Beruflich Dokumente

Kultur Dokumente

Infosys Results Q3-2008-09

Hochgeladen von

Niranjan Prasad0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

38 Ansichten4 SeitenInfosys Results Q3-2008-09

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenInfosys Results Q3-2008-09

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

38 Ansichten4 SeitenInfosys Results Q3-2008-09

Hochgeladen von

Niranjan PrasadInfosys Results Q3-2008-09

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Report for the third quarter ended December 31, 2008

Infosys Technologies Limited

Regd. Office: Electronics City, Hosur Road,

Bangalore 560 100, India

Tel : 91 80 2852 0261 Fax : 91 80 2852 0362

Letter to the shareholder

Dear Shareholder,

We are delighted to report an outstanding quarter despite a challenging environment coupled with drastic movement in cross currencies. Our revenues stood at

Rs. 5,786 crore, an increase of 35.5% from the corresponding quarter last fiscal. The sequential revenue growth was 6.8%. Operating margins increased sequentially

to 31.9% from 29.9% in the corresponding quarter last fiscal. As per the International Financial Reporting Standards (IFRS), the third quarter revenues stood at

US$ 1,171 million, an increase of 8.0% from the corresponding quarter last fiscal. The revenue growth in constant currency terms was 14.6% and the sequential

revenue growth in constant currency terms was 1.0%.

We evinced an all-round performance. Infosys and its subsidiaries associated themselves with 30 new clients, and added 5,997 employees (gross) during the

quarter. Our Retail practice and Banking and Financial services registered growth. Finacle, Infosys universal banking solution, gained strong momentum in

Europe, Middle East, and Australia. Our offshore volume of work increased, indicating clients interest in getting value for their money in a challenging economic

environment. We are well positioned to meet this requirement as we have been consistently focusing on training and certification of our employees. Nonetheless,

we have enhanced our investment in these areas.

We are also increasingly focusing on value-based pricing models for our offerings to augment value for our clients. In the second quarter, we had launched our

retail solution, ShoppingTrip360. This quarter, we partnered with Bharti Airtel to enhance the customer experience of its Direct-to-Home TV service through

Infosys Digital Convergence Platform.

Leading companies across industries continue to value our work. An energy major sought Infosys help to transform its IT shared services organization supporting

its oil, gas and power businesses globally. A manufacturing firm chose Infosys to support its global sales and distribution SAP platform. An aircraft company

engaged Infosys in software acceptance testing and quality measurements of its applications.

We endure as a trusted transformation partner for clients in the Banking and Financial services industry. A leading bank engaged Infosys in multiple projects

such as customizing services, running targeted advertisement campaigns to improve cross-sell rates, and streamlining the companys online product application

process. A credit rating agency partnered with Infosys to implement and support its CRM to analyze campaigns and segment its customers better.

Our engineering services continue to see high traction. An aero-structures company engaged Infosys to design, develop and analyze aircraft structures. For one

aerospace company, we are developing fuselage structures and for another, we are engineering aircraft structure, systems, interiors and wiring harness.

We continue to perform well in newer markets. Infosys will manage the transition of applications for an insurance and banking company that is restructuring its

core systems to improve overall efficiency. A Middle Eastern company consulted Infosys to set up the business process of its insurance division. The engagement

includes developing the companys business requirements and planning for business analysis.

Our position as an industry leader was strengthened by accolades received from several industry bodies and customers. Infosys is now a member of The Global

Dow, an index that measures blue chips by size, reputation and importance. We won the Outsourcing Institute and Vantage Partners first-ever customer relationship

management award. We were recognized in the Most Admired Knowledge Enterprise (MAKE) study for our excellence in knowledge management. NASSCOM

acclaimed the best practices of Infosys Womens Inclusivity Network (IWIN) to promote gender empowerment and leadership development. Infosys BPO won

the 2008 Six Sigma and Business Improvement Award for Organizational Business Improvement in Transactional Services at the third Annual Global Lean, Six

Sigma & Business Improvement Summit, USA.

As part of our efforts to increase transparency and disclosure levels on financial reporting in the country, we have started the practice of adding a disclosure

relating to detailed information on our cash and bank balances in our financial statements, starting this quarter.

