Beruflich Dokumente

Kultur Dokumente

2014 Indiana Legislative Update # 4

Hochgeladen von

The Bose Insurance BlogCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2014 Indiana Legislative Update # 4

Hochgeladen von

The Bose Insurance BlogCopyright:

Verfügbare Formate

Legislative Report

January 31, 2014 BOSE PUBLIC AFFAIRS GROUP INSURANCE BULLETIN XIV, NUMBER 4

In This Issue

GENERAL ASSEMBLY OVERVIEW

The Indiana House voted to amend House Joint Resolution 3 this week in a surprising turn of events. On Monday, Rep. Randy Truitt (RWest Lafayette) offered an amendment to strike the second sentence of HJR 3 that would have banned civil unions in Indiana. The amendment led to powerful speeches on both sides of the aisle, and both sides of the issue, ending in a vote of 52-43 to approve striking the second sentence. The 52 yes votes consisted of 23 Republicans and 29 Democrats, a very bipartisan measure indeed. The vote likely ensures that the constitutional amendment will not reach the public for a vote until at least 2016, if at all. A constitutional amendment must be approved by two, separately elected legislatures to be placed on the ballot for approval. HJR 3 now proceeds to the Senate for discussion. Two differing versions of a business personal property tax cut passed the House and Senate this week. It should be noted both HB 1001 and SB 1 differ from Governor Pences agenda for decreasing the business personal property tax. The House version, HB 1001, is authored by Rep. Eric Turner (R-Cicero). Significant points of the bill include: At a countys option, exempt newly-acquired personal property (i.e., each county would have the option to exempt personal property that is new to Indiana not just new to the county). If a county exercises the option to exempt new personal property, the ordinance must be adopted by a county option income tax (COIT) council, which includes representatives from the county and cities/towns. Local option income tax (LOIT) would serve as the mechanism for local governments to collect any replacement revenue, if necessary. Excludes utility personal property; in other words, utilities would continue to pay personal property tax (in 2013, utilities paid $252.4 million in personal property taxes). Provides that a county income tax council may adopt an ordinance to exempt from property taxation any new business personal property (other than utility personal property) that is located in the county.

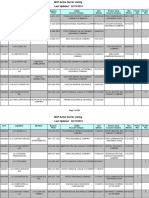

General Assembly Overview Unclaimed Life Insurance Benefits IDOI Bill Electronic Delivery of Insurance Notices and Documents Motor Vehicle Financial Responsibility Pollution Exclusion Lawsuit Lending Workers Comp Abortion Coverage Mandate High Cost Program Study Welfare Drug Testing Bill Biosimilar Bill

Useful Links House Committee Schedule Senate Committee Schedule Contact Your Legislator Indiana Register Contact Us 111 Monument Circle Suite 2700 Indianapolis, IN 46204 317-684-5400 www.bosepublicaffairs.com

HB 1001 passed the full House by a vote of 63-33 and will now

proceed to the Senate where Sen. Brandt Hershman (R-Buck Creek) will sponsor the bill. The Senate version, SB 1, is authored by Sen. Brandt Hershman. SB 1 includes the following provisions: Reduces Indianas corporate income tax rate to 4.9% by July 1, 2019. Once fully implemented, this would put $132 M back into the private sector economy annually. Exempts small businesses from personal property tax liability if they have less than $25,000 of personal property in a county. This change is projected to exempt up to 71% of business personal property tax filers. Revises and eliminates certain tax credits to help finance these tax cuts, including reducing the state R&D tax credit by 50%. Creates an 11-member Blue Ribbon Commission to study the impact of the business personal property tax on Indianas economic competitiveness.

SB 1 passed the full Senate by a vote of 35-11. Next week marks the halfway point of the 2014 legislative session. You will notice a significant amount of introduced bills drop from the bill track lists as many bills never make the cut to advance to the second house. The House will conclude the first half on Monday. The Senate technically could end their third reading calendar Wednesday; however, an impending snow storm has caused Senate President Pro Tem David Long (R-Fort Wayne) to aim for Tuesday to ensure safe travel for all.

