Beruflich Dokumente

Kultur Dokumente

Unit 5

Hochgeladen von

divyaimranOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Unit 5

Hochgeladen von

divyaimranCopyright:

Verfügbare Formate

UNIT 5 NATIONAL INCOME

National income is the final outcome of total economic activities of a nation. Economic activities generate two kinds of flow in a modern economy namely, product-flow and money-flow. Product-flow refers to flow of goods and services from producers to final consumers. Money flow refers to flow of money in exchange of goods and services. In this exchange of goods and services, money income is generated in the form of wages, rent, interest and profits, which is known as factor earning. ased on these two kinds of flows, national income is defined in terms of! Product flow Money flow DEFINITION OF NATIONAL INCOME National Income in Terms of Product Flow National income is the sum of money value of goods and services generated from total economic activities of a nation. Economic activities result into production of goods and services and make net addition to the national stock of capital. "hese together constitute the national income of closed economy#. $losed economy refers to an economy, which has no economic transactions with the rest of the world. however, in an open economy, national income also includes the net results of its transactions with the rest of the world, i.e., exports less imports. Economic activities should %e distinguished from the non-economic activities from national income point of view. roadly speaking, economic activities include all human activities, which create goods and services that can %e valued at market price. Economic activities include production %y farmers &whether for household consumption or for market', production %y firms in industrial sector, production of goods and services %y the government enterprises, and services produced %y %usiness intermediaries &wholesaler and retailer', %anks and other financial organi(ations, universities, colleges and hospitals. )n the other hand, noneconomic activities arc those activities, which produce goods and services that do **+t have economic value. "he non-economic activities include spiritual, psychological, social and

political services, ho%%ies, service to self services of housewives services of mem%ers of family to other mem%ers and exchange of mutual services %etween neigh%ours. National Income in Terms of Mone Flow ,hile economic activities generate flow of goods and services, on the other hand, they also generate money-flow in the form of factor payments such as, wages, interest, rent, profits and earnings of self-employed. "hus, national income can also %e o%tained %y adding the factor earnings after ad-usting the sum for indirect taxes, and su%sidies. "he national income thus o%tained is known as national income at factor cost. "he concept of national income is linked to the society as a whole. .owever, it differs fundamentally from the concept of private income. $onceptually, national income refers to the money value of the final goods and services resulting from all economic activities of a country. .owever, this is **+t true for the private income in addition, there are certain receipts of money or of goods and services that are not ordinarily included in private incomes %ut are included in the national incomes and vice versa. National income includes items such as employer#s contri%ution to the social security and welfare funds for the %enefit of employees, profits of pu%lic enterprises and services of owner occupied houses. .owever, it excludes the interest on war-loans, social security %enefits and pensions. Instead, these items are included in the private incomes. "he national income is therefore, not merely an aggregation of the private incomes. .owever, an estimate of national income can %e o%tain %y summing up the private incomes after making necessary ad-ustment for the items excluded from the national income.

MEA!U"E! OF NATIONAL INCOME "he various measures of national income are as follows! #ross National Product $#NP% "here are several measures of national income used in the analysis of national income. /NP is the most important and widely used measure of national income. /NP is defined as the value of final goods and services produced during a specific period, usually one year, plus the difference %etween foreign receipts and0 payment. "he /NP so defined is identical to the concept of #/ross National Income &/Nl'#, "hus, /NP 1 /NI. "he difference %etween the two is that while /NP is

estimated on the %asis of product-flows, the /NI is estimated on the %asis of money flows. Net National Product $NNP% Net National Product &NNP' is the total market value of all final goods and services produced %y citi(ens of an economy during a given period of time minus depreciation, i.e., /ross National Product less depreciation. NNP 1 /NP - 2epreciation 2epreciation is that part of total productive assets, which is used to replace the capital worn out in the process of creating /NP. In other words, while producing goods and services including capital goods, a part of total stock of capital is used up. "his part of capital that is used up is termed as depreciation. 3n estimated value of depreciation is deducted from the /NP to arrive at NNP. "he NNP, as defined a%ove, gives the measure of net output availa%le for consumption the society &including consumers, producers and the government', NNP is the real measure of the national income. In other words, NNP is same as the national income at factor cost. It should %e noted that NNP is measured at market prices including direct taxes. .owever, indirect taxes are not included in the actual cost of production. "herefore, to o%tain real national income, indirect taxes are deducted from the NNP. "hus, National income 1 NNP - Indirect taxes National income! 4ome accounting relationships 5elations at market price /NP 1 /NI o /ross 2omestic Product &/2P' 1 /NP less net income from a%road o NNP 1 /NP less depreciation o N2P &Net 2omestic Product' 11 NNP less net income from a%road 5elations at factor cost o /NP at factor cost 1 /NP at market price less net indirect taxes. o NNP at factor cost 1 NNP at market price less net indirect taxes o N2P at factor cost 1 NNP at market price less net income from a%road o N)P at factor cost 1 N2P at market price less net indirect taxes o N)P at factor cost 1 /)P at market price less depreciation

