Beruflich Dokumente

Kultur Dokumente

Aet Jefferson Buy

Hochgeladen von

sinnlosOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aet Jefferson Buy

Hochgeladen von

sinnlosCopyright:

Verfügbare Formate

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

FINANCIAL SONAR FOR AET 3RD QUARTER 2012

N

RIS

OUR EVALUATION OF AET

AETNA INC is showing strong Earnings Quality, Operating Efficiency and Balance Sheet Quality, and Valuation suggests a lower amount of price risk, but Cash Flow Quality is weak. When combined, AET deserves a BUY rating. The Cash Flow Quality rating declined the most during the recent quarter. Though this dimension and all of the others were either down or unchanged at best, it was not sufficient to lower the overall rating.

UA AL

T IO

EARN

STR O

NG

ING SQ

UA

ES

LIT

LO

HISTORICAL RATINGS

B ALANC

EARNINGS QUALITY CASH FLOW QUALITY OPERATING EFFICIENCY BALANCE SHEET VALUATION

STRONGEST STRONGEST STRONG STRONG LOW RISK

STRONGEST STRONGEST STRONG STRONG LOW RISK

STRONGEST STRONG STRONGEST STRONG LOW RISK

STRONGEST WEAK STRONGEST STRONG LOW RISK

OPE

ST R ONGEST

R A TI N G E F FIC I EN

CY

PRICE TRENDS AND VALUATION

Price (AS OF 01/10/13) PRICE/EARNINGS PRICE/ADJUSTED EARNINGS $55 $45.80 8.6 7.8 MARKET CAP. PRICE/EARNINGS GROWTH PRICE/ADJUSTED EARNINGS GROWTH $15.3 BILLION 1.9 176.5 PRICE/SALES PRICE/CASH FLOW PRICE/ADJUSTED CASH FLOW 0.4 6.7 6.9 $55

52 Week High: $50.16 on 03/26/12 $50 $50

$45

CA

$45 $40 $35 $30 20 Million Nov Dec 2013 Report prepared on January 11, 2013 Page 1 of 11

$40

$35

52 Week Low: $36.67 on 07/23/12

$30

Average Weekly Volume

20 Million Jan 2012 Feb Mar Apr May Jun Jul Aug Sep Oct

2013 Jefferson Research & Management www.jeffersonresearch.com

SH

FLO

OVERALL RATING

BUY

BUY

BUY

BUY

WE

Q4 2011

Q1 2012

Q2 2012

Q3 2012

W Q U ALITY

AK

STRO

NG

E SH

EE

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

EARNINGS QUALITY: STRONGEST

Earnings quality has long been analyzed and used by investors as a measure of the fundamental quality of the company and its future prospects. Companies may be including certain items that increase reported earnings and often the amount of cash flow supporting the earnings may be weak. Jefferson adjusts for these kinds of items and other anomalies to produce an adjusted earnings number that more accurately reflects ongoing business fundamentals at AETNA INC. Reported earnings are compared to the Jefferson adjusted earnings as a means to gauge earnings quality. Also measured is the amount of cash flow that underpins earnings. The earnings quality for AET remains STRONGEST. With an adjusted net income of $530.0M in the last quarter that was greater than the reported number, AET's quality of net income earnings is extremely high. In addition, operating cash flow increased during the last quarter to $167.0M from $90.0M, and the ratio of operating cash flow to earnings has also improved.

NET INCOME VS. ADJUSTED NET INCOME

$ IN MILLIONS Adjusted Net Income 106.4%

EARNINGS VS. OPERATING CASH FLOW

Operating Cash Flow as a Percentage of Earnings 79.9% 126.3% 96.2%

$ IN MILLIONS Reported Operating Cash Flow 19.7% 33.5%

Adjusted Net Income as a Percentage of Net Income 98.4% 104.5% 101.7% 100.0%

3,000 2,000 2,074.1 1,872.1 2,364.0 1,738.3 2,000 530.0 457.0 457.0 499.0

1,332.0

1,840.0

1,840.0

1,985.0

1,985.0

1,766.0

1,766.0

457.0

499.0 9.2% Q3 2012 9.3%

1,000

1,592.0

1,000

0 Q2 2012 Q3 2012

Fiscal Year 2010

Fiscal Year 2011

Trailing 12 Months

Fiscal Year 2010

Fiscal Year 2011

Trailing 12 Months

Q2 2012

49.0

Q3 2012 % OF SALES

ACCRUALS

Actual Accruals 10.0% 8.0% Forcasted Accruals

6.0%

4.0%

2.0% 9.0% 9.0% 9.0% 8.4% 9.6% 8.6% 8.6% 8.8% 8.8% 8.8% 9.3% 8.3% 8.7% 9.1%

0.0%

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 2 of 11

93.0

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

CASH FLOW QUALITY: WEAK

Cash flow is considered by many investors to be the ultimate measure of company performance and more reliable than reported earnings. The Jefferson measurement eliminates items that are not part of recurring cash flow or the result of actual operations for AETNA INC. These adjustments to cash flow provide a truer measure of cash flow and the resultant cash flow quality rating. The cash flow quality rating for AET declined from STRONG to WEAK The annual operating cash flow quality declined with a reported number of $2,507M and an adjusted number that was 94.3% of reported. In addition, the quarterly operating cash flow quality weakened with a reported number of $167.0M and an adjusted number that was 55.7% of reported. Together these changes represent a deterioration from the previous period when the ratio of reported to adjusted cash flows was higher.

