Beruflich Dokumente

Kultur Dokumente

Nuclear Energy Out Look Report

Hochgeladen von

Herminio CerqueiraOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nuclear Energy Out Look Report

Hochgeladen von

Herminio CerqueiraCopyright:

Verfügbare Formate

Nuclear Energy Outlook in 2014: Strong Growth in a More Global Sector

by Peter Bachsleitner & Darren Glynn & Sean OBrien

FC Business Intelligence

Nuclear Energy Outlook in 2014: Strong Growth in a More Global Sector

It is so easy to believe that the nuclear industry has reached its peak: The continuing fallout at Fukushima will remain an on-going reminder of the high risks associated with past and current nuclear technologies. New discoveries and technologies in oil and gas have further extended the reserve base and helped keep energy prices at reasonable levels. Renewable energy generation is still heavily expanding across the globe and volume has helped drive down cost to allow reduction of subsidies and the ever increasing bill for the decommissioning of legacy nuclear power plants. So why should nuclear be seen as an attractive market for talent, suppliers, or investors? In the coming year we expect attractive opportunities for sustainable growth in all three subsectors: new build, operations, and decommissioning.

www.nuclearenergyinsider.com

Nuclear Energy Outlook in 2014: Strong Growth in a More Global Sector

Country Specics Although the outlook for nuclear power in some OECD countries seems weaker than pre-Fukushima, the International Energy Agency (IEA) still expects global nuclear capacity to rise - in their central new policies scenario - by 60 percent to 2035. Over 60 reactors are currently being constructed in 13 countries, mostly in Asia and Russia, leading to a new reactor starting around every 25 days in the upcoming years, and that doesnt cover the predicted acceleration in energy demand in Asia, Africa, or South America. Even oil-rich United Arab Emirates has awarded a $20.4 billion contract to a South Korean consortium to build the countrys rst reactors by 2020. Especially with the growing demand for clean energy, nuclear appears to remain a viable alternative to fossil fuels as a strong base load companion to renewables - maybe not in all Western countries, but certainly on a global scale. Even though countries like Germany have recently decided to opt out of nuclear and others, such as the United States, have put a hold or a more critical review on lifetime extensions, it is not unlikely that in times of increasing budget pressure, some will follow the Swedish pattern. In Sweden a public referendum following the Three Mile Island accident in 1979 led to a decision to phase-out nuclear by 2010; but the demand for aordable base load power and investments in improving security standards have more than doubled the share of nuclear in the energy mix since then. A 2010 Parliament decision allowed new construction at existing sites to replace the present 10 units. Accepting life-time expansion of existing nuclear plants as a means of preserving employment or to prevent industries migrating to countries where low energy costs are seen as a prime way of attracting investment should not be ruled out. Even in anti-nuclear democracies the majority of taxpayers might opt back into nuclear over time - particularly in times of tight budgets and ever increasing taxes - to mitigate huge upfront spend in renewables plus required infrastructure. In countries with largely unresolved decommissioning, on-plant site storage without utilization of the fuels cash generation potential could soon be black-marked as a waste of taxpayers money - especially when new nuclear is being built just a few kilometers away across the border. The third nuclear subsector, decommissioning and waste management, is also on the edge of an impressive growth agenda through a number of drivers: the dismantling, treatment, transport, and storage of material from a growing eet of retired plants; a more progressive drive to minimize low, medium, and high level waste in the rst place (in line with the waste hierarchy); and an increasing demand for improvement to state-ofthe art operations and risk management, leading even to the decommissioning of old decommissioning sites. But the biggest challenge and opportunity, in our opinion, is a substantial cultural change towards developing stronger leadership and increased transparency and communication in managing the complex problems that surface in this highly regulated industry with an increasingly diverse arena of stakeholders.

