Beruflich Dokumente

Kultur Dokumente

Francisco Rodriguez Vs Francisco Martinez: For Agent

Hochgeladen von

Ashley CandiceOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Francisco Rodriguez Vs Francisco Martinez: For Agent

Hochgeladen von

Ashley CandiceCopyright:

Verfügbare Formate

NIL 1).

FRANCISCO RODRIGUEZ vs FRANCISCO MARTINEZ FACTS: The judgment of the court below contains the following finding of facts: "The evidence introduced at the trial shows that the defendant executed his promissory note on the !th of "ctober# $%&# for the sum of '#%%% pesos# (exican currency# payable to one Felipe C) (ontalvo* that the said (ontalvo# for value received# sold and transferred the said promissory note to the plaintiff before maturity* that the said plaintiff received the same without notice of any conditions existing against the note* that the plaintiff# before buying the note# went to the defendant and as+ed him in respect thereto# and was informed by him that the note was good and that he would pay the same at a discount* and that the note was delivered by the defendant to the said (ontalvo in payment of a gambling debt which the defendant owed (ontalvo)

?@107A: Bes) A ban+ is bound to +now the signatures of its customers* and if it pays a forged chec+# it must be considered as ma+ing the payment out of its own funds# and cannot ordinarily charge the amount so paid to the account of the depositor whose name was forged) The signatures to the chec+ being forged# under section &C of the 7egotiable 0nstruments 1aw they are not a charge against plaintiff nor are the chec+s of any value to the defendant) 0t must therefore be held that the proximate cause of loss was due to the negligence of the 8an+ of the 9hilippine 0slands in honoring and cashing the two forged chec+s) "#$ Gr%a& Eas&%rn 'i(% Ins)ran*% Co vs$ +ongkong and Shanghai Banking Cor,$ Facts: The plaintiff is an insurance corporation# and the defendants are ban+ing corporations# and each is duly licensed to do its respective business in the 9hilippines 0slands(ay C# $&%# the plaintiff drew its chec+ for 9&#%%% on the .ong+ong and Shanghai 8an+ing Corporation with whom it had an account# payable to the order of 1aDaro (elicor) >) () (aasim fraudulently obtained possession of the chec+# forged (elicor;s signature# as an endorser# and then personally endorsed and presented it to the 9hilippine 7ational 8an+ where the amount of the chec+ was placed to his credit) After having paid the chec+# and on the next day# the 9hilippine national 8an+ endorsed the chec+ to the .ong+ong and Shanghai 8an+ing Corporation which paid it and charged the amount of the chec+ to the account of the plaintiff) About four months after the chec+ was charged to the account of the plaintiff# it developed that 1aDaro (elicor# to whom the chec+ was made payable# had never received it# and that his signature# as an endorser# was forged by (aasim# who presented and deposited it to his private account in the 9hilippine 7ational 8an+) /ith this +nowledge # the plaintiff promptly made a demand upon the .ong+ong and Shanghai 8an+ing Corporation that it should be given credit for the amount of the forged chec+# which the ban+ refused to do# and the plaintiff commenced this action to recover the 9&#%%% which was paid on the forged chec+) The Shanghai 8an+ denies any liability# but prays that# if a judgment should be rendered against it# in turn# it should have li+e judgment against the 9hilippine 7ational 8an+ which denies all liability to either party) ?uling: The legal presumption is that the drawee ban+ would not honor the chec+ without the genuine indorsement of the payee) The drawee ban+ had no legal right to pay except as to the drawer or to its order The collecting ban+ also had no license or authority to pay money to forger or to anyone upon a forged indorsement) 0t was its legal duty to +now that the indorsement was genuine before cashing the chec+) E/here a chec+ is drawn payable to the order of one person and is presented to a ban+ by another and purports upon its face to have been duly indorsed by the payee of the chec+ # it is the duty of the ban+ to +now that the chec+ was duly indorsed by the original payee and where the ban+ pays the amount of the chec+ to a Crd person # who has forged the signature of the payee # the loss falls upon the ban+ who cashed the chec+ # and its remedy is against the person to whom it paid the money)F -#$ PNB vs GOZON Facts: 0n 5une $!C# Francisco AoDon 00 went to the 9hilippine 7ational 8an+ 2Caloocan City3 accompanied by his friend >rnesto Santos) AoDon left Santos in his car and while AoDon was at the ban+# Santos too+ a chec+ from AoDonGs chec+boo+ and forged AoDonGs signature# filling out the chec+ with the amount of 9H#%%%)%%) Santos was able to encash the chec+ that day with 978) AoDon learned of this when his statement arrived) Santos eventually admitted to forging AoDonGs signature) AoDon then demanded the 978 to refund him the amount) 978 refused) The CF0 ruled in favor of AoDon) 978 appealed on certiorari) 0SS@>: /hether or not 978 is liable) .>14: Bes) A ban+ is bound to +now the signatures of its customers) The prime duty of a ban+ is to ascertain the genuineness of the signature of the drawer or the depositor on the chec+ being encashed) 0t is expected to use reasonable business prudence in accepting and cashing a chec+ presented to it) 0f it pays a forged chec+# it must be considered as ma+ing the payment out of its own funds# and cannot ordinarily change the amount so paid to the account of the depositor whose name was forged) 978 failed to meet its obligation to +now the signature of its correspondent 2AoDon3) 9etitioner was negligent in encashing said forged chec+ without carefully examining the signature which shows mar+ed variation from the genuine signature of private respondent) EThe act of plaintiff in leaving his chec+boo+ in the car while he went out for a short while cannot be considered negligence sufficient to excuse the defendant ban+ from its own negligence) 0t should be borne in mind that when defendant left his car# >rnesto Santos# a long time classmate and friend remained in the same) 4efendant could not have been expected to +now that the said >rnesto Santos would remove a chec+ from his chec+boo+) 4efendant had trust in his classmate and friend) .e had no reason to suspect that the latter would breach that trust)F

