Beruflich Dokumente

Kultur Dokumente

Transportation & Logistics Transportation & Logistics

Hochgeladen von

So Lok0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten2 SeitenThe proposals aim to make entities recognise revenue from customers more consistently regardless of the industry they operate in. Transportation and logistics entities that currently take a "percentage-of-completion" approach to the recognition of revenue could be impacted.

Originalbeschreibung:

Originaltitel

634304445709318435_tl_industrypack_revenue_2010

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe proposals aim to make entities recognise revenue from customers more consistently regardless of the industry they operate in. Transportation and logistics entities that currently take a "percentage-of-completion" approach to the recognition of revenue could be impacted.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten2 SeitenTransportation & Logistics Transportation & Logistics

Hochgeladen von

So LokThe proposals aim to make entities recognise revenue from customers more consistently regardless of the industry they operate in. Transportation and logistics entities that currently take a "percentage-of-completion" approach to the recognition of revenue could be impacted.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Transportation & logistics Transportation & logistics

New guidance on recognition of revenue a big issue

for the transportation & logistics industry

Application date: An exposure draft was issued in June 2010; a standard is expected in 2011. The

effective date is anticipated to be no earlier than 2014 with full retrospective application required.

What is the issue?

The International Accounting Standards Board (IASB)

and US Financial Accounting Standards Board (FASB)

have released an exposure draft on accounting for

revenue recognition in contracts with customers. The

proposals aim to make entities recognise revenue from

customers more consistently regardless of the industry

they operate in.

Why is this issue significant for the

transportation & logistics industry?

Many entities in the transportation & logistics industry

enter into multi-element arrangements with customers to

provide one-stop solutions with bundled transportation

and logistics services. The accounting for these multi-

element arrangements will be significantly different

under the proposals with revenue from each element of

the sale (known as performance obligations under the

proposals) accounted for separately (based on their

relative fair value).

Furthermore, the percentage-of-completion method

would no longer exist as a separate and distinct revenue

recognition model. Under the proposals, an entity may

only recognise revenue for its activities (consistent with

the current percentage-of-completion method) when

those activities concurrently satisfy performance

obligations through the transfer of control of assets

(good or service) to the customer. For example, when

the customer controls the product or where there is a

continuous transfer of assets to the customer. The

proposals could have a considerable impact on the

amount and timing of revenue recognition if control of an

asset (service) is transferred at a time that is different to

the transfer of risks and rewards or stage of completion

of the service.

Entities should analyse the potential effects of the

proposed model on their current business activities,

including those processes associated with contract

negotiations, budgeting/forecasting, systems changes,

taxes, and other related revenue recognition processes.

Are most transportation & logistics

entities impacted?

It depends. Transportation & logistics entities that

currently take a percentage-of-completion approach to

the recognition of revenue or that enter into contracts

which contain multiple elements will be significantly

affected. The degree of the impact will depend upon the

extent to which the entity enters into service arrange-

ments and the time given to complete the service.

What are the overarching proposals?

Entities recognise revenue upon the satisfaction of

performance obligations within contracts. This occurs

when control of an asset (a good or service) transfers

to the customer. Entities will need to identify all

performance obligations, including those embodied in

the terms and conditions of the arrangement and any

constructive and statutory obligations.

Entities that enter into contracts with multiple

elements (eg, where goods and services are sold

together but delivered at different times) will need to

ascribe revenue to each element and recognise that

revenue when performance is complete.

The transaction price in a contract reflects the

consideration the customer promises to pay in

exchange for goods and services. The transaction

price is allocated at the inception of the contract

based on the stand-alone selling price of the

associated goods and services. The price includes

variable consideration to the extent that it can be

measured reliably.

What issues in practice might arise

when applying the proposals?

Revenue could be recognised as each

performance obligation is completed and control

is transferred to the customer. The proposals align

the accounting with the obligations under the contract

rather than the estimation of revenue based on the

costs incurred or other means. For example, under a

voyage charter arrangement the proposals are

unclear about whether control can be continuously

passed to customers (over the course of the voyage)

or only at the completion of the contract (upon

discharge of the cargo). If control can be continuously

passed to customers, this may bring forward the

recognition of revenue. If it cant be, this will typically

result in more deferral of revenue recognition. Either

way, changes to systems may be required to reflect

the contractual obligations and capture the relevant

data for revenue recognition, particularly for entities

that provide container shipping which have

performance obligations to various customers in

each voyage.

