Beruflich Dokumente

Kultur Dokumente

Comparison Religare and Apollo

Hochgeladen von

Sumit BhandariCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Comparison Religare and Apollo

Hochgeladen von

Sumit BhandariCopyright:

Verfügbare Formate

Parent Company

Fortis Group

Entry Parameters

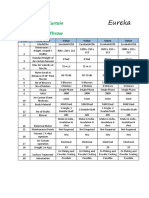

Plan Age @ Entry Renewals Inpatient Treatment Pre Hospitalisation Post hospitalisation Room Rent & Icu Charges, doctor fees, other charges Day care Procedure Any sublimit Restoration of Basic SI NO Claim Bonus Claim based Loading on renewals Pre Screening Medicals Copay Organ donor Domicilliary Treatment Waiting period for exclusions DAILY Cash Benefit Health Check Up Ambulance charges Max Sum Insured

Religare Care with NCB Super

Individual & Floater No Limits Life Long renewals Covered Upto 30 days upto 60 days Private room 170 No capping 100% automatic Recharge in case of any claim No Claims Bonus on Sum Assured for Every claim free year sub to max of 150% (60 , 60 , 10 , 10 , 10 ) Not applicable Age above 46 at company cost No Covered Covered Waiting period 24 months for certain diseases. 500 per day upto 5 days Every year from first year 2000 and more per claim 60 lac

Premium for 5 lac

16080 (NCB Super) 14618 (Normal Care)

Benefits

Yearly check up for 2 adults

150% NCB No cap Auto Recharge on any claim

Cashless Network in Ambala Bansal Hospital (Civil Lines) Jaspal Nursing Home (Model Town) Leelawati Hospital (Inder Nagar) Mehra Hospital (Police Lines) Saket Hospital (Jagadhri Road)

1. Sum Insured .. Religare care is better than Optima restore as it has option of sum insured enhancement upto 60 lac , whe

2. Restore vs Recharge :- Religare Care has again edge over Optima Restore as recharge option is far better than restore. It w

3. Room Rent :- Optima restore has no room rent limit , where as Religare care allows maximum Private room (Sum Insured 5 4. Claim based Loading :- Here both products are similar as there is no claim based loading 5. Premium:- Not a significant difference

6. Annual Health Checkup :- Religare care is better than Optima restore due to this major Feature , as Religare Care offers fre

7. No claim Bonus :- Religare Care NCB Super has better feature here in terms of higher no claim bonus than Optima Restore

Comparing all these basic features , Religare Care is far better product than Apollo Optima Rest person is taking a policy to safeguard his savings in case of an emergency. Most likely, Religare will perform better in every extreme case.

Apollo Group

Apollo Munich Optima Restore

Individual & Floater No Limits Life Long renewals Covered Upto 60 days upto 180 days Private room 140 No capping 100% automatic Restoration in case Sum insured expired No Claims Bonus on Sum Assured for Every claim free year sub to max of 100% (50 , 50 ) Not applicable Age above 46 at customer cost(50%) No Covered Covered Waiting period 24 months for certain diseases. No No 1500 and more per claim 15 lac

15337

FAMILY SIZE ( 2 Adults and 2 Child) Max age 43

Benefits

Pre post higher limit

100% NCB No cap Auto Restoration on expiry of Sum Insured

Cashless Network in Ambala Healing Touch Super Speciality Hospital Jaspal Nursing Home & City Medical Center Leelawathi Hospital Loomba Maternity & Ent Hospital

as option of sum insured enhancement upto 60 lac , where as Optima restore has maximum sum insured of 15 lac.

Restore as recharge option is far better than restore. It works like giving double sum insured from very first day.

igare care allows maximum Private room (Sum Insured 5 lac and above) . Here Optima Restore is similar to Religare care.

o claim based loading

ore due to this major Feature , as Religare Care offers free medical checkup to all adults from very first year of policy. in terms of higher no claim bonus than Optima Restore

far better product than Apollo Optima Restore. A case of an emergency. Most likely, Religare care every extreme case.

