Beruflich Dokumente

Kultur Dokumente

Capital Ratio Swiss Banks

Hochgeladen von

DBurriezaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Ratio Swiss Banks

Hochgeladen von

DBurriezaCopyright:

Verfügbare Formate

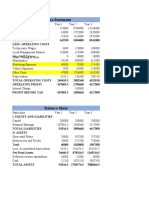

Core capital ratios (tier 1 ratings) of SSPA members

Data as of March 21, 2011 Issuer (issue vehicle) Bank Julius Br & Co. Ltd. Bank Julius Br & Co. Ltd. Guernsey Branch Barclays Bank PLC Bank Sarasin & Co. Ltd. Bank Sarasin (CI) Ltd Bank Vontobel AG Vontobel Financial Products Ltd. Banque Cantonale Vaudoise Banque Cantonale Vaudoise, Guernsey Branch Clariden Leu AG Clariden Leu Ltd., Nassau Branch Commerzbank Credit Suisse Guernsey Branch Credit Suisse London Branch Credit Suisse Nassau Branch Credit Suisse International Deutsche Bank AG Deutsche Bank AG, London Branch Deutsche Bank AG, Zuerich Branch Domicile Zurich Guernsey London Basel Guernsey Zurich Dubai Lausanne Guernsey Zurich Nassau Frankfurt Guernsey London Nassau London Frankfurt London Zurich Relationship to rated company with core capital ratio (tier 1 ratings) same legal entity Bank Julius Br & Co. Ltd. branch, same legal entity subsidiary same legal entity Bank Sarasin & Co. Ltd. subsidiary same legal entity subsidiary same legal entity Banque Cantonale Vaudoise branch, same legal entity same legal entity Clariden Leu2) branch, same legal entity same legal entity branch, same legal entity branch, same legal entity branch, same legal entity same legal entity same legal entity branch, same legal entity branch, same legal entity Deutsche Bank AG

12.3 H2 2010 IFRS 23.9 H2 2010 US-GAAP 18 H1 2010 Swiss GAAP FER 15.3 H2 2010 IFRS 23.8 H2 2010 IFRS

Company with core capital ratio (tier 1 ratings)

Core capital ratio (tier 1 in %)

Closing date

Accounting standards

Barclays PLC

13.5

H2 2010

IFRS

Bank Vontobel AG1) Vontobel Holding AG

21.8

H2 2010

IFRS IFRS

Commerzbank

11.2

Q3 2010

IFRS

Credit Suisse2)

17.2

H2 2010

US-GAAP

Credit Suisse International2)

US-GAAP

1/3

Core capital ratios (tier 1 ratings) of SSPA members

Data as of March 21, 2011 Issuer (issue vehicle) EFG Financial Products AG EFG Financial Products (Guernsey) Ltd. Goldman Sachs International Macquarie Structured Products (Europe) GmbH Merrill Lynch Capital Markets AG Merrill Lynch International & Co. Netherlands Antilles Merrill Lynch SA Morgan Stanley & Co. Inc. Morgan Stanley & Co. International Plc. Morgan Stanley B.V. Sal. Oppenheim jr. & Cie. KGaA SGA Socit Gnrale Acceptance N.V. Socit Gnrale Effekten GmbH The Royal Bank of Scotland N.V., London Branch UBS AG UBS AG, Jersey Branch UBS AG, London Branch UniCredit Bank AG Zrcher Kantonalbank Zrcher Kantonalbank Finance (Guernsey) Ltd Domicile Zurich Guernsey London Frankfurt Zurich Curaao Relationship to rated company with core capital ratio (tier 1 ratings) subsidiary EFG International AG subsidiary subsidiary Tochtergesellschaft subsidiary subsidiary Bank of America Corporation

11.24 H2 2010 US-GAAP 14 H2 2010 IFRS

Company with core capital ratio (tier 1 ratings)

Core capital ratio (tier 1 in %)

Closing date

Accounting standards

Goldman Sachs Group, Inc. Macquarie Bank Limited

15.2 11.5

H1 2010 H1 2010

US-GAAP IFRS

Luxembourg subsidiary Wilmington London Amsterdam Cologne Curaao Frankfurt London Zurich Jersey London Mnchen Zurich Guernsey same legal entity subsidiary subsidiary same legal entity subsidiary Socit Gnrale subsidiary branch, same legal entity same legal entity branch, same legal entity branch, same legal entity same legal entity same legal entity Zrcher Kantonalbank subsidiary

14.1 H2 2010 RRV-EBK 10.6 H2 2010 IFRS

Morgan Stanley & Co. Inc.

