Beruflich Dokumente

Kultur Dokumente

About - S&P Bse Sensex

Hochgeladen von

bkamithOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

About - S&P Bse Sensex

Hochgeladen von

bkamithCopyright:

Verfügbare Formate

About - S&P BSE SENSEX

Equity Group Websites Derivatives MF/ETFs

Page 1

Get Quote

Debt/Others

20,376.56

+65.82 +0.32%

Enter Scrip Name / Code / ID Enter Underlying Index Name / Scrip Name Enter Scrip Name / Code / ID Enter Scrip Name / Code / ID

About BSE

Markets

Public Issues / OFS

Corporates

Members

Investors

Products & Services

Training & Certification

BSE Plus

Ads by Google

Index Watch Market Wide Circuit Monthly Report Historical Data Indices S&P BSE Index Notices Index Licensing S&P BSE SENSEX

BlueChip Stocks 2014 List

Exclusive List of Indian BlueChip Stocks for 2014. Get Free Copy Now!

HDFC Life Term Plan

1 Cr. Life Cover at Just Rs 23/Day. 25 Yrs Cover + Tax Benefit*. Buy Now

The 2014 Fluidic Verna

Best in class power-128 PS, Next Gen 1.6 CRDi VGT. Test drive Now! Ads by Google

Home

Indices

Index Reach

Index Reach - S&P BSE SENSEX

S&P BSE SENSEX - The Barometer of Indian Capital Markets

Introduction S&P BSE SENSEX, first compiled in 1986, was calculated on a "Market Capitalization-Weighted" methodology of 30 component stocks representing large, well-established and financially sound companies across key sectors. The base year of S&P BSE SENSEX was taken as 1978-79. S&P BSE SENSEX today is widely reported in both domestic and international markets through print as well as electronic media. It is scientifically designed and is based on globally accepted construction and review methodology. Since September 1, 2003, S&P BSE SENSEX is being calculated on a free-float market capitalization methodology. The "free-float market capitalization-weighted" methodology is a widely followed index construction methodology on which majority of global equity indices are based; all major index providers like MSCI, FTSE, STOXX, and Dow Jones use the free-float methodology. The growth of the equity market in India has been phenomenal in the present decade. Right from early nineties, the stock market witnessed heightened activity in terms of various bull and bear runs. In the late nineties, the Indian market witnessed a huge frenzy in the 'TMT' sectors. More recently, real estate caught the fancy of the investors. S&P BSE SENSEX has captured all these happenings in the most judicious manner. One can identify the booms and busts of the Indian equity market through S&P BSE SENSEX. As the oldest index in the country, it provides the time series data over a fairly long period of time (from 1979 onwards). Small wonder, the S&P BSE SENSEX has become one of the most prominent brands in

http://www.bseindia.com/indices/DispIndex.aspx?iname=BSE30&index_Code=16&page=B16FEF6B-3A5C-45B8-89F9-C79E8...

2/9/2014 9:41:54 PM

About - S&P BSE SENSEX

Page 2

Base Year

1978-79

Base Index Value

100 01-01-1986

Date of Launch

Method of calculation

Launched on full market capitalization method and effective September 01, 2003, calculation method shifted to free-float market capitalization.

