Beruflich Dokumente

Kultur Dokumente

Second Paper: Elements of Financial Management

Hochgeladen von

GuruKPOOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Second Paper: Elements of Financial Management

Hochgeladen von

GuruKPOCopyright:

Verfügbare Formate

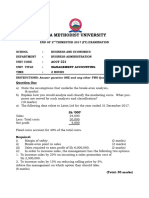

B.

Com(PartII)Examination,2010

(10+2+3Patterns) (FacultyofCommerce)

Second Paper: Elements of Financial Management

Objective Part- I

Time : One Hour Max. Marks.: 40

1.

Attempt all questions. Each question carriers 2 marks. Answer should not exceed 20 words. (i) (ii) (iii) (iv) (v) (vi) (vii) Define Financial Management. What do you mean by Financial Analysis? Give the formula of operating ratio. What do you mean by liquidity? Define fund-flow Statement? Discuss the two disadvantages excessive working capital. What is debenture?

(viii) What is line of credit? (ix) (x) 2. what is cash budget? What is Re-order level? Attempt question. Each question carries 4 marks. Answer should not exceed 50 words each. (i) (ii) Describe four characteristics of financial management. Calculate current ratio from the following data relating to companies X and Y: Particulars Assets Cash in hand Cash in bank Debtors Stock Total Amounts of Rupees Company (X) Company (Y) 2,000 2,000 3,000 3,000 7,000 7,000 8,000 8,000 20,000 20,000

Liability Creditors B/P Provision of Taxation

Company (X) 6,000 3,000 1,000 10,000

Company (Y) 7,000 8,000 3,000 18,000

(iii) (iv) (v)

Distinguish between Redeemable preference Shares and redeemable debentures. Explain any four ways of improving efficiency in cash of collection. Following data relate to inventory handling in Tekesh Ltd: Annual consumption Cost price per unit Ordering cost Carrying cost 5,000 units Rs. 100 Rs.500 per order 20% of the cost price

DESCRIPTIVE PART-I

Time Allowed: 2 Hours Max. Marks: 60 Attempt three questions in all, selecting at least one question from each Section. Section-I 3. What is Financial Management? How does a modern Financial Management differ from Traditional Financial management? 5 + 15

4. From the following Balance Sheets and information prepare ; (i) Statement of changes in working capital and (ii) Fund flow statement

Balance Sheet Amount in Rs. Liability Creditors Loan from Mr.A Bank Loan 2008 40,000 25,000 40,000 December, 31 2009 44,000 50,000

Capital Total

1,25,000 2,30,000

1,53,000 2,47,000

Assets Cash Balance Debtors Stock Machinery Land Building Total

2008 10,000 30,000 35,000 80,000 40,000 35,000 2,30,000

Amount of Rs. December, 31 2009 7,000 50,000 25,000 55,000 50,000 60,000 2,47,000

During the year a machine costing Rs.10,000 (accumulated depreciation Rs.3,000) was sold for Rs.5,000 provision for depreciation against machinery as on 31st December, 2008 and 2009 were Rs.25,000 and Rs.45,000 respectively. Net profit for the year amounted to Rs.45,000.

Section-B 5. What is meant by working capital? Explain the determinant factors of working capital in a business or an industry. 8-12

6. The financial position of Menesh Limited in the year 2009 was as follows: Amount in Rs. Sales Variable costs Fixed costs Find out the following: (i) Profit volume ratio (P/V Ratio) (ii) (iii) (iv) Break even point Net profit for the sales of Rs.6,00,000 Required sales for the net profit of Rs.1,40,000 4,00,000 3,00,000 30,000

Section-C 7. Critically examine the Welter's Modal of Dividend Decision. 8. Jareda Ltd. is considered to purchase a machine. Two machines A and B are available at a cost of Rs.60,000 each. Earning after tax are expected as follows: Year Profit after tax (Cash inflows) Machine A Rs. 1 2 3 4 5 25,000 20,000 15,000 10,000 10,000 Machine B Rs. 10,000 15,000 25,000 20,000 20,000

Das könnte Ihnen auch gefallen

- Accountancy and Business Statistics Second Paper: Management AccountingDokument10 SeitenAccountancy and Business Statistics Second Paper: Management AccountingGuruKPONoch keine Bewertungen