More disaggregation of contracts and increased

use of estimates to allocate the transaction price

to separate elements in an arrangement.

Estimates will be necessary for those obligations that

are not usually sold separately. This may be an issue

for logistics entities that provide bundled and tailored

services to customers, which are provided at different

times throughout the contract. For example, the

provision of project logistics services typically

involves not only the product transportation, but also

warehousing, safety control, technical service and

later maintenance, etc. For these entities, allocating

the selling price is challenging for continuous-delivery

contracts and inappropriate because the performance

obligations are typically interdependent and

unavailable for separate pricing.

Less opportunity to capitalise costs. Under the

proposals, costs to acquire contracts (including sales

costs) are specifically prohibited from being

capitalised. The IASB proposals reiterate that

contract costs should be expensed as incurred

unless they meet the definition of an asset in another

standard such as inventory, fixed assets or intangible

assets. This may present a challenge for some

entities that may have capitalised or deferred certain

costs to acquire contracts or customers (e.g. sales

commissions, shipping operating costs, etc) that may

not necessarily meet the definition of an asset. We

encourage transportation & logistics entities to watch

this space as there will be a potential impact on

existing treatment for capitalisation of contract costs.

How the business community

responded to the initial proposals

(issued via a discussion paper)

Common themes

Broad support for the Boards objectives to develop a

single, converged revenue recognition standard.

Concern that developing one model for all contracts

in all industries may not be possible.

General support for the principles suggested, but

many believe:

A significant amount of clarification is needed

especially around control transfer and

identification of performance obligations.

A more complete model is required before

ultimate conclusions can be reached.

Specific concerns of the transportation &

logistics industry

There are significant concerns around the application

of control transfer in practice. In particular:

Is it intended to be overly legalistic? For example,

will there be inconsistency in terms of the revenue

recognition practices associated with

simultaneous delivery of two identical services in

two different jurisdictions made at two different

occasions only because of different local rules

concerning the transfer of ownership or accepted

delivery terms?

How is control determined for shipped goods (e.g.

cargo) which is transferred to the customer? Is it

precluding percentage-of-completion accounting

and does it result in the recognition of revenue

only upon completion of those service contracts?

How is that linked with, or differentiated from, the

transfer of risks and rewards?

Those entities that currently apply the percentage-of-

completion method are keen to ensure the guidance

included in the final standard is clear. For example,

it is currently difficult to determine how obligations

in long term service contracts would be identified

consistently because there are many ways the

contract could be divided into separate performance

obligations.

There is strong support for the current guidance on

pre-contract costs to be maintained.

2010 PricewaterhouseCoopers. All rights reserved. "PricewaterhouseCoopers" and "PwC" refer to the network of member firms of PricewaterhouseCoopers International Limited

("PwCIL"). Each member firm is a separate legal entity and does not act as agent of PwCIL or any other member firm. PwCIL does not provide any services to clients. PwCIL is not

responsible or liable for the acts or omissions of any of its member firms nor can it control the exercise of their professional judgment or bind them in any way. No member firm is responsible

or liable for the acts or omissions of any other member firm nor can it control the exercise of another member firm's professional judgment or bind another member firm or PwCIL in any way.

Disclaimer

These materials have been prepared by PricewaterhouseCoopers International Limited; the information is for general reference only. Information contained in these materials may not be

current or accurate. These materials are not a substitute for reading any relevant accounting standard, professional pronouncement or guidance or any other relevant material. Specific

company structure, facts and circumstances will have a material impact on the financial reports. No entity should undertake or refrain from any action based on the information in these

materials; advice which is specific to your circumstances should always be sought from a professional adviser. No responsibility for any loss incurred as a result of reliance on these

materials will be accepted by PricewaterhouseCoopers.