16

H2 2010

US-GAAP

Sal. Oppenheim jr. & Cie.

8.7

H2 2008

IFRS

The Royal Bank of Scotland N.V.

12.5

Q3 2010

IFRS

UBS AG

17.7

H2 2010

IFRS

UniCredit Bank AG

16

Q3 2010

IFRS

2/3

Core capital ratios (tier 1 ratings) of SSPA members

Data as of March 21, 2011 Issuer (issue vehicle) Key: Issuer (issue vehicle) Domicile Relationship to rated company with core capital ratio (tier 1 rating) Company with core capital ratio (tier 1 rating) Core capital ratio (tier 1 in %) Closing date Accounting standard Q H 1) 2) Sources: Important: Domicile Relationship to rated company with core capital ratio (tier 1 ratings) Company with core capital ratio (tier 1 ratings) Core capital ratio (tier 1 in %) Closing date Accounting standards

Issuer of a structured product. Issuers (issue vehicle's) legal domicile. Nature of legal relationship to the parent company. Listed only if the issuer or issue vehicle is other than the parent company. - Branch: Legally the same as the parent company. - Subsidiary: Independent legal entity (in which the parent company has a majority stake) in the country/judicial district concerned. Business for which a core capital ratio is available. The tier 1 core capital ratio (according to Basel II) is the ratio of core capital and risk-weighted credit amounts. The core capital is made up of the share capital, disclosed reserves and profit carried forward. Equity requirements according to Basel II require a minimum tier 1 rating of 4%. Publication date / Issuers calculation of core capital ratio. This refers to the end of the respective reporting period. The accounting standard indicates which regulations the companys accounts adhere to. The main accounting standards are IFRS (International Financial Reporting Standards), US-GAAP (United States Generally Accepted Accounting Principles), Swiss GAAP FER and RRV-EBK. Core capital ratio not published. quarter half-year Bank Vontobel AG is a 100% subsidiary of Vontobel Holding AG. Clariden Leu, Credit Suisse and Credit Suisse International are 100% subsidiaries of Credit Suisse Group AG. Issuers Please note that the core capital ratio (tier 1 ratings) is only one of several criteria influencing the choice of a structured product. The information below should not be considered investment advice, nor does it constitute an offer or recommendation to buy or sell a product or take the place of a person-to-person consultation. Rather than investing in a single product, we recommend diversification. This prevents a single product in an investment portfolio from gaining too much weight, and in cases of default having too great an effect on the portfolios overall value. Core capital ratio information is provided by issuer. The SSPA and the issuers listed are in no way responsible for the completeness or accuracy of the information. No special verification procedures were performed.

3/3

Das könnte Ihnen auch gefallen

- Banking 101 - Large Cap Bank Primer - Deutsche Bank (2011) PDFDokument112 SeitenBanking 101 - Large Cap Bank Primer - Deutsche Bank (2011) PDFJcove100% (2)

- Illustrative Consolidated Financial StatementsDokument209 SeitenIllustrative Consolidated Financial Statementsalexichi100% (2)

- Urban Water PartnersDokument2 SeitenUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- SocGen Stress TestDokument22 SeitenSocGen Stress Testjonny1836Noch keine Bewertungen

- Update The Barclays Euro Government Inflation-Linked Bond EGILB IndexDokument6 SeitenUpdate The Barclays Euro Government Inflation-Linked Bond EGILB IndexabandegenialNoch keine Bewertungen

- Trust Bank ICAAP ReportDokument16 SeitenTrust Bank ICAAP ReportG117100% (2)

- NASDAQDokument112 SeitenNASDAQparaoaltoeavante100% (1)

- Sample Balance Sheet Concierge Service IndustryDokument12 SeitenSample Balance Sheet Concierge Service IndustrykpsrikanthvNoch keine Bewertungen

- Unit 10 Financial MarketsDokument9 SeitenUnit 10 Financial MarketsDURGESH MANI MISHRA PNoch keine Bewertungen

- Cost of Capital Study 2011-2012-KPMGDokument52 SeitenCost of Capital Study 2011-2012-KPMGanil14bits87Noch keine Bewertungen

- IFRS 13 Guide to Fair Value MeasurementDokument11 SeitenIFRS 13 Guide to Fair Value Measurementmulualem100% (4)

- AP 5904Q InvestmentsDokument4 SeitenAP 5904Q Investmentskristine319Noch keine Bewertungen

- RBB Otchet 2014 Eng LowDokument122 SeitenRBB Otchet 2014 Eng LowsciacjNoch keine Bewertungen

