Beruflich Dokumente

Kultur Dokumente

A Beginner

Hochgeladen von

Ahmad Fauzi MehatCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Beginner

Hochgeladen von

Ahmad Fauzi MehatCopyright:

Verfügbare Formate

A Beginner's Guide to Exchange Rates and the Foreign Exchange Market [Part 1: Exchange Rates - What are they

and ho

are they ca!cu!ated"# $y Mike Mo%%att

Like most other rates in economics, the exchange rate is essentially a price and can be analyzed in the same way we would a price. Take a typical supermarket price, say lemons are selling at the price of 3 for a dollar or 33 cents each. Then we can think of the dollar-to-lemon exchange rate as being 3 lemons because if we give up one dollar, we can get three lemons in return. imilarly, the lemon-to-dollar exchange rate is !"3 of a dollar or 33 cents, because if you sell a lemon, you will get 33 cents in return. o when we speak of an #-to-$ exchange rate of %, this means that if we give up ! unit of #, we get % units of $ in return. &f we want to know the $-to-# exchange rate, we calculate it using the simple exchange rate formula'

Y-to-X exchange rate = 1 / X-to-Y exchange rate

(f course, the exchange rates we read in the paper or hear on radio or T) are not prices for # and $ or for oranges and lemons. &nstead they*re relative prices for different currencies, but they work in the same fashion. (n +ebruary ,-, ,..3 the /. .-to-0apan exchange rate was !!1 yen, so this means that you can purchase !!1 0apanese yen in exchange for ! /. . dollar. To figure out how many /. . dollars you can get for ! 0apanese yen, we can 2ust use the formula'

Japan-to-U.S. exchange rate = 1 / U.S.-to-Japan exchange rate Japan-to-U.S. exchange rate = 1 / 117 = .00854

o this tells us that one 0apanese yen is worth ...345 /. . dollars, which is less than a penny. imilarly if the 6anadian dollar is worth .-1 /. . dollars, we have a 6anada-to-/. exchange rate of .-1. &f we want to know how many 6anadian dollars we can buy with ! /. . dollar, we use the formula'

U.S.-to-Canada exchange rate = 1/Canada-to-U.S. Exchange rate U.S.-to-Canada exchange rate = 1/0.67 = 1.4925

o one /. . dollar can get us 7!.58 in 6anadian funds. To see why these relationships must hold, we*ll look at the wonderful world of arbitrage.

Part &: Exchange Rates - Ar$itrage#

uppose the 9lgerian dinars-to-:ulgarian leva exchange rate is ,. ;e would expect then that the :ulgarian-to-9lgerian exchange rate would be !", or ..4. :ut suppose for a second that it wasn*t. &nstead assume that the current market :ulgarian-to9lgerian exchange rate is ..-. Then an investor could take five 9lgerian dinars and exchange them for !. :ulgarian leva. he could then take her !. :ulgarian leva and exchange them back for 9lgerian dinars. 9t the :ulgarian-to-9lgerian exchange rate, she*d give up !. leva and get back - dinars. <ow she has one more 9lgerian dinar than she did before. This type of exchange is known as arbitrage. ince our investor gained a dinar, and since we*re not creating or destroying any currency, the rest of the market must have lost a dinar. This of course is bad for the rest of the market. ;e would expect that the other agents in the currency exchange market will change the exchange rates that they offer so these opportunities to get exploited are taken away. till there is a class of investors known as arbitrageurs who try to exploit these differences. 9rbitrage generally takes on more complex forms than this, involving several currencies. uppose that the 9lgerian dinars-to-:ulgarian leva exchange rate is , and the :ulgarian leva-to-6hilean peso is 3. To figure out what the 9lgerian-to6hilean exchange rate needs to be, we 2ust multiply the two exchange rates together'

A-to-C = (A-to-B)*(B-to-C)

