Beruflich Dokumente

Kultur Dokumente

Nder Diversity in Board, Its Impact On Financial Performance (Mohd Fairuz Adnan) PP 151-160

Hochgeladen von

upenapahangOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nder Diversity in Board, Its Impact On Financial Performance (Mohd Fairuz Adnan) PP 151-160

Hochgeladen von

upenapahangCopyright:

Verfügbare Formate

KONAKA 2013

Gender Diversity in Board: Its Impact on Financial Performance

Mohd Fairuz Adnan Nurshamimi Sabli Azizah Abdullah

ABSTRACT The purpose of this study is to investigate the association between board diversity and firm performance of 26 government-linked companies (GLCs) and 26 non-government linked companies (non-GLCs) in Malaysia. The study focused on gender variable to explain the board diversity and tested its relationship towards firm financial performance as measured by return on equity (ROE) and return on asset (ROA). Due to limited previous research conducted on diversity in Malaysian firms, this article attempts to fill the gap. It is hypothesised that in general, diversity in board has a positive effect on the firm performance. In order to investigate the findings, a final sample of 203 GLCs and non-GLCs listed on the Bursa Malaysia are used across four years from 2007 to 2010. It is analyzed using a quantitative method that is employed by SPSS which compared characteristics of boards with firm performance. The finding reveals that board diversity as measured by gender differences was negatively and significantly related to ROA and ROE in both GLCs and non-GLCs. The results failed to satisfy the expectation made under this study, thus rejecting the hypothesis that gender board diversity is positively related to firm performance. As a conclusion, this study could not establish that diversity in board would enhance firm performances. Hence, a future need to address a balance between men and women would be of greater importance rather than the presence of woman in the board in ensuring better firm performance. Keywords: board diversity, gender, firm performance

Introduction

Growing businesses face a range of challenges. As a business grows, different problems and opportunities demand different solutions. Frequent business challenges require a team namely the board of directors (BODs) who can act as a top level advisor and monitor the firm. They are responsible to protect shareholders' assets and ensure they receive decent returns on their investment (Kennon, 2011). A well-functioned BODs is also expected to maximize shareholders wealth through an effective monitoring and controlling over the management as well as ensuring good corporate governance practices are well performed in the firm. Board characteristics affect the effectiveness of monitoring the management and the quality of corporate governance (Chien, 2008). It should be noted that demographic is one of the characteristics of the boards. Demographic characteristics (e.g. age, tenure, gender, specialization) are related with many cognitive bases, values and perceptions that influence the decision making of BODs (Marimuthu and Kolandaisamy, 2009). Therefore, the more complex the decision is (e.g. decision in strategic measure of the company), the more important an individuals characteristics of the decision maker are required (Zee and Swagerman, 2009). Demographics characteristic such as tenure, age, experience, and board size are only some parts of the characteristics that contribute to the diversity of the board (McIntyre, Murphy & Mitchell, 2007). However, this study is focusing on one demographic characteristics of board diversity; i.e. gender to investigate its effect towards firms financial performance. The current study has selected a final sample of 203 listed Government-Linked Companies (GLCs) and Non Government-Linked Companies (non-GLCs) for a period of 4 years starting from 2007 until 2010. A four-year window period from the year 2007 to 2010 is chosen as to reflect the effects of the revised corporate governance in Malaysia in year 2007 (The Malaysian Code on Corporate Governance, 2007) as well as to enable a better analysis with current issues and environment. Choosing these types of companies as the sample for the current study is to create a gap between the prior research conducted in Malaysia which has looked at the 100 public listed companies in Malaysia (Marimuthu and Kolandaisamy, 2009). It should be noted that the Malaysian Government has performed the GLC Transformation Programme and one of the key principles is to create economic and shareholders value through enhanced or improved performance of GLCs (http://www.khazanah.com.my/faq.htm). Therefore, by examining the impact of board diversity on GLCs financial performance, the result of this study may be used to assist in realizing the key principle of 151

KONAKA 2013 GLCs transformation as well as to contribute to the development of GLCs in Malaysia. The statistical result of this study revealed a significant but in contrast effect with what had been expected and hypothesized.

