Beruflich Dokumente

Kultur Dokumente

Financial Statement

Hochgeladen von

Ahmad Fauzi MehatCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Statement

Hochgeladen von

Ahmad Fauzi MehatCopyright:

Verfügbare Formate

State Bank of India (California)

Annual Disclosure Statement

In accordance with FDIC Law, Regulations, Related Acts Part 350 - Disclosure of Financial and Other Information by FDICInsured State-Chartered Banks that are not members of the Federal Reserve System, State Bank of India (California) (the Bank)

is required to prepare, and make available annual disclosure statements of the Bank's financial condition for the financial years

ending March 31, 2011 and 2010.

The included statements consist of the Bank's Bar~nce sheets, Statements of Income, Statements of Comprehensive Income,

Statements of Changes in Stockholder's Equity, Changes in Allowance for Loan and Lease Losses and Past due and Non Accrual

Loans, leases, and Other Assets.

Disclaimer: This Statement has not been reviewed, or confirmed for accuracy or relevance, by the Federal Deposit Insurance

Corporation.

I hereby attest that the aforementioned statements included in this financial disclosure (appended below) are, to the best of my

knowledge, correct and complete.

~::!y

President and Chief Executive Officer,

State bank of India (California)

707 Wilshire Blvd, Suite 1995,

Los Angeles, CA 90017

STATE BANK OF INDIA (CALIFORNIA)

BALANCE SHEETS FOR YEARS ENDED

MJ~"ch31,

ASSETS

2011

Cash & cash equivalents

Securities available for sale, at fair value

Loans

Allowances

for loan losses

Net Loans

2010

74,286,460

123,325,843

88,561,095

112,601,220

634,289,428

629,667,787

(21,386,oag)

(15,449,364)

612,903,3Q~i

614,218,423

Foreclosed assets held for sale

1,330,000

Furniture, fixtures and equipment, net

2,189,575

1,322,219

Federal Home Loan Bank stock, at cost

3,754,800

4,163,300

Prepaid and recoverable

6,194,492

income taxes

5,456,414

Interest receivable and other assets

Due from Affiliate

489,512

Deferred tax assets - net

AND STOCKHOLDER'S

6,208,267

9,295,5~Q

Total assets

LIABILITIES

7,699,313

804,461,324

611,762,285

869,538,585

EaUITY

Liabilities:

Deposits

Federal Home Loan Bank borrowings

50,650,000

69,250,000

Income taxes payable

151,832

Interest payable and other liabilities

Total liabilities

Commitments

and Contingencies

Stockholder's

Equity:

719,387,885

1,937,3$4

2,735,349

682,949,639

772,925,066

69,500,000

69,500,000

Common stock - $100 par value

Authorized

- 760,000 shares

Issued and outstanding

- @95,OOOshares

To be issued

25,000,000

Additional paid-in capital

Retained earnings

Accumulated

other comprehensive

Total stockholder's

income

equity

Total liabilities and stockholder's

eQuity

1,500,000

1,500,000

24,893,954

23,555,390

617,7~1

2,058,129

121,511.68.5

. 96.613.519

804,461.324

869,538,585

STATE BANK OF INDIA (CALIFORNIA)

STATEMENTS

OF INCOME

For the Years Ended March 31,

2010

2011

Interest

income

Securities

Total interest income

Interest

35,758,596

35,965,103

Interest on Loans

4,126,797

7,669,795

40,091,900

43,428,391

7,095,046

12,729,692

expense

Deposits

797,941

Borrowed Funds

Total interest expense

Net interest

Provision

.1,343,755

<

14.073,447

7,892,987,

29,354,944

32,198,913

income

for loan losses

8,355,017

21 ,524,27J,

10,674,642

20,999,927

Income from foreign currency excHange transactions

1,638,137

1,219,424

Gain on sale of securities avaiiaBie for sale

1,164,565

Net interest

income

Non interest

after provision

for ioan losses

income:

859,616

731,872

3.662,318.

1,951,296

Salaries and employee benefits

6,599,964

4,814,7~7

Occupancy expenses

1.087.360

817,041

381,703

378,733

94,760

73,570

Other non-interest

income

Total non-interest

Noninterest

income

expenses:

Furniture. fixtures and equiomeni expense

Advertising

Expense

Foreclosed assets expense

250.000

FDIC and other deposit assessrrierits

Other operating expenses

Total non-interest

Income

before provision

(Credit)

Provision

3.786,687 ...

