Beruflich Dokumente

Kultur Dokumente

Beogradske Elektrane Financial Statements

Hochgeladen von

Blazen MinicCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Beogradske Elektrane Financial Statements

Hochgeladen von

Blazen MinicCopyright:

Verfügbare Formate

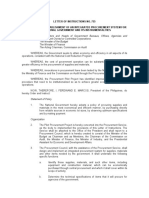

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

12-Feb-14 Relevant information Currency Average Exchange Rate Exchange rate at date Annual Electricity Production in Serbia Distribution company consumption Transmission losses Transmission output Key Financials Auditor / Opinion Total Revenues Gross Profit EBITDA EBIT Net Profit / Loss Net Operating CF CF from Investing Activities CF from Financing Activities CF from Equity Activities Balance Sheet Total Current Assets Fixed Assets ST Liabilities LT Liabilities Senior Debt Equity Equity incl. Subdebt Tangible Net Worth 31-Dec-09

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 100% #DIV/0! #DIV/0! #DIV/0! #DIV/0! 100% #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

31-Dec-09 000 EUR 93.8992 95.8888

31-Dec-10 000 EUR 102.8993 105.4982 35,731 GWh 29,952 GWh 1,065 GWh 41,549 GWh

31-Dec-11 000 EUR 101.9653 104.6409 35,959 GWh 30,076 GWh 1,096 GWh 41,565 GWh 31-Dec-11 210,651 56,067 10,696 -4,456 -12,994 168,100 230 7,243 4,819 276,458 72,370 204,087 227,269 11,705 1,147 36,334 36,334 35,749 31-Dec-11 4.6 x -2.2% 5.1% 13.1% -0.8% -0.4 year(s)

31-Dec-12 000 EUR 113.0415 113.718 31,000 GWh

31-Dec-09

31-Dec-10

31-Dec-12 212,631 81,371 39,280 25,128 3,204 4,240 -7 2,154 12,026 278,650 87,568 191,082 227,090 13,950 1,059 36,555 36,555 35,458 31-Dec-12 3.7 x 8.2% 18.5% 13.1% 10.1% -0.2 year(s)

100% 27% 5% -2% -6% 80% 0% 3% 2% 100.0 26% 74% 82% 4% 0% 13.1% 13% 13%

100% 38% 18% 12% 2% 2% 0% 1% 6% 100.0 31% 69% 81% 5% 0% 13.1% 13% 13%

3,556

#DIV/0!

31-Dec-10 #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

Rating Ratios

EBITDA/Interest Cover (IS21/IS30) Ordinary Income Margin (IS35/IS10) EBTDA Margin (IS21 / IS10)

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! Adjusted Equity Ratio (EQ17+AI15)/(A42+AI15+16) Return on Assets an(IS35+IS30)/av(A42+AI15+AI16)#DIV/0! Debt Amortization Period see below *

* (L4+L22+SD03-A01-A02)/an(IS35+ IS22 or AI01)

#DIV/0!

S&P Risk Ratios

S&P Financial Risk Profile FFO/Debt (%) Debt/EBITDA (x) Debt/Equity

31-Dec-09

31-Dec-10 #DIV/0! #DIV/0! #DIV/0!

31-Dec-11 917.7% -0.4 x -11.8%

31-Dec-12 2726.9% -0.2 x -18.1%

Indicative ratio

A A A

Financial Summary

Confidential

Page 1

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

31-Dec-09 95.8888

A

01 02 03 03a 04 05 06 07 09 10 11 12 13 14 15 16 17 18 19 20 21 21a 21b 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42