OPERATING CASH FLOW

$ IN MILLIONS Adjusted Operating Cash Flow

FREE CASH FLOW

$ IN MILLIONS Adjusted Free Cash Flow -955.7%

Adjusted Operating Cash Flow as a Percentage of Operating Cash Flow 94.4% 94.3% 89.9% 54.7% 55.8% 3,000 2,364.0 2,000 2,507.0 1,332.0 1,000 0

Adjusted Free Cash Flow as a Percentage of Free Cash Flow 92.8% 92.7% 84.3% 56.6% 2,000 1,000 1,825.0

1,968.0

1,107.0

1,139.0

1,027.0

960.0

-53.0

-94.0

1,592.0

1,412.0

1,771.0

167.0

0 93.0 -1,000

Fiscal Year 2010

Fiscal Year 2011

Trailing 12 Months

90.0

49.0

Q2 2012

Q3 2012

Fiscal Year 2010

Fiscal Year 2011

Trailing 12 Months

Q2 2012

Q3 2012

FLOW RATIO

0.40 0.30

CASH FLOW ROI

Adjusted Cash Flow ROI 30.0%

20.0% 0.20 10.0% 0.10

0.00 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

0.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

DEBT COVERAGE

Adjusted Debt Coverage 75

50

25

0 Q4 10

2013 Jefferson Research & Management www.jeffersonresearch.com

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12 Report prepared on January 11, 2013 Page 3 of 11

7.0

-66.0

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

OPERATING EFFICIENCY: STRONGEST

The ability of AETNA INC to earn a profit is in part the result of how rapidly it converts its collection of assets into revenues and the resulting earnings and cash flow margins available. Operating Efficiency is measured by a combination of factors including: return on invested capital (ROIC), gross margin, EBIT margin, asset turnover, equity turnover, and lastly Staff, General, and Administrative costs as a percentage of sales (SGA). The operating efficiency rating for AET remains STRONGEST as the EBIT margin, net margin, gross margin, and SGA costs strengthened over the last quarter, while at the same time the ROIC weakened. Even though the EBIT margin improved from 8.6% to 10.0%, the decline in ROIC offset this, deteriorating from 12.7%to 12.6%. The lower ROIC indicates that AET is producing less profit per dollar of capital invested in the business.

GROSS MARGIN

Change from previous quarter: UPL 32.0%

EBIT MARGIN

Adjusted EBIT Margin 15.0% 12.5% Change from previous quarter: UPL

30.0% 10.0% 28.0% 7.5%

26.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

5.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

NET MARGIN

Adjusted Net Margin 8.0% Change from previous quarter: UPL

SG&A AS A PERCENTAGE OF SALES

Change from previous quarter: DOWNM 21.0% 20.0%

6.0% 19.0% 4.0% 18.0%

2.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

17.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 4 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

RETURN ON INCREMENTAL INVESTED CAPITAL

OPERATING EFFICIENCY: STRONGEST

ROIC

Adjusted ROIC 15.0% Change from previous quarter: DOWNM 50.0% 0.0% 14.0% -50.0% 13.0% -100.0% Change from previous quarter: DOWNM

12.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

-150.0% Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

ASSET TURNOVER

1.00 0.95

EQUITY TURNOVER

2.70

0.90

2.65

0.85

0.80 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

2.60 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

CASH CONVERSION CYCLE Data not available for this chart.

IN DAYS

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 5 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

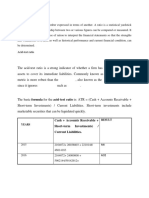

BALANCE SHEET QUALITY: STRONG

The balance sheet shows the ability of AETNA INC to pay its bills and fund future growth. It also provides clues to aggressive accounting since reported earnings that do not generate cash flow generally end up somewhere on the balance sheet. The following are analyzed in determining balance sheet quality: quick ratio, current ratio, cash position, accounts receivable days sales outstanding (AR DSOs), and number of days inventory is held prior to sale to customers (Inv Days). The balance sheet rating for AET remains STRONG as the debt/equity and debt/assets strengthened over the last quarter while the AR DSOs and cash position weakened. the decline in AR DSOs offset this by deteriorating from 20 to 22 days. The higher AR DSOs indicates that AET has lengthened the time it takes on average to receive payment from its customers, thereby decreasing liquidity.

