Beruflich Dokumente

Kultur Dokumente

How Stocks and The Stock Market Work.

Hochgeladen von

Andreea CristeaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How Stocks and The Stock Market Work.

Hochgeladen von

Andreea CristeaCopyright:

Verfügbare Formate

How Stocks and the Stock Market Work.

A Simple Example

Let's say that you want to start a business, and you decide to open a restaurant. You go out and buy a building, buy all the kitchen equipment, tables and chairs that you need, buy your supplies and hire your cooks, ser ers, etc. You ad ertise and open your doors. Let's say that!

You spend "#$$,$$$ buying the building and the equipment. %n the &irst year, you spend "'#$,$$$ on supplies, &ood and the payroll &or your employees. At the end o& your &irst year, you add up all o& the money you ha e recei ed &rom customers and &ind that your total income is "($$,$$$.

Since you ha e made "($$,$$$ and paid out the "'#$,$$$ &or expenses, your net profit is! $300,000 (income) - $2 0,000 (expense) ! $ 0,000 (profit) At the end o& the second year, you bring in "('#,$$$ and your expenses remain the same, &or a net pro&it o& ")#,$$$. At this point, you decide that you want to sell the business. *hat is it worth+ ,ne way to look at it is to say that the business is -worth- "#$$,$$$. %& you close the restaurant, you can sell the building, the equipment and e erything else and get "#$$,$$$. .his is a simpli&ication, o& course // the building probably went up in alue, and the equipment went down because it is now used. Let's 0ust say that things balance out to "#$$,$$$. .his is the asset "a#$e, or %ook "a#$e, o& the business // the alue o& all o& the business's assets i& you sold them outright today. 1owe er, i& you keep it going, it will probably make at least ")#,$$$ this year // you know that &rom your history with the business. .here&ore, you can think o& the restaurant as an in estment that will pay out something like ")#,$$$ in interest e ery year. Looking at it that way, someone might be willing to pay ")#$,$$$ &or the restaurant, as a ")#,$$$ return per year on a ")#$,$$$ in estment represents a 2$/percent rate o& return. Someone might e en be willing to pay "2,#$$,$$$, which represents a #/percent rate o& return, or more i& he or she thought that the restaurant's income would grow and increase earnings o er time at a rate &aster than the rate o& in&lation. .he restaurant's owner, there&ore, will set the price accordingly. You might price the restaurant at "2,#$$,$$$. *hat i& 2$ people come to you and say, -*ow, % would like to buy your restaurant but % don't ha e "2,#$$,$$$.- You might want to somehow di ide your restaurant into 2$ equal pieces and sell each piece &or "2#$,$$$. %n other words, you might sell shares in the restaurant. .hen, each person who bought a share would recei e one/tenth o& the pro&its at the end o& the year, and each person would ha e one out o& 2$ otes in any business

decisions. ,r, you might di ide ownership up into 2,#$$ shares and sell each share &or "2,$$$ to make the price something that more people could a&&ord. ,r, you might di ide ownership up into (,$$$ shares, keep 2,#$$ &or yoursel&, and sell the remaining shares &or "#$$ each. .hat way, you retain a ma0ority o& the shares 3and there&ore the otes4 and remain in control o& the restaurant while sharing the pro&it with other people. %n the meantime, you get to put ")#$,$$$ in the bank when you sell the 2,#$$ shares to other people. Stock, at its core, is really that simple. %t represents ownership o& a company's assets and pro&its. A di"idend on a share o& stock represents that share's portion o& the company's pro&its, generally dispersed yearly. %& the restaurant has 2$ owners, each owning one share o& stock, and the restaurant makes ")#,$$$ in pro&it during the year, then each owner gets a di idend o& "),#$$. A large company like %56 has millions o& shares o& stock outstanding // around 2.2 billion in ,ctober, 2777 3see this page &or details4. %n this case, the total pro&its o& the company are di ided by 2.2 billion and sent to the shareholders as di idends. ,ne measure o& the alue o& a company, at least as &ar as in estors are concerned, is the product o& the number o& outstanding shares multiplied by the share price. .his alue is called the capita#i&ation o& the company.

