Beruflich Dokumente

Kultur Dokumente

CIN Accounting Entries

Hochgeladen von

venkat6299Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIN Accounting Entries

Hochgeladen von

venkat6299Copyright:

Verfügbare Formate

Page 1 of 6 www.mySAPhelp.

com

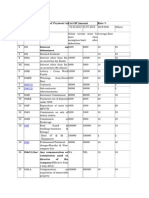

CIN Accounting Entries

Page 2 of 6 www.mySAPhelp.com

Presented By

Author : mySAPhelp.com

Doc Code : BOOK10XXXs

Subject : CIN Accounting Entries

Book For : SAP FI / MM / CIN Consultant

Language : English

Sap Ver : Up to ECC 6.0

Technical Description

No of Page : 26

Format : PDF

Version History

Version : Release

V 1.0 : 11

th

July 2008

Contact Us

For any suggestion / improvement / feedback / correction / error

write us

At

admin@mysaphelp.com

Page 3 of 6 www.mySAPhelp.com

This Document explains about Country India Version (Excise / Vat / Service Tax)

related accounting entries. This document is very useful for SAP FI / MM / CIN

consultant / end users who have to work in CIN.

Content Highlights

This document explains about accounting entries for below mention scenario

Goods movements

Goods are issued to the production order

Goods are received from the production order

Goods are dispatched to customer through delivery

Goods are issued to a cost center or charged off against expenses

Invoice generation

Export sales

Debit memos

Sale of scrap

Advances from customers

Goods receipt

Excise invoice verification

Vendor invoice verification

Down payment for capital (tangible) assets

Security deposits /earnest money deposit received from vendors

Payment of tour advance domestic tours

Settlement of tour advances domestic/foreign

Banking operations

Maintenance of bank master

Bank accounting

Cheque deposit- customer receipts

Cheque deposit other than customer receipts

Cheque bouncing other than customer receipts

Bank reconciliation

Cheque received from customer

Cheque issued to vendors

Direct debit in bank

Direct credit in bank

Bank fixed deposits

Cheque management/ cheque printing cum advice

Cash management/liquidity analysis

You can buy complete document on

mysaphelp.com Click here to know more and

buy now!

Page 4 of 6 www.mySAPhelp.com

All the Inventory transactions will look for the valuation class and the

corresponding G.L. Accounts and post the values in the G.L accounts.

For Example: during Goods Receipt

Stock Account Dr

G/R I/R Account Cr

Freight Clearing account Cr

Other expenses payable Cr

During Invoice Verification

G/R I/R Account Dr

Vendor Cr

1.1 When the Goods are issued to the Production Order the following

transactions takes place:

Consumption of Raw Materials Dr

Stock A/c Cr

1.2 When the Goods are received from the Production Order the following

transactions takes place:

Inventory A/c Dr

Cost of Goods Produced Cr

Price difference Dr/Cr

(depending on the difference between standard cost and actual cost)

1.3 When the Goods are dispatched to customer through delivery the

following transactions takes place:

Page 5 of 6 www.mySAPhelp.com

Cost of Goods Sold Dr

Inventory A/c Cr

1.4 When the Goods are issued to a Cost Center or charged off against

expenses the following transactions takes place:

Repairs and Maintenance Dr

Inventory A/c Cr

1.5 When the Goods are stock transferred from one plant to another, the

following transactions takes place:

Stock A/c Dr (Receiving location)

Stock A/c Cr (Sending location)

Price difference Dr/Cr

(due to any difference between the standard costs between the

two locations)

1.6 When the stocks are revalued, the following transactions takes place:

Stock A/c Dr/Cr

Inventory Revaluation A/c Cr / Dr

When the Work in Progress is calculated the following transaction

takes place:

Work in Progress A/c Dr

Change WIP A/c Cr

1.7 Physical verification /shortages and excesses : Shortages/excesses

on authorizations shall be adjusted using the physical inventory count

transaction.

Page 6 of 6 www.mySAPhelp.com

Invoi ce Generation

1.8 Invoices will be generated at the Smelters and stock points. The

accounting entries for the sale of goods despatched will flow from the

Sales invoice generated in SAP Sales and Distribution module. The

following entries shall be passed

Customer Account Dr

Revenue Cr

Excise Duty Payable Cr

Sales Tax Payable (local or central) Cr

Note: As mentioned above in the FI document, which is created in the

background, the SD invoice number shall be captured. However as per

the current accounting procedure the accounting entry passed is as

follows :-

Customer Account Dr

Revenue Cr

Excise Duty Billed Cr

Sales Tax Payable (local or central) Cr

Excise duty paid a/c Dr

Excise duty payable a/c Cr

You can buy complete document on

mysaphelp.com Click here to know more and

buy now!

