Beruflich Dokumente

Kultur Dokumente

Tilak Quarter

Hochgeladen von

Ashu158Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tilak Quarter

Hochgeladen von

Ashu158Copyright:

Verfügbare Formate

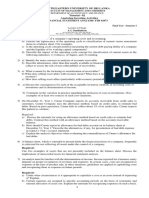

BSE CODE : 503663 AUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 31.03.

2011 PARTICULARS

Quarter Ended 31.03.11 31.03.2010 Year Ended 31.03.10

Audited Income Sales/Income from Operation Other Income Total Income Expenditure Operating cost Operating Profit before Dep. & Tax Employee Cost Depreciation Other Expenditure Profit before Taxation Earlier year Tax Provision for Tax, FBT, Deffered Tax 230.00 230.00 209.71 20.29 7.45 4.41 10.74 (2.31) (2.83)

Unaudited 113.90 113.90 15.85 98.05 39.47 3.82 9.97 44.79 14.27 30.52 24.50 -

Audited 245.56 0 245.56 13.93 231.63 43.87 3.82 16.91 167.03 55.90 111.13 24.50 107.62

Rs. In Lacs Year Ened 31.03.11 Audited 758.87 31.38 790.25 697.03 93.22 38.92 17.52 16.71 20.07 12.33 7.74 1,222.00 567.11

Net Profit / Loss 0.52 Paid-up Equity Share Capital, FV Rs.10/1,222.00 Reserves excluding Revaluation Reserve as per balance sheet of Previous accounting Year. Earning Per share(EPS) (a) Basic and diluted EPS before Extraordinary Items for the period for the year to date and for the previous year (not to be annualized) 0.00 (b) Basic and diluted EPS after Extraordinary items for the period for the year to date and for the previous year (not to be annualised) 0.00 Aggregate of Non-Promoter Holding (a) No. of Shares 4764250 (b) Percentage of Holding 38.99%

Promoters and Promoter Group share holding

12.46

45.36

0.09

12.46 95750 38.08%

45.36 65850 26.88%

0.09 4,764,250 38.99%

(a) Pledged/Encumbered -Number of shares Nil -Percentage of shareholding(as a %of the total shareholding of promoter & promoter group Nil -Percentage of shareholding(as a %of the total sharecapital of the company) Nil (b) Non-encumbered -Number of shares 7455750 -Percentage of shareholding(as a %of the total shareholding of promoter & promoter group 100% -Percentage of shareholding(as a %of the total sharecapital of the company) 61.01%

Nil Nil Nil 149250 100% 60.92%

Nil Nil Nil 179150 100% 73.12%

Nil Nil Nil 7,455,750 100% 61.01%

Statement of Assets & Liabilities as per clause 41(V)(ea) of the Listing Agreement as on 31.03.2011 As on As on 31.03.2010 31.03.2011 PARTICULARS (Audited) (Audited) SOURCES OF FUNDS Shareholders fund Share capital 24.50 1,222.00 Reserve & Surplus 107.63 572.99 Deferred Tax (liablity) 8.83 17.45 TOTAL 140.96 1,812.44 APPLICATION OF FUNDS Fixed Assets 104.19 86.95 Investments Current Assets Inventories Sundry Debtors Cash and Bank Balance Loans & Advances Deferred Tax (Assets) Current Liabilities & Provisions Net Current Assets Misc. Expeses (Assets)

27.63 59.64 87.27 50.50 36.77

240.52 10.83 1,475.43 1,726.78 8.51 1,718.27 7.22

TOTAL

140.96

1,812.44

NOTE: (1) THE ABOVE RESULTS HAVE BEEN REVIEWED BY THE AUDIT COMMITTEE AND APROVED BY THE OF DIRECTORS IN THEIR MEETING HELD ON 30.05.2011 (2) FIGURES FOR THE EARLIER PERIODS HAVE BEEN REGROUPED/REARRANGED. (3) DURRING THE YEAR COMPANY HAS ALLOTTED 980000 EQUITY SHARES AS BONUS SHARES ( RAT (4) DURRING THE YEAR COMPANY HAS ISSUED 1,09,95,000 EQUITY SHARES ON PREFERENTIAL BAS