1.

Considering that the note had an unlawful origin# can petitioner enforce the same against the ma+er, According to the facts set out in the judgment of the court below# the plaintiff ac-uired the ownership of the note in -uestion by virtue of its indorsement# he having paid the value thereof to its former holder) .e did so without being aware of the fact that the note had an unlawful origin# since he as not given notice# as the court found# of any conditions existing against the note) Furthermore# he accepted it in good faith# believing the note was valid and absolutely good# and that the defendant would not repudiate it for the reason that he# the defendant# had assured him before the purchase of the note that the same was good and that he would pay it at a discount) /ithout such assurance from the defendant we can hardly believe that the plaintiff would have bought the note) 0t is thus inferred from the fact that he# the plaintiff# in-uired from the defendant about the nature of the note before accepting its indorsement) These facts sufficiently show that the plaintiff bought the note upon the statement of the defendant that the same had no legal defect and that he was thereby induced to buy the same by the personal act of said defendant) 0n view of this# we are of the opinion that the defendant can not be relieved from the obligation of paying the plaintiff the amount of the note alleged to have been executed for an unlawful consideration) 0f such unlawful consideration did in fact exist# the defendant deliberately and maliciously concealed it from the plaintiff)

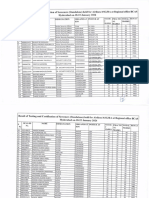

2). San Carlos Milling vs BPI and China Bank 5 Phil 5 FACTS: San Carlos (illing Co) 1td) 2San Carlos3 was in the hands of Alfred 4) Cooper# its agent under general power of attorney with authority of substitution) The principal employee in the (anila office was 5oseph 1) /ilson# to whom had been given a general power of attorney but without power of substitution) 0n $&6# Cooper# desiring to go on vacation# gave a general power of attorney to 7ewland 8aldwin and at the same time revo+ed the power of /ilson relative to the dealings with 890) About a year thereafter /ilson# conspiring together with one Alfredo 4olores# a messenger:cler+ in plaintiff;s (anila office# sent a cable gram in code to the company in .onolulu re-uesting a telegraphic transfer to the China 8an+ing Corporation of (anila of < %%#%%%) The money was transferred by cable# and upon its receipt the China 8an+ing Corporation# li+ewise a ban+ in which plaintiff maintained a deposit# sent an exchange contract to plaintiff corporation offering the sum of 9&% #%%%# which was then the current rate of exchange) "n this contract was forged the name of 7ewland 8aldwin) September 28, 1927: A manager's check on the China Banking Corporation for P2 1! pa"ab#e to San Car#os $i##ing Compan" or order was receipted for by 4olores) "n the same date# September &=# $&!# the manger;s chec+ was deposited with the 8an+ of the 9hilippine 0slands by the following endorsement: For deposit only with 8an+ of the 9hilippine 0slands# to credit of account of San Carlos (illing Co)# 1td) 8y 2Sgd)3 7>/1A74 8A14/07 For Agent The endorsement to which the name of 7ewland 8aldwin was affixed was spurious) 8efore delivering the money# the ban+ as+ed 4olores for 9 to cover the cost of pac+ing the money# and he left the ban+ and shortly afterwards returned with another chec+ for 9 # purporting to be signed by 7ewland 8aldwin) /hereupon the money was turned over to 4olores# who too+ it to plaintiff;s office# where he turned the money over to /ilson and received as his share# 9 %#%%%) Shortly thereafter the crime was discovered# and upon the defendant ban+ refusing to credit plaintiff with the amount withdrawn by the two forged chec+s of 9&%%#%%% and 9 # suit was brought against the 8an+ of the 9hilippine 0slands# and finally on the suggestion of the defendant ban+# an amended complaint was filed by plaintiff against both the 8an+ of the 9hilippine 0slands and the China 8an+ing Corporation) 2to ma+e it short# nag forge ang duha: si /ilson ug si 4olores3 ISSUE! /"7 890 was bound to inspect the chec+s and shall therefore be liable in case of forgery)