Literature Review

Board Diversity Coffey and Wang (1998) define board diversity as the variation among its members and it is probably derived from multiple sources of board characteristic such as expertise and managerial background, personalities, learning styles, education, age and values. The more diverse of board, the more it can contribute to improve organizational performance by providing new idea, insight and perspective to the boards (Siciliano, 1996). However, several studies show that the effect of board diversity on team performance is not uniform (Dahlin et al., 2005). For instance, Carter et al. (2007) examine the relationship of ethnic and gender diversity in the three functions of the board committees namely, audit, executive compensation, and director nomination on firms performance and find that gender diversity has a positive impact on firms performance through audit committees of the board but not in executive compensation and director nomination committee, while ethnic diversity turn out to be positively impact on the firms performance through all functions of the board committees. Dahlin et al. (2005) suggest that working in a diversified team can be challenging because the nature of the team diversity with various perspectives could result in difficulty for the team members to perform, communicate and coordinate their work. Gender Diversity Prior literatures stated that the positive impact after the corporate scandals and the collapse of high-profile companies such as Enron and WorldCom have enhanced the importance of monitoring role and corporate governance (Campbell and Vera, 2008). The existence of a new legislative after the crisis such as Sarbanes Oxley Act (SOX) 2002 has provides the guidelines of board composition, board audit committees, board independence and other corporate governance practices but neither one of that mentions the gender composition or diversity of BODs. However, although none of SOX guidelines specifically addresses any aspect of gender diversity, it is believed that the provisions of SOX and the listing exchanges have indirectly have a major impact on the needs of roles and responsibilities of women in the board as a part of contributor to the firm performances (Dalton and Dalton, 2010). Previous studies have found a negative result on gender diversity in the board. Adams and Ferreira (2009) argue that the average effect of gender diversity on firms performance i s negative. At first impression, the correlation between gender diversity and firm value seems to be positive, however it changed once they apply reasonable procedures to tackle omitted variables and reverse causality problems. Their finding suggests that gender diversity positively affects performance in firms that have weak governance. However, in firms with strong and well governance practices, they assert that determining gender quotas in BODs can reduce the firms value due to excessive monitoring. Wan g and Clift (2009) examined the relationship between gender diversity and firm performance on top 500 Australian and indicate that there is no statistically significant association between ROA, ROE and shareholder return with the percentage of woman members on the board. They conclude that there is no strong relationship between gender diversity on the board and financial performance based on two reasons, firstly there are very few woman on the boards which is insufficient to give the benefit of womans talents on the board. Secondly, women representation is probably assumed to be only a process of socialisation and consequently, the contribution of woman directors on firms performance has never been realized on the boards (Rose, 2007). This argument is sup ported by Marimuthu and Kolandaisamy (2009) who argue that the effect of gender diversity is only for a short run and woman did not play the main role to contribute to the firm. Their study on Top 100 Public Listed Companies in Malaysia on gender effect among the board members did not turn out to be significant with regard to ROA and ROE. Even though the results are contradicting and the positive or negative impact of woman directors is still undetermined, most of the studies on relationship between gender diversity and performance suggest that woman directors have positive impact on board performance (Radlach et al., 2008). For example, Carter et al. (2007) used all firms listed on the U.S Fortune 500 over the periods of 1998-2002 which result in 152

KONAKA 2013 approximately 2,000 firm-years data to investigate the effects of gender diversity on firm performance. The result supports that gender diversity in board committees appears to influence positively on the financial performance by increasing value for shareholders particularly through the audit function. Consistently, Bathula (2008) did a study based on data of firms listed on New Zealand Stock Exchange constitute of four years from 2004 to 2007, support the argument that gender diversity leads to enhance firm performance. Their finding provides evidence to stakeholder perspective and resource dependency perspective that diversity is beneficial to firms and suggests that women directors have the probability to bring their point of views more effectively in a smaller board rather than in a larger board. In addition, previous study suggests presence of gender diversity in the board contributes to enhance firm performance.

Research Framework

This study analyzes board characteristics; gender which represents the diversity of the boards and its relationship with both ROA and ROE as firm financial performances. The study also takes into account the firms size and industry types as control variables to avoid firms performance being influenced by other factors. Then, the research framework is designed to illustrate the relationship between dependent and control variables with the firm performance. Figure 1: The effects of gender diversity on firm financial performance. INDEPENDENT VARIABLE Gender Diversity DEPENDENT VARIABLES ROA ROE

CONTROL VARIABLES Firm Size Firm Industry

Figure 1 outlines the research framework for this study. Based on research framework, this study attempts to examine the relationship between the gender diversity of the board with ROA and ROE. It is expected that gender diversity has a positive relationship with both ROA and ROE. The study also includes two control variables which are the firms size and firm industry to prevent the effect of other factors that would probably influence firms performance and to avoid biased results on the relationship.

Hypotheses Development

Previous studies on board diversity shows mixed results for the relationship between gender diversity in the board of director and firms performance. Marimuthu and Kolandaisamy (2009) assert that the impact of gender diversity among the board members is found to be not significant with regard to financial performance. They conclude that womans role is not felt in the board composition. In fact, the effect is only for a short run. Similarly, Wang and Clift (2009) indicate that there is no statistically significant relationship between firms performance which is ROA, ROE and shareholders return with gender diversity in the board. The reason is the very small number of women in the board is insufficient to deliver a critical impact and the advantages of womens talents to the board. However, most studies find a positive result on the association between gender diversity in board and firms performance. Campbell and Vera (2008) argue that gender diversity in BODs has a positive impact on firms value. They suggest that, the most important focus for Spanish companies should be the balance between women and men in board rather than simply having the presence of women. They find that investors

153

KONAKA 2013 in Spain do not penalise firms which increase their woman board membership, in fact, investors expect that greater gender diversity in board may generate economic benefits. Furthermore, Vera and Martinez (2010) who studies gender diversity in SMEs board of director find that gender diversity in BODs has a positive effect on firms performance. They indicate that womans representation on the boards creates an advantage for the firms and contribute to benefits on work groups such as variety of alternatives, opinions and strategies that able to overcome the problems of integration as well as slowness and difficulties in decisions making process. On the other hand, Carter et al. (2007) find that gender diversity in BODs has a positive effect on the financial performance particularly in audit committees. The result shows that gender diversity among board members appear to create value for shareholders. Finally, board with diverse gender has more alternatives to employ in decision making process (Vera and Martinez, 2010) and this variation may improve the appearance of the firm which positively affect the customers view and perception of the firm and contribute to a better performance (Pohjanen et al., 2010). Therefore, these arguments have been used to develop hypotheses that support a strong correlation between gender diversity in BODs and firms financial performance: H1 : Gender diversity among board members is positively related with firms performance.

