Beruflich Dokumente

Kultur Dokumente

The Health and Fitness Group

Hochgeladen von

saeed_r2000422Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Health and Fitness Group

Hochgeladen von

saeed_r2000422Copyright:

Verfügbare Formate

The Health and Fitness Group (HFG), which is privately owned, operates three centres in the country of Mayland.

Each centre offers dietary plans and fitness programmes to clients under the supervision of dieticians and fitness trainers. Residential accommodation is also available at each centre. The centres are located in the towns of Ayetown, Beetown and Ceetown. The following information is available: (1) Summary financial data for HFG in respect of the year ended 31 May 2008. Ayetown Beetown $000 $000 Revenue: Fees received 1,800 2,100 Variable costs (468) (567)

_______

Ceetown $000 4,500 (1,395) 3,105 (2,402) 703

Total $000 8,400 (2,430) 5,970 (4,430) 1,540 (180) 1,360 (408) 952

Contribution Fixed costs Operating profit

1,332 (936) 396

1,533 (1,092) 441

Interest costs on long-term debt at 10% Profit before tax Income tax expense Profit for the year Average book values for 2008: Assets Non-current assets 1,000 Current assets 800 Total assets 1,800

2,500 900 3,400

3,300 1,000 4,300

6,800 2,700 9,500

Equity and liabilities: Share capital Retained earnings Total equity Non-current liabilities Long-term borrowings Total non-current liabilities Current liabilities Total current liabilities Total liabilities Total equity and liabilities 80 80 240 240 480 480

2,500 4,400 6,900

1,800 1,800 800 800 2,600 9,500

(2) HFG defines Residual Income (RI) for each centre as operating profit minus a required rate of return of 12% of the total assets of each centre. (3) At present HFG does not allocate the long-term borrowings of the group to the three separate centres. (4) Each centre faces similar risks.

(5) Tax is payable at a rate of 30%. (6) The market value of the equity capital of HFG is $9 million. The cost of equity of HFG is 15%. (7) The market value of the long-term borrowings of HFG is equal to the book value. (8) The directors are concerned about the return on investment (ROI) generated by the Beetown centre and they are considering using sensitivity analysis in order to show how a target ROI of 20% might be achieved. (9) The marketing director stated at a recent board meeting that The Groups success depends on the quality of service provided to our clients. In my opinion, we need only to concern ourselves with the number of complaints received from clients during each period as this is the most important performance measure for our business. The number of complaints received from clients is a perfect performance measure. As long as the number of complaints received from clients is not increasing from period to period, then we can be confident about our future prospects. Required: (a) The directors of HFG have asked you, as management accountant, to prepare a report providing them with explanations as to the following: (i) Which of the three centres is the most successful? Your report should include a commentary on return on investment (ROI), residual income (RI), and economic value added (EVA) as measures of financial performance. Detailed calculations regarding each of these three measures must be included as part of your report; Note: A maximum of seven marks is available for detailed calculations. (14 marks)

(ii) The percentage change in revenue, total costs and net assets during the year ended 31 May 2008 that would have been required in order to have achieved a target ROI of 20% by the Beetown centre. Your answer should consider each of these three variables in isolation. State any assumptions that you make. (6 marks) (iii) Whether or not you agree with the statement of the marketing director in note (9) above. (5 marks) Professional marks for appropriateness of format, style and structure of the report. (4 marks) (b) The Superior Fitness Co (SFC), which is well established in Mayland, operates nine centres. Each of SFCs centres is similar in size to those of HFG. SFC also provides dietary plans and fitness programmes to its clients. The directors of HFG have decided that they wish to benchmark the performance of HFG with that of SFC. Required: Discuss the problems that the directors of HFG might experience in their wish to benchmark the performance of HFG with the performance of SFC, and recommend how such problems might be successfully addressed. (7 marks) (Total: 36 marks)

Das könnte Ihnen auch gefallen

- CV Midterm Exam 1 - Solution GuideDokument11 SeitenCV Midterm Exam 1 - Solution GuideKala Paul100% (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Aberdeen Asset Management PLC - Ar - 09!30!2015Dokument168 SeitenAberdeen Asset Management PLC - Ar - 09!30!2015Tanu ChaurasiaNoch keine Bewertungen