RECEIVABLES DAYS OUT

Change from previous quarter: UPL 22

INVENTORY DAYS OUT Data not available for this chart.

21

20

19 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

CURRENT RATIO

0.80

QUICK RATIO

0.70

0.75

0.65

0.70 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

0.60 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 6 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

DEBT/ASSETS

BALANCE SHEET QUALITY: STRONG

DEBT/EQUITY

Debt/Tangible Equity 150 Change from previous quarter: DOWNM 16 Debt/Tangible Assets Change from previous quarter: DOWNM

100

14

50

12

0 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

CASH

4,000

$ IN MILLIONS Change from previous quarter: DOWNM

3,500

3,000

2,500 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 7 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

VALUATION: LOW RISK

A favorable valuation (a LEAST RISK or LOW RISK rating) implies lower potential downward price risk that is evidenced by a company price multiple that is lower than the corresponding sector average. The valuation rating is based on both absolute and relative levels at AETNA INC compared to its peers within its sector based on price to earnings (PE), price to earnings growth (PEG), price to sales (PS), and price to cash flow (PCF). The valuation rating for AET remains a LOW RISK as the price to sales ratio became more attractive over the last quarter while the PEG and price to cash flow ratios became less attractive. Even though AET's PS ratio relative to the sector average PS improved from 1.83X to 0.80X during the last quarter, the decline in the PCF ratio relative to the sector average PCF offset this by deteriorating from 0.42X to 0.63X.

PRICE/EARNINGS

RANGE LAST 2 YEARS Reported Price/Earnings Adjusted Price/Earnings Sector Price/Earnings LOW 7.00 6.30 13.00 HIGH 9.30 8.70 16.20 AVERAGE 15 8.49 7.78 14.35 10 5 0 Q4 2011 Q1 2012 Q2 2012 Q3 2012 16.0 0.5 Q3 2012 Page 8 of 11 0.0 10.7 0.0 8.4 7.0 8.8 0.6 8.6 6.7 1.9 6.3 7.8 0.4 Q4 2011 Q1 2012 Q2 2012 Report prepared on January 11, 2013 0.6 0.5 0.5 1.3 1.1 1.1 176.5 6.9 7.9 7.6 0.1 10.5 As Reported Adjusted Health Care Providers & Services Sector

PRICE/CASH FLOW

RANGE LAST 2 YEARS Reported Price/Cash Flow Adjusted Price/Cash Flow Sector Price/Cash Flow LOW 5.30 5.60 9.70 HIGH 7.00 7.30 12.60 AVERAGE 15 6.48 6.79 10.75 10 5 0 Q4 2011 Q1 2012 Q2 2012 12.6 10.1 6.9 6.5 5.6 6.7 5.3 7.1 Q3 2012 As Reported Adjusted Health Care Providers & Services Sector

PRICE/EARNINGS GROWTH

RANGE LAST 2 YEARS Reported Price/Earnings Growth Adjusted Price/Earnings Growth Sector Price/Earnings Growth LOW 0.20 0.20 0.00 HIGH 1.90 176.50 0.60 AVERAGE 0.51 22.29 0.13 As Reported 200 150 100 0.0 0.4 0.2 0.3 0.3 0 0.1 0.6 50 0.5 0.5 Adjusted Health Care Providers & Services Sector

Q4 2011

Q1 2012

Q2 2012

Q3 2012

PRICE/SALES

RANGE LAST 2 YEARS Reported Price/Sales Sector Price/Sales LOW 0.40 0.50 HIGH 1.40 0.60 AVERAGE 1.50 1.10 0.54 1.00 0.50 0.00 As Reported Health Care Providers & Services Sector

2013 Jefferson Research & Management www.jeffersonresearch.com

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY PEER VALUATION COMPARISON

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

PRICE ON PRICE/ 01/10/13 EARNINGS $32.60 $62.20 $55.60 $45.80 $33.20 $43.00 $69.20 0.0 8.1 10.1 8.6 4.7 13.4 9.1 16.0 PRICE/ SALES 1.5 0.3 0.6 0.4 0.4 0.1 0.3 0.5 PRICE/ CASH FLOW 11.3 6.7 7.6 6.7 2.7 9.7 7.0 10.7 PRICE/ EARNINGS GROWTH 0.0 3.1 0.7 1.9 0.1 0.9 NA 0.0 VALUATION RATING LEAST RISK LEAST RISK LEAST RISK LOW RISK LEAST RISK LEAST RISK LOW RISK

TICKER

COMPANY

MARKET CAP. $19.7 B $18.9 B $15.9 B $15.3 B $14.7 B $14.6 B $11.0 B $5.1 B

FMS FRESENIUS MED CARE AG -ADR WLP WELLPOINT INC CI CIGNA CORP AET AETNA INC HCA HCA HOLDINGS INC CAH CARDINAL HEALTH INC HUM HUMANA INC HEALTH CARE PROVIDERS & SERVICES SECTOR