5#$ +ong .ong / Shanghai Banking Cor,$ vs P%o,l%s Bank / Tr)s& Co0,an1 Facts: The 9hilippine 1ong 4istance Telephone Company 2914T3 drew the chec+ on the .ong+ong I Shanghai 8an+ing Corporation 2.S8C3 and in favor of the same ban+ in the sum of 9 '#6%=)%H) This chec+ was sent by mail to the 9ayee) Somehow or other# the chec+ fell in the hands of a certain Florentino Changco# who was able to erase the name of the payee 8an+ and instead typed his own name on the chec+) Changco had opened a current account with 4efendant 9eoples 8an+ and Trust Company and deposited the altered chec+ in his name) This chec+ was presented by the 9eoples 8an+ for clearing and was duly cleared by the .S8C) As a result# the 9eoples 8an+ credited Changco with the amount of the chec+) Changco began to withdraw from his account until he closed it) 0n the meantime# the cancelled chec+ was returned to the 914T when the alteration in the name of the payee was discovered) 9eoples 8an+ was notified of the alteration and the .S8C re-uested 9eoples 8an+ to refund to it the sum of 9 '#6%=)%H which had been previously credited by 9laintiff 8an+ in favor of 4efendant 8an+) The 9eoples 8an+ refused to refund such amount) 0ssue: /"7 the 9eoples 8an+ is liable for a refund to the .S8C) .eld: 7") The "&':hour" clearing house rules apply# which states that# "All items cleared at :%% o;cloc+ a)m) shall be returned not later than &:%% o;cloc+ p)m) on the same day and all items cleared at C:%% o;cloc+ p)m) shall be returned not later than =:C% a)m) of the following business day# except for items cleared on Saturday which may be returned not later than =:C% of the following day)" Thus: "0t is a settled rule that a person who presents for payment chec+s such as are here involved guarantees the genuineness of the chec+# and the drawee ban+ need concern itself with nothing but the genuineness of the signature# and the state of the account with it of the drawee)" 20nterstate Trust Co) v) @nited States 7ational 8an+# =H 9ac) &6%# $ $3) 0t at all# then# whatever remedy the plaintiff has would lie not against defendant 8an+ but as against the party responsible for changing the name of the payee) 0ts failure to call the attention of defendant 8an+ as to such alteration until after the lapse of &! days would# in the light of the above Central 8an+ circular# negate whatever right it might have had against defendant 8an+) 2#$ R%,)3li* vs E4)i&a3l% Banking Cor,ora&ion Facts: The ?epublic of the 9hilippines see+s to recover from the >-uitable 8an+ing Corporation the sum of 9 !# %%# representing the aggregate value of four 2'3 treasury warrants and from the 8an+ of the 9hilippine 0slands the total sum of 9C'&#!6!)6C# representing the aggregate value of twenty:four 2&'3 warrants) 8oth transactions were paid to said ban+s by the Treasurer of the 9hilippines thru the Clearing "ffice of the Central 8an+ of the 9hilippines) These claims for refund are based upon a common ground that the signature thereon of the drawing office and that of the representative of the Auditor Aeneral in that office are forged) The Corporacion de los 9adres 4ominicos had ac-uired the twenty:four 2&'3 treasury warrants by accommodating its former trusted employee who as+ed the Corporacion to cash the warrants# alleging that it was difficult to do so directly with the Aovernment and that his wife expected a sort of commission for the encashment) The Corporacion acceded to CarranDa;s re-uest# provided that the warrants would first be accepted and cleared by the Treasurer and the proceeds thereof duly credited to the account of the Corporacion in the 890) The warrants were# accordingly# deposited by the Corporacion with said ban+# which accepted them "subject to collection only") Subse-uently# the 890 presented the warrants for payment to the Clearing "ffice of the Central 8an+ and after being cleared# the warrants were paid by the Treasurer) 1ater on# at different dates# the twenty:four 2&'3 warrants were returned to the Central 8an+ by the Treasurer on the ground of forgery) The Central 8an+ referred the warrants to the 890 and as+ed for the reimbursement of the amount but the latter opposed its return) The same situation happened to the four 2'3 warrants that were deposited in the >-uitable 8an+) 0ssue: /"7 the two ban+s are liable for reimbursement to the government) .eld: 7") The twenty:eight 2&=3 warrants were cleared and paid by the Treasurer# in view which the 890 and the >-uitable 8an+ credited the corresponding amounts to the respective depositors of the warrants and then honored their chec+s for said amounts) Thus# the Treasury had not only been negligent in clearing its own warrants# but had# also# thereby induced the 890 and the >-uitable 8an+ to pay the amounts thereof to said depositors) The gross nature of the negligence of the Treasury becomes more apparent when we consider that each one of the twenty:four 2&'3 warrants was for over 9H#%%%# and# hence* beyond the authority of the auditor of the Treasury J whose signature thereon had been forged J to approve) 0n other words# the irregularity of said warrants was apparent the face thereof# from the viewpoint of the Treasury) (oreover# the same had not advertised the loss of genuine forms of its warrants) 7either had the 890