- F5 ATC Pass Card 2012 PDFDokument102 SeitenF5 ATC Pass Card 2012 PDFsaeed_r2000422100% (1)

- Financial Statement Analysis MCQs With AnswerDokument5 SeitenFinancial Statement Analysis MCQs With AnswerHamza Khan Yousafzai100% (1)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Country of GuyanaDokument3 SeitenCountry of Guyanasaeed_r2000422Noch keine Bewertungen

- AssignmentDokument20 SeitenAssignmentbabarakhssNoch keine Bewertungen

- Homework 2: Q1:: Is Should IncludeDokument35 SeitenHomework 2: Q1:: Is Should IncludeMichael MaNoch keine Bewertungen

- Pma FacsDokument27 SeitenPma FacsGopi NathanNoch keine Bewertungen

- P5 RM March 2016 Questions PDFDokument12 SeitenP5 RM March 2016 Questions PDFavinesh13Noch keine Bewertungen

- 20 QuestionsDokument11 Seiten20 QuestionsMamunoor RashidNoch keine Bewertungen

- The Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Dokument9 SeitenThe Institute of Chartered Accountants of Sri Lanka: Ca Professional (Strategic Level I) Examination - December 2011Amal VinothNoch keine Bewertungen

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDokument9 SeitenPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNoch keine Bewertungen

- Financial Management Tutorial QuestionsDokument8 SeitenFinancial Management Tutorial QuestionsStephen Olieka100% (2)

- Practice Exam 2020Dokument11 SeitenPractice Exam 2020ana gvenetadzeNoch keine Bewertungen

- Ig Group Annualres - Jul12Dokument39 SeitenIg Group Annualres - Jul12forexmagnatesNoch keine Bewertungen

- FY20 Media Release - 260620 (F)Dokument5 SeitenFY20 Media Release - 260620 (F)Gan Zhi HanNoch keine Bewertungen

- MINI CASE CH 9Dokument7 SeitenMINI CASE CH 9Samara SharinNoch keine Bewertungen

- Commonwealth Bank (AutoRecovered)Dokument13 SeitenCommonwealth Bank (AutoRecovered)Shivam Anand ShuklaNoch keine Bewertungen

- SFM 5 PDFDokument4 SeitenSFM 5 PDFketulNoch keine Bewertungen

- Information Services Group Announces Second Quarter Financial ResultsDokument6 SeitenInformation Services Group Announces Second Quarter Financial Resultsappelflap2Noch keine Bewertungen

- AkzoNobel ICI Annual Report 2005 Tcm9-51534Dokument162 SeitenAkzoNobel ICI Annual Report 2005 Tcm9-51534sggggNoch keine Bewertungen

- Thame and London Quarterly Report To Note Holders 2019 Q2 FINALDokument44 SeitenThame and London Quarterly Report To Note Holders 2019 Q2 FINALsaxobobNoch keine Bewertungen

- Thame and London Quarterly Report To Note Holders 2019 Q3 FINALDokument40 SeitenThame and London Quarterly Report To Note Holders 2019 Q3 FINALsaxobobNoch keine Bewertungen

- Chapter-Two: Financial Planning and ProjectionDokument6 SeitenChapter-Two: Financial Planning and Projectionমেহেদী হাসানNoch keine Bewertungen

- Hup Seng AnalysisDokument7 SeitenHup Seng AnalysisWillson Chong100% (1)

- Financial Aspect - drft01Dokument1 SeiteFinancial Aspect - drft01linxetcarcherNoch keine Bewertungen

- Information Services Group Announces Third Quarter Financial ResultsDokument6 SeitenInformation Services Group Announces Third Quarter Financial ResultsfdopenNoch keine Bewertungen

- CCCCC LTDDokument91 SeitenCCCCC LTDAbhii46Noch keine Bewertungen

- Analyst Presentation - Aptech LTD Q3FY13Dokument31 SeitenAnalyst Presentation - Aptech LTD Q3FY13ashishkrishNoch keine Bewertungen

- This Study Resource Was Shared Via: Liu Djiu Fun 17525Dokument7 SeitenThis Study Resource Was Shared Via: Liu Djiu Fun 17525Priyanka AggarwalNoch keine Bewertungen

- Financial, Treasury and Forex Management: NoteDokument7 SeitenFinancial, Treasury and Forex Management: Noteexcelsis_Noch keine Bewertungen