Follow Bose Public Affairs Group on Twitter Get timely updates on the legislative session by following the Bose Public Affairs Group on Twitter @BosePAG or visit http://www.twitter.com/bosepag

UNCLAIMED LIFE INSURANCE BENEFITS

SB 220, authored by Sen. Travis Holdman (R), requires insurers to use the SSAs Death Master File or a database as inclusive to help with the accurate administration of unclaimed death benefits. The bill passed out of the Senate last week with an amendment that would apply the bill prospectively for policies issued in Indiana after June 30, 2015. This week, the AGs office expressed concern over the prospective treatment of the bill and they may seek to have it amended in the House back to its original form. The bill will likely receive a hearing in the House Insurance Committee on the second or third Wednesday of February. Stay tuned.

IDOI BILL

HB 1206, authored by House Insurance Chairman Matt Lehman (R), does the following: (1) removes a requirement for life insurers to submit individual investments to the Department of Insurance; (2) removes a requirement that a foreign or alien insurer submit an application for admission to do business in Indiana in duplicate; (3) changes from March 15 to July 1 of each year the due date for

certain insurance holding company filings; (4) adopts ORSA; (5) repeals a provision requiring the Commissioner to examine and publish a foreign or alien insurers annual condensed statement of assets and liabilities; and (6) specifies requirements for service contracts. The bill passed the House last week. It is expected to receive a hearing in the Senate Insurance Committee on the second or third Thursday of February.

ELECTRONIC DELIVERY OF INSURANCE NOTICES AND DOCUMENTS

HB 1058 (Rep. Peggy Mayfield), which passed out of the House Insurance Committee last week, provides for the electronic delivery of insurance notices and documents instead of other modes of delivery otherwise required for such notices and documents. The bill also requires a recipient's consent to electronic delivery and a method to withdraw consent. The bill was amended and engrossed on second reading in the House to include provisions regarding electronic posting of documents on an insurers website. The bill passed the House on Monday by a vote of 92-0.

MOTOR VEHICLE FINANCIAL RESPONSIBILITY

HB 1059 (Rep. Matt Lehman) makes various changes to the motor vehicle financial responsibility law, including the: (1) definition of "registration" to include the license plate issued in connection with the registration of a vehicle; (2) requirement of proof of financial responsibility and reinstatement fees; (3) suspension of a registration as a consequence of operation of the vehicle without financial responsibility in effect; and (4) requirement of proof of future financial responsibility for five years related to operating a vehicle without financial responsibility in effect. The introduced version of this bill was prepared by the interim study committee on insurance. The bill passed the House on Monday by a vote of 81-13.

POLLUTION EXCLUSION

HB 1241, authored by Rep. Martin Carbaugh (R), is a resurrection of last sessions HB 1269, which clarifies when environmental coverage is excluded from a commercial general liability insurance policy. Amendments were adopted on second reading in the House which include additional consumer notification provisions as well as language that would apply the bill prospectively. The bill passed by the House by a vote of 57-36 and Senator Holdman

was named the Senate Sponsor.

LAWSUIT LENDING

HB 1205, authored by House Chairman Matt Lehman (R), regulates the practice of lawsuit lending subject to the jurisdiction of the Indiana Department of Insurance. The bill was amended on second reading in the House to increase the interest rate cap from 25% to 38%. As amended, the bill passed the House by a vote of 57-39. Senator Holdman was named the Sponsor and Senator Eckerty as cosponsor.

WORKERS COMP

As an encore to HEA 1320 (from last session), SB 294 originally provided the following: additional restrictions on repackaged prescription drugs; reduction to the reimbursement cap from 200% of Medicare to 150% of Medicare; cap on reimbursement for implants; clarified the definition of medical service provider. The bill was amended in the Senate Pensions & Labor Committee hearing on Wednesday and now only contains language relative to repackaged drugs and clarification with respect to the definition of a medical service provider. As amended, the bill passed out of Committee unanimously. It is scheduled for second reading in the Senate on Monday.

ABORTION COVERAGE MANDATE PASSES HOUSE

A bill requiring that abortion coverage is offered only as a separate rider to a major medical policy passed the House 80-14 this week. HB 1123 mandates that abortion coverage be offered as an election to a health plan and not a part of essential coverage. The bill was amended on the House floor to remove a provision that exempted student health plans. Sen. Greg Walker is the primary Senate sponsor for HB 1123. It will likely be referred to the Senate Health and Provider Services Committee.

HIGH COST POOL STUDY PASSES HOUSE

A bill directing the Legislative Council to study whether the state should start a new high risk program in place of ICHIA passed the House this week. HB 1335 was filed by Rep. Tim Brown and requires a study of the implementation of a high cost management program for individuals who incur more than $1.5 million in health care costs due to chronic conditions. Given the delays and slow uptake of health plans offered

in Indiana on the federal health insurance marketplace, there has been concern over shutting down the current high risk pool and moving high cost patients out of that program.

