Beruflich Dokumente

Kultur Dokumente

Banking and Finance 2013

Hochgeladen von

GuruKPOCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banking and Finance 2013

Hochgeladen von

GuruKPOCopyright:

Verfügbare Formate

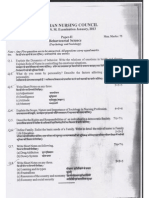

Model Test Paper 2013 B.Com.

-I

EAFM-II (B) Banking and Finance

Answer the following questions:2x5 = 10 1. Define the term Bank, according to the Banking regulation Act 1948? 2. Name the following: a. ICICI b. DIC 3. Name two development banks of India. 4. List any four functions of RBI. 5. Define garnishee order and Right to set off. 6. What is federal finance? 7. List any ten public and private banks of India. 8. Define grants-in aid. 9. What do you understand bybudget deficit and external debt? 10. What do you mean by Credit and credit creation? Answer the following questions in 100 words each: 5x4=20 1. Give short note on: Investment Banks. Narsimham Committee. 2. Explain the different accounts of banks. 3. What are the problems faced by RRBs. Explain in detail. 4. Discuss the methods of credit creation. 5. Loans are the children of deposits; Deposits are the children of Loans. Comment. 6. What are the objectives of RRBs? What are the problems faced by RRBs in attaining those objectives. 7. What are the various functions of RBI? 8. What is NABARD? How NABARD helps RRBs to grow. 9. What are the various methods of credit control? 10. What are negotiable instruments? Explain its characteristics. 11. What do you mean by crossing of cheques? 12. Give the procedure of collection and payments of cheques. 13. What do you mean by Public finance?Compare public finance and private finance. 14. What are the basic components of public expenditure? 15. What are the different accounts of banks? Explain. 16. Give the classification of banks. 17. How banks helps in economic development of the country. 18. Classify tax on different bases. 19. Give a brief note about public expenditure and revenue.

20. Discuss the relationship of union and state government. Answer any two of the following questions: 10x2=20 1. RBI is known as Bankers bank. Comment. 2. Discuss the methods of credit creation by banks. 3. Throw light on the recent trends took place in Indian Banking Sector. 4. Discuss the major functions of modern commercial banks. 5. Insurance is one of the major tools of Investment banking. Comment. 6. What are the recent trends taking place in Indian Banking System? Explain in detail. 7. What are the different canons of taxations? 8. Discuss the salient features of Indian banking regulation Act 1949. 9. What are the legal procedures under which a cheque gets dishonored? 10. What is meant by Public debt? How it is related with deficit budget.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Advertising and Sales PromotionDokument75 SeitenAdvertising and Sales PromotionGuruKPO100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Algorithms and Application ProgrammingDokument114 SeitenAlgorithms and Application ProgrammingGuruKPONoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- OptimizationDokument96 SeitenOptimizationGuruKPO67% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Applied ElectronicsDokument40 SeitenApplied ElectronicsGuruKPO75% (4)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Applied ElectronicsDokument37 SeitenApplied ElectronicsGuruKPO100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Abstract AlgebraDokument111 SeitenAbstract AlgebraGuruKPO100% (5)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Production and Material ManagementDokument50 SeitenProduction and Material ManagementGuruKPONoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Biyani's Think Tank: Concept Based NotesDokument49 SeitenBiyani's Think Tank: Concept Based NotesGuruKPO71% (7)

- Computer Graphics & Image ProcessingDokument117 SeitenComputer Graphics & Image ProcessingGuruKPONoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Think Tank - Advertising & Sales PromotionDokument75 SeitenThink Tank - Advertising & Sales PromotionGuruKPO67% (3)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Biyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014Dokument1 SeiteBiyani Group of Colleges, Jaipur Merit List of Kalpana Chawala Essay Competition - 2014GuruKPONoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Community Health Nursing I July 2013Dokument1 SeiteCommunity Health Nursing I July 2013GuruKPONoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Phychology & Sociology Jan 2013Dokument1 SeitePhychology & Sociology Jan 2013GuruKPONoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Phychology & Sociology Jan 2013Dokument1 SeitePhychology & Sociology Jan 2013GuruKPONoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Fundamental of Nursing Nov 2013Dokument1 SeiteFundamental of Nursing Nov 2013GuruKPONoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Algorithms and Application ProgrammingDokument114 SeitenAlgorithms and Application ProgrammingGuruKPONoch keine Bewertungen

- Data Communication & NetworkingDokument138 SeitenData Communication & NetworkingGuruKPO80% (5)

- Community Health Nursing Jan 2013Dokument1 SeiteCommunity Health Nursing Jan 2013GuruKPONoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Paediatric Nursing Sep 2013 PDFDokument1 SeitePaediatric Nursing Sep 2013 PDFGuruKPONoch keine Bewertungen

- Biological Science Paper 1 Nov 2013Dokument1 SeiteBiological Science Paper 1 Nov 2013GuruKPONoch keine Bewertungen

- Biological Science Paper I July 2013Dokument1 SeiteBiological Science Paper I July 2013GuruKPONoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Community Health Nursing I Nov 2013Dokument1 SeiteCommunity Health Nursing I Nov 2013GuruKPONoch keine Bewertungen

- Business LawDokument112 SeitenBusiness LawDewanFoysalHaqueNoch keine Bewertungen

- Biological Science Paper 1 Jan 2013Dokument1 SeiteBiological Science Paper 1 Jan 2013GuruKPONoch keine Bewertungen

- Banking Services OperationsDokument134 SeitenBanking Services OperationsGuruKPONoch keine Bewertungen