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Prelims 2016 - Government SchemesDokument57 SeitenPrelims 2016 - Government SchemesSahil KapoorNoch keine Bewertungen

- JEE Syllabus N CAT SyllabusDokument13 SeitenJEE Syllabus N CAT Syllabusvenkat6299Noch keine Bewertungen

- World's Top 10 and India's Top 10Dokument12 SeitenWorld's Top 10 and India's Top 10venkat6299Noch keine Bewertungen

- BT Brinjal Case StudyDokument26 SeitenBT Brinjal Case StudyVeerendra Singh NagoriaNoch keine Bewertungen

- Averages: Quantities of - No Quantities All of SumDokument8 SeitenAverages: Quantities of - No Quantities All of SumSumeet KumarNoch keine Bewertungen

- Coordinate GeometryDokument8 SeitenCoordinate Geometry45satishNoch keine Bewertungen

- Group 1 Syllabus and PatternDokument7 SeitenGroup 1 Syllabus and Patternsai198Noch keine Bewertungen

- JEE Syllabus N CAT SyllabusDokument13 SeitenJEE Syllabus N CAT Syllabusvenkat6299Noch keine Bewertungen

- What Is The Difference Between Updated Project and End To End ProjectDokument6 SeitenWhat Is The Difference Between Updated Project and End To End Projectvenkat6299Noch keine Bewertungen

- Implementation - Payroll in TALLYDokument258 SeitenImplementation - Payroll in TALLYvenkat6299Noch keine Bewertungen

- Loc Id Bangalore 1 Delhi 2 Chennai 3 Mumbai 4 Bhubaneswar 5 Pune 6 Noida 7 Hyderabad 8 Nellore 9 Patna 10 Rajmundry 11 Hubli 12 Lucknow 13 Kolkata 14 Srinagar 15 Karoor 16 Amritsar 17Dokument10 SeitenLoc Id Bangalore 1 Delhi 2 Chennai 3 Mumbai 4 Bhubaneswar 5 Pune 6 Noida 7 Hyderabad 8 Nellore 9 Patna 10 Rajmundry 11 Hubli 12 Lucknow 13 Kolkata 14 Srinagar 15 Karoor 16 Amritsar 17venkat6299Noch keine Bewertungen

- Binomial Distribution TutorialDokument4 SeitenBinomial Distribution Tutorialvenkat6299Noch keine Bewertungen

- Hermann Samuel ReimarusDokument1 SeiteHermann Samuel Reimarusvenkat6299Noch keine Bewertungen

- SapfanDokument9 SeitenSapfanvenkat6299Noch keine Bewertungen

- 1) Benjamin Franklin Autobiography 2) Books by Emerson 3)Dokument1 Seite1) Benjamin Franklin Autobiography 2) Books by Emerson 3)venkat6299Noch keine Bewertungen

- George GallopDokument1 SeiteGeorge Gallopvenkat6299Noch keine Bewertungen

- Tiles Vincent QuotationDokument1 SeiteTiles Vincent Quotationvenkat6299Noch keine Bewertungen

- Compare Features in OBIEE 10g and 11gDokument23 SeitenCompare Features in OBIEE 10g and 11gvenkat6299Noch keine Bewertungen

- GSLV-D5 Success: A Major "Booster" To India's Space ProgramDokument3 SeitenGSLV-D5 Success: A Major "Booster" To India's Space Programvenkat6299Noch keine Bewertungen

- Benjamin Franklin - The AutobiographyDokument111 SeitenBenjamin Franklin - The AutobiographyD. ManchesterNoch keine Bewertungen

- New EntriesDokument4 SeitenNew Entriesvenkat6299Noch keine Bewertungen

- ABC Company Set UpDokument209 SeitenABC Company Set Upvenkat6299Noch keine Bewertungen

- New Science and Technology 2003Dokument21 SeitenNew Science and Technology 2003venkat6299Noch keine Bewertungen

- With Holding Tax RatesDokument3 SeitenWith Holding Tax Ratesvenkat6299Noch keine Bewertungen

- Introduction To Document Splitting in New GLDokument8 SeitenIntroduction To Document Splitting in New GLvenkat6299Noch keine Bewertungen

- Eula Microsoft Visual StudioDokument3 SeitenEula Microsoft Visual StudioqwwerttyyNoch keine Bewertungen

- Co-Ordinator Research Cell: Exam Fee For Engineering Course: Rs.2000Dokument1 SeiteCo-Ordinator Research Cell: Exam Fee For Engineering Course: Rs.2000venkat6299Noch keine Bewertungen

