Beruflich Dokumente

Kultur Dokumente

1 PB

Hochgeladen von

docbiswasOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1 PB

Hochgeladen von

docbiswasCopyright:

Verfügbare Formate

www.ccsenet.org/ijbm International Journal of Business and Management Vol. 6, No.

6; June 2011

ISSN 1833-3850 E-ISSN 1833-8119 242

Relationship between Foreign Direct Investment and Economic

Growth Case Study of Nepal

Xinfeng Yan (Corresponding author)

Donghua University, Shanghai 200051, China

Tel: 86-21-6237-3066 E-mail: yanxf@dhu.edu.cn

Majagaiya, Kundan Pokhrel

Glorious Sun School of Management, Donghua University

Shanghai 200051, China

E-mail: kundanpokhrel@yahoo.com

Received: February 9, 2010 Accepted: December 20, 2010 doi:10.5539/ijbm.v6n6p242

Abstract

This study examines the serial correlation ship between foreign direct investment and economic growth of Nepal

in terms of GDP for the period of 1983-2007.This study has been carried out with log and non log - values using

Durbin-Watson Test and Cochrance-Orcutt method. The result shows that even though marginal effect seems to

be because of presence of auto-correlation, without presence of auto-correlation FDI does not adequately

describe the GDP.

Keywords: FDI, GDP, Autocorrelation

1. Introduction

Foreign Direct Investment Continues to play a crucial role around the world and its importance to the global

economy cannot be understated. Researchers from different disciplines are pursuing their work in FDI to better

understand, explain and report the most recent findings. Flow of Foreign Direct Investment has grown faster

over recent past. Higher flows of Foreign Direct Investment over the world always reflect a better economic

environment in the presence of economic reforms and investment-oriented policies. As the forces of

globalization have continued to integrate the world economy, foreign direct investment (FDI) has proliferated.

FDI in developing countries like Nepal seems to be a new terminology and issue. However, historical records

and literature presents its long history stating that FDI is not a new phenomenon.

The inflow of FDI in Nepal began in the early 1980s through the gradual opening up of the economy. From 1980

to 1989, FDI inflows to Nepal were minimal with an annual average of US$ 500,000. FDI inflow showed a

distinct acceleration during the 1990s averaging US$ 11 million per annum during 1990-2000, peaking at

US$ 23 million in 1997 (UNCTAD, 2003b and 2006). This was primarily due to Nepals more liberal trade

policies, which comprised tariff rate reductions, the introduction of a duty drawback scheme, the adoption of a

current account convertibility system and liberalization of the exchange rate regime. A reversal in the rising

trend took place from the beginning of the 2000s. All in all, FDI inflow is the lowest in Nepal even when

compared with other landlocked countries (World Bank, 2003)

2. Literature Review

Proponents of foreign direct investment such as development institutions, economists, academics and policy

makers argued that foreign direct investment ensures efficient allocation of resources as compared to other forms

of capital inflows. However, some literature suggests that the FDI inflows have a positive impact on economic

growth of host countries and other literature suggests not at all. Although a large volume of econometric

literature includes the impacts of FDI on economic growth in developing countries, not enough studies has been

carried out on the question of serial correlation between them. Though there have been a few studies on the

related topic for academic and non academic purposes but these studies do not reflect the exact serial relation.

www.ccsenet.org/ijbm International Journal of Business and Management Vol. 6, No. 6; June 2011

Published by Canadian Center of Science and Education 243

Bengoa and Sanchez-Robles

showed that FDI is positively correlated with economic growth, but host countries

require human capital, economic stability and liberalized markets in order to benefit from long term FDI inflows.

Where as Durham

fails to identify a positive relationship between FDI and Economic growth in terms of GDP,

but suggest that effects of FDI are contingent on the absorptive capability of host countries

.