(5) INVESTOR COMPLAINTS FOR THE QUARTER ENDED 31/3/2011. Opening -Nil, Received -Nil , Resolved -Nil,Closing

For TILAK FINANCE LIMITED Place : Mumbai Date : 30.05.2011 Sd/Girraj Kishor Agrawal Director

ATIO 4:1) SIS

Das könnte Ihnen auch gefallen

- Basic Financial Accounting and Reporting: Ishmael Y. Reyes, CPADokument39 SeitenBasic Financial Accounting and Reporting: Ishmael Y. Reyes, CPAJonah Marie Therese Burlaza92% (13)

- Part1 SU1 2015 Rev2Dokument86 SeitenPart1 SU1 2015 Rev2Mustafa Tevfik ÖzkanNoch keine Bewertungen

- Attock Oil RefineryDokument2 SeitenAttock Oil RefineryOvais HussainNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- TaxDokument8 SeitenTaxClaire BarrettoNoch keine Bewertungen

- Consolidated Balance Sheet: As at 31st December, 2011Dokument21 SeitenConsolidated Balance Sheet: As at 31st December, 2011salehin1969Noch keine Bewertungen

- KFA - Published Unaudited Results - Sep 30, 2011Dokument3 SeitenKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNoch keine Bewertungen

- Bil Quarter 2 ResultsDokument2 SeitenBil Quarter 2 Resultspvenkatesh19779434Noch keine Bewertungen

- HCL Technologies LTD 170112Dokument3 SeitenHCL Technologies LTD 170112Raji_r30Noch keine Bewertungen

- Rationale of Mergers & Acquisitions: Assignment 1Dokument6 SeitenRationale of Mergers & Acquisitions: Assignment 1mujtabaansariNoch keine Bewertungen

- Consolidated AFR 31mar2011Dokument1 SeiteConsolidated AFR 31mar20115vipulsNoch keine Bewertungen

- Proforma Profit and Loss StatementDokument6 SeitenProforma Profit and Loss Statementgirishjain2000Noch keine Bewertungen

- Avt Naturals (Qtly 2011 06 30) PDFDokument1 SeiteAvt Naturals (Qtly 2011 06 30) PDFKarl_23Noch keine Bewertungen

- BS PL Dalmia ShreeDokument4 SeitenBS PL Dalmia ShreeAbhishek RawatNoch keine Bewertungen

- Fin STMTDokument8 SeitenFin STMTGuru_McLarenNoch keine Bewertungen

- Analisis Laporan Keuangan PT XL AXIATA TBKDokument9 SeitenAnalisis Laporan Keuangan PT XL AXIATA TBKmueltumorang0% (1)

- Q2 Fy2011-12 PDFDokument2 SeitenQ2 Fy2011-12 PDFTushar PatelNoch keine Bewertungen

- Group 4 Symphony FinalDokument10 SeitenGroup 4 Symphony FinalSachin RajgorNoch keine Bewertungen

- Balance SheetDokument1 SeiteBalance SheetAshutosh KumarNoch keine Bewertungen

- Standalone Cash Flow Statement 11Dokument2 SeitenStandalone Cash Flow Statement 11Suhaib RaisNoch keine Bewertungen

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Dokument16 SeitenStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Application of Funds (In Rs. Crores)Dokument4 SeitenApplication of Funds (In Rs. Crores)Basil SamlioneNoch keine Bewertungen

- Annual Report EClerx 2011 084Dokument4 SeitenAnnual Report EClerx 2011 084sudhak111Noch keine Bewertungen

- AuditedStandaloneFinancialresults 31stmarch, 201111121123230510Dokument2 SeitenAuditedStandaloneFinancialresults 31stmarch, 201111121123230510Kruti PawarNoch keine Bewertungen

- New Listing For PublicationDokument2 SeitenNew Listing For PublicationAathira VenadNoch keine Bewertungen

- Mark and Spencer Excel For Calc - 130319 FINAL DRAFTDokument12 SeitenMark and Spencer Excel For Calc - 130319 FINAL DRAFTRama KediaNoch keine Bewertungen

- CAP2 EstadosFinancieros2014Dokument17 SeitenCAP2 EstadosFinancieros2014LuisAlonzoNoch keine Bewertungen

