Beruflich Dokumente

Kultur Dokumente

FM Q.B.

Hochgeladen von

archana_anuragiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FM Q.B.

Hochgeladen von

archana_anuragiCopyright:

Verfügbare Formate

KANPUR INSTITUTE OF TECHNOLOGY, KANPUR QUESTION BANK-1 CLASS: MBA IInd Semeste S!"#e$t: F%n&n$%&' M&n&(ement )MBA *+,1.

What do you mean by business finance? Discuss various approaches to finance function. 2. Finance function is concerned with allocating funds to specific assets and obtaining the best mix of financing in relation to the overall valuation of the firm. Discuss. !. What do you understand by "usiness finance? #. What is financial management process? $. What is finance function? What are its ob%ectives? &. What is financial management? What ma%or decisions are re'uired to be ta(en in finance? ). *aximi+ation of profits is regarded as the proper ob%ective of investment decision, but it is not as exclusive as maximi+ing shareholders- wealth. .omment. /. 0xplain the ob%ective of financial management. 1. Finance function of a business is closely related to its other functions. Discuss. 12. Why is maximi+ing wealth a better goal than maximi+ing profits? 11. 3ow should the finance of an enterprise be organi+ed? 12. .ritically analy+es the functions of financial manager in a modern business organi+ation. 1!. What is the concept of 4time value-? 5ame the techni'ues of 6ime value of money. 1#. What is time preference for money? 1$. Define the following7 8a9 :nnuity, 8b9 Discount rate, 8c9 Future value,8d9 :nnuity discount factor, 1&. : rational human being has a time preference for money. What are the reasons for such a preference? 1). 0xplain the mechanics of calculating present value of cash flows giving suitable examples. 1/. What is ;is(? 3ow can ris( of an asset be calculated? 0xplain. 11. What are the types of ris( involved in an investment? :naly+e the ris( and return relationship in ta(ing <nvestment decisions. 22. 3igher the return, higher will be the ris(. <n this context, discuss the various ris( associated with an asset.

QUESTION BANK-+ CLASS: MBA IInd Semste S!"#e$t: F%n&n$%&' M&n&(ement )MBA *+,1. 2. !. #. $. &. What do mean by appraisal of pro%ects? 0xplain the various considerations involved in such appraisal. Discuss the problems of identification, formulation, appraisal and implementation of new pro%ects. Discuss in detail the various stages involved in the execution and management of a pro%ect. Define capital budgeting. What is the need of capital budgeting? 0xplain the concept of capital budgeting and what is it-s practical utility? What do you understand capital budgeting process? 0numerate briefly the ma%or steps involved in capital budgeting. ). .apital "udgeting is long term planning for ma(ing and financial proposed capital outlays 0xplain. What are the limitations of its. /. Write short notes on 7 8a9 profitability index,8b9 time ad%usted rate of return, 8c9 .apital rationing, 8d9 5=> vs <;;,8e9 .apital expenditure,8f9=ay bac( period method,8g9 accounting rate of return. 1. What is meant by financial leverage? 3ow does it magnify the revenue available for e'uity shareholders? 12. Discuss the relation between debt financing and financial leverage. 11. Distinguish between operating leverage and financial leverage. Do you thin( that they are related to capital structure?

QUESTION BANK-. CLASS: MBA IInd Semeste S!"#e$t: F%n&n$%&' M&n&(ement )MBA *+,1. .ritically examine the advantages and disadvantages of raising funds by issuing shares of different types. 2. What are debentures? What type of debentures can a %oint stoc( company issue? 0valuate debentures as a source of funds. !. "etween e'uity shares and debentures which is profitable for raising additional long term capital for a manufacturing company and why? #. What is factoring? $. Write a brief note on commercial paper as a source of finance. &. Write short notes on7 8a9 .onvertible debentures,8b9 =reference share,8c9 0'uity shares,8d9 ?ease financing, 8e9 @elf financing, ). .ommercial "an( provides only short term finance. Do you agree? 0xplain the various forms of ban( finance. /. ?easing is beneficial to both, the lessee as well as the lessor . 0xamine. 1. What are the main sources of finance available to industries for meeting shortAterm as well as longAterm financial re'uirements? Discuss. 12. What do you understand by capital structure? What are the ma%or determinants of capital structure? 11. Bsing imaginary figure show how to determined the value of firm under 8a9 6he 5etA<ncome85<9 approach, 8b9 6he 5et Cperating <ncome 85C<9 approach. 12. What is weighted average cost of capital? 0xamine the rational behind the use of W:... 1!. What is cost of capital? 0xplain the significance of cost of capital. 1#. What is relevance cost of capital in capital budgeting and capital structure planning decisions? 1$. Dive a critical appraisal of the traditional approach and the *odiglianiA*illers approach to the problem of capital structure.

