Beruflich Dokumente

Kultur Dokumente

AML / BSA Monitoring

Hochgeladen von

Oceansys PublicCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

AML / BSA Monitoring

Hochgeladen von

Oceansys PublicCopyright:

Verfügbare Formate

AML / BSA Monitoring Ocean Systems offers The Enhanced Compliance Solution (ECS) as a comprehensive and detailed AML

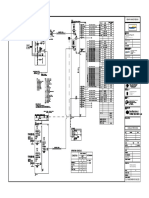

monitoring software system designed for the specific use of anti-money laundering and guiding financial institutions in complying with PATRIOT Act regulations. In fact, the ECS system analyzes transaction activity throughout all modules by utilizing statistical methods in order to identify and prevent fraudulent behavior. The following modules are utilized collectively within the ECS to secure and protect account information and activity:

Customers / Relationship / Account Cash Activity / Transactions Alerts / Reports / FinCEN Wire Analysis / Case Management KYC / EDD Information Customers / Relationship / Account ECS uses the customer information from the core banking system to monitor the relationship between customers and accounts. Related parties assigned to an account such as signers, beneficiaries, trustees and others are also secured in ECS for monitoring and evaluation. All associated accounts are brought in from banks core processing system. This information includes account name, type, status, officer, account risk and much more. Cash Activity / Transactions The ECS Cash Activity module captures and analyzes all cash activities individually to monitor the regulatory amount of cash deposited and withdrawn. This includes mixed deposits. All transactions imported from the banks core processing system are

brought into ECS while secondary processes maintain additional transaction details for Wires, SWIFT, Itemized Checks and Cash Activity. Alerts / Reports / FinCEN The ECS AML software allows for alerts to be automated directly to either a specific user or group to protect the account from fraudulent behavior by utilizing statistical analyses configured through the BSA Compliance Group. Reports are generated to retrieve and monitor activity information. Results may be stored in various formats. In addition, specific parameters may be used for pre-defined queries. Lastly, FinCEN 314A is a bi-weekly search embedded within ECS functionality. All matches which are not in accordance to customer information and activity are displayed. Wire Analysis / Case Management Wire activity is obtained from the wire transfer system Wire Activity Analyzer inspects detailed account information from wires received from beneficiaries, originators, countries and correspondent banks. Configuration for wire analysis allows for wire activity to be disclosed under selected criteria. Case Management is integrated within ECS by grouping events, notes and user reviews to accommodate the filing of any case under review. These groups include Watch Lists, Special Investigations, Subpoenas, and SARS. KYC / EDD Information The ECS supports Know You Customer (KYC) and Enhanced Due Diligence (EDD) information. This information is used for thorough monitoring and analysis to ensure authentication and anti-money laundering. Through account profiling in accordance to KYC and EDD information, fraudulent behavior is immediately detected. Bio: Since 1991, Ocean Systems has been proven leaders in software compliance solutions by providing specialized, comprehensive and advanced software compliance platforms to prevent fraudulent behavior. Ocean Systems advances their goal in connecting experience, creativity and technology to provide secured banking and financial solutions in compliance with corresponding sections of the US PATRIOT Act. Visit us online today to learn more. Summary: The AML / BSA Monitoring system ECS or Enhanced Compliance Solution is briefly outlined by correlated modules which work together to monitor and secure account safety by monitoring wire activity in compliance with the US PATRIOT Act. Keywords: AML software, wire transfer system, compliance monitoring, OFAC compliance, AML monitoring software, anti-money laundering, federal reserve wire transfer, anti-money laundering software, OFAC screening

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- EL-1104 Wiring Diagram PTM, PUTR PKG.R2Dokument1 SeiteEL-1104 Wiring Diagram PTM, PUTR PKG.R2Muh FarhanNoch keine Bewertungen

- Mutual FundDokument33 SeitenMutual FundGaurav SolankiNoch keine Bewertungen

- Updates On Buy Back Offer (Company Update)Dokument52 SeitenUpdates On Buy Back Offer (Company Update)Shyam SunderNoch keine Bewertungen