Number of scrips

30

Index calculation frequency

Real Time

Index calculation and Maintenance

Click here for Index calculation and maintenance

Historical Notices

S& BSE SENSEX Calculation Methodology

Click to search Historical Notices on Index Replacements

S&P BSE SENSEX is calculated using the "Free-float Market Capitalization" methodology, wherein, the level of index at any point of time reflects the free-float market value of 30 component stocks relative to a base period. The market capitalization of a company is determined by multiplying the price of its stock by the number of shares issued by the company. This market capitalization is further multiplied by the free-float factor to determine the free-float market capitalization. The base period of S&P BSE SENSEX is 1978-79 and the base value is 100 index points. This is often indicated by the notation 1978-79=100. The calculation of S&P BSE SENSEX involves dividing the free-float market capitalization of 30 companies in the Index by a number called the Index Divisor. The Divisor is the only link to the original base period value of the S&P BSE SENSEX. It keeps the Index comparable over time and is the adjustment point for all Index adjustments arising out of corporate actions, replacement of scrips etc. During market hours, prices of the index scrips, at which latest trades are executed, are used by the trading system to calculate S&P BSE SENSEX on a continuous basis. S&P BSE Dollex-30 BSE also calculates a dollar-linked version of S&P BSE SENSEX and historical values of this index are available since its inception. (For more details click 'Dollex series of BSE indices') S&P BSE SENSEX - Scrip Selection Criteria 1. Equities of companies listed on BSE Ltd. (excluding companies classified in Z group, listed mutual funds, scrips suspended on the last day of the month prior to review date, stocks objected by the Surveillance department of the Exchange and those that are traded under permitted category and SME category) shall be considered eligible 2. Listing History: The scrip should have a listing history of at least three months at BSE. An exception may be granted to one month, if the average free-float market capitalization of a newly listed company ranks in the top 10 of all companies listed at BSE. In the event that a company is listed on account of a merger / demerger / amalgamation, a minimum listing history is not required. 3. The stock should have been traded on each and every trading day in the last three months at BSE. Exceptions can be made for extreme reasons like scrip suspension etc. 4. Companies that have reported revenue in the latest four quarters from its core activity are considered eligible. 5. From the list of constituents selected through Steps 1-4, the top 75 companies based on free-float market capitalisation (avg. 3 months) are selected as well as any additional companies that are in the top 75 based on full market capitalization (avg. 3 months). 6. The filtered list of constituents selected through Step 5 (which can be greater than 75 companies) is then ranked on absolute turnover (avg. 3 months). 7. Any company in the filtered, sorted list created in Step 6 that has Cumulative Turnover of >98%, are excluded, so long as the remaining list has more than 30 scrips. 8. The filtered list calculated in Step 7 is then sorted by free float market capitalization. Any company having a weight within this filtered constituent list of <0.50% shall be excluded 9. All remaining companies will be sorted on sector and sub-sorted in the descending order of rank on free-float market capitalization. 10. Industry/Sector Representation: Scrip selection will generally attempt to maintain index sectoral weights that are broadly in-line with the overall market.

Note:

BSE and S&P Dow Jones Indices (S&P DJI) have entered into an alliance to calculate, disseminate, and license the widely followed suite of BSE indices from February 19, 2013, pursuant to which the corporate action policy for all S&P BSE Indices will be implemented in line with that of

http://www.bseindia.com/indices/DispIndex.aspx?iname=BSE30&index_Code=16&page=B16FEF6B-3A5C-45B8-89F9-C79E8...

2/9/2014 9:41:54 PM

About - S&P BSE SENSEX

Page 3

Understanding Free-float Methodology Concept Free-float methodology refers to an index construction methodology that takes into consideration only the free-float market capitalization of a company for the purpose of index calculation and assigning weight to stocks in the index. Free-float market capitalization takes into consideration only those shares issued by the company that are readily available for trading in the market. It generally excludes promoters' holding, government holding, strategic holding and other locked-in shares that will not come to the market for trading in the normal course. In other words, the market capitalization of each company in a free-float index is reduced to the extent of its readily available shares in the market. Subsequently all S&P BSE indices with the exception of S&P BSE-PSU index have adopted the free-float methodology. Major advantages of Free-float Methodology A Free-float index reflects the market trends more rationally as it takes into consideration only those shares that are available for trading in the market. Free-float Methodology makes the index more broad-based by reducing the concentration of top few companies in Index. A Free-float index aids both active and passive investing styles. It aids active managers by enabling them to benchmark their fund returns vis- vis an investible index. This enables an apple-to-apple comparison thereby facilitating better evaluation of performance of active managers. Being a perfectly replicable portfolio of stocks, a Free-float adjusted index is best suited for the passive managers as it enables them to track the index with the least tracking error. Free-float Methodology improves index flexibility in terms of including any stock from the universe of listed stocks. This improves market coverage and sector coverage of the index. For example, under a Full-market capitalization methodology, companies with large market capitalization and low free-float cannot generally be included in the Index because they tend to distort the index by having an undue influence on the index movement. However, under the Free-float Methodology, since only the free-float market capitalization of each company is considered for index calculation, it becomes possible to include such closely-held companies in the index while at the same time preventing their undue influence on the index movement. Globally, the Free-float Methodology of index construction is considered to be an industry best practice and all major index providers like MSCI, FTSE, S&P and STOXX have adopted the same. MSCI, a leading global index provider, shifted all its indices to the Free-float Methodology in 2002. The MSCI India Standard Index, which is followed by Foreign Institutional Investors (FIIs) to track Indian equities, is also based on the Freefloat Methodology. NASDAQ-100, the underlying index to the famous Exchange Traded Fund (ETF) - QQQ is based on the Free-float Methodology.