Research Methodology

Sample Selection The sample consists of Government Linked Companies (GLCs) and non-Government-Linked Companies (non-GLCs) listed on Bursa Malaysia over the periods 2007 until 2010. The list of GLCs was obtained from the Ministry of Finance (MOF) website; (http://www.malaysiaco.com/government-linked-company). For the purpose of the study, only listed companies and other than financial companies on Bursa Malaysia are being selected while the remaining of not listed and financial firms are being excluded. The selection of nonfinancial companies is important to control the heterogeneous characteristics of the companies selected (Marimuthu and Kolandaisamy, 2009). The list of listed GLCs in Bursa Malaysia was obtained from the website of Putrajaya Committee on GLCs High Performance (PCG); (http://www.pcg.gov.my/trans_manual.asp). It states that the total listed GLCs in Malaysia are 33 companies as at 13 March 2009. Thus, after excluding 7 listed financial companies, it leaves a balance of 26 listed GLCs companies for this study. Since the purpose of the study is to make a comparison between GLCs and non-GLCs, another 26 non-GLCs have been selected from companies listed on Bursa Malaysia in order to match them with GLCs. The complete data of this study initially consist of 208 samples generated from each 26 GLCs and 26 non-GLCs for four-year period from 2007 to 2010 (104 samples of GLCs and 104 samples of non-GLCs). However, due to unavailability of important data to perform this study from several firms annual report, the number was reduced to a final sample of 203 firms constitutes of 102 samples of GLCs and 101 non-GLCs as shown in Table 1: Table 1: Firms by industry GLCs Trading/services 56 Plantation 8 Consumer products 12 Industrial Products 12 Technology 3 Construction 4 IPC 4 Properties 3 Total 102 Non-GLCs 54 8 12 11 4 4 4 4 101

Valid

Data Collection The data for this study comes from multiple sources of secondary data. The primary sources of this study are extracted from companys annual report downloaded from Bursa Malaysia website. The information 154

KONAKA 2013 regarding the gender of the board was collected from the companys annual report as to further examine the gender diversity in board. In addition, financial databases namely DataStream and OSIRIS were used in order to complete our data regarding the size, performances and the financial ratios of the firms. Data on the independent variables represented by the board characteristics consist of gender, ethnic, education and tenure diversity was obtained from the annual report for each company through content analysis. For control variables, the firms size was collected from the OSIRIS which explains the total assets of the firm while types of firms industries were classified in reference to Bursa Malaysia. Variable Measurement In this study, the general multivariate model is used as the basis of empirical analysis for testing the hypotheses. The hypothesized relationships are modelled as follows: Model 1: GLCs LogROAt LogROEt = = 0 + 1gendert + 5CFirmSizet + 6Industryt + t 0 + 1gendert + 5CFirmSizet + 6Industryt + t

Model 2: Non-GLCs LogROAt LogROEt = 0 + 1gendert + 5CFirmSizet + 6Industryt + t = 0 + 1gendert + 5CFirmSizet + 6Industryt + t

All variables included in this study are measured as shown in Table 2: Table 2: Measurement of variables Measurements Literatures

Variables Dependent variables Financial performance : 1) Return on asset (ROA) 2) Return on equity (ROE)

Net Income divided by total asset

Marimuthu and Kolandaisamy (2009)

Net Income divided by total equity. Marimuthu and Kolandaisamy (2009) Pohjanen et al. (2010) Ratio scale: Woman directors divided by total board directors. Marimuthu and Kolandaisamy (2009) Pohjanen et al. (2010)

Independent Variables 1) Gender diversity

Control Variables 1) Firm size :

Approximated by the natural logarithm of total assets. Control for industry with a dummy variable. Industry dummy for property, construction, trading and services, consumer product, infrastructure, plantations, industrial product and technology. Measured as dummy variable taking the value of 1 if the firm belongs to a particular industry, otherwise 0.

2) Firm Industry :

Ees, Postma and Sterken (2003) Campbell and Vera (2008) Carter et al. (2007) Post et al. (2011) Ehikioya (2007)

155

KONAKA 2013

Data Analysis The multiple regression was used to test the hypotheses. By using Statistical Package for Social Science (SPSS), this study examines whether or not there is a significant relationship between gender diversity in board and both ROA and ROE.

Findings and Discussions

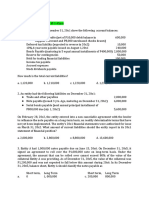

To analyze the result, statistical tools employed for this study are descriptive statistics, Independent sample ttest, Kolmogorov-Smirnov test, Pearson correlation and multiple regressions.Firstly, all the variables are explained by descriptive statistical tests which involved descriptive statistic test for the numerical variables (gender diversity, total assets, return on assets and return on equity); and frequency statistic test for the categorical variable (firm industry). The results are shown in Table 3. Table 3: Descriptive Statistic test for numerical variables N Range Minimum Maximum Gender Diversity Total Assets (Firms size) Return on Assets Return on Equity Industry GLCs NonGLCs GLCs NonGLCs GLCs NonGLCs GLCs NonGLCs GLCs NonGLCs 102 101 102 101 102 101 102 101 102 101 .38 .33 74,021,874 262,000,000 74.62 81.82 125.35 244.34 7 7 .00 .00 59,226 190,870 -41.21 -9.13 -63.00 -28.66 1 1 .38 .33 7,4081,100 262,000,000 33.41 72.69 62.35 215.68 8 8 Mean .10 .06 1,1420294 8,381,384 7.34 7.63 11.10 14.80 2.42 2.51 Std Deviation .10 .09 1,653,9659 32,179,119 8.15 13.49 13.11 35.16 1.98 2.07