An excellent third quarter validates our business model as well as our skilled and talented employees, yet again. The economic environment continues to remain

challenging and we believe we will emerge stronger when the economic situation improves. We close this quarter on a note of optimism and look forward to

meeting our guidance of Rs. 5,494 crore to Rs. 5,699 crore for the fourth quarter. We thank our investors, employees, customers, and all stakeholders and seek

your continued support.

Bangalore

January 13, 2009

S. Gopalakrishnan

Chief Executive Officer and

Managing Director

S. D. Shibulal

Chief Operating Officer

and Director

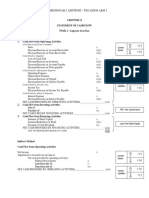

Select Financial Data Indian GAAP (Consolidated)

Profit and loss account for the quarter ended

in Rs. crore, except per share data

December 31, 2008 December 31, 2007 Year-on-year

Growth (%)

September 30, 2008 Sequential

Growth (%)

Income from software services, products

and business process management

5,786 4,271 35.5 5,418 6.8

Software development and business

process management expenses

3,075 2,325 32.3 2,891 6.4

Gross profit 2,711 1,946 39.3 2,527 7.3

Operating expenses:

Selling and marketing expenses 274 205 33.7 303 (9.6)

General and administration expenses 406 349 16.3 430 (5.6)

Total operating expenses 680 554 22.7 733 (7.2)

Operating profit before depreciation and

minority interest

2,031 1,392 45.9 1,794 13.2

Depreciation 187 153 22.2 177 5.6

Operating profit before tax and

minority interest

1,844 1,239 48.8 1,617 14.0

Other income, net 40 158 (74.7) 66 (39.4)

Provision for Investment (2)

Net profit before tax and

minority interest

1,882 1,397 34.7 1,683 11.8

Provision for taxation* 241 166 45.2 251 (3.9)

Net profit after tax and before

minority interest

1,641 1,231 33.3 1,432 14.6

Minority interest

Net profit after tax and minority interest 1,641 1,231 33.3 1,432 14.6

Earnings per share (Equity shares,

par value Rs. 5/- each)

Basic 28.66 21.54 33.1 25.02 14.5

Diluted 28.63 21.47 33.3 24.97 14.7

*Provision for taxation includes reversal of tax provisions amounting to Rs. 62 crore and Rs. 50 crore for the quarter ended December 31, 2008 and 2007 respectively.

Balance sheet

in Rs. crore

December 31, 2008 March 31, 2008

Sources of funds

Shareholders funds 17,516 13,795

Minority interest

17,516 13,795

Application of funds

Fixed assets 5,272 4,777

Sundry debtors 3,510 3,297

Cash and cash equivalents ** 9,686 8,307

Deferred tax assets 138 119

Other net current assets (1,090) (2,705)

17,516 13,795

**Including liquid mutual funds, deposits with corporations and certificates of deposit

Select Financial Data IFRS (Consolidated)

Income statement for the quarter ended

in United States Dollar millions, except per share data

December 31, 2008 December 31, 2007 Year-on-year

Growth (%)

September 30, 2008 Sequential

Growth (%)

Revenues $1,171 $1,084 8.0 $1,216 (3.7)

Cost of sales 661 629 5.1 691 (4.3)

Gross profit $510 $455 12.1 $525 (2.9)

Operating expenses

Selling and marketing expenses 55 52 5.8 68 (19.1)

Administrative expenses 82 89 (7.9) 96 (14.6)

Total operating expenses 137 141 (2.8) 164 (16.5)

Operating profit $373 $314 18.8 $361 3.3

Other income / (expense) (39) (3) (28) 39.3

Finance income 46 43 7.0 43 7.0

Profit before income taxes 380 354 7.3 376 1.1

Income tax expense* 48 42 14.3 56 (14.3)

Net Profit 332 312 6.4 320 3.8

Attributable to:

Minority interest

Equity holders 332 312 6.4 320 3.8

Net Profit $332 $312 6.4 $320 3.8

Earnings per equity share

Basic $0.58 $0.55 5.5 $0.56 3.6

Diluted $0.58 $0.55 5.5 $0.56 3.6

*Income tax expense includes reversal of income tax amounting to $12 million and $13 million, for the quarter ended December 31, 2008 and 2007 respectively.

