Beruflich Dokumente

Kultur Dokumente

Capital Expenditure Vs

Hochgeladen von

Rashid HussainOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Expenditure Vs

Hochgeladen von

Rashid HussainCopyright:

Verfügbare Formate

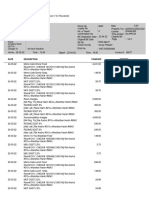

Capital Expenditure Vs.

Revenue Expenditure

Gazu Lakhotia FOLLOW Capital Expenditure Vs. Revenue Expenditure The main points of distinction between capital expenditure and revenue expenditure are follows. (i) Purpose : Capital expenditure is incurred for acquisition or erection of fixed assets to used in the business. On the other hand, revenue expenditure is incurred for the day-to conduct of business. (ii) Earning Capacity : Capital expenditure increases the earning capacity of the business whereas revenue expenditure does not increase the earning capacity as it is incurred maintaining the existing earning capacity. (iii) Period of Benefit : The benefit of capital expenditure extends to more than one year, the benefit of revenue expenditure extends only to the current year. Capital Expenditure Vs. Revenue Expenditure The main points of distinction between capital expenditure and revenue expenditure are follows. (i) Purpose : Capital expenditure is incurred for acquisition or erection of fixed assets to used in the business. On the other hand, revenue expenditure is incurred for the day-to conduct of business. (ii) Earning Capacity : Capital expenditure increases the earning capacity of the business whereas revenue expenditure does not increase the earning capacity as it is incurred maintaining the existing earning capacity. (iii) Period of Benefit : The benefit of capital expenditure extends to more than one year, the benefit of revenue expenditure extends only to the current year. (iv) Accounting Treatment: Capital expenditure is shown in the Balance Sheet as an asset, the other hand, revenue expenditure is shown as an expense in the Trading Account or Pro and Loss Account. (v) Nature : Capital expenditure is of a non-recurring nature because such expenditure is nd incurred every day. On the contrary, revenue expenditure is recurring in nature as it is incurred on day to day operations. , (vi) Effect on Assets : Capital expenditure leads to increase in the value of fixed assets. But revenue expenditure does not result in increase in the value of these assets. Revenue expenditure treated as Capital Expenditure

The following expenses are revenue in nature. But they are treated as capital expenditure in the following circumstances. 1. Raw Materials and Stores : When these are used for manufacturing a fixed asset, these expenses are treated as capital expenditure. 2. Carriage and Freight : If these expenses are paid on the transportation of newly acquired fixed asset, these are treated as capital expenditure. 3. Wages : Wages paid for the construction of a building or for the installation of a machine are reated as capital expenditure and are added to the cost of the asset. 4. Repairs : Expenses incurred to repair a second hand machine, purchase by the firm, to make it usable are treated as capital expenditure. 5. Preliminary Expenses : Expenses incurred on the formation of a company are treated as capital expenses because their benefit will be available over a long period. 6. Brokerage : Brokerage paid on the purchase of a fixed asset is treated as capital expenditure. 7. Legal Expenses : Stamp duty and other legal expenses incurred in connection with the acquisition of fixed assets is treated as capital expenditure. 8. Advertising : Advertising expenses incurred for introducing a new product in the market are reated as capital expenditure. 9. Interest : Interest paid on loan and capital when paid during the construction of a fixed asset :s treated as capital expenditure.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Home Business Fall 2017Dokument52 SeitenHome Business Fall 2017Home Business Magazine100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Gat Sample TestDokument32 SeitenGat Sample TestRashid HussainNoch keine Bewertungen

- Saudi Arabia Food MarketDokument73 SeitenSaudi Arabia Food MarketViktor BisovetskyiNoch keine Bewertungen

- Section 68 (2020)Dokument10 SeitenSection 68 (2020)ungku bahiyahNoch keine Bewertungen

- Supply Chain Management in Retail ManagementDokument83 SeitenSupply Chain Management in Retail ManagementMohammadAneesNoch keine Bewertungen

- Cir v. Cebu HoldingsDokument4 SeitenCir v. Cebu HoldingsAudrey50% (2)

- Oracle Iprocurement: Confidential © Sierra Atlantic, IncDokument69 SeitenOracle Iprocurement: Confidential © Sierra Atlantic, IncpvarmavsNoch keine Bewertungen

- Irrelevant DatabaseDokument44 SeitenIrrelevant DatabasearebellionNoch keine Bewertungen

- BS 4-1 1993 PDFDokument21 SeitenBS 4-1 1993 PDFMohd IllahiNoch keine Bewertungen

- Coreworx Improving Project Outcomes With Interface ManagementDokument18 SeitenCoreworx Improving Project Outcomes With Interface ManagementtriNoch keine Bewertungen

- A Feasibility Study On Flappy Eggs in Barangay MesaoyDokument49 SeitenA Feasibility Study On Flappy Eggs in Barangay Mesaoydantoy86100% (1)