nor the >-uitable 8an+ been informed of any irregularity in connection with any of the warrants involved in these two 2&3 cases or after the warrants had been cleared and honored J when the Treasury gave notice of the forgeries adverted to above) As a conse-uence# the loss of the amounts thereof is mainly imputable to acts and omissions of the Treasury# for which the 890 and the >-uitable 8an+ should not and cannot be penaliDed) 5#$ PNB vs$ CA FACTS: "ne Augusto 1im deposited in his current account with 9C0 8an+ 29adre Faura 8ranch3 a AS0S chec+ drawn against 978) The signatures of the Aeneral (anager and Auditor of AS0S were forged) 9C08an+ stamped at the bac+ of the chec+ EAll prior indorsements or lac+ of indorsements guaranteed# 9C0 8an+)F 9C08an+ sent the chec+ to 978 through the Central 8an+) 978 did not return the chec+ to 9C08an+* and thus 9C08an+ credited 1imGs account) As AS0S has informed 978 that the chec+ was lost two months before said transaction# its account was recredited by 978 upon its demand 2due to the forged chec+3) 978 re-uested for refund with 9C0 8an+) The latter refused) 0SS@>: /ho shall bear the loss resulting from the forged chec+) .>14: The collecting ban+ is not liable as the forgery existing are those of the drawersG and not of the indorsersG) The indorsement of the intermediate ban+ does not guarantee the signature of the drawer) 978Gs failure to return the chec+ to the collecting ban+ implied that the chec+ was good) 0n fact# 978 even honored the chec+ even if AS0S has reported two months earlier that the chec+ was stolen and the ban+ thus should stop payment) 978Gs negligence was the main and proximate cause for the corresponding loss) 978 thus should bear such loss) @pon payment by 978# as drawee# the chec+ ceased to be a negotiable instrument# and became a mere voucher or proof of payment) 6#$ 7ai8Alai Cor,ora&ion v$ BPI Facts: 9etitioner deposited in its current account with respondent ban+ several chec+s# all ac-uired from Antonio 5) ?amireD# a regular bettor at the jai:alai games and a sale agent of the 0nter:0sland Aas Service# 0nc)# the payee of the chec+s) The deposits were all temporarily credited to petitioner;s account) Subse-uently# ?amireD resigned and after the chec+s had been submitted to inter:ban+ clearing# the 0nter:0sland Aas discovered that all the indorsements made on the chee+s were forgeries) 0t informed petitioner# the respondent# the drawers and the drawee ban+s of the said chec+s and forgeries and filed a criminal complaint against its former employee) 0n view of these circumstances# the respondent 8an+ debited the petitioner;s current account and forwarded to the latter the chec+s containing the forged indorsements# which petitioner refused to accept) 1ater# petitioner drew against its current account a chec+) This chec+ was dishonored by respondent as its records showed that petitioner;s balance after netting out the value of the chec+s with the forged indorsement# was insufficient to cover the value of the chec+ drawn) A complaint was filed by petitioner in the CF0 but the same was dismissed# as well as by the Court of Appeals# on appeal) .ence# this petition for review) 0ssue: /hether or not the respondent had the right to debit the petitioner;s current account and therefore cannot be held liable for damages, ?uling: Bes# respondent acted within legal bounds when it debited the petitioner;s account) Since under Section &C of the 701# a forged signature in a negotiable instrument is wholly inoperative and no right to discharge it or enforce its payment can be ac-uired through or under the forged signature except against a party who cannot invo+e the forgery# it stands to reason# that the respondent# as a collecting ban+ which indorsed the chec+s to the drawee:ban+s for clearing# should be liable to the latter for reimbursement# for# as found by the court a -uo and by the appellate court# the indorsements on the chec+s had been forged prior to their delivery to the petitioner) 0n legal contemplation# therefore# the payments made by the drawee:ban+s to the respondent on account of the said chec+s were ineffective* and# such being the case# the relationship of creditor and debtor between the petitioner and the respondent had not been validly effected# the chec+s not having been properly and legitimately converted into cash)

Das könnte Ihnen auch gefallen

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsVon EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsBewertung: 5 von 5 Sternen5/5 (1)