- Business Accounting Question PaperDokument3 SeitenBusiness Accounting Question PaperGajendra GargNoch keine Bewertungen

- Examination Paper-2010Dokument5 SeitenExamination Paper-2010api-248768984Noch keine Bewertungen

- Question Bank - Management AccountingDokument7 SeitenQuestion Bank - Management Accountingprahalakash Reg 113Noch keine Bewertungen

- FINANCIAL MANAGEMENT October 20172016 PatternSemester IIDokument4 SeitenFINANCIAL MANAGEMENT October 20172016 PatternSemester IISwati DafaneNoch keine Bewertungen

- June 2018Dokument2 SeitenJune 2018peronNoch keine Bewertungen

- 10) The Data Relating To 2 Companies Are Given BelowDokument2 Seiten10) The Data Relating To 2 Companies Are Given Belowmohanraokp2279Noch keine Bewertungen

- University of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013Dokument3 SeitenUniversity of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013GuruKPO0% (1)

- AssignmentsDokument7 SeitenAssignmentspratikshakurhade04Noch keine Bewertungen

- Question Papers Supplementary Exam 2007Dokument24 SeitenQuestion Papers Supplementary Exam 2007ce1978Noch keine Bewertungen

- June 07 MCS-035Dokument6 SeitenJune 07 MCS-035Vishal FalakeNoch keine Bewertungen

- CH18601 FM - II Model PaperDokument5 SeitenCH18601 FM - II Model PaperKarthikNoch keine Bewertungen

- Afm 2810001 Dec 2018Dokument4 SeitenAfm 2810001 Dec 2018PILLO PATELNoch keine Bewertungen

- Finance Question Papers Pune UniversityDokument12 SeitenFinance Question Papers Pune UniversityJincy GeevargheseNoch keine Bewertungen

- MCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreeDokument3 SeitenMCA (Revised) Term-End Examination December, 2018: Note: 1 Compulsory ThreepayalNoch keine Bewertungen

- M. C. (Revised) Term-End Examination June, 2019: Mcs-035: Accountancy and Financial ManagementDokument3 SeitenM. C. (Revised) Term-End Examination June, 2019: Mcs-035: Accountancy and Financial ManagementpayalNoch keine Bewertungen

- End Term Examin N: Ot: Ttempt An Fi Qu Tion N Lu in Whi Hi Mpul or - Select One Qu Tion FR M Hun TDokument2 SeitenEnd Term Examin N: Ot: Ttempt An Fi Qu Tion N Lu in Whi Hi Mpul or - Select One Qu Tion FR M Hun TBarkha JoonNoch keine Bewertungen

- Test Papers: FoundationDokument23 SeitenTest Papers: FoundationUmesh TurankarNoch keine Bewertungen

- Mid Term PaperDokument9 SeitenMid Term Paperthorat82Noch keine Bewertungen

- (2013 Pattern) PDFDokument230 Seiten(2013 Pattern) PDFSanket SonawaneNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledSaraswathy ArunachalamNoch keine Bewertungen

- 0102 Managerial Economics and Financial AnalysisDokument7 Seiten0102 Managerial Economics and Financial AnalysisFozia PanhwerNoch keine Bewertungen

- 12th Accountacy Model Test PaperDokument5 Seiten12th Accountacy Model Test PaperJas Singh DevganNoch keine Bewertungen

- Management Accounting (Acct 321) P2 PT 2ND Trimester 2017Dokument5 SeitenManagement Accounting (Acct 321) P2 PT 2ND Trimester 2017Nodeh Deh SpartaNoch keine Bewertungen

- Accountancy and Auditing-2010Dokument5 SeitenAccountancy and Auditing-2010Umar ZamarNoch keine Bewertungen

- Commerce Ias - Main 2004Dokument3 SeitenCommerce Ias - Main 2004Nija KumarNoch keine Bewertungen

- Accountancy Paper II 2014Dokument2 SeitenAccountancy Paper II 2014Qasim IbrarNoch keine Bewertungen

- (2008 Pattern) PDFDokument231 Seiten(2008 Pattern) PDFKundan DeoreNoch keine Bewertungen

- Accountancy Auditing 2020Dokument6 SeitenAccountancy Auditing 2020Abdul basitNoch keine Bewertungen