- Celcom JanDokument2 SeitenCelcom JanThee Suh ShyanNoch keine Bewertungen

- Financial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter QuestionsDokument24 SeitenFinancial Planning and Forecasting Financial Statements: Answers To Beginning-Of-Chapter Questionscostel11100% (1)

- Intro To Corporate FinanceDokument75 SeitenIntro To Corporate FinanceRashid HussainNoch keine Bewertungen

- Introduction To Human Resource ManagementDokument17 SeitenIntroduction To Human Resource ManagementRashid HussainNoch keine Bewertungen

- Role of Banks in Economic DevelopmentDokument8 SeitenRole of Banks in Economic DevelopmentRashid HussainNoch keine Bewertungen

- EC Fiscal Policy Quiz ANSWERSDokument5 SeitenEC Fiscal Policy Quiz ANSWERSRashid HussainNoch keine Bewertungen

- Role of Banks in Economic DevelopmentDokument8 SeitenRole of Banks in Economic DevelopmentRashid HussainNoch keine Bewertungen

- Accounting Basics: Financial Statements 7Dokument13 SeitenAccounting Basics: Financial Statements 7Rashid HussainNoch keine Bewertungen

- Current Affairs - SayedDokument2 SeitenCurrent Affairs - SayedRashid HussainNoch keine Bewertungen

- Chapter 1 Principles of MarketingDokument18 SeitenChapter 1 Principles of MarketingRashid HussainNoch keine Bewertungen

- Financial Leverage and Capital Structure PolicyDokument21 SeitenFinancial Leverage and Capital Structure PolicyRashid HussainNoch keine Bewertungen

- The Basics of Supply and DemandDokument5 SeitenThe Basics of Supply and DemandRashid HussainNoch keine Bewertungen

- Failed To Get Proc Address For Getlogicalprocessorinformation (Kernel32.Dll)Dokument1 SeiteFailed To Get Proc Address For Getlogicalprocessorinformation (Kernel32.Dll)Rashid HussainNoch keine Bewertungen

- KPMG Flash News Vinod Soni and OthersDokument3 SeitenKPMG Flash News Vinod Soni and OthersSundar ChandranNoch keine Bewertungen

- SM QuestionDokument7 SeitenSM QuestionPRiNCEMagNus100% (1)

- PerfumeURS Perfumes ContratiposDokument5 SeitenPerfumeURS Perfumes Contratiposܚܠܕܒܪܬ ܟܗNoch keine Bewertungen

- Soal-Soal VocabDokument6 SeitenSoal-Soal VocabShella OktafianiNoch keine Bewertungen

- Comparative Management 4203Dokument8 SeitenComparative Management 4203Dhananjana JoshiNoch keine Bewertungen

- Frank7e Chapter09 Micro Accessible FinalDokument36 SeitenFrank7e Chapter09 Micro Accessible FinalismaylalmasudNoch keine Bewertungen

- Montana Articles of IncorporationDokument3 SeitenMontana Articles of IncorporationRocketLawyerNoch keine Bewertungen

- I. Occupational Competence (70%) Manual/Operation Tasks: Total Score Total Rating For I ( (Total Score / 22) X 70%)Dokument2 SeitenI. Occupational Competence (70%) Manual/Operation Tasks: Total Score Total Rating For I ( (Total Score / 22) X 70%)Emmanuel DionisioNoch keine Bewertungen

- Accounts List (Summary) : CC Puno Jr. Construction, IncDokument4 SeitenAccounts List (Summary) : CC Puno Jr. Construction, IncAndrew CatamaNoch keine Bewertungen

- ABC TutotialDokument6 SeitenABC TutotialChandran PachapanNoch keine Bewertungen

- Invoice::: Group Agent: Company Name Fssai NoDokument2 SeitenInvoice::: Group Agent: Company Name Fssai NoSuryaNoch keine Bewertungen

- BT Group PLC: An Event StudyDokument48 SeitenBT Group PLC: An Event StudyFisher BlackNoch keine Bewertungen

- Commonweath Bank Global Market Research - Economics: PerspectiveDokument25 SeitenCommonweath Bank Global Market Research - Economics: PerspectiveAlan PosnerNoch keine Bewertungen

- INSAT: Inside Southern African Trade - October 2008 (USAID - 2008)Dokument20 SeitenINSAT: Inside Southern African Trade - October 2008 (USAID - 2008)HayZara MadagascarNoch keine Bewertungen

- 中美冠科與JSR Corporation合併案投資人問答 PDFDokument6 Seiten中美冠科與JSR Corporation合併案投資人問答 PDF段潔帆 JessieNoch keine Bewertungen

- Suggested Answers: QuestionsDokument104 SeitenSuggested Answers: QuestionsabhishekkgargNoch keine Bewertungen

- Resume 5Dokument5 SeitenResume 5KL LakshmiNoch keine Bewertungen

- Personal QuestionnaireDokument6 SeitenPersonal QuestionnaireSharma GokhoolNoch keine Bewertungen