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemVon EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemBewertung: 4 von 5 Sternen4/5 (16)

- The Crime of EstafaDokument33 SeitenThe Crime of EstafaClint M. MaratasNoch keine Bewertungen

- Facts: Respondent Filed A Complaint For Sum: Indebiti Harks Back To The Ancient PrincipleDokument2 SeitenFacts: Respondent Filed A Complaint For Sum: Indebiti Harks Back To The Ancient PrincipleWnz NaiveNoch keine Bewertungen

- Campos Chap 4Dokument24 SeitenCampos Chap 4Roberts SamNoch keine Bewertungen

- CENAS Vs SantosDokument1 SeiteCENAS Vs SantosJL A H-DimaculanganNoch keine Bewertungen

- Estafa & BP22 PDFDokument11 SeitenEstafa & BP22 PDFJosiah Samuel EspanaNoch keine Bewertungen

- BPI Vs CA Case DigestDokument2 SeitenBPI Vs CA Case DigestMa Geobelyn LopezNoch keine Bewertungen

- Almeda V VillaluzDokument3 SeitenAlmeda V VillaluzjerushabrainerdNoch keine Bewertungen

- C. Drawee: Case PNB V Manila Oil RefiningDokument5 SeitenC. Drawee: Case PNB V Manila Oil RefiningbangkamoonNoch keine Bewertungen

- Special Civil Actions 2000 Edition: Rule 62 InterpleaderDokument3 SeitenSpecial Civil Actions 2000 Edition: Rule 62 InterpleaderbubblingbrookNoch keine Bewertungen

- Ang Tek Lian Vs CA GR No. L-2516Dokument2 SeitenAng Tek Lian Vs CA GR No. L-2516Kram Nuj Onitnelot OgnatNoch keine Bewertungen

- Rico, Lim (Vs. People)Dokument3 SeitenRico, Lim (Vs. People)Arlando G. ArlandoNoch keine Bewertungen

- Narratives: Constitutional Law IIDokument9 SeitenNarratives: Constitutional Law IILen Vicente - FerrerNoch keine Bewertungen

- DigestDokument15 SeitenDigestBreAmberNoch keine Bewertungen

- BP 22 Bouncing Checks LawDokument4 SeitenBP 22 Bouncing Checks LawLe Obm SizzlingNoch keine Bewertungen

- Persons DigestDokument5 SeitenPersons DigestPaulo Miguel GernaleNoch keine Bewertungen

- Nego Q&AsDokument16 SeitenNego Q&AsGerardPeterMarianoNoch keine Bewertungen

- People Vs AbnerDokument5 SeitenPeople Vs AbnerAbigail DeeNoch keine Bewertungen

- (Consti 2 DIGEST) 130 - Caras Vs CADokument7 Seiten(Consti 2 DIGEST) 130 - Caras Vs CACharm Divina LascotaNoch keine Bewertungen

- Banco Espanol Filipino vs. Palanca: FACTS: (Note: Not in Bernas)Dokument3 SeitenBanco Espanol Filipino vs. Palanca: FACTS: (Note: Not in Bernas)JessaMarizNoch keine Bewertungen

- Motion For Demand of Verified Complaint in IllinoisDokument7 SeitenMotion For Demand of Verified Complaint in IllinoisMarc MkKoy100% (7)

- Mortgage Foreclosure RecoupmentDokument28 SeitenMortgage Foreclosure Recoupmentjvo197077% (13)

- Judgment For Mr. Henry Femi Osobu v. Mrs. Aniekeme Adewa FaboroDokument10 SeitenJudgment For Mr. Henry Femi Osobu v. Mrs. Aniekeme Adewa FaboroYetty19Noch keine Bewertungen

- RIVERA, Lyka A. (Assign 4 - Law)Dokument4 SeitenRIVERA, Lyka A. (Assign 4 - Law)Lysss EpssssNoch keine Bewertungen

- IBL Digests 1Dokument23 SeitenIBL Digests 1jbguidoteNoch keine Bewertungen

- Javellana v. D.ODokument2 SeitenJavellana v. D.Oclandestine2684Noch keine Bewertungen

- Prove A Creditor Is in Violation - Automatic Win For $1000Dokument7 SeitenProve A Creditor Is in Violation - Automatic Win For $1000FreedomofMind100% (11)

- Here's The HAMMER You Need To Win A Mortgage DisputeDokument6 SeitenHere's The HAMMER You Need To Win A Mortgage DisputeBob Hurt100% (2)

- Republic of The Philippines Office of The City Prosecutor Bacolod City - OooDokument3 SeitenRepublic of The Philippines Office of The City Prosecutor Bacolod City - OooKevin Patrick Magalona DegayoNoch keine Bewertungen

- Laurel Notes RemedialDokument20 SeitenLaurel Notes RemedialAnne YuchNoch keine Bewertungen