Das könnte Ihnen auch gefallen

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- IFRS 15 For Transport and LogisticsDokument8 SeitenIFRS 15 For Transport and Logisticsarianne chiuNoch keine Bewertungen

- Ifrs 15 (Telecom Industry)Dokument19 SeitenIfrs 15 (Telecom Industry)Emezi Francis Obisike100% (2)

- Mega Project Assurance: Volume One - The Terminological DictionaryVon EverandMega Project Assurance: Volume One - The Terminological DictionaryNoch keine Bewertungen

- Implications On The Industries IFRS 15Dokument11 SeitenImplications On The Industries IFRS 15Liyana ChuaNoch keine Bewertungen

- MFRS 15 Implementation Issues and Challenges in For The Construction, TelecommunDokument6 SeitenMFRS 15 Implementation Issues and Challenges in For The Construction, TelecommunNik RubiahNoch keine Bewertungen

- Group 6-Psak 72 (Makalah) PDFDokument25 SeitenGroup 6-Psak 72 (Makalah) PDFdwi davisNoch keine Bewertungen

- FASB Topic 606 Revenue From Contracts With CustomersDokument47 SeitenFASB Topic 606 Revenue From Contracts With Customerskhánh nguyễnNoch keine Bewertungen

- Revenue Revisited: The Global Body For Professional AccountantsDokument3 SeitenRevenue Revisited: The Global Body For Professional AccountantsPANTUGNoch keine Bewertungen

- Ifrs 15 Transport and LogisticsDokument13 SeitenIfrs 15 Transport and LogisticsIvonnie RenitaNoch keine Bewertungen

- Technical LineDokument27 SeitenTechnical LinemalisevicNoch keine Bewertungen

- Accounting Theory - Revenue RecognitionDokument5 SeitenAccounting Theory - Revenue RecognitionHeather Hudson100% (1)

- Problems in Revenue RecognitionDokument4 SeitenProblems in Revenue RecognitionNaga Praveen TNoch keine Bewertungen

- On The Radar - Revenue Recognition - WSJDokument7 SeitenOn The Radar - Revenue Recognition - WSJjayaNoch keine Bewertungen

- Applying IFRS Power-UtilitiesDokument20 SeitenApplying IFRS Power-Utilitiesstudentul1986100% (1)

- Implementing PFRS 15: Challenges of An Accounting ChangeDokument3 SeitenImplementing PFRS 15: Challenges of An Accounting ChangeNathanielNoch keine Bewertungen

- TN02 FeesandChargesDokument4 SeitenTN02 FeesandChargesJemimah BurgasNoch keine Bewertungen

- Revenue Revisited - Part 1 - ACCA GlobalDokument7 SeitenRevenue Revisited - Part 1 - ACCA Globalvivsubs18Noch keine Bewertungen

- TO: Atty. Stephen Yu FROM: Maria Ludica B. Oja DATE: January 13, 2017 Subject: Transfer Pricing Transfer Pricing DefinedDokument4 SeitenTO: Atty. Stephen Yu FROM: Maria Ludica B. Oja DATE: January 13, 2017 Subject: Transfer Pricing Transfer Pricing DefinedLudica OjaNoch keine Bewertungen

- IFRS 15 Revenue From Contracts With CustomersDokument5 SeitenIFRS 15 Revenue From Contracts With CustomersADEYANJU AKEEMNoch keine Bewertungen

- IFRS 15 Revenue From Contracts With Customers-2Dokument8 SeitenIFRS 15 Revenue From Contracts With Customers-2abbyNoch keine Bewertungen

- MODULE 8 (Part 2)Dokument6 SeitenMODULE 8 (Part 2)trixie maeNoch keine Bewertungen

- Ind As 115 Revenue From Contracts With Customers Overview and Impact OnDokument34 SeitenInd As 115 Revenue From Contracts With Customers Overview and Impact OnVM educationzNoch keine Bewertungen

- Busi4424 Term PaperDokument12 SeitenBusi4424 Term Papersusieqnorthrock0% (1)

- PFRS 15, MarbellaDokument3 SeitenPFRS 15, MarbellaDazzelle BasarteNoch keine Bewertungen

- Chapter 6 - Revenue RecognitionDokument7 SeitenChapter 6 - Revenue RecognitionGebeyaw BayeNoch keine Bewertungen

- Making Sense of A Complex WorldDokument16 SeitenMaking Sense of A Complex WorldciaranharronNoch keine Bewertungen

- PWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018Dokument12 SeitenPWC Reportinginbrief Companies Indian Accounting Standards Amendment Rules 2018sourabhbansal108Noch keine Bewertungen

- Revenue Revisited: Student Accountant Hub PageDokument4 SeitenRevenue Revisited: Student Accountant Hub PageNozimanga ChiroroNoch keine Bewertungen

- To The Point: Boards Near Completion of The Revenue Recognition StandardDokument4 SeitenTo The Point: Boards Near Completion of The Revenue Recognition StandardTHE THIZZNoch keine Bewertungen