www.nuclearenergyinsider.com

Nuclear Energy Outlook in 2014: Strong Growth in a More Global Sector

In many countries nuclear decommissioning has become the Achilles heel for the future of the whole sector, which cant be protected simply by fences or excellence in engineering anymore. Therefore, state-of-the-art operations will not only need further privatization, but also a new breed of leader and manager who can inject lessons learned and best practices from other industries around the globe. Aside from the current country-specic standing of the nuclear segment, Pcubed sees three major trends continuing to shape the overall agenda of nuclear regulators, suppliers, and operators in 2014 and beyond. Further Globalization of the Nuclear Supply Chain, Operations, and Regulation After more than 50 years of operation the time has come to further accelerate the standardization of reactor design and the harmonization of regulatory standards. Historic national diversity is not only a cost driver, but also comes with a higher operational risk for humanity if best practices in safety arent continuously explored and implemented across the globe. A nuclear accident anywhere is an accident everywhere. In this respect, watch for on-going global consolidation of major industry players as well as cross-national co-investments. An example: The recent announcement in the United Kingdom about various consortia participants from France, China, Japan, the United States, and (possibly) Russia and Finland working hand in hand. This practice will not only help reduce investor risk but will also contribute to safety in nuclear construction and operations, especially in countries that are just beginning to introduce nuclear power. With its approach to new build and also the privatization of the management of decommissioning sites to international consortia, the United Kingdom has become a test bed watched worldwide, where a more standardized and sustainable future of nuclear power may evolve. Pair this with a drive for a stable, harmonized international regulatory framework as we have recently seen it with the EU stress test and the growing respect for the Western European Regulators Association (WENRA) and the European Nuclear Safety Regulators group. Together, these shifts in practice could have the power to attract more direct investment from infrastructure funds and increase public acceptance of nuclear energy. Upgrading of the IT landscape To Improve Safety and Security IT is playing an ever more important role in nuclear plant operation and decommissioning, driven by the needs to further improve safety and adapt to on-going regulatory www.nuclearenergyinsider.com

Nuclear Energy Outlook in 2014: Strong Growth in a More Global Sector

changes. In the space sector wed expect always to nd the latest technology. However, the long planning period and life span of space missions often leads to massive delays in deployment of state-of-the-art technology in operations. Changes to core systems accelerate the risk of mission failure and loss of massive investments. In a similar way, any changes to core operating systems of a nuclear power plant or decommissioning site requires balancing the risks from the perceived improvements delivered by new tech. But technologies are becoming essential enablers of improved health, safety, and environment (HSE) and security. Getting technical license renewal these days requires the replacement of outdated systems and upgrades to eective low risk, full scope systems for plant/site operation and automated emergency measures, simulation and operator training or structural health and seismic warning. Even more, the strategic integration of newer technology should be viewed as an opportunity to regain wider public acceptance of current nuclear technology. Although seen as less critical in the shadow of massive spends on core energy systems, the deployment and use of state-of-the-art systems for document and enterprise project management are important tools to support another major trend, the improvement of project and program management (PPM) standards. Improvement of PPM Standards PPM enables the organization to deliver new investment projects on time and on budget and drive cultural change more eectively. Finnish utility TVO and its two primary contractors for the Olkiluoto 3 reactor, AREVA and Siemens, are facing a major compensation suit related to a potential seven-year completion delay as a result of deciencies in stakeholder and risk management. New build investments and decommissioning programs and projects are facing increasing pressure to provide better value for taxpayers. (For evidence read the latest report by the UK National Audit Oce on deciencies in project delivery at the Sellaeld reprocessing site as a recent example.) We have found that a strong focus on security and engineering has led to strong resistance to change or transparency. Organizations in the nuclear segment risk a further decline in nuclear acceptance if they dont address the cultural aspects of change management and substantially improve their PPM maturity, particularly in a world where social media and citizen journalists are increasingly driving the conversation.

www.nuclearenergyinsider.com

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Home Entertainment Catalogue 2013Dokument40 SeitenHome Entertainment Catalogue 2013Herminio CerqueiraNoch keine Bewertungen

- Asbestos Feb13Dokument45 SeitenAsbestos Feb13Herminio CerqueiraNoch keine Bewertungen

- SurCode For Dolby Digital 51 UMDokument23 SeitenSurCode For Dolby Digital 51 UMHerminio CerqueiraNoch keine Bewertungen

- Status Title Author Publisher List Price Binding PGN Pubn Year IsbnDokument2 SeitenStatus Title Author Publisher List Price Binding PGN Pubn Year IsbnHerminio CerqueiraNoch keine Bewertungen

- IZotope Mixing Guide Principles Tips TechniquesDokument70 SeitenIZotope Mixing Guide Principles Tips TechniquesRobinson Andress100% (1)

- 2013 Weapons Systems Modernization Priorities - 0Dokument230 Seiten2013 Weapons Systems Modernization Priorities - 0Herminio CerqueiraNoch keine Bewertungen

- The Global CorruptionDokument21 SeitenThe Global CorruptionHerminio CerqueiraNoch keine Bewertungen

- Linux Mint 15.0 EnglishDokument50 SeitenLinux Mint 15.0 Englishsfreud1Noch keine Bewertungen

- EU Cyberseg - 2013 06 19Dokument18 SeitenEU Cyberseg - 2013 06 19Herminio CerqueiraNoch keine Bewertungen

- Desert Hawk III BrochureDokument6 SeitenDesert Hawk III Brochurejohnjoviedo100% (1)

- FMI-Carta de Inteções PPDokument25 SeitenFMI-Carta de Inteções PPHerminio CerqueiraNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Attachment 1 - Bk12dhz PumpsDokument14 SeitenAttachment 1 - Bk12dhz PumpsluisalonsonucetteranNoch keine Bewertungen