- FIN 551 - Costco Porfolio Invesment - HanhNguyenDokument11 SeitenFIN 551 - Costco Porfolio Invesment - HanhNguyenHanh ThuyNoch keine Bewertungen

- Assessment-2 FMDokument12 SeitenAssessment-2 FMMarcela PassosNoch keine Bewertungen

- Cases Relating To Audit PlanningDokument5 SeitenCases Relating To Audit PlanningRazib DasNoch keine Bewertungen

- Business Reporting July 2010 Marks PlanDokument24 SeitenBusiness Reporting July 2010 Marks PlanMohammed HammadNoch keine Bewertungen

- P2 Mar2014 QPDokument20 SeitenP2 Mar2014 QPjoelvalentinorNoch keine Bewertungen

- Ma Assignment # 7Dokument18 SeitenMa Assignment # 7Aeron Paul AntonioNoch keine Bewertungen

- Dividend PolicyDokument8 SeitenDividend PolicySumit PandeyNoch keine Bewertungen

- Chaturvedi Tutorials Dushyant Chaturvedi: Theoretical ProblemsDokument13 SeitenChaturvedi Tutorials Dushyant Chaturvedi: Theoretical ProblemsAnonymous f2VwMWiNoch keine Bewertungen

- Ajooni BiotechDokument21 SeitenAjooni BiotechSunny RaoNoch keine Bewertungen

- 056.ASX IAW Aug 31 2009 16.05 2009 Full Year ResultDokument12 Seiten056.ASX IAW Aug 31 2009 16.05 2009 Full Year ResultASX:ILH (ILH Group)Noch keine Bewertungen

- Tutorial questions-MOODLEDokument3 SeitenTutorial questions-MOODLERami RRKNoch keine Bewertungen

- Investor Relations: TO: From: Date: REDokument2 SeitenInvestor Relations: TO: From: Date: REMark ReinhardtNoch keine Bewertungen

- Bsbfim601 Mustafa's ReportDokument12 SeitenBsbfim601 Mustafa's Reportmustafa mohammedNoch keine Bewertungen

- B1 Free Solving Nov 2019) - Set 3Dokument5 SeitenB1 Free Solving Nov 2019) - Set 3paul sagudaNoch keine Bewertungen

- Infosys Results Q1-2009-10Dokument4 SeitenInfosys Results Q1-2009-10Niranjan PrasadNoch keine Bewertungen

- Segment and Interim Reporting: Chapter OutlineDokument32 SeitenSegment and Interim Reporting: Chapter OutlineJordan YoungNoch keine Bewertungen

- Stastic CoDokument2 SeitenStastic Conur iman qurrataini abdul rahmanNoch keine Bewertungen

- 2011.06.30 ASX Annual ReportDokument80 Seiten2011.06.30 ASX Annual ReportKevin LinNoch keine Bewertungen

- Profitability AnalysisDokument9 SeitenProfitability AnalysisBurhan Al MessiNoch keine Bewertungen

- D15 Hybrid F5 QPDokument7 SeitenD15 Hybrid F5 QPadad9988Noch keine Bewertungen

- OldMutualInterims2009Announcement PDFDokument121 SeitenOldMutualInterims2009Announcement PDFKristi DuranNoch keine Bewertungen

- Assignment - Doc 301 Advanced Financial Accounting II - 24042016112440Dokument4 SeitenAssignment - Doc 301 Advanced Financial Accounting II - 24042016112440waresh36Noch keine Bewertungen

- Saa P5Dokument12 SeitenSaa P5smartguy0Noch keine Bewertungen

- Performance 6.10Dokument2 SeitenPerformance 6.10George BulikiNoch keine Bewertungen

- Exam (Unfinished)Dokument4 SeitenExam (Unfinished)Joy BerjuegaNoch keine Bewertungen

- Highlights For The Six Months Ended June 30, 2015 (Company Update)Dokument137 SeitenHighlights For The Six Months Ended June 30, 2015 (Company Update)Shyam SunderNoch keine Bewertungen

- 13 CantorDokument3 Seiten13 CantorBurhanuddinNoch keine Bewertungen

- Ienergizer Limited 31 March 2021 - Annual ReportDokument86 SeitenIenergizer Limited 31 March 2021 - Annual ReportKartikaeNoch keine Bewertungen

