Beruflich Dokumente

Kultur Dokumente

Industrial and Office Market Update Presentation

Hochgeladen von

Andrea Anthony0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten16 SeitenCreated by: Andrew Petrozzi, vice-president, research (B.C.), Avison Young

Metro Vancouver regional planning and agriculture committee

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCreated by: Andrew Petrozzi, vice-president, research (B.C.), Avison Young

Metro Vancouver regional planning and agriculture committee

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten16 SeitenIndustrial and Office Market Update Presentation

Hochgeladen von

Andrea AnthonyCreated by: Andrew Petrozzi, vice-president, research (B.C.), Avison Young

Metro Vancouver regional planning and agriculture committee

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

4.

Industrial and Office Market Update Presentation

Andrew Petrozzi Vice-President, Research (BC) Avison Young Metro Vancouver Regional Thank you. Planning & Agriculture Committee February 7, 2014

avisonyoung.com 2013 Avison Young Inc. All rights reserved.

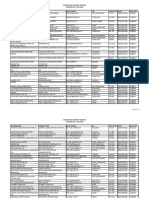

Metro Vancouver Industrial Market Vacancy

Q4 2013 Update

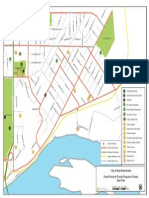

Richmond: 4% Surrey: 2.5% Burnaby: 4.1% Vancouver: 2.8% Delta: 6.4% Langley: 2.3% Coquitlam: 4.4% Port Coquitlam: 5.5% Abbotsford: 3.7% North Vancouver: 2.9% New Westminster: 2.1% Maple Ridge/Pitt Meadows: 1.6% Metro Vancouver: 3.7% Total SF: 186,833,932

Metro Vancouver Industrial Market Update

New inventory: From Q3 2012 to Q3 2013, there was 2,952,943 sf of new industrial inventory added to Metro Vancouver. Between Q3 2013 and Q4 2013, an additional 486,539 sf of new product was delivered to the market. Under construction: More than 2,000,000 sf of new industrial space is currently under construction, primarily in Delta (650,000 sf+) and Burnaby (420,000sf+) with more limited activity in Surrey (235,000+sf), Richmond (235,000sf+) and Pitt Meadows (200k). Almost half of total square footage (904k) under construction is in four developments. Very limited large-bay opportunities: Only four spec projects in excess of 100,000 sf are currently under construction: Boundary Bay Industrial Park (phase I) (Delta) 440K; Millennium VI (Delta) 163k; Golden Ears Business Park (Pitt Meadows) 200K; and Blackthorn IV (Surrey) 101k.

Metro Vancouver Office Market

Metro Vancouver Office Inventory

(Square Feet)

1,477,580

1,551,572 2,562,843 4,200,538

Downtown Yaletown 21,353,887 Broadway Burnaby Richmond

9,181,817

Surrey New Westminster North Shore 2,021,244 6,681,377

Metro Vancouver Office Market

Metro Vancouver Office Market

Metro Vancouver Office Inventory (All Classes)

1,200,000 1,000,000 800,000 600,000 516,367 Absorption (SF) 400,000 200,000 0 -200,000 -400,000 -600,000 -800,000 -1,000,000 -1,200,000 2007 2008 2009 2010 2011 2012 2013 2014F -6% -1,034,999 -8% -10% Absorptio n -158,905 3.6% 2.7% 532,275 407,197 249,777 2% 0% -2% -4% 640,019 568,510 7.9% 8.4% 7.4% 7.0% 7.8% 8.3% 10% 8% 6% 4% Vacancy Rate (%)

Metro Vancouver recorded negative absorption for the first time since 2009

Metro Vancouver Office Vacancy (Year End 2013)

20% 18% 16% Vacancy Rate by Class 14% 12% 10% 8% 6% 4% 2% 0% New Westminster Burnaby Broadway Richmond Surrey North Shore Downtown Yaletown

5.70% 4.00% 5.10% 9.10% 9.30% 8.50% 15.40% 17.30%

Downtown Vancouver Vacancy Forecast

Suburban Vancouver Vacancy Forecast

Next Generation of Downtown Towers

Next Generation of Suburban Towers

Next Generation of Suburban Towers (continued)

Andrew Petrozzi Vice-President, Research (BC) Avison Young andrew.petrozzi@avisonyoung.com 604.646.8392 www.avisonyoung.com

Thank you.

avisonyoung.com 2013 Avison Young Inc. All rights reserved.