This property of exchange rates is known as transitivity. To avoid arbitrage we would need the 9lgerian-to-6hilean exchange rate to be - and the 6hilean-to-9lgerian exchange rate needs to be !"-. uppose it was only !"4. Then our investor could again take five 9lgerian dinars and exchange them for !. :ulgarian leva. he could then take her !. leva and get 3. 6hilean pesos at the :ulgarian-to-6hilean exchange rate of 3. &f she then exchanged her 3. 6hilean pesos at the 6hilean-to-9lgerian rate of !"4, she*d get - 9lgerian dinars in return. (nce again our investor has gained a dinar and the rest of the market has lost one. +or any three currencies 9, :, and 6, trading 9 for :, : for 6 and 6 for 9 is known as a currency cycle. The 9-to-6 exchange rate not only places restrictions on the 6-to-9 exchange rate, but it also places restriction on the 9-to-: and :-to-6 pair of exchange rates. =ost of the time all the exchange rates on the market will be synchronized like this, but occasionally they*ll become out of sync and arbitrageurs can make a profit from currency cycles. The relative prices of currencies are not set 2ust to ensure that profitable currency cycles do not exist. 9rbitrageurs only play a small, but important, role in the value of a currency. 6urrencies are simply a commodity, like any other, which has a price. ince the exchange rate is simply a price, it has the same basic determinants that any other price has' supply and demand. +irst we*ll look at supply.

[Part ': Exchange Rates - (u))!y# :asic econonomic theory teaches us that if the supply of a good increases, and nothing else changes, the price of that good will decrease. &f the supply of a country*s currency increases, we should see that it takes more of that currency to purchase a different currency than it did before. uppose there was a big 2ump in the supply of the 6anadian dollar. ;e would expect to see the 6anadian dollar become less valuable relative to other currencies. o the 6anadian-to-/. . >xchange rate should decrease, from -1 cents down to, say, 4. cents. >ach 6anadian dollar would give us less 9merican dollars than it did before. imilarly, the /. .-to-6anadian exchange rate would increase from 7!.58 to 7,..., so each /. . dollar would give us more 6anadian dollars than it did before, as a 6anadian dollar is less valuable than it used to be. Why ou!d the su))!y o% a currency increase"

6urrencies are traded on the foreign exchange market, and the supply of a currency on that market will change over time. There are a few different organizations whose actions will cause a rise in the supply of the foreign exchange market'

1* Ex)ort +o,)anies

uppose a outh 9frican farm sells the cashews it produces to a large 0apanese firm. &t is likely that the contract will be negotiated in 0apanese yen, so the farm will receive its revenue in a currency with limited use outside of 0apan. ince the company needs to pay it*s employees in the local currency, namely the outh 9frican rand, the company would sell its yen on a foreign exchange market and buy rands. The supply of 0apanese yen on the foreign exchange market will increase, and the supply of outh 9frican rands will decrease. This will cause the rand to appreciate in value ?become more valuable@ relative to other currencies and the yen to depreciate.

&* Foreign -n.estors

9 Aerman automobile manufacturer wants to build a new plant in ;indsor, (<, 6anada. To purchase the land, hire construction workers, etc., the firm will need 6anadian dollars. Bowever most of their cash reserves are held in euros. The company will be forced to go to the foreign exchange market, sell some of its euros, and buy 6anadian dollars. The supply of euros on the foreign exchange market goes up, and the supply of 6anadian dollars goes down. This will cause 6anadian dollars to appreciate and euros to depreciate. +oreign investment does not have to be in tangible goods such as land. &f Aerman investors buy 6anadian stocks, such as stocks listed on the Toronto tock >xchange or purchase 6anadian dollar bonds, we will have the same situation as above.

'* ()ecu!ators

Like the stock market, there are investors who try to make a fortune ?or at least a living@ by buying and selling currencies. uppose a currency investor thinks that the =exican peso will depreciate in the future, so it will be less valuable than other currencies than it is now. &n that case, she is likely to sell her pesos on the foreign exchange market and buy a different currency instead, such as the outh Corean won. The supply of pesos goes up and the supply of won goes down. This causes pesos to depreciate, and won to appreciate. <ote the self-fulfilling nature of the beliefs investors hold. &f investors feel that a currency will depreciate in the future, they will try to sell it today. ince the currency is being sold by investors, the supply of it will go up, and the price of it will decrease. The investor thought that the currency would depreciate, she acted on that belief and sold her currency, and the act of selling caused the depreciation to take place. elf-fulfilling prophecies such as this one are Duite common in economics.

