Beruflich Dokumente

Kultur Dokumente

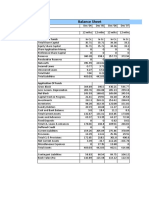

Background Page Key Financial Data for Exam Calculations

Hochgeladen von

Alex GomezOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Background Page Key Financial Data for Exam Calculations

Hochgeladen von

Alex GomezCopyright:

Verfügbare Formate

Background Page:

You may use the information on this page for any part of the exam. All values are current.

Company Business

Asset

Beta

Equity

Beta

Equity

Standard

Deviation Debt

Total

Firm

Value

Stock

Price

Next

Dividend

Per Share

This Years

Cash Flows

EJ H Construction 0.9 0.45 $40M $100M $1.00 $5M

KMS Design 1.5 0.50 $50M $500M $40.00 $1.50 $20M

CSH Construction 0.40 $2.13 $0.75 $4M

The cash flows in this table are cash flows available for stock holders.

Total firm value means equity plus debt.

Risk-free rate: 0.03

Market risk premium (E[R

m

] - r

f

) =0.07

Assume that the beta of debt is always zero.

The corporate tax rate is 35%.

Capital structure changes have no transaction costs and do not affect investment policy.

For each stock, the next dividend will be paid in exactly one year.

NAME______________________________

1 of 4

1. KMS has a higher standard deviation than CSH. What does this imply about CSHs

equity beta compared to KMS equity beta? Explain. [8]

Nothing. As we discussed in class, beta measures only systematic risk while standard

deviation measures total risk. Furthermore, beta and standard deviation are not

quoted in the same units, so you cannot directly compare them. It is quite possible

that even though KMS has a higher total risk (standard deviation) than CSH, less of

that total risk is due to systematic risk than it is for CSH, so CSH could have a

higher beta, meaning more systematic risk, but still have a lower standard deviation

(just by having a small amount of unsystematic risk).

2. What is a good estimate of the equity value of CSH? Explain your reasoning. [8]

CSH and EJH are both in the construction business, so your best bet is to use the

way the market values CSH to value EJH. The background page shows that EJH

has a total firm value of $100M and debt of $40M, meaning that its equity is $60M.

You also see that EJHs current cash flows for equity holders are $5M. Thus, EJH is

trading at 12 times cash flows ($60M/$5M = 12). Since CSH is also in the

construction business, it would be reasonable to assume that the market will value it

similarly, also pricing it at 12 times cash flows. CSHs cash flows are $4M, so its

equity value would be $48M.

3. If the stock market is efficient, that means the expected NPV of investing in the market is

zero. Does that mean you shouldnt invest? Explain. [8]

No. A zero NPV simply means that you are getting a fair return for the amount of

(systematic) risk you are taking-on. There is nothing wrong with getting the fair

return. In an efficient market, you should not expect to get an abnormally high

return for the amount of risk you are takingif such an opportunity were offered,

everyone would want to buy it, and the price would rise until the return was just

fair again. In the long run, simply earning the fair market return has compounded

to a substantial growth in the initial investment.

NAME______________________________

2 of 4

4. If a portfolio that is 30% KMS stock and 70% CSH stock has a portfolio beta of 1.29,

what is the expected return of CSH stock? [10]

We know that the beta of a portfolio is a weighted average of the betas of the stocks

in the portfolio. Also, the background sheet shows that KMS beta is 1.5. Thus,

1.29 (.30)(1.5) (.70) 1.2

P CSH CSH

| | | = = + = . Armed with that information, you can

use the CAPM to compute the expected return on CSH stock:

( ) [ ] .03 1.2 .07 .114

CSH

E R = + = .

5. If you have a portfolio that consists of $4,000 in KMS bonds and $36,000 in KMS equity,

what would be the expected return of your portfolio? [8]

The most common approach is: r

D

= .03+0(.07)=.03. r

E

= .03+1.5(.07)=.135

R

P

= (.10)(.03)+(.90)(.135)=.1245

Heres another way: The weights on your portfolio are 4000/(4000+36000) = .10 in debt and

36000/(4000+36000)=.90 in equity. These are also the weights of debt and equity in KMS capital

structure. KMS has a total value of $500M and is $50M debt, meaning that it has $450M equity.