31-Dec-10 105.4982

%

31-Dec-11 104.6409

%

31-Dec-12 113.718

%

2.0%

ASSETS Cash & Bank Deposits ST Securities (Trading Book) Other ST Financial Assets thereof Intragroup (EPS related) Subtotal Liquid Assets (sum A 01:03) Trade Receivables thereof Intragroup Receivables (EPS related) thereof trade related Receivables against Tax Authority / Social Security Other Receivables Subtotal Receivables (sum A 05:10-06) thereof longterm Raw Materials, Supplies Semifinished and Finished Goods Work in Progress Advances for Work in Progress & Semifin. Goods Merchandise Advances to Suppliers Other Inventory Subtotal Inventory (sum A 13:19) Accrued & Deferred Items thereof FX Losses on Long term debt thereof Intragroup (EPS related) accrued revenues Total Current Assets (A 04+11+20+21) Land & Buildings thereof leasehold improvements Plant, Machinery and Leased Assets Furniture, Fixtures & Fittings, Equipment Accumulated Depreciation Advances for Tangible Fixed Assets Construction of Tangible Fixed Assets in Progress Subtotal Tangible Fixed Assets (sum A 23:29-24) Goodwill (considered as stable of value) Rights, Patents, Licenses, Trademarks Other Capitalized Expenses (R&D,...) Accumulated Amortization Subtotal Intangible Fixed Assets (sum A31:34) Investments LT Securities Other LT Financial Assets thereof intragroup (EPS related) Subtotal Financial Fixed Assets (sum A36:38) Total Fixed Assets (sum A 30;35;40) Total Assets (A 22+41)

EUR, ths

EUR, ths

EUR, ths 5,435.8

EUR, ths 7,693.4

%

2.8%

5,435.8 41,447.8

2.0% 15.0%

7,693.4 49,410.0

3% 18%

3,098.9 44,546.7 22,387.9

1.1%

2,189.6 51,599.7 28,275.0

1%

16.1%

19%

8.1%

10%

22,387.9

8.1%

28,275.0

10%

72,370.4 202,855.3

26.2% 73.4%

87,568.1 189,429.6

31% 68%

202,855.3 584.2

73.4%

189,429.6 1,096.8

68%

0.2%

0%

584.2 108.6 309.1 230.2 648 204,087 276,458

0.2% 0.0% 0.1% 0.1%

1,096.8 96.7 221.3 237.6 556 191,082 278,650

0% 0% 0% 0%

0.2% 73.8% 100.0%

0% 69% 100%

CFA CHANGES IN FIXED ASSETS

01 02 03 04 05 06 07 08 09 10

Historical Cost of Fixed Assets * Reported Opening Net Book Value * + Total CAPEX + Revaluations +/+/Write Downs Depreciation / Amortization Book Value of Fixed Assets Disposed Effects of Changes in Consolidation Circle Other Re- / Devaluation -230 -230 -7 203,432 203,439

Reported Closing Net Book Value *

* includes reported Tangible & Intangible Fixed Assets (whole Goodwill) as well as Financial Fixed Assets

Assets

Confidential

Page 2

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

31-Dec-09 95.8888

L

01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33

31-Dec-10 105.4982

%

31-Dec-11 104.6409

%

31-Dec-12 113.718

%

0.4%

LIABILITIES ST Bank Loans Other ST Loans (3rd party, non-bank) Current Portion of LT Debt Subtotal ST Interest Bearing Debt (sum L 01:03) ST Accounts Payable thereof from capital expenditure ST Advances from Customers ST Intragroup Payables thereof trade payables ST Provisions Accrued Expenses & Deferred Revenues Payables to Tax Authorities / Social Security Dividends Payable Other ST Liabilities thereof wages & salaries Total ST Liabilities (sum L 04:15-06-09-15) LT Bank Loans Bonds / LT Debt Instruments Other LT Loans (3rd party, non-bank) Loans from Shareholders / Owners (not subordinated) Capitalized Lease Obligations Subtotal LT Interest Bearing Debt (sum L 17:21) LT Accounts Payable thereof from capital expenditures LT Advances from Customers LT Intragroup Payables thereof trade payables Provisions for Pensions / Retirement Funds Other LT Provisions Deferred Taxes Other Deferred Liabilities Other LT Liabilities Total LT Liabilities (sum L 22:32-24-27)

EUR, ths

EUR, ths

EUR, ths 1,147

EUR, ths 1,059

%

0.4%

1,147 81,607

0.4% 29.5%

1,059 85,070

0.4% 30.5%

144,277 1,385 227,269

52.2%

140,604 1,417 227,090

50.5%

0.5%

0.5%

82.2%

81.5%

5,608 6,096 0 11,705

2.0% 2.2%

5,611 8,338 0 13,950

2.0% 3.0%

0.0% 4.2%

0.0% 5.0%

SD SUBORDINATED DEBT

01 02 03

Subordinated Loans from Shareholders Other Subordinated Debt Total Subordinated Debt (SD 01+02)