PEER OPERATING COMPARISON

GROSS MARGIN (%) 38.3 21.7 13.7 28.6 18.9 4.7 22.7 EBIT MARGIN (%) 16.1 7.6 11.9 10.0 13.8 1.7 7.3 NET MARGIN (%) 7.7 4.5 6.3 5.6 4.5 1.1 4.4 CASH CONVERSION ROIC (%) CYCLE (DAYS) 8.5 7.6 11.3 12.6 17.5 13.2 12.4 96.0 0.0 0.0 0.0 38.0 8.0 0.0 OPERATING EFFICIENCY RATING LEAST RISK LOW RISK LOW RISK LEAST RISK LOW RISK LEAST RISK LOW RISK

TICKER FMS WLP CI AET HCA CAH HUM

COMPANY FRESENIUS MED CARE AG -ADR WELLPOINT INC CIGNA CORP AETNA INC HCA HOLDINGS INC CARDINAL HEALTH INC HUMANA INC

MARKET CAP. $19.7 B $18.9 B $15.9 B $15.3 B $14.7 B $14.6 B $11.0 B

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 9 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY DEFINITIONS

Adjusted Net Income: Adjusted Net Income is a companys reported net income less adjustments for one-time and non-operating items yielding a more realistic picture of a companys ongoing earnings. Accruals Forecasted and Actual: The comparison of forecasted and actual accruals identifies a discretionary build not attributable to a companys sales growth, and could be a sign of poor earnings quality. For our purposes, the forecasted accrual component is an aggregate measurement of total accruals (short-term balance sheet accounts) that distinguishes between normalized and extraordinary accruals. The normalized accruals are based on historical relationships between sales and accruals and are dynamically adjusted over time to account for changes in the ratio between these two variables. Normally, short term accruals will grow as sales grow i.e., the normalized measure. Discretionary accruals are the portion of accruals that are in excess of the base factor and therefore exceed the normal and are extraordinary. Adjusted Operating Cash Flow: Adjusted Operating Cash Flow is reported operating cash flow less adjustments for one-time and non-operating items yielding a more realistic picture of a companys ongoing cash flow from operations. Adjusted Free Cash Flow: Adjusted Free Cash Flow is reported operating cash flow less adjustments for one-time, non-operating items and capital expenditures. This provides a more realistic picture of a companys ongoing cash generation from operations after capital investments. Flow Ratio: The Flow Ratio is a measurement of managements effectiveness in managing its working capital to maximize the companys cash flows. The measure is a ratio of a companys non-cash current assets to its non-interest bearing short-term liabilities. These non-cash assets include items such as accounts receivable (which are essentially interest-free loans to customers) and inventory (which is subject to obsolescence or spoilage). The non-interest bearing liabilities are essentially interest-free loans to the company. A lower ratio implies tighter cash management for a company as it has less cash tied up in non-cash current assets and is able to utilize interest free loans from suppliers. Cash Flow Return on Investment: Cash Flow ROI is a measure of a companys ability to generate operating cash flow from its invested capital. Many analysts consider this measure preferable to an earnings return measure such as ROE since cash flow is considered a more reliable measure. Adjusted Cash Flow Return on Investment: Adjusted Cash Flow ROI is a measure of the ability to generate operating cash flow from its investment in capital calculated using a companys adjusted cash flow. Debt Coverage: Debt Coverage is a measure of a companys ability to cover its debt obligations with cash flow it generated from continuing operations.

2013 Jefferson Research & Management www.jeffersonresearch.com

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

Adjusted Debt Coverage: Adjusted Debt Coverage is a measure of a companys ability to cover its debt obligations with cash flow it generated from continuing operations, calculated using a companys adjusted cash flow. Adjusted Return on Invested Capital: Adjusted ROIC assesses a companys efficiency at allocating the capital to profitable investments using a companys adjusted net income (see above) yielding a measure of how well a company is using its capital to generate returns. Adjusted EBIT Margin: Adjusted EBIT Margin is a measure of a companys earnings before interest and income taxes less adjustments for one-time and non-operating items divided by a companys sales. Adjusted Net Margin: Adjusted Net Margin is a measure of a companys net income less adjustments for one-time and non-operating items divided by a companys sales. Return on Incremental Invested Capital: ROIIC measures the relationship between incremental investment and incremental net operating profit after tax. This provides a measure of the returns a company is earning on recent investments rather than all investments as measured by ROIC. Cash Conversion Cycle: The Cash Conversion Cycle measures the number of days working capital is tied up from the date of purchase of raw materials until the collection of cash from the sale of the product. Debt to Tangible Equity: Debt to Tangible Equity is a ratio of a companys debt to equity less adjustments for goodwill and other intangible assets yielding tangible equity. Debt to Tangible Assets: Debt to Tangible Assets is a ratio of a companys debt to total assets less adjustments for goodwill and other intangible assets. Price/Adjusted Earnings: Adjusted Price/Earnings is a relative valuation measure comparing a companys share price to its adjusted net income. Price/Adjusted Cash Flow: Adjusted Price/Cash Flow is a relative valuation measure comparing a companys share price to its adjusted cash flow. Price/Adjusted Earnings Growth: Adjusted Price/Earnings Growth is a relative valuation measure comparing a companys share price to its growth in adjusted earnings.