- Topic:-Evaluate The Financial Performance of Marks &spencer PLCDokument27 SeitenTopic:-Evaluate The Financial Performance of Marks &spencer PLCAnonymous ohYFoO4Noch keine Bewertungen

- Financial Statement Analysis of HDFC BankDokument58 SeitenFinancial Statement Analysis of HDFC BankArup SarkarNoch keine Bewertungen

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Dokument4 SeitenAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Analysis of Financial StatementDokument4 SeitenAnalysis of Financial StatementArpitha RajashekarNoch keine Bewertungen

- Axis Bank Limited Group - Consolidated Profit & Loss AccountDokument66 SeitenAxis Bank Limited Group - Consolidated Profit & Loss Accountshreyjain88Noch keine Bewertungen

- Ratio Anaylsis With Excel (Hypothetical)Dokument7 SeitenRatio Anaylsis With Excel (Hypothetical)awhan sarangiNoch keine Bewertungen

- Consolidated Financial Results For March 31, 2016 (Result)Dokument3 SeitenConsolidated Financial Results For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Dokument1 SeiteUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNoch keine Bewertungen

- Paper Accounts SPL (Con) - Sep-2011Dokument4 SeitenPaper Accounts SPL (Con) - Sep-2011Shafiul MuznabinNoch keine Bewertungen

- ITC Consolidated FinancialsDokument49 SeitenITC Consolidated FinancialsVishal JaiswalNoch keine Bewertungen

- Consolidated Accounts June-2011Dokument17 SeitenConsolidated Accounts June-2011Syed Aoun MuhammadNoch keine Bewertungen

- Final Grace CorpDokument14 SeitenFinal Grace CorpAnonymous 0M5Kw0YBXNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Financial Results For December 31, 2015 (Result)Dokument1 SeiteFinancial Results For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- ITC Consolidated FinancialsStatement 2015 PDFDokument53 SeitenITC Consolidated FinancialsStatement 2015 PDFAbhishek DuttaNoch keine Bewertungen

- 1st QTR 30 Sep 11Dokument18 Seiten1st QTR 30 Sep 11m__saleemNoch keine Bewertungen

- Financial Results For Dec 31, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Segment Reporting (Rs. in Crore)Dokument8 SeitenSegment Reporting (Rs. in Crore)Tushar PanhaleNoch keine Bewertungen

- Cash Flow ExerciseDokument1 SeiteCash Flow ExercisecoeprodpNoch keine Bewertungen

- Updates On Financial Results & Limited Review Report For Sept 30, 2015 (Result)Dokument4 SeitenUpdates On Financial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderNoch keine Bewertungen

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument72 SeitenCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNoch keine Bewertungen

- 2011 Financial Statements NESTLE GROUPDokument118 Seiten2011 Financial Statements NESTLE GROUPEnrique Timana MNoch keine Bewertungen

- Myer AR10 Financial ReportDokument50 SeitenMyer AR10 Financial ReportMitchell HughesNoch keine Bewertungen

- Assets: Analisis Vertical 2011 %Dokument11 SeitenAssets: Analisis Vertical 2011 %Christian CoronelNoch keine Bewertungen

- Biocon - Ratio Calc & Analysis FULLDokument13 SeitenBiocon - Ratio Calc & Analysis FULLPankaj GulatiNoch keine Bewertungen

- Afm PDFDokument5 SeitenAfm PDFBhavani Singh RathoreNoch keine Bewertungen

- Bajaj Bal SheetDokument3 SeitenBajaj Bal SheetSukshith ShettyNoch keine Bewertungen

- TCS Condensed IndianGAAP Q3 12Dokument29 SeitenTCS Condensed IndianGAAP Q3 12Neha SahaNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument1 SeiteFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- ICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Dokument9 SeitenICI Pakistan Limited Condensed Interim Unconsolidated Balance Sheet (Unaudited) As at March 31, 2011Sehrish HumayunNoch keine Bewertungen

- Working Capital of Hindalco Industries LTD For THE YEARS 2009-2013Dokument30 SeitenWorking Capital of Hindalco Industries LTD For THE YEARS 2009-2013VaibhavSonawaneNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Result)Dokument5 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderNoch keine Bewertungen

- Ebix, Inc.: FORM 10-QDokument39 SeitenEbix, Inc.: FORM 10-QalexandercuongNoch keine Bewertungen