Met&ods of Measurin' National Income 6or measuring the national income, the national economy is viewed as follows! "he national economy is considered as an aggregate of producing units com%ining different sectors such as agriculture, mining, manufacturing and trade and commerce. "he whole national economy is viewed as a com%ination of individuals and household owning different kinds of factors of production, which they use themselves or sell-their factor services to make their livelihood. National economy is also viewed as a collection of consuming, saving and investing units &individuals, households and government'. "he a%ove notions of a national economy helps to measure national Income %y following three different methods! Net output method 6actor-income method Expenditure method "hese methods are followed in measuring national income in a 7closed economy#, Net Out(ut Met&od "his is also called as net product method or value-added method. "his method is used when whole national economy is considered as an aggregate of producing units. In its standard form, this method consists of three stages! *. Measurement of 'ross )alue of domestic out(ut in t&e )arious *ranc&es of (roduction+ 6or measuring the gross value of domestic product, output is classified under various categories on the %asis of the nature of activities from which they originate. "he output classification varies from country to country depending on &i' the nature of domestic activities, &ii' their significance in aggregate economic activities and &iii' availa%ility offer-uisite data. 6or example, in 843, a%out seventy-one divisions and su%-divisions are used to classify the national output, in $anada and Netherlands, classification ranges from a do(en to a score and in 5ussia, only half-a-do(en divisions are used. 3ccording to the $4) pu%lication, If flee su%-categories are currently used in India. 3fter the output is classified under the various categories the value of gross output is is

computed in two alternative ways %y! 3. Multiplying the output of each category of factor %y their respective market price and adding them together. . $ollecting data regarding the gross sales and changes in inventories from the account of the manufacturing firms to compute the value of /2P. If there arc gaps in data then some estimates are made to fill the gaps. ,Estimation of cost of materials and ser)ices used arid de(reciation of (& sical assets+ "he next step in estimating the net national income is to estimate &he cost of production including depreciation. Estimating cost of production is, however, a relatively more complicated and difficult task %ecause of non-availa%ility of ade9uate and re9uisite data. Much more difficult task is to estimate depreciation since it involves %oth conceptual and statistical pro%lems. 6or this reason, many countries adopt factor income method for estimating their national income. .owever, countries adopting netproduct method find some means to calculate the deducti%le cost. "he costs are estimated either in a%solute terms &where input data are ade9uately availa%le' or as an overall ratio of input to the total output. "he general practice in estimating depreciation is to follow the usual %usiness practice of depreciation accounting. "raditionally, depreciation is calculated at some percentage of capital, permissi%le under the tax-laws. In some estimates of national income, the estimators have deviated from the traditional practice and have instead estimated depreciation as some ratio of the current output of final goods. 6oI*owing a suita%le method, deducti%le costs including depreciation are estimated for each sector. "he cost estimates are then deducted from the sectoral gross output to o%tain the net sect oral products. "he net sect oral products are then added together. "he total thus o%tained is taken to %e: the measure of net national products or national income %y product method. ;. 2eduction of these costs and depreciation from gross value to o%tain the net value of domestic product! Net value of domestic product is often called the value added or income product. Income product is e9ual to the sum of wages, salaries, supplementary la%our

incomes, interest, profits, and net rent paid or accrued.

6actor-Income Method "his method is also known as income method and factor-share method. 6actor -income method is used when national economy is considered as a com%ination of factor-owners and users. 8nder this method, the national income is calculated %y adding up all the income accruing to the %asic factors of production used in producing the national product. 6actors of production are c*assified as land, la%our, capital and organi(ation. 3ccordingly, National income 1 5ent < ,ages < Interest < Profits .owever, it is conceptually very difficult in a modern economy to make a distinction %etween earnings from land and capital and %etween the &earnings from ordinary la%our and organi(ational efforts including entrepreneurship. "herefore, for estimating national income factors of production arc %roadly grouped as la%our and capital. 3ccordingly, national income is supposed to originate from two primary factors, vi(., la%our and capital. .owever, in some activities, la%our and capital are -ointly supplied and it is difficult to separate la%our and capital from the total earnings of the supplier. 4uch incomes are termed as mixed incomes. "hus, the total factor-incomes are grouped under three categories! =a%our incomes $apital income Mixed incomes. =a%our Income! =a%our incomes included in the national income have five components! ,ages and salaries paid to the residents of the country including %onus, commission and social security payments. 4upplementary la%our incomes including employer#s contri%ution to social security and employee#s welfare funds and direct pension payments to retired employees. 4upplementary la%our incomes in kind such as free health, education, food, clothing and accommodation. $ompensations in kind in the form of domestic servants and other free ofcost services provided to the employees arc included in la%our income.

onuses, pensions, service grants are not included in la%our income as they are regarded as #transfer payments#. $ertain other categories of income such as incomes from incidental -o%s, gratuities and tips are ignored %ecause of non-availa%ility of data.