QUESTION BANK-/ CLASS: MBA Ist Semeste S!"#e$t: F%n&n$%&' M&n&(ement )MBA *+,1. What do you understand by management of earnings? Discuss its scope. 2. What do understand by retained 4retained earnings-? Discuss the merits and demerits of ploughing bac( of profits. !. ;etained earnings do not involve any cost . Do you agree? #. 3ow far do you agree that dividends are irrelevant? $. 0xplain the theories of dividend. &. 3ow do dividends affect the value of a share? ). @tate the various advantages of stability of dividends? /. Why stable dividend policy is dangerous? 1. ?ist the various constraints on =aying Dividends? 12. What are the preferences of shareholders? Do they want dividend income or capital gains? 11. What are the financial needs of the company? 12. 3ow much should be paid out as dividends? What are the constraints on paying dividends? 1!. @hould the company follow a stable dividend policy? 1#. What should be the form of dividends? 1$. What are the options available for Dividend decision? 1&. ?ist the various models available for ta(ing dividend decisions? 1). What do you mean by traditional approach to the dividend policy and what are its limitations? 1/. 3ow Walter *odel is different from Dordon-s Dividend .apitali+ation *odel? 11. 0xplain in detail about Dordon-s Dividend .apitali+ation *odel? 22. :naly+e critically of the :ssumptions of ** model in dividend decision? 21. What are the critical assumptions of *iller E *odigliani *odel? 22. <n Walter-s approach, the dividend policy of a firm depends on availability of investment opportunity and the relationship between the firm-s internal rate of return and its cost of capital. 2!. What are the sources of bonus issue? Write detailed note on the issue of bonus shares. 2#. Define the term wor(ing capital. What factors would you ta(e into consideration in estimating the wor(ing capital needs of concern? 2$. 0xplain factors influencing the wor(ing capital. 2&. Discuss the wor(ing capital cycle. 2). What do you understand by cash management? 3ow can it be underta(en? 2/. 0fficient cash management will aim at maximi+ing the cash inflows and showing cash outflows. 21. What is meant by inventory management? Why is it essential to a business concern? !2. What is :A"A. analysis? 3ow is it useful as tool of inventory management? !1. What are the assumptions of ** hypothesis? !2. 4Wor(ing capital management deals with decisions regarding the appropriate mix and level of current assets and current liabilities-. 0lucidate the statement. !!. ?ength of operating cycle is the ma%or determinant of wor(ing capital needs of a business firm. 0xplain. !#. Describe in brief the various factors, which are ta(en into account in determining the wor(ing capital needs of a firm. !$. What is receivables management? 3ow is it useful for business concerns? !&. What should be the considerations in forming a credit policy? !). ;eceivables forecasting is important for the proper management of receivables forecasting. !/. .an a firm have an optimal capital structure? What do you mean by flexibility of capital structure? !1. Discuss any five factors relevant in determining the capital structure. #2. <f debt is cheaper source of finance, then why every firm is not a 11F debt firm? 0numerate the legal provisions in this respect. #1. 3ow the consideration of control affects the composition of capital structure? #2. 0xplain the feature of 0"<6 A0=@ analysis, cash flow analysis and valuation models approach to determinations of capital structure. #!. <n addition to wealth considerations, what other factors might a firm consider while ma(ing capital structure decisions? ##. 0xplain the capital structure decision from the point of view of minimi+ation of ris(.