According to

Balasuramanyam, Salisu and Spasford

and De Mello; FDI is a capital bundle of capital stock, knowhow and

technology and can augment the existing stock of knowledge in the recipient economy through labor training

skill acquisition and diffusion and the introduction of alternative management practices and organizational

arrangement. Unfortunately, the impact of FDI on growth remains more contentious in empirical than in

theoretical studies. While some studies observe a positive impact of FDI in economic growth, other detects a

negative relationship between these two variables.

3. Analytical Framework and Methodology

The most celebrated test for detecting serial correlation is developed by Durbin and Watson and is defined by,

=

=

=

N

t

t

N

t

t t

e

e e

d

1

2

2

1

2

) (

1)

which is simply the ratio of sum of squared differences in successive residuals to the residual sum of square

(RSS) and can be written as;

) 1 ( 2 ~ d

2)

Here in equation 2 we define

=

t

t t

e

e e

2

1

and assume

1

2 2

&

t t e e

are

approximately equal as they differ by only one observation.

Since

1 1 s s

, equation 2 implies that

4 0 s s d 3)

Decision can be made regarding the presence of positive or negative correlation with this lower and upper

bounds. Here in eq. 2

If

0 =

, d=2 implies there is no serial correlation.

If

1 + =

, d=0 implies perfect positive correlation.

If

1 =

, d=4 implies perfect negative correlation.

It is important to know that if the estimated value lies between lower limit and upper limit we can not predict

whether auto correlation exit or not. That means this is the case of indecision. To overcome this drawback,

Cochrance - Orcutt method is carried out.

An alternative to estimate from DurbinWatson d is the frequently used Cochrane-Orcutt method that uses

the estimated residuals e

t

to obtain information about the unknown .

To explain the method, consider the two variable models:

t t t u X Y + + = 2 1 | |

4)

And assume that t u is generated by the AR (1) scheme, then;

t t t u u c + = 1

5)

The data used in this study is aggregate annual time series at constant prices for gross domestic product (GDP)

and total net inflows for foreign direct investment (FDI) covering the period of 1983-2007 in 25 pairs of

observations. The data was extracted from the International Monetary Fund, World economic Outlook and

World Investment Report, Fact book of various years and Econ- stat.

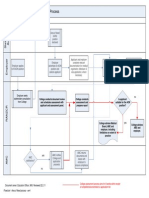

(Insert Fig.1 here)

www.ccsenet.org/ijbm International Journal of Business and Management Vol. 6, No. 6; June 2011

ISSN 1833-3850 E-ISSN 1833-8119 244

4. Empirical results

The estimated simple linear regression model of GDP on FDI along with t-statistic in parenthesis is,

6)

0.3804

The results obtained from the simple linear regression model of GDP on FDI are presented in table.1

The estimated log linear regression model of GDP on FDI along with t-statistic in parenthesis is

7)

0.545

The results obtained from the log linear regression model of GDP on FDI are presented in table.2

The linear Cochrane-Orcutt iterative procedure history is presented in table.3

The log linear Cochrane-Orcutt iterative procedure history is presented in table.4

The estimated log linear Cocharane-Orcutt iterative regression model of GDP on FDI along with t-statistic in

parenthesis is

8)

1.309

The results obtained from the log linear Cocharane-Orcutt iterative regression model of GDP on FDI are

presented in table.5

5. Result and Discussion

From the simple linear regression model of GDP on FDI, value of R

2

indicates that 9 percent of variation in GDP

is explained by FDI. The calculated F= 2.476 indicates that the regression model is not significant at 1 percent

level of significance because significance F value 0.128 >0.01.

The marginal effect of FDI on GDP is 64.16. This means that an increase of unit on FDI is expected to increase

GDP, on average, by 64.16 units. The t- statistic for constant is significant at 1% level of significance and FDI

coefficient is not significant at 1 percent level, as the p-value for constant (p-value= 0.000) is less than 0.01 but

p-value for FDI coefficient (p-value=0.128) is greater that 0.01.

From the estimated regression we observe that the Durbin-Watson d indicates the presence of autocorrelation.