$apital Incomes! 3ccording to 4tudents, capital incomes include following Incomes! 2ividends excluding inter-corporate dividends 8ndistri%uted profits of corporation %efore-tax Interests on %onds, mortgages and savings deposits &excluding interests on %onds and on consumer credit' Interest. earned %y insurance companies and credited to the insurance policy reserves Net interest paid %y commercial %anks Net rents from land and %uildings including imputed net rents on owner -occupied dwellings 5oyalties Profits of government enterprises. "he data for the first two incomes is o%tained from the firms# accounts su%mitted for taxation purposes. "here exist difference in definition of profit for national accounting purposes and taxation purposes. "herefore, it is necessary to make some ad-ustments in the income-tax data for o%taining these incomes. "he income-tax data ad-ustments generally pertain to &i' Excessive allowance of depreciation made %y tax authorities, &ii' Elimination of capital gains and losses since these do not reflect the changes in current income, and &iii' Elimination of under +,# overvaluation of inventories on %ook-value, Mixed Income! Mixed incomes include income from &a' fanning &%' sole proprietorship s¬ included, index profit or capital income' &c' other professions such as legal and medical practices, consultancy services, trading and transporting. Mixed income also includes incomes of those who earn their living through various sources such as wages, rent on own property and interest on own capital. 3ll the three kinds of incomes, vi(., la%our incomes, capital incomes and mixed incomes

added together give the measure of national income %y factor income method. Expenditure Method "he expenditure method, is also known as final product method. "his method is used when national economy is viewed as a collection of spending units. It measures national income at the final expenditure stages. In other words, this method measures final expenditure on #/2P at market prices# at the stage of disposal of /2P during an accounting year. In estimating the total national expenditure, any of the following two methods are followed! 6irst method! 8nder this method all the items of expenditure which are taken into account under the first method are &a' private consumption expenditure, &%' direct tax payments, &c' payment> to the non-profit-making institutions and charita%le organi(ations like schools, hospitals and orphanage, and &d' private savings. 4econd Method! 8nder this method the value of all the products finally disposed of are computed and added up to arrive at the total national expenditure. 8nder the second method, the following items are considered Private consumer goods and services Private investment goods Pu%lic goods and services Net investment from a%oard. "his method is extensively used %ecause the re9uisite da?@ re9uired %y this method can %e collected with greater ease and accuracy. Inflation and 2eflation "he term #inflation# is used in many senses and it is difficult to give a generally accepted, precise and scientific definition of the term. Popularly, inflation refers *) a rise in price level. Aemmerer states, 0Inflation is too much money and deposit currency that is too much currency in relation to the physical volume of %usiness %eing done.0 "his is what $oe%urn also means when he defines inflation as, 0"oo much money chasing too few goods0. 3ccording to ".E. /regory, inflation is 0a%normal increase in the 9uantity of money0. "he implication in these definitions is that prices rise due to an increase in the volume of money as compared to the supply of goods. "his is the 9uantity approach to the rise in the price

level. .owever, it should %e noted that prices may rise due to other factors also such as rise in wages and profits. rising of the prices. Aeynesian 2efinition Aeynesian deals inflation to a price level that comes into existence after the stage of full employment. ,hile, the 9uantity approach emphasi(es the volume of money to %e responsi%le for rise in the price level. Aeynes distinguishes %etween two types of rise in prices &a' rise in prices accompanied %y increase in production &h' rise in prices not accompanied %y increase in production. If an economy is working at a low level, with a large num%er of unemployed men and unutili(ed resources then expansion of money or some other. factors leading to an increase in demand will result not only in a rise in the price level %ut also rise in the volume of goods and services in an economy. "his will continue until all unemployed men tend employment arid capital and other resources are more fully utili(ed, i.e., the stage of full employment. prices %ut lI) corresponding rise in production or employment. Aeynes states that the initial rise in prices up to the stage of full employment is a good thing far the country #since there is an increase in. output and employment. 2emand-pull Inflation "he most common calls for inflation is the pressure of ever-rising demand on a stagnant or less rapidly increasing supply of goods and services. "he expansion in aggregate demand may %e due to rapidly increasing private investment or expanding government expenditure for war or economic development. 3t a time when demand is expanding and exerting pressure on pricesB attempts are made to expand production. .owever, this may not %e possi%le either due to no availa%ility unemployed resources or shortages of transport, power, capital and e9uipment. Expansion in aggregate demand, after the level of full employment, results into rise in the price level. In a developing economy =ike India, resources are used for growth, for creating fixed assets and production of consumer goods. Necessarily, large expenditure will create. =arge money income and large demand %ut without a corresponding increase in supply of real output. $ost-push Inflation eyond this stage, however, any increase in the volume of money or rise in demand will lead to a rise in esides, there can %e an inflationary pressure on prices without actually