.he 5asic %dea

%& % am a pri ate citi8en who owns a restaurant, and % am selling my restaurant stock to other pri ate citi8ens in the community, % might do the whole transaction by word/o&/mouth, or by placing an ad in the newspaper. .his makes selling the stock easy &or me. 1owe er, it creates a problem down the line &or in estors who want to sell their stock in the restaurant. .he seller has to go out and &ind a buyer, which can be hard. A -stock market- sol es this problem. Stocks in publicly traded companies are bought and sold at a stock market 3also known as a stock exchan'e4. .he 9ew York Stock Exchange 39YSE4 is an example o& such a market. %n your neighborhood, you ha e a -supermarket- that sells &ood. .he reason you go the supermarket is because you can go to one place and buy all o& the di&&erent types o& &ood that you need in one stop // it's a lot more con enient than dri ing around to the butcher, the dairy &armer, the baker, etc. .he 9YSE is a supermarket &or stocks. .he 9YSE can be thought o& as a big room where e eryone who wants to buy and sell shares o& stocks can go to do their buying and selling. .he exchange makes buying and selling easy. You don't ha e to actually tra el to 9ew York to isit the 9ew York Stock Exchange // you can call a stock %roker who does business with the 9YSE, and he or she will go to the 9YSE on your behal& to buy or sell your stock. %& the exchange did not exist, buying or selling stock would be a lot harder. You would ha e to place a classi&ied ad in the newspaper, wait &or a call and haggle on a price whene er you wanted to sell stock. *ith an exchange in place, you can buy and sell shares instantly.

.he stock exchange has an interesting side e&&ect. 5ecause all the buying and selling is concentrated in one place, it allows the price o& a stock to be known e ery second o& the day. .here&ore, in estors can watch as a stock's price &luctuates based on news &rom the company, media reports, national economic news and lots o& other &actors. 5uyers and sellers take all o& these &actors into account. So, &or example, when the :AA 3:ederal A iation Administration4 shut down the company ;alu<et &or a month in <une 277=, the alue o& the stock plummeted. %n estors could not be sure that the airline represented a -going concern- and began selling, dri ing the price down. .he asset alue o& the company acted as a &loor on the share price. .he price o& a stock also re&lects the di idend that the stock pays, the pro0ected earnings o& the company in the &uture, the price o& tea in >hina 3especially Lipton stock4 and so on.

>orporations

Any business that wants to sell shares o& stock to a number o& di&&erent people does so by turning itsel& into a corporation. .he process o& turning a business into a corporation is called incorporatin'. %& you start a restaurant by taking your own money to buy the building and the equipment, then what you ha e done is &ormed a so#e proprietorship. You own the entire restaurant yoursel& // you get to make all o& the decisions and you keep all o& the pro&it. %& three people pool their money together and start a restaurant as a team, what they ha e done is &ormed a partnership. .he three people own the restaurant themsel es, sharing the pro&it and decision/making. A corporation is di&&erent, and it is a pretty interesting concept. A corporation is a - irtual person-. .hat is, a corporation is registered with the go ernment, it has a social security number 3known as a federa# tax () n$m%er4, it can own property, it can go to court to sue people, it can be sued and it can make contracts. 5y de&inition, a corporation has stock that can be bought and sold, and all o& the owners o& the corporation hold shares o& stock in the corporation to represent their ownership. ,ne incredibly interesting characteristic o& this - irtual person- is that it has an inde&inite and potentially in&inite li&e span. .here is a whole body o& law that controls corporations // these laws are in place to protect the shareholders and the public. .hese laws control a number o& things about how a corporation operates and is organi8ed. :or example, e ery corporation has a %oard of directors 3i& all o& the shares o& a corporation are owned by one person, then that one person can decide that there will only be one person on the board o& directors, but there is still a board4. .he shareholders in the company meet e ery year to ote on the people &or the board. .he board o& directors makes the decisions &or the company. %t hires the o&&icers 3the president and other ma0or o&&icers o& the company4, makes the company's