- Sourcing and Selection-V1Dokument9 SeitenSourcing and Selection-V1John LiburtiNoch keine Bewertungen

- Dissertation On Revenue RecognitionDokument7 SeitenDissertation On Revenue RecognitionCollegePaperGhostWriterSterlingHeights100% (1)

- Private Finance InitiativeDokument5 SeitenPrivate Finance InitiativeNurul AsyiqinNoch keine Bewertungen

- Budgeting Management Accounting: Types of VariancesDokument8 SeitenBudgeting Management Accounting: Types of VariancesRaheel MumtazNoch keine Bewertungen

- Impact and Implication of PFRS 15Dokument7 SeitenImpact and Implication of PFRS 15Jethermaine BaybayanNoch keine Bewertungen

- Related Party TransactionDokument3 SeitenRelated Party TransactionzaniNoch keine Bewertungen

- EY Devel80 Revenue May2014Dokument4 SeitenEY Devel80 Revenue May2014Tanjim TanimNoch keine Bewertungen

- PRFS 15Dokument3 SeitenPRFS 15Heneir FloresNoch keine Bewertungen

- The Future of Leasing - Jan 2010Dokument5 SeitenThe Future of Leasing - Jan 2010avinash_usa2003Noch keine Bewertungen

- Outsourcing Services (BPO Services) - Amicorp Delivers ResponsiveDokument6 SeitenOutsourcing Services (BPO Services) - Amicorp Delivers ResponsiveAnusha VenkatNoch keine Bewertungen

- Sourcing - Reference Guide PDFDokument78 SeitenSourcing - Reference Guide PDFJulio Garcia GarciaNoch keine Bewertungen

- Research Paper Revenue RecognitionDokument7 SeitenResearch Paper Revenue Recognitionorlfgcvkg100% (1)

- Accounting For Fixed Consideration in Licence Arrangements in The Pharmaceutical and Life Sciences Industry PWC in Brief INT2018-08Dokument4 SeitenAccounting For Fixed Consideration in Licence Arrangements in The Pharmaceutical and Life Sciences Industry PWC in Brief INT2018-08Oscar Fajardo SosaNoch keine Bewertungen

- Pricing Model For Infosys BPO LimitedDokument4 SeitenPricing Model For Infosys BPO LimitedAdil JahangeerNoch keine Bewertungen

- PWC Revenue From Contracts With CustomersDokument16 SeitenPWC Revenue From Contracts With CustomersJobelyn CasimNoch keine Bewertungen

- The New Revenue Recognition Rules: What Is The Impact For Franchisors?Dokument25 SeitenThe New Revenue Recognition Rules: What Is The Impact For Franchisors?Tag SenNoch keine Bewertungen

- Week 3 IFRS 15-Revenue From Contracts With CustomersDokument20 SeitenWeek 3 IFRS 15-Revenue From Contracts With CustomerskoketsoNoch keine Bewertungen

- Combining Logistics With Financing For Enhanced ProfitabilityDokument19 SeitenCombining Logistics With Financing For Enhanced ProfitabilityNilesh VadherNoch keine Bewertungen

- EDLeasesSnapShot May2013Dokument16 SeitenEDLeasesSnapShot May2013Keat YingNoch keine Bewertungen

- AFAR-06 (Revenue From Contracts With Customers - Other Topics)Dokument26 SeitenAFAR-06 (Revenue From Contracts With Customers - Other Topics)MABI ESPENIDONoch keine Bewertungen

- No. 2016-08 March 2016: Revenue From Contracts With Customers (Topic 606)Dokument40 SeitenNo. 2016-08 March 2016: Revenue From Contracts With Customers (Topic 606)Omar Londoño UribeNoch keine Bewertungen

- International TP Handbook 2011Dokument0 SeitenInternational TP Handbook 2011Kolawole AkinmojiNoch keine Bewertungen

- IFRS Industry Insights: Technology SectorDokument3 SeitenIFRS Industry Insights: Technology SectorKiranmai GogireddyNoch keine Bewertungen

- The Objective of General Purpose Financial ReportingDokument86 SeitenThe Objective of General Purpose Financial ReportingAlex liaoNoch keine Bewertungen

- Capitulo Reconocimiento Ingresos Politica GrupoDokument28 SeitenCapitulo Reconocimiento Ingresos Politica Grupoaclinares9Noch keine Bewertungen