WELFARE DRUG TESTING BILL PASSES BY WIDE MARGIN

A bill placing limits on benefits for people receiving TANF benefits passed the House 71-22. HB 1351 requires FSSA to administer a drug testing program and curb benefits for those who test positive for drugs. The bill also puts restrictions on what type of food could be purchased under a statewide nutrition assistance program (SNAP). Similar legislation has failed to pass the last two sessions but seems to have broader support this year.

BIOSIMILAR BILL MOVES TO HOUSE

A biosimilar substitution bill that has been historically controversial passed the Senate 38-11. SB 262 establishes a process by which a pharmacist could substitute a brand name drug for a biosimilar. The substitution is limited to drugs the FDA has determined are interchangeable and can only occur if a prescriber permits substitution on the prescription. The pharmacist must also notify the physician of the substitution within five days. Rep. Ed Clere, who chairs the House Public Health Committee, is the House sponsor for SB 262.

For more information

Trent Hahn tfhahn@bosepublicaffairs.com Mike OBrien mobrien@bosepublicaffairs.com Telephone: 317/684-5400 Fax: 317/684-5432

Das könnte Ihnen auch gefallen

- 50 Vetoes: How States Can Stop the Obama Health Care LawVon Everand50 Vetoes: How States Can Stop the Obama Health Care LawNoch keine Bewertungen

- BPAG Insurance Bulletin 2-20-15Dokument7 SeitenBPAG Insurance Bulletin 2-20-15The Bose Insurance BlogNoch keine Bewertungen

- BPAG Insurance Bulletin 1-23-15Dokument7 SeitenBPAG Insurance Bulletin 1-23-15The Bose Insurance BlogNoch keine Bewertungen

- BPAG Legislative Insurance Bulletin 2-27-15Dokument2 SeitenBPAG Legislative Insurance Bulletin 2-27-15The Bose Insurance BlogNoch keine Bewertungen

- Legislative Wrap Up February 18-22Dokument7 SeitenLegislative Wrap Up February 18-22delegatearoraNoch keine Bewertungen

- Newsletter - June 11, 2010Dokument2 SeitenNewsletter - June 11, 2010Betsy Fleming GrayNoch keine Bewertungen

- LegislativeUpdate3 22 13Dokument1 SeiteLegislativeUpdate3 22 13Dave ThompsonNoch keine Bewertungen

- The North Dakota Legislative ReviewDokument7 SeitenThe North Dakota Legislative ReviewBrett NarlochNoch keine Bewertungen

- Parlimentarian LetterDokument13 SeitenParlimentarian LetterColin MeynNoch keine Bewertungen

- House Repubs. Want To Block DADT Repeal in Lame DuckDokument4 SeitenHouse Repubs. Want To Block DADT Repeal in Lame DuckJoeSudbayNoch keine Bewertungen

- 2013 House Notes - Week 7Dokument4 Seiten2013 House Notes - Week 7RepNLandryNoch keine Bewertungen

- 2013 4 30 Week in ReviewDokument2 Seiten2013 4 30 Week in Reviewapi-215003736Noch keine Bewertungen

- Pages From Ballot ItDokument8 SeitenPages From Ballot ItTeaPartyCheerNoch keine Bewertungen

- Week 7 Reg. SessionDokument3 SeitenWeek 7 Reg. SessionRepNLandryNoch keine Bewertungen

- House Republican Conference 4-10-11Dokument2 SeitenHouse Republican Conference 4-10-11TEA_Party_RockwallNoch keine Bewertungen

- 2012 End of Session Report - FRADokument3 Seiten2012 End of Session Report - FRADiana LewisNoch keine Bewertungen

- Legislative Session ReviewDokument4 SeitenLegislative Session ReviewCarisa AzariaNoch keine Bewertungen

- LegislativeUpdate2 22 13Dokument1 SeiteLegislativeUpdate2 22 13Dave ThompsonNoch keine Bewertungen

- LegislativeUpdate4 22-29 13Dokument1 SeiteLegislativeUpdate4 22-29 13Dave ThompsonNoch keine Bewertungen

- 10-30-09 Top 10 Reasons To Oppose Pelosi-CareDokument5 Seiten10-30-09 Top 10 Reasons To Oppose Pelosi-CareChris RowanNoch keine Bewertungen

