Beruflich Dokumente

Kultur Dokumente

Holding Semiannual Value Levels at 3930 / 3920 Nasdaq Keys Stability.

Hochgeladen von

Richard SuttmeierOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

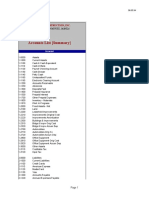

Holding Semiannual Value Levels at 3930 / 3920 Nasdaq Keys Stability.

Hochgeladen von

Richard SuttmeierCopyright:

Verfügbare Formate

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com. ValuEngine is a fundamentally-based quant research firm in Melbourne, FL.

ValuEngine covers over 8,000 stocks every day. A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks, and commentary can be found http://www.valuengine.com/nl/mainnl To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe?

February 6, 2014 Holding semiannual value levels at 3930 / 3920 Nasdaq keys stability.

If the Nasdaq holds my semiannual value levels at 3930 / 3920 stocks should rebound to semiannual pivots at 1764 S&P 500, 7245 Dow Transports and 1133.29 Russell 2000. In-between is my quarterly pivot at 7086 on Dow Transports. If this weeks closes are below the five-week modified moving averages at 16,062 Dow Industrials, 1805.4 S&P 500, 4105 Nasdaq, 7280 Dow Transports and 1142.52 Russell 2000 all five weekly charts will shift to negative confirming the January highs as cycle highs as the equity bubbles start to pop. My market call for 2014 is that all five major averages will test their 200-day simple moving averages at 15,479 Dow Industrials, 1709.4 S&P 500, 3747 Nasdaq, 6706 Dow Transports and 1060.30 Russell 2000. The Dow Industrial Average has been below its 200-day the last two days. My annual value levels are: 14,835 / 13,467 Dow Industrials, 1539.1 / 1442.1 S&P 500, 3471 / 3063 Nasdaq, 6249 / 5935 Dow Transports and 966.72 / 879.39 Russell 2000. US Treasury Yields - The yield on the US Treasury 10-Year note (2.671%) set a new 2014 low at 2.570% on Monday and remains below its 21-day and 50-day SMAs at 2.792% and 2.839% with a quarterly pivot at 2.628% and the 200-day SMA at 2.555%. The weekly chart still favors lower yields with its five-week MMA at 2.798% and the 200-week at 2.448%. The yield on the US Treasury 30Year bond (3.649%) set a new 2014 low at 3.525% on Monday and remains below its 21-day, 50-day and 200-day SMAs at 3.724%, 3.814% and 3.611%. The weekly chart still favors lower with its fiveweek MMA at 3.759% and 200-week at 3.566%. Comex Gold ($1257.3) has a positive daily chart with its 21-day, 50-day and 200-day SMAs at $1247.3, $1236.2 and $1315.2. The weekly chart is neutral with its 5-week MMA at $1248.2. Nymex Crude Oil ($97.32) has a neutral daily chart with its 21-day, 50-day and 200-day SMAs at $95.24 and $96.14 and $99.30. The weekly chart is positive with its five-week MMA and 200-week SMA at $96.33 and $92.68. The Euro (1.3535) has a negative daily chart with the 21-day, 50-day and 200-day SMAs at 1.3600, 1.3650 and 1.3382. The weekly chart is negative with five-week at 1.3599 and 200-week at 1.3312. Daily Dow: (15,440) has a negative but oversold daily chart with its 21-day, 50-day and 200-day SMAs at 16,097, 16,116 and 15,479. The weekly chart is negative with the five-week MMA at 16,060 and the 200-week at 12,886. My annual value levels are 14,835 and 13,467 with monthly and semiannual risky levels at 15,986 and 16,245, the Dec. 31 all-time intraday high at 16,588.25 and