Das könnte Ihnen auch gefallen

- Solution Problem 1 Problems Handouts MicroDokument25 SeitenSolution Problem 1 Problems Handouts MicrokokokoNoch keine Bewertungen

- GB550 Course PreviewDokument8 SeitenGB550 Course PreviewNatalie Conklin100% (1)

- Solution Manual For Practical Financial Management 8th Edition by LasherDokument6 SeitenSolution Manual For Practical Financial Management 8th Edition by Lashera161631812Noch keine Bewertungen

- Case Study PPDokument3 SeitenCase Study PParchana_anuragi100% (1)

- Consolidated FM NotesDokument227 SeitenConsolidated FM NotesTitus GachuhiNoch keine Bewertungen

- MADRAS University - 2 & 5 & 10 Mark Questions - Financial ManagementDokument17 SeitenMADRAS University - 2 & 5 & 10 Mark Questions - Financial Managementjeganrajraj50% (2)

- 03 LasherIM Ch03Dokument47 Seiten03 LasherIM Ch03Sana Khan100% (1)

- Fund For Local Cooperation (FLC) : Application FormDokument9 SeitenFund For Local Cooperation (FLC) : Application FormsimbiroNoch keine Bewertungen

- BA7202-Financial Management Question BankDokument10 SeitenBA7202-Financial Management Question BankHR HMA TECHNoch keine Bewertungen

- Mba-608 (CF)Dokument14 SeitenMba-608 (CF)Saumya jaiswalNoch keine Bewertungen

- Financial ManagementDokument197 SeitenFinancial ManagementDEEPAK100% (1)

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDokument2 SeitenACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNoch keine Bewertungen

- Financial Management QuestionsDokument3 SeitenFinancial Management Questionsjagdish002Noch keine Bewertungen

- Tutorial Questions FinDokument16 SeitenTutorial Questions FinNhu Nguyen HoangNoch keine Bewertungen

- Question Bank FMDokument4 SeitenQuestion Bank FMN Rakesh100% (3)

- Que Bank PFMDokument5 SeitenQue Bank PFMAmit KesharwaniNoch keine Bewertungen

- Financial Decesion Assignment No 1Dokument8 SeitenFinancial Decesion Assignment No 1Umesh AllannavarNoch keine Bewertungen

- Finance Question BankDokument2 SeitenFinance Question Banksiddhesh0812Noch keine Bewertungen

- A.Rahman Salah AmerDokument14 SeitenA.Rahman Salah AmerA.Rahman SalahNoch keine Bewertungen

- Chapter 11 Global Capital Markets: International Business: Environments and Operations, 16e (Daniels Et Al.)Dokument28 SeitenChapter 11 Global Capital Markets: International Business: Environments and Operations, 16e (Daniels Et Al.)batataNoch keine Bewertungen

- Capital Structure Ultratech Cement Sahithi Project 111111Dokument85 SeitenCapital Structure Ultratech Cement Sahithi Project 111111Sahithi PNoch keine Bewertungen

- Capital Sta - Ultratech - 24Dokument92 SeitenCapital Sta - Ultratech - 24Sahithi PNoch keine Bewertungen

- BA7202 Financial ManagementDokument10 SeitenBA7202 Financial ManagementabavithraaNoch keine Bewertungen

- BA7024 CorporateFinancequestionbankDokument5 SeitenBA7024 CorporateFinancequestionbankNorman MberiNoch keine Bewertungen

- CH 13Dokument28 SeitenCH 13lupavNoch keine Bewertungen

- Questions OadsDokument12 SeitenQuestions OadsMuhammad ShaheerNoch keine Bewertungen

- Question Bank Sem VDokument23 SeitenQuestion Bank Sem VVivek Kumar'c' 265Noch keine Bewertungen

- Financial Management Economics For Finance 1679035282Dokument135 SeitenFinancial Management Economics For Finance 1679035282Alaka BelkudeNoch keine Bewertungen