- Newsletter 334Dokument13 SeitenNewsletter 334Henry CitizenNoch keine Bewertungen

- MADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Dokument7 SeitenMADSA Guide To 2020 Ballot Questions in Georgia Overview: 1) 2) 3) 4) 5)Louis BourbonNoch keine Bewertungen

- Civil Services Mentor November 2013Dokument134 SeitenCivil Services Mentor November 2013Dida KhalingNoch keine Bewertungen

- O Driscoll 5-3Dokument2 SeitenO Driscoll 5-3api-215003736Noch keine Bewertungen

- Abakada Guro Party List Vs Executive SecretaryDokument8 SeitenAbakada Guro Party List Vs Executive SecretaryAndrea TiuNoch keine Bewertungen

- Florida Constitutional Amendments 2012Dokument6 SeitenFlorida Constitutional Amendments 2012Peggy W SatterfieldNoch keine Bewertungen

- WaterLog 5.15Dokument2 SeitenWaterLog 5.15citybizlist11Noch keine Bewertungen

- Issue 2 Talking Points - 9-25-15Dokument4 SeitenIssue 2 Talking Points - 9-25-15api-291984455Noch keine Bewertungen

- Tax Bill Moves To Senate After House Passage Along Party Lines - The New York TimesDokument8 SeitenTax Bill Moves To Senate After House Passage Along Party Lines - The New York TimesAnonymous XZ6icAtLNoch keine Bewertungen

- Brown Week in ReviewDokument3 SeitenBrown Week in Reviewapi-215003736Noch keine Bewertungen

- Emergency Economic Stabilization ActDokument4 SeitenEmergency Economic Stabilization Actmusic2hisearsNoch keine Bewertungen

- Ohio in Congress, 20110121Dokument1 SeiteOhio in Congress, 20110121The News-HeraldNoch keine Bewertungen

- 2022.12.05 TPPA Weekly Washington ReportDokument11 Seiten2022.12.05 TPPA Weekly Washington ReportTea Party PatriotsNoch keine Bewertungen

- 2014 Indiana Legislative Update # 5Dokument3 Seiten2014 Indiana Legislative Update # 5The Bose Insurance BlogNoch keine Bewertungen

- House Hearing, 111TH Congress - The Administration's Expedited Rescission ProposalDokument45 SeitenHouse Hearing, 111TH Congress - The Administration's Expedited Rescission ProposalScribd Government DocsNoch keine Bewertungen

- Washington Weekly, November 10Dokument3 SeitenWashington Weekly, November 10jeffreyjhillNoch keine Bewertungen

- D25News 03 Mar2010Dokument6 SeitenD25News 03 Mar2010Della Au BelattiNoch keine Bewertungen

- Dodd Frank Act-2016088Dokument18 SeitenDodd Frank Act-2016088nikhilNoch keine Bewertungen

- Pederson Week in ReviewDokument2 SeitenPederson Week in Reviewapi-215003736Noch keine Bewertungen

- State of Minnesota: Office of Governor Tim Walz Lt. Governor Peggy FlanaganDokument7 SeitenState of Minnesota: Office of Governor Tim Walz Lt. Governor Peggy FlanaganjpcoolicanNoch keine Bewertungen

- October 2012 VoterDokument7 SeitenOctober 2012 VoterPamela RW KandtNoch keine Bewertungen

- Debt Deal Almost Done: Washington Policy AnalysisDokument6 SeitenDebt Deal Almost Done: Washington Policy Analysiskmpaatel68Noch keine Bewertungen

- House Hearing, 109TH Congress - Markup of H.R. 1316 The 527 Fairness Act of 2005Dokument42 SeitenHouse Hearing, 109TH Congress - Markup of H.R. 1316 The 527 Fairness Act of 2005Scribd Government DocsNoch keine Bewertungen

- ABAKADA Guro Party List Vs Executive SecretaryDokument18 SeitenABAKADA Guro Party List Vs Executive SecretaryrheaNoch keine Bewertungen

- Congressman Paul RyanDokument3 SeitenCongressman Paul Ryanapi-25906695Noch keine Bewertungen

- Letter From CM Gray To Councilmembers On MCO Contract Legislation (6.28.21)Dokument3 SeitenLetter From CM Gray To Councilmembers On MCO Contract Legislation (6.28.21)Vincent C. GrayNoch keine Bewertungen