3.170,169

expenses

13,479.368

10.601,333

tctx;;';s

1357,592

12,349,890

for income

for income

1,347,063

1,278,894

taxes

4,647,647

(480,972) ...

Net Income

1,338,564

STATEMENTS

OF COMPREHENSIVE

7,702,243

INCOME

For the Years Ended March 31,

2011

Net income

Other comprehensive

income

Income tax credit

Comprehensive

loss

(1055) income

1,338,564

7.702.243

before tax;

Unrealized holding loss arising duHhg period

Other comprehensive

2010

(2,400,663)

(172,227)

(960;265)

(68,891)

(103,336)

(1,440.398) "

(101,834)

7,598,907

STATE BANK OF INDIA (CALIFORNIA)

STATEMSNTS

OF CHANGES IN STOCKHOLDER'S

EQUITY

FOR. THE TWO YEARS ENDED MARCH 31, 2011

Accumulated

Common

Shares

Common

Stock

Other

Additional

~etained

Comprehensive

Paid-In-Capital

Earnings

Income (Loss)

to be

Outstanding

Balance, March 31, 2009

Comprehensive

Stock

issued

695,000 $69,500,000

1,500,000 $15,853,141

2,161,465 s 89,014,612

income:

Net Income

unrealized

7,702,243

7,702,243

Other comprehensive

loss, net change in

gain on securities

available for sale,

net of tax arising during the period

Reclassification

adjustment

Total comprehensive

Comprehensive

(652,644)

(652,644)

549,308

549,30$

income

Balance, March 31, 2010

7,598,907

695,000 $69,500,000

1,500,000 $23,555,390

2,058,129

96,613,si9

income:

Net Income

1,338,564

1,338,564

Other comprehensive

unrealized

Total

loss, net change in

gain on securities

available for sale.

net of tax arising during the period

Reclassification

adjustment

Total comprehensive

loss

Common stock (to be issued)

Balance, March 31, 2011

(2,757,967)

(2,757,967)

1,317,569

1,317,569

(101,834)

25,000,000

25,000,000

69S,000 $69,500,000 $25,000,000

1,500,000 $24,893,954.

617,731 $121,511,685

.'.STATE BANK OF INDIA (CALIFORNIA)

STATEMENT

OF CHANGES

fOR

IN ALLOWANCE

FOR LOAN AND LEASE: LOSSES

THE YEARS ENDED MARCH 31, 2011 and 2010

March 31, 2011

Commercial

Allowance

Commercial

Real Estate

Others

Allowance

Total

Allowance

for Unfunded

Total

For loan losses

Commitments

Allowance

for loan and lease losses

Beginning Balance

Chargeoffs

Recoveries

Ending Balance individually

evaluated for impairment

$11,421,387

(5,534,995)

(10,163,144)

$ 2,681

$ 15,449,364

j

$

Ending Balance collectively

evaluated for impairment

17,156,983

2,970,579

$18,415,226

1,178,724

$12,887,106

2,970,579

163,324

15,612,688

(15,698,139)

33,800

33,800

4,446,478

1,791.1355

(15,698,139)

33,800

Provision

Ending Balance

4,025,296

(2,454)

21,601,007

227

$ 21,386,032

5,528,120

$18,415,226

(76,736)

86,588

$ 14,065,830

227

7,320,202

227

$ 21,386,032

21,524,271

21,472,620

14,065,830

7,406,790

86,588

86,588

21,472,620

March 31, 2010

Commercial

Allowance

Commercial

Real Estate

Others

Allowance

Total

Allowance

for Unfunded

Total

For loan losses

Commitments

Allowance

for loan and lease losses

Beginning Balance

5,936,118

$ 5,324,578

Chargeoffs

(549,018)

(3,548,736)

Recoveries

30,940

Provision

Ending Balance

Ending Balance individually

evaluated for impairment

805

$ 11,261,501

11,324,484

(4,097,754)

30,940

30,940

9,645,545

1,876

8,254,67~

,.$

4,025,296

$11,421,387

$ 2,681

$ 15,449,364

1,781,568

$ 4,910,045

2,243,728

6,511,342

2,681

8,757,751

4,025,296

$11,421,387

$ 2,681

$ 15,449,364

62,983

(4,097,754)

(1,392,744)

Ending Balance collectively

evaluated for impairment

100,341

163,324

6,691,613

8,355,018

15,612,688

6,691,618

163,324

163,324

8,921,075

15,612,Ba8

STAn BANK of India (California)

