Beruflich Dokumente

Kultur Dokumente

Lecture11 Nonlinear

Hochgeladen von

kukurusoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lecture11 Nonlinear

Hochgeladen von

kukurusoCopyright:

Verfügbare Formate

Econ 3720, Introduction to Regression Analysis

Professor Ariell Reshef

University of Virginia

Lecture 11 Non-Linear Models

1

In this lecture we will see how you can transform non-linear models into linear ones, so that we can estimate

them using OLS. All the assumptions that are required for OLS to be unbiased, BLUE and consistent will

have to hold in the transformed model. However, you do need to pay more attention to the interpretation

of the coecients.

Please review the Chapter 8 in Stock and Watson for more non-linear models and interpretations, and

some illuminating examples.

1 Polynomials

These are models of the type

1

I

= ,

0

+,

1

A

I

+,

2

A

2

I

+... +,

|

A

|

I

+-

I

.

Estimating this kind of model requires transforming it into a linear model. You must generate new variables

A

2I

= A

2

I

A

3I

= A

3

I

.

.

.

A

|I

= A

|

I

and estimate

1

I

= ,

0

+,

1

A

I

+,

2

A

2I

+... +,

|

A

|I

+-

I

,

which is just a multiple linear regression model.

When evaluating the eect of changing A

I

you must remember that the eect is

01

I

0A

I

= ,

1

+ 2 ,

2

A

I

+... +/ ,

|

A

|1

I

,

so you need to decide at which value of A

I

to evaluate the derivative. In other words, your statements on

the marginal eect of A

I

on 1

I

will depend on the value of A

I

around which you are making changes.

1

See also Chapter 8 in Stock and Watson.

1

Example: returns to experience. Many economic outcomes exhibit diminishing returns with respect

to some factor. It turns out that the relationship between wages and experience (or age) exhibit

diminishing returns that are well captured by a hyperbola

\

I

= ,

0

+,

1

A

I

+,

2

A

2

I

+-

I

,

where \

I

is wages and A

I

is experience.

2

So you would expect ,

1

to be positive and ,

2

to be negative.

Estimating this model requires computing A

2I

= A

2

I

and estimating

\

I

= ,

0

+,

1

A

I

+,

2

A

2I

+-

I

.

Just remember that the eect of one more year of experience is not ,

1

but changes with experience:

,

1

+ 2 ,

2

A

I

.

2 The log-log model

Suppose that you want to estimate a Cobb-Douglas production function:

1 = 1

o

1o

.

This is a non linear model, but by taking logs on both sides you get

ln(1 ) = ln() +cln(1) + (1 c) ln() ,

which is linear in the log variables. Estimating this model requires transforming it into a linear model. You

must generate new variables

j = ln(1 )

/ = ln(1)

: = ln()

and estimate

j

I

= ,

0

+,

1

/

I

+,

2

:

I

+-

I

,

which is just a multiple linear regression model. In this case, ,

0

= ln(), ,

1

= c and ,

2

= 1 c.

Notice that in this way you can test whether some production function exhibits constant returns to scale by

H

0

: ,

1

+,

2

= 1.

If we want to estimate the parameters of the model without bias and in a consistent way using OLS,

then we require that 1 (-

I

j/

I

, :

I

) = 0. This means that in the original Cobb-Douglas production function

2

In the data this relationship does not hold well in levels, but if you replace W

i

with ln (W

i

), then the relationship is very

tight. In one of the following subsections you will see how to tackle such a model.

2

1 = 1

o

1o

, there is actually an additional multiplicative term c

:i

such that 1 = 1

o

1o

c

:

. It is

useful to think about what might justify this additional term. Usually it is assumed to be a technological

shock. It is also important to notice that given 1 (-

I

j/

I

, :

I

) = 0, 1 (c

:

j1, ) is not c

0

= 1. The reason is that

a zero mean error inside a convex function (the exponential) has a level eect. If - is normally distributed

around zero, i.e. -

0, o

2

:

, then 1 (c

:

j1, ) = c

1

2

c

2

"

1.