decisions and sets the company's policies. .he board o& directors can be thought o& as the -brain- o& the - irtual person.:rom this description, you can see that a corporation has a group o& owners // the shareholders. .he owners elect a board o& directors to make the company's ma0or decisions. .he owners o& a corporation become owners by buying shares o& stock in the corporation. .he board o& directors decides how many total shares there will be. :or example, a company might ha e one million shares o& stock. .he company can either be pri"ate#* he#d or p$%#ic#* he#d. %n a pri ately held company, the shares o& stock are owned by a small number o& people who probably all know one another. .hey buy and sell their shares amongst themsel es. A publicly held company is owned by thousands o& people who trade their shares on a public stock exchange. ,ne o& the big reasons why corporations exist is to create a structure &or collecting lots o& in estment dollars in a business. Let's say that you would like to start your own airline. 6ost people cannot do this, because an airplane costs millions o& dollars. An airline needs a whole &leet o& planes and other equipment, plus it has to hire a lot o& employees. A person who wants to start an airline will there&ore &orm a corporation and sell stock in order to collect the money needed to get started. A corporation is an easy way to gather large quantities o& in"estment capita# // money &rom in estors. *hen a corporation &irst sells stock to the public, it does so in an (+, 3%nitial ?ublic ,&&ering4. .he company might sell one million shares o& stock at "'$ a share to raise "'$ million ery quickly 3that is a simpli&ication // the brokerage house in charge o& the %?, will extract its &ee &rom the "'$ million, but let's ignore that here4. .he company then in ests the "'$ million in equipment and employees. .he in estors 3the shareholders who bought the "'$ million in stock4 hope that with the equipment and employees, the company will make a pro&it and pay a di idend. Another reason that corporations exist is to limit the #ia%i#it* o& the owners to some extent. %& the corporation gets sued, it is the corporation that pays the settlement. .he corporation may go out o& business, but that is the worst that can happen. %& you are a sole proprietor who owns a restaurant and the restaurant gets sued, you are the one who is being sued. -You- and -the restaurant- are the same thing. %& you lose the suit then you, personally, can lose e erything you own in the process.

Stock ?rices

Let's say that a new corporation is created and in its %?, it raises "'$ million by selling one million shares &or "'$ a share. .he corporation buys its equipment and hires its employees with that money. %n the &irst year, when all the income and expenses are added up, the company makes a pro&it o& "2 million. .he board

o& directors o& the company can decide to do a number o& things with that "2 million! %t could put it in the bank and sa e it &or a rainy day. %t could decide to gi e all o& the pro&its to its shareholders, so it would declare a di idend o& "2 per share. %t could use the money to buy more equipment and hire more employees to expand the company. %t could pick some combination o& these three options. %& a company traditionally pays out most its pro&its to its shareholders, it is generally called an income stock. .he shareholders get income &rom the company's pro&its. %& the company puts most o& the money back into the business, it is called a 'rowth stock. .he company is trying to grow larger by increasing the amount o& equipment and the number o& people who run it. .he price o& an income stock tends to stay &airly &lat. .hat is, &rom year to year, the price o& the stock tends to remain about the same unless pro&its 3and there&ore di idends4 go up. ?eople are getting their money each year and the business is not growing. .his would be the case &or stock in a single restaurant that distributes all o& its pro&its to the shareholders each year. Let's say that the single restaurant decides, &or se eral years, to sa e its pro&its, and e entually it opens a second restaurant. .hat is the beha ior o& a 'rowth compan*. .he alue o& the stock rises because, when the second restaurant opens, there is twice as much equipment and twice as much pro&it being earned by the company. %n a growth stock, the shareholders do not get a yearly di idend, but they own a company whose alue is increasing. .here&ore, the shareholders can get more money when they sell their shares // someone buying the stock would see the increasing book alue o& the company 3the alue o& the buildings, equipment, etc.4 and the increasing pro&it that the company is earning and, based on these &actors, pay a higher price &or the stock. %n a publicly traded company, all o& the &inancial in&ormation about the company is public. .he Securities and Exchange >ommission 3SE>4 is in charge o& collecting this in&ormation and making it a ailable to in estors. Shareholders also use a number o& other indicators to determine how much a stock is worth. ,ne simple indicator is the price-earnin's ratio. .his is the price o& the stock di ided by the earnings per share. .here are all sorts o& indicators like these, as well as a great deal o& other &inancial in&ormation a ailable on any stock. You can look up all o& it on the *eb in thousands o& di&&erent places // see the links at the end o& this article &or details.

