Beruflich Dokumente

Kultur Dokumente

Calculate - How Much Is Your Life Worth - Yahoo India Finance

Hochgeladen von

rajusha_rahulOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Calculate - How Much Is Your Life Worth - Yahoo India Finance

Hochgeladen von

rajusha_rahulCopyright:

Verfügbare Formate

Thu, 13 Feb, 2014 2:39PM - Indian Markets close in 51 mins

Calculate: How much is your life worth?

By Deepak Y ahannan | MyInsuranceClub Tue 11 Feb, 2014 1:33 PM IST

To insure a car, home, or any other material asset, the general procedure involves valuing them in terms of rupees as per its market value. But what about life? Determining how much you are worth and insuring it is a surely no easy task The Human Life Value (HLV) approach comes to your rescue here. It calculates your lifes worth, and expresses it in rupee terms, thereby helping you decide a suitable life cover.

Life sure is priceless and one can really not attach a value tag to it. The Human Life Value calculation is an indicative value and assists you in deciding the insurance amount. It serves as a guidance to arrive at an appropriate value for your familys secure financial future. Also See: Your financial horoscope for 2014

Your financial horoscope for 2014 (Click on the im age to view your horoscope)

Getting to Know HLV Better The Human Life Value approach calculates the amount of money that would be required for your family to sustain the same lifestyle and standard of living, in case of your untimely death, It is the amount which your family would require to not only meet their day to day household expenses, but also to achieve their financial goals- of childrens education or marriage.

Technically, the approach calculates the value of money, that is expected to be earned over an individuals life time, expressing it in rupee terms. This value of money is adjusted for inflation to get a more accurate value.

Factors to be Considered in HLV Calculation

While calculating a suitable life cover, through the Human Life Value, the following factors are considered. These factors, help in assessing financial needs and goals better and thus arrive at a suitable life cover.

Years till retirement: What would be your age of retirement and for how many more years you would have to provide for your dependents. For your spouse, you should cater to his/her remaining lifespan. In the case of children, you could consider till their higher education or marriage goals are met.

Number of dependents: Not just the number of dependents, bear in mind to list out their individual financial goals that you wish to save for.

Your current income expenses- Whats your monthly household expenditure- on children, household and lifestyle expenses.

Loans and liabilities- Loans such as home loans, personal loans and even credit card dues if any should be included.

Existing investments and savings: What are your assets and savings?

Calculating Your Human Life Value

Calculating the HLV may sure seem a complicated procedure for many, however technically speaking it isnt really so. For practical purposes here is a simplified version to iunderstand how it goes about.

Step 1- Determine your anticipated annual income over your remaining earning years, after deducting personal expenses.

Step 2- Calculate Present Value of future income, adjusting for inflation. (You could use the PMT function in excel to help you calculate this)

Step 3- Add your loans and liabilities and amount required for financial goals,

Step 4- Deduct current savings, assets and investments to arrive at the final value.

Let us understand this better with the help of an example.

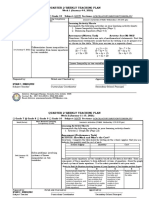

Ravi, age 30 years works for a software company. Married with a 2 year old son, he plans to retire in another 20 years, at age 50. His gross annual income is Rs. 6, 00,000 and his personal expenses work out annually at Rs. 1, 20,000.He currently has an outstanding home loan of Rs. 20, 00,000. He also wishes to save Rs. 20 lakhs for his sons future. His current savings, fixed deposits, investments and other assets sum up to Rs.10, 00,000. His investments on an average fetch him 13%. Let us assume the inflation to be 9%.

Calculating Ravis HLV...

Ravi must this insure himself for Rs. 99,64,909 to ensure his familys needs and goals are met, without having to compromise on their lifestyle.

A Final Word.

insurance calcultor

The factors that are considered for the calculation of the Human Life Value are not constant and vary with the passing years. Thus, to make the whole process meaningful, it is advisable to review your insurance needs regularly.

Another point that must be kept in mind is that the HLV is just an indicative value. It should be used as a guideline, and the final insurance portfolio should be worked out as per your individual financial position, liquidity and ability to save money.

Written By: Deepak Yohannan

The author is the CEO of MyInsuranceClub.com, an online insurance price & features comparison portal

For more articles by Deepak Yohannan, please visit MyInsuranceClub.com

You may contact him directly on Twitter: @dyohannan

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Financial Management: Syllabus Financial Management: Investment-Need, Appraisal and Criteria, Financial Analysis TechDokument13 SeitenFinancial Management: Syllabus Financial Management: Investment-Need, Appraisal and Criteria, Financial Analysis TechNiket KawaleNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Dcu2gr55so4dxqu4kp4maojz PDFDokument0 SeitenDcu2gr55so4dxqu4kp4maojz PDFrajusha_rahulNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 111Dokument1 Seite111rajusha_rahulNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Vendor Management System - Wikipedia, The Free EncyclopediaDokument5 SeitenVendor Management System - Wikipedia, The Free Encyclopediarajusha_rahulNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Ctv001 RetailDokument24 SeitenCtv001 Retailrajusha_rahulNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Staples Energy Management CsaDokument2 SeitenStaples Energy Management Csarajusha_rahulNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- An Introduction To Regression Analysis: The Inaugural Coase LectureDokument33 SeitenAn Introduction To Regression Analysis: The Inaugural Coase LectureMeenarli SharmaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 3 Steps To Yes - Gene BedellDokument1 Seite3 Steps To Yes - Gene Bedellrajusha_rahulNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Statistic FormulasDokument3 SeitenStatistic FormulasKiran PoudelNoch keine Bewertungen