- Nego ReviewerDokument10 SeitenNego ReviewerMissy AnsaldoNoch keine Bewertungen

- Ethics DigestsDokument49 SeitenEthics Digestsaerosmith_julio6627Noch keine Bewertungen

- In Re - Atty. Felizardo M. de GuzmanDokument1 SeiteIn Re - Atty. Felizardo M. de Guzmanmwaike100% (1)

- A.C. No. 11246, June 14, 2016ARNOL D Pacao Atty. Sinamar LimosDokument23 SeitenA.C. No. 11246, June 14, 2016ARNOL D Pacao Atty. Sinamar LimosRabelais MedinaNoch keine Bewertungen

- Filinvest Land Vs CA - EdDokument2 SeitenFilinvest Land Vs CA - Edida_chua8023Noch keine Bewertungen

- Business Law - Negotiable InstrumentsDokument8 SeitenBusiness Law - Negotiable InstrumentsPrincessa Lopez MasangkayNoch keine Bewertungen

- BPI vs. de RenyDokument4 SeitenBPI vs. de RenyArvin Antonio OrtizNoch keine Bewertungen

- Midterms - Case DigestsDokument192 SeitenMidterms - Case DigestskuheDSNoch keine Bewertungen

- Acain v. Iac DigestDokument2 SeitenAcain v. Iac DigestErla ElauriaNoch keine Bewertungen

- Corpuz Vs PP Case DigestDokument6 SeitenCorpuz Vs PP Case DigestRicca ResulaNoch keine Bewertungen

- Execution Pending AppealDokument19 SeitenExecution Pending AppealCielo MarisNoch keine Bewertungen

- Rule 60-PR ReplevinDokument5 SeitenRule 60-PR ReplevinanjisyNoch keine Bewertungen

- Petitioner Vs Vs Respondent Tumangan & Partners The Solicitor GeneralDokument10 SeitenPetitioner Vs Vs Respondent Tumangan & Partners The Solicitor GeneralRobert Jayson UyNoch keine Bewertungen

- RCBC v. de Castro 168 Scra 49Dokument10 SeitenRCBC v. de Castro 168 Scra 49rudyblaze187Noch keine Bewertungen

- Pacific Farms V Esguerra (1969)Dokument3 SeitenPacific Farms V Esguerra (1969)Zan BillonesNoch keine Bewertungen

- Acain vs. IACDokument5 SeitenAcain vs. IACYong NazNoch keine Bewertungen

- Case Digest New 9142022Dokument6 SeitenCase Digest New 9142022Eun Ae YinNoch keine Bewertungen

- Kenya Law-Bills of ExchangeDokument6 SeitenKenya Law-Bills of ExchangeFrancis Njihia KaburuNoch keine Bewertungen

- GALO MONGE, Petitioner, v. PEOPLE OF THE PHILIPPINES, Respondent. Resolution Tinga, J.Dokument4 SeitenGALO MONGE, Petitioner, v. PEOPLE OF THE PHILIPPINES, Respondent. Resolution Tinga, J.Ryan WilliamsNoch keine Bewertungen

- Moreno v. WolffDokument7 SeitenMoreno v. WolffDexter LedesmaNoch keine Bewertungen

- Tan Vs Rodil DigestDokument3 SeitenTan Vs Rodil DigestJennilyn TugelidaNoch keine Bewertungen

- 150534-1951-Abeto v. PeopleDokument3 Seiten150534-1951-Abeto v. PeopleMoira SarmientoNoch keine Bewertungen

- BPI Leasing V Court of Appeals G.R. 127624Dokument5 SeitenBPI Leasing V Court of Appeals G.R. 127624Dino Bernard LapitanNoch keine Bewertungen

- 105 Samson Road, Caloocan City: WWW - Ue.edu - Ph/caloocanDokument8 Seiten105 Samson Road, Caloocan City: WWW - Ue.edu - Ph/caloocanjanus lopezNoch keine Bewertungen

- Nego Digests 1Dokument5 SeitenNego Digests 1Bryan MagnayeNoch keine Bewertungen

- Ceniza vs. RubiaDokument6 SeitenCeniza vs. RubiaPaulo Miguel GernaleNoch keine Bewertungen

- Written Statement in O.S.105-2013-Duddu KotaiahDokument5 SeitenWritten Statement in O.S.105-2013-Duddu KotaiahVemula Venkata PavankumarNoch keine Bewertungen

- Negotiable Instruments Law (Nil) : I. General Concepts Negotiable Instrument (Ni)Dokument22 SeitenNegotiable Instruments Law (Nil) : I. General Concepts Negotiable Instrument (Ni)Aries BautistaNoch keine Bewertungen

- Vysick V Commissioner of Police (1971) 17 WIR 391Dokument12 SeitenVysick V Commissioner of Police (1971) 17 WIR 391Okeeto DaSilvaNoch keine Bewertungen