Balance sheet data as at

in United States Dollar millions

December 31, 2008 March 31, 2008

Cash and cash equivalents ** $1,948 $2,058

Available-for-sale financial assets 18

Investments in certificates of deposit 41

Trade receivables 721 824

Property, plant and equipment 938 1,022

Other assets 568 585

Total assets $4,216 $4,507

Other liabilities 612 591

Total equity 3,604 3,916

Total liabilities and equity $4,216 $4,507

**Cash and cash equivalents include deposits with corporations

Ratio analysis Indian GAAP consolidated

Quarter ended

December 31, 2008 December 31, 2007 September 30, 2008

Software development expenses / total revenue (%) 53.15 54.44 53.36

Gross profit / total revenue (%) 46.85 45.56 46.64

SG&A expenses / total revenue (%) 11.75 12.97 13.53

Operating profit / total revenue (%) 35.10 32.59 33.11

Tax / PBT (%) **** 16.10 15.46 14.91

Days sales outstanding (DSO) (LTM) 62 60 68

Cash and cash equivalents / total assets (%) *** 55.30 54.25 55.65

ROCE (PBIT / average capital employed) (%) (LTM) 40.55 42.10 41.21

Return on average invested capital (%) (LTM) *** 70.94 72.05 73.58

*** Investments in liquid mutual fund units and certificates of deposit have been considered as cash and cash equivalents for the above ratio analysis

****The effective tax rate for the quarter ended December 31, 2008 and December 31, 2007 has been calculated excluding the reversal of tax provisions amounting to Rs. 62 crore and

Rs. 50 crore respectively.

LTM - Last Twelve Months

Select Financial Data U.S. GAAP (Consolidated)

Income statement for the quarter ended

in United States Dollar millions, except per share data

December 31, 2008 December 31, 2007 Year-on-year

Growth (%)

September 30, 2008 Sequential

Growth (%)

Revenues $1,171 $1,084 8.0 $1,216 (3.7)

Cost of revenues 661 629 5.1 690 (4.2)

Gross profit 510 455 12.1 526 (3.0)

Operating income 371 312 18.9 359 3.3

Net income $330 $310 6.5 $318 3.8

Balance Sheet data as at

in United States Dollar millions

December 31, 2008 March 31, 2008

Cash and cash equivalents ** $1,948 $2,058

Investments in liquid mutual fund units 18

Investment in certificates of deposit 41

Trade accounts receivable, net of allowances 721 824

Property, plant and equipment, net 938 1,022

Other assets 551 570

Total assets $4,199 $4,492

Other liabilities 606 582

Total stockholders equity 3,593 3,910

Total liabilities and stockholders equity $4,199 $4,492

**Cash and cash equivalents include deposits with corporations

Additional Information

The following information for the quarter and nine months ended December 31, 2008 is available in the Investors section of our website (www.infosys.com)

Audited balance sheet, profit & loss account, cash flow statement, schedules, significant accounting policies and notes on accounts for the quarter and 1.

nine months ended December 31, 2008 and the related auditors report: Indian GAAP standalone and Indian GAAP consolidated.

Ratio analysis and shareholder information. 2.

Infosys is concerned about the environment and utilizes natural resources in a sustainable way. To this end, we have sent the quarterly report via email to

shareholders who have updated their email addresses with the depository participant. We request you to kindly update your email addresses with your depositary

participant. Your cooperation will help conserve paper and minimize our impact on the environment.

This Report is furnished to investors for informational purposes only. Investors should continue to rely on the official filed versions of financial statements and

related information and not rely on this Report while making investment decisions. Investors in our securities registered and traded in the United States of

America should rely on official filings with the United States Securities and Exchange Commission.

Safe Harbour

Certain statements in this release concerning our future growth prospects are forward-looking statements, within the meaning of Section 27A of the U.S. Securities

Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, which involve a number of risks and uncertainties that could

cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are

not limited to, risks and uncertainties regarding the success of our investments, risks and uncertainties regarding fluctuations in earnings, our ability to sustain

our previous levels of profitability, our ability to manage growth, intense competition in information technology, business process outsourcing and consulting

services including those factors which may affect our cost advantage, wage increases in India, our ability to attract and retain highly skilled professionals, time

and cost overruns on fixed-price, fixed-time frame contracts, client concentration, restrictions on immigration, industry segment concentration, our ability to

manage our international operations, reduced demand for technology in our key focus areas, disruptions in telecommunication networks or system failures,

our ability to successfully complete and integrate potential acquisitions, liability for damages on our service contracts, the success of the companies in which

we have made strategic investments, withdrawal of governmental fiscal incentives, political instability and regional conflicts, legal restrictions on raising capital

or acquiring companies outside India, unauthorized use of our intellectual property, economic slowdowns or adverse economic conditions in the markets for

our services and general economic conditions affecting our industry . Additional risks that could affect our future operating results are more fully described in

our United States Securities and Exchange Commission filings including our Annual Report on Form 20-F for the fiscal year ended March 31, 2008, Quarterly

Reports on Form 6-K for the quarters ended June 30, 2008 and September 30, 2008 and our other recent filings. These filings are available at www.sec.gov.

We may, from time to time, make additional written and oral forward-looking statements, including statements contained in our filings with the Securities and

Exchange Commission and our reports to shareholders. We do not undertake to update any forward-looking statements that may be made from time to time

by or on our behalf.

Das könnte Ihnen auch gefallen

- 1001 CHeckmates Fred - Reinfeld PDFDokument269 Seiten1001 CHeckmates Fred - Reinfeld PDFNiranjan Prasad90% (10)

- Facebook - DCF ValuationDokument9.372 SeitenFacebook - DCF ValuationDibyajyoti Oja0% (2)

- Wal-Mart Case Study ProjectDokument33 SeitenWal-Mart Case Study ProjectThomas Burton80% (5)

- Complete Notes On Special Sit Class Joel GreenblattDokument307 SeitenComplete Notes On Special Sit Class Joel Greenblattrc753450% (2)

- CH 05 - Consolidation of Less-than-Wholly Owned Subsidiaries PDFDokument71 SeitenCH 05 - Consolidation of Less-than-Wholly Owned Subsidiaries PDFjonjon111Noch keine Bewertungen

- NIST Risk Management FrameworkDokument93 SeitenNIST Risk Management FrameworkNiranjan PrasadNoch keine Bewertungen

- Aimr - Investing Separately Alpha and Beta PDFDokument102 SeitenAimr - Investing Separately Alpha and Beta PDFAnonymous Mgq9dupCNoch keine Bewertungen

- GenpactDokument57 SeitenGenpactAlan JacobNoch keine Bewertungen

- Grade 11 TestDokument4 SeitenGrade 11 TestTherese de VeraNoch keine Bewertungen

- TridentDokument65 SeitenTridentEr Puneet GoyalNoch keine Bewertungen

- Report For The Third Quarter Ended December 31, 2010: Letter To The ShareholderDokument4 SeitenReport For The Third Quarter Ended December 31, 2010: Letter To The ShareholderharikirthikaNoch keine Bewertungen

- Report For The Second Quarter Ended September 30, 2009: Letter To The ShareholderDokument4 SeitenReport For The Second Quarter Ended September 30, 2009: Letter To The ShareholderAshutosh KumarNoch keine Bewertungen

- Report For The Second Quarter Ended September 30, 2011: Letter To The ShareholderDokument4 SeitenReport For The Second Quarter Ended September 30, 2011: Letter To The ShareholderNiranjan PrasadNoch keine Bewertungen

- Infosys Results Q3-2009-10Dokument4 SeitenInfosys Results Q3-2009-10Niranjan PrasadNoch keine Bewertungen

- Infosys Results Q2-2007-08Dokument4 SeitenInfosys Results Q2-2007-08Niranjan PrasadNoch keine Bewertungen

- Report For The Third Quarter Ended December 31, 2011: Letter To The ShareholderDokument4 SeitenReport For The Third Quarter Ended December 31, 2011: Letter To The ShareholderfunaltymNoch keine Bewertungen

- Infosys Results Q1-2009-10Dokument4 SeitenInfosys Results Q1-2009-10Niranjan PrasadNoch keine Bewertungen

- Infosys Results Q2-2005-06Dokument4 SeitenInfosys Results Q2-2005-06Niranjan PrasadNoch keine Bewertungen

- Infosys Technologies: Cautious in The Realm of Rising UncertaintyDokument7 SeitenInfosys Technologies: Cautious in The Realm of Rising UncertaintyAngel BrokingNoch keine Bewertungen