- Globalinvestmentfunds Annualreport 706Dokument368 SeitenGlobalinvestmentfunds Annualreport 706xuhaibimNoch keine Bewertungen

- Autocallables en 1511487Dokument9 SeitenAutocallables en 1511487r6h987mrn6Noch keine Bewertungen

- Conclusion: Investor DayDokument6 SeitenConclusion: Investor DaySabri_naNoch keine Bewertungen

- JPM Annual ReportDokument50 SeitenJPM Annual ReportSummaiya BarkatNoch keine Bewertungen

- VTB Group 1q20 Transcript EngDokument12 SeitenVTB Group 1q20 Transcript EngDmitry SurnovNoch keine Bewertungen

- Undervalued Global Bank Stocks: Country GDP Growth Rate %2 Unemployment Rate %3 Inflation Rate3 Interest Rate3Dokument3 SeitenUndervalued Global Bank Stocks: Country GDP Growth Rate %2 Unemployment Rate %3 Inflation Rate3 Interest Rate3Oscar BaroveroNoch keine Bewertungen

- SNB Ar2012Dokument232 SeitenSNB Ar2012kirkhereNoch keine Bewertungen

- Connecting Customers To Opportunities: HSBC in 2011Dokument32 SeitenConnecting Customers To Opportunities: HSBC in 2011Jack Hyunsoo KimNoch keine Bewertungen

- Presentation - Guenter Faschang, Vontobel Asset Management - Vilnius, Lithuania - March 22, 2002Dokument35 SeitenPresentation - Guenter Faschang, Vontobel Asset Management - Vilnius, Lithuania - March 22, 2002cgs005Noch keine Bewertungen

- Financial Service UK Banks Performance Benchmarking Report HY Results 2011Dokument66 SeitenFinancial Service UK Banks Performance Benchmarking Report HY Results 2011Amit JainNoch keine Bewertungen

- DZ BANK Presentation PDFDokument13 SeitenDZ BANK Presentation PDFCIBPNoch keine Bewertungen

- BarCap - Brave or Foolish - ROE Targets by European Banks (MAR11)Dokument26 SeitenBarCap - Brave or Foolish - ROE Targets by European Banks (MAR11)rjokelly1Noch keine Bewertungen

- IFRS Compared To Russian GAAP O 200510Dokument0 SeitenIFRS Compared To Russian GAAP O 200510MichaelonseaNoch keine Bewertungen

- Roland Berger Investment Banking 20120710Dokument12 SeitenRoland Berger Investment Banking 20120710Iago SelemeNoch keine Bewertungen

- Credit Suisse AR 2010Dokument526 SeitenCredit Suisse AR 2010Karl SvenningssonNoch keine Bewertungen

- Swedbank's Interim Report Q2 2012Dokument47 SeitenSwedbank's Interim Report Q2 2012Swedbank AB (publ)Noch keine Bewertungen

- Sassaf Citi PresDokument29 SeitenSassaf Citi PresakiskefalasNoch keine Bewertungen

- Fitch SG Q2 2014 ResultsDokument3 SeitenFitch SG Q2 2014 ResultsredaNoch keine Bewertungen

- SAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011Dokument36 SeitenSAMPLE MANUFACTURING COMPANY LIMITED FINANCIAL STATEMENTS FOR YEAR ENDED DEC 31, 2011talhaadnanNoch keine Bewertungen

- Script Topic 1 Fall 2020 IFRSDokument20 SeitenScript Topic 1 Fall 2020 IFRSyingqiao.panNoch keine Bewertungen

- Raiffeisen Bank International Q3 ReportDokument138 SeitenRaiffeisen Bank International Q3 ReportCiocoiu Vlad AndreiNoch keine Bewertungen

- The Debt Forum PresentationsDokument72 SeitenThe Debt Forum PresentationsrobcannonNoch keine Bewertungen

- Bank Profitability: Proposals For A Revision of Oecd Banking Statistics and IndicatorsDokument23 SeitenBank Profitability: Proposals For A Revision of Oecd Banking Statistics and IndicatorsRakhee PalsaniaNoch keine Bewertungen

- Deutche Bank Doc 1 - Deutsche Bank at A GlanceDokument14 SeitenDeutche Bank Doc 1 - Deutsche Bank at A GlanceUriGrodNoch keine Bewertungen

- Dbfy2009 Annual ReviewDokument80 SeitenDbfy2009 Annual ReviewVishal N ChowdriNoch keine Bewertungen