- Affidavit of HeirshipDokument1 SeiteAffidavit of HeirshipAshley CandiceNoch keine Bewertungen

- Sample Affidavit of ClosureDokument1 SeiteSample Affidavit of ClosureWil BonillaNoch keine Bewertungen

- Bill of RightsDokument1 SeiteBill of RightsAshley CandiceNoch keine Bewertungen

- Updated Verification TemplateDokument1 SeiteUpdated Verification TemplateAshley CandiceNoch keine Bewertungen

- Judicial Department - Topic OutlineDokument1 SeiteJudicial Department - Topic OutlineAshley CandiceNoch keine Bewertungen

- Sample Affidavit of ClosureDokument1 SeiteSample Affidavit of ClosureWil BonillaNoch keine Bewertungen

- PT BriefDokument2 SeitenPT BriefAshley CandiceNoch keine Bewertungen

- Steps To Correct Entry of Name in Birth CertificateDokument2 SeitenSteps To Correct Entry of Name in Birth CertificateNaomi CartagenaNoch keine Bewertungen

- Urgent Motion To Enter Into Plea BargainingDokument1 SeiteUrgent Motion To Enter Into Plea BargainingAshley CandiceNoch keine Bewertungen

- IBP Recommended FeesDokument2 SeitenIBP Recommended FeesKarissa Tolentino88% (33)

- Poseur Buyer and ForensicDokument13 SeitenPoseur Buyer and ForensicAshley CandiceNoch keine Bewertungen

- Affidavit of Desistance: CertificationDokument1 SeiteAffidavit of Desistance: CertificationAshley CandiceNoch keine Bewertungen

- Visiting A Drug Den-JurisprudenceDokument2 SeitenVisiting A Drug Den-JurisprudenceAshley CandiceNoch keine Bewertungen

- Under Article 353 of The Revised Penal Code of The PhilippinesDokument3 SeitenUnder Article 353 of The Revised Penal Code of The Philippineschill21gg100% (1)

- Request For Dar Clearance 1Dokument1 SeiteRequest For Dar Clearance 1Ashley CandiceNoch keine Bewertungen

- Phil Am Life v. GramajeDokument12 SeitenPhil Am Life v. GramajeAshley CandiceNoch keine Bewertungen

- Verification: IN WITNESS WHEREOF, I Hereunto Affixed My Signature This 15Dokument1 SeiteVerification: IN WITNESS WHEREOF, I Hereunto Affixed My Signature This 15Ashley CandiceNoch keine Bewertungen

- Cross Exam Questions - Buy BustDokument4 SeitenCross Exam Questions - Buy Bustgilberthufana44687790% (29)

- ROSARIO CRUZ, of Legal Age, Filipino, Widow and A Resident of DAVAO CITY, On OathDokument1 SeiteROSARIO CRUZ, of Legal Age, Filipino, Widow and A Resident of DAVAO CITY, On OathAshley CandiceNoch keine Bewertungen

- Table of ContentsDokument2 SeitenTable of ContentsAshley CandiceNoch keine Bewertungen

- New Research in AcquittalDokument21 SeitenNew Research in AcquittalAshley CandiceNoch keine Bewertungen

- TA Services Agreement DBSADokument26 SeitenTA Services Agreement DBSAbryanNoch keine Bewertungen

- Jao Vs BCC Products Sales Inc. - CDDokument2 SeitenJao Vs BCC Products Sales Inc. - CDAshley CandiceNoch keine Bewertungen

- Poseidon Fishing V NLRC - CDDokument3 SeitenPoseidon Fishing V NLRC - CDAshley CandiceNoch keine Bewertungen

- Lazaro Vs SSSDokument2 SeitenLazaro Vs SSSAshley CandiceNoch keine Bewertungen

- Jao Vs BCC Products Sales Inc. - CDDokument2 SeitenJao Vs BCC Products Sales Inc. - CDAshley CandiceNoch keine Bewertungen

- Ufe v. Nestle DigestDokument2 SeitenUfe v. Nestle DigestAshley CandiceNoch keine Bewertungen

- BSFTI v. CADokument2 SeitenBSFTI v. CAAshley CandiceNoch keine Bewertungen

- Jardin Vs NLRC - CDDokument1 SeiteJardin Vs NLRC - CDAshley CandiceNoch keine Bewertungen

- Penaflor vs. Outdoor Clothing Case DigestDokument2 SeitenPenaflor vs. Outdoor Clothing Case DigestAshley Candice50% (2)

- VKC Group of Companies Industry ProfileDokument5 SeitenVKC Group of Companies Industry ProfilePavithraPramodNoch keine Bewertungen

- Digest of Ganila Vs CADokument1 SeiteDigest of Ganila Vs CAJohn Lester LantinNoch keine Bewertungen

