Beruflich Dokumente

Kultur Dokumente

CIN VAT&CST Configuration

Hochgeladen von

nk2205_541161413Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIN VAT&CST Configuration

Hochgeladen von

nk2205_541161413Copyright:

Verfügbare Formate

Tax configuration for condition based tax procedure - TAXINN Other terms VAT, CIN,TAXINN, Tax Procedure, Tax

Conditions Reason and Prerequisites Legal Change The customers ho ha!e alread" made the rele!ant changes for VAT #$$% ould onl" ha!e to ma&e the changes accordingl"' Solution (or VAT #$$), *AP recommends all customers to loo& into this note onl"' Initial Settings: Tax procedure for countr" India is +TAXINN+' If "ou are using an" other Tax procedure similar to TAXINN , use the same in place of TAXINN in the recommended configuration settings' C, - Capital ,oods -. - .aterial other than Capital ,oods CI* - Client Independent *etting

Glossary Overview A *et of Ne Tax condition t"pes ha!e been introduced for Purchase and *ales Process' These ne condition t"pes should be used from /st of April #$$)' 0efine the tax conditions that are currentl" Non deductible as VAT Non deductible ' This ill enable "ou to address the transition to VAT at a later point of time' This ould help in reporting Taxes on *ales1Purchases for the Tax 2ear #$$)' (or Inbound transactions fi!e ne Tax condition t"pes ha!e been introduced3

4VC*3 A1P C*T Non 0eductible under VAT 4V-03 A1P VAT -. 0eductible 4V-N3 A1P VAT -. Non 0eductible 4VC03 A1P VAT C, 0eductible 4VCN3 A1P VAT C, Non 0eductible 5ach of the condition t"pe mentioned abo!e should be assigned to a separate Transaction1Account 6e" and a separate ,1L account' This ill help in the period end processing here ind!idual taxes need to be clearl" identified 7 reported' (or e'g' a separate treatment ma" be re8uired for taxes on interstate sale, that could !ar" from state to state'

Note: Certain settings ha!e to be a!ailable on the production s"stem hen "ou start the transaction for the Tax 2ear #$$)' Those settings are highlighted ith "TY2 !" and "ou should capture these in separate re8uest' "on#iguration Ste$s: 1. Create Tax Conditions Types for Sales/Purchases %"IS&: I., - (inancial Accounting - (inancial Accounting ,lobal *ettings - Tax on *ales1Purchases - 9asic *ettings- Chec& Calculation Procedure - 0efine Condition T"pes :;9</= a) Create Condition Type JVCS: A/P CST Non deducti le under VAT as a copy of J!PC for "TA#!NN" .aintain Condition Categor" as >0>-+Tax' .aintain the Access se8uence as >4*T/>' ) Create Condition Type JV$%: A/P VAT $& %educti le as a copy of J!PC .aintain Condition Categor" as >0>-+Tax+'5nsure the Access se8uence +4*T/+ c) Create Condition Type JV$N: A/P VAT $& Non'%educti le as a copy of J!PC .aintain Condition Categor" as >0>-+Tax+'5nsure the Access se8uence +4*T/+ d) Create Condition Type JVC%: A/P VAT C( %educti le as a copy of J!PC .aintain Condition Categor" as >0>-+Tax+'5nsure the Access se8uence +4*T/+ e) Create Condition Type JVCN: A/P VAT C( Non'%educti le as a copy of J!PC .aintain Condition Categor" as >0>-+Tax+'5nsure the Access se8uence +4*T/+ Note3 5nsure that all the existing Condition T"pes used in Tax procedure TAXINN ha!e the follo ing attributes' These settings are re8uired to or& ithout an" 4urisdiction Code' These changes are applicable from /st April #$$)' This is o!er and abo!e the ne condition t"pes created' "TY2 !" Access *e8uence 3 4*T/ Condition Categor" 3 0 ). %efine Ne* Transaction +ey for the ne* TA# Conditions:%"IS& I., ? (inancial Accounting ? (inancial Accounting ,lobal *ettings ? Tax on *ales1Purchases ? 9asic *ettings ? Chec& and Change *ettings for Tax Processing :;9CN= A&e" 0escription Tax T"pe Non 0educt Posting Ind 4P@3 A1P C*T Non 0eductible # X %

4P)3 A1P VAT -. 0eductible # # 4PA3 A1P VAT -. Non 0eductible # X % 4PB3 A1P VAT C, 0eductible # # 4PC3 A1P VAT C, Non 0eductible # X %