Thus the weights of debt and equity in KMS capital structure are 10% and 90% as well. We know

that if we hold a portfolio of the debt and equity of a company in proportion to their weights in the

capital structure, our portfolio will have an expected return equal to the firms pre-tax WACC:

Assets equity debt

E D

WACC r r r

D E E D

= = +

+ +

. Also note that as we discussed in class, the pre-tax

WACC is the firms expected return on its assets as a whole, which can be computed from the CAPM

using its asset beta. Now, you just need KMS asset beta. KMS has an equity beta of 1.5 and has

$50M in debt and $450M in equity:

1.5(.90) 0(.10) 1.35

a e d

E D

D E D E

| | | = + = + =

+ +

Now, you are ready to get the expected return on your portfolio from the CAPM:

[ ] .03 1.35(.07) .1245

P

E R = + =

6. If EJ H has 2 million shares outstanding, what do you expect the price per share to be

immediately after the next dividend is paid (hint: start by figuring the current price)? [10]

In question 2, we figured out that EJH has a total equity value of $60M. If it has 2M

shares outstanding, then each share must have a price of $60M/2M = $30.

According to the background sheet, EJH pays a dividend of $1 per share. So, what

you have is

1

1

30 1

[ ]

30

t t t t

EJH

t

P P D P

E R

P

+ +

= = , but we need to know E[R

EJH

] to solve

this. We can find that from the CAPM is we know the equity beta of EJH. EJH has

an asset beta of 0.9, $40M in debt and $60M in equity:

40

0.9 0.9 1.5

60

e a a

D

E

| | |

| |

= + = + =

|

\ .

. With that, you can solve for the expected

return on EJH equity and then use that to compute next years expected price:

30 1

[ ] .03 1.5(.07) .135 $33.05

30

t

EJH t

P

E R P

+

= + = = =

NAME______________________________

3 of 4

7. EJ H is considering a capital structure change. It will issue $20 million in new debt with a

coupon rate of 5% and reduce its stock by $20 million. The debt will be permanent.

a. What will the new value of EJ H be? How much will be equity and how much will be

debt? [8]

Since the debt will be permanent, you can compute the PV of the interest tax

shield using a perpetuity: (.35)(20) 7

C D

ITS C

D

Dr

PV D

r

t

t = = = = , so the swap would

create a tax shield with a PV of $7 million. The new value of the firm will be:

V

New

= V

Old

+ Equity + Debt + PV

ITS

Transaction Costs

V

New

= 100 -20 + 20 + 7 0 (since the background sheet says there will be no trans. costs).

EJH started with $40M in debt and added $20M, so the new total debt will be $60M, leaving

$107-$60M = $47M as the residual for the equity holders.

b. By how much will its stockholders expected return increase? [8]

In question 6, we computed that EJH had an equity beta of 1.5 and an expected

return on equity of .135. The capital structure change will change the equity beta

(but not the asset beta), and hence the expected return on equity. The new

amount of debt is $60M and equity is $47M and the asset beta is still 0.9, so the

new equity beta is:

60

0.9 0.9 2.05

47

e a a

D

E

| | |

| |

= + = + =

|

\ .

and the new expected

return on equity is 0.03+2.05(.07)=.1735. Since the old expected return on equity

was .135, the increase is 0.0385 (3.85%).

8. If KMS and CSH stock have a correlation of 0.3, what is a 95% prediction interval for

next years return for a portfolio that is 50% KMS and 50% CSH? [8]

We need the expected return plus or minus 2 standard deviations:

( )( ) ( ) ( ) ( ) ( ) ( ) ( ) ( )

2 2 2 2 2

.5 .4 .5 .5 2 .5 .5 .4 .5 .3 0.1325

.1325 .364

P

P

o

o

= + + =

= =

To get the expected return, we need the portfolio beta, or the expected returns of

each stock. Earlier, we computed the expected return of CSH as 0.114 and of KMS

as 0.135.