- Card Holder Dispute FormDokument1 SeiteCard Holder Dispute Formcool3420Noch keine Bewertungen

- BNI Mobile Banking: Histori TransaksiDokument7 SeitenBNI Mobile Banking: Histori TransaksiErwin NasrullahNoch keine Bewertungen

- IIBF Vision July 2019Dokument8 SeitenIIBF Vision July 2019Rakesh KumarNoch keine Bewertungen

- Engagement Letter ExampleDokument3 SeitenEngagement Letter ExamplemerrillvanNoch keine Bewertungen

- Ethics Jamuna BankDokument25 SeitenEthics Jamuna BankAl HasanNoch keine Bewertungen

- List of Market Makers and Primary DealersDokument38 SeitenList of Market Makers and Primary DealersJP Tarud-KubornNoch keine Bewertungen

- Satyam Fraud Failure of Corporate GovernanceDokument12 SeitenSatyam Fraud Failure of Corporate GovernanceOm Prakash Yadav100% (8)

- Reddy Ice Disclosure StatementDokument757 SeitenReddy Ice Disclosure Statementbankrupt0Noch keine Bewertungen

- Double Entry SystemDokument17 SeitenDouble Entry SystemDastaan Ali100% (1)

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Dokument10 SeitenIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNoch keine Bewertungen

- Bank Reconciliation: Intermediate Accounting 1Dokument4 SeitenBank Reconciliation: Intermediate Accounting 1Kesiah FortunaNoch keine Bewertungen

- Credit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionDokument18 SeitenCredit Rationing and Repayment Performance (Problems) in The Case of Ambo Woreda Eshet Microfinance InstitutionImpact JournalsNoch keine Bewertungen

- Financial Analysis Spreadsheet From The Kaplan GroupDokument4 SeitenFinancial Analysis Spreadsheet From The Kaplan GroupPrince AdyNoch keine Bewertungen

- Act No 1120 FRIAR LANDS ACTDokument6 SeitenAct No 1120 FRIAR LANDS ACThannahNoch keine Bewertungen

- OPD Form IHealthcare-2Dokument2 SeitenOPD Form IHealthcare-2Masoom Kazmi100% (1)

- Specialized Marine DiplomaDokument3 SeitenSpecialized Marine DiplomaAnkur PatilNoch keine Bewertungen

- Project On Bajaj AllianzDokument70 SeitenProject On Bajaj AllianzRanjeet Rajput100% (1)

- Visa Prepaid - Myanma Apex BankDokument2 SeitenVisa Prepaid - Myanma Apex BankMyo NaingNoch keine Bewertungen

- Chap-6-Verification of Assets and LiabilitiesDokument48 SeitenChap-6-Verification of Assets and LiabilitiesAkash GuptaNoch keine Bewertungen

- GPR 410 Dissertation Ombaka 2012Dokument60 SeitenGPR 410 Dissertation Ombaka 2012Kclf- Kenya Christian LawyersNoch keine Bewertungen

- Member List Derivatives NYSE LiffeDokument15 SeitenMember List Derivatives NYSE LiffeNathan FergusonNoch keine Bewertungen

- AXIS BANK Project Word FileDokument28 SeitenAXIS BANK Project Word Fileअक्षय गोयलNoch keine Bewertungen

- Assured Returns.: Our PromiseDokument12 SeitenAssured Returns.: Our PromiseVinodkumar ShethNoch keine Bewertungen

- IELTS Workshop Test Schedule 2015Dokument2 SeitenIELTS Workshop Test Schedule 2015Raihan YamangNoch keine Bewertungen

- KMC SAE '19 ChallanDokument1 SeiteKMC SAE '19 ChallanPartha DeyNoch keine Bewertungen

- Articles of AgreementDokument2 SeitenArticles of AgreementMd Rajikul IslamNoch keine Bewertungen

- International Transport DocumentDokument13 SeitenInternational Transport DocumentGlobal Negotiator100% (1)