STATEMENT OF PAST DUE AND NON-ACCRUAL LOANS, LEASES AND OTHER ASSETS FOR TV\tO YEARS ENDED MARCH 31, 2011

March 31, 2011

Past Due

30-59 days

Commercial

and Other

Commercial

Real Estate - Construction

Commercial

Real Estate - Other

r-otal

60-89 days

past due

past due

(Accruing)

(Accruing)

Greater

90 days

(Non-Accrual)

Recorded

investment>

than

2,228,046

Total

Total

Past due

Current

90 davs

Total Loans

2,228,046

s 175,423,834

$ 177,651,880

5,020,732

5,020,732

12,941,309

1,715,731

22,995,185

37,652,225

413,%4,591

451,616,816

$ iZ,941,309

$ 1,715,731

25,223,231

$ 39,880,271

$ 594,;409,157

$ 634,289,428

and accruing

March 31, 2010

Past Due

30-59 days

~ommercial

and Other

Commercial

Real Estate - Construction

Commercial

Real Estate - Other

ifotal

60-89 days

90 days

past due

past due

(Accruing)

(Accruing)

(Non-Accrual)

$ 2,258,268

2,915,447

2,915,447

$ 2,258,268

Recorded

investment>

Greater than

Total

fotal

Past due

Current

90 days,

Total Loans

2,661,467

$ 178,228,344

28,iB1,761

28,331,761

15,379,289

18,294,736

4Q~,151,479

420,446,215

15,782,488

$ 20,956,203

$ 608,711,584

$ 629,667,7il7

403,199

180,889,811

and accruing

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Early Event Planning TemplateDokument3 SeitenEarly Event Planning TemplateZohaib Sunesara100% (16)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Export + Import Process Flow - Break Bulk Cargo 27072010Dokument11 SeitenExport + Import Process Flow - Break Bulk Cargo 27072010Ahmad Fauzi Mehat100% (1)

- Swift Standards Category 6 Treasury Markets Precious Metals MT600 MT699Dokument103 SeitenSwift Standards Category 6 Treasury Markets Precious Metals MT600 MT699Ahmad Fauzi Mehat100% (1)

- 10 - Over The Top Player EU PDFDokument137 Seiten10 - Over The Top Player EU PDFVicky Cornella SNoch keine Bewertungen

- Mt100 To 199 (Customer Payments)Dokument286 SeitenMt100 To 199 (Customer Payments)Perez CorazaNoch keine Bewertungen

- How To Analyse An Annual ReportDokument3 SeitenHow To Analyse An Annual ReportAhmad Fauzi MehatNoch keine Bewertungen

- Retail and Franchise AssignmentDokument8 SeitenRetail and Franchise AssignmentAkshay Raturi100% (1)

- Bus Ticket Invoice 1673864116Dokument2 SeitenBus Ticket Invoice 1673864116SP JamkarNoch keine Bewertungen

- Intellectual Property Prelim NotesDokument5 SeitenIntellectual Property Prelim NotesGretchen CanedoNoch keine Bewertungen

- Accountancy ManualDokument61 SeitenAccountancy ManualAhmad Fauzi MehatNoch keine Bewertungen

- Cost PlanningDokument20 SeitenCost PlanningsoloclarinetNoch keine Bewertungen

- Swift Standards Category 4 Collections Cash LettersDokument128 SeitenSwift Standards Category 4 Collections Cash LettersAhmad Fauzi MehatNoch keine Bewertungen

- OHSA Field Safety Manual PDFDokument265 SeitenOHSA Field Safety Manual PDFNaeem IqbalNoch keine Bewertungen

- Deed of SaleDokument7 SeitenDeed of SaleRab AlvaeraNoch keine Bewertungen

- World Bank Report FinalDokument76 SeitenWorld Bank Report FinalAhmad Fauzi MehatNoch keine Bewertungen

- Welcome To The Gold Guidelines: Page 1 of 9Dokument9 SeitenWelcome To The Gold Guidelines: Page 1 of 9Ahmad Fauzi MehatNoch keine Bewertungen

- BPPM FulltextDokument673 SeitenBPPM FulltextAhmad Fauzi MehatNoch keine Bewertungen

- Dry Bulk Cargo - (Import and Export)Dokument12 SeitenDry Bulk Cargo - (Import and Export)Ahmad Fauzi Mehat100% (1)