Definition of Free-float Shareholding of investors that would not, in the normal course come into the open market for trading are treated as 'Controlling/ Strategic Holdings' and hence not included in free-float. Specifically, the following categories of holding are generally excluded from the definition of Free-float: Shares held by founders/directors/ acquirers which has control element Shares held by persons/ bodies with "Controlling Interest" Shares held by Government as promoter/acquirer Holdings through the FDI Route Strategic stakes by private corporate bodies/ individuals Equity held by associate/group companies (cross-holdings) Equity held by Employee Welfare Trusts Locked-in shares and shares which would not be sold in the open market in normal course.

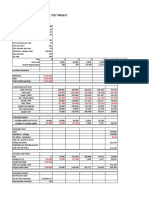

The remaining shareholders fall under the Free-float category. Determining Free-float Factors of Companies BSE has designed a Free-float format, which is filled and submitted by all index companies on a quarterly basis. (Format available on www.bseindia.com). BSE determines the Free-float factor for each company based on the detailed information submitted by the companies in the prescribed format. Free-float factor is a multiple with which the total market capitalization of a company is adjusted to arrive at the Free-float market capitalization. Once the Free-float of a company is determined, it is rounded-off to the higher multiple of 5 and each company is categorized into one of the 20 bands given below. A Free-float factor of say 0.55 means that only 55% of the market capitalization of the company will be considered for index calculation. Free-float Bands:

% Free-Float >0 - 5% >5 - 10%

Free-Float Factor 0.05 0.10

% Free-Float >50 - 55% >55 - 60%

Free-Float Factor 0.55 0.60

http://www.bseindia.com/indices/DispIndex.aspx?iname=BSE30&index_Code=16&page=B16FEF6B-3A5C-45B8-89F9-C79E8...

2/9/2014 9:41:54 PM

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Indian Money MarketDokument22 SeitenIndian Money MarketbkamithNoch keine Bewertungen

- ExamplesDokument1 SeiteExamplesbkamithNoch keine Bewertungen

- Order Types 2Dokument5 SeitenOrder Types 2bkamith100% (1)

- Non-Perfoming Assets Uti Bank Project Report Mba FinanceDokument81 SeitenNon-Perfoming Assets Uti Bank Project Report Mba FinancebkamithNoch keine Bewertungen

- Chapter 2 - Corporate GovernanceDokument34 SeitenChapter 2 - Corporate GovernancebkamithNoch keine Bewertungen

- Income Tax Law Practice Question PaperDokument0 SeitenIncome Tax Law Practice Question PaperbkamithNoch keine Bewertungen

- Financial Services 7Dokument1 SeiteFinancial Services 7bkamithNoch keine Bewertungen

- Jhoom Le - HariharanDokument1 SeiteJhoom Le - HariharanbkamithNoch keine Bewertungen

- Business EnvironmentDokument37 SeitenBusiness EnvironmentbkamithNoch keine Bewertungen

- Export Study of HandicraftsDokument27 SeitenExport Study of Handicraftsbkamith0% (1)

- Mba Final Year Project On Customer SatisfactionDokument64 SeitenMba Final Year Project On Customer SatisfactionArun75% (20)

- Chapter Ii - Primary MarketDokument4 SeitenChapter Ii - Primary MarketbkamithNoch keine Bewertungen

- Syllabus of MG UniversityDokument48 SeitenSyllabus of MG Universitybkamith33% (3)

- Securitization IndiaDokument2 SeitenSecuritization IndiabkamithNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Overview of Underground Gas Storage in The WorldDokument16 SeitenOverview of Underground Gas Storage in The WorldSuvam PatelNoch keine Bewertungen

- Wallstreetjournal 20171124 TheWallStreetJournalDokument42 SeitenWallstreetjournal 20171124 TheWallStreetJournalTevinWaiguruNoch keine Bewertungen