For 25 observations and 1 explanatory variable the 1% Durbin- Watson table shows that d

L

=1.05 and d

U

=1.21,

and the estimated d (0.3804) is below the lower critical limit (d

L

=1.0). Which indicates the regression equation 6

is plagued by auto correlation and we can not trust on the estimated t ratios, and coefficient of determination.

From the log linear regression model of GDP on FDI, value of R

2

indicates that 14.4 percent of variation in log

GDP is explained by log FDI. The calculated F= 4.21 indicates that the regression model is not significant at 1

percent level of significance because significance F value 0.051 >0.01.

The marginal effect of log FDI on log GDP is 2.03. This means that an increase of unit on log FDI is expected to

increase log GDP, on average, by 2.03 units. Since the p-values for constant (p-value= 0.807) and coefficient

(p-value=0.051) are greater than 0.01, t- statistic for both constant and coefficient is not significant at 1 per cent

level.

From the estimated regression we observe that the Durbin- Watson d indicates the presence of autocorrelation.

For 25 observations and 1 explanatory variable the 1% Durbin- Watson table shows that d

L

=1.05 and d

U

=1.21,

and the estimated (d =0.545) is below the lower critical limit (d

L

=1.05).

From the both procedure above, we can not predict the actual relationship between the variables; so,

Cochrane-Orcutt iterative procedure is carried out.

From the above Cochrane-Orcutt iterative history, iterations from 1 to 4 shows that there is positive

autocorrelation as estimated DW statistic lies below the lower critical limit and iterations from 5 to 9 shows that

www.ccsenet.org/ijbm International Journal of Business and Management Vol. 6, No. 6; June 2011

Published by Canadian Center of Science and Education 245

we can not conclude that whether there is autocorrelation or not?; as estimated DW statistic lies between lower

and upper critical limit. So, for more precise decisions regarding GDP and FDI we carried out log linear

Cochrane-Orcutt iterative procedure.

The log linear Cochrane-Orcutt iterative procedure was terminated at step 3 as estimated DW statistic (d=1.309)

shows that there is no autocorrelation.

From the log linear Cocharane-Orcutt iterative regression model of GDP on FDI, value of R

2

indicates that 0.34

percent of variation in GDP is explained by FDI. Negative adjusted value of R

2

(R

2

=0.083) indicates that the FDI

does not adequately describe the GDP.The calculated F= 0.079 indicates that the regression model is not

significant at 1 percent level of significance because significance F value 0.781 >0.01.

The marginal effect of FDI on GDP is -0.051. This means that an increase of unit on log FDI is expected to

decrease log GDP, on average by 0.051 units. The t- statistic for FDI coefficient is not significant at 1 per cent

level, since p-value (=0.781) for FDI coefficient is greater that 0.01. From the estimated (d=1.309) shows that

there is no presence of autocorrelation at 1% level of significance.

6. Conclusion

There was no direct way of identifying the linkage between FDI and GDP. Unavailability of necessary data was

an additional constraint Therefore; the research had to be based on the secondary, which may not provide a

representative picture of the overall situation of FDI and GDP in Nepal. Our result shows that even though

marginal effect seems to be not significant because of presence of auto-correlation, but without presence of

auto-correlation FDI does not adequately describe the GDP.

References

Agrawal P. (2000). Economic impact of foreign direct investment in south Asia. Indira Gandhi Institute of

Development Research, Gen. A.K. Bombay; India.

Balasubramanyam, V.N., M. Salisu and D. Spas ford. (1996). Foreign direct investment and economic growth in

EP an IS countries. Econ. J., 106: 92-105.

Choe, J.I. (2003). Do foreign direct investment and gross domestic investment promote economic growth? Rev.

Develop. Econ, 7:44-57.

Gujarati, D. (2003). Basic Econometrics. 4

th

Ed

n

., McGraw-Hill, New York. 1002pp ISBN: 0-07-233542-4.

Noorzoy, M.S. (1980). Flows Direct Investment and their effects on US domestic investment. Econ. Lett., 5:

311-317.