EQ EQUITY

01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21

Registered Share Capital or Fixed Equity Accounts SPP Preference Share Capital or Variable Equity Accounts SPP Capital Not Paid-Up Additional Paid-In Capital or Private Equity Contribution SPP Taxed Reserves Revaluation Reserves Accumulated Retained Earnings (prior years) Current Year's Result Untaxed Reserves Minority Interests Translation Differences Treasury Stock Claims on Shareholders Goodwill (considered as not stable of value) Virtual Liability for Dividends announced / proposed Other Equity Equity (sum EQ 01:16) Claims on Shareholders Goodwill (considered as not stable of value) Virtual Liability for Dividends announced / proposed Reported Equity (sum EQ 17:20)

for information purposes only

62,037

22.4%

57,085

20.5%

55,293 -80,997

20.0% -29.3%

-20,530

-7.4%

36,334

13.1%

36,555

13.1%

36,334 276,454

13.1%

36,555 278,654

13.1%

22

SPP

Tot. Liab. & Subdebt & Equity (L 16+33+SD 03+EQ 17) = for Sole Proprietorships and Partnerships

100.0%

100.0%

Liabilities & Equity

Confidential

Page 3

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

31-Dec-09

93.8992 IS INCOME STATEMENT *

01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62

31-Dec-10

102.8993 %

31-Dec-11

101.9653 %

31-Dec-12

113.0415 %

90.7%

EUR, ths

EUR, ths

EUR, ths 191,108

EUR, ths 193,611

%

91.1%

Total Sales thereof electricity distribution interconnection transfer capacity other Discounts & Rebates Own Work Capitalized TCM Changes in Inventory of Own Production TCM Other Operating Income thereof release of provisions Total Revenues (sum IS 01+05:08) CoS/ CoGS / Cost of Materials & Consumables thereof electricity transmission losses thereof other Gross Profit (IS 10-11) Personnel Expenses

TCM TCM

19,543 210,651 154,584

9.3%

19,020 212,631 131,260

8.9%

100.0% 73.4%

100.0% 61.7%

56,067 26,642 18,728

26.6% 12.6%

81,371 25,704 16,387

38.3% 12.1%

Rental and Lease Expenses SG&A-Expenses, Other Operating Expenses thereof EPS services thereof EBITDA (IS 15-16-17-18 or IS 24+AI 01) Depreciation and Provisions thereof depreciation EBIT (IS15-16-17-18-22 or IS 15-16-17-18-AI 01) Interest Income Income from Investm. in Subsidiaries/Affiliates FX Gains Other Ordinary Financial Income Financial Income (sum IS 25:28) Interest Expense Loss from Investm. in Subsidiaries/Affiliates FX Losses Other Ordinary Financial Expenses Financial Expenses (sum IS 30:33) Ordinary Income (IS 24+29-34) Extraordinary Income thereof gain on disposal of fix. ass. & investm. thereof revaluation of fix. ass. & investm. thereof FX gains thereof adjustments to current assets thereof release of provisions thereof positive effects of accounting change Extraordinary Expenses thereof loss on disposal of fix. ass. & investm. thereof write-down of fix. ass. & investm. thereof FX losses thereof adjustments to current assets thereof transfer to provisions thereof negative effects of accounting change thereof amort. of goodwill (not stable of value) thereof restructuring charges Extraordinary Result, net (IS 36-44) Pre-Tax Profit / Loss (IS 35+53) Minority Interests Income Taxes (cash relevant) Income Taxes (deferred) Net Profit / Loss (IS 54+sum 55:57) Releases of / Transfers to Taxed Reserves Releases of / Transfers to Untaxed Reserves Transfer of Profit or Loss Current Year's Result (IS 58+sum 59:61)

TCM

8.9%

7.7%

10,696 15,153 -4,456 2,202

5.1% 7.2%

39,280 14,152 25,128 2,983

18.5% 6.7%

-2.1% 1.0%

11.8% 1.4%

2,202 2,337

1.0% 1.1%

2,983 10,645

1.4% 5.0%

2,337 -4,591 7,591

1.1% -2.2% 3.6%

10,645 17,466 5,901

5.0% 8.2% 2.8%

15,957

7.6%

17,419

8.2%

-8,366 -12,957 37 -12,994

-4.0% -6.2%

-11,518 5,948 2,744 3,204

-5.4% 2.8%

0.0%

1.3%

-6.2%

1.5%

-12,994

-6.2%

3,204

1.5%

* combining COGS-Method and Total Cost Method, special items for Total Cost Method marked