Stock A erages

E ery day on the news you hear about the )ow .ones (nd$stria# /"era'e , and other a erages like the S0+ 00 or 1he 2$sse# 2000. .hese are broad market a erages designed to tell you how companies traded on the stock market are doing in general. :or example, the @ow <ones %ndustrial A erage is simply the a erage alue o& ($ large, industrial stocks. 5ig companies like Aeneral 6otors, Aoodyear, %56 and Exxon are the companies that make up this index 3this page

tells you which companies are currently in the @ow <ones a erage4. .he SB? #$$ is the a erage alue o& #$$ large companies. .he Cussel '$$$ index a erages the alues o& ',$$$ smaller companies. *hat these a erages tell you is the general health o& stock prices as a whole. %& the economy is -doing well,- then the prices o& stocks as a group tend to rise in what is re&erred to as a -%$## market.- %& it is -doing poorly,- prices as a group tend to &all in what is called a -%ear market.- .he a erages re eal these tendencies in the market as a whole.

Exchanges and 5rokers

.here are three big stock exchanges in the Dnited States! 34S5 / 9ew York Stock Exchange /M56 / American Stock Exchange 3/S)/7 / 9ational Association o& Securities @ealers A company -lists- its stock on an exchange. :or example, the 9YSE has about (,$$$ companies listed. According to the 9YSE!

At the end o& 9o ember, 277E, there were (,2$F companies with stock listed on the 9YSE. .hese companies had o er '(= billion shares worth a total o& "2$.2 trillion a ailable &or trading on the Exchange, gi ing the 9YSE the world's largest market capitali8ation 3in global market/ alue terms, the total global alue o& the 9YSE/listed companies exceeded "2'.E trillion4.

Anyone who wants to buy or sell stock in any o& these (,$$$ or so companies goes to the 9ew York Stock Exchange to do it. ,& course, no one wants to &ly to 9ew York to buy or sell their shares. A person there&ore calls a stock %roker in a &irm that is authori8ed to trade at the exchange. .here are do8ens o& such brokerage houses, including such &amiliar names as 6errill Lynch, >harles Schwab and 6organ Stanley. *hen you call up a broker at one o& these companies, he or she relays your trade to the &loor o& the appropriate exchange, and a representati e o& the company 3or, more commonly, a computer representing the company4 makes the trade on your behal&. You pay the broker a commission 3generally "2$ to "2$$ per trade, depending on the broker4 to pro ide this ser ice to you. Stocks that are not listed on an exchange are sold ,"er 1he 8o$nter 3,.>4. ,.> stocks are generally in smaller, riskier companies. Dsually, an ,.> stock is stock in a company that does not meet the requirements o& an exchange.

Das könnte Ihnen auch gefallen

- Welcome-to-FAITH (Script)Dokument11 SeitenWelcome-to-FAITH (Script)qnetexposedNoch keine Bewertungen

- Clil Humanities and Social Science 6: As Easy As 1, 2, 3 MillionDokument3 SeitenClil Humanities and Social Science 6: As Easy As 1, 2, 3 MillionAngela OcañaNoch keine Bewertungen

- Safal Niveshak InvestmentDokument70 SeitenSafal Niveshak InvestmentTrilok Chand Gupta100% (1)

- IPO - NetworthDokument73 SeitenIPO - NetworthsaiyuvatechNoch keine Bewertungen

- Bahan Ajar RetailDokument10 SeitenBahan Ajar RetailSalma MahmudNoch keine Bewertungen

- WWW - Referat.ro-Engleza Pentru AfaceriDokument22 SeitenWWW - Referat.ro-Engleza Pentru Afacerirazvan65Noch keine Bewertungen

- How To Make Money in The Stock MarketDokument15 SeitenHow To Make Money in The Stock Marketnirav_k_pathakNoch keine Bewertungen

- 10 Mistakes Every Investor Makes and How To Avoid ThemDokument26 Seiten10 Mistakes Every Investor Makes and How To Avoid ThemCarmenMoldovan100% (1)

- How Stocks and The Stock Market WorkDokument2 SeitenHow Stocks and The Stock Market WorkShikhar ParekhNoch keine Bewertungen