/* +entra! Bankers

The central bank of the /nited tates is the +ederal Eeserve, more commonly known as FThe +edF. (ne of the responsibilities of the +ed is to control the supply, or the amount, of currency in a country. The most obvious way to increase the supply of money is to simply print more currency, though there are much more sophisticated ways of changing the money supply. &f the +ed prints more !. and ,. dollar bills, the money supply will increase. ;hen the government increases the money supply, it is likely some of this new money will make its way to the foreign exchange market, so the supply of /. . dollars will increase there as well. 9 central bank will often directly increase the supply of money on the foreign exchange markets. 6entral banks like the +ed keep a supply of most ?if not all@ currencies in reserve and will often use them to influence the exchange rate. &f the +ed decides that the /. . dollar has appreciated in value too much relative to the 0apanese yen, it will sell some of the /. . dollars it has in reserve and buy 0apanese yen. This will increase the supply of dollars on the foreign exchange market, and decrease the supply of yen, causing a depreciation in the value of the dollar relative to the yen. (f course, the +ed cannot do this as much as it would like, because it may end up running out of some currencies. 9s well, the 0apanese central bank ?named the :ank of 0apan@ could decide that the +ed is manipulating the price of the yen too much and the :ank of 0apan could counteract the +ed by selling yen and by buying dollars. These are the organizations who will increase the supply of currency on the exchange market. <ow we*ll investigate the demand side of foreign exchange markets.

Part /: Exchange Rates - 0e,and#

Why

ou!d the de,and %or a currency increase"

<ot surprisingly pretty much the same organizations who caused supply changes will cause demand changes. They are as follows'

1* -,)ort +o,)anies

9 :ritish retailer specializing in 6hinese merchandise will often have to pay for that merchandise in 6hinese yuan. o if the popularity of 6hinese goods goes up in other countries the demand for 6hinese yuan will go up as retailers purchase yuan to make purchases from 6hinese wholesalers and manufacturers.

&* Foreign -n.estors

9s before a Aerman automobile manufacturer wants to build a new plant in ;indsor, (<, 6anada. To purchase the land, hire construction workers, etc., the firm will need 6anadian dollars. o the demand for 6anadian dollars will rise.

'* ()ecu!ators

&f an investor feels that the price of =exican pesos will rise in the future, she will demand more pesos today. This increased demand leads to an increased price for pesos.

/* +entra! Bankers

9 central bank might decide that its holdings of a particular currency are too low, so they decide to buy that currency on the open market. They might also want to have the exchange rate for their currency decline relative to another currency. o they put their currency on the open market and use it to buy another currency. o 6entral :anks can play a role in the demand for currency. upply and demand are often thought of as being two sides of the same coin. Bere we see that this is the case, as in every transaction there is a buyer and a seller, or in other words, a demander and a supplier. <ow we know what agents can cause price changes and for what reasons. ;e can use our knowledge to analyze what happens in the Freal worldF. 9n interesting case is the 6anadian-to-9merican exchange rate. Gue to the geographical proximity and economic intergration of the two countries the 6anadian-to-9merican exchange rate is often examined. The sharp decline in the value of the 6anadian dollar relative to the 9merican one is widely discussed in the news, so we*ll discuss it now.

Part /: Exchange Rates - 0e,and#

Why

ou!d the de,and %or a currency increase"

<ot surprisingly pretty much the same organizations who caused supply changes will cause demand changes. They are as follows'

1* -,)ort +o,)anies

9 :ritish retailer specializing in 6hinese merchandise will often have to pay for that merchandise in 6hinese yuan. o if the popularity of 6hinese goods goes up in other countries the demand for 6hinese yuan will go up as retailers purchase yuan to make purchases from 6hinese wholesalers and manufacturers.

&* Foreign -n.estors

9s before a Aerman automobile manufacturer wants to build a new plant in ;indsor, (<, 6anada. To purchase the land, hire construction workers, etc., the firm will need 6anadian dollars. o the demand for 6anadian dollars will rise.

'* ()ecu!ators

&f an investor feels that the price of =exican pesos will rise in the future, she will demand more pesos today. This increased demand leads to an increased price for pesos.