From Table 3, first of all, with regard to gender diversity, the statistics show the mean is 0.10 for GLCs ranging from a minimum of 0 to a maximum of 0.38 which explains that the average percentage of woman on board is just near 10 percent. The average for gender diversity in Non-GLCs is 0.06 at a minimum of 0 to a maximum of 0.33 which is lower than GLCs. Next, for total assets, looking at the maximum and minimum amount in both GLCs and Non-GLCs, the results generally showed a huge difference in firms size. On the other hand, the result for the dependent variables shows the average ROA and ROE for GLCs are 7.34 and 11.10 respectively. These indicate that the mean for ROA is below the mean of ROE. The average ROE for non-GLCs is 7.63 and 14.80 for ROA. Similar result with GLCs, the mean for ROA is also below the mean of ROE. Meanwhile, for the firm industry variable, we can see that there is not much difference between the mean for GLCs (2.42) and Non-GLCs (2.51).Next, Table 4 reports the significant difference of mean variance for ROA and ROE between GLCs and non-GLCs, as performed by the independent-sample t-test. The t-test results show that there are no significant differences in the mean value of ROA and ROE in both GLCs and Non-GLCs. Table 4: T-test for mean comparison of ROA and ROE between GLCs and Non-GLCs Mean difference t-stat P-value Variable ROA -.284 -.181 .856 ROE -3.70 -.994 .321

Note: Grouping variable: (GLC assigned value of 1, non-GLC, assigned value of 2) ***Significance at 0.01 level; **Significance at 0.05 level; *Significance at 0.10 level

156

KONAKA 2013

Further, correlation analysis test is used to determine linearity of relationship (Magpayo,2007) and describe the strength as well as the direction of the linear relationship. Table 5 reports the correlations between the variables used in the regressions for GLCs and non-GLCs. From the result, it shows that for GLCs, there is no significant relationship between independent variable, i.e. gender diversity and the dependent variables, i.e. ROA and ROE. Yet, the result shows a significant negative correlation at 5% level between the two variables (-.28 and -.22 respectively) in Non-GLCs. Nonetheless, there are highly significant positive correlations at 1% level between ROA and ROE as a measure for firms performance in both GLCs (.80) and Non-GLCs (.96). Table 5: Pearson Correlation Test for both GLCs and Non-GLCs Gender Total Assets Firm Industry ROA Diversity GLCs Gender Diversity Total Assets Firm Industry ROA ROE 1 .26** -.23** -.19 -.14 NonGLCs 1 .05 .20* -.28* -.22* GLCs .26** 1 -.35** -.07 .01 NonGLCs .05 1 -.06 -.004 -.02 GLCs -.23* -.35** 1 -.30** -.36** NonGLCs -.20* -.06 1 -.03 -.004 GLCs -.19 -.07 -.30** 1 .80** NonGLCs -.28* -.004 -.03 1 .96**

ROE GLCs -.14 .013 -.36** .80** 1 NonGLCs -.22* -.02 -.004 .96** 1

Finally, multiple regression analysis is conducted to test the hypothesis developed in this study. To ensure a valid model being performed in this study, the natural log of ROA and natural log of ROE are regressed separately on the independent and control variables. Data transformation using natural logarithm is being used to have a normal data distribution for ROA and ROE. Table 6 and 7 reported the statistical results for Model 1 and Model 2. Table 6: Regression results for Model 1: GLCs (N=102) Unstandardized LogROA (t-stat) Unstandardized Coefficient Beta Coefficient Beta 2.52 -1.39 -1.06 -.14 16.42*** -2.05** -2.45** -3.64*** 14.2% 6.176 (0.001) 3.01 -1.37 -8.24 -.15

Variables (Constant) Gender Diversity Total Assets Firm Industry Adjusted r

2

LogROE (t-stat) 21.79** -2.24** -2.12** -4.27*** 17.1% 7.278 (0.000)

F-Statistic(P-value)

Notes: *** Significant at the 0.01 level; ** Significant at the 0.05 level; and * Significant at the 0.10 level

Based on Table 6, the adjusted r2 values indicate that independent and control variables in GLCs contributed about 14.2% to changes in ROA and 17.1% to ROE. Then, in order to observe the overall significance of the model, F-test is conducted by using Analysis of Variance (ANOVA). From the result in Table 6, the F-ratio value of 6.176 and 7.278 are significant at 1% indicating that at least one of the explanatory variables in Model 1 has an effect on the dependent variables, i.e. ROA and ROE. Furthermore, the results show significant negative results at 5% level between gender diversity and firms performance , i.e. ROA (-2.05) and ROE (-2.24). Next, based on Table 7, the adjusted r2 values showed that independent and control variables in NonGLCs contributed about 26.5% to changes in ROA and 13.7% to ROE. The F-ratio value of 11.715 and 5.385 are both significant at 1% level % indicating that at least one of the explanatory variables in Model 2 has an effect on the dependent variables, i.e. ROA and ROE. In addition, again, the results appear the same significant negative results in Non-GLCs, but at 1% level between gender diversity and firms performance, i.e. ROA (-5.37) and ROE (-3.98). Hence, despite its significance on both models, it shows the opposite sign 157

KONAKA 2013 than what has been expected from this study. Thus, the regression results for both model 1 and 2 rejected the hypothesis, H1, i.e. Gender diversity among board members is positively related with firms performance. Table 7: Regression results for Model 2: Non-GLCs (N=101) Unstandardized LogROA (t-stat) Unstandardized Coefficient Beta Coefficient Beta 2.04 -7.41 3.23 -.07 10.63*** -5.37*** .95 -1.19 26.5% 11.715 (0.000) 2.43 -6.13 3.11 .01

Variables (Constant) Gender Diversity Total Assets Firm Industry Adjusted r

2

LogROE (t-stat) 11.52*** -3.98*** .87 .16 13.7% 5.385 (0.002)

F-Statistic(P-value)

Notes: *** Significant at the 0.01 level; ** Significant at the 0.05 level; and * Significant at the 0.10 level