- Report For The First Quarter Ended June 30, 2012: Letter To The ShareholderDokument4 SeitenReport For The First Quarter Ended June 30, 2012: Letter To The Shareholderjimaerospace05Noch keine Bewertungen

- Information Services Group Announces Third Quarter Financial ResultsDokument6 SeitenInformation Services Group Announces Third Quarter Financial ResultsfdopenNoch keine Bewertungen

- Q1 Revenues Grew by 13.3% Year On Year Sequentially Grew by 4.3%Dokument7 SeitenQ1 Revenues Grew by 13.3% Year On Year Sequentially Grew by 4.3%Aradhya SrivastavaNoch keine Bewertungen

- Financial Statement AnalysisDokument18 SeitenFinancial Statement AnalysisSaema JessyNoch keine Bewertungen

- Q1 Revenues Grew by 12.7% Year On Year Sequentially Declined by 2.9%Dokument8 SeitenQ1 Revenues Grew by 12.7% Year On Year Sequentially Declined by 2.9%dhwaneelNoch keine Bewertungen

- Patni Q3 Earnings Release Sealed 2011Dokument5 SeitenPatni Q3 Earnings Release Sealed 2011Subbiah SomasundaramNoch keine Bewertungen

- Kellton Tech Surges Ahead in 2014-15Dokument18 SeitenKellton Tech Surges Ahead in 2014-15api-234474152Noch keine Bewertungen

- Information Services Group Announces Second Quarter Financial ResultsDokument6 SeitenInformation Services Group Announces Second Quarter Financial Resultsappelflap2Noch keine Bewertungen

- HCL Technologies Financial ReportsDokument2 SeitenHCL Technologies Financial ReportsMechWindNaniNoch keine Bewertungen

- Cubic Annual Report 2010 Editorial RevDokument32 SeitenCubic Annual Report 2010 Editorial RevRyan MichaelNoch keine Bewertungen

- Bharti Airtel Annual Report 2012Dokument240 SeitenBharti Airtel Annual Report 2012Saurav PatroNoch keine Bewertungen

- Datamatics Global Services LTD.: StocksDokument28 SeitenDatamatics Global Services LTD.: Stocksjespo barretoNoch keine Bewertungen

- TCS Q3 Revenues at $1,483 Million: EspañolDokument3 SeitenTCS Q3 Revenues at $1,483 Million: Españolxyris_sNoch keine Bewertungen

- iGATE Reports Q1 RevenuesDokument16 SeiteniGATE Reports Q1 RevenuesRashikh Khan RashikhkhanNoch keine Bewertungen

- Thomas Cook CommunicationDokument8 SeitenThomas Cook CommunicationArvind SinghNoch keine Bewertungen

- TCS Financial Results: Quarter I FY 2014 - 15Dokument28 SeitenTCS Financial Results: Quarter I FY 2014 - 15Bethany CaseyNoch keine Bewertungen

- Management Discussion AnalysisDokument5 SeitenManagement Discussion AnalysisSumit TodiNoch keine Bewertungen

- Consol FY11 Annual Fin StatementDokument13 SeitenConsol FY11 Annual Fin StatementLalith RajuNoch keine Bewertungen

- Ig Group Annualres - Jul12Dokument39 SeitenIg Group Annualres - Jul12forexmagnatesNoch keine Bewertungen

- Facebook Reports Third Quarter 2018 ResultsDokument11 SeitenFacebook Reports Third Quarter 2018 ResultsNivetha ThomasNoch keine Bewertungen

- HCL Infosystems Limited: Q1 FY17 Investor UpdateDokument13 SeitenHCL Infosystems Limited: Q1 FY17 Investor UpdateRajasekhar Reddy AnekalluNoch keine Bewertungen

- Performance Highlights: NeutralDokument13 SeitenPerformance Highlights: NeutralAngel BrokingNoch keine Bewertungen

- Bharti Airtel Annual Report 2012 PDFDokument240 SeitenBharti Airtel Annual Report 2012 PDFnikhilcsitmNoch keine Bewertungen

- Accounting Report FinalDokument10 SeitenAccounting Report FinalAhmer FarooqNoch keine Bewertungen

- Session 1 Financial Accounting Infor Manju JaiswallDokument41 SeitenSession 1 Financial Accounting Infor Manju JaiswallpremoshinNoch keine Bewertungen