- VatDokument1 SeiteVatvenkat6299Noch keine Bewertungen

- Commitment Management in SAPDokument26 SeitenCommitment Management in SAPvenkat6299100% (1)

- Configure Automatic Postings: Further InformationDokument13 SeitenConfigure Automatic Postings: Further Informationvenkat6299Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Cours 1 - Defining MarketingDokument39 SeitenCours 1 - Defining MarketingKévin PereiraNoch keine Bewertungen

- Shoppers StopDokument35 SeitenShoppers StopAditi JindalNoch keine Bewertungen

- Prod Pre EOQDokument79 SeitenProd Pre EOQGwenNoch keine Bewertungen

- The Disposable Diaper CaseDokument11 SeitenThe Disposable Diaper CaseLavanya KashyapNoch keine Bewertungen

- Proficiency TestDokument5 SeitenProficiency TestElena SomovaNoch keine Bewertungen

- Chapter - 10, 11 Standard Costing and Operating Performance MeasuresDokument21 SeitenChapter - 10, 11 Standard Costing and Operating Performance Measuresmuhammad bilal baigNoch keine Bewertungen

- Part C F5 RevisionDokument20 SeitenPart C F5 RevisionMazni HanisahNoch keine Bewertungen

- 020311Dokument60 Seiten020311swapsheetNoch keine Bewertungen

- Present Values, The Objectives of The Firm, and Corporate GovernanceDokument31 SeitenPresent Values, The Objectives of The Firm, and Corporate GovernanceTanvi KatariaNoch keine Bewertungen

- Coca Cola FinalDokument12 SeitenCoca Cola FinalSamuel MosesNoch keine Bewertungen

- MCOM SyllabusDokument38 SeitenMCOM SyllabusPavan KumarNoch keine Bewertungen

- Economic and Legal Analysis of Inflation and DeflationDokument23 SeitenEconomic and Legal Analysis of Inflation and Deflationbindu priyaNoch keine Bewertungen

- Basics of Spreading: Ratio Spreads and BackspreadsDokument20 SeitenBasics of Spreading: Ratio Spreads and BackspreadspkkothariNoch keine Bewertungen

- Introductory Microeconomics (Lecture Notes) PDFDokument25 SeitenIntroductory Microeconomics (Lecture Notes) PDFFateNoch keine Bewertungen

- Cva HedgingDokument16 SeitenCva HedgingjeanturqNoch keine Bewertungen

- Aguko - Value Chain Analysis and Organizational Performance of Beer Manufacturing Companies in KenyaDokument54 SeitenAguko - Value Chain Analysis and Organizational Performance of Beer Manufacturing Companies in KenyaMar Lester PanganNoch keine Bewertungen

- Demand Side PolicyDokument15 SeitenDemand Side PolicyAnkit Shukla100% (1)

- 2 VW NBD Passat b7 Service Pricing GuideDokument1 Seite2 VW NBD Passat b7 Service Pricing Guidemanuel19941Noch keine Bewertungen

- Agreement For The Sale of ScrapDokument4 SeitenAgreement For The Sale of ScrapMhilet57% (23)

- Elasticity MarianDokument4 SeitenElasticity MarianMARIAN Sports FreeNoch keine Bewertungen

- Acquisition Based LearningsDokument32 SeitenAcquisition Based LearningsVarun SharmaNoch keine Bewertungen

- Step by Step Guide To Exporting 2011Dokument54 SeitenStep by Step Guide To Exporting 2011Kathy PrestaNoch keine Bewertungen

- New Criteria For Market SegmentationDokument9 SeitenNew Criteria For Market Segmentationsumit jhaNoch keine Bewertungen

- Tools FinanceDokument40 SeitenTools FinanceHasnatNoch keine Bewertungen

- Eco7 Case NotesDokument6 SeitenEco7 Case NotesValerie Bodden KlugeNoch keine Bewertungen

- Valuation of Metals and Mining CompaniesDokument81 SeitenValuation of Metals and Mining CompaniesAnna Kruglova100% (1)

- Closed-Loop Supply Chain Models With Product Remanufacturingn Models With Product RemanufacturingDokument15 SeitenClosed-Loop Supply Chain Models With Product Remanufacturingn Models With Product RemanufacturingJaykrishnan GopalakrishnanNoch keine Bewertungen

- 4 2006 Dec QDokument9 Seiten4 2006 Dec Qapi-19836745Noch keine Bewertungen

- This Paper Is Not To Be Removed From The Examination HallsDokument12 SeitenThis Paper Is Not To Be Removed From The Examination HallsSithmi HimashaNoch keine Bewertungen