- Mva & EvaDokument8 SeitenMva & Evathexplorer008Noch keine Bewertungen

- Africa Horizons: A Unique Guide To Real Estate Investment OpportunitiesDokument18 SeitenAfrica Horizons: A Unique Guide To Real Estate Investment OpportunitiesJonathan MahengeNoch keine Bewertungen

- Role of Banks in The Development of Indian Economy: Prof. Jagdeep KumariDokument4 SeitenRole of Banks in The Development of Indian Economy: Prof. Jagdeep KumariJOEL JOHNNoch keine Bewertungen

- Pabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessDokument8 SeitenPabrai Investment Funds Annual Meeting Notes - 2014 - Bits - ) BusinessnabsNoch keine Bewertungen

- Engagement Opportunity GuideDokument40 SeitenEngagement Opportunity GuideDavid BriggsNoch keine Bewertungen

- Economics Unit 4 - Past Paper Section A 20 & 30 Mark QuestionsDokument7 SeitenEconomics Unit 4 - Past Paper Section A 20 & 30 Mark QuestionsNigov ChigovNoch keine Bewertungen

- EC Bulletin Annual Incentive Plan Design SurveyDokument6 SeitenEC Bulletin Annual Incentive Plan Design SurveyVikas RamavarmaNoch keine Bewertungen

- India International ExchangeDokument1 SeiteIndia International ExchangeSugan Pragasam100% (1)

- Project Report For New Business - FormatDokument4 SeitenProject Report For New Business - FormatRajiv Ranjan0% (1)

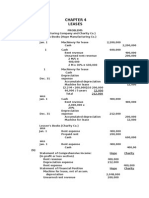

- Financial Accounting 2 Chapter 4Dokument27 SeitenFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNoch keine Bewertungen

- Companies Joint Venture Agreement TemplateDokument5 SeitenCompanies Joint Venture Agreement TemplateSreeNoch keine Bewertungen

- Financial Accounting and Reporting Retained EarningsDokument68 SeitenFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- Understanding The Bad Bank - McKinsey QuarterlyDokument11 SeitenUnderstanding The Bad Bank - McKinsey QuarterlyitsalmaitiNoch keine Bewertungen

- 4 - Ona V CirDokument6 Seiten4 - Ona V CircloudNoch keine Bewertungen

- Financial Statement Analysis - Concept Questions and Solutions - Chapter 2Dokument20 SeitenFinancial Statement Analysis - Concept Questions and Solutions - Chapter 2stefy934100% (2)

- Ashirbad Production HomeDokument4 SeitenAshirbad Production Homeanon_913070355Noch keine Bewertungen

- Insolvency To Innovation: The Five-Year RecordDokument16 SeitenInsolvency To Innovation: The Five-Year RecordGeorge RegneryNoch keine Bewertungen

- Far East Bank & Trust Bank of The Philippine IslandsDokument2 SeitenFar East Bank & Trust Bank of The Philippine IslandsClyette Anne Flores BorjaNoch keine Bewertungen

- Esso Ar2014 enDokument116 SeitenEsso Ar2014 endjokouwmNoch keine Bewertungen

- IDBI Bank Result UpdatedDokument13 SeitenIDBI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Internship Proposal Learning AgreementDokument4 SeitenInternship Proposal Learning AgreementAshish SoinNoch keine Bewertungen

- 40 'Invaluable' Investing Lessons From Tony DedenDokument20 Seiten40 'Invaluable' Investing Lessons From Tony DedenCGrenga100Noch keine Bewertungen

- BB AD 2016 - MCQ Maths SolutionDokument9 SeitenBB AD 2016 - MCQ Maths Solutionmahin100% (1)

- Pgdba - Fin - Sem III - Capital MarketsDokument27 SeitenPgdba - Fin - Sem III - Capital Marketsapi-3762419100% (1)

- Substantive Tests of Transactions and Account Balances EditedDokument85 SeitenSubstantive Tests of Transactions and Account Balances EditedPiaElemos100% (2)

- Oracle R12Dokument50 SeitenOracle R12adagio2007Noch keine Bewertungen

- Deductions Under Chapter VIDokument4 SeitenDeductions Under Chapter VIMonisha ParekhNoch keine Bewertungen

- Capital Budgeting Example ExcelDokument1 SeiteCapital Budgeting Example ExcelNgoc Hong DuongNoch keine Bewertungen