/* +entra! Bankers

9 central bank might decide that its holdings of a particular currency are too low, so they decide to buy that currency on the open market. They might also want to have the exchange rate for their currency decline relative to another currency. o they put their currency on the open market and use it to buy another currency. o 6entral :anks can play a role in the demand for currency. upply and demand are often thought of as being two sides of the same coin. Bere we see that this is the case, as in every transaction there is a buyer and a seller, or in other words, a demander and a supplier. <ow we know what agents can cause price changes and for what reasons. ;e can use our knowledge to analyze what happens in the Freal worldF. 9n interesting case is the 6anadian-to-9merican exchange rate. Gue to the geographical proximity and economic intergration of the two countries the 6anadian-to-9merican exchange rate is often examined. The sharp decline in the value of the 6anadian dollar relative to the 9merican one is widely discussed in the news, so we*ll discuss it now. Part 1: +ase (tudy: +anada - -ntroduction#

&n 0anuary !88. the 6anada-to-/. . exchange rate was around 34 9merican cents. Less than nine years later, the 6anadian dollar had depreciated to -4 cents. This substantial drop in the value of the 6anadian dollar has been Duite upsetting to many 6anadians. 9lmost every 6anadian spends a large fraction of his"her income on 9merican goods and many take vacations in the /nited tates. ince the savings of most 6anadians are in assets priced in 6anadian dollars, their savings could now buy much fewer 9merican goods and services. This was particularly noticable to 6anadian seniors who spend much of the winter in 9rizona and +lorida. The following chart shows how the 6anadian-to-9merican exchange rate has declined since !88.'

<ow we can see the problem, we can investigate what caused this drop. The rapid decline of the 6anadian dollar can be explained by the supply and demand framework illustrated in the previous two sections of this article. Bere are three factors which caused a change in supply and"or demand and subseDuently a devaluation of the 6anadian dollar. Part 2: +ase (tudy: +anada - -nterest Rates# Factor &: -nterest Rates Guring the early !88.s, the :ank of 6anada ?:o6@, 6anada*s central bank, embarked on a policy to lower interest rates, particularly interest rates on government bonds. The :o6 succeeded and 6anadian interest rates dropped much faster than 9merican rates. The 6anadian prime rate of interest was around !5H during !88. while the 9merican prime rate was around !.H. ;e usually compare interest rates by basis points, where !.. basis points a difference of !H, say between 4H and -H or between !1H and !3H. o here we have a 5.. point difference in rates. :y !881 the 6anadian prime rate of interest was 314 points lower than the 9merican one. The following chart shows the difference between the 6anadian rate and the 9merican one'

6hanges in interest rates can have a drastic effect on exchange rates. &nvestors interested in purchasing a security that pays interest, such as a bond, will buy the bond that gives them the highest interest rate, all else being eDual. ince 6anadian bonds had a lower interest rate than 9merican bonds, investors were more interested in purchasing 9merican bonds, and less interested in 6anadian ones. &n order to purchase 9merican bonds, they would need to buy 9merican dollars on the foreign exchange market, causing a reduction in the supply of /. . dollars and a rise in their value relative to other currencies such as the 6anadian one. &f 6anadians are buying /. . bonds, they*ll be selling 6anadian dollars and buying 9merican ones, so we*ll see an increase in the supply of 6anadian dollars and a decline in their value. ;e should then expect to see periods where the exchange rate and the interest rate move in the same direction. )isually it would be helpful to plot them both on the same set of axes. To do this & had to perform a scaling operation on the interest rate gap. :y taking the gap, dividing it by 4. then adding ..1 to this figure, & was able to plot both on the same chart'

The exchange rate is the blue line which starts higher and the interest rate gap is the purple line which starts lower. <ote how both decline until !881. The correlation coefficient for the interest rate gap and the exchange rate from 0anuary !88. to Gecember !88- is ..13I the two were highly positively related during this period. Bowever during the 9sian crisis of !881-!883 the two went in opposing directions and the correlation coefficient was -..8!. 6hanges in the interest rates gap have not gone in the same direction as changes in the exchange rate since !883 as the correlation coefficient is -..14. &t would appear that if we*re looking for reasons why the 6anadian dollar may have been weak since !883, we*ll have to look elsewhere for an answer. 3ext )age J Kart 3' 6as Part 4: +ase (tudy: +anada - -nternationa! Factors# Factor ': -nternationa! Factors and ()ecu!ation