quarterly and semiannual risky levels at 16,761 and 16,860. S&P 500 (1751.64) has a negative but oversold daily chart with the 21-day, 50-day and 200-day SMAs at 1810.9, 1810.1 and 1709.4. The weekly chart is negative with the five-week MMA at 1805.0 and the 200-week at 1385.0. Annual value levels are 1539.1 and 1442.1 with semiannual pivots at 1764.4 and 1797.3, my monthly risky level at 1832.9, the Jan. 15 all-time intraday high at 1850.84, and quarterly risky level at 1896.0. NASDAQ (4012) has a negative daily chart with the 21-day, 50-day and 200-day SMAs at 4138, 4100 and 3747. The weekly chart shifts to negative with a close this week below its five-week MMA at 4103. My semiannual and annual value levels are 3930, 3920, 3471 and 3063 with the Jan. 22 multiyear intraday high at 4246.55 and monthly and quarterly risky levels at 4267 and 4274. NASDAQ 100 (NDX) (3455) has a negative but oversold daily chart with the 21-day, 50-day and 200-day SMAs at 3546, 3523 and 3214. The weekly chart shifts to negative with a close this week below its five-week MMA at 3522. My annual value levels are 3078 and 2669 with semiannual pivots at 3458 and 3456, a monthly risky level at 3639, the Jan. 22 multiyear intraday high at 3634.65 and quarterly risky level at 3714. Dow Transports (7076) has a negative but oversold daily chart with 21-day, 50-day and 200-day SMAs at 7334, 7273 and 6706. The weekly chart shifts to negative with a close this week below the five-week MMA at 7289. My annual value levels are 6249 and 5935 with quarterly and semiannual pivots at 7086 and 7245, semiannual and monthly risky levels at 7376 and 7412 and the Jan.23 alltime high at 7591.43. Russell 2000 (1093.59) has a negative but oversold daily chart with the 21-day, 50-day and 200-day SMAs at 1146.97, 1140.19 and 1060.30. The weekly chart shifts to negative with a close this week below the five-week MMA at 1142.02. My annual value levels are 966.72 and 879.39 with semiannual pivots at 1133.29, 1130.79, quarterly and monthly risky level at 1180.35 and 1189.18 and the Jan. 22 all-time intraday high at 1182.04. The SOX (518.46) has a negative but oversold daily chart with the 21-day, 50-day and 200-day SMAs at 532.01, 523.36 and 489.40. The weekly chart shifts to negative with a close this week below its five-week MMA at 525.08. My semiannual and annual value levels are 490.52, 371.58 and 337.74 with my semiannual risky level at 548.36. Dow Utilities - (496.53) has a neutral daily chart with the 21-day, 50-day and 200-day SMAs at 494.28, 489.47 and 493.62. The weekly chart is positive with the five-week MMA at 493.59. My annual and quarterly value levels are 497.53 and 496.84 with monthly and semiannual pivots at 504.53 and 504.74 with semiannual and annual risky levels at 524.37 and 548.70. To learn more about ValuEngine check out www.ValuEngine.com. Any comments or questions contact me at RSuttmeier@gmail.com.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Power of The Pivots Continue For The Major Equity Averages.Dokument2 SeitenThe Power of The Pivots Continue For The Major Equity Averages.Richard SuttmeierNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Daily Charts Are Negative For The Five Major Equity Averages.Dokument2 SeitenDaily Charts Are Negative For The Five Major Equity Averages.Richard SuttmeierNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- We Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Dokument2 SeitenWe Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Richard SuttmeierNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Dow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Dokument2 SeitenDow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Richard SuttmeierNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Power of The Pivots' Remains The 2014 Stock Market Theme.Dokument2 SeitenThe Power of The Pivots' Remains The 2014 Stock Market Theme.Richard SuttmeierNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Transports and Russell 2000 Lag in Reaction To Fed Chief Yellen.Dokument2 SeitenTransports and Russell 2000 Lag in Reaction To Fed Chief Yellen.Richard SuttmeierNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- El Código Secreto Del Espiritu SantoDokument2 SeitenEl Código Secreto Del Espiritu SantoEdwar Pineda100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Cover PageDokument10 SeitenCover PageAvijit GhoshNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- BT Group PLC: An Event StudyDokument48 SeitenBT Group PLC: An Event StudyFisher BlackNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Siemens PLM Generative Design Ebook Mi 63757 - tcm27 31974 PDFDokument4 SeitenSiemens PLM Generative Design Ebook Mi 63757 - tcm27 31974 PDFJose Alejandro Mansutti GNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- EP16020 Dated 23.06.2020 - TID - 562 - SOR - EP16020Dokument6 SeitenEP16020 Dated 23.06.2020 - TID - 562 - SOR - EP16020pravesh sharmaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Maintenance Planning and SchedullingDokument3 SeitenMaintenance Planning and SchedullingAnnisa MarlinNoch keine Bewertungen