- Past Exam Question APMDokument3 SeitenPast Exam Question APMWenhidzaNoch keine Bewertungen

- Sa Sept12 p5 BenchmarkingDokument9 SeitenSa Sept12 p5 BenchmarkingIndra ThapaNoch keine Bewertungen

- 2.4 Mock Exam Jun 06 Answer-AJ PDFDokument20 Seiten2.4 Mock Exam Jun 06 Answer-AJ PDFsaeed_r2000422Noch keine Bewertungen

- P2 May 2010 Answers PDFDokument14 SeitenP2 May 2010 Answers PDFjoelvalentinorNoch keine Bewertungen

- Not-For-Profit: TechnicalDokument3 SeitenNot-For-Profit: TechnicalMuntazir HussainNoch keine Bewertungen

- P2 Mar 2012 Exam PaperDokument16 SeitenP2 Mar 2012 Exam Papermigueljorge007Noch keine Bewertungen

- Cut and StichDokument1 SeiteCut and Stichsaeed_r2000422Noch keine Bewertungen

- Budgetary DiagramDokument1 SeiteBudgetary Diagramsaeed_r2000422Noch keine Bewertungen

- F5 Mock 1 AnswerDokument14 SeitenF5 Mock 1 Answersaeed_r2000422Noch keine Bewertungen

- ACCA P4 Investment International.Dokument19 SeitenACCA P4 Investment International.saeed_r2000422100% (1)

- Field Service Schedule 24-29Dokument2 SeitenField Service Schedule 24-29saeed_r2000422Noch keine Bewertungen

- D. Bahadur & Co. Chartered Accountants: Prepared By: Reviewed By: Approved byDokument31 SeitenD. Bahadur & Co. Chartered Accountants: Prepared By: Reviewed By: Approved bysaeed_r2000422Noch keine Bewertungen

- F5 Final Mock June 13Dokument7 SeitenF5 Final Mock June 13saeed_r2000422Noch keine Bewertungen

- AP Aging 2013 - AuditDokument1 SeiteAP Aging 2013 - Auditsaeed_r2000422Noch keine Bewertungen

- Luke 12:42: w13 7/15 23 Par. 14Dokument3 SeitenLuke 12:42: w13 7/15 23 Par. 14saeed_r2000422Noch keine Bewertungen

- Cash PaymentDokument8 SeitenCash Paymentsaeed_r2000422Noch keine Bewertungen

- Accounting & Business Connections (A.B.C) Expenses: Date Description Inv# AmtDokument2 SeitenAccounting & Business Connections (A.B.C) Expenses: Date Description Inv# Amtsaeed_r2000422Noch keine Bewertungen

- LeDokument1 SeiteLesaeed_r2000422Noch keine Bewertungen

- Accounting & Business Connections (A.B.C) Expenses: Date Description Inv# AmtDokument2 SeitenAccounting & Business Connections (A.B.C) Expenses: Date Description Inv# Amtsaeed_r2000422Noch keine Bewertungen

- Bible HighlightsDokument1 SeiteBible Highlightssaeed_r2000422Noch keine Bewertungen

- Eron LallDokument4 SeitenEron Lallsaeed_r2000422Noch keine Bewertungen

- P3-Syll and SG 2013Dokument14 SeitenP3-Syll and SG 2013Shazia PashaNoch keine Bewertungen

- Ratiios SummaryDokument2 SeitenRatiios Summarysaeed_r2000422Noch keine Bewertungen

- Mock t7Dokument3 SeitenMock t7saeed@atcNoch keine Bewertungen

- Budget QuizDokument1 SeiteBudget Quizsaeed_r2000422Noch keine Bewertungen

- 2.4 Mock Exam Jun 06 Answer-AJDokument20 Seiten2.4 Mock Exam Jun 06 Answer-AJsaeed_r2000422Noch keine Bewertungen

- 2.4 Mock Exam Jun 06 Question-AJDokument15 Seiten2.4 Mock Exam Jun 06 Question-AJsaeed_r2000422Noch keine Bewertungen

- Mock Exam Dec 2013Dokument4 SeitenMock Exam Dec 2013saeed_r2000422Noch keine Bewertungen

- Valuation of Bonds and SharesDokument79 SeitenValuation of Bonds and SharesVaishnav KumarNoch keine Bewertungen