Guring !881 and !883, the economies of most 9sian countries went into steep decline which became known as the 9sian 6risis. The 9sian crisis had a far greater impact on 6anada than it did on the /nited tates. >xports take up a much smaller portion of the /. . economy than they do of the 6anadian economy. o the 9merican dollar is much more insulated to international events than the 6anadian dollar. 6anada also exports a large amount of construction materials to 9sian countries, so when the economies of these countries went into severe decline, new construction became non-existent so raw materials were no longer demanded. This drop in the demand for commodities caused a decline in the price of the 6anadian dollar relative to other non-9sian currencies. /nderstandably most investors are somewhat risk-averse, so they will avoid unnecessary risk. &nvestors during times of international turmoil prefer to invest in large countries that are more insulated from turmoil in other counries. The /nited tates is a haven for investors trying to avoid this type of uncertainty, whereas smaller open economies like 6anada are not. o not surprisingly the 6anadian dollar declined during the 9sian crisis. This still doesn*t explain why the 6anadian dollar declined from !883 to ,..,. /nfortunately & can*t provide any solid evidence of why this happened, but here are three possibilities. !. 5he Bush E!ection in' The Eepublicans are seen as a party which will create an environment positive for investors. &t is conceivable that many international investors moved their money from 6anada to the /nited tates when the ;hite Bouse went from Gemocratic to Eepublican control. ,. -nternationa! 6ncertainty' 9s mentioned before investors will flock to a country like the /nited tates during time of unrest. &nvestors have been worried that a global recession might occur during the beginning of this decade. Terrorist threats and military actions in 9fghanistan and &raD may have caused investors to put their money into large countries like the /nited tates. 3. 5he Be!ie%s o% +urrency ()ecu!ators' =any currency speculators felt that the 6anadian dollar would continue to decline in the future. =any investors did not want to be part of a sinking ship, so they sold their holdings of 6anadian dollars, further reducing the price. &f investors feel that the 6anadian dollar will improve in the near future, they will 2ump back on the bandwagon by buying 6anadian dollars and the value of the 6anadian dollar will rise. &t appears this is what has been happening in the beginning of ,..3. <ext week &*ll be adding pages on Kurchasing Kower Karity, +ixed vs. +loating Eates, and 6urrency /nions. 9s always please e-mail me if you have any Duestions, comments, criticism, or suggestions.

Das könnte Ihnen auch gefallen

- A Few Examples of How A Different Margin Could Affect Your Transaction FollowDokument6 SeitenA Few Examples of How A Different Margin Could Affect Your Transaction FollowAhmad Fauzi MehatNoch keine Bewertungen

- Authorized Letter For Verification of Fund-RMBDokument2 SeitenAuthorized Letter For Verification of Fund-RMBAhmad Fauzi MehatNoch keine Bewertungen

- U.S. DOT Federal Transit Administration Best Practices Procurement ManualDokument673 SeitenU.S. DOT Federal Transit Administration Best Practices Procurement ManualAhmad Fauzi MehatNoch keine Bewertungen

- Suggested End of Chapter 5 SolutionsDokument8 SeitenSuggested End of Chapter 5 SolutionsAhmad Fauzi MehatNoch keine Bewertungen

- Rentas ModuleDokument1 SeiteRentas ModuleAhmad Fauzi MehatNoch keine Bewertungen

- Exchange Control RulesDokument14 SeitenExchange Control RulesAhmad Fauzi Mehat100% (1)

- Bond Pricing in The MarketDokument53 SeitenBond Pricing in The MarketAhmad Fauzi MehatNoch keine Bewertungen

- Roll On or Roll of Process FlowsDokument11 SeitenRoll On or Roll of Process FlowsAhmad Fauzi MehatNoch keine Bewertungen

- Valuation of Debt Instruments: Debt Securities Are Government Securities (Government Bonds, Government BillsDokument13 SeitenValuation of Debt Instruments: Debt Securities Are Government Securities (Government Bonds, Government BillsJoslin FernandesNoch keine Bewertungen

- Export + Import Process Flow - Break Bulk Cargo 27072010Dokument11 SeitenExport + Import Process Flow - Break Bulk Cargo 27072010Ahmad Fauzi Mehat100% (1)