E[R

P

]=(0.5)(0.114)+(0.5)(0.135)=.1245

So, the 95% confidence interval is .1245 2(.364) to .1245+2(.364), which is -0.6035

to +0.8525.

NAME______________________________

4 of 4

9. What is KMS after-tax WACC? [8]

We already have computed KMS r

E

to be 0.135 and its r

D

to be 0.03 (since its debt

beta is zero). Also, KMS is 90% equity and 10% debt: 450/500 is equity and 50/500

is debt. The tax rate is given as 35%

( ) % (1 ) % 0.135 0.90 0.03(1 0.35)(0.10) 0.123

WACC AfterTax E D C

r r E r T D

= + = + =

10. You have a company that has two divisions: design and construction. Your design

division has cash flows of $2 million and your construction division has cash flows of $3

million this year. What is your companys pre-tax WACC? [8]

Using the P/CF ratios from the information page, you can value each of the

divisions. KMS equity has a value of $450 million relative to $20 million in cash

flows, so its ratio is 450/20 = 22.5. EJH has a total equity value of $60 million

relative to cash flows of $5 million, so its ratio is 60/5 = 12. We can value our two

divisions:

Design: $2 million x 22.5 = $45 million.

Construction: $3 million x 12 = $36 million

Our companys pre-tax WACC is a weighted average of the pre-tax WACCs of the

two divisions, where the weights come from the divisional values. The pre-tax

WACC of the design division should be the same as KMS pre-tax WACC and for

construction should be the same as EJH or CSH, both of which are in construction.

We can use the formula from #9 without the tax adjustment to get the pre-tax

WACC for KMS: 0.9(.135)+0.1(0.03)=.1245

For EJH, we have the asset beta of 0.9, so we can use the CAMP: 0.03+.9(.07)=0.093

So your overall pre-tax WACC is:

45 36

0.1245 0.093 0.1105

36 45 36 45

pre tax A

WACC r

| | | |

= = + =

| |

+ +

\ . \ .

11. Your friend notices that Starbucks has a beta of 1.2 and asks you what that means. Write

your explanation of what a beta of 1.2 means. [8]

Beta is a measure of systematic risk. Using the market as a basis with a beta of 1,

this means that Starbucks has more than average systematic risk, such that ON

AVERAGE, when the markets excess return is 1% up or down, Starbucks excess

return is 1.2% in the same direction.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Example of PM Interview PresentationDokument12 SeitenExample of PM Interview PresentationAlex Gomez0% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- DA4387 Level I CFA Mock Exam 2018 Morning ADokument37 SeitenDA4387 Level I CFA Mock Exam 2018 Morning AAisyah Amatul GhinaNoch keine Bewertungen

- Capital BudgetingDokument16 SeitenCapital Budgetingrahul9288100% (7)

- 4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFDokument883 Seiten4) Principles of International Taxation (Mulligan EmerOats Lynne) PDFElgun JafarovNoch keine Bewertungen

- R.A. No. 11976 - Ease of Paying TaxesDokument18 SeitenR.A. No. 11976 - Ease of Paying TaxesBeaNoch keine Bewertungen

- Finding Your Passion PDFDokument13 SeitenFinding Your Passion PDFhello2222222Noch keine Bewertungen

- Proj Review QuestionDokument2 SeitenProj Review QuestionMax RossiNoch keine Bewertungen

- True or False Earth Science DocumentDokument9 SeitenTrue or False Earth Science DocumentAlex GomezNoch keine Bewertungen

- Project Archive ChecklistDokument7 SeitenProject Archive ChecklistMax RossiNoch keine Bewertungen

- Answer Exam I GeoDokument8 SeitenAnswer Exam I GeoAlex GomezNoch keine Bewertungen

- MBA Viewbook 2011 2012 FinalDokument19 SeitenMBA Viewbook 2011 2012 FinalAlex GomezNoch keine Bewertungen