The interpretation of the coecients in the log-log model is that of elasticities. After all, the elasticity

of 1 with respect to 1 is dened as

j

,|

=

01

01

1

1

=

d ln(1 )

d ln(1)

ln(1 )

ln(1)

.

Remember: log dierences are approximately percent changes

ln(1 ) = ln(1

2

) ln(1

1

)

1

2

1

1

1

1

=

1

1

.

So in our Cobb-Douglas model increasing 1 by 1 percent will increase 1 by ,

1

percent.

3 Half-log models

These are models of the type

1

I

= c

o

0

+o

1

i+:i

.

This is a non linear model, but by taking logs on both sides you get

ln(1

I

) = ,

0

+,

1

A

I

+-

I

. (1)

As with the log-log models, you need to create the log variables from the original ones, j = ln(1 ), and

estimate

j

I

= ,

0

+,

1

A

I

+-

I

The interpretation of the coecients again depends on the point at which the marginal eects are eval-

uated. The eect of A on 1 in 1 is a "half elasticity":

,

1

=

0 ln(1 )

0A

ln(1 )

A

.

This means that a change in one unit of A will result in a change of ,

1

percent in 1 . But the level eect is

going to be

01

0A

= ,

1

c

o

0

+o

1

i

,

which depends on A. I conveniently assumed that -

I

= 0. In practice, you will need to assume something

about what is -

I

, but let us not get into this right now.

When making expectations about levels we must take into account the fact that the zero mean error has

non-zero eects on the level of the left hand side variable, in a similar way to what we saw above in the

log-log model.

3

Example: The Mincer model of human capital accumulation and wages. This model gives rise to a

wage equation that is half log:

\

I

= c

o

0

+o

1

i+o

2

2

i

+o

3

Si+:i

,

where \

I

are wages, A

I

is experience and o

I

is years of schooling (what labor economists call "invest-

ment in human capital"). Taking logs we obtain

ln\

I

= ,

0

+,

1

A

I

+,

2

A

2

I

+,

3

o

I

+-

I

.

This model combines both the half log and polynomial.

Another form of half-log models is

1

I

= ,

0

+,

1

ln(A

I

) +-

I

. (2)

You need to create the log variables from the original ones, r = ln(A), and estimate

1

I

= ,

0

+,

1

r

I

+-

I

.

The interpretation of ,

1

depends on the point at which the marginal eect are evaluated. The eect of

A on 1 is

,

1

=

01

0 ln(A)

1

ln(A)

.

This means that a change of 1 percent of A will result in a change in ,

1

units of 1 . But the level eect is

going to be

d1

dA

= ,

1

1

A

.

4 Models with dummy variables and interactions

Models with dummy variables and interactions are also non-linear models. See Lecture 12.

4

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- PDF To Image Converter v2 HOW TO USEDokument3 SeitenPDF To Image Converter v2 HOW TO USEfairfaxcyclesNoch keine Bewertungen

- Oracle Database 11g Transparent Data EncryptionDokument40 SeitenOracle Database 11g Transparent Data EncryptionYelena BytenskayaNoch keine Bewertungen

- Midterm rp - Nguyễn Phú Minh Nhật - 20202795Dokument1 SeiteMidterm rp - Nguyễn Phú Minh Nhật - 20202795Minh Nhật100% (1)

- WDM Bi553Dokument138 SeitenWDM Bi553florea_madfoxNoch keine Bewertungen

- Arthashastra: Citation NeededDokument4 SeitenArthashastra: Citation NeededtusharNoch keine Bewertungen

- Diagnosis and Testing: Four Wheel Drive (4WD) Systems - Electronic ShiftDokument38 SeitenDiagnosis and Testing: Four Wheel Drive (4WD) Systems - Electronic ShiftLojan Coronel José Humberto100% (1)

- Minihydro GANZ enDokument5 SeitenMinihydro GANZ enRade NovakovicNoch keine Bewertungen