- Karishma WorkDokument14 SeitenKarishma WorkApoorva MathurNoch keine Bewertungen

- Maruti Suzuki (Latest)Dokument44 SeitenMaruti Suzuki (Latest)utskjdfsjkghfndbhdfnNoch keine Bewertungen

- GCSR Formats RevisedDokument8 SeitenGCSR Formats RevisedAshu158Noch keine Bewertungen

- Live Project of Soft Skill LabDokument1 SeiteLive Project of Soft Skill LabAshu158Noch keine Bewertungen

- Bba 6Dokument17 SeitenBba 6mithasuhelNoch keine Bewertungen

- Participants in OTCEI MarketDokument7 SeitenParticipants in OTCEI MarketAshu158Noch keine Bewertungen

- Executive Summery: 6th Floor, 'Kailash'Dokument33 SeitenExecutive Summery: 6th Floor, 'Kailash'Ashu158Noch keine Bewertungen

- 1.1 HistoryDokument40 Seiten1.1 HistoryAshu158Noch keine Bewertungen

- Capital Asset Pricing Model IntroductionDokument8 SeitenCapital Asset Pricing Model IntroductionAshu158Noch keine Bewertungen

- SSBL PL Fy1011Dokument1 SeiteSSBL PL Fy1011Ashu158Noch keine Bewertungen

- Capital Asset Pricing Model IntroductionDokument8 SeitenCapital Asset Pricing Model IntroductionAshu158Noch keine Bewertungen

- Bba 6Dokument17 SeitenBba 6mithasuhelNoch keine Bewertungen

- Investment Valuation Ratios Profit and Loss Account RatiosDokument1 SeiteInvestment Valuation Ratios Profit and Loss Account RatiosAshu158Noch keine Bewertungen

- Participants in OTCEI MarketDokument7 SeitenParticipants in OTCEI MarketAshu158Noch keine Bewertungen

- Jignesh G. Kalsaria: GujaratDokument2 SeitenJignesh G. Kalsaria: GujaratAshu158Noch keine Bewertungen

- Clearing and SettlementDokument1 SeiteClearing and SettlementMarius AngaraNoch keine Bewertungen

- Paraguay Feb 11Dokument6 SeitenParaguay Feb 11Ashu158Noch keine Bewertungen

- Subject: Subject: Subject: Subject: Goals and Objectives Goals and Objectives Goals and Objectives Goals and ObjectivesDokument2 SeitenSubject: Subject: Subject: Subject: Goals and Objectives Goals and Objectives Goals and Objectives Goals and ObjectivesAshu158Noch keine Bewertungen

- Competitive Analysis of Major Broking PlayerDokument1 SeiteCompetitive Analysis of Major Broking PlayerHarshad PatelNoch keine Bewertungen

- Short Cut KeyDokument4 SeitenShort Cut KeyAshu158Noch keine Bewertungen

- Basics of Intellectual Property LawDokument50 SeitenBasics of Intellectual Property LawMuralis MuralisNoch keine Bewertungen

- Case Study Example - Principle 11: TheDokument1 SeiteCase Study Example - Principle 11: Thevicky_vrocksNoch keine Bewertungen

- Decent Overview of The Workings of A DCF Model Click HereDokument5 SeitenDecent Overview of The Workings of A DCF Model Click HererajsalgyanNoch keine Bewertungen

- Front PageDokument3 SeitenFront PageAshu158Noch keine Bewertungen

- Paraguay WT/TPR/S/245: NtroductionDokument5 SeitenParaguay WT/TPR/S/245: NtroductionAshu158Noch keine Bewertungen

- Summer Internship Project: Master of Business AdministrationDokument10 SeitenSummer Internship Project: Master of Business AdministrationAshu158Noch keine Bewertungen

- Essential Commodities Act1955Dokument18 SeitenEssential Commodities Act1955Parveen KumarNoch keine Bewertungen

- Interpretation of Financial Statements - IntroductionDokument19 SeitenInterpretation of Financial Statements - Introductionsazid9Noch keine Bewertungen

- BiodataDokument1 SeiteBiodataAshu158Noch keine Bewertungen

- Short Cut KeyDokument4 SeitenShort Cut KeyAshu158Noch keine Bewertungen

- TY BBA-5th SemesterDokument9 SeitenTY BBA-5th SemesterSagar TankNoch keine Bewertungen