Das könnte Ihnen auch gefallen

- Overseas Travel Insurance Claim FormDokument3 SeitenOverseas Travel Insurance Claim FormSumit BhandariNoch keine Bewertungen

- Lifeline Supreme BrochureDokument5 SeitenLifeline Supreme BrochureSumit BhandariNoch keine Bewertungen

- Lifeline Master BrochureDokument5 SeitenLifeline Master BrochureSumit BhandariNoch keine Bewertungen

- Pro Health Plus Plan: Key FeaturesDokument3 SeitenPro Health Plus Plan: Key FeaturesSumit BhandariNoch keine Bewertungen

- Health Suraksha - Ind BrochureDokument2 SeitenHealth Suraksha - Ind BrochureSumit BhandariNoch keine Bewertungen

- Apollo Munich Optima Restore BrochureDokument8 SeitenApollo Munich Optima Restore BrochureSumit BhandariNoch keine Bewertungen

- Izfke Leslvj &1 Visy Ls 30 Flrecj RD: Class Xii Subject ChemistryDokument1 SeiteIzfke Leslvj &1 Visy Ls 30 Flrecj RD: Class Xii Subject ChemistrySumit BhandariNoch keine Bewertungen

- HomeDokument11 SeitenHomeSumit BhandariNoch keine Bewertungen

- Eureka Air Curtains CatalogueDokument3 SeitenEureka Air Curtains CatalogueSumit BhandariNoch keine Bewertungen

- Muhurats For ConstructionDokument6 SeitenMuhurats For ConstructionSumit BhandariNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Annmarie Villanueva ResumeDokument2 SeitenAnnmarie Villanueva Resumeapi-496718295Noch keine Bewertungen

- Olson v. J&J Et Al. - Justice Lebovits JNOV Decision - Asbestos/Talc Mesothelioma LawsuitDokument61 SeitenOlson v. J&J Et Al. - Justice Lebovits JNOV Decision - Asbestos/Talc Mesothelioma LawsuitJeromeNoch keine Bewertungen

- PhysioEx9,1: Exercise 7 Activity 2: PEX-07-02Dokument8 SeitenPhysioEx9,1: Exercise 7 Activity 2: PEX-07-02mishael_baig100% (11)

- Fisiologia de La Cerda Ing. Magdiel SorianoDokument37 SeitenFisiologia de La Cerda Ing. Magdiel SorianoFAUSTO JOSU� RODR�GUEZ AMADORNoch keine Bewertungen

- Smriti PDFDokument5 SeitenSmriti PDFmikikiNoch keine Bewertungen

- Circ15 2012 PDFDokument7 SeitenCirc15 2012 PDFJanice Villaroya Jarales-YusonNoch keine Bewertungen

- OceanofPDF - Com DR Sebi Herpes Solution DR Sebis 3-Ste - Serena BrownDokument145 SeitenOceanofPDF - Com DR Sebi Herpes Solution DR Sebis 3-Ste - Serena BrownKristine Gerbolingo100% (1)

- Using Deep Learning To Classify X-Ray Images of Potential Tuberculosis PatientsDokument8 SeitenUsing Deep Learning To Classify X-Ray Images of Potential Tuberculosis PatientsDr. Kaushal Kishor SharmaNoch keine Bewertungen

- NSS - Ass 3 - 120ar0010Dokument3 SeitenNSS - Ass 3 - 120ar0010Arpita SahooNoch keine Bewertungen

- What Are The Current Benefits of Having Foods Made From Genetically Modified Crops?Dokument1 SeiteWhat Are The Current Benefits of Having Foods Made From Genetically Modified Crops?Shee YingNoch keine Bewertungen