In certain circumstances, prices are pushed up %y wage increases, forced upon the economy %y la%our leaders under the threat of strike. $osts can also %e raised %y manufacturers through a system of fixing a higher margin of profit. "he common man generally %lames profiteers, speculators, hoards and others for pushing up the costs and prices. 3gain, the government is responsi%le for raising the costs %y imposing new taxes and continuously raising the tax rates of existing commodity. "herefore, rising rates of commodity taxes, in a sellers market, will ena%le the producers to raise the prices %y the full amount of taxes. 8nder conditions of rising prices, %usiness and industrial units find it easy to pass on the %urden of higher wages to the consumers %y raising the prices. )ther $lassifications of Inflation )pen Inflation! Inflation is said to %e open when prices rise without any interruption. It may ultimately end into hyper-inflation. 4uppressed inflation! 4uppressed inflation refers to a situation in which price level is not allowed to rise with the use of price controls and rationing, even though conditions exist for rise in the price level. "he price level may rise when the control measures are lifted. 4uppressed inflation results in &a' postponement of present demand to a future date &%' diversion of demand from one kind of goods to another, i.e., from those goods which are su%-ect to price control. and rationing to those whose prices are uncontrolled and nonrationed. 4uppressed inflation has many dangers. 6irst, it creates administrative pro%lems of controls and rationing. 4econdly, it leads to corruption of the price control administration and rise of hack markets. "hirdly. it chases diversion of productive resources from essential goods industries whose prices are: mixed or controlla%le to those . Industries whose products are less essential %ut prices are uncontrolla%le. $reeping, 5unning and /alloping Inflation! In the initial stage of rise in the price level, prices may %e rising slowly and this is referred as creeping inflation. In course of time, the rise in the price level %ecomes more marked and alarming. "his is referred as running inflation. however, when the rise in the price level is staggering and extremely rapid, it is often referred to as galloping inflation or hyper-inflation, which a country should avoid at all costs.

$ontrol of Inflation Inflation should %e controlled in the %eginning stage, otherwise it wills take the shape of hyperinflation which will completely run the country. "he different methods used to control inflation are known as anti-inflationary measures. "hese measures attempt mainly at reducing aggregate demand for goods and services on the %asic assumption that inflationary rise in prices is due to an excess of demand over a given supply of goods and services. 3nti-inflationary measures are of four types! Monetary policy 6iscal policy Price controlling motioning )ther methods

Monetary Policy It is the policy of the central %ank of the country, which is the supreme monetary and %anking authority in a country. "he central %ank may use such methods as the %ank rate, open market operations, the reserve ratio and selective controls in order to control the credit creation operation of commercial %anks and thus restrict the amounts of %ank deposits in the country. #this is known as tight money policy. Monetary policy to control inflation is %ased on the assumption that a rise in prices is due to a larger demand for goods and services, which is the direct result of expansion of %ank credit. "o the extent this is true, the central %ank#s policy will %e successful. 6iscal Policy It is the policy of a government with regard to taxation, expenditure and pu%lic %orrowing. It has a very important influence on %usiness and economic activity. "axes determine the si(e or the volume of disposa%le income in the hands of the pu%lic. "he proper tax policy to control inflation will avoid tax cuts, introduce new taxes and raise the rates of existing taxes. "he purpose %eing to reduce the volume of purchasing power in the hands of the pu%lic and thus reduces their demand. 3 precisely similar effect will %e achieved if voluntary or compulsory savings are increased. 4avings will reduce current demand for goods and thus reduce the

inflationary rise in prices. 3s an anti-inflationary measure, government expenditure should %e reduced. "his .indicates that demand for goods and services will %e further reduced. "his policy of increasing pu%lic revenue through taxation and decreasing pu%lic expenditure is known as surplus %udgeting. .owever, there is one important difficulty is this policy. It may %e easy to increase revenue in times of inflation when people have more money income )ther Methods 3nother important anti-inflationary device is to increase the supply of goods through either increased production or imports. Production may %e increased %y shifting factors of production from the production of less inflation sensitive goods, which are in comparative a%undance to the production -of those goods which are in short supply and which are inflation-sensitiveC Moreover, shortage of goods internally may %e relieved through imports of inflation sensitive goods, either on credit or in exchange for export of luxury goods and other non-essentials. 3 word may %e added a%out the measures to control cost-push inflation. It is suggested that wages, salaries and profit margins should %e controlled and fixed through a system of income free(e. usiness units may particularly welcome wage free(e. .owever, wage free(e is not so easy or -ust, unless trade unions agree to the proposal and there is also free(ing of prices. 3t the same time, the /overnment should not raise the rates of commodity taxes. "hus, it is difficult to control cost push inflation through controlling wages and other incomes. "he %est method is to %ring a rapid increase in production, which will automatically check prices and wages also. 2eflation It will decrease prices anD a%normally high, it is indeed desira%le to have a fall in prices. 4uch a fall in the price level is good for the community, as it will not lead to a fall in the level of production or employment. "he process designed to reverse the inflationary trend in prices, without creating unemployment, is generally known as disinflation. ut if prices fall from the level of full employment, then income and employment will %e adversely affected and this situation is termed as deflation.