- FM414 LN 3 Master Copy Presentation Solutions - Working Capital MGT - 2024 ColorDokument15 SeitenFM414 LN 3 Master Copy Presentation Solutions - Working Capital MGT - 2024 ColorAntonio AguiarNoch keine Bewertungen

- International Financial Managment For OnlineDokument331 SeitenInternational Financial Managment For OnlineAmity-elearning75% (4)

- Acc216 Lecture Notes 2017Dokument38 SeitenAcc216 Lecture Notes 2017elfigio gwekwerereNoch keine Bewertungen

- Financial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Dokument2 SeitenFinancial Management (I-Mba V) Important Questions (Module 1&3) (I.e. Asked in GTU Question Papers)Sabhaya Chirag100% (3)

- Financial ManagementDokument26 SeitenFinancial ManagementbassramiNoch keine Bewertungen

- Unit-I: BA7024 Corporate FinanceDokument5 SeitenUnit-I: BA7024 Corporate FinanceHaresh KNoch keine Bewertungen

- FM All ModDokument105 SeitenFM All ModHarsh VartakNoch keine Bewertungen

- Financial Management SummariesDokument7 SeitenFinancial Management SummariesPatrick MfungweNoch keine Bewertungen

- Financial ManagementDokument60 SeitenFinancial ManagementDEAN TENDEKAI CHIKOWONoch keine Bewertungen

- Paper 12: Financial Management and International FinanceDokument12 SeitenPaper 12: Financial Management and International FinanceRajat PawanNoch keine Bewertungen

- Questionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Dokument14 SeitenQuestionnaire For Financial Investors : 1. How Often Do You Invest in Stocks?Rohit BichkarNoch keine Bewertungen

- Chapter 1 Financial Management and Financial ObjectivesDokument11 SeitenChapter 1 Financial Management and Financial ObjectivesHarris LuiNoch keine Bewertungen

- "financial Managements" (For The, "Honours" Candidates Only)Dokument4 Seiten"financial Managements" (For The, "Honours" Candidates Only)shouvik palNoch keine Bewertungen

- Financial Management: Course OutlineDokument3 SeitenFinancial Management: Course OutlinelibraolrackNoch keine Bewertungen

- Fin515-Week 1 HomeworkDokument4 SeitenFin515-Week 1 Homeworkwhi326Noch keine Bewertungen

- 10 Must-Know Topics To Prepare For A Financial Analyst InterviewDokument3 Seiten10 Must-Know Topics To Prepare For A Financial Analyst InterviewAdilNoch keine Bewertungen

- QuestionsDokument6 SeitenQuestionsSrinivas NaiduNoch keine Bewertungen

- IM Ch3-7e - WRLDokument49 SeitenIM Ch3-7e - WRLAnonymous Lih1laax0% (1)

- Dissertation InvestmentDokument8 SeitenDissertation InvestmentWriteMyPaperForMeCheapSingapore100% (1)

- Mckinsey On Finance: The Enduring Value of FundamentalsDokument84 SeitenMckinsey On Finance: The Enduring Value of FundamentalsKavya K GowdaNoch keine Bewertungen

- Term Paper Topics For Investment ManagementDokument8 SeitenTerm Paper Topics For Investment Managementaflskkcez100% (1)

- Accounting and Finance For ManagersDokument54 SeitenAccounting and Finance For ManagersHafeezNoch keine Bewertungen

- Financial Management and Corporate Finance AssignmentDokument1 SeiteFinancial Management and Corporate Finance AssignmentArchi VarshneyNoch keine Bewertungen

- Q 1. Write Down The Objectives of Financial Management and Corporate Finance?Dokument7 SeitenQ 1. Write Down The Objectives of Financial Management and Corporate Finance?Saad MalikNoch keine Bewertungen

- Revised BDM - Sample Q&A SolveDokument13 SeitenRevised BDM - Sample Q&A SolveSonam Dema DorjiNoch keine Bewertungen

- Full Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDokument36 SeitenFull Download Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualdrizitashao100% (43)

- Investment Management: Industry ScopeDokument21 SeitenInvestment Management: Industry ScopeAnonymous qAegy6GNoch keine Bewertungen