- Business Ethics and EthosDokument36 SeitenBusiness Ethics and EthosGuruKPO100% (3)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Product and Brand ManagementDokument129 SeitenProduct and Brand ManagementGuruKPONoch keine Bewertungen

- BA II English (Paper II)Dokument45 SeitenBA II English (Paper II)GuruKPONoch keine Bewertungen

- Software Project ManagementDokument41 SeitenSoftware Project ManagementGuruKPO100% (1)

- Service MarketingDokument60 SeitenService MarketingGuruKPONoch keine Bewertungen

- INDIVIDUAL ASSINGMENT FIN420 (Syu)Dokument9 SeitenINDIVIDUAL ASSINGMENT FIN420 (Syu)nurainna syuhadaNoch keine Bewertungen

- Analysis and Interpretation of FSDokument5 SeitenAnalysis and Interpretation of FSRizia Feh EustaquioNoch keine Bewertungen

- Somaliland CC Headings Web FDokument6 SeitenSomaliland CC Headings Web FAbdiaziz HassanNoch keine Bewertungen

- The Economic Impact of Closing The Racial Wealth GapDokument20 SeitenThe Economic Impact of Closing The Racial Wealth Gapokmaya_2000788Noch keine Bewertungen

- Credit and CollectionDokument23 SeitenCredit and CollectionMary Anne TribujeniaNoch keine Bewertungen

- Exchange Control Directive RU 28 of 2019Dokument16 SeitenExchange Control Directive RU 28 of 2019nickie2611Noch keine Bewertungen

- Commerce SS2Dokument17 SeitenCommerce SS2adesuwaNoch keine Bewertungen

- Financial MatrixDokument6 SeitenFinancial MatrixAsNoch keine Bewertungen

- Sample Bloomberg Audit - Bob RamersDokument12 SeitenSample Bloomberg Audit - Bob RamersBob Ramers100% (5)

- MacDonald v. National City Bank DigestDokument2 SeitenMacDonald v. National City Bank DigestBobby Olavides SebastianNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Haji AliDokument9 SeitenHaji AliVaibhav PakhaleNoch keine Bewertungen

- Math of InvestmentDokument34 SeitenMath of InvestmentJohn Alfred LangiNoch keine Bewertungen

- Branch Accounting Examination BankDokument71 SeitenBranch Accounting Examination BankNicole TaylorNoch keine Bewertungen

- TenStepsToIssueSecurityTokens AlphaPoint PDFDokument30 SeitenTenStepsToIssueSecurityTokens AlphaPoint PDFGorazd OcvirkNoch keine Bewertungen

- Financial Analysis of Wipro LTD (2) (Repaired)Dokument80 SeitenFinancial Analysis of Wipro LTD (2) (Repaired)Sanchit KalraNoch keine Bewertungen

- (G.R. No. L-17725. February 28, 1962.) Republic of The Philippines, Plaintiff-Appellee, vs. Mambulao Lumber COMPANY, ET AL., Defendants-AppellantsDokument38 Seiten(G.R. No. L-17725. February 28, 1962.) Republic of The Philippines, Plaintiff-Appellee, vs. Mambulao Lumber COMPANY, ET AL., Defendants-AppellantsJanineNoch keine Bewertungen

- Slides On Taxes and Corporate Decision MakingDokument21 SeitenSlides On Taxes and Corporate Decision Makingyebegashet100% (1)

- Chapter 7 Brief ExercisesDokument6 SeitenChapter 7 Brief ExercisesPatrick YazbeckNoch keine Bewertungen

- Interest Rate SwapsDokument6 SeitenInterest Rate SwapsKanchan ChawlaNoch keine Bewertungen

- Milken Institute - Mortgage Crisis OverviewDokument84 SeitenMilken Institute - Mortgage Crisis Overviewpemmott100% (3)

- Bailment and PledgeDokument14 SeitenBailment and PledgeAkhil Ranjan TarafderNoch keine Bewertungen

- Affidavit of Merit: Republic of The Philippines) Marikina City, Metro Manila) S. SDokument2 SeitenAffidavit of Merit: Republic of The Philippines) Marikina City, Metro Manila) S. SVanNoch keine Bewertungen

- Financial Analysis - Planning NotesDokument49 SeitenFinancial Analysis - Planning NotesMadhan Kumar BobbalaNoch keine Bewertungen

- Financial Management Assignment ReportDokument16 SeitenFinancial Management Assignment Reportaddyie_26509406591% (22)

- Chapter 3Dokument47 SeitenChapter 3Marsleno WaheedNoch keine Bewertungen

- Topic TwoDokument67 SeitenTopic TwoMerediths KrisKringleNoch keine Bewertungen

- MAIN PPT Stock Exchange of India - pptmATDokument42 SeitenMAIN PPT Stock Exchange of India - pptmATAnkit Jain100% (1)

- Arise AB (ARISE) : Financial and Strategic SWOT Analysis ReviewDokument34 SeitenArise AB (ARISE) : Financial and Strategic SWOT Analysis ReviewPartha SarathyNoch keine Bewertungen

- Leverages ProblemsDokument4 SeitenLeverages Problemsk,hbibk,n0% (1)

- PNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesDokument5 SeitenPNB V. Ca, Ibarrola: As Payments For The Purchase of MedicinesKhayzee AsesorNoch keine Bewertungen

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthVon EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthBewertung: 4 von 5 Sternen4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursVon EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursBewertung: 4.5 von 5 Sternen4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisVon EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisBewertung: 5 von 5 Sternen5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialVon EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialBewertung: 4.5 von 5 Sternen4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 3.5 von 5 Sternen3.5/5 (8)