- Tutorial 2Dokument5 SeitenTutorial 2Hirushika BandaraNoch keine Bewertungen

- Apk Report g5 2013Dokument38 SeitenApk Report g5 2013Mohd Johari Mohd ShafuwanNoch keine Bewertungen

- Niagara Agriculture Profile Dec 2022Dokument34 SeitenNiagara Agriculture Profile Dec 2022samsinghania54321Noch keine Bewertungen

- U93090MH2018PTC308253 T dlmbvvm3vg0bh6Dokument161 SeitenU93090MH2018PTC308253 T dlmbvvm3vg0bh6Ankit NathNoch keine Bewertungen

- Chapter 1 - ThesisDokument8 SeitenChapter 1 - ThesisRed SecretarioNoch keine Bewertungen

- ADVAC2Dokument64 SeitenADVAC2Shenna Mae LibradaNoch keine Bewertungen

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Dokument6 SeitenCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNoch keine Bewertungen

- BCIBF-103 Financial AccountingDokument423 SeitenBCIBF-103 Financial AccountingS.M Documents SolutionsNoch keine Bewertungen

- Budgetary Control and Standard CostingDokument15 SeitenBudgetary Control and Standard CostingPratyay DasNoch keine Bewertungen

- Libby7ce PPT Ch09Dokument47 SeitenLibby7ce PPT Ch09Moussa ElsayedNoch keine Bewertungen

- Special Audit of Sugar MillsDokument2 SeitenSpecial Audit of Sugar MillsZoyaNoch keine Bewertungen

- Acc117-Chapter 2Dokument26 SeitenAcc117-Chapter 2Fadilah JefriNoch keine Bewertungen

- SG - FSDokument20 SeitenSG - FSRoxieNoch keine Bewertungen

- Combine Tax Module 2020 - For BIRDokument2.701 SeitenCombine Tax Module 2020 - For BIRDave Banay Yabo, LPTNoch keine Bewertungen

- Ch-3 Cost BehaviorDokument25 SeitenCh-3 Cost BehaviorNeelesh MishraNoch keine Bewertungen

- CBSE Class 12 Accountancy Accounting Ratios WorksheetDokument3 SeitenCBSE Class 12 Accountancy Accounting Ratios WorksheetJenneil CarmichaelNoch keine Bewertungen

- FMGT 1321 Midterm 1 Review Questions: InstructionsDokument7 SeitenFMGT 1321 Midterm 1 Review Questions: InstructionsAnnabelle Wu0% (1)

- Leverages - 42.5 (2ND Version) - Main Material0201Dokument17 SeitenLeverages - 42.5 (2ND Version) - Main Material0201Sampath SanguNoch keine Bewertungen

- Henderson vs. CollectorDokument8 SeitenHenderson vs. CollectorMutyaAlmodienteCocjinNoch keine Bewertungen

- Frosty Sweet Street Frosty SweetDokument52 SeitenFrosty Sweet Street Frosty SweetDanicaEsponillaNoch keine Bewertungen

- Accounting 1Dokument4 SeitenAccounting 1Shoaib YousufNoch keine Bewertungen

- ACC3140 Lecture 3 Employment Income 1920Dokument39 SeitenACC3140 Lecture 3 Employment Income 1920Madalina LazarNoch keine Bewertungen

- Quiz 1 - StrataxDokument3 SeitenQuiz 1 - Strataxspongebob SquarepantsNoch keine Bewertungen

- fc7bb - Tech Shristi Salary Income TaxDokument76 Seitenfc7bb - Tech Shristi Salary Income TaxGopal SharmaNoch keine Bewertungen

- Kalinga State University College of Business, Entrepreneurship & Accountancy Test Questions Mockbord Theory of Accounts Midterm ExaminationDokument10 SeitenKalinga State University College of Business, Entrepreneurship & Accountancy Test Questions Mockbord Theory of Accounts Midterm ExaminationJaymee Andomang Os-agNoch keine Bewertungen

- 8e Ch3 Mini Case Planning MemoDokument8 Seiten8e Ch3 Mini Case Planning Memotom0% (3)

- Audit ProbDokument16 SeitenAudit ProbJewel Mae Mercado100% (1)