- Malaysia Haulage Charges (Base On Point-Butterworth, Penang)Dokument2 SeitenMalaysia Haulage Charges (Base On Point-Butterworth, Penang)Ahmad Fauzi MehatNoch keine Bewertungen

- World Financial Infrastructure and MoneyDokument129 SeitenWorld Financial Infrastructure and MoneyAhmad Fauzi MehatNoch keine Bewertungen

- This Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsDokument77 SeitenThis Page Is Designed For The Sole Purpose of Teaching Someone How To Read Financial StatementsAhmad Fauzi MehatNoch keine Bewertungen

- Journalizing: Sarat Kumar Budumuru, Consultant BD, Synchroserve Global Solutions, VizagDokument24 SeitenJournalizing: Sarat Kumar Budumuru, Consultant BD, Synchroserve Global Solutions, VizagAhmad Fauzi MehatNoch keine Bewertungen

- Highland Bankruptcy FilingDokument16 SeitenHighland Bankruptcy FilingZerohedge100% (1)

- MARS Brochure NewDokument13 SeitenMARS Brochure NewMars FreightsNoch keine Bewertungen

- MRPDokument43 SeitenMRPTariku AbateNoch keine Bewertungen

- B.C. Liquor Control and Licensing Branch Documents About The 2011 Stanley Cup RiotDokument98 SeitenB.C. Liquor Control and Licensing Branch Documents About The 2011 Stanley Cup RiotBob MackinNoch keine Bewertungen

- Strategic Marketing Planning VOLVO: Ali AbdurahimanDokument14 SeitenStrategic Marketing Planning VOLVO: Ali AbdurahimanAli Abdurahiman100% (1)

- Chapter 13 - HW With SolutionsDokument9 SeitenChapter 13 - HW With Solutionsa882906100% (1)

- Trade Facilitation Book-ASIA PacificDokument212 SeitenTrade Facilitation Book-ASIA PacificjessicaNoch keine Bewertungen

- SBI ProjectDokument82 SeitenSBI Projectchandan sharmaNoch keine Bewertungen

- Downloadable Test Bank For Principles of Cost Accounting 16th Edition Vanderbeck 1Dokument99 SeitenDownloadable Test Bank For Principles of Cost Accounting 16th Edition Vanderbeck 1Carl Joshua MontenegroNoch keine Bewertungen

- Bulletin - 2014 2015 - Final6 18 14print6Dokument656 SeitenBulletin - 2014 2015 - Final6 18 14print6Ali Amer Pantas OmarNoch keine Bewertungen

- Module 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDokument7 SeitenModule 013 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNoch keine Bewertungen

- Shiny Hill Farms Case StudyDokument2 SeitenShiny Hill Farms Case StudyDana WilliamsNoch keine Bewertungen

- Accounting AssmntDokument11 SeitenAccounting AssmntasadNoch keine Bewertungen

- T.poojithaDokument92 SeitenT.poojithaSaroj SinghNoch keine Bewertungen

- Aqeeq-Far East - Special DirectDokument2 SeitenAqeeq-Far East - Special DirectRyan DarmawanNoch keine Bewertungen

- Downtown Parking Analysis and Recommendations Walker Parking Consultants 11-01-2013Dokument36 SeitenDowntown Parking Analysis and Recommendations Walker Parking Consultants 11-01-2013L. A. PatersonNoch keine Bewertungen

- MANACCDokument22 SeitenMANACCNadine KyrahNoch keine Bewertungen

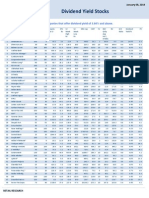

- High Dividend Yield StocksDokument3 SeitenHigh Dividend Yield StockskaizenlifeNoch keine Bewertungen

- Gr. Reggane Nord - Tender No - cfb-0295-20 - Provision of Tubular Running ServicesDokument1 SeiteGr. Reggane Nord - Tender No - cfb-0295-20 - Provision of Tubular Running ServicesOussama AmaraNoch keine Bewertungen

- Combinepdf 2Dokument6 SeitenCombinepdf 2saisandeepNoch keine Bewertungen

- Thư Tín - NN5-2020 - UpdatedDokument60 SeitenThư Tín - NN5-2020 - UpdatedK59 Nguyen Minh ChauNoch keine Bewertungen

- Anthony Mosha CVDokument6 SeitenAnthony Mosha CVanthony_mosha2445Noch keine Bewertungen

- ASQ ISO Infographic DigitalDokument1 SeiteASQ ISO Infographic Digitalinder_sandhuNoch keine Bewertungen