- Ac PaperDokument6 SeitenAc PaperAshwini SakpalNoch keine Bewertungen

- Accountancy & Auditing-II 2021Dokument2 SeitenAccountancy & Auditing-II 2021Zeeshan Ashraf MalikNoch keine Bewertungen

- MBG-206 2019-20 09-12-2021Dokument4 SeitenMBG-206 2019-20 09-12-2021senthil.jpin8830Noch keine Bewertungen

- Fourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementDokument4 SeitenFourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementsimranNoch keine Bewertungen

- The Figures in The Margin On The Right Side Indicate Full MarksDokument16 SeitenThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaNoch keine Bewertungen

- Company Secretary PapersDokument8 SeitenCompany Secretary PapersMohit BhatnagarNoch keine Bewertungen

- Jaya College of Arts and Science Department of ManagDokument4 SeitenJaya College of Arts and Science Department of ManagMythili KarthikeyanNoch keine Bewertungen

- ICMA Questions Apr 2011Dokument55 SeitenICMA Questions Apr 2011Asadul HoqueNoch keine Bewertungen

- Management Accounting Set 1 FinDokument3 SeitenManagement Accounting Set 1 FinÃrhan KhañNoch keine Bewertungen

- FM12 Financial Management: Assignment No.IDokument3 SeitenFM12 Financial Management: Assignment No.ISrajan KhareNoch keine Bewertungen

- 2013 PDFDokument126 Seiten2013 PDFomiraskar1212Noch keine Bewertungen

- Bba 2012Dokument134 SeitenBba 2012gbulani11Noch keine Bewertungen

- F1 FIOO - L-December-2020Dokument8 SeitenF1 FIOO - L-December-2020Laskar REAZNoch keine Bewertungen

- Question and Answer FOR JUNE 2018Dokument86 SeitenQuestion and Answer FOR JUNE 2018Simbarashe ChigwendeNoch keine Bewertungen

- Accountancy Sample Question PaperDokument8 SeitenAccountancy Sample Question PaperSoNam ZaNgmoNoch keine Bewertungen

- Output PDFDokument81 SeitenOutput PDFPravin ThoratNoch keine Bewertungen

- McomDokument302 SeitenMcommostfaNoch keine Bewertungen

- Question (Apr 2012)Dokument49 SeitenQuestion (Apr 2012)Monirul IslamNoch keine Bewertungen

- B. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Dokument103 SeitenB. B. M. (I.B.) (Semester - I) Examination - 2011: Total No. of Questions: 4) (Total No. of Printed Pages: 2Smruti Mehta100% (1)

- Screenshot 2023-08-27 at 11.56.55 AMDokument34 SeitenScreenshot 2023-08-27 at 11.56.55 AMShajid HassanNoch keine Bewertungen

- Question Bank Sem IIDokument16 SeitenQuestion Bank Sem IIPrivate 4uNoch keine Bewertungen

- CAP-III Advanced Financial ReportingDokument17 SeitenCAP-III Advanced Financial ReportingcasarokarNoch keine Bewertungen

- Financial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)Dokument5 SeitenFinancial Reporting & Financial Statement Analysis Paper - Dse 6.1A FM - 80 Group - A (5x3 15)tanmoy sardarNoch keine Bewertungen

- Paper ID (B0210) : MBA/PGDBM (205) (S05) (Old) (Sem. - 2) Financial ManagementDokument3 SeitenPaper ID (B0210) : MBA/PGDBM (205) (S05) (Old) (Sem. - 2) Financial ManagementDeep NarayanNoch keine Bewertungen

- ImcfDokument64 SeitenImcfHʌɩɗɘʀ AɭɩNoch keine Bewertungen

- Delhi Public School Jodhpur: General InstructionsDokument4 SeitenDelhi Public School Jodhpur: General Instructionssamyak patwaNoch keine Bewertungen

- Mcom AnnualDokument140 SeitenMcom AnnualKiran TakaleNoch keine Bewertungen

- C&ma RWQDokument5 SeitenC&ma RWQPrabhakar RaoNoch keine Bewertungen

- MBA Ii Semester Financial Management: Section-ADokument3 SeitenMBA Ii Semester Financial Management: Section-AVundi RohitNoch keine Bewertungen