- Second Quarter 2013: Profit For The QuarterDokument58 SeitenSecond Quarter 2013: Profit For The QuarterSwedbank AB (publ)Noch keine Bewertungen

- CBS Data StructureDokument15 SeitenCBS Data StructurePrabhakar SharmaNoch keine Bewertungen

- Deutsche Bank issues €1.75 billion Additional Tier 1 notesDokument76 SeitenDeutsche Bank issues €1.75 billion Additional Tier 1 notesomidreza tabrizianNoch keine Bewertungen

- Wal-Mart Business Valuation and Risk AnalysisDokument27 SeitenWal-Mart Business Valuation and Risk AnalysisVaishali SharmaNoch keine Bewertungen

- Hedge Value - enDokument9 SeitenHedge Value - enmadridbillNoch keine Bewertungen

- Black Stone Webcast - Outlook For US & Europe 2011.10.05Dokument12 SeitenBlack Stone Webcast - Outlook For US & Europe 2011.10.05nicknyseNoch keine Bewertungen

- Ifrs and External Indepdent ReportDokument27 SeitenIfrs and External Indepdent ReportHyder AliNoch keine Bewertungen

- Financial Analysis - RATIOSDokument55 SeitenFinancial Analysis - RATIOSRoy YadavNoch keine Bewertungen

- Amanda ButavandDokument12 SeitenAmanda ButavandGrigore TurcanNoch keine Bewertungen

- Central Bank sees muted growth in 2022Dokument6 SeitenCentral Bank sees muted growth in 2022wdqkj.nsd,ndsNoch keine Bewertungen

- Abn Amro 2010 Annual ReportDokument280 SeitenAbn Amro 2010 Annual ReportPetar PetrovicNoch keine Bewertungen

- Market Outlook 22nd November 2011Dokument4 SeitenMarket Outlook 22nd November 2011Angel BrokingNoch keine Bewertungen

- Fitch RatingsDokument7 SeitenFitch RatingsTareqNoch keine Bewertungen

- BANK Quarterly Jun 10Dokument27 SeitenBANK Quarterly Jun 10alihennawiNoch keine Bewertungen

- Research On Banking Sector by Witty AdvisoryDokument141 SeitenResearch On Banking Sector by Witty AdvisoryAnkit GuptaNoch keine Bewertungen

- Analysis and Estimate of The Enterprises Bankruptcy RiskDokument6 SeitenAnalysis and Estimate of The Enterprises Bankruptcy RiskMajed Abou AlkhirNoch keine Bewertungen

- DB Oil and NoksekDokument5 SeitenDB Oil and Noksekjoesmith25Noch keine Bewertungen

- Interim Management StatementDokument30 SeitenInterim Management StatementPriyanka RaipancholiaNoch keine Bewertungen

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryVon EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Bogdanka: Investment Story & RecommendationDokument4 SeitenBogdanka: Investment Story & Recommendationp_barankiewiczNoch keine Bewertungen

- Document Incorporated by Reference Base Prospectus 2010 2015 05 12Dokument112 SeitenDocument Incorporated by Reference Base Prospectus 2010 2015 05 12ArcadiosNoch keine Bewertungen

- Eu Yan Sang International LTD Swot Analysis BacDokument14 SeitenEu Yan Sang International LTD Swot Analysis BacCyrille Lacaba ParedesNoch keine Bewertungen

- Barcap GDP Weighted FXDokument2 SeitenBarcap GDP Weighted FXRoberto PerezNoch keine Bewertungen

- Private Equity Holding AGDokument68 SeitenPrivate Equity Holding AGArvinLedesmaChiongNoch keine Bewertungen

- MSF 506-Final DocumentDokument22 SeitenMSF 506-Final Documentrdixit2Noch keine Bewertungen

- Engie Hybrid Final ProspectusDokument94 SeitenEngie Hybrid Final ProspectusMohamed Ali AmaraNoch keine Bewertungen

- 1617aFBI 5Dokument13 Seiten1617aFBI 5TarllingNoch keine Bewertungen

- 2030 Energy Outlook BookletDokument80 Seiten2030 Energy Outlook BookletSungho KimNoch keine Bewertungen

- Multiple CamScanner ScansDokument14 SeitenMultiple CamScanner ScansDBurriezaNoch keine Bewertungen

- Yacobucci, Guillermo - Comentario Fallo EspósitoDokument12 SeitenYacobucci, Guillermo - Comentario Fallo EspósitoDBurriezaNoch keine Bewertungen

