letterjeff_roberts881100% (3)

- Defendants' Motion To DismissDokument37 SeitenDefendants' Motion To Dismissjeff_roberts881100% (4)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Marbury vs. Madison Case DigestDokument1 SeiteMarbury vs. Madison Case DigestChen Cordovez Pacala Hermosilla100% (2)

- Hapag-Lloyd Bill of Lading Terms and ConditionsDokument2 SeitenHapag-Lloyd Bill of Lading Terms and ConditionsThuAnNoch keine Bewertungen

- SEC v. Coinbase, Coinbase Pre-Motion Letter - 12 (C) MotionDokument4 SeitenSEC v. Coinbase, Coinbase Pre-Motion Letter - 12 (C) Motionjeff_roberts881Noch keine Bewertungen

- FB Biometrics FilingDokument74 SeitenFB Biometrics Filingjeff_roberts881Noch keine Bewertungen

- D.E. 1 - FTX Class Action Complaint and Demand For Jury TrialDokument41 SeitenD.E. 1 - FTX Class Action Complaint and Demand For Jury Trialjeff_roberts881100% (1)

- ECF 1 - Complaint - 20-Cv-2747Dokument22 SeitenECF 1 - Complaint - 20-Cv-2747jeff_roberts881Noch keine Bewertungen

- Coinbase Class ActionDokument26 SeitenCoinbase Class Actionjeff_roberts881100% (1)

- 11-7-18 Letter To Judge Irizarry Requesting Pre-Motion Conference (Filed) (00168166xDE802)Dokument3 Seiten11-7-18 Letter To Judge Irizarry Requesting Pre-Motion Conference (Filed) (00168166xDE802)jeff_roberts881Noch keine Bewertungen

- Tax Cuts and Jobs Act - Full TextDokument429 SeitenTax Cuts and Jobs Act - Full TextWJ Editorial Staff0% (1)

- BLDF Defense Filing - 4.26.23Dokument39 SeitenBLDF Defense Filing - 4.26.23jeff_roberts881Noch keine Bewertungen

- Binance ComplaintDokument12 SeitenBinance Complaintjeff_roberts881Noch keine Bewertungen

- SEC v. Coinbase, Coinbase Answer To ComplaintDokument177 SeitenSEC v. Coinbase, Coinbase Answer To Complaintjeff_roberts881100% (1)

- Jarrett - DRAFT Complaint 05-18-2021Dokument8 SeitenJarrett - DRAFT Complaint 05-18-2021jeff_roberts881Noch keine Bewertungen

- Harris Timothy Mckimmy Opensea: I. (A) PlaintiffsDokument2 SeitenHarris Timothy Mckimmy Opensea: I. (A) Plaintiffsjeff_roberts881Noch keine Bewertungen

- FINAL - Tornado Cash ComplaintDokument20 SeitenFINAL - Tornado Cash Complaintjeff_roberts881Noch keine Bewertungen

- Coinbase MurderDokument7 SeitenCoinbase Murderjeff_roberts881Noch keine Bewertungen

- Coinbase Regulatory Framework FinalDokument28 SeitenCoinbase Regulatory Framework Finaljeff_roberts881Noch keine Bewertungen

- Ripple V SEC ProceduralDokument2 SeitenRipple V SEC Proceduraljeff_roberts881Noch keine Bewertungen

- Silk Road OrderDokument3 SeitenSilk Road Orderjeff_roberts881Noch keine Bewertungen

- Preliminary Statement To Ripple Answer 1.27.20Dokument8 SeitenPreliminary Statement To Ripple Answer 1.27.20jeff_roberts881Noch keine Bewertungen

- Ripple XRP ContractDokument9 SeitenRipple XRP Contractjeff_roberts881Noch keine Bewertungen

- FB Class ActionDokument57 SeitenFB Class Actionjeff_roberts881100% (1)

- 2019-09-09 Filed Opinion (DCKT)Dokument38 Seiten2019-09-09 Filed Opinion (DCKT)jeff_roberts881Noch keine Bewertungen

- Coinbase - Order Denying Mot To Compel, Mot To Dismiss in Part - 8!6!19Dokument8 SeitenCoinbase - Order Denying Mot To Compel, Mot To Dismiss in Part - 8!6!19jeff_roberts881Noch keine Bewertungen

- Ripple CounterclaimDokument41 SeitenRipple Counterclaimjeff_roberts881Noch keine Bewertungen

- Manafort IndictmentDokument31 SeitenManafort IndictmentKatie Pavlich100% (5)

- Shutterfly RulingDokument19 SeitenShutterfly Rulingjeff_roberts881Noch keine Bewertungen

- Coinbase IRS RulingDokument12 SeitenCoinbase IRS Rulingjeff_roberts881100% (1)

- Palin V NY Times - Opinion and Order Dismissing LawsuitDokument26 SeitenPalin V NY Times - Opinion and Order Dismissing LawsuitLegal InsurrectionNoch keine Bewertungen