[Online] Available: http://www.d21.org

[Online] Available: http://www.econstats.com/weo/CAFG.htm

[Online] Available: http://www.imf.org

[Online] Available: http://www.nrb.org

[Online] Available: http://www.unctad.org;

[Online] Available: http://www.undp.org

[Online] Available: http://www.worldbank.org

[Online] Available: http://www.wto.org

Table 1.

R- square Adj.R -square F-statistics Intercept FDI Significance F

0.090117206

0.053721894 2.476066 4100.391265 64.15577932 0.128162616

Table 2.

R- square Adj.R -square F-statistics Intercept FDI Significance F

0.144291687 0.110063354 4.215563 -0.49357304 2.029842082 0.0506583

www.ccsenet.org/ijbm International Journal of Business and Management Vol. 6, No. 6; June 2011

ISSN 1833-3850 E-ISSN 1833-8119 246

Table 3.

Iteration Rho SE Rho DW MSE

1 .71441186 .14283086 .3804767 497977.96

2 .86960371 .10078636 .7622389 228920.14

3 .91898258 .08048577 .9352987 175261.52

4 .94582775 .06627275 1.0272812 152490.94

5 .95840176 .05826165 1.0632767 143364.99

6 .96248702 05538454 1.0729413 140610.57

7 .96347016 .05466765 1.0750664 139963.10

8 96367909 .05451399 1.0755070 139826.27

9 .96372208 .05448232 1.0755971 139798.15

Table 4.

Iteration Rho SE Rho DW MSE

1 .68680025 .14836686 .545 0.004

2 .86809920 .10132534 1.142 0.002

3 90846588 .08531553 1.309 0.001

Table 5.

R- square Adj.R -square F-statistics Intercept FDI Significance F

0.00342754 -0.08323096 0.079 -0.0510199 3.9801612 0.78103002

Fig.1 Decision/indecision Region

Legend

H

o

: No positive autocorrelation

H

1

: No negative autocorrelation

Accept H

o

or H

1

or both

Reject H

o

Evidence

of

positive

autocorr

elation

Zone of

indecision

Zone of

indecision

Reject H

1

Evidence

of negative

autocorrel

ation

0 d

L 2

4- d

U

4- d

L 4 d

U

Figure 1. Description for decision / Indecision Region

(Source: Gujarati, D., 2003. Basic Econometrics. 4

th

Ed

n

., McGraw-Hill, New York. 1002pp ISBN:

0-07-233542-4)

Das könnte Ihnen auch gefallen

- .Npadminassetsuploadsannual PublicationsGrid 2076 PDFDokument130 Seiten.Npadminassetsuploadsannual PublicationsGrid 2076 PDFdocbiswasNoch keine Bewertungen

- Pharmaceutical Business Plan AfricaDokument119 SeitenPharmaceutical Business Plan Africadocbiswas100% (1)

- Nepal New Emerging Pharma MarketDokument5 SeitenNepal New Emerging Pharma MarketdocbiswasNoch keine Bewertungen

- AON FlowchartDokument1 SeiteAON FlowchartdocbiswasNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Case Study of AmoebiasisDokument16 SeitenCase Study of AmoebiasisGlorielle ElvambuenaNoch keine Bewertungen

- The Biography of Hazrat Shah Qamaos Sahib in One PageDokument3 SeitenThe Biography of Hazrat Shah Qamaos Sahib in One PageMohammed Abdul Hafeez, B.Com., Hyderabad, IndiaNoch keine Bewertungen

- Fluid Mechanics Formulas Nov 2021Dokument6 SeitenFluid Mechanics Formulas Nov 2021Benjie MorenoNoch keine Bewertungen

- Enga10 Speaking Test3Dokument2 SeitenEnga10 Speaking Test3luana serraNoch keine Bewertungen

- Determining The Value of The Acceleration Due To Gravity: President Ramon Magsaysay State UniversityDokument12 SeitenDetermining The Value of The Acceleration Due To Gravity: President Ramon Magsaysay State UniversityKristian Anthony BautistaNoch keine Bewertungen