- BASICS of Finance, Modeling ValuationDokument32 SeitenBASICS of Finance, Modeling Valuationgoodthoughts0% (1)

- ACF 361 Chapter 1 To 3Dokument148 SeitenACF 361 Chapter 1 To 3edithyemehNoch keine Bewertungen

- Question Bank For FM Both Part - A & Part - BDokument167 SeitenQuestion Bank For FM Both Part - A & Part - BnandhuNoch keine Bewertungen

- Chapter 1 Corporate FinanceDokument11 SeitenChapter 1 Corporate FinanceYuk SimNoch keine Bewertungen

- Literature Review On Financial Statement Analysis of BanksDokument8 SeitenLiterature Review On Financial Statement Analysis of Banksc5nc3whzNoch keine Bewertungen

- Chapter 17Dokument18 SeitenChapter 17sundaravalliNoch keine Bewertungen

- The Corporate Executive’s Guide to General InvestingVon EverandThe Corporate Executive’s Guide to General InvestingNoch keine Bewertungen

- Active Balance Sheet Management: A Treasury & Investment PerspectiveVon EverandActive Balance Sheet Management: A Treasury & Investment PerspectiveNoch keine Bewertungen

- Working Capital ManagementDokument6 SeitenWorking Capital Managementarchana_anuragiNoch keine Bewertungen

- Summer Training Project Report ON: Consumer Perception AT Amul ProductDokument117 SeitenSummer Training Project Report ON: Consumer Perception AT Amul Productarchana_anuragiNoch keine Bewertungen

- Ansoff Growth MatrixDokument10 SeitenAnsoff Growth Matrixarchana_anuragiNoch keine Bewertungen

- Financial ManagementDokument6 SeitenFinancial Managementarchana_anuragiNoch keine Bewertungen

- Institute of Chartered Accountant of India (ICAI) Are As FollowsDokument8 SeitenInstitute of Chartered Accountant of India (ICAI) Are As Followsarchana_anuragiNoch keine Bewertungen

- Receivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial ManagementDokument46 SeitenReceivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial Managementarchana_anuragi100% (1)

- Fundamentalanalysisandtechnicalanalysis 141021114401 Conversion Gate01Dokument80 SeitenFundamentalanalysisandtechnicalanalysis 141021114401 Conversion Gate01archana_anuragiNoch keine Bewertungen

- Functions of Financial ManagementDokument6 SeitenFunctions of Financial Managementarchana_anuragi100% (1)

- Cost Accounting Unit 1Dokument16 SeitenCost Accounting Unit 1archana_anuragiNoch keine Bewertungen

- Current Affairs Pocket PDF - January 2016 by AffairsCloud - FinalDokument25 SeitenCurrent Affairs Pocket PDF - January 2016 by AffairsCloud - FinalRAGHUBALAN DURAIRAJUNoch keine Bewertungen

- Research Project Report ON: Consumer Buying Behaviour and Brand Perception in Shopping Malls of IndiaDokument109 SeitenResearch Project Report ON: Consumer Buying Behaviour and Brand Perception in Shopping Malls of Indiaarchana_anuragiNoch keine Bewertungen

- AssignmentDokument4 SeitenAssignmentarchana_anuragiNoch keine Bewertungen

- QB For Me Unit 2Dokument4 SeitenQB For Me Unit 2archana_anuragiNoch keine Bewertungen

- Evolution of SbiDokument6 SeitenEvolution of Sbiarchana_anuragiNoch keine Bewertungen

- Research Report Format-MBADokument6 SeitenResearch Report Format-MBAarchana_anuragi100% (1)

- Unit - 1Dokument8 SeitenUnit - 1arjunmba119624Noch keine Bewertungen

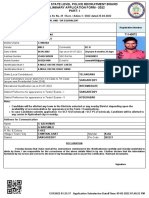

- Test Centre List (F-15 MAT)Dokument2 SeitenTest Centre List (F-15 MAT)archana_anuragiNoch keine Bewertungen

- Examination Regulations: Registration For ExaminationsDokument4 SeitenExamination Regulations: Registration For Examinationsarchana_anuragiNoch keine Bewertungen