Effects of Deflation "he following are the adverse effects of deflation! )n production! 2eflation has an adverse effect on the level of production, %usiness activity and employment. 2uring deflation, prices fall due contracting demand for goods and services. 6all in price results in losses# and sometimes forcing many firms to go into li9uidation. In the face of declining demand for goods, firms arc forced to close down either completely or leave part of their plants idle. "hus, production of income is curtailed and unemployment is increased. it is a serious defect of deflation, as compared to inflation in which normally there may not %e an adverse effect on production and employment. )n distri%ution! 2eflation adversely affects distri%ution of income too. In the first place, producers, merchants and speculators lose %adly during this period %ecause priceC of their goods fall at a far greater rate than their costs, most of which tend to %e fixed or sticky. esides, most of these people are de%tors who use %orrowed funds in their %usinesses. "hey have to repay their de%ts in money, which has now more value %ecause of deflation. 6or some de%tors, who do not have ade9uate means to repay their loans had to go into

li9uidation.

Com(arison *etween Inflation and Deflation Inflation is rise in prices unaccompanied %y increase in employment, while deflation is fall in prices accompanied %y increasing unemployment. Inflation distorts the distri%ution of income %etween different groups of people in# the country in such an un-ust manner that the rich gain at the expense of the poor. 2eflation, on the other hand, reduces national income through contraction of production and increaseC in unemployment. Inflation is un-ust and demorali(ing. 2eflation, on the other hand, inflicts on the people the harsh punishment of general unemployment. "here exist factories and mills on one hand and workers ready to work on the other hand, however, the whole team remaining idle, on the other. Inflation at least implies that all factors are employed in some way or the other. "here is one more reason why deflation is worse than inflation. Inflation can %e controlled except occasionally it gets out of control. .owever, deflation, if once started, in-ects so much pessimism into %usinessmen and %ankers that it is highly difficult to control. .owever, there is nothing to choose %etween the two and the proper o%-ective should %e to aim at economic sta%ili(ation at the level of full employment.

P&ases of a Trade C cle Every trade cycle is characteri(ed %y two main phases namely, the upward phase and the downward phase of 7the trade cycle. "hese two phases further have four or five different su%phases, such as depression, recovery, full employment, %oom and recession. In monetary terminology, the same phases . correspond to depression, deflation, full employment, disinflation and deflation. "he following 6igure E.F shows: the different stages: of a trade cycle. 6E represents the full employment line-it may %e taken as the dividing line. 3%ove this line, there is %usiness prosperity and %oom and %elow this line, there is %usiness depression. 3s a trade cycle is a continuous phenomenon, it is essential to %reak it somewhere. It is customary to start at the lowest point of the upward Gphase, namely, the depression.

De(ression! 2uring depression, the level of economic activity is extremely low. "he price level is low, profit margins do not exist, firms incur losses and unemployment is high. Interests, wages and profits are all low. ,hile all sections in the economy suffer, some suffer more than others do. 6or instance, the producers of agricultural goods suffer %adly %ecause the prices of agricultural goods fall the most during depression. "his is due to ina%ility of the farmers to ad-ust their output according to the market demand, which is low. "he worst hits are the working classes that suffer heavily %ecause of unemployment. "he depression is thus, a period of great suffering, low income and unemployment. "he phase of recovery! 2epression gives place to recovery. "here is revival of %usiness and economic activity. "here is greater demand for goods and services and conse9uently there is greater production. Prices, wages, interests and profits all start rising. Employment increases and so docs the national income. "here is increase in investment, %ank loans and advances, velocity of circulation of money due to more %risk tide. "hrough multiplier and acceleration effects, the economy is proceeding upward steadily and rapidly. "he process of revival and recovery %ecomes cumulative. Increased receipts result in increased expenditure causing further increase in receipts. ,hich in turn, result in further increased expenditure and so on. "he phase of full employment! "he cumulative process of recovery continues until the

economy reaches full employment. 6ull employment implies that all the availa%le men arc employed. "he economy has reached the optimum level of economic activity. 2uring this phase, there is an all round economic sta%ility referring to sta%ility of output, wages, prices and income. ,ages, interests and profits are high, output is highest with the given technology and employment is maximum. "here may %e small percentage of unemployment, %ut it is not of an involuntary type %ut of voluntary and frictional type. "he period of full employment has %ecome the usual goal of most national economic policies. "he phase of %oom or inflation! "he phase of recovery fre9uently ends not in a sta%le state of full employment oC prosperity %ut further leads to a %oom or inflation. materials and rise in wages and prices. 5ecession! "he entrepreneurs reali(e their mistakes and find that many of that! ventures started in the rosy anticipation of the %oom are not profita%le. "he over optimism of the %oom gives way to pessimism characteri(ed %y feelings of hesitation, dou%t and fear. 6resh enterprises are postponed for some remote future date and those in hand are a%andoned. $redit is suddenly curtailed sharply as the %anks are afraid of failure. )rder the cancelled and workers are laid off. =i9uidity preference suddenly rises and people prefer to hoard rather that invest uilding activity slows down and unemployment appears in construction: industries. 8nemployment spreads to other sectors also %ecause the multiplier effect %egins to work in the downward direction. 8nemployment leads to fall in income, expenditure, prices, profits and industrial and trade activities. Panic prevail in the stock market and the prices of shares fall rapidly., )nce %usiness and economic activity start declining, it %ecomes almost difficult to stop this decline and finally ,ends in a hopeless depression. Monetar Polic "he instruments of monetary policy include discount %ank rate policy, open market operations, statutory reserve ratios and selective credit controls. )f these, first two instruments are adopted in the context of %alance of payment policy. "his however should not mean that other instruments are not relevant. "he government is free to choose any or all of these instruments aim adopt them simultaneously. "o solve the pro%lem of deficit in the %alance of payments, a #tight money policy# or #dear eyond the stage of full employment, the rise in investment results in increased pressure for the availa%le men and