- Senate Democratic Conference Introduce The "Clean Up Albany" Legislative PackageDokument6 SeitenSenate Democratic Conference Introduce The "Clean Up Albany" Legislative PackageNew York State Senate Democratic ConferenceNoch keine Bewertungen

- 2010 Taxpayers League of Minnesota ScorecardDokument6 Seiten2010 Taxpayers League of Minnesota ScorecardThe Taxpayers League of MinnesotaNoch keine Bewertungen

- JWT Newletter 3-24-11Dokument3 SeitenJWT Newletter 3-24-11barrywpgNoch keine Bewertungen

- WVML Issue I - January 23, 2014Dokument2 SeitenWVML Issue I - January 23, 2014Kyle LangsleyNoch keine Bewertungen

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDokument10 SeitenLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNoch keine Bewertungen

- Builders Outlook: 82nd Legislature Ends, Texas Builders Prepare For 83rdDokument16 SeitenBuilders Outlook: 82nd Legislature Ends, Texas Builders Prepare For 83rdTedEscobedoNoch keine Bewertungen

- Legislative Wrap-Up: Library and Information Services, Department of Legislative ServicesDokument4 SeitenLegislative Wrap-Up: Library and Information Services, Department of Legislative ServicesdelegatearoraNoch keine Bewertungen

- 2011 2012 Legislative ScorecardDokument8 Seiten2011 2012 Legislative ScorecardSean FurrNoch keine Bewertungen

- Final - 2016 Newsletter - DraftDokument2 SeitenFinal - 2016 Newsletter - Draftapi-263289045Noch keine Bewertungen

- Legislative Update 4.12.13Dokument1 SeiteLegislative Update 4.12.13Dave ThompsonNoch keine Bewertungen

- Legislative UpdateDokument3 SeitenLegislative Updateapi-215003736Noch keine Bewertungen

- Ohio Supreme Court Ruling On Income Taxes For NonresidentsDokument33 SeitenOhio Supreme Court Ruling On Income Taxes For NonresidentsJessie BalmertNoch keine Bewertungen

- Danske Markets - US Debt Default Unlikely 20110727Dokument10 SeitenDanske Markets - US Debt Default Unlikely 20110727SynergyFinanceNoch keine Bewertungen

- Letter From CM Gray To Councilmembers On MCO Contract Legislation (5.28.21)Dokument4 SeitenLetter From CM Gray To Councilmembers On MCO Contract Legislation (5.28.21)Vincent C. GrayNoch keine Bewertungen

- BPAG Insurance Bulletin 3-6-15Dokument2 SeitenBPAG Insurance Bulletin 3-6-15The Bose Insurance BlogNoch keine Bewertungen

- 6-14-cv-06002-GAP-TBS (Doc. 78) (Brewer)Dokument14 Seiten6-14-cv-06002-GAP-TBS (Doc. 78) (Brewer)The Bose Insurance BlogNoch keine Bewertungen

- Capitol Body OrderDokument2 SeitenCapitol Body OrderThe Bose Insurance BlogNoch keine Bewertungen

- 2015-02-25 (145) Magistrate's Report and Recommendation On Motions To DismissDokument13 Seiten2015-02-25 (145) Magistrate's Report and Recommendation On Motions To DismissThe Bose Insurance BlogNoch keine Bewertungen

- 2014 Indiana Legislative Update # 5Dokument3 Seiten2014 Indiana Legislative Update # 5The Bose Insurance BlogNoch keine Bewertungen

- 1 Original Petition Eric C Blue BankruptcyDokument48 Seiten1 Original Petition Eric C Blue BankruptcyEric GreenNoch keine Bewertungen

- Cause of Loss - Basic Form - CP 10 10Dokument6 SeitenCause of Loss - Basic Form - CP 10 10Steve SolakNoch keine Bewertungen

- SSS, GSIS, ECP Table of BenefitsDokument16 SeitenSSS, GSIS, ECP Table of BenefitsVincentRaymondFuellasNoch keine Bewertungen

- Conwar 2004 - War Risks Clause For Voyage CharteringDokument3 SeitenConwar 2004 - War Risks Clause For Voyage CharteringEnriqueNoch keine Bewertungen

- MCQSDokument5 SeitenMCQSJiteshNoch keine Bewertungen

- 02 14 CorpoDokument69 Seiten02 14 CorpoFelip MatNoch keine Bewertungen

- Contract Agreement of IpankDokument21 SeitenContract Agreement of IpankRahmat SantanaNoch keine Bewertungen