- (2019 PATTRN) - April - 2023Dokument145 Seiten(2019 PATTRN) - April - 2023Kadam RohitNoch keine Bewertungen

- Supply Chain Management and Business Performance: The VASC ModelVon EverandSupply Chain Management and Business Performance: The VASC ModelNoch keine Bewertungen

- Think Tank - Advertising & Sales PromotionDokument75 SeitenThink Tank - Advertising & Sales PromotionGuruKPO67% (3)

- Applied ElectronicsDokument40 SeitenApplied ElectronicsGuruKPO75% (4)

- Abstract AlgebraDokument111 SeitenAbstract AlgebraGuruKPO100% (5)

- OptimizationDokument96 SeitenOptimizationGuruKPO67% (3)

- Advertising and Sales PromotionDokument75 SeitenAdvertising and Sales PromotionGuruKPO100% (3)

- Applied ElectronicsDokument37 SeitenApplied ElectronicsGuruKPO100% (2)

- Biyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014Dokument1 SeiteBiyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014GuruKPONoch keine Bewertungen

- Biyani's Think Tank: Concept Based NotesDokument49 SeitenBiyani's Think Tank: Concept Based NotesGuruKPO71% (7)

- Production and Material ManagementDokument50 SeitenProduction and Material ManagementGuruKPONoch keine Bewertungen

- Data Communication & NetworkingDokument138 SeitenData Communication & NetworkingGuruKPO80% (5)

- Computer Graphics & Image ProcessingDokument117 SeitenComputer Graphics & Image ProcessingGuruKPONoch keine Bewertungen

- Business Ethics and EthosDokument36 SeitenBusiness Ethics and EthosGuruKPO100% (3)

- Algorithms and Application ProgrammingDokument114 SeitenAlgorithms and Application ProgrammingGuruKPONoch keine Bewertungen

- Algorithms and Application ProgrammingDokument114 SeitenAlgorithms and Application ProgrammingGuruKPONoch keine Bewertungen

- Biological Science Paper I July 2013Dokument1 SeiteBiological Science Paper I July 2013GuruKPONoch keine Bewertungen

- Phychology & Sociology Jan 2013Dokument1 SeitePhychology & Sociology Jan 2013GuruKPONoch keine Bewertungen

- Phychology & Sociology Jan 2013Dokument1 SeitePhychology & Sociology Jan 2013GuruKPONoch keine Bewertungen

- Community Health Nursing I Nov 2013Dokument1 SeiteCommunity Health Nursing I Nov 2013GuruKPONoch keine Bewertungen

- Community Health Nursing Jan 2013Dokument1 SeiteCommunity Health Nursing Jan 2013GuruKPONoch keine Bewertungen

- Fundamental of Nursing Nov 2013Dokument1 SeiteFundamental of Nursing Nov 2013GuruKPONoch keine Bewertungen

- Biological Science Paper 1 Nov 2013Dokument1 SeiteBiological Science Paper 1 Nov 2013GuruKPONoch keine Bewertungen

- Biological Science Paper 1 Jan 2013Dokument1 SeiteBiological Science Paper 1 Jan 2013GuruKPONoch keine Bewertungen

- Business LawDokument112 SeitenBusiness LawDewanFoysalHaqueNoch keine Bewertungen

- Paediatric Nursing Sep 2013 PDFDokument1 SeitePaediatric Nursing Sep 2013 PDFGuruKPONoch keine Bewertungen

- Community Health Nursing I July 2013Dokument1 SeiteCommunity Health Nursing I July 2013GuruKPONoch keine Bewertungen

- Service MarketingDokument60 SeitenService MarketingGuruKPONoch keine Bewertungen

- Banking Services OperationsDokument134 SeitenBanking Services OperationsGuruKPONoch keine Bewertungen

- Product and Brand ManagementDokument129 SeitenProduct and Brand ManagementGuruKPONoch keine Bewertungen

- BA II English (Paper II)Dokument45 SeitenBA II English (Paper II)GuruKPONoch keine Bewertungen

- Software Project ManagementDokument41 SeitenSoftware Project ManagementGuruKPO100% (1)