Conclusion

This study attempts to examine the relationship between gender diversity and the firms performance. A research was performed to give a thorough explanation of how gender diversity in board affects firm performance measured as return on equity (ROE) and return on assets (ROA). The study was conducted in Malaysia using 26 GLCS and 26 non-GLCs listed on Bursa Malaysia over the years 2007 until 2010. The results showed that Non-GLCs exhibit more negative impact with regard to the relationship between gender diversity in board and firms performance, even after controlling firms specific factors such as firms size and industry. The results indicate that significant relationships are found between gender diversity and firms performance, i.e. ROA and ROE for both GLCs (at 5% level) and Non-GLCs (at 1 percent level). Surprisingly, these significant results show a negative relationship on firms performances. The finding is totally against the hypothesis developed in this study which suggests that gender diversity in board have positive impact on firm performances. It is believed that the reason for this is related to the small number of women directors in board. Similar to other countries such as Sweden (Pohjanen et al., 2010), Spain (Campbell and Vera, 2008), Malaysian large-cap firms have minimal womans participation in the board which is not enough to give the board a critical impact or the advantages of womens involvement (Wang and Clift, 2009) in Malaysian firm. As for the conclusion, the finding suggests that homogeneity in gender have more competitive advantage rather than heterogeneity among board members. It could be that man and woman may have varied opinions to manage a firm which can lead to conflicts and lower the firms performance. However, the results may be affected by the small average samples of gender diversity which indicate that the composition of women directors in the board is unbalanced and dominated by men directors. If Malaysian firms have higher level of gender diversity in the board to be used as sample in this research, it may result in different findings such as increase performance as had been showed by previous study (Carter et al., 2007; Campbell & Vera, 2008). Recently, the announcement made by the Prime Minister that the Cabinet has now approved a policy that women must comprise at least 30% of those in decision-making positions in the corporate sector by 2016 (Nik Anis, 2011) can be seen as the first step to develop and encourage more diversity in the corporate board. Additionally, the new policy that women must comprise at least 30% by 2016 in decisionmaking positions executed by the Government is seen as a wise action and this policy should be supported and assisted by regulatory bodies to ensure that firms in Malaysia are in line with the policy. Recommendations for Future Research There is a lot of other areas and extensions that could be possible for future research. This study could be replicated by considering other board characteristics variables such as ethnicity, education, tenure, age and religion of the directors in the board. It would be interesting to know the impact on those diverse variables on the firms performance. In addition, future research may consider employing different formulas to measure the firms performance instead of financial performances such as ROE and ROA. As Bursa Malaysia views 158

KONAKA 2013 corporate social responsibility (CSR) as an integral part towards being an internationally competitive marketplace, it would be very useful to find whether the CSR of the firms is influenced by the diversity of the board. Furthermore, future research should be extended by taking newly updated list of GLCs. Lastly, future research may also focus on all GLCs regardless of listed or non-listed in Bursa Malaysia. Due to their unique features and policies, there is a probability that the result will contribute to better governance practices in GLCs and provide value added feature to regulators as well as Malaysian Government as a major institutional ownership.

References

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94, pp. 291-309. Bathula, H.(2008). Board characteristics and firm performance: evidence from New Zealand. Unpublished PHD thesis, Auckland University of Technology. Campbell, K., & Vera, A. M. (2008). Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics. 83, pp. 435451. Carter, D. A., DSouza F., Simkins B. J., & Simpson W. G.(2007). The diversity of corporate board committees and financial performance. Working paper series. Available at SSRN: http://ssrn.com/abstract=1106698. Chien, A.(2008). The effect of board characteristics on foreign ownership: Empirical evidence from Taiwan. International Research Journal of Finance and Economics, (22), pp. 1450-2887. Coffey, B.S., & Wang, J.(1998). Board diversity and managerial control as predictors of corporate social performance. Journal of Business Ethics, (17), pp. 15951603. Cuomo, S., Mapelli, A., Paolino, C., & Simonella, Z. (2009). The different facets of diversity in boards of directors and their impact on firm performance. Dir Research Project 2009, pp. 1-15. Dahlin, K. B., Weingart, L. R., & Hinds, P. J.(2005). Team diversity and information use. Unpublished Research. Dalton, D.R., & Dalton, C.M.(2010). Women and corporate boards of directors: The promise of increased, and substantive, participation in the post Sarbanes-Oxley era. Business Horizons, 53, pp.257-268. Ees, H. V., Postma, T. J., & Sterken, E.(2003). Board characteristics and corporate performance in the Netherlands. Eastern Economic Journal, 29 (1), pp. 41-58. Ehikioya, B. I. ( 2007). Corporate governance structure and firm performance in developing economies: evidence from Nigeria. Corporate Governance, 9(3), pp. 231-243. Kennon, J. (2011). The board of directors responsibility, role, and structure. Retrieved from http://beginnersinvest.about.com/cs/a/aa2203a.htm (accessed 7 April 2011). Khazanah Nasional Berhad. (2011). GLCs and GLCs Transformation System. Retrieved from http://www.khazanah.com.my/faq.htm (accessed 7 March 2011). Putrajaya Committee on GLCs High Performance (PCG). List of listed GLCs as at 31 March 2009. Retrieved from http://www.pcg.gov.my/trans_manual.asp (accessed 29 July 2011). Malaysia Co. Government linked companies. Retrieved from http://www.malaysiaco.com/government- linked-company (accessed 7 March 2011).