- BSDC CCOE DRAWING FOR 2x6 KL R-1Dokument1 SeiteBSDC CCOE DRAWING FOR 2x6 KL R-1best viedosNoch keine Bewertungen

- Case Title: G.R. No.: Date: Venue: Ponente: Subject: TopicDokument3 SeitenCase Title: G.R. No.: Date: Venue: Ponente: Subject: TopicninaNoch keine Bewertungen

- CIE Physics IGCSE: General Practical SkillsDokument3 SeitenCIE Physics IGCSE: General Practical SkillsSajid Mahmud ChoudhuryNoch keine Bewertungen

- Project Guidelines (Issued by CBSE) : CA. (DR.) G.S. GrewalDokument51 SeitenProject Guidelines (Issued by CBSE) : CA. (DR.) G.S. GrewalShruti Yadav0% (1)

- Digitalisasi Alquran-1 PDFDokument40 SeitenDigitalisasi Alquran-1 PDFMohammad Zildan Pasyha MNoch keine Bewertungen

- Cap. 1Dokument34 SeitenCap. 1Paola Medina GarnicaNoch keine Bewertungen

- Computer Graphics Mini ProjectDokument25 SeitenComputer Graphics Mini ProjectGautam Singh78% (81)

- Risk, Return & Capital BudgetingDokument18 SeitenRisk, Return & Capital BudgetingMuhammad Akmal HussainNoch keine Bewertungen

- Design of Accurate Steering Gear MechanismDokument12 SeitenDesign of Accurate Steering Gear Mechanismtarik RymNoch keine Bewertungen

- MGT 201 Midterm Exam, Version BDokument8 SeitenMGT 201 Midterm Exam, Version BCybelle TradNoch keine Bewertungen

- Farmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesDokument13 SeitenFarmers' Satisfaction With The Paddy Procurement Practices of The National Food Authority in The Province of Palawan, PhilippinesPsychology and Education: A Multidisciplinary JournalNoch keine Bewertungen

- Steinway Case - CH 03Dokument5 SeitenSteinway Case - CH 03Twēéty TuiñkleNoch keine Bewertungen

- Basic Details: Government Eprocurement SystemDokument4 SeitenBasic Details: Government Eprocurement SystemNhai VijayawadaNoch keine Bewertungen

- Dorks List For Sql2019 PDFDokument50 SeitenDorks List For Sql2019 PDFVittorio De RosaNoch keine Bewertungen

- Midterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsDokument3 SeitenMidterm Quiz 01 - Adjusting Entries From Accrual To Provision For Uncollectible AccountsGarp Barroca100% (1)

- 04.CNOOC Engages With Canadian Stakeholders PDFDokument14 Seiten04.CNOOC Engages With Canadian Stakeholders PDFAdilNoch keine Bewertungen

- SWOT Analysis Microtel by WyndhamDokument10 SeitenSWOT Analysis Microtel by WyndhamAllyza Krizchelle Rosales BukidNoch keine Bewertungen

- You Wouldnt Want To Sail On A 19th-Century Whaling Ship 33 Grisly EnglishareDokument36 SeitenYou Wouldnt Want To Sail On A 19th-Century Whaling Ship 33 Grisly EnglishareDušan MićovićNoch keine Bewertungen

- CS506 Mid SubjectiveDokument2 SeitenCS506 Mid SubjectiveElma AlamNoch keine Bewertungen

- Renvoi in Private International LawDokument4 SeitenRenvoi in Private International LawAgav VithanNoch keine Bewertungen

- About UPSC Civil Service Examination Schedule and Subject ListDokument4 SeitenAbout UPSC Civil Service Examination Schedule and Subject Listjaythakar8887Noch keine Bewertungen

- Tankguard AR: Technical Data SheetDokument5 SeitenTankguard AR: Technical Data SheetAzar SKNoch keine Bewertungen

- Business Mathematics and Statistics: Fundamentals ofDokument468 SeitenBusiness Mathematics and Statistics: Fundamentals ofSamirNoch keine Bewertungen

- Kudla Vs PolandDokument4 SeitenKudla Vs PolandTony TopacioNoch keine Bewertungen

- OMS - Kangaroo Mother CareDokument54 SeitenOMS - Kangaroo Mother CareocrissNoch keine Bewertungen

- 2023-2024 Draft Benzie County Budget BookDokument91 Seiten2023-2024 Draft Benzie County Budget BookColin MerryNoch keine Bewertungen

- HyderabadDokument3 SeitenHyderabadChristoNoch keine Bewertungen

- A Comprehensive Review On Renewable and Sustainable Heating Systems For Poultry FarmingDokument22 SeitenA Comprehensive Review On Renewable and Sustainable Heating Systems For Poultry FarmingPl TorrNoch keine Bewertungen