- Swing Trading: From Zero to Hero Learn How to Make Money in the Stock Market in this Simple Guide for BeginnersVon EverandSwing Trading: From Zero to Hero Learn How to Make Money in the Stock Market in this Simple Guide for BeginnersBewertung: 3 von 5 Sternen3/5 (1)

- Binary Options BullyDokument54 SeitenBinary Options BullyWilliam Merino QuinterosNoch keine Bewertungen

- How Stock Market WorksDokument9 SeitenHow Stock Market Worksmansi_patel150Noch keine Bewertungen

- Busplan 1Dokument12 SeitenBusplan 1api-254287085Noch keine Bewertungen

- Mandee's Stock Market Lesson Number TwoDokument3 SeitenMandee's Stock Market Lesson Number TwoJon Vincent DeaconNoch keine Bewertungen

- Mandee's Stock Lesson Number 1Dokument2 SeitenMandee's Stock Lesson Number 1Jon Vincent DeaconNoch keine Bewertungen

- Project MergersDokument42 SeitenProject MergersKaran DhantoleNoch keine Bewertungen

- Chapter 3:-Forms of Business OrganizationDokument7 SeitenChapter 3:-Forms of Business OrganizationErnee ZolkafleNoch keine Bewertungen

- Article On Introduction To ERPDokument8 SeitenArticle On Introduction To ERPSwapnil YeoleNoch keine Bewertungen

- Fashion Show HRM ObjectivesDokument2 SeitenFashion Show HRM ObjectivesMark Rainer Yongis LozaresNoch keine Bewertungen

- Stock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksVon EverandStock Market Investing For Beginners - Fundamentals On How To Successfully Invest In StocksNoch keine Bewertungen

- Objective of The StudyDokument68 SeitenObjective of The StudyArchie SrivastavaNoch keine Bewertungen

- Busplan 1Dokument13 SeitenBusplan 1api-254374254Noch keine Bewertungen

- What You Won't Find Here:: So You Want To Become A Professional Trader?Dokument27 SeitenWhat You Won't Find Here:: So You Want To Become A Professional Trader?athos8000Noch keine Bewertungen

- Doing Business in AustraliaDokument5 SeitenDoing Business in Australiaandreea143Noch keine Bewertungen

- Stocks A Newbies' Guide: An Everyday Guide to the Stock Market: Newbies Guides to Finance, #3Von EverandStocks A Newbies' Guide: An Everyday Guide to the Stock Market: Newbies Guides to Finance, #3Bewertung: 4.5 von 5 Sternen4.5/5 (4)

- True Money ManagementDokument12 SeitenTrue Money Managementeldosrajan100% (2)

- Title 1 - How Any Small Buisness Can Create A Flood of New Sales... With One Often Ignored Direct Marketing SecretDokument22 SeitenTitle 1 - How Any Small Buisness Can Create A Flood of New Sales... With One Often Ignored Direct Marketing SecretJason MitchellNoch keine Bewertungen

- Stock Market For BeginnersDokument23 SeitenStock Market For BeginnersMRT10Noch keine Bewertungen

- SU VRSN XOM USB BK DVADokument2 SeitenSU VRSN XOM USB BK DVAdanarasmussenNoch keine Bewertungen

- ENGL191 Extra Credit 7Dokument6 SeitenENGL191 Extra Credit 7Armielyn PagaduanNoch keine Bewertungen

- How To Start BuissnessDokument14 SeitenHow To Start BuissnesscbhattNoch keine Bewertungen

- 1035unit 1 FranchisingDokument18 Seiten1035unit 1 FranchisingMagdalena Bonis100% (1)

- How Stocks and The Stock Market WorkDokument16 SeitenHow Stocks and The Stock Market WorkVictoria GomezNoch keine Bewertungen

- Running Head:: Business PlanDokument12 SeitenRunning Head:: Business PlanSha SharonNoch keine Bewertungen

- Li Ka ShingDokument6 SeitenLi Ka ShingMarc Edwards100% (1)

- Secrets of a Serial Entrepreneur: A Business Dragon's Guide to SuccessVon EverandSecrets of a Serial Entrepreneur: A Business Dragon's Guide to SuccessNoch keine Bewertungen

- Quickstart Guide TO: InvestingDokument21 SeitenQuickstart Guide TO: InvestingAmir Syazwan Bin MohamadNoch keine Bewertungen