- Problems and Prospects of E-Banking in Bangladesh PDFDokument6 SeitenProblems and Prospects of E-Banking in Bangladesh PDFJaynul Abedin50% (2)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Law On Partnership SummaryDokument10 SeitenLaw On Partnership SummaryBarbette Jane Chin100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Managing Change in The Aviation IndustryDokument27 SeitenManaging Change in The Aviation IndustryYan Jian LaiNoch keine Bewertungen

- Giignl The LNG Industry 2011Dokument38 SeitenGiignl The LNG Industry 2011srpercy100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Studio Culture EdenspiekermannDokument5 SeitenStudio Culture EdenspiekermannGustavo Dos Santos AngeliNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- BIZ202CRN1151 - NAYAK - A - Micro Environment ReportDokument8 SeitenBIZ202CRN1151 - NAYAK - A - Micro Environment ReportLegendary NinjaNoch keine Bewertungen

- Equity Mutual FundsDokument49 SeitenEquity Mutual FundskeneoNoch keine Bewertungen

- Nit - 10 01 19Dokument7 SeitenNit - 10 01 19gopal krishnaNoch keine Bewertungen

- Study of Consumer Behaviour About at Hindustan Uniliver Limited - NewDokument108 SeitenStudy of Consumer Behaviour About at Hindustan Uniliver Limited - NewAmit GusainNoch keine Bewertungen

- Application For Ngo PartnershipDokument5 SeitenApplication For Ngo PartnershipPrajoth Kumar0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- BSC Basics & Strategy MapDokument15 SeitenBSC Basics & Strategy MapAshlesh MangrulkarNoch keine Bewertungen

- Lufthansa Airlines Flights ReservationsDokument2 SeitenLufthansa Airlines Flights ReservationsLisa JONESNoch keine Bewertungen

- International Monetary Asymmetries and The Central BankDokument31 SeitenInternational Monetary Asymmetries and The Central BankJuan Carlos Lara GallegoNoch keine Bewertungen

- Investment in AssociateDokument10 SeitenInvestment in AssociateJan Paul GalopeNoch keine Bewertungen

- 01 Charles Shaver Axalta Coatings SystemsDokument20 Seiten01 Charles Shaver Axalta Coatings SystemsJames JunghannsNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Indian Economy On The Eve of IndependenceDokument17 SeitenIndian Economy On The Eve of IndependenceNoorunnishaNoch keine Bewertungen

- Faasos Case StudyDokument6 SeitenFaasos Case Studyrajiv66Noch keine Bewertungen

- Application Letter: Prepared by Ruchi ModiDokument11 SeitenApplication Letter: Prepared by Ruchi ModiHitesh VermaNoch keine Bewertungen

- Company Law Tutor 1Dokument4 SeitenCompany Law Tutor 1Karen Christine M. Atong0% (1)

- Iaps 1001 - Practice NoteDokument2 SeitenIaps 1001 - Practice NoteIvan Tamayo BasasNoch keine Bewertungen

- Accounts List (Summary) : CC Puno Jr. Construction, IncDokument4 SeitenAccounts List (Summary) : CC Puno Jr. Construction, IncAndrew CatamaNoch keine Bewertungen

- Factors Affecting Centralisation and Decentralisation: Presented By:-Himanshu SharmaDokument12 SeitenFactors Affecting Centralisation and Decentralisation: Presented By:-Himanshu SharmaSridhar KodaliNoch keine Bewertungen

- Plustalc H15: Functional ExtenderDokument2 SeitenPlustalc H15: Functional ExtenderAPEX SONNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)