- Wipro AnalysisDokument20 SeitenWipro AnalysisYamini NegiNoch keine Bewertungen

- Infosys vs. TcsDokument30 SeitenInfosys vs. TcsRohit KumarNoch keine Bewertungen

- 18 Financial StatementsDokument35 Seiten18 Financial Statementswsahmed28Noch keine Bewertungen

- Bharti Airtel Annual Report Full 2010-2011Dokument164 SeitenBharti Airtel Annual Report Full 2010-2011Sidharth ChopraNoch keine Bewertungen

- DB Corp: Key Management TakeawaysDokument6 SeitenDB Corp: Key Management TakeawaysAngel BrokingNoch keine Bewertungen

- Introduction InfosysDokument10 SeitenIntroduction InfosysHarshit Rathod0% (1)

- Tcs v. InfosysDokument40 SeitenTcs v. Infosysneetapai3859Noch keine Bewertungen

- Declaration: "Ebit & Eps of Wipro Limited" Project ReportDokument24 SeitenDeclaration: "Ebit & Eps of Wipro Limited" Project ReportRohit ChoudharyNoch keine Bewertungen

- RPC Annual Report 2009-2010Dokument124 SeitenRPC Annual Report 2009-2010Prabhath KatawalaNoch keine Bewertungen

- Elpl 2009 10Dokument43 SeitenElpl 2009 10kareem_nNoch keine Bewertungen

- FM Assignment 2Dokument20 SeitenFM Assignment 2Earl FarragoNoch keine Bewertungen

- PI Industries DolatCap 141111Dokument6 SeitenPI Industries DolatCap 141111equityanalystinvestorNoch keine Bewertungen

- AR2008Dokument98 SeitenAR2008Joko YanNoch keine Bewertungen

- Infosys Balance SheetDokument28 SeitenInfosys Balance SheetMM_AKSINoch keine Bewertungen

- Infosys Technologies LimitedDokument14 SeitenInfosys Technologies LimitedGosai JaydeepNoch keine Bewertungen

- Larsen and Toubro Infotech LimitedDokument55 SeitenLarsen and Toubro Infotech Limitedlopcd8881Noch keine Bewertungen

- Q2 Revenues Grew by 16.7% Year On Year Sequentially Grew by 4.5%Dokument6 SeitenQ2 Revenues Grew by 16.7% Year On Year Sequentially Grew by 4.5%FirstpostNoch keine Bewertungen

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDokument4 SeitenHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152Noch keine Bewertungen

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Management Consulting Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandManagement Consulting Services Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Sales Financing Revenues World Summary: Market Values & Financials by CountryVon EverandSales Financing Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Executive Placement Service Revenues World Summary: Market Values & Financials by CountryVon EverandExecutive Placement Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Professional & Management Development Training Revenues World Summary: Market Values & Financials by CountryVon EverandProfessional & Management Development Training Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Fragile States Index 2015: TotalDokument8 SeitenFragile States Index 2015: TotalNiranjan PrasadNoch keine Bewertungen

- Urdu VocabularyDokument5 SeitenUrdu VocabularyNiranjan PrasadNoch keine Bewertungen

- Christian MonasteriesDokument5 SeitenChristian MonasteriesNiranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2008Dokument152 SeitenInfosys Annual Report 2008Niranjan PrasadNoch keine Bewertungen

- My Top Scotch Picks: Niranjan Prasad 5 October, 2014Dokument6 SeitenMy Top Scotch Picks: Niranjan Prasad 5 October, 2014Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2007Dokument178 SeitenInfosys Annual Report 2007Niranjan PrasadNoch keine Bewertungen

- Infosys Results Q1-2009-10Dokument4 SeitenInfosys Results Q1-2009-10Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2006Dokument176 SeitenInfosys Annual Report 2006Niranjan PrasadNoch keine Bewertungen

- Infosys Results Q2-2005-06Dokument4 SeitenInfosys Results Q2-2005-06Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2003Dokument198 SeitenInfosys Annual Report 2003Niranjan PrasadNoch keine Bewertungen

- Infy Subsidiaries Financial 2010 11Dokument146 SeitenInfy Subsidiaries Financial 2010 11Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2005Dokument208 SeitenInfosys Annual Report 2005Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2004Dokument156 SeitenInfosys Annual Report 2004Niranjan PrasadNoch keine Bewertungen