- Technical Support Engineer - Home AssignmentDokument5 SeitenTechnical Support Engineer - Home AssignmentRahul KohliNoch keine Bewertungen

- What Is A Stress Intensification FactorDokument7 SeitenWhat Is A Stress Intensification FactorMahendra RathoreNoch keine Bewertungen

- E-Studio 205L, 255, 305, 355, 455 MFP Service HandbookDokument732 SeitenE-Studio 205L, 255, 305, 355, 455 MFP Service HandbookAnonymous gn8qxx66% (35)

- Metron 05 CR DataDokument10 SeitenMetron 05 CR DatamkgohNoch keine Bewertungen

- Modern Age Waste Water ProblemsDokument364 SeitenModern Age Waste Water Problemsromaehab201912Noch keine Bewertungen

- Seborg Chapter 1Dokument3 SeitenSeborg Chapter 1maykesguerraNoch keine Bewertungen

- CS 161 (Stanford, Winter 2024)Dokument2 SeitenCS 161 (Stanford, Winter 2024)Catriel LopezNoch keine Bewertungen

- 3 Statement Model: Strictly ConfidentialDokument13 Seiten3 Statement Model: Strictly ConfidentialLalit mohan PradhanNoch keine Bewertungen

- Unit 1Dokument29 SeitenUnit 1Biswajit MishraNoch keine Bewertungen

- Beration of LightDokument7 SeitenBeration of LightAnonymous i71HvPXNoch keine Bewertungen

- LAB 7 - Getting Started With Google BigQueryDokument10 SeitenLAB 7 - Getting Started With Google BigQueryRama VNoch keine Bewertungen

- 5510 0004 04 - 18 1021 Basic Principles of Ship Propulsion - MAN PDFDokument68 Seiten5510 0004 04 - 18 1021 Basic Principles of Ship Propulsion - MAN PDFAlex FatecNoch keine Bewertungen

- FELPRO - Tablas-de-Torque - 035Dokument1 SeiteFELPRO - Tablas-de-Torque - 035Clodoaldo BiassioNoch keine Bewertungen

- 808D ADV Commiss Man 1218 en-USDokument480 Seiten808D ADV Commiss Man 1218 en-USBaldev SinghNoch keine Bewertungen

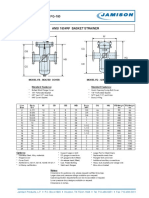

- FB-150 FQ-150 Basket StrainerDokument1 SeiteFB-150 FQ-150 Basket Strainerklich77Noch keine Bewertungen

- Back To Basics in Optical Communications TechnologyDokument178 SeitenBack To Basics in Optical Communications TechnologyAyanNoch keine Bewertungen

- API-650 Design Procedure ExampleDokument21 SeitenAPI-650 Design Procedure Examplegdwvcd93% (14)

- Grade 9 Cells and Cell Movements Formative WorksheetDokument8 SeitenGrade 9 Cells and Cell Movements Formative WorksheetHari PatelNoch keine Bewertungen

- Valve & Amplifier Design, Valve EquivalentsDokument51 SeitenValve & Amplifier Design, Valve EquivalentsValve Data80% (5)

- Buenos Aires, Argentina Sabe/Aep Rnpzrwy31: JeppesenDokument1 SeiteBuenos Aires, Argentina Sabe/Aep Rnpzrwy31: Jeppesenfrancisco buschiazzoNoch keine Bewertungen

- DefaultDokument49 SeitenDefaultmaruka33100% (1)

- Mole Concept - L1rr PDFDokument27 SeitenMole Concept - L1rr PDFLegend KillerNoch keine Bewertungen

- The Relationship Between Emotional Maturity and Psychosocial Adjustment Among First-Year Undergraduate Students in Amhara Region Public Universities, EthiopiaDokument11 SeitenThe Relationship Between Emotional Maturity and Psychosocial Adjustment Among First-Year Undergraduate Students in Amhara Region Public Universities, EthiopiaYared FentawNoch keine Bewertungen