- Valuation (Finance) - Wikipedia, The Free EncyclopediaDokument6 SeitenValuation (Finance) - Wikipedia, The Free Encyclopediarajusha_rahulNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Aries Versus ScorpioDokument1 SeiteAries Versus Scorpiorajusha_rahulNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Why RMB Will Be A Global Currency by 20151Dokument2 SeitenWhy RMB Will Be A Global Currency by 20151rajusha_rahulNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Statistic FormulasDokument3 SeitenStatistic FormulasKiran PoudelNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- National Institute of Technology Trichy: Computer Science and Engineering CurriculumDokument25 SeitenNational Institute of Technology Trichy: Computer Science and Engineering CurriculumprashantsaraswatiNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- National Institute of Technology Trichy: Computer Science and Engineering CurriculumDokument25 SeitenNational Institute of Technology Trichy: Computer Science and Engineering CurriculumprashantsaraswatiNoch keine Bewertungen

- Introduction To Pharmacology by ZebDokument31 SeitenIntroduction To Pharmacology by ZebSanam MalikNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Computer in Community Pharmacy by Adnan Sarwar ChaudharyDokument10 SeitenComputer in Community Pharmacy by Adnan Sarwar ChaudharyDr-Adnan Sarwar Chaudhary100% (1)

- Intraoperative RecordDokument2 SeitenIntraoperative Recordademaala06100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- PBPO008E FrontmatterDokument13 SeitenPBPO008E FrontmatterParameswararao Billa67% (3)

- Prospectus (As of November 2, 2015) PDFDokument132 SeitenProspectus (As of November 2, 2015) PDFblackcholoNoch keine Bewertungen

- Portfolio Write-UpDokument4 SeitenPortfolio Write-UpJonFromingsNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Function and Importance of TransitionsDokument4 SeitenThe Function and Importance of TransitionsMarc Jalen ReladorNoch keine Bewertungen

- CSR Report On Tata SteelDokument72 SeitenCSR Report On Tata SteelJagadish Sahu100% (1)

- The Art of Street PhotographyDokument13 SeitenThe Art of Street PhotographyDP ZarpaNoch keine Bewertungen

- Resolution: Owner/Operator, DocketedDokument4 SeitenResolution: Owner/Operator, DocketedDonna Grace Guyo100% (1)

- New - BMP3005 - ABF - Assessment Brief - FDokument5 SeitenNew - BMP3005 - ABF - Assessment Brief - Fmilka traykovNoch keine Bewertungen

- The Global Entrepreneurship and Development Index 2014 For Web1 PDFDokument249 SeitenThe Global Entrepreneurship and Development Index 2014 For Web1 PDFAlex Yuri Rodriguez100% (1)

- Final Notice To Global Girls Degree CollgeDokument2 SeitenFinal Notice To Global Girls Degree CollgeIbn E AdamNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Appendix 3 COT RPMS For T I III SY 2020 2021 in The Time of COVID 19Dokument12 SeitenAppendix 3 COT RPMS For T I III SY 2020 2021 in The Time of COVID 19Marjun PachecoNoch keine Bewertungen

- O Repensar Da Fonoaudiologia Na Epistemologia CienDokument5 SeitenO Repensar Da Fonoaudiologia Na Epistemologia CienClaudilla L.Noch keine Bewertungen

- A Short History of Denim: (C) Lynn Downey, Levi Strauss & Co. HistorianDokument11 SeitenA Short History of Denim: (C) Lynn Downey, Levi Strauss & Co. HistorianBoier Sesh PataNoch keine Bewertungen

- 120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnDokument9 Seiten120 Câu Tìm Từ Đồng Nghĩa-Trái Nghĩa-Dap AnAlex TranNoch keine Bewertungen

- Abacus 1 PDFDokument13 SeitenAbacus 1 PDFAli ChababNoch keine Bewertungen

- 2 Year Spares List For InstrumentationDokument2 Seiten2 Year Spares List For Instrumentationgudapati9Noch keine Bewertungen

- Present Perfect Tense ExerciseDokument13 SeitenPresent Perfect Tense Exercise39. Nguyễn Đăng QuangNoch keine Bewertungen

- Little: PrinceDokument18 SeitenLittle: PrinceNara Serrano94% (18)

- Teaching Plan - Math 8 Week 1-8 PDFDokument8 SeitenTeaching Plan - Math 8 Week 1-8 PDFRYAN C. ENRIQUEZNoch keine Bewertungen

- Mtech Vlsi Lab ManualDokument38 SeitenMtech Vlsi Lab ManualRajesh Aaitha100% (2)

- ERP22006Dokument1 SeiteERP22006Ady Surya LesmanaNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Indian Traditional Musical InstrumentsDokument3 SeitenIndian Traditional Musical InstrumentsPiriya94Noch keine Bewertungen

- Elementary Electronics 1968-09-10Dokument108 SeitenElementary Electronics 1968-09-10Jim ToewsNoch keine Bewertungen

- SLTMobitel AssignmentDokument3 SeitenSLTMobitel AssignmentSupun ChandrakanthaNoch keine Bewertungen

- Rule 7bDokument38 SeitenRule 7bKurt ReoterasNoch keine Bewertungen

- Wits Appraisalnof Jaw Disharmony by JOHNSONDokument20 SeitenWits Appraisalnof Jaw Disharmony by JOHNSONDrKamran MominNoch keine Bewertungen

- New Compabloc IMCP0002GDokument37 SeitenNew Compabloc IMCP0002GAnie Ekpenyong0% (1)