- Introduction to Project Management CourseDokument24 SeitenIntroduction to Project Management CourseAlex GomezNoch keine Bewertungen

- CH 7 PPT Lecture (Nutr 121)Dokument18 SeitenCH 7 PPT Lecture (Nutr 121)Alex GomezNoch keine Bewertungen

- Answer Exam II GeoDokument7 SeitenAnswer Exam II GeoAlex GomezNoch keine Bewertungen

- The Hiring of Wynn Las VegasDokument41 SeitenThe Hiring of Wynn Las VegasAlex GomezNoch keine Bewertungen

- Data Mining For The MassesDokument264 SeitenData Mining For The MassesKumarecitNoch keine Bewertungen

- CH 3 PPT Lecture (Nutr 121)Dokument16 SeitenCH 3 PPT Lecture (Nutr 121)Alex GomezNoch keine Bewertungen

- CH 4 PPT Lecture (Nutr 121) - 1Dokument16 SeitenCH 4 PPT Lecture (Nutr 121) - 1Alex GomezNoch keine Bewertungen

- CH 4 PPT Lecture (Nutr 121) - 1Dokument16 SeitenCH 4 PPT Lecture (Nutr 121) - 1Alex GomezNoch keine Bewertungen

- CH 3 PPT Lecture (Nutr 121)Dokument16 SeitenCH 3 PPT Lecture (Nutr 121)Alex GomezNoch keine Bewertungen

- Beverage ServiceDokument30 SeitenBeverage ServiceAlex GomezNoch keine Bewertungen

- CH 10 PPT Lecture (Nutr 121)Dokument18 SeitenCH 10 PPT Lecture (Nutr 121)Alex GomezNoch keine Bewertungen

- Ch.3 - Thompson Study Guide (Nutr 121)Dokument12 SeitenCh.3 - Thompson Study Guide (Nutr 121)Alex Gomez100% (1)

- CH 1 PPT Lecture (Nutr 121) - 2Dokument20 SeitenCH 1 PPT Lecture (Nutr 121) - 2Alex GomezNoch keine Bewertungen

- CH 4 PPT Lecture (Nutr 121) - 1Dokument16 SeitenCH 4 PPT Lecture (Nutr 121) - 1Alex GomezNoch keine Bewertungen

- CH 1 PPT Lecture (Nutr 121) - 2Dokument20 SeitenCH 1 PPT Lecture (Nutr 121) - 2Alex GomezNoch keine Bewertungen

- 401 PM Assignment Grid-1Dokument1 Seite401 PM Assignment Grid-1Alex GomezNoch keine Bewertungen

- CH 1 PPT Lecture (Nutr 121) - 2Dokument20 SeitenCH 1 PPT Lecture (Nutr 121) - 2Alex GomezNoch keine Bewertungen

- CH 1 PPT Lecture (Nutr 121) - 2Dokument20 SeitenCH 1 PPT Lecture (Nutr 121) - 2Alex GomezNoch keine Bewertungen

- CH 1 PPT Lecture (Nutr 121) - 2Dokument20 SeitenCH 1 PPT Lecture (Nutr 121) - 2Alex GomezNoch keine Bewertungen

- Ch.3 - Thompson Study Guide (Nutr 121)Dokument12 SeitenCh.3 - Thompson Study Guide (Nutr 121)Alex Gomez100% (1)

- Papers That Do Not Conform To The Following Format Will Be Penalized 10 Points To StartDokument1 SeitePapers That Do Not Conform To The Following Format Will Be Penalized 10 Points To StartAlex GomezNoch keine Bewertungen

- Fab 159 Service Exam Study Guide Worth 150 Points TotalDokument2 SeitenFab 159 Service Exam Study Guide Worth 150 Points TotalAlex GomezNoch keine Bewertungen

- Pengaruh Kinerja Keuangan Terhadap Pertumbuhan Laba PadaDokument16 SeitenPengaruh Kinerja Keuangan Terhadap Pertumbuhan Laba PadaRizky MuharromNoch keine Bewertungen