Income Statement

Confidential

Page 4

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

31-Dec-09

CF CASH FLOW REPORT

31-Dec-10 105.4982

%

31-Dec-11 104.6409

%

31-Dec-12 113.718

%

EUR, ths

EUR, ths

EUR, ths 10,696 37 5,608 -41,448 -22,388 -3,099 81,607 145,661 165,942 176,601 2,202 2,337 -8,366 168,100

EUR, ths 39,280 2,744 3 -7,962 -5,887 909 3,463 -3,641 -13,116 23,420 2,983 10,645 -11,518 4,240

EBITDA (IS 24+22 or IS 24+AI 01)

-

Cash Relevant Portion of Income Taxes (IS 56)

+/- Changes in ST and LT Provisions ([chg. sum. L 10;28;29]+IS 42-IS 49) +/- Changes in Trade Receivables (chg. A 05+07) +/- Changes in Inventory (chg. A 20) +/- Changes in Other ST Receivables (chg. sum A 06-07;9;10;21) +/- Changes in ST Accounts Payable (chg. sum L 05;09) +/- Changes in ST Advances from Customers (chg. L 07) +/- Changes in Other ST Liabilities (chg. sum. L 08-09;11;12;13;14) +/- Offset Re-/Devaluation of Current Assets (IS 41+48) = = + -

Total Changes in Working Capital Operating Cash Flow Financial Income excl. FX Gains (IS 29-27) Financial Expenses (IS 34) Net Operating Cash Flow Total CAPEX (CFA 03)

+/- Extraordinary Result [(IS 36-37-39-40-41-42-43)-(IS 44-45-46-48-49-50-51)] =

+ +

Book Value of Fixed Assets Disposed (CFA 07) Net Result of Sale of Fixed Assets & Investments ( IS 37-IS 45) -230 230 3,556 4,819 -7 -7 12,026

+/- Offset Changes in Consolid. Circle or Other Re- / Devaluation (CFA 08:09) +/- Changes in Liquid Assets (excl. Cash) (chg. A 02:03) =

Cash Flow from Investing Activities Dividends paid (CIE 05)

+/- Other Cash Relevant Changes in Equity (CIE 04-05) +/- Changes in Claims on Shareholders (chg. EQ 13) +/- Changes in Subdebt (chg. SD 03) =

Cash Flow from Equity & Subdebt Activities

3,556

4,819 1,147

12,026 -88

+/- Changes in ST Interest Bearing Debt (chg. L 04) +/- Changes in LT Interest Bearing Debt (chg. L 22) +/- Changes in LT Advances from Customers (chg. L 25) +/- Changes in LT Accounts Payable (chg. L 23) +/- Changes in Intragroup Payables (LT) (chg. L 26) +/- Changes in Other LT Liabilities (chg. sum L 30;31;32) =

6,096 7,243 -3,556 170,294

2,242 2,154 -5,624

Cash Flow from Financing Activities Net Changes in Cash Position

Non-Cash-Relevant Changes in Equity (CIE 06) Offset Increase of Revaluation Reserve (if not reflected in IS) (CFA 04-IS 39) Minority Interests & Deferred Income Taxes (IS 55+57) FX Gains (per definition considered non-cash relevant) (IS 27+40) Effects of Accounting Changes (IS 43+50)

Adjusted Changes in Cash Position (for comparison purposes only) Changes in Cash according to Balance Sheet (chg. A 01) Balanced / Not Balanced Difference

CIE CHANGES IN EQUITY

01 02

5,436

2,258

Reported Opening Equity Net Profit / Loss (IS 58) thereof Minority Interests & Deferred Taxes (IS 55+IS 57) Virtual Equity before Additional Changes Additional Cash-Relevant Changes in Equity thereof Dividends Additional Non-Cash-Relevant Changes in Equity Reported Closing Equity

03 04 05 06 07

Cash Flow

Confidential

Page 5

Strictly confidential and for internal use only!