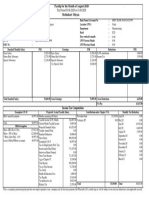

,. %efine (/- Accounts: I., ? (inancial Accounting ? ,eneral Ledger Accounting ? ,1L Accounts .aster -ecords ? ,1L Account Creation and Processing ? 5dit ,1L Account :Indi!idual Processing= ? 5dit ,1L Account Centrall" :(*$$= (or *AP -1% @'$93 I., ? (inancial Accounting ? ,eneral Ledger Accounting ? ,1L Accounts .aster 0ata ? ,1L Account Creation ? ;ne *tep .anual1Automatic :Alternati!e %= ? Alternati!e .ethods to Create ,L Accounts ? Create ,L Account .anuall" :(*$/= Create ne Tax ,1L Accounts for all ne Tax transaction &e"s created abo!e' .. %efine Tax Accounts: I., ? (inancial Accounting ? (inancial Accounting ,lobal *ettings ? Tax on *ales1Purchases ? Posting ? 0efine Tax Accounts :;9@$= Assign appropriate ,1L Accounts to the Transaction &e"s' Note:The 'hanges to the ta( $ro'edure would )e a$$li'a)le #rom *st +$ril 2 /. Chan0e TA#!NN procedure: I., ? (inancial Accounting ? (inancial Accounting ,lobal *ettings ? Tax on *ales1Purchases ? 9asic *ettings ? Chec& Calculation Procedure ? 0efine Procedure :;9<%= *elect Procedure TAXINN'Add 4VC*, 4V-0,4V-N, 4VC0, and 4VCN in TAXINN immediatel" after 4IPC' Assign Transaction1 Account 6e"s and Alternati!e Calculation t"pe as follo s !,

4VC* - 4P@ :*T in!entor" - India= 4V-0 - 4P) :*T setoff - India= 4V-N - 4PA :*T in!entor" - India= 4VC0 - 4PB :*T setoff - India= 4VCN - 4PC :*T in!entor" - India= New Pri'ing "onditions in S-, The follo ing condition t"pes ha!e to be created' 4IVP3 A1- VAT Pa"able 4IVC3 A1- C*T Pa"able 1. %efine Condition Types: I., ? *ales and 0istribution ? 9asic (unctions ? Pricing ? Pricing Control ? .aintain Condition T"pes :V1$A= Create Condition T"pe 4IVP3 A1- VAT Pa"able as a Cop" of 4L*T 7 .aintainthe same attribute as in 4L*T'

Create Condition T"pe 4IVC3 A1- C*T Pa"able under VAT as a Cop" of 4L*T 7 .aintain the same attribute as in 4L*T' 2. %efine Ne* Transaction +ey for the ne* TA# Conditions:%"IS& I., ? (inancial Accounting ? (inancial Accounting ,lobal *ettings ? Tax on *ales1Purchases ? 9asic *ettings ? Chec& and Change *ettings for Tax Processing :;9CN= A&e" 0escription Tax T"pe Non 0educt Posting Ind 4NA3 A1- VAT Pa"able / # 4NB3 A1- C*T Pa"able under VAT / #

3. %efine (/- Accounts: I., ? (inancial Accounting ? ,eneral Ledger Accounting ? ,1L Accounts .aster -ecords ? ,1L Account Creation and Processing ? 5dit ,1L Account :Indi!idual Processing= ? 5dit ,1L Account Centrall" :(*$$= (or *AP -1% @'$93 I., ? (inancial Accounting ? ,eneral Ledger Accounting? ,1L Accounts .aster 0ata ? ,1L Account Creation ? ;ne *tep .anual1Automatic :Alternati!e %= ? Alternati!e .ethods to Create ,L Accounts ? Create ,L Account .anuall" :(*$/= Create ne Tax ,1L Accounts for all ne Tax transaction &e"s created abo!e' 4. %efine Tax Accounts: I., ? (inancial Accounting ? (inancial Accounting ,lobal *ettings ? Tax on *ales1Purchases ? Posting ? 0efine Tax Accounts :;9@$= Assign appropriate ,1L Accounts to the Transaction &e"s' "hange S- Pri'ing Pro'edure%s&: +$$li'a)le #rom *st +$ril 2 !

I., ? *ales and 0istribution ? 9asic (unctions ? Pricing ? Pricing Control ? 0efine and assign Pricing Procedure ? .aintain Pricing Procedure :V1$C= *elect the rele!ant *0 Procedure' Add 4IVP, 4IVC after 4L*T' in NVV no need to gi!e an" ,1L