Report prepared on January 11, 2013 Page 10 of 11

FINANCIAL SONAR: REALITY RADAR ON COMPANY PERFORMANCE NYSE

AET

HEALTH CARE PROVIDERS & SERVICES INDUSTRY ABOUT THE FINANCIAL SONAR REPORT & METHODOLOGY

AETNA INC OVERALL RATING FOR 3RD QUARTER 2012 BUY

The Jefferson Financial Sonar ratings system classifies companies into three categories: Buy, Hold and Sell. The Financial Sonar rating is the result of a point scoring system derived from the five main criteria. The more negative the rating, the more likely the overall rating will be a Sell. More positive criteria will support an Overall Rating of Buy. Jefferson Research & Management has developed the Financial Sonar Rating System which is based upon five analytical criteria: Earnings Quality, Cash Flow, Operating Efficiency, Balance Sheet, and Valuation. The first four criteria are rated in one of four categories (best to worst): Strongest, Strong, Weak, Weakest. Valuation is also rated in one of four categories (best to worst): Least Risk, Low Risk, Medium Risk, Most Risk.

ABOUT JEFFERSON RESEARCH & MANAGEMENT

Jefferson Research & Management is an independent investment research and advisory firm founded in 1989 and based in Portland, Oregon. The firm has been providing fundamental research to institutional and individual clients for more than 20 years. Financial Sonar ratings are based on a proprietary rating system developed by Jefferson Research & Management that measures the changes in company fundamentals using information from financial statements.

DISCLAIMER

This report is for information purposes only for clients of Jefferson Research & Management and in no way should be interpreted as a complete investment recommendation. This report has been prepared exclusively by Jefferson Research & Management. Information contained in this report is obtained from sources believed to be reliable, but no guarantee is made to its accuracy and no representation is made that it is complete, or that errors, if discovered, will be corrected. 1) Jefferson Research & Management and its staff are not involved in investment banking activities for firms covered. 2) No employee of Jefferson Research & Management is on the board of any covered company and no outsiders are members of Jefferson Research & Managements board. 3) Jefferson Research & Management employees trading stock in rated companies are subject to trading restrictions prior to release (once identified) and for a one day period subsequent to rating changes but do not individually or collectively own more than 1 percent of the outstanding stock of a covered company. No part of this report can be reprinted or transmitted electronically without the prior written authorization of Jefferson Research & Management.

2013 Jefferson Research & Management www.jeffersonresearch.com

Report prepared on January 11, 2013 Page 11 of 11

Das könnte Ihnen auch gefallen

- Financial Ratio Analysis AssignmentDokument10 SeitenFinancial Ratio Analysis Assignmentzain5435467% (3)

- Benefit Hub License AgreementDokument15 SeitenBenefit Hub License AgreementDaniel TorsonNoch keine Bewertungen

- Quail FarmingDokument9 SeitenQuail Farminghenrymcdo100% (2)

- Credit Evaluation ProcessDokument73 SeitenCredit Evaluation ProcessNeeRaz Kunwar100% (2)

- Financial Analysis P&GDokument10 SeitenFinancial Analysis P&Gsayko88Noch keine Bewertungen

- Financial Statement Analysis For MBA StudentsDokument72 SeitenFinancial Statement Analysis For MBA StudentsMikaela Seminiano100% (1)

- RATIO AnalysisDokument89 SeitenRATIO Analysisjain2547100% (1)

- Financial Ratio AnalysisDokument5 SeitenFinancial Ratio AnalysisIrin HaNoch keine Bewertungen

- Assignment Next PLCDokument16 SeitenAssignment Next PLCJames Jane50% (2)

- Assignment of Financial AccountingDokument15 SeitenAssignment of Financial AccountingBhushan WadherNoch keine Bewertungen

- EasyJet CompanyDokument21 SeitenEasyJet CompanyHassan ZaryabNoch keine Bewertungen

- Peabody Energy - Bmo Presentation SubmittedDokument24 SeitenPeabody Energy - Bmo Presentation SubmittedsinnlosNoch keine Bewertungen

- FusionApplicationHCM Implementation PDFDokument70 SeitenFusionApplicationHCM Implementation PDFacs_rectNoch keine Bewertungen

- Swift 103-202Dokument2 SeitenSwift 103-202Akhmad Zaeny100% (11)