- OECD Discussion Draft Implementation Guidance On HTVIDokument8 SeitenOECD Discussion Draft Implementation Guidance On HTVIMario AlfaroNoch keine Bewertungen

- IFRS 15 - Revenue From Contracts With CustomersDokument5 SeitenIFRS 15 - Revenue From Contracts With CustomersAnkur MittalNoch keine Bewertungen

- IFRS 15 Is An I-WPS OfficeDokument3 SeitenIFRS 15 Is An I-WPS OfficeAnn StylesNoch keine Bewertungen

- IFRS 15 Revenue From Contracts With CustomersDokument18 SeitenIFRS 15 Revenue From Contracts With CustomersHamza JavaidNoch keine Bewertungen

- Order FormDokument2 SeitenOrder FormSo LokNoch keine Bewertungen

- Agriculture: Hong Kong Accounting Standard 41Dokument38 SeitenAgriculture: Hong Kong Accounting Standard 41So LokNoch keine Bewertungen

- I GAAPDokument3 SeitenI GAAPSo LokNoch keine Bewertungen

- US Social Housing Bond (Colonial Capital) PDFDokument6 SeitenUS Social Housing Bond (Colonial Capital) PDFSo LokNoch keine Bewertungen

- Global Islamic FinanceDokument88 SeitenGlobal Islamic FinanceSo LokNoch keine Bewertungen

- Valuation Concepts and Issues (IASB 2007)Dokument70 SeitenValuation Concepts and Issues (IASB 2007)So LokNoch keine Bewertungen

- Business Valuations: Fundamentals, Techniques and Theory.Dokument772 SeitenBusiness Valuations: Fundamentals, Techniques and Theory.Matthew Parham100% (12)

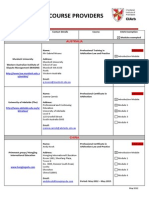

- Recognised Course Providers ListDokument13 SeitenRecognised Course Providers ListSo LokNoch keine Bewertungen

- Generator Service 0750614536Dokument3 SeitenGenerator Service 0750614536Digital pallet weighing scales in Kampala UgandaNoch keine Bewertungen

- SWOT Analysis - StarbucksDokument9 SeitenSWOT Analysis - StarbucksTan AngelaNoch keine Bewertungen

- Carlzan Jay C. Reyes: EducationalDokument3 SeitenCarlzan Jay C. Reyes: EducationalAries BautistaNoch keine Bewertungen

- Certificate No: Report of Testing Examination of Hoists/Lifting Machines, Tackles, Chains & SlingsDokument9 SeitenCertificate No: Report of Testing Examination of Hoists/Lifting Machines, Tackles, Chains & SlingsNupur AgrawalNoch keine Bewertungen

- SWOT AnalysisDokument9 SeitenSWOT AnalysisAnjali SinghNoch keine Bewertungen

- Pengajuan Borongan Ke Kontrak 2021 F1 Update RumahDokument13 SeitenPengajuan Borongan Ke Kontrak 2021 F1 Update Rumahiduy emailsNoch keine Bewertungen

- Free Trade Vs ProtectionismDokument6 SeitenFree Trade Vs ProtectionismSakshi LatherNoch keine Bewertungen

- 7th Party in Logistic ManagementDokument2 Seiten7th Party in Logistic ManagementParmeet kaur100% (1)

- Mathematics: Estimating SumDokument11 SeitenMathematics: Estimating SumEvelyn AfricaNoch keine Bewertungen

- Autonomous, Connected, Electric and Shared VehiclesDokument52 SeitenAutonomous, Connected, Electric and Shared VehiclesAmatek Teekay 特克纳Noch keine Bewertungen

- Appendix 14 - Instructions - BURSDokument1 SeiteAppendix 14 - Instructions - BURSthessa_starNoch keine Bewertungen

- Washington Mutual (WMI) - Attachments/Exhibits To The Final Report of The Examiner (Part 4/10)Dokument427 SeitenWashington Mutual (WMI) - Attachments/Exhibits To The Final Report of The Examiner (Part 4/10)meischerNoch keine Bewertungen

- Horlicks NoodlesDokument9 SeitenHorlicks NoodlesdhawalearchanaNoch keine Bewertungen