- Rift Valley University Chiro Campus: Collega of Business and EconomicsDokument35 SeitenRift Valley University Chiro Campus: Collega of Business and EconomicsBobasa S AhmedNoch keine Bewertungen

- FAR FPB With Answer KeysDokument16 SeitenFAR FPB With Answer KeysPj ManezNoch keine Bewertungen

- Nigerian Insurance Sector & Digital Imperative: A Legal Re-Awakening Occasioned by Covid-19 Virus OutbreakDokument16 SeitenNigerian Insurance Sector & Digital Imperative: A Legal Re-Awakening Occasioned by Covid-19 Virus OutbreakGlobal Research and Development ServicesNoch keine Bewertungen

- As 4915-2002 (Reference Use Only) Project Management - General ConditionsDokument9 SeitenAs 4915-2002 (Reference Use Only) Project Management - General ConditionsSAI Global - APACNoch keine Bewertungen

- Tender Details OF Notice Inviting Tender: Nit No.: Mdi/Gurugram/Project/Pgpm//2017Dokument10 SeitenTender Details OF Notice Inviting Tender: Nit No.: Mdi/Gurugram/Project/Pgpm//2017lucky dudeNoch keine Bewertungen

- J 1Dokument224 SeitenJ 1Grace RomeroNoch keine Bewertungen

- Sales IllustrationDokument23 SeitenSales IllustrationMahakala AnahatakeshwaraNoch keine Bewertungen

- Pro-Rata 2019-20Dokument2 SeitenPro-Rata 2019-20আরিক মোঃ ইসতিয়াকNoch keine Bewertungen

- March 29, 2013 Strathmore TimesDokument31 SeitenMarch 29, 2013 Strathmore TimesStrathmore TimesNoch keine Bewertungen

- Compensation ManagementDokument212 SeitenCompensation ManagementSyed Adil Hussain100% (1)

- Project: Life Insurance Corporation of IndiaDokument47 SeitenProject: Life Insurance Corporation of IndiaharshNoch keine Bewertungen

- Pricing Strategies: Product and Customer ManagementDokument18 SeitenPricing Strategies: Product and Customer ManagementAatam ShahNoch keine Bewertungen

- Income Tax MCQDokument28 SeitenIncome Tax MCQancy mathewsNoch keine Bewertungen

- Thelma Vda. de Canilang, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. GR No. 92492 June 17, 1993Dokument2 SeitenThelma Vda. de Canilang, Petitioner, vs. Hon. Court of Appeals and Great Pacific Life Assurance Corporation, Respondents. GR No. 92492 June 17, 1993ChaNoch keine Bewertungen

- G.R. No. 146494 July 14, 2004 GOVERNMENT SERVICE INSURANCE SYSTEM, Cebu City Branch, Petitioner, MILAGROS O. MONTESCLAROS, RespondentDokument6 SeitenG.R. No. 146494 July 14, 2004 GOVERNMENT SERVICE INSURANCE SYSTEM, Cebu City Branch, Petitioner, MILAGROS O. MONTESCLAROS, RespondentShally Lao-unNoch keine Bewertungen

- INSURANCEDokument14 SeitenINSURANCEEm-em Maguen100% (1)

- Chapter 3Dokument12 SeitenChapter 3geexellNoch keine Bewertungen

- Full Download Understanding Business Strategy Concepts Plus 3rd Edition Ireland Solutions ManualDokument36 SeitenFull Download Understanding Business Strategy Concepts Plus 3rd Edition Ireland Solutions Manualkiffershidx100% (26)

- Overview Duties and Liabilities of Directors in Canada A1Dokument2 SeitenOverview Duties and Liabilities of Directors in Canada A1Vasile SoltanNoch keine Bewertungen

- Final ThesisDokument49 SeitenFinal ThesisAdil AwanNoch keine Bewertungen

- Cold Store BijapurDokument42 SeitenCold Store Bijapurmdalt9180Noch keine Bewertungen

- Quiz Questions Risk and Insurance MGTDokument4 SeitenQuiz Questions Risk and Insurance MGTShashi Kumar C GNoch keine Bewertungen

- Dissertation Akshay SuriDokument10 SeitenDissertation Akshay SuriUmesh TyagiNoch keine Bewertungen