159

KONAKA 2013 Marimuthu, M., & Kolandaisamy I. (2009). Can demographic diversity in top management team contribute for greater financial performance? An empirical discussion. The Journal of International Social Research, 2(8), pp. 273-286. Marimuthu, M., & Kolandaisamy, I. (2009). Ethnic and gender diversity in boards of directors and their relevance to financial performance of Malaysian companies. Journal of Sustainable Development, 2(3), pp. 139-148. McIntyre, M. L., Murphy, S. A., & Mitchell, P. (2007). The top team: Examining board composition and firm performance. Corporate Governance, 7(5), pp. 547-561. Nik Anis, M.(2011). PM: 30% of corporate decision-makers must be women. The Star Online.Retrieved from http://thestar.com.my/news/story.asp?file=/2011/6/27/nation/20110627131533&sec=nation. Pohjanen, B., Bengtsson, D., & Smith, E.(2010). Return on diversity? A study on how diversity in board of directors and top management teams affects firm performance. Unpublished bachelor thesis, Kristianstad University College, pp. 1- 107. Post, C., Rahman, N., & Rubow, E.(2011). Green governance, board of director composition and environmental corporate social responsibility. Business & Society, 50(1) pp. 189-223. Radlach, P., Schlemmbach, K., & Smith, E.(2008). The board of directors and its influence on risk propensity and firm performance : An empirical study of their relations in the banking sector. Unpublished Master Dissertation, Kristianstad University College, pp. 1-88. Rose, C.(2007). Does female board representation influence firm performance? The Danish evidence. Corporate Governance: An International Review, 15(2), pp. 404-13. Siciliano, J. I. (1996). The relationship of board member diversity to organizational performance. Journal of Business Ethics,15(12), pp. 1313-1320. Vera, A. M., & Martinez, R. P.(2010). Female directors and SMEs: An empirical analysis. Journal of Global Strategic Management, 8, pp. 34-46. Wang, Y., & Clift, B.(2009). Is there a business case for board diversity?. Pacific Accounting Review, 21(2), pp. 88-103. Zee, A.V.D., & Swagerman, D.(2009). Upper echelon theory and ethical behaviour : An illustration of the theory and a plea for its extension towards ethical behaviour. Journal of Business System, Governance and Ethics, 4(2), pp. 27-43. ______________________________________________________________________________________ MOHD FAIRUZ BIN ADNAN, NURSHAMIMI BT SABLI. Universiti Teknologi MARA (Pahang). fairuz@pahang.uitm.edu.my, nurshamimi@pahang.uitm.edu.my. AZIZAH BT ABDULLAH. Universiti Teknologi MARA Shah Alam, azizahabd@hotmail.com.

160

Das könnte Ihnen auch gefallen

- Inovasi 1-Fermented Weed Juice As Catalyzer On Growth and Yield (Muhammad Amir Shah Yusop) PP 241-246Dokument6 SeitenInovasi 1-Fermented Weed Juice As Catalyzer On Growth and Yield (Muhammad Amir Shah Yusop) PP 241-246upenapahangNoch keine Bewertungen

- 32.antibacterial Activities of Terminalia Catappa Leaves Againsts (Noorshilawati Abdul Aziz) PP 225-229Dokument5 Seiten32.antibacterial Activities of Terminalia Catappa Leaves Againsts (Noorshilawati Abdul Aziz) PP 225-229upenapahangNoch keine Bewertungen

- 34.properties of Wood Plastic Composites (WPC) From Batai SPP (Paraserianthes Falcataria) (Jamaludin Kasim) PP 234-240Dokument7 Seiten34.properties of Wood Plastic Composites (WPC) From Batai SPP (Paraserianthes Falcataria) (Jamaludin Kasim) PP 234-240upenapahangNoch keine Bewertungen

- Respondent Based Fuzzy Numbers in Fuzzy Decision Making (Fairuz Shohaimay) PP 206-211Dokument6 SeitenRespondent Based Fuzzy Numbers in Fuzzy Decision Making (Fairuz Shohaimay) PP 206-211upenapahangNoch keine Bewertungen

- 30.factor Converting To Organic Farming in Malaysia (Anisah Mohammed) PP 212-217Dokument6 Seiten30.factor Converting To Organic Farming in Malaysia (Anisah Mohammed) PP 212-217upenapahangNoch keine Bewertungen

- Owth and Yield Performances of (Abelmoschus Esculentus) (Nur Suraya Abdullah) PP 230-233Dokument4 SeitenOwth and Yield Performances of (Abelmoschus Esculentus) (Nur Suraya Abdullah) PP 230-233upenapahangNoch keine Bewertungen

- 31.relationship of Board Density (Jamaludin Kasim) PP 218-224Dokument7 Seiten31.relationship of Board Density (Jamaludin Kasim) PP 218-224upenapahangNoch keine Bewertungen

- 26.preliminary Study On The Impact of Flow Rate and Sediment Load To The Geometry Formation of Meanders (Noor Safwan Muhamad) PP 181-190Dokument10 Seiten26.preliminary Study On The Impact of Flow Rate and Sediment Load To The Geometry Formation of Meanders (Noor Safwan Muhamad) PP 181-190upenapahangNoch keine Bewertungen

- 18.study On Drying of Oil Palm Trunk With Ethanol (Fauzi Othman) PP 127-133Dokument7 Seiten18.study On Drying of Oil Palm Trunk With Ethanol (Fauzi Othman) PP 127-133upenapahangNoch keine Bewertungen

- Owth and Yield Performance of Pegaga (Centella Asiatica) (Nur Masriyah Hamzah) PP 163-168Dokument6 SeitenOwth and Yield Performance of Pegaga (Centella Asiatica) (Nur Masriyah Hamzah) PP 163-168upenapahangNoch keine Bewertungen