- Foreign OperationsDokument30 SeitenForeign OperationspavishalekhaNoch keine Bewertungen

- Corporate Finance Midterm Exam 201810 With CorrectionsDokument7 SeitenCorporate Finance Midterm Exam 201810 With CorrectionsMohd OzairNoch keine Bewertungen

- Statement (3202142) !Dokument1 SeiteStatement (3202142) !asa sscNoch keine Bewertungen

- Calcul Ating T He Co ST O F CapitalDokument50 SeitenCalcul Ating T He Co ST O F CapitalSyrell NaborNoch keine Bewertungen

- Anurag PIS - Week 3 ReviewDokument4 SeitenAnurag PIS - Week 3 ReviewANURAG JENANoch keine Bewertungen

- LS Session1 IntroductionDokument60 SeitenLS Session1 Introductionbaptiste.morinNoch keine Bewertungen

- Problems SCMDokument16 SeitenProblems SCMMohit ShahNoch keine Bewertungen

- Final Exam - Fall 2007Dokument9 SeitenFinal Exam - Fall 2007jhouvanNoch keine Bewertungen

- 58 Method of Valuation of GoodwillDokument12 Seiten58 Method of Valuation of Goodwillrahul_mhabde20059812Noch keine Bewertungen

- Profit/Loss & Cash Flow ProjectionsDokument9 SeitenProfit/Loss & Cash Flow ProjectionsKervin DavantesNoch keine Bewertungen

- Osdl - GistDokument7 SeitenOsdl - Gistsandeep raj (RA1861001010024)Noch keine Bewertungen

- Financial Accounting The Impact On Decision Makers 10th Edition Porter Solutions ManualDokument41 SeitenFinancial Accounting The Impact On Decision Makers 10th Edition Porter Solutions Manualhildabacvvz100% (27)

- Project Report: Title of The ProjectDokument31 SeitenProject Report: Title of The Projectsharanya mukherjeeNoch keine Bewertungen

- Module 7Dokument5 SeitenModule 7trixie maeNoch keine Bewertungen

- Functional Area of ManagementDokument16 SeitenFunctional Area of ManagementNazrul Alam KabirNoch keine Bewertungen

- Intercompany DividendsDokument6 SeitenIntercompany DividendsClauie BarsNoch keine Bewertungen

- Comprehensive Financial Markets Topics Test BankDokument15 SeitenComprehensive Financial Markets Topics Test BankMichelle V. LaurelNoch keine Bewertungen

- MBA Exam 1 Spring 2009Dokument12 SeitenMBA Exam 1 Spring 2009Kamal AssafNoch keine Bewertungen

- BB PT SantosaDokument62 SeitenBB PT SantosaSiti ZahraNoch keine Bewertungen

- CF NotesDokument22 SeitenCF NotesApeksha JhalaniNoch keine Bewertungen

- AAAA Final ProgramDokument10 SeitenAAAA Final ProgramShahifol Arbi IsmailNoch keine Bewertungen

- Soal Akuntansi OSN Ekonomi Dan PembahasaDokument6 SeitenSoal Akuntansi OSN Ekonomi Dan PembahasaQurrotul AyuniNoch keine Bewertungen

- Conceptual Famework FASB IASBDokument36 SeitenConceptual Famework FASB IASBMusab AhmedNoch keine Bewertungen

- SM Garrison MGR Acc 13e Ch16Dokument49 SeitenSM Garrison MGR Acc 13e Ch16YuliArdiansyahNoch keine Bewertungen

- SOIC Allocation Sheet Lyst3011Dokument4 SeitenSOIC Allocation Sheet Lyst3011Manish GargNoch keine Bewertungen

- Activity Sheets in Fundamentals of Accountanc2Dokument5 SeitenActivity Sheets in Fundamentals of Accountanc2Irish NicolasNoch keine Bewertungen

- Engro Fertilizer - Financial AnalysisDokument16 SeitenEngro Fertilizer - Financial AnalysisHasan AshrafNoch keine Bewertungen

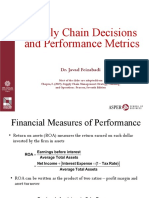

- 3-Supply Chain Decisions and Performance Metrics (A)Dokument21 Seiten3-Supply Chain Decisions and Performance Metrics (A)eeman kNoch keine Bewertungen