- Walmart PainfulDokument5 SeitenWalmart PainfulJosue GonzalezNoch keine Bewertungen

- RBSA ProfileDokument32 SeitenRBSA ProfileShailesh KumarNoch keine Bewertungen

- Financial Analysis of Ashok LeylandDokument9 SeitenFinancial Analysis of Ashok LeylandvayuputhrasNoch keine Bewertungen

- Case Prep Marketing MathDokument28 SeitenCase Prep Marketing MathKrishnan SethumadhavanNoch keine Bewertungen

- ESE400/540 Midterm Exam #1Dokument7 SeitenESE400/540 Midterm Exam #1Kai LingNoch keine Bewertungen

- Assignment Brief TaxationsDokument11 SeitenAssignment Brief TaxationsUmer TahirNoch keine Bewertungen

- Ey Corporate and Commercial Law Global Update Spring 2017Dokument46 SeitenEy Corporate and Commercial Law Global Update Spring 2017Herbert Girón LemusNoch keine Bewertungen

- Executive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankDokument56 SeitenExecutive Summary: The Report Explains The Concept of CRM in Private Bank With The Case Study On ICICI BankKevin DarrylNoch keine Bewertungen

- News Bulletin From Aidan Burley MP 83Dokument1 SeiteNews Bulletin From Aidan Burley MP 83Aidan Burley MPNoch keine Bewertungen

- WTW FI Risk Index Apr 2016 PDFDokument60 SeitenWTW FI Risk Index Apr 2016 PDFEdielyn CenabreNoch keine Bewertungen

- Investment Fundamentals Guide PDFDokument36 SeitenInvestment Fundamentals Guide PDFShashank Gaurav100% (1)

- FINS5530 Individual Case Assignment PDFDokument2 SeitenFINS5530 Individual Case Assignment PDF钱智烽Noch keine Bewertungen

- Marriott-Corporation - HBR CaseDokument4 SeitenMarriott-Corporation - HBR CaseAsif RahmanNoch keine Bewertungen

- Chapter - 6: Beta Estimation and The Cost of EquityDokument14 SeitenChapter - 6: Beta Estimation and The Cost of EquityInnocentNoch keine Bewertungen

- Implementation Support and Follow-Up Unit: LogisticsDokument88 SeitenImplementation Support and Follow-Up Unit: LogisticsMuhammed MuhammedNoch keine Bewertungen

- Summer Internship of Angel BrokingDokument11 SeitenSummer Internship of Angel BrokingGovind Parmar0% (1)

- Business Plan Bolt & Nuts - Financial AspectsDokument14 SeitenBusiness Plan Bolt & Nuts - Financial AspectsgboobalanNoch keine Bewertungen

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDokument2 SeitenManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshNoch keine Bewertungen

- Business CorrespondentDokument22 SeitenBusiness CorrespondentdivyangNoch keine Bewertungen

- Oblicon CasesDokument103 SeitenOblicon CasesAlexis Capuras EnriquezNoch keine Bewertungen

- PM Unit 1 Q & ADokument17 SeitenPM Unit 1 Q & APriya Guna100% (1)

- Derivates NotesDokument7 SeitenDerivates NotesSachin MethreeNoch keine Bewertungen

- Moving AveragesDokument2 SeitenMoving Averagesapi-3831404Noch keine Bewertungen

- Clinton 4Dokument531 SeitenClinton 4MagaNWNoch keine Bewertungen

- D&O Seminar - Final Eng & Viet - MarshDokument43 SeitenD&O Seminar - Final Eng & Viet - Marshthreestars41220027340Noch keine Bewertungen

- 9 CIR Vs CA YMCADokument28 Seiten9 CIR Vs CA YMCAcyhaaangelaaaNoch keine Bewertungen

- MG University Syllabus MBA FIN and HRDokument13 SeitenMG University Syllabus MBA FIN and HRcheriyettanNoch keine Bewertungen

- A Comparative Study of NBFC in IndiaDokument28 SeitenA Comparative Study of NBFC in IndiaGuru Prasad0% (1)

- Best PDFDokument569 SeitenBest PDFnidamahNoch keine Bewertungen

- Analysis of Company Law TribunalDokument15 SeitenAnalysis of Company Law TribunalAyush RaoNoch keine Bewertungen