Beogradske Elektrane Serbia - Financial Statement Analysis

31-Dec-09

R

01 02 03 04 05 06 07 08

31-Dec-10

31-Dec-11

31-Dec-12

EFFICIENCY RATIOS Asset Turnover Receivables Period Inventory Period Payables Period Operating Cycle Financing Gap Prod.ivity per Employee Avg. Employee Costs LEVERAGE RATIOS Equity Ratio Equity & Subdebt Ratio Tang. Net Worth Ratio Gearing Fixed Assets Coverage EBITDA / Interest Exp. Net Sen. Debt / Free CF Net Sen. Debt / EBITDA FFO / Total Debt Operating Cash Flow Operating CF Margin CAPEX New Borrowings (net) New Equity & Sub. (net) Free Cash Flow LIQUIDITY RATIOS Current Ratio Quick Ratio OTHER RATIOS Return on Equity Hypothetical Interest Rate Sales Growth Ratio EBITDA Growth Ratio NFA/GFA Intragroup exposure

anIS01/avA42 365/(anIS01/av(A05+A07+AI07)) 365/(anIS11/avA20)

365/((anIS11,16,18/av(L5-6+27+23-24))

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

1.38 x 40 days 26 days 76 days 66 days -10 days 140.52 19.59

0.70 x 86 days 70 days 178 days 156 days -22 days 142.26 18.89 13.1%

R02+R03 R05-R04 anIS01/AI03 or AI04 anIS16 or anAI02 / AI03 or AI04

09 10 11 12 13 14 15 16 17

EQ17/A42 (EQ17+SD03)/A42 (EQ17-A35)/(A42-A35) [(L04+L22)-A01-A02]/EQ17 (EQ17+L33+SD03)/(A41+A21) IS21/IS30 (L04+L22-A01-A02)/anR23 (L04+L22-A01-A02)/anIS21

#DIV/0!

#DIV/0!

13.1%

#DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0!

-0.12 x 0.24 x 4.6 x 0.0 x -0.40 x 917.7% 176,601

-0.18 x 0.26 x 3.7 x -1.6 x -0.17 x 2726.9% 23,420 11.0% -88 4,248 0.4 x 0.3 x 8.8% 1005.3% 1.3% 267.2% #DIV/0!

see below/(L04+L22+SD03+AI16)

CASH FLOW INFORMATION

18 19 20 21 22 23 Net Operating CF Net Operating CF/IS10 CFA03 Change in LT + ST debt CF from Equity & Subdebt Act. see below

#DIV/0!

83.8% 1,147 167,870

24 25

(A22-A12-A21)/L16 (A04+A11-A12)/L16

#DIV/0! #DIV/0! #DIV/0! #DIV/0!

#DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! N/A

0.3 x 0.2 x -71.5% 203.8% #DIV/0! #DIV/0! #DIV/0! N/A

26 27 28 29 30 31

anIS58/avEQ17 anIS30/(L04+L22+SD03) (IS01-IS01py)/IS01py (IS21-IS21py)/IS21py (A41/CFA01)

an = annualized, av = average, py = prev. year, * = IS method changed, Free Cash Flow = anIS35+anIS22 (or anAI01) -CFA03+anIS56 +/- CIE04 +/- WC changes, FFO = Funds From Operations = an(IS35+IS56+IS22 or AI01)

Ratios

Confidential

Page 6

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- NBA 1946-2009 Part 2Dokument1.495 SeitenNBA 1946-2009 Part 2Blazen MinicNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Small Countries Government Model HC Le LP em TX Im M LC P QDokument13 SeitenSmall Countries Government Model HC Le LP em TX Im M LC P QBlazen MinicNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- INdexation Calculation For O&MDokument2 SeitenINdexation Calculation For O&MBlazen MinicNoch keine Bewertungen