- Social Forestry Malaysia Experience (Aminuddin Mohammad) PP 202-205Dokument4 SeitenSocial Forestry Malaysia Experience (Aminuddin Mohammad) PP 202-205upenapahangNoch keine Bewertungen

- 19.physical Activity and Health-Related Quality of Life Among Staff in UiTM Pahang (Wan Mohd Norsyam Wan Norman) PP 134-139Dokument6 Seiten19.physical Activity and Health-Related Quality of Life Among Staff in UiTM Pahang (Wan Mohd Norsyam Wan Norman) PP 134-139upenapahangNoch keine Bewertungen

- Exploring Mathematics Anxiety Among Computer Science Students (Rizal Razak) PP 158-162Dokument5 SeitenExploring Mathematics Anxiety Among Computer Science Students (Rizal Razak) PP 158-162upenapahangNoch keine Bewertungen

- Parison of Antioxidant Activity in Tea Drinks Using FRAP Assay (Sharifah Nor Hafizai) PP 175-180Dokument6 SeitenParison of Antioxidant Activity in Tea Drinks Using FRAP Assay (Sharifah Nor Hafizai) PP 175-180upenapahangNoch keine Bewertungen

- 21.physiological Responses and Adaptations To Exposure From Moderate To Extreme Altitude (Adam Feizrel Linoby) PP 152-157Dokument6 Seiten21.physiological Responses and Adaptations To Exposure From Moderate To Extreme Altitude (Adam Feizrel Linoby) PP 152-157upenapahangNoch keine Bewertungen

- Effects of Screened Particle Sizes and Wood Polypropylene Mixing (Nurrohana Ahmad) PP 70-73Dokument4 SeitenEffects of Screened Particle Sizes and Wood Polypropylene Mixing (Nurrohana Ahmad) PP 70-73upenapahangNoch keine Bewertungen

- 20.synthesis of Fe-Salen-MCM-41 Hybrid Catalysts (Syuhada Mohd Tahir) PP 140-151Dokument12 Seiten20.synthesis of Fe-Salen-MCM-41 Hybrid Catalysts (Syuhada Mohd Tahir) PP 140-151upenapahangNoch keine Bewertungen

- Adsorption of Methylene Blue Onto Xanthogenated-Modified Chitosan Microbeads (Zurhana Mat Hussin) PP 119-126Dokument8 SeitenAdsorption of Methylene Blue Onto Xanthogenated-Modified Chitosan Microbeads (Zurhana Mat Hussin) PP 119-126upenapahangNoch keine Bewertungen

- Determination of Metals Concentrations and Water Quality Status Along Ulu Jempul River (Siti Norhafiza Mohd Khazaai) PP 26-34Dokument9 SeitenDetermination of Metals Concentrations and Water Quality Status Along Ulu Jempul River (Siti Norhafiza Mohd Khazaai) PP 26-34upenapahangNoch keine Bewertungen

- Digit Ratio (2D-4D) Profile of Varsity Rugby Players (Mohd Zulkhairi Mohd Azam) PP 103-107Dokument5 SeitenDigit Ratio (2D-4D) Profile of Varsity Rugby Players (Mohd Zulkhairi Mohd Azam) PP 103-107upenapahangNoch keine Bewertungen

- 14.ergonomic Workstation Design For Science Laboratory (Norhafizah Rosman) PP 93-102Dokument10 Seiten14.ergonomic Workstation Design For Science Laboratory (Norhafizah Rosman) PP 93-102upenapahangNoch keine Bewertungen

- 3.the Effects of Five Different Types of Planting Medium On The Growth Performance of Chilli (Fazidah Rosli) PP 10-17Dokument8 Seiten3.the Effects of Five Different Types of Planting Medium On The Growth Performance of Chilli (Fazidah Rosli) PP 10-17upenapahangNoch keine Bewertungen

- Effect of Casting Rate On The Development of Polysulfone Flat Sheet Ultrafiltration Membrane For The Aluminium Removal (Siti Hawa Rosli) PP 42-46Dokument5 SeitenEffect of Casting Rate On The Development of Polysulfone Flat Sheet Ultrafiltration Membrane For The Aluminium Removal (Siti Hawa Rosli) PP 42-46upenapahangNoch keine Bewertungen

- 12.study On The Removal of PB (II) Ions From Aqueous Solution Using Chemically Modified Corn Cob. (Siti Raihan Zakaria) PP 74-81Dokument8 Seiten12.study On The Removal of PB (II) Ions From Aqueous Solution Using Chemically Modified Corn Cob. (Siti Raihan Zakaria) PP 74-81upenapahangNoch keine Bewertungen

- 10.implementing IT Security Penetration Testing in Higher Education Institute (Zulazeze Sahri) PP 63-69Dokument7 Seiten10.implementing IT Security Penetration Testing in Higher Education Institute (Zulazeze Sahri) PP 63-69upenapahangNoch keine Bewertungen

- 9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62Dokument6 Seiten9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62upenapahangNoch keine Bewertungen

- 6.analysis and Managementof Methane Emissions From Dumping Pond A Cases Study at FeldaJengka 8 Palm Oil Mill (Khairuddin MN) PP 35-41Dokument7 Seiten6.analysis and Managementof Methane Emissions From Dumping Pond A Cases Study at FeldaJengka 8 Palm Oil Mill (Khairuddin MN) PP 35-41upenapahangNoch keine Bewertungen

- 2.VO2max Status of Universiti Teknologi MARA Pahang Football Players (Pahang Tigers) During New Competitive Season 2013 (Sufyan Zaki) PP 6-9Dokument4 Seiten2.VO2max Status of Universiti Teknologi MARA Pahang Football Players (Pahang Tigers) During New Competitive Season 2013 (Sufyan Zaki) PP 6-9upenapahangNoch keine Bewertungen