- Infosys Annual Report 2009Dokument168 SeitenInfosys Annual Report 2009Niranjan PrasadNoch keine Bewertungen

- Sourav - Khemka 2010Dokument2 SeitenSourav - Khemka 2010Saket KhaitanNoch keine Bewertungen

- A Study On Potential of Life Insurance Industry in Gulbarga MarketDokument54 SeitenA Study On Potential of Life Insurance Industry in Gulbarga MarketDayarathod DayaNoch keine Bewertungen

- Inti Agri Resources TBK.: Company Report: January 2019 As of 31 January 2019Dokument3 SeitenInti Agri Resources TBK.: Company Report: January 2019 As of 31 January 2019Yohanes ImmanuelNoch keine Bewertungen

- 3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant ExampleDokument6 Seiten3 B Business Plan Financial Projections - Moderate Complexity - Using Restaurant Examplemohd_shaarNoch keine Bewertungen

- R&D Productivity in The Chemical Industry: Blev@stern - Nyu.eduDokument35 SeitenR&D Productivity in The Chemical Industry: Blev@stern - Nyu.eduSanty MustikaNoch keine Bewertungen

- Monetary Theory PDFDokument34 SeitenMonetary Theory PDFGypsy HeartNoch keine Bewertungen

- Valuation MethodologyDokument2 SeitenValuation MethodologyJatin KalraNoch keine Bewertungen

- FTP ExercisesDokument34 SeitenFTP ExercisesRummanBinAhsanNoch keine Bewertungen

- Chapter 10 Measuring Outcomes of Brand Equity Capturing Market PerformanceDokument13 SeitenChapter 10 Measuring Outcomes of Brand Equity Capturing Market PerformanceprosmaticNoch keine Bewertungen

- By David Harding and Georgia Nakou, Winton Capital ManagementDokument5 SeitenBy David Harding and Georgia Nakou, Winton Capital ManagementCoco BungbingNoch keine Bewertungen

- Antelope 21 December 2015Dokument3 SeitenAntelope 21 December 2015Viswanathan SrkNoch keine Bewertungen

- RFQ Qualification ZistDokument2 SeitenRFQ Qualification ZistRajeev GargNoch keine Bewertungen

- Ichimoku Cloud Definition and UsesDokument9 SeitenIchimoku Cloud Definition and Usesselozok1Noch keine Bewertungen

- The Dow TheoryDokument2 SeitenThe Dow TheoryaNoch keine Bewertungen

- RELATIVE VALUATION Theory PDFDokument5 SeitenRELATIVE VALUATION Theory PDFPrateek SidharNoch keine Bewertungen

- English For Accounting A - Z Word List: Email - Wordlist Copy - QXD 4/4/07 3:40 PM Page 1Dokument8 SeitenEnglish For Accounting A - Z Word List: Email - Wordlist Copy - QXD 4/4/07 3:40 PM Page 1Do NguyenNoch keine Bewertungen

- NISM KotakDokument167 SeitenNISM KotakSachin Kumar100% (2)

- Capital MarketDokument41 SeitenCapital MarketAhmed Jan DahriNoch keine Bewertungen

- 2Dokument36 Seiten2Amit PoddarNoch keine Bewertungen

- Wakala ModelDokument24 SeitenWakala ModelNurul Syuhada Ismail0% (1)

- Bali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock ReturnsDokument51 SeitenBali Brown Tang 2016 Dec Is Economic Uncertainty Priced in The Cross-Section of Stock Returnsroblee1Noch keine Bewertungen

- About Hantec MarketsDokument12 SeitenAbout Hantec MarketsSrini VasanNoch keine Bewertungen

- Materi Chapter 23 Cash FlowDokument2 SeitenMateri Chapter 23 Cash FlowM Reza andriantoNoch keine Bewertungen

- Introduction To Business 16 BUS101: Chapter 21: Accounting FundamentalsDokument11 SeitenIntroduction To Business 16 BUS101: Chapter 21: Accounting Fundamentalsnahidul202Noch keine Bewertungen

- Msci Indonesia Esg Leaders Index Usd GrossDokument3 SeitenMsci Indonesia Esg Leaders Index Usd GrossputraNoch keine Bewertungen