money.pEIicy# is, adopted. $onse9uently, under nonna* conditions, the demand #for institutional funds for investment decreases. ,ith the fall in investment and through its multiplier effect, income of the people decreases. lf marginal propensity to consume is greater than (ero, demand for goods and services decreases. "he decrease in demand also implies a simultaneous decrease in imports while other things remain same. "his is how #a tight money policy# corrects deficit in %alance of payments. "he efficacy of #tight money policy# is however dou%tful under following conditions! &i' when rates of returns are much higher than the increased %ank rate due to inflationary conditions, &ii' when investors have already affected their investment in anticipation of increase in the rate of interest. "he tight money policy is then com%ined with open market operation, i.e., sale of government %onds and securities. "hese two instruments together help to reduce demand for capital and other goods. "herefore, if all goes well then the deficit in the %alance of payments is %ound to decrease. Fiscal Polic 6iscal policy as a tool of income regulation includes venation in taxation and pu%lic expenditure. "axation reduces household disposa%le income. 2irect taxes directly transfer the household income to the pu%lic reserves while indirect taxes serve the same purpose through increased prices of the taxed commodities. 2irect taxes reduce personal savings directly in a greater amount while indirect taxes do it in a relatively smaller amount. "axation reduces the disposa%le income of the household and there%y the aggregate demand including the demand for imports. "axation also helps to curtail investment %y taxing capital at progressive rates. "he government can reduce income and demand also %y adopting the policy of surplus %udgeting in which the government keeps its expenditure less than its revenue. this reduces disposa%le income of household and pu%lic expenditure increases household#s income and their purchasing power. .owever, multiplier effect of pu%lic expenditure is greater %y one than the multiplier effect of taxation. "herefore, while adopting surplus-%udget policy due consideration should %e given to this fact. "o account for this fact, it is necessary that surplus is so large that the total cumulative effect of taxation on disposa%le income exceeds the effect of pu%lic expenditure. "he reduction in income that will %e necessary to achieve a certain given target of reducing %alance of payments deficit depends on the rate foreign trade multiplier. .

E.c&an'e De(reciation and De)aluation 5educing #excess demand through price measures involves changing relative prices of imports and exports. 5ealties prices of imports and exports can %e changed through exchange depreciation and devaluation. Exchange depreciation refers to fall in the value of home currency in terms of foreign currency and devaluation refers to fall in the value of home currency in terms of gold. .owever, ill terms of purchasing power, parity %etween devaluation and depreciation turns out to %e the same and its impact on foreign demand is also the same. "herefore, we shall consider them as one in their role of correcting adverse %alance of payments. 2evaluation and exchange depreciation change the relative prices of imports and exports, i.e., import prices increase and export prices decrease, though not necessarily in the proportion of devaluation. 3s a result of change in relative prices of exports and imports, the demand for imports decreases in the country, which devalues its currency and foreign demand for its goods increases provided foreign demand for imports is price elastic. "hus, if devaluation or exchange depreciation is: effective, imports will decrease and exports will increase. $ountry#s payments for imports would decrease and export earnings would increase. "his ultimately decreases the deficits in the %alance of payments in due course of time. .owever, whether expected results of devaluation or exchange depreciation are achieved or not depends on the following condition. "he most important condition in this regard is the Marshall-=erner condition. "he Marshall-=erner condition states that devaluation will. Improve the %alance of payments only if the sum of elastici(es of home demand for imports and foreign demand for exports is greater than unity. If &he sum of elastici(es is less than unity, the %alance of payments can %e improved through revaluation instead of devaluation. 2evaluation can %e successful only if the all selected countries do no devalue their currency in retaliation. 2evaluation must not change the cost-price structure in favour of imports. 6inally, the government ensures that inflation. ,hich may %e the result of devaluation, is kept under control, so that the effect of devaluation is not counter-%alanced %y the effect of inflation. Direct Measure+ E.c&an'e Control