- Jeevan Tara, Sansad Marg NEW DELHI-11001 Regonal Office (North Zone) E MailDokument3 SeitenJeevan Tara, Sansad Marg NEW DELHI-11001 Regonal Office (North Zone) E MailGourav SharmaNoch keine Bewertungen

- Robot Structural Analysis 2017 Help - Push Over Analysis ParametersDokument3 SeitenRobot Structural Analysis 2017 Help - Push Over Analysis ParametersJustin MusopoleNoch keine Bewertungen

- South WestDokument1 SeiteSouth WestDarren RadonsNoch keine Bewertungen

- Taxation One Complete Updated (Atty. Mickey Ingles)Dokument116 SeitenTaxation One Complete Updated (Atty. Mickey Ingles)Patty Salas - Padua100% (11)

- Bob Dylan Diskografija Prevodi PesamaDokument175 SeitenBob Dylan Diskografija Prevodi PesamaJolanda NešovićNoch keine Bewertungen

- Convention Concerning The Protection of The WorldDokument41 SeitenConvention Concerning The Protection of The WorldMonica Ardeleanu100% (1)

- LEASE CONTRACT Taytay Residentialhouse Kei Inagaki Nena TrusaDokument6 SeitenLEASE CONTRACT Taytay Residentialhouse Kei Inagaki Nena TrusaJaime GonzalesNoch keine Bewertungen

- Consumer Information On Proper Use of YogaDokument168 SeitenConsumer Information On Proper Use of Yogaskwycb04Noch keine Bewertungen

- INSTRUCTIONS FOR USOL PRIVATE REAPPEAR DE January 2022Dokument4 SeitenINSTRUCTIONS FOR USOL PRIVATE REAPPEAR DE January 2022RaghavNoch keine Bewertungen

- Finance Budget - Ankur WarikooDokument28 SeitenFinance Budget - Ankur WarikooVivek Gupta100% (1)

- Checklist-Telephone - Mobile ExpenseDokument2 SeitenChecklist-Telephone - Mobile ExpenseMichelle Domanacal UrsabiaNoch keine Bewertungen

- End-Of-Chapter Questions: CambridgeDokument17 SeitenEnd-Of-Chapter Questions: CambridgeMido MidoNoch keine Bewertungen

- Price and Output Determination Under OligopolyDokument26 SeitenPrice and Output Determination Under OligopolySangitha Nadar100% (1)

- Contractions 29.01Dokument1 SeiteContractions 29.01Katita la OriginalNoch keine Bewertungen

- Govt Considers Putting ShahbazDokument27 SeitenGovt Considers Putting ShahbazWanderer123Noch keine Bewertungen

- How To Make Papaya SoapDokument10 SeitenHow To Make Papaya SoapEmz GamboaNoch keine Bewertungen

- 3 Social Policy and Social Welfare AdministrationDokument284 Seiten3 Social Policy and Social Welfare AdministrationJoseph Kennedy100% (5)

- Program 2019 MTAPTL Annual Convention PDFDokument3 SeitenProgram 2019 MTAPTL Annual Convention PDFrichardlfigueroaNoch keine Bewertungen

- Peter Zumthor - Thinking Architecture PDFDokument33 SeitenPeter Zumthor - Thinking Architecture PDFDiana Sterian73% (11)

- People Vs SB - Paredes - Ex Post FactoDokument2 SeitenPeople Vs SB - Paredes - Ex Post FactoMara Aleah CaoileNoch keine Bewertungen

- Celebrations Around The WorldDokument3 SeitenCelebrations Around The WorldpaolaNoch keine Bewertungen

- Zimbabwe National Code Ccorporate GovernanceDokument96 SeitenZimbabwe National Code Ccorporate GovernanceHerbert NgwaraiNoch keine Bewertungen

- Lubi Dewatering PumpDokument28 SeitenLubi Dewatering PumpSohanlal ChouhanNoch keine Bewertungen

- China Email ListDokument3 SeitenChina Email ListRosie Brown40% (5)

- Buchanan, KeohaneDokument34 SeitenBuchanan, KeohaneFlorina BortoșNoch keine Bewertungen