- Welcome To The Gold Guidelines: Page 1 of 9Dokument9 SeitenWelcome To The Gold Guidelines: Page 1 of 9Ahmad Fauzi MehatNoch keine Bewertungen

- Malaysia Haulage Charges (Base On Point-Butterworth, Penang)Dokument2 SeitenMalaysia Haulage Charges (Base On Point-Butterworth, Penang)Ahmad Fauzi MehatNoch keine Bewertungen

- Contract c8Dokument9 SeitenContract c8Ahmad Fauzi MehatNoch keine Bewertungen

- World Bank Report FinalDokument76 SeitenWorld Bank Report FinalAhmad Fauzi MehatNoch keine Bewertungen

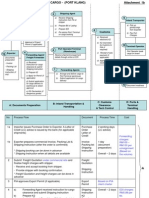

- Dry Bulk Cargo - (Import and Export)Dokument12 SeitenDry Bulk Cargo - (Import and Export)Ahmad Fauzi Mehat100% (1)

- BG and SBLCDokument1 SeiteBG and SBLCKwadwo AsaseNoch keine Bewertungen

- Mt100 To 199 (Customer Payments)Dokument286 SeitenMt100 To 199 (Customer Payments)Perez CorazaNoch keine Bewertungen

- World Financial Infrastructure and MoneyDokument129 SeitenWorld Financial Infrastructure and MoneyAhmad Fauzi MehatNoch keine Bewertungen

- Swift Standards Category 4 Collections Cash LettersDokument128 SeitenSwift Standards Category 4 Collections Cash LettersAhmad Fauzi MehatNoch keine Bewertungen

- Swift Standards Category 6 Treasury Markets Precious Metals MT600 MT699Dokument103 SeitenSwift Standards Category 6 Treasury Markets Precious Metals MT600 MT699Ahmad Fauzi Mehat100% (1)

- Samad and Gardner and Cook - Islamic Banking and Finance PDFDokument18 SeitenSamad and Gardner and Cook - Islamic Banking and Finance PDFAhmad Fauzi MehatNoch keine Bewertungen

- Bullion Coins BookletDokument17 SeitenBullion Coins BookletAhmad Fauzi MehatNoch keine Bewertungen

- Types of Credit Instruments & Its FeaturesDokument22 SeitenTypes of Credit Instruments & Its Featuresninpra94% (18)

- 30 Currencies Including The G7Dokument6 Seiten30 Currencies Including The G7Ahmad Fauzi MehatNoch keine Bewertungen

- Swift Standards Category 7 Documentary Credits & GuaranteesDokument209 SeitenSwift Standards Category 7 Documentary Credits & GuaranteesMEGHANALOKSHANoch keine Bewertungen

- Swift Standards Category 7 Documentary Credits & GuaranteesDokument209 SeitenSwift Standards Category 7 Documentary Credits & GuaranteesMEGHANALOKSHANoch keine Bewertungen

- Bank GuaranteeDokument6 SeitenBank GuaranteeAhmad Fauzi MehatNoch keine Bewertungen

- Financial StatementDokument6 SeitenFinancial StatementAhmad Fauzi MehatNoch keine Bewertungen

- Banking-Theory-Law and PracticeDokument151 SeitenBanking-Theory-Law and PracticeAhmad Fauzi MehatNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Certificate of Indigency (Emergency Philhealth)Dokument3 SeitenCertificate of Indigency (Emergency Philhealth)Barangay AmasNoch keine Bewertungen

- A4V Procedure - Trvth's Presentation of SFsDokument22 SeitenA4V Procedure - Trvth's Presentation of SFsBob Hurt100% (7)

- 06Dokument9 Seiten06Shubham RawatNoch keine Bewertungen

- Hugh Hendry Eclectica Nov09Dokument8 SeitenHugh Hendry Eclectica Nov09marketfolly.comNoch keine Bewertungen

- Statement 25197479 EUR 2024-02-02 2024-03-03Dokument4 SeitenStatement 25197479 EUR 2024-02-02 2024-03-03Gabriel BuitiNoch keine Bewertungen