- BS1 - Balance Sheet Summary Dec 2008Dokument7 SeitenBS1 - Balance Sheet Summary Dec 2008Avanti GampaNoch keine Bewertungen

- Company Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesDokument9 SeitenCompany Finance Balance Sheet (Rs in CRS.) : Company: ITC LTD Industry: CigarettesAnimesh GuptaNoch keine Bewertungen

- Project Finance Model AnalysisDokument101 SeitenProject Finance Model Analysisleilo4kaNoch keine Bewertungen

- Test Bank For Financial Statement Analysis and Valuation 2nd Edition EastonDokument36 SeitenTest Bank For Financial Statement Analysis and Valuation 2nd Edition Eastonbdelliumtiliairwoct100% (41)

- Sorsogon State University module analyzes financial statementsDokument11 SeitenSorsogon State University module analyzes financial statementserickson hernanNoch keine Bewertungen

- Review of Literature For Altman Z ScoreDokument5 SeitenReview of Literature For Altman Z ScoreLakshmiRengarajanNoch keine Bewertungen

- Yta School BBL 301023Dokument9 SeitenYta School BBL 301023aahil.dakoraNoch keine Bewertungen

- Mycbseguide: Class 12 - Accountancy Sample Paper 03Dokument15 SeitenMycbseguide: Class 12 - Accountancy Sample Paper 03sneha muralidharanNoch keine Bewertungen

- CH 6Dokument32 SeitenCH 6Zead MahmoodNoch keine Bewertungen

- Corporate Finance Chapter 001Dokument35 SeitenCorporate Finance Chapter 001thuy37Noch keine Bewertungen

- BRDS Fee Structure Bhanwar Rathore Design StudioDokument1 SeiteBRDS Fee Structure Bhanwar Rathore Design Studioczw9fj2jwdNoch keine Bewertungen

- Air Arabia 2017 Financial StatementsDokument62 SeitenAir Arabia 2017 Financial StatementsRatika AroraNoch keine Bewertungen

- e-StatementBRImo 033501085857502 May2023 20230527 114024Dokument2 Seitene-StatementBRImo 033501085857502 May2023 20230527 114024Jon Muardi SimarmataNoch keine Bewertungen

- Partnership Accounting QuestionsDokument15 SeitenPartnership Accounting QuestionsNhel AlvaroNoch keine Bewertungen

- Chapter 34Dokument17 SeitenChapter 34Mike SerafinoNoch keine Bewertungen

- Sources of Finance (Equity)Dokument10 SeitenSources of Finance (Equity)Dayaan ANoch keine Bewertungen

- Finman Midterms Part 1Dokument7 SeitenFinman Midterms Part 1JerichoNoch keine Bewertungen

- Edison CorporationDokument2 SeitenEdison CorporationJuan Diego del Prado SánchezNoch keine Bewertungen

- Financial Management MCQDokument11 SeitenFinancial Management MCQdylan.cosgrove2000Noch keine Bewertungen

- Bankruptcy Problems MirzaDokument3 SeitenBankruptcy Problems MirzaKesarapu Venkata ApparaoNoch keine Bewertungen

- Management Accounting - Chapters 1 2 3Dokument39 SeitenManagement Accounting - Chapters 1 2 3lobo.larisseNoch keine Bewertungen

- MS-4 Dec 2012 PDFDokument4 SeitenMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNoch keine Bewertungen

- VIKAS Blackbook ProjectDokument12 SeitenVIKAS Blackbook Projectansari danish75% (4)

- Kajian Kes Tentang ASNBDokument180 SeitenKajian Kes Tentang ASNBzahrahassan78Noch keine Bewertungen

- Hieu Nguyen Valuation Description: Domino Pizza (DPZ)Dokument3 SeitenHieu Nguyen Valuation Description: Domino Pizza (DPZ)Hiếu Nguyễn Minh HoàngNoch keine Bewertungen