"he exchange control refers to a set of restrictions imposed on the international transactions and payments, %y the government or the exchange control authority. Exchange control may %e partial, confined to only few kinds of transactions or payments, or total covering all kinds of international transactions depending on the re9uirement of the country. "he main features of a full-fledged exchange control system are as follows! "he government ac9uires, through the legislative measures, a $omplete domination over the foreign exchange transactions. "he government monopoli(es the purchase and sale of foreign exchange. =aw imitates the sale and purchase of foreign exchange %y the resident individuals. Even holding foreign exchange without exchange control authority declared illegal. 3ll payments to the foreigners and receipts from them are routed through the exchange control authority or the authori(ed agents. 6oreign exchange payments arc restricted, generally, to the import of essential goods and service such as food items, raw materials, industrial inputs like petroleum products. 3 system of rationing is adopted in the foreign exchange allocation for essential imports. "o ensure the effectiveness of the exchange control system and to Prevent the possi%le evasion, strict, stringent laws like 6E53 and $)6EP)43 in India arc enacted. "he circuitous legal procedure of ac9uiring import and export licenses is %rought in force. In the process, the converti%ility of the .ome-currency is sacrificed. other essential informing the

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- JD Edwards EnterpriseOne Applications 1099 Year-End Processing Guide 2013Dokument148 SeitenJD Edwards EnterpriseOne Applications 1099 Year-End Processing Guide 2013Sivakumar VellakkalpattiNoch keine Bewertungen

- STF 2023-03-20 1679339081483Dokument4 SeitenSTF 2023-03-20 1679339081483ayogboloNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Dokument15 SeitenPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- K to 12 Arts and Design Track Subject on Leadership and ManagementDokument10 SeitenK to 12 Arts and Design Track Subject on Leadership and ManagementKarl Winn Liang100% (1)

- International Product Life CycleDokument6 SeitenInternational Product Life CyclehmghodkeNoch keine Bewertungen

- Formal Offer To Sell (Napindan Property, Taguig City, Philippines)Dokument5 SeitenFormal Offer To Sell (Napindan Property, Taguig City, Philippines)Anonymous XPcJbR56% (16)

- Tax 5th Semeter Selected Questions PDFDokument40 SeitenTax 5th Semeter Selected Questions PDFAvBNoch keine Bewertungen

- 5 Plant Location and Layout POM Hand Out 5Dokument12 Seiten5 Plant Location and Layout POM Hand Out 5divyaimranNoch keine Bewertungen

- 9 Excise Duty& CENVAT Sales Tax & VAT HandoutDokument10 Seiten9 Excise Duty& CENVAT Sales Tax & VAT HandoutdivyaimranNoch keine Bewertungen

- 12 Japanese Manufacturing Systems POM Handout 12Dokument13 Seiten12 Japanese Manufacturing Systems POM Handout 12divyaimranNoch keine Bewertungen

- 10 Fema-It-Ipr Hand OutDokument12 Seiten10 Fema-It-Ipr Hand OutdivyaimranNoch keine Bewertungen

- 9 Excise Duty& CENVAT Sales Tax & VAT HandoutDokument10 Seiten9 Excise Duty& CENVAT Sales Tax & VAT HandoutdivyaimranNoch keine Bewertungen

- MotivationDokument14 SeitenMotivationdivyaimranNoch keine Bewertungen

- 3 Lesson 3bussiness Law Sale of GoodsDokument9 Seiten3 Lesson 3bussiness Law Sale of GoodsdivyaimranNoch keine Bewertungen

- Quality Circles: A Way to Improve QualityDokument18 SeitenQuality Circles: A Way to Improve QualityShrawan DwivediNoch keine Bewertungen

- Profit MaximizationDokument23 SeitenProfit MaximizationdivyaimranNoch keine Bewertungen

- P1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbaDokument16 SeitenP1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbadivyaimranNoch keine Bewertungen

- Profit MaximizationDokument23 SeitenProfit MaximizationdivyaimranNoch keine Bewertungen

- 12 Japanese Manufacturing Systems POM Handout 12Dokument12 Seiten12 Japanese Manufacturing Systems POM Handout 12divyaimranNoch keine Bewertungen

- Case Study - 1 Smokestack Industrial Belt Transforms Into IT HubDokument1 SeiteCase Study - 1 Smokestack Industrial Belt Transforms Into IT HubdivyaimranNoch keine Bewertungen

- P1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbaDokument16 SeitenP1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbadivyaimranNoch keine Bewertungen

- Multiple Choice Questions Unit-I: Operations Management Question Bank Unit-1Dokument5 SeitenMultiple Choice Questions Unit-I: Operations Management Question Bank Unit-1divyaimranNoch keine Bewertungen

- 8 Material Handling Unit POM Hand Out 8Dokument3 Seiten8 Material Handling Unit POM Hand Out 8divyaimranNoch keine Bewertungen

- P1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbaDokument16 SeitenP1Bab01 Essentials of Management: Vel Tech DR - RR & DR - SR Technical University Department of MbadivyaimranNoch keine Bewertungen

- 4 Production Planning Unit POM Hand Out 4Dokument10 Seiten4 Production Planning Unit POM Hand Out 4divyaimranNoch keine Bewertungen

- MBA I Unit NotesDokument18 SeitenMBA I Unit NotesdivyaimranNoch keine Bewertungen

- 11 Quality POM Handout 11Dokument8 Seiten11 Quality POM Handout 11Sivakumar VedachalamNoch keine Bewertungen

- 7 Inventory Management POM Hand Out 7Dokument10 Seiten7 Inventory Management POM Hand Out 7divyaimranNoch keine Bewertungen