- Unemployment Statistics in IndiaDokument2 SeitenUnemployment Statistics in Indiaarchana_anuragiNoch keine Bewertungen

- Bromate Prove Ulr en 2016-01-06 HintDokument3 SeitenBromate Prove Ulr en 2016-01-06 Hinttata_77Noch keine Bewertungen

- Pharmacology NCLEX QuestionsDokument128 SeitenPharmacology NCLEX QuestionsChristine Williams100% (2)

- Copyright IP Law Infringment of CopyrightDokument45 SeitenCopyright IP Law Infringment of Copyrightshree2485Noch keine Bewertungen

- New Car Info PDFDokument1 SeiteNew Car Info PDFSelwyn GullinNoch keine Bewertungen

- Nitotile LM : Constructive SolutionsDokument2 SeitenNitotile LM : Constructive SolutionsmilanbrasinaNoch keine Bewertungen

- Comprehensive Drug Abuse Prevention and Control Act of 1970Dokument2 SeitenComprehensive Drug Abuse Prevention and Control Act of 1970Bryan AbestaNoch keine Bewertungen

- ACCOUNTS Foundation Paper1Dokument336 SeitenACCOUNTS Foundation Paper1mukni613324100% (1)

- ITMC (International Transmission Maintenance Center)Dokument8 SeitenITMC (International Transmission Maintenance Center)akilaamaNoch keine Bewertungen

- Webdynpro ResumeDokument4 SeitenWebdynpro ResumeAmarnath ReddyNoch keine Bewertungen

- Define Constitution. What Is The Importance of Constitution in A State?Dokument2 SeitenDefine Constitution. What Is The Importance of Constitution in A State?Carmela AlfonsoNoch keine Bewertungen

- AMM Company ProfileDokument12 SeitenAMM Company ProfileValery PrihartonoNoch keine Bewertungen

- Assignment Mid Nescafe 111173001Dokument5 SeitenAssignment Mid Nescafe 111173001afnan huqNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledsai gamingNoch keine Bewertungen

- Position PaperDokument9 SeitenPosition PaperRoel PalmairaNoch keine Bewertungen

- FIP & CouponsDokument5 SeitenFIP & CouponsKosme DamianNoch keine Bewertungen

- AWS Migrate Resources To New RegionDokument23 SeitenAWS Migrate Resources To New Regionsruthi raviNoch keine Bewertungen

- OCDI 2009 EnglishDokument1.025 SeitenOCDI 2009 EnglishCUONG DINHNoch keine Bewertungen

- Buffett Wisdom On CorrectionsDokument2 SeitenBuffett Wisdom On CorrectionsChrisNoch keine Bewertungen

- Measurement System AnalysisDokument42 SeitenMeasurement System Analysisazadsingh1Noch keine Bewertungen

- Packing Shipping InstructionsDokument2 SeitenPacking Shipping InstructionsJ.V. Siritt ChangNoch keine Bewertungen

- Instructions For Comprehensive Exams NovemberDokument2 SeitenInstructions For Comprehensive Exams Novembermanoj reddyNoch keine Bewertungen

- Bangalore University: Regulations, Scheme and SyllabusDokument40 SeitenBangalore University: Regulations, Scheme and SyllabusYashaswiniPrashanthNoch keine Bewertungen

- 1.2 Server Operating SystemDokument20 Seiten1.2 Server Operating SystemAzhar AhmadNoch keine Bewertungen

- Vigi Module Selection PDFDokument1 SeiteVigi Module Selection PDFrt1973Noch keine Bewertungen

- Salary Data 18092018Dokument5.124 SeitenSalary Data 18092018pjrkrishna100% (1)

- MAYA1010 EnglishDokument30 SeitenMAYA1010 EnglishjailsondelimaNoch keine Bewertungen

- Case Study 05 PDFDokument5 SeitenCase Study 05 PDFSaltNPepa SaltNPepaNoch keine Bewertungen

- Long Term Growth Fund Fact SheetDokument2 SeitenLong Term Growth Fund Fact SheetmaxamsterNoch keine Bewertungen