- 4th-LAS-Q1-MAPEH-7-SY-2021-2022 ReviewerDokument20 Seiten4th-LAS-Q1-MAPEH-7-SY-2021-2022 ReviewerClark RabulasNoch keine Bewertungen

- Water Is The Basic Necessity For The Functioning of All Life Forms That Exist On EarthDokument2 SeitenWater Is The Basic Necessity For The Functioning of All Life Forms That Exist On EarthJust TineNoch keine Bewertungen

- hsp3c UDokument19 Seitenhsp3c Uapi-390148276Noch keine Bewertungen

- Miranda 2001 PDFDokument8 SeitenMiranda 2001 PDFAlexandre FerreiraNoch keine Bewertungen

- Assessment Diagnosis Planning Intervention Rationale EvaluationDokument2 SeitenAssessment Diagnosis Planning Intervention Rationale EvaluationMary Hope BacutaNoch keine Bewertungen

- Physical Education Research Paper TopicsDokument8 SeitenPhysical Education Research Paper Topicsefdvje8d100% (1)

- Assignment On Marital Rape As A Ground For Divorce: Submitted ToDokument18 SeitenAssignment On Marital Rape As A Ground For Divorce: Submitted ToAishwarya MathewNoch keine Bewertungen

- Application of Machine Learning To Predict Occurrence of Accidents at Finnish Construction SitesDokument61 SeitenApplication of Machine Learning To Predict Occurrence of Accidents at Finnish Construction SitesMohamed TekoukNoch keine Bewertungen

- 60 71 Virgianti Nur FaridahDokument12 Seiten60 71 Virgianti Nur FaridahSopian HadiNoch keine Bewertungen

- Milk Bank Ordinance - OneDokument6 SeitenMilk Bank Ordinance - OneRichard GomezNoch keine Bewertungen

- Abundance Script - PDF-45-49Dokument5 SeitenAbundance Script - PDF-45-49patrickchatezviNoch keine Bewertungen

- Environmental Impacts of Cattle ProductionDokument30 SeitenEnvironmental Impacts of Cattle ProductionAdinugroho PurboNoch keine Bewertungen

- Hospital Familiarization: Charry Mae Romero, DMDDokument21 SeitenHospital Familiarization: Charry Mae Romero, DMDJoyce EbolNoch keine Bewertungen

- Risk Assesment - Lifting Tubing Hanger To Splice SLB DHPG Cable and NU Xmass TreeDokument4 SeitenRisk Assesment - Lifting Tubing Hanger To Splice SLB DHPG Cable and NU Xmass Treesatish9889Noch keine Bewertungen

- Tety Yuliantine, Indasah, Sandu SiyotoDokument8 SeitenTety Yuliantine, Indasah, Sandu SiyotopuriNoch keine Bewertungen

- Assessment of The Urinary System: Chelsye Marviyouna Dearianto 1814201018Dokument19 SeitenAssessment of The Urinary System: Chelsye Marviyouna Dearianto 1814201018Sinta WuLandariNoch keine Bewertungen

- Asme B I Addenda: To Asme Metallic Gaskets For Pipe Flanges Ring-Joint, Spiral-Wound, and JacketedDokument51 SeitenAsme B I Addenda: To Asme Metallic Gaskets For Pipe Flanges Ring-Joint, Spiral-Wound, and JacketedTimilehin OladiranNoch keine Bewertungen

- Act02 - Healthy Food Habits - A1Dokument5 SeitenAct02 - Healthy Food Habits - A1Dj-Junior Carhuatanta O̲̲̅̅f̲̲̅̅ı̲̲̅̅c̲̲̅̅ı̲̲̅̅a̲̲̅̅l̲̲̅̅f̲̲̅̅bNoch keine Bewertungen

- Pharmacovigilance Guidance AustraliaDokument38 SeitenPharmacovigilance Guidance AustraliamarielaNoch keine Bewertungen

- Reading 2Dokument72 SeitenReading 2Ng HoaNoch keine Bewertungen