- Implementation and ControlDokument13 SeitenImplementation and ControlSivakumar VedachalamNoch keine Bewertungen

- 7 Inventory Management POM Hand Out 7Dokument10 Seiten7 Inventory Management POM Hand Out 7divyaimranNoch keine Bewertungen

- Body LanguageDokument11 SeitenBody LanguagedivyaimranNoch keine Bewertungen

- 4 Production Planning Unit POM Hand Out 4Dokument10 Seiten4 Production Planning Unit POM Hand Out 4divyaimranNoch keine Bewertungen

- 7 Inventory Management POM Hand Out 7Dokument10 Seiten7 Inventory Management POM Hand Out 7divyaimranNoch keine Bewertungen

- 7 Inventory Management POM Hand Out 7Dokument10 Seiten7 Inventory Management POM Hand Out 7divyaimranNoch keine Bewertungen

- 4 Production Planning Unit POM Hand Out 4Dokument10 Seiten4 Production Planning Unit POM Hand Out 4divyaimranNoch keine Bewertungen

- Let NDokument3 SeitenLet NEllen Mae OlaguerNoch keine Bewertungen

- VAT Zero Rated Transactions PhilippinesDokument8 SeitenVAT Zero Rated Transactions PhilippineskmoNoch keine Bewertungen

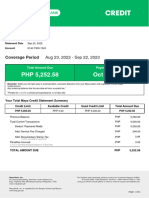

- MayaCredit SoA 2023SEPDokument3 SeitenMayaCredit SoA 2023SEPjepoy palaruanNoch keine Bewertungen

- Knowledge Utilization as a Networking ProcessDokument27 SeitenKnowledge Utilization as a Networking ProcessKathy lNoch keine Bewertungen

- Projected income statement for Mang Juan's ProductDokument2 SeitenProjected income statement for Mang Juan's ProductFrancis BordonNoch keine Bewertungen

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDokument1 SeiteGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNoch keine Bewertungen

- Topic: Consumer Attitude Towards Street Food and Restaurant FoodDokument13 SeitenTopic: Consumer Attitude Towards Street Food and Restaurant FoodAnsh BajajNoch keine Bewertungen

- 3 Power Sector Assets and Liabilities Management Corporation v. Commissioner of Internal RevenueDokument10 Seiten3 Power Sector Assets and Liabilities Management Corporation v. Commissioner of Internal RevenueChristian Edward CoronadoNoch keine Bewertungen

- Consensus Report 2-Page BriefDokument2 SeitenConsensus Report 2-Page BriefchrsbakrNoch keine Bewertungen

- Defining quality in IT training invoiceDokument1 SeiteDefining quality in IT training invoicendoriNoch keine Bewertungen

- Risk Analysis ExampleDokument8 SeitenRisk Analysis ExampleRyan SooknarineNoch keine Bewertungen

- Supreme Court: Republic of The Philippines ManilaDokument6 SeitenSupreme Court: Republic of The Philippines ManilaJopan SJNoch keine Bewertungen

- REmedies Procedure Lecture 1Dokument5 SeitenREmedies Procedure Lecture 1Susannie AcainNoch keine Bewertungen

- 07-19-11 EditionDokument28 Seiten07-19-11 EditionSan Mateo Daily JournalNoch keine Bewertungen

- CD Asia Technologies, Inc.: Bookmarks My Queries History Back Search Help Log OutDokument34 SeitenCD Asia Technologies, Inc.: Bookmarks My Queries History Back Search Help Log OutRegi PonferradaNoch keine Bewertungen

- Ebook Economics 11Th Edition Michael Parkin Solutions Manual Full Chapter PDFDokument39 SeitenEbook Economics 11Th Edition Michael Parkin Solutions Manual Full Chapter PDFodilemelanie83au100% (10)

- CHAN, James L. Government Accounting - An Assessment of Theory, Purposes and StandardsDokument9 SeitenCHAN, James L. Government Accounting - An Assessment of Theory, Purposes and StandardsHeloisaBianquiniNoch keine Bewertungen

- Date Sheet Dec 2015 PDFDokument126 SeitenDate Sheet Dec 2015 PDFamandeep651Noch keine Bewertungen

- Cancer PlanDokument10 SeitenCancer PlanGURPREET SINGHNoch keine Bewertungen

- Mock Exam Questions 2022Dokument21 SeitenMock Exam Questions 2022ZHANG EmilyNoch keine Bewertungen

- Penang Realty Case Against IRBDokument15 SeitenPenang Realty Case Against IRBsimson singawahNoch keine Bewertungen

- Copeland 1968Dokument17 SeitenCopeland 1968Aningtyas RatriNoch keine Bewertungen

- Soudamini Resume 1Dokument2 SeitenSoudamini Resume 1Soudamini MohapatraNoch keine Bewertungen

- CAF-02 Final All Notes of September 2023 SessionDokument41 SeitenCAF-02 Final All Notes of September 2023 Sessionfahadkhn871Noch keine Bewertungen