- Είδη Μεταφοράς ή Συσκευασίας Από Πλαστικές Ύλες.2016714104726Dokument959 SeitenΕίδη Μεταφοράς ή Συσκευασίας Από Πλαστικές Ύλες.2016714104726traceNoch keine Bewertungen

- Peabody Energy - JP Morgan SubmittedDokument27 SeitenPeabody Energy - JP Morgan SubmittedsinnlosNoch keine Bewertungen

- Ratio Analysis of ITCDokument22 SeitenRatio Analysis of ITCDheeraj Girase100% (1)

- SAP Vistex - Billback ManagementDokument4 SeitenSAP Vistex - Billback ManagementDayanandamurthy50% (2)

- Foreign Exchange Guidelines by Bangladesh Bank PDFDokument380 SeitenForeign Exchange Guidelines by Bangladesh Bank PDFMohammad Khaled Saifullah Cdcs100% (1)

- Next Gen BankingDokument8 SeitenNext Gen BankingTarang Shah0% (1)

- SLIM Sri LankaDokument93 SeitenSLIM Sri Lankabnsamy100% (1)

- Cat Jefferson Buy+Dokument11 SeitenCat Jefferson Buy+sinnlosNoch keine Bewertungen

- Financial Statement Analysis - HulDokument15 SeitenFinancial Statement Analysis - HulNupur SinghalNoch keine Bewertungen

- MarKs and Spencer Financial AnalysisDokument10 SeitenMarKs and Spencer Financial Analysispatrick olaleNoch keine Bewertungen

- Capitaland CoDokument11 SeitenCapitaland CoLucas ThuitaNoch keine Bewertungen

- Ratio Analysis: (Type The Document Subtitle)Dokument16 SeitenRatio Analysis: (Type The Document Subtitle)Maliha JahanNoch keine Bewertungen

- An Assignment On Financial Modeling: Submitted ToDokument15 SeitenAn Assignment On Financial Modeling: Submitted ToAsif AbdullahNoch keine Bewertungen

- Financial Analysis of Astrazeneca and GSKDokument29 SeitenFinancial Analysis of Astrazeneca and GSKBhavishNoch keine Bewertungen

- ACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnDokument13 SeitenACI Limited Submitted To:: ULAB School of Business Bachelor of Business Administration (B.B.A.) Term Paper OnashikNoch keine Bewertungen

- Case 3: BNL StoresDokument16 SeitenCase 3: BNL StoresAMBWANI NAREN MAHESHNoch keine Bewertungen

- Tata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & InterpretationDokument31 SeitenTata Steel Limited Annual Report 2008-09 & 2009-10: Ratio Analysis & Interpretationaditya_sanghviNoch keine Bewertungen

- Bilgin Demir: Financial Statement & Security Analysis Case StudyDokument20 SeitenBilgin Demir: Financial Statement & Security Analysis Case StudyadiscriNoch keine Bewertungen

- AXIS Bank AnalysisDokument44 SeitenAXIS Bank AnalysisArup SarkarNoch keine Bewertungen

- Topic 8ำำำำำำำำำำำำDokument5 SeitenTopic 8ำำำำำำำำำำำำTaylor Kongitti PraditNoch keine Bewertungen

- Ratio Analysis - Montex PensDokument28 SeitenRatio Analysis - Montex Penss_sannit2k9Noch keine Bewertungen

- Why Are Ratios UsefulDokument11 SeitenWhy Are Ratios UsefulKriza Sevilla Matro100% (3)

- Financial Analysis - LowesDokument2 SeitenFinancial Analysis - Lowesanand737Noch keine Bewertungen

- 4.analysis and InterpretationDokument55 Seiten4.analysis and InterpretationRocky Bassig100% (1)

- 4.analysis and InterpretationDokument55 Seiten4.analysis and InterpretationRocky BassigNoch keine Bewertungen

- Ratio AnaalysisDokument10 SeitenRatio AnaalysisMark K. EapenNoch keine Bewertungen

- Financial Statement Analysis ReportDokument30 SeitenFinancial Statement Analysis ReportMariyam LiaqatNoch keine Bewertungen

- Financial Ratio Analysis of Dabur India LTDDokument11 SeitenFinancial Ratio Analysis of Dabur India LTDHarshit DalmiaNoch keine Bewertungen

- Project On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Dokument23 SeitenProject On Final Accounts: Vishal Jadhav Nilesh Wadhwa Pankaj Kathayat Ravi Gera MBA 2010Ravi GeraNoch keine Bewertungen

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Dokument40 SeitenStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNoch keine Bewertungen

- Profitability AnalysisDokument9 SeitenProfitability AnalysisAnkit TyagiNoch keine Bewertungen

- Financial Accounting Week 11Dokument28 SeitenFinancial Accounting Week 11Nashmia KhurramNoch keine Bewertungen