5.3

Proposed Extension

Subject Site

Das könnte Ihnen auch gefallen

- Queensborough Community PlanDokument296 SeitenQueensborough Community PlanAndrea AnthonyNoch keine Bewertungen

- Flood Hazard Development Permit AreaDokument5 SeitenFlood Hazard Development Permit AreaAndrea AnthonyNoch keine Bewertungen

- New Westminster Snow Removal Map: MidtownDokument1 SeiteNew Westminster Snow Removal Map: MidtownAndrea Anthony100% (1)

- New Westminster Snow Removal Map: EastDokument1 SeiteNew Westminster Snow Removal Map: EastAndrea AnthonyNoch keine Bewertungen

- New Westminster Snow Removal Map: WestDokument1 SeiteNew Westminster Snow Removal Map: WestAndrea AnthonyNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Canada Emplyoment AgenciesDokument11 SeitenCanada Emplyoment AgenciesAnkur Shrivastava100% (1)

- Canadian Shopping Centres by SizeDokument29 SeitenCanadian Shopping Centres by SizeNick Chehab100% (1)

- Ophthalmologists in BC 2011 DecDokument14 SeitenOphthalmologists in BC 2011 Decbaby_goatNoch keine Bewertungen

- Canada Mortgage and Housing Corporation 2020 Rental Market ReportDokument165 SeitenCanada Mortgage and Housing Corporation 2020 Rental Market ReportPeterborough ExaminerNoch keine Bewertungen

- Colleges in British ColumbiaDokument6 SeitenColleges in British ColumbiaD.J Drunkin OfficialNoch keine Bewertungen

- Fast and Frequent Transit Network: CoquitlamDokument1 SeiteFast and Frequent Transit Network: CoquitlamWasawat JoongjaiNoch keine Bewertungen

- City of Vancouver Empty Homes ReportDokument31 SeitenCity of Vancouver Empty Homes ReportThe Vancouver SunNoch keine Bewertungen

- 2015 Business Licences Issued Located Outside of The City by Business CategoryDokument29 Seiten2015 Business Licences Issued Located Outside of The City by Business Categorytai_sao_khong_1307Noch keine Bewertungen

- Imagine. The Year Is 1880.: S S S SDokument15 SeitenImagine. The Year Is 1880.: S S S Sjohn baNoch keine Bewertungen

- Vancouver Airport HistoryDokument46 SeitenVancouver Airport HistoryCAP History Library100% (1)

- Jessie Couzelis ResumeDokument3 SeitenJessie Couzelis ResumeDave TeixeiraNoch keine Bewertungen

- NewspapersDokument2.154 SeitenNewspapersaptureincNoch keine Bewertungen

- Employment Agencies BC Name Aug 13 2014-1 PDFDokument20 SeitenEmployment Agencies BC Name Aug 13 2014-1 PDFdeja980Noch keine Bewertungen

- Jessie Couzelis ResumeDokument3 SeitenJessie Couzelis ResumeDave TeixeiraNoch keine Bewertungen

- Employment Agencies BC Name Aug 13 2015Dokument20 SeitenEmployment Agencies BC Name Aug 13 2015yilongwei.comNoch keine Bewertungen

- Brief History of VancouverDokument3 SeitenBrief History of VancouverIsabel TrujilloNoch keine Bewertungen

- TransLink System Map - April 2018Dokument1 SeiteTransLink System Map - April 2018The UrbanistNoch keine Bewertungen

- F-3 - TOL - Sept. 11Dokument68 SeitenF-3 - TOL - Sept. 11Miranda GathercoleNoch keine Bewertungen

- MFGEmployees 4Dokument58 SeitenMFGEmployees 4Abirami SivakumarNoch keine Bewertungen

- Zone 5 Seniors and Adults With Disabilities PDFDokument7 SeitenZone 5 Seniors and Adults With Disabilities PDFStephen OlsonNoch keine Bewertungen

- DTZ Barnicke Q4 2010 Industrial Report (HQ)Dokument4 SeitenDTZ Barnicke Q4 2010 Industrial Report (HQ)dtzvancouverNoch keine Bewertungen

- Douglas College - New Westminster Campus MapDokument12 SeitenDouglas College - New Westminster Campus MapMarcusNoch keine Bewertungen

- Burnaby$!27s Heritage - An Inventory of Buildings and StructuresDokument82 SeitenBurnaby$!27s Heritage - An Inventory of Buildings and StructuresBill LeeNoch keine Bewertungen

- Banks ListDokument124 SeitenBanks ListGeorgiyNoch keine Bewertungen

- Test Document For Website Design PurposesDokument70 SeitenTest Document For Website Design PurposesChris WaltersNoch keine Bewertungen

- HospitallistDokument22 SeitenHospitallistRakesh MahadasaNoch keine Bewertungen

- Canada Emplyoment AgenciesDokument11 SeitenCanada Emplyoment AgenciesDanish ShaikhNoch keine Bewertungen

- Housing Listing Aug 22nd 2016Dokument12 SeitenHousing Listing Aug 22nd 2016api-287631960Noch keine Bewertungen