- BP Master Ex Ship LNG Sale and Purchase Agreement 2019 EditionDokument67 SeitenBP Master Ex Ship LNG Sale and Purchase Agreement 2019 EditionBlankformNoch keine Bewertungen

- Entrepreneurship, Business Ideas, and Opportunity GuideDokument42 SeitenEntrepreneurship, Business Ideas, and Opportunity Guidemaungbejo100% (1)

- Power Infrastructure Solutions - Products Catalogue 2016 LRDokument91 SeitenPower Infrastructure Solutions - Products Catalogue 2016 LRJerry MarshalNoch keine Bewertungen

- Pump Seal PlansDokument56 SeitenPump Seal PlansKwang Je LeeNoch keine Bewertungen

- Market Intelligent InsightDokument29 SeitenMarket Intelligent Insightumar.daha6484Noch keine Bewertungen

- Information MemorandumDokument90 SeitenInformation MemorandumKhandaker Amir Entezam50% (2)

- Oregon Resilience Plan DraftDokument21 SeitenOregon Resilience Plan DraftStatesman Journal100% (1)

- Tecumseh AE Information Package-2014!10!21-EnDokument36 SeitenTecumseh AE Information Package-2014!10!21-EnjoseiutNoch keine Bewertungen

- Haldor Topsoe A-S - Promoting Medium-Temperature CO Shift Catalysts PDFDokument1 SeiteHaldor Topsoe A-S - Promoting Medium-Temperature CO Shift Catalysts PDFzorro21072107Noch keine Bewertungen

- Areva Transformer ManualDokument97 SeitenAreva Transformer Manualnidnitrkl051296100% (2)

- The Business Case For High Speed RailDokument25 SeitenThe Business Case For High Speed RailHighSpeedRailNoch keine Bewertungen

- OPEXDokument3 SeitenOPEXYosef Camposano RodriguezNoch keine Bewertungen

- KPMG Renewable Energy Ma ReportDokument48 SeitenKPMG Renewable Energy Ma ReportAnand KVNoch keine Bewertungen

- STLE2018 - CMF VI - Session 6B - P. Rabbat - BASF PAG-Based Finished Lubricant Solutions PDFDokument18 SeitenSTLE2018 - CMF VI - Session 6B - P. Rabbat - BASF PAG-Based Finished Lubricant Solutions PDFHiMichael LiangNoch keine Bewertungen

- A Fuel Saving Revolution?: The Rise of Electric TaxiingDokument92 SeitenA Fuel Saving Revolution?: The Rise of Electric Taxiingrey1004100% (1)

- Cost Break Down Analysis From MoUDCDokument212 SeitenCost Break Down Analysis From MoUDCABAMELANoch keine Bewertungen

- Cablewire 2008 Technical PapersDokument159 SeitenCablewire 2008 Technical PapersAnurag Bajpai100% (3)

- Exergy BIZWhitepaper v10Dokument30 SeitenExergy BIZWhitepaper v10Vinod JeyapalanNoch keine Bewertungen

- Intern Presentation SlideDokument41 SeitenIntern Presentation Slidejun xiong leeNoch keine Bewertungen

- Siemens DTC PresentationDokument8 SeitenSiemens DTC Presentationgiolgau01Noch keine Bewertungen

- Cement ProjectDokument3 SeitenCement ProjectPonnoju ShashankaNoch keine Bewertungen

- 5672 RGA Manual TehnicDokument48 Seiten5672 RGA Manual TehnicOarga CalinNoch keine Bewertungen

- Operation of The Kiln Line: TrainingDokument32 SeitenOperation of The Kiln Line: TraininglafecapoNoch keine Bewertungen

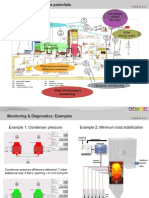

- Monitoring & Diagnostics potentials - Benchmarking, Root Cause Analysis, Unplanned DowntimeDokument18 SeitenMonitoring & Diagnostics potentials - Benchmarking, Root Cause Analysis, Unplanned DowntimeNassim Ben AbdeddayemNoch keine Bewertungen

- Liquid Flow Meter Proving and LACT UnitsDokument4 SeitenLiquid Flow Meter Proving and LACT UnitsDayo IdowuNoch keine Bewertungen

- Fichtner PDFDokument76 SeitenFichtner PDFbacuoc.nguyen356Noch keine Bewertungen

- Products: Braking and Storm BrakingDokument13 SeitenProducts: Braking and Storm BrakingErc Nunez VNoch keine Bewertungen

- DTech Catalog - 2015.1Dokument64 SeitenDTech Catalog - 2015.1Mihai-Eugen PopaNoch keine Bewertungen

- Iec 62446 2 2020Dokument15 SeitenIec 62446 2 2020Quoc AnhNoch keine Bewertungen