- Q1 2012 Supplemental InformationDokument6 SeitenQ1 2012 Supplemental InformationMihir BhatiaNoch keine Bewertungen

- Cash Flow and Ratio AnalysisDokument7 SeitenCash Flow and Ratio AnalysisShalal Bin YousufNoch keine Bewertungen

- VK FIN AnalysisDokument98 SeitenVK FIN AnalysisVrajlal SapovadiaNoch keine Bewertungen

- Sats Ar 2011-12Dokument180 SeitenSats Ar 2011-12Francisco2105Noch keine Bewertungen

- Series 1: 1. Profit Margin RatioDokument10 SeitenSeries 1: 1. Profit Margin RatioPooja WadhwaniNoch keine Bewertungen

- Information Services Network Ltd. (ISN)Dokument16 SeitenInformation Services Network Ltd. (ISN)Onickul HaqueNoch keine Bewertungen

- Constellation Software Inc.: A. Historical Figures Restated To Comply With Revised DefinitionDokument8 SeitenConstellation Software Inc.: A. Historical Figures Restated To Comply With Revised DefinitionsignalhucksterNoch keine Bewertungen

- Days Sales Outstanding: Introduction To Business Finance Assignment No 1Dokument10 SeitenDays Sales Outstanding: Introduction To Business Finance Assignment No 1Varisha AlamNoch keine Bewertungen

- Ratio Analysis: Liquidity RatiosDokument7 SeitenRatio Analysis: Liquidity RatiosAneeka NiazNoch keine Bewertungen

- 2021 Finance ReportDokument25 Seiten2021 Finance ReportSanjana SinghNoch keine Bewertungen

- Integrated Case 4-26Dokument6 SeitenIntegrated Case 4-26Cayden BrookeNoch keine Bewertungen

- Financial Analysis of Indigo Airlines From Lender's PerspectiveDokument12 SeitenFinancial Analysis of Indigo Airlines From Lender's PerspectiveAnil Kumar Reddy100% (1)

- Ratio Analysis of Pepsi Co.Dokument88 SeitenRatio Analysis of Pepsi Co.ZAS100% (2)

- Balancesheet and Ratios Analysis PPT Uid 2191003Dokument14 SeitenBalancesheet and Ratios Analysis PPT Uid 2191003AmanjotNoch keine Bewertungen

- Financial Analysis of SSGDokument12 SeitenFinancial Analysis of SSGAdnan GulfamNoch keine Bewertungen

- FM BSPL Idea ProjectDokument11 SeitenFM BSPL Idea Projectdipen007Noch keine Bewertungen

- Working Capital & Dividend PolicyDokument9 SeitenWorking Capital & Dividend PolicyLipi Singal0% (1)

- Unit TrustDokument23 SeitenUnit TrustqairunnisaNoch keine Bewertungen

- Title Page .. 1Dokument24 SeitenTitle Page .. 1kelvin pogiNoch keine Bewertungen

- AgilityDokument5 SeitenAgilityvijayscaNoch keine Bewertungen

- Financial Management (1) (8818)Dokument22 SeitenFinancial Management (1) (8818)georgeNoch keine Bewertungen

- Ratio AnalysisDokument8 SeitenRatio AnalysisikramNoch keine Bewertungen

- BK Adbl 030079 PDFDokument18 SeitenBK Adbl 030079 PDFPatriciaFutboleraNoch keine Bewertungen

- High Performance: Still The Holy Grail in BankingDokument9 SeitenHigh Performance: Still The Holy Grail in BankingL.T. (Tom) HallNoch keine Bewertungen

- Aristotle Energeia EntecheiaDokument10 SeitenAristotle Energeia EntecheiasinnlosNoch keine Bewertungen

- Peabody Energy Corporation: SSI BTU ESV Meec Cmre-B SDRL DNR Fsys ValeDokument4 SeitenPeabody Energy Corporation: SSI BTU ESV Meec Cmre-B SDRL DNR Fsys ValesinnlosNoch keine Bewertungen

- Aquion Battery Technology - 1216Dokument18 SeitenAquion Battery Technology - 1216sinnlosNoch keine Bewertungen

- Carry Row 0 1 0 Input A 0 0 1 1 Input B 0 0 1 0 OutputDokument3 SeitenCarry Row 0 1 0 Input A 0 0 1 1 Input B 0 0 1 0 OutputsinnlosNoch keine Bewertungen

- Install - SerialDokument1 SeiteInstall - Serialw6rNoch keine Bewertungen

- Finance: More Results Peabody Energy Corporation (Nyse:Btu) Add To Portfolio CompanyDokument5 SeitenFinance: More Results Peabody Energy Corporation (Nyse:Btu) Add To Portfolio CompanysinnlosNoch keine Bewertungen

- ( (NYSE - Peabody Energy CorporationDokument5 Seiten( (NYSE - Peabody Energy CorporationsinnlosNoch keine Bewertungen