- Indian Currency MarketDokument15 SeitenIndian Currency MarketSneha PatelNoch keine Bewertungen

- PSLE Maths Challenging Word Problems Set02Dokument10 SeitenPSLE Maths Challenging Word Problems Set02Smith100% (1)

- Macroeconomics 10th Edition Colander Test Bank Full Chapter PDFDokument66 SeitenMacroeconomics 10th Edition Colander Test Bank Full Chapter PDFcarlarodriquezajbns100% (10)

- Vitalik Buterin BiographyDokument3 SeitenVitalik Buterin BiographywilsonlariosNoch keine Bewertungen

- Value of Taxable Supply - Transaction ValueDokument36 SeitenValue of Taxable Supply - Transaction ValueArun JyothiNoch keine Bewertungen

- Oracle FLEXCUBE Universal Banking Primer - CoreDokument23 SeitenOracle FLEXCUBE Universal Banking Primer - CoremuruganandhanNoch keine Bewertungen

- Three Essays On Macroeconomic Management 2008Dokument214 SeitenThree Essays On Macroeconomic Management 2008Chan RithNoch keine Bewertungen

- Worded Problems: - Number - Coin - Age - Work - MixtureDokument37 SeitenWorded Problems: - Number - Coin - Age - Work - Mixturearnel cabesasNoch keine Bewertungen

- Tanzania civic education quizDokument2 SeitenTanzania civic education quizKANDONGA FARAJANoch keine Bewertungen

- Bank Abbreviations PDFDokument6 SeitenBank Abbreviations PDFVineeth VivekanandanNoch keine Bewertungen

- Zambia Kwacha Currency Rebasing Brochure BarclaysDokument12 SeitenZambia Kwacha Currency Rebasing Brochure BarclaysBen MusimaneNoch keine Bewertungen

- Guido Candela, Paolo Figini Auth. The Economics of Tourism Destinations PDFDokument626 SeitenGuido Candela, Paolo Figini Auth. The Economics of Tourism Destinations PDFMelania PaceNoch keine Bewertungen

- Janata BankDokument53 SeitenJanata BankAriful Islam FahimNoch keine Bewertungen

- Study of Impacts of Demonetization in IndiaDokument46 SeitenStudy of Impacts of Demonetization in IndiaSoumya RanjanNoch keine Bewertungen

- Microeconomics - Theory Through ApplicationsDokument828 SeitenMicroeconomics - Theory Through ApplicationsRunal Bhanamgi100% (1)

- ZTYRDokument6 SeitenZTYRshikhar singhNoch keine Bewertungen

- CyberPunk 2020 - Unofficial - Magazine - EdgeRunner Vol2 Issue01Dokument14 SeitenCyberPunk 2020 - Unofficial - Magazine - EdgeRunner Vol2 Issue01llokuniyahooesNoch keine Bewertungen

- Dinar To Naira - Google SearchDokument1 SeiteDinar To Naira - Google SearchJenna CarolineNoch keine Bewertungen

- Chapter 3 - Money and Credit: CBSE Notes Class 10 Social Science EconomicsDokument3 SeitenChapter 3 - Money and Credit: CBSE Notes Class 10 Social Science EconomicsWIN FACTSNoch keine Bewertungen

- Gold and Silver First Tetrarchic Issues From The Mint of Alexandria / D. Scott VanHornDokument33 SeitenGold and Silver First Tetrarchic Issues From The Mint of Alexandria / D. Scott VanHornDigital Library Numis (DLN)Noch keine Bewertungen

- Brazil's currency slides to new lowDokument2 SeitenBrazil's currency slides to new lowFunded FXNoch keine Bewertungen

- Cash Count SheetDokument5.468 SeitenCash Count SheetchrischuwaNoch keine Bewertungen

- Unit 1 PPT 1Dokument35 SeitenUnit 1 PPT 1Shristi SinhaNoch keine Bewertungen

- Lawful Money Defined: What It Is and How It Differs From Fiat CurrencyDokument4 SeitenLawful Money Defined: What It Is and How It Differs From Fiat CurrencyLedoNoch keine Bewertungen

- For Individuals and Sole Proprietorship (BALH)Dokument6 SeitenFor Individuals and Sole Proprietorship (BALH)Ghulam Hyder100% (1)