- Market Strategy Part IIDokument2 SeitenMarket Strategy Part IIJon Vincent Deacon100% (1)

- Golden RulesDokument4 SeitenGolden RulesCharlie True FriendNoch keine Bewertungen

- Books. This Is Not Linked With Any Organization. This Project Will Help TheDokument63 SeitenBooks. This Is Not Linked With Any Organization. This Project Will Help TheBharat Ahuja0% (1)

- Bulls On Wall StreetDokument50 SeitenBulls On Wall StreetKushal RaoNoch keine Bewertungen

- Stock Market 101: Investing for Beginners: 3 Hour Crash CourseVon EverandStock Market 101: Investing for Beginners: 3 Hour Crash CourseBewertung: 5 von 5 Sternen5/5 (1)

- The FOREX Master PlanDokument13 SeitenThe FOREX Master Planvladislav.djuricNoch keine Bewertungen

- Unit 5-Size Matters in Bussiness pg.127Dokument30 SeitenUnit 5-Size Matters in Bussiness pg.127Maria Inez Lara Haeussler de MejicanoNoch keine Bewertungen

- Copywriting Notes 07 FinalDokument108 SeitenCopywriting Notes 07 FinalRohan SinghaniaNoch keine Bewertungen

- Stock Market Investing for Beginners & DummiesVon EverandStock Market Investing for Beginners & DummiesBewertung: 4.5 von 5 Sternen4.5/5 (25)

- How To Use PLR in Your Online BusinessDokument18 SeitenHow To Use PLR in Your Online BusinessKaren BanesNoch keine Bewertungen

- Starting Your Own Small Business Today On The CheapDokument3 SeitenStarting Your Own Small Business Today On The CheapRajkumar BevaraNoch keine Bewertungen

- Dividend Investing Explained In Less Than 45 PagesVon EverandDividend Investing Explained In Less Than 45 PagesNoch keine Bewertungen

- Xaviers Institute of Business Management StudiesDokument8 SeitenXaviers Institute of Business Management StudiesremoroNoch keine Bewertungen

- 25 Ways To Build Your Buyers List Susan Lassiter-LyonDokument4 Seiten25 Ways To Build Your Buyers List Susan Lassiter-Lyonkyle_luithlyNoch keine Bewertungen

- How Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueDokument3 SeitenHow Does ??? Impact The Three Financial Statements?: What Is APV?? Adjusted Present ValueSaakshi AroraNoch keine Bewertungen

- Muslim Investor: The Stock Market Made SimpleVon EverandMuslim Investor: The Stock Market Made SimpleBewertung: 5 von 5 Sternen5/5 (1)

- How They Make A Living Out Of Flying First Class For CheapVon EverandHow They Make A Living Out Of Flying First Class For CheapNoch keine Bewertungen

- Calusarii Horia Barbu OprisanDokument146 SeitenCalusarii Horia Barbu OprisanAndreea Cristea50% (2)

- Nita Ibrian p2Dokument31 SeitenNita Ibrian p2Andreea CristeaNoch keine Bewertungen

- Bony Badlands Northwest Stinger's CornerDokument1 SeiteBony Badlands Northwest Stinger's CornerAndreea CristeaNoch keine Bewertungen

- Soflex OverNight English BookletDokument17 SeitenSoflex OverNight English BookletAndreea CristeaNoch keine Bewertungen

- Parte 3 Medical PlantsDokument46 SeitenParte 3 Medical PlantsAndreea CristeaNoch keine Bewertungen

- How File Compression WorksDokument4 SeitenHow File Compression WorksAndreea CristeaNoch keine Bewertungen

- 1285 15Dokument4 Seiten1285 15Andreea CristeaNoch keine Bewertungen

- Runes Are An Ancient Germanic AlphabetDokument43 SeitenRunes Are An Ancient Germanic AlphabetAndreea CristeaNoch keine Bewertungen

- Anglais OverconsumptionDokument3 SeitenAnglais OverconsumptionAnas HoussiniNoch keine Bewertungen

- About Debenhams Company - Google SearchDokument1 SeiteAbout Debenhams Company - Google SearchPratyush AnuragNoch keine Bewertungen