- ( (NYS FsysDokument4 Seiten( (NYS FsyssinnlosNoch keine Bewertungen

- ( (NYSE - BTU - 4.32 0.03 (0.70%) - Peabody Energy CorporationDokument6 Seiten( (NYSE - BTU - 4.32 0.03 (0.70%) - Peabody Energy CorporationsinnlosNoch keine Bewertungen

- Amk Dussel OnDokument20 SeitenAmk Dussel OnsinnlosNoch keine Bewertungen

- 2A / 150Khz Buck DC-DC Converter: General DescriptionDokument10 Seiten2A / 150Khz Buck DC-DC Converter: General DescriptionsinnlosNoch keine Bewertungen

- Compresor Tecumseh 1 - 6 AEA1343AGSDokument1 SeiteCompresor Tecumseh 1 - 6 AEA1343AGSsinnlosNoch keine Bewertungen

- Datasheet (2) Fmb26l SchottkyDokument2 SeitenDatasheet (2) Fmb26l SchottkysinnlosNoch keine Bewertungen

- Low-Noise Fast-Transient-Response 1.5-A Low-Dropout Voltage RegulatorsDokument28 SeitenLow-Noise Fast-Transient-Response 1.5-A Low-Dropout Voltage RegulatorssinnlosNoch keine Bewertungen

- Ciena Thompson Hold+Dokument6 SeitenCiena Thompson Hold+sinnlosNoch keine Bewertungen

- Nickel-Free Manganese Phosphate Processes: Product InfoDokument2 SeitenNickel-Free Manganese Phosphate Processes: Product InfojaymuscatNoch keine Bewertungen

- Project On NJ India Invest PVT LTDDokument68 SeitenProject On NJ India Invest PVT LTDbabloo200650% (2)

- Neuro MarketingDokument20 SeitenNeuro MarketingSaad ZanifiNoch keine Bewertungen

- Eng 01 Catalogue 2016Dokument640 SeitenEng 01 Catalogue 2016Anonymous SDeSP1Noch keine Bewertungen

- Breakeven AnalysisDokument5 SeitenBreakeven AnalysismmmugambiNoch keine Bewertungen

- Home First Finance CompanyDokument12 SeitenHome First Finance CompanyJ BNoch keine Bewertungen

- Channel Conflict Group16v0 2Dokument14 SeitenChannel Conflict Group16v0 2Joan DelNoch keine Bewertungen

- Report On Poultry Product Marketing of CP Bangladesh Co LTDDokument30 SeitenReport On Poultry Product Marketing of CP Bangladesh Co LTDMohammed RaihanNoch keine Bewertungen

- Credit Risk ManagementDokument23 SeitenCredit Risk ManagementRavinder Kumar AroraNoch keine Bewertungen

- Schedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterDokument16 SeitenSchedule 1 Allison Manufacturing Sales Budget For The Quarter I Ended March 31 First QuarterSultanz Farkhan SukmanaNoch keine Bewertungen

- The Production Cycle 2Dokument45 SeitenThe Production Cycle 2Desy RachmawatiNoch keine Bewertungen

- SNE Libya Security Summary 05 January 2015Dokument15 SeitenSNE Libya Security Summary 05 January 2015klatifdgNoch keine Bewertungen

- PoliciesDokument44 SeitenPoliciesGabriel Joseph AdanNoch keine Bewertungen

- MEFA All UnitsDokument138 SeitenMEFA All Unitsshiva santoshNoch keine Bewertungen

- 1 SM PDFDokument20 Seiten1 SM PDFImpossibleCrash 69Noch keine Bewertungen

- Forrester Smart Computing Drives New Era of ItDokument44 SeitenForrester Smart Computing Drives New Era of ItJamison DuffieldNoch keine Bewertungen

- Perenco - Oil and Gas - A Leading Independent Exploration and Production CompanyDokument3 SeitenPerenco - Oil and Gas - A Leading Independent Exploration and Production CompanyCHO ACHIRI HUMPHREYNoch keine Bewertungen

- GTCAP: AXA Completes Acquisition of Charter Ping AnDokument2 SeitenGTCAP: AXA Completes Acquisition of Charter Ping AnBusinessWorldNoch keine Bewertungen

- Topic 6 Partnership: 6.1 FormationDokument5 SeitenTopic 6 Partnership: 6.1 FormationxxpjulxxNoch keine Bewertungen

- Twelve and Not StupidDokument14 SeitenTwelve and Not StupidRivenNoch keine Bewertungen

- As 2001.2.4-1990 Methods of Test For Textiles Physical Tests - Determination of Bursting Pressure of TextileDokument2 SeitenAs 2001.2.4-1990 Methods of Test For Textiles Physical Tests - Determination of Bursting Pressure of TextileSAI Global - APAC0% (1)