- The Effects of Shade Levels and Additional Calcium Nitrate On The Morphology of Cyrtandra Bracheia B.L. Burt (Siti Maslizah) PP 18-25Dokument8 SeitenThe Effects of Shade Levels and Additional Calcium Nitrate On The Morphology of Cyrtandra Bracheia B.L. Burt (Siti Maslizah) PP 18-25upenapahangNoch keine Bewertungen

- Hypoglycemic Effect of Parkia Speciosa, Leucaena Leucocephala and Laurus Nobili in Oral Glucose-Loaded Rats (Siti Suhaila Harith) .PP 1-5Dokument5 SeitenHypoglycemic Effect of Parkia Speciosa, Leucaena Leucocephala and Laurus Nobili in Oral Glucose-Loaded Rats (Siti Suhaila Harith) .PP 1-5upenapahangNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Summary-AHM 510 PDFDokument70 SeitenSummary-AHM 510 PDFSiddhartha KalasikamNoch keine Bewertungen

- Chapter 6 Mental AccountingDokument6 SeitenChapter 6 Mental AccountingAbdulNoch keine Bewertungen

- Punjab National Bank - WikipediaDokument11 SeitenPunjab National Bank - WikipediaJayaNoch keine Bewertungen

- A Formal Language For Analyzing Contracts - Nick Szabo - Prelim Draft From 2002Dokument27 SeitenA Formal Language For Analyzing Contracts - Nick Szabo - Prelim Draft From 2002John PNoch keine Bewertungen

- Kinh Do Group Corporation (KDC) : Relentless Business ExpansionDokument6 SeitenKinh Do Group Corporation (KDC) : Relentless Business ExpansionSujata ShashiNoch keine Bewertungen

- Chapter 14Dokument43 SeitenChapter 14Dominic RomeroNoch keine Bewertungen

- 335872Dokument7 Seiten335872pradhan13Noch keine Bewertungen

- Bitong v. CADokument36 SeitenBitong v. CAReemNoch keine Bewertungen

- General Power of AttorneyDokument1 SeiteGeneral Power of AttorneyAriel Hartung100% (1)

- Mahusay Acc227 Module 4Dokument4 SeitenMahusay Acc227 Module 4Jeth MahusayNoch keine Bewertungen

- Accounting For Lawyers Notes, 2022Dokument114 SeitenAccounting For Lawyers Notes, 2022Nelson burchard100% (1)

- V LO Wroclaw Sprawdzian Kompetencji Jezykowych 2020 PDokument11 SeitenV LO Wroclaw Sprawdzian Kompetencji Jezykowych 2020 PARKINoch keine Bewertungen

- Study Material INVESMATE (English)Dokument80 SeitenStudy Material INVESMATE (English)Achyut KanungoNoch keine Bewertungen

- Mergers, Acquisitions and RestructuringDokument34 SeitenMergers, Acquisitions and RestructuringMunna JiNoch keine Bewertungen

- The Role of ESG Scoring and Greenwashing Risk in Explaining The Yields of Green Bonds - A Conceptual Framework and An Econometric AnalysisDokument16 SeitenThe Role of ESG Scoring and Greenwashing Risk in Explaining The Yields of Green Bonds - A Conceptual Framework and An Econometric AnalysisEdna AparecidaNoch keine Bewertungen

- Test 2 FarDokument3 SeitenTest 2 FarMa Jodelyn RosinNoch keine Bewertungen

- Court Rules Expropriation for Private Subdivision Not Valid Public UseDokument489 SeitenCourt Rules Expropriation for Private Subdivision Not Valid Public UseNico FerrerNoch keine Bewertungen

- Lesson 1.6 Compound InterestDokument103 SeitenLesson 1.6 Compound Interestglenn cardonaNoch keine Bewertungen

- 3 Accounting Cycle UDDokument13 Seiten3 Accounting Cycle UDERICK MLINGWANoch keine Bewertungen

- Curriculum Vitae OF Munyaradzi Mare Makwate Village, Mahalapye, BotswanaDokument7 SeitenCurriculum Vitae OF Munyaradzi Mare Makwate Village, Mahalapye, BotswanaAnonymous 4RLKj1Noch keine Bewertungen

- Global Employer Branding PDFDokument32 SeitenGlobal Employer Branding PDFIuliana DidanNoch keine Bewertungen

- ICICI Balanced Advantage Fund - One PagerDokument2 SeitenICICI Balanced Advantage Fund - One PagerjoycoolNoch keine Bewertungen

- Project of Company LawDokument22 SeitenProject of Company LawHimanshu ChaudharyNoch keine Bewertungen

- 1.4 Partnership Liquidation - 1Dokument4 Seiten1.4 Partnership Liquidation - 1Leane Marcoleta100% (2)

- Oct 3rd Week Details (Eng) by AffairsCloudDokument27 SeitenOct 3rd Week Details (Eng) by AffairsCloudAniket ZunkeNoch keine Bewertungen

- Vizco, Krizia Mae H.Dokument11 SeitenVizco, Krizia Mae H.Meng VizcoNoch keine Bewertungen

- Stock Exchange in India OverviewDokument72 SeitenStock Exchange in India OverviewRizwana BegumNoch keine Bewertungen

- Guidelines For Withdrawal PDFDokument3 SeitenGuidelines For Withdrawal PDFMary LeandaNoch keine Bewertungen

- Financial AnalysisDokument12 SeitenFinancial AnalysisShubham BansalNoch keine Bewertungen