- The Mineral Industry of Latin America and CanadaDokument9 SeitenThe Mineral Industry of Latin America and CanadaDBurriezaNoch keine Bewertungen

- Corrections - Instructions To PrintersDokument1 SeiteCorrections - Instructions To PrintersDBurriezaNoch keine Bewertungen

- Digital TV: The Effect of Delay When Watching FootballDokument4 SeitenDigital TV: The Effect of Delay When Watching FootballDBurriezaNoch keine Bewertungen

- Financial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak AggarwalDokument6 SeitenFinancial Analysis Report On Ambuja Cement LTD.: Submitted To: Ak Aggarwalsehrawat009mNoch keine Bewertungen

- MS-4 Dec 2012 PDFDokument4 SeitenMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNoch keine Bewertungen

- CW 13 LTF Key 1Dokument6 SeitenCW 13 LTF Key 1Jedidiah ManglicmotNoch keine Bewertungen

- Set D (MC), Question and Answers Chapter 20 - BudgetingDokument4 SeitenSet D (MC), Question and Answers Chapter 20 - BudgetingJohn Carlos DoringoNoch keine Bewertungen

- Financial Planning and Forecasting GuideDokument24 SeitenFinancial Planning and Forecasting GuidePervin ScribdNoch keine Bewertungen

- Horizontal Analysis of The Balance SheetDokument5 SeitenHorizontal Analysis of The Balance SheetCristaiza R. DumpitNoch keine Bewertungen

- Chapter 13 EUROPEAN PUBLIC SECTOR ACCOUNTING Consolidation MethodsDokument40 SeitenChapter 13 EUROPEAN PUBLIC SECTOR ACCOUNTING Consolidation MethodsSakura AlexaNoch keine Bewertungen

- Topics Covered: How Corporations Issue SecuritiesDokument7 SeitenTopics Covered: How Corporations Issue SecuritiesTam DoNoch keine Bewertungen

- Busi370 Midterm Practice Summer2016Dokument12 SeitenBusi370 Midterm Practice Summer2016NicoleNoch keine Bewertungen

- Solution Manual For Cost Accounting 16th Edition Horngren Datar RajanDokument53 SeitenSolution Manual For Cost Accounting 16th Edition Horngren Datar RajanLo Wingc0% (2)

- Instructions: Submit Within Due DateDokument4 SeitenInstructions: Submit Within Due DateDanish SajjadNoch keine Bewertungen

- CFA Level 1 Curriculum Changes 2021 (300hours)Dokument1 SeiteCFA Level 1 Curriculum Changes 2021 (300hours)Sumalya BhattaacharyaaNoch keine Bewertungen

- AP5Dokument5 SeitenAP5Sweetcell Anne50% (2)

- Financial Analysis - PT Telekomunikasi Indonesia TBKDokument25 SeitenFinancial Analysis - PT Telekomunikasi Indonesia TBKYuukiNoch keine Bewertungen

- Accounting 34 Module 8 AssignmentDokument2 SeitenAccounting 34 Module 8 AssignmentCzarina SalazarNoch keine Bewertungen

- Financial Modeling Handbook 3rd EditionDokument93 SeitenFinancial Modeling Handbook 3rd EditionMaunik ParikhNoch keine Bewertungen

- FlyByU AG Balance Sheet and Profit and Loss StatementDokument1 SeiteFlyByU AG Balance Sheet and Profit and Loss StatementChiara AnindaNoch keine Bewertungen

- Pert 9 - Equity InvestmentDokument2 SeitenPert 9 - Equity InvestmentVidya IntaniNoch keine Bewertungen

- Chap 14 Interest Rate and Currency SwapsDokument23 SeitenChap 14 Interest Rate and Currency SwapsT MNoch keine Bewertungen

- Backflush costing and JIT problemsDokument2 SeitenBackflush costing and JIT problemsdoora keysNoch keine Bewertungen

- The Concept of Modern Stock Markets: A Study From Islamic PerspectiveDokument83 SeitenThe Concept of Modern Stock Markets: A Study From Islamic PerspectiverfdNoch keine Bewertungen

- ACCT 302 Financial Reporting II Lecture 7Dokument63 SeitenACCT 302 Financial Reporting II Lecture 7Jesse NelsonNoch keine Bewertungen

- FR 2019 Paper FinalDokument58 SeitenFR 2019 Paper FinalshashalalaxiangNoch keine Bewertungen

- AFFIDAVIT OF UNDERTAKING For ZING BMADokument2 SeitenAFFIDAVIT OF UNDERTAKING For ZING BMABernard AsperinNoch keine Bewertungen