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Investment Management - PresentationDokument119 SeitenInvestment Management - Presentationnk2205_54116141350% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Treasury and Risk Management Configuration PDFDokument259 SeitenTreasury and Risk Management Configuration PDFnk2205_541161413100% (2)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 5.product CostingDokument103 Seiten5.product Costingnk2205_54116141350% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Electronic Bank Statement-MT940 Format - SAPDokument21 SeitenElectronic Bank Statement-MT940 Format - SAPSuresh Paramasivam0% (1)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Funds Management Enduser Training ManualDokument95 SeitenFunds Management Enduser Training ManualSatya Prasad100% (7)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Premium ReceiptDokument1 SeitePremium ReceiptVivekanand Gupta0% (2)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Bir Form 1600Dokument3 SeitenBir Form 1600Joseph Rod Allan AlanoNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Kunci Jawab Paket ADokument31 SeitenKunci Jawab Paket ASilva Fitri AnjaniNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- PacSun BOL 588446 - 447Dokument1 SeitePacSun BOL 588446 - 447robert bailleresNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Documentary Stamp Tax Declaration/Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Dokument3 SeitenDocumentary Stamp Tax Declaration/Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Jansen SantosNoch keine Bewertungen

- Statement: February 2023Dokument5 SeitenStatement: February 2023Nayelly PichardoNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- New Rekening Koran Online 617601026184532 2023-08-01 2023-08-25 00330316Dokument3 SeitenNew Rekening Koran Online 617601026184532 2023-08-01 2023-08-25 00330316Bayu Tris PranantoNoch keine Bewertungen

- TransNum Nov 18 223225Dokument1 SeiteTransNum Nov 18 223225alpha_numericNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- F FDYpk RZGK MMVX 4 WDokument4 SeitenF FDYpk RZGK MMVX 4 WRaghu Varma PorankiNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Cash AccountDokument2 SeitenCash Accountapi-404956516Noch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Direct Deposit Enrollment Form: Stride Bank, N.A. 123Dokument1 SeiteDirect Deposit Enrollment Form: Stride Bank, N.A. 123BotaNoch keine Bewertungen

- Federal University of Agriculture, Abeokuta: Processing Charges: N750.00 School Fees: N18,250.00Dokument1 SeiteFederal University of Agriculture, Abeokuta: Processing Charges: N750.00 School Fees: N18,250.00Deyeba AkandeNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Hafis SayedNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Caticlan-Boracay Aerial Ropeway: Project-Sheet-July-2018-v2 PDFDokument2 SeitenCaticlan-Boracay Aerial Ropeway: Project-Sheet-July-2018-v2 PDFKevin Luis Markus PinedaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDokument1 SeiteUttarakhand Transport Corporation E-Ticket: Fare DetailAnindya SharmaNoch keine Bewertungen

- Certified International Payment Systems ProfessionalDokument6 SeitenCertified International Payment Systems ProfessionalMakarand LonkarNoch keine Bewertungen

- 2D46D407Dokument1 Seite2D46D407Dhyan MothukuriNoch keine Bewertungen

- Donald 2022Dokument8 SeitenDonald 2022Kgalalelo DonaldNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Special and Combination JournalsDokument1 SeiteSpecial and Combination JournalsVivienne LayronNoch keine Bewertungen

- Bhujbal NoticeDokument5 SeitenBhujbal NoticeJating JamkhandiNoch keine Bewertungen

- MLM 0001Dokument52 SeitenMLM 0001amit01dubeyNoch keine Bewertungen

- ITX 240.01.B - VAT Monthly ReturnDokument2 SeitenITX 240.01.B - VAT Monthly ReturnFredben BenardNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Appendix 34 - CHECKS AND ADVICES TO DEBIT ACCOUNT DISBURSEMENTS RECORDDokument1 SeiteAppendix 34 - CHECKS AND ADVICES TO DEBIT ACCOUNT DISBURSEMENTS RECORDPau PerezNoch keine Bewertungen

- Mody School: Lakshmangarh - 332311 Dist. Sikar (Raj) PH: 01573-225001-12 (12 Lines) Fax: 01573-225045Dokument1 SeiteMody School: Lakshmangarh - 332311 Dist. Sikar (Raj) PH: 01573-225001-12 (12 Lines) Fax: 01573-225045Parth UpmanNoch keine Bewertungen

- Account Statement From 1 Jul 2012 To 31 Dec 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument8 SeitenAccount Statement From 1 Jul 2012 To 31 Dec 2012: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancersreddysNoch keine Bewertungen

- Individual Activity - Adjusting and Closing Entries - FABMDokument6 SeitenIndividual Activity - Adjusting and Closing Entries - FABMVenus Tek-ingNoch keine Bewertungen

- Dcom208 Banking Theory and Practice PDFDokument251 SeitenDcom208 Banking Theory and Practice PDFLakshmanrao NayiniNoch keine Bewertungen

- Mi BillDokument1 SeiteMi BillJagannath MandalNoch keine Bewertungen

- A Study On MFS in India FinalDokument83 SeitenA Study On MFS in India Finalanas khanNoch keine Bewertungen

- Tag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaDokument3 SeitenTag Life Science Corporation: Purok Uno, Minante II, Cauayan City, IsabelaBrandon Jorjs HolgadoNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)