- Dessert Banana Cream Pie RecipeDokument2 SeitenDessert Banana Cream Pie RecipeimbuziliroNoch keine Bewertungen

- Baseball Stadium Financing SummaryDokument1 SeiteBaseball Stadium Financing SummarypotomacstreetNoch keine Bewertungen

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityDokument15 SeitenOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraNoch keine Bewertungen

- 13th Format SEX Format-1-1: Share This DocumentDokument1 Seite13th Format SEX Format-1-1: Share This DocumentDove LogahNoch keine Bewertungen

- I See Your GarbageDokument20 SeitenI See Your GarbageelisaNoch keine Bewertungen

- Timeline of American OccupationDokument3 SeitenTimeline of American OccupationHannibal F. Carado100% (3)

- Part I Chapter 1 Marketing Channel NOTESDokument25 SeitenPart I Chapter 1 Marketing Channel NOTESEriberto100% (1)

- Case Report On Salford Estates (No. 2) Limited V AltoMart LimitedDokument2 SeitenCase Report On Salford Estates (No. 2) Limited V AltoMart LimitedIqbal MohammedNoch keine Bewertungen

- Linking Social Science Theories/Models To EducationDokument2 SeitenLinking Social Science Theories/Models To EducationAlexa GandioncoNoch keine Bewertungen

- Quality Audit Report TemplateDokument3 SeitenQuality Audit Report TemplateMercy EdemNoch keine Bewertungen

- Mock 10 Econ PPR 2Dokument4 SeitenMock 10 Econ PPR 2binoNoch keine Bewertungen

- Cantorme Vs Ducasin 57 Phil 23Dokument3 SeitenCantorme Vs Ducasin 57 Phil 23Christine CaddauanNoch keine Bewertungen

- California Department of Housing and Community Development vs. City of Huntington BeachDokument11 SeitenCalifornia Department of Housing and Community Development vs. City of Huntington BeachThe Press-Enterprise / pressenterprise.comNoch keine Bewertungen

- Computer Engineering Project TopicsDokument5 SeitenComputer Engineering Project Topicskelvin carterNoch keine Bewertungen

- Statis Pro Park EffectsDokument4 SeitenStatis Pro Park EffectspeppylepepperNoch keine Bewertungen

- Deed OfAdjudication Cresencio Abuluyan BasilioDokument4 SeitenDeed OfAdjudication Cresencio Abuluyan BasilioJose BonifacioNoch keine Bewertungen

- People vs. PinlacDokument7 SeitenPeople vs. PinlacGeenea VidalNoch keine Bewertungen

- Abnormal Psychology: A Case Study of Disco DiDokument7 SeitenAbnormal Psychology: A Case Study of Disco DiSarah AllahwalaNoch keine Bewertungen

- Mormond History StudyDokument16 SeitenMormond History StudyAndy SturdyNoch keine Bewertungen

- ,وثيقة تعارفDokument3 Seiten,وثيقة تعارفAyman DarwishNoch keine Bewertungen

- Mulanay SummaryDokument1 SeiteMulanay SummaryJex Lexell BrionesNoch keine Bewertungen

- Sally Tour: TOUR ITINRARY With QuoteDokument2 SeitenSally Tour: TOUR ITINRARY With QuoteGuillermo Gundayao Jr.Noch keine Bewertungen

- UNIDO EIP Achievements Publication FinalDokument52 SeitenUNIDO EIP Achievements Publication FinalPercy JacksonNoch keine Bewertungen

- Persephone and The PomegranateDokument3 SeitenPersephone and The PomegranateLíviaNoch keine Bewertungen

- CTC VoucherDokument56 SeitenCTC VoucherJames Hydoe ElanNoch keine Bewertungen

- Mentor-Mentee 2020-2021Dokument17 SeitenMentor-Mentee 2020-2021sivakulanthayNoch keine Bewertungen

- Expense ReportDokument8 SeitenExpense ReportAshvinkumar H Chaudhari100% (1)

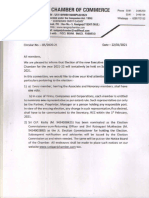

- EC-21.PDF Ranigunj ChamberDokument41 SeitenEC-21.PDF Ranigunj ChamberShabbir MoizbhaiNoch keine Bewertungen