- Impact of Ifrs Power and UtilitiesDokument36 SeitenImpact of Ifrs Power and UtilitiesBlazen MinicNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- IPRDokument25 SeitenIPRsimranNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- An Assignment: Case Study of Dell Inc.-Push or Pull?Dokument3 SeitenAn Assignment: Case Study of Dell Inc.-Push or Pull?Shahbaz NaserNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- GeM BidDokument7 SeitenGeM BidVipul MishraNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- B2011 Guidebook 2 PDFDokument175 SeitenB2011 Guidebook 2 PDFRkakie KlaimNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Victoria Girls' High School Grade 8 EMS Accounting Source Documents Term 2 Assignment Total: 40 MarksDokument3 SeitenVictoria Girls' High School Grade 8 EMS Accounting Source Documents Term 2 Assignment Total: 40 Marksmongiwethu ndhlovuNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Pso Summer Internship ReportDokument19 SeitenPso Summer Internship ReportMaria Masood100% (3)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Press Release: पेट्रोलियम एवं प्राकृलिक गैस लवलियामक बोर्ड Petroleum and Natural Gas Regulatory BoardDokument3 SeitenPress Release: पेट्रोलियम एवं प्राकृलिक गैस लवलियामक बोर्ड Petroleum and Natural Gas Regulatory BoardSWPL HYBRIDNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Progress Test 3Dokument7 SeitenProgress Test 3myriamdzNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Types of Population PyramidDokument4 SeitenTypes of Population PyramidEleonor Morales50% (2)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Mawb LR 749-30816310Dokument1 SeiteMawb LR 749-30816310Hemant PrakashNoch keine Bewertungen

- Decision Making Case AnalysisDokument52 SeitenDecision Making Case AnalysisNikhil ThaparNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Interest Bond CalculatorDokument6 SeitenInterest Bond CalculatorfdfsfsdfjhgjghNoch keine Bewertungen

- BBA V Indian Financial Systems PDFDokument16 SeitenBBA V Indian Financial Systems PDFAbhishek RajNoch keine Bewertungen

- Chapter 2 ReviseDokument4 SeitenChapter 2 ReviseFroy Joe Laroga Barrera IINoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Signed Off Entrepreneurship12q1 Mod2 Recognize A Potential Market v3Dokument23 SeitenSigned Off Entrepreneurship12q1 Mod2 Recognize A Potential Market v3Marrian Alamag50% (2)

- Ice Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalDokument13 SeitenIce Fili Analysis: Presented by Group11-Anuraj Antil Ishan Malik Kanishka Singh Sunny Malik Surya DeswalKanishka SinghNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Red Zuma ProjectDokument6 SeitenRed Zuma Projectazamat13% (8)

- Strama Quiz 8Dokument2 SeitenStrama Quiz 8Yi ZaraNoch keine Bewertungen

- 爭議帳款聲明書Dokument2 Seiten爭議帳款聲明書雞腿Noch keine Bewertungen

- 5th Ed Chapter 01Dokument24 Seiten5th Ed Chapter 01Hữu NghĩaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Eo - 359-1989 PS-DBMDokument3 SeitenEo - 359-1989 PS-DBMKing Gerazol GentuyaNoch keine Bewertungen

- MBA Class of 2019: Full-Time Employment StatisticsDokument4 SeitenMBA Class of 2019: Full-Time Employment StatisticsakshatmalhotraNoch keine Bewertungen

- R2003D10581013 Assignment 2 - Finance & Strategic ManagementDokument14 SeitenR2003D10581013 Assignment 2 - Finance & Strategic ManagementMandy Nyaradzo Mangoma0% (1)

- Week 10-11-Tutorial Questions Answers - RevisedDokument5 SeitenWeek 10-11-Tutorial Questions Answers - RevisedDivya chandNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- BCOM (Hons) - Sem - II-IV-VI-08-03-2022Dokument2 SeitenBCOM (Hons) - Sem - II-IV-VI-08-03-2022anshul yadavNoch keine Bewertungen

- 2009 Tao TourismSustainableLivelihoodStrategyDokument9 Seiten2009 Tao TourismSustainableLivelihoodStrategydiego rinconNoch keine Bewertungen

- Project On Ibrahim Fibers LTDDokument53 SeitenProject On Ibrahim Fibers LTDumarfaro100% (1)

- AU Small Finance Bank - Research InsightDokument6 SeitenAU Small Finance Bank - Research InsightDickson KulluNoch keine Bewertungen

- HRMS Project Plan FinalDokument17 SeitenHRMS Project Plan FinalSaravana Kumar Papanaidu100% (2)

- University of National and World EconomyDokument11 SeitenUniversity of National and World EconomyIva YarmovaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)