- Coinbase Summons DetailsDokument10 SeitenCoinbase Summons Detailsjeff_roberts881Noch keine Bewertungen

- 2 - BA Attack OutlineDokument41 Seiten2 - BA Attack OutlineJenna AliaNoch keine Bewertungen

- Samuel Arnado vs. Atty AdazaDokument15 SeitenSamuel Arnado vs. Atty AdazaGerald HernandezNoch keine Bewertungen

- Aaa v. BBB Gr212448Dokument7 SeitenAaa v. BBB Gr212448Zen JoaquinNoch keine Bewertungen

- Dynamic Conservation EasementsDokument41 SeitenDynamic Conservation Easementsduncansother100% (1)

- Kelley v. Fashion Nova - Order Transferring VenueDokument4 SeitenKelley v. Fashion Nova - Order Transferring VenueSarah BursteinNoch keine Bewertungen

- Court of Appeals Decision Overturned in Land Dispute CaseDokument9 SeitenCourt of Appeals Decision Overturned in Land Dispute Casekarl doceoNoch keine Bewertungen

- RCPI v. Lantin rules on execution pending appealDokument2 SeitenRCPI v. Lantin rules on execution pending appealJunelyn T. EllaNoch keine Bewertungen

- 26 Li Yao vs. CIRDokument2 Seiten26 Li Yao vs. CIRMichelle Montenegro - AraujoNoch keine Bewertungen

- Dichoso, Jr. vs. MarcosDokument3 SeitenDichoso, Jr. vs. MarcosgeelovesgalaxyboyNoch keine Bewertungen

- SC Decision on Recovery of Possession Case Involving Land in Baliuag, BulacanDokument20 SeitenSC Decision on Recovery of Possession Case Involving Land in Baliuag, BulacanTaga BukidNoch keine Bewertungen

- Land Titles and Deeds SyllabusDokument11 SeitenLand Titles and Deeds SyllabusPafra BariuanNoch keine Bewertungen

- #51 PNB Vs CA and MataDokument1 Seite#51 PNB Vs CA and MataEleasar Banasen PidoNoch keine Bewertungen

- Belgium V SenegalDokument33 SeitenBelgium V SenegalAida ZaidiNoch keine Bewertungen

- (PC) Ludrate Burton v. L. Rumsey, Et Al. - Document No. 5Dokument1 Seite(PC) Ludrate Burton v. L. Rumsey, Et Al. - Document No. 5Justia.comNoch keine Bewertungen

- Stokes Vs MalayanDokument3 SeitenStokes Vs MalayanMary Fatima BerongoyNoch keine Bewertungen

- Position of Operational Creditors Under IBC - by Karan ChopraDokument4 SeitenPosition of Operational Creditors Under IBC - by Karan ChopraKritiKrishnaNoch keine Bewertungen

- Yu Bun Guan v. OngDokument1 SeiteYu Bun Guan v. Ongiwamawi100% (1)

- Answers to 2017 Bar Exam QuestionsDokument18 SeitenAnswers to 2017 Bar Exam QuestionsGarfit BumacasNoch keine Bewertungen

- Presotea Confidentiality AgreementDokument2 SeitenPresotea Confidentiality AgreementNha Nguyen HoangNoch keine Bewertungen

- Blueprint Studios Trends v. Theoni - ComplaintDokument40 SeitenBlueprint Studios Trends v. Theoni - ComplaintSarah BursteinNoch keine Bewertungen

- Complaint in Rem AcpaDokument9 SeitenComplaint in Rem AcpamschwimmerNoch keine Bewertungen

- THAN - Motion by AIG Companies To Reopen Bankruptcy Case To Enforce Audit RightsDokument88 SeitenTHAN - Motion by AIG Companies To Reopen Bankruptcy Case To Enforce Audit RightsKirk Hartley0% (1)

- G.R. No. 150429Dokument5 SeitenG.R. No. 150429kmanligoyNoch keine Bewertungen

- Usufruct cases 2013-2014Dokument1 SeiteUsufruct cases 2013-2014Shammah Rey MahinayNoch keine Bewertungen

- Notice of Intent To File A LawsuitDokument2 SeitenNotice of Intent To File A LawsuitFreedomofMind80% (5)

- In Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Dokument2 SeitenIn Re Estate of Joseph F. Abely, Deceased. William F. Abeley, Co-Executor v. Commissioner of Internal Revenue, 489 F.2d 1327, 1st Cir. (1974)Scribd Government DocsNoch keine Bewertungen

- Santana-Diaz v. United States, 86 F.3d 1146, 1st Cir. (1996)Dokument2 SeitenSantana-Diaz v. United States, 86 F.3d 1146, 1st Cir. (1996)Scribd Government DocsNoch keine Bewertungen

- Charles Hook Gordon Logie WillDokument11 SeitenCharles Hook Gordon Logie WillLee DrewNoch keine Bewertungen