- How To Make An Advance Payment?Dokument6 SeitenHow To Make An Advance Payment?Renzo SantiagoNoch keine Bewertungen

- Robotic Process AutomationDokument13 SeitenRobotic Process AutomationSamir NweeryNoch keine Bewertungen

- Inward ManifestDokument102 SeitenInward Manifestjohn yreNoch keine Bewertungen

- Advertising in PakistanDokument11 SeitenAdvertising in PakistanWaleed UQNoch keine Bewertungen

- AbcdefghijkDokument13 SeitenAbcdefghijkGaurav DwivediNoch keine Bewertungen

- Ez Payment 2 UDokument12 SeitenEz Payment 2 USophy Sufian SulaimanNoch keine Bewertungen

- Business English IDokument171 SeitenBusiness English ISofija100% (2)

- De: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolDokument6 SeitenDe: PAGES, Yann Enviado El: Viernes, 21 de Octubre de 2022 16:15 Para: Ander Aramburu CC: Warwas, KarolJONNoch keine Bewertungen

- Understanding Digital Marketing - TheoriDokument45 SeitenUnderstanding Digital Marketing - TheoriIon FainaNoch keine Bewertungen

- Corporate IdentityDokument64 SeitenCorporate IdentityGeetanshi Agarwal100% (1)

- 1567180324761CcdPKH14u18v1CaW PDFDokument6 Seiten1567180324761CcdPKH14u18v1CaW PDFSathyasai SharmaNoch keine Bewertungen

- Butlers ChocolatesDokument2 SeitenButlers ChocolatesIshita JainNoch keine Bewertungen

- What Is TradeDokument24 SeitenWhat Is Tradesehrish_ims53Noch keine Bewertungen

- Relationship Manager or Client Servicing or Private BankingDokument3 SeitenRelationship Manager or Client Servicing or Private Bankingapi-77339284Noch keine Bewertungen

- Lesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSDokument6 SeitenLesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSMayeng MonayNoch keine Bewertungen

- Tally ERP 9: Shortcut Key For TallyDokument21 SeitenTally ERP 9: Shortcut Key For TallyDhurba Bahadur BkNoch keine Bewertungen

- Liquidity GapsDokument18 SeitenLiquidity Gapsjessicashergill100% (1)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureVon EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureBewertung: 4.5 von 5 Sternen4.5/5 (100)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (98)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (91)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Having It All: Achieving Your Life's Goals and DreamsVon EverandHaving It All: Achieving Your Life's Goals and DreamsBewertung: 4.5 von 5 Sternen4.5/5 (65)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveVon EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNoch keine Bewertungen

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizVon EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizBewertung: 4.5 von 5 Sternen4.5/5 (112)

- Every Tool's a Hammer: Life Is What You Make ItVon EverandEvery Tool's a Hammer: Life Is What You Make ItBewertung: 4.5 von 5 Sternen4.5/5 (249)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderVon EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderBewertung: 4.5 von 5 Sternen4.5/5 (61)

- Transformed: Moving to the Product Operating ModelVon EverandTransformed: Moving to the Product Operating ModelBewertung: 4 von 5 Sternen4/5 (1)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveVon EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveBewertung: 4.5 von 5 Sternen4.5/5 (89)

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachVon EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachBewertung: 3.5 von 5 Sternen3.5/5 (6)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldVon Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldBewertung: 5 von 5 Sternen5/5 (20)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoVon EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoBewertung: 4 von 5 Sternen4/5 (1)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberVon EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberBewertung: 5 von 5 Sternen5/5 (39)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziVon Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNoch keine Bewertungen

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyVon EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyBewertung: 5 von 5 Sternen5/5 (22)

- The Master Key System: 28 Parts, Questions and AnswersVon EverandThe Master Key System: 28 Parts, Questions and AnswersBewertung: 5 von 5 Sternen5/5 (62)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andVon EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andBewertung: 4.5 von 5 Sternen4.5/5 (709)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeVon EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeBewertung: 4 von 5 Sternen4/5 (49)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (58)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayVon EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayBewertung: 5 von 5 Sternen5/5 (42)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessVon EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessBewertung: 4.5 von 5 Sternen4.5/5 (26)

- The Bitcoin Standard: The Decentralized Alternative to Central BankingVon EverandThe Bitcoin Standard: The Decentralized Alternative to Central BankingBewertung: 4.5 von 5 Sternen4.5/5 (41)