Beruflich Dokumente

Kultur Dokumente

PR2-2001 Capital Allowance

Hochgeladen von

Kelly Tan Xue LingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PR2-2001 Capital Allowance

Hochgeladen von

Kelly Tan Xue LingCopyright:

Verfügbare Formate

(Translation from the original Bahasa Malaysia text) Public Ruling No. 2/200 !

"MP#T$T%"N "& %N%T%$' ( $NN#$' $''")$N!*+ %N R*+P*!T "& P'$NT ( M$!,%N*R-

1.0

T$. '$) This Ruling applies in respect of the computation of annual allowances for plant and machinery under paragraph 15, Schedule 3, %ncome Tax $ct /01 and the %ncome Tax (2ualifying Plant $nnual $llo3ances) Rules 2000 [P.U.(A) 52/2000] . This Ruling is effecti e for year of assessment !000 "current year #asis$ and su#se%uent years of assessment.

!.0

T,* $PP'%!$T%"N "& T,%+ R#'%N4 This Ruling considers& !.1 The implications of the reclassifying of plant and machinery into the 3 main categories under the %ncome Tax (2ualifying Plant $nnual $llo3ances) Rules 2000 [hereinafter referred to as the new Rules ] with effect from year of assessment !000 "current year #asis$ [hereinafter referred to as ' /A 2000 (CY) ]( and !.! The computation of initial allowances [)*] and annual allowances [**] for new assets and annual allowances for e+isting assets for ',* !000 "-'$ and su#se%uent years of assessment.

3.0

,") T,* T$. '$) $PP'%*+

3.1 !lassification of $ssets 3.1.1 3 main categories .nder the new Rules, assets that %ualify for annual allowances under paragraph 15, Schedule 3 of the )ncome

Ta+ *ct [the Act] are classified into 3 main categories with effect from ',* !000 "-'$. The main categories and the prescri#ed rates of ** for them are as follows& Assets Rates /ea y machinery, motor !0 0 ehicles 1lant and machinery 12 0 3thers 10 0

5or the year of assessment [Y/A ] in which %ualifying plant e+penditure [QE ] is incurred, )* at the rate of !00 of the 67 "unless otherwise specified& see paragraph 3.1.3 $ is also to #e allowed in addition to **. 3.1.! New assets The prescri#ed rates in paragraph 3.1.1 a#o e [hereinafter referred to as the new rates] are to #e applied to any asset [ ther than an asset t wh!ch paragraph 3.1.3 appl!es] ac%uired in the #asis period for the ',* !000 "-'$ and su#se%uent years of assessment [hereinafter referred to as a new asset ], irrespecti e of the type of industry or the nature of the #usiness in which the asset is used. 3.1.3 Assets for which special Rules or special rates apply 5or a new asset that is to #e dealt with under any of the following Rules [hereinafter referred to as the spec!al Rules ] or an e+isting asset already so dealt with in a prior ',*, the person ma8ing the claim must ensure that the asset is dealt with "or continues to #e dealt with$ under the rele ant special Rules and the rates of )* and , or ** as set out under those special Rules [hereinafter referred to as the spec!al rates ] are applied instead of the new rates under paragraph 3.1.1& *. )ncome Ta+ "6ualifying 1lant *llowances$ "Scheduled 9astes$ Rules 1::5 [ P.U.(A) 33"/1""5 ]( ;. )ncome Ta+ "6ualifying 1lant *llowances$ Rules 1::< [ P.U.(A) 2#5/1""$ ]( -. )ncome Ta+ "6ualifying 1lant *llowances$ "=o. !$ Rules 1::< [ P.U.(A) %$%/1""$ ]( >. )ncome Ta+ "6ualifying 1lant *llowances$ "-omputers and )nformation Technology

7. 5. @.

7%uipment$ Rules 1::? [P.U.(A) 1&$/1""& ]( )ncome Ta+ "6ualifying 1lant )nitial *llowances$ Rules 1::? [ P.U.(A) 2"%/1""& ]( )ncome Ta+ "6ualifying 1lant *llowances$ "-ontrol 7%uipment$ Rules 1::? [ P.U.(A) 2"5/1""& ]( or )ncome Ta+ "6ualifying 1lant *llowances$ "-ost of 1ro ision of -omputer Software$ Rules 1::: [P.U.(A) 2$2/1""" ].

3.1.2

Classifying or reclassifying an asset )n classifying or reclassifying an asset, the following should #e noted& *. ABotor ehiclesA generally include all forms of transport which use motors to operate. [ E'a(ples& motorcycle( aircraft( ship( motoriCed #icycle, etc.] ;. A/ea y machineryA is determined generally #y the nature of its usage. [ E'a(ples & #ulldoCer( crane( ditcher( e+ca ator( grader( loader( ripper( roller( rooter( scraper( sho el( tractor( i#rator( wagon( etc.] [) te* + r !(p rte, hea-. (ach!ner. use, !n the + ll w!ng !n,ustr!es/ !.e. 0u!l,!ng 1 c nstruct! n/ plantat! n/ (!n!ng an, t!(0er/ see paragraph 3.1.3.C a0 -e]( -. A1lant and machineryA include general plant and machinery not falling under the category Ahea y machinery, motor ehiclesA. [ E'a(ples& air conditioners( compressors( ele ators( medical and la#oratory e%uipment( o ens( etc.] >. A3thersA refer to office e%uipment and furniture D fittings.

3.1.5

Assets with life span not exceeding 2 years: replacement basis 7+penditure on assets that ha e an e+pected life span of not more than ! years "implements, utensils and articles$ is to #e dealt with on a replacement #asis. This means that no )* or ** is to #e allowed, as the cost of purchase of such assets is not regarded as 67. /owe er, the cost of replacing

such assets is to #e allowed as deducti#le e+penditure under section 33"1$"c$ of the *ct in determining the adEusted income of the #usiness. *ny amount reco ered from the disposal of the replaced assets will #e treated as income of the #usiness. [ E'a(ples & #edding D linen( croc8ery D glassware( cutlery D coo8ing utensils "other than stainless steel or sil er$( loose tools( accessories.] [ 2ee als E'a(ple 1 !n paragraph 3.3.1 0el w .]

3.! !laims for initial an5 annual allo3ances

3.!.1

Claims to be made in the return and in writing

*.

;.

-laims for )* and ** must #e made in writing in the return for the -/$ . The details of the claim should #e shown in a certified statement in the ta+ computation. *fter one of the alternati e approaches under paragraph 3.3.!.; has #een applied, re iew or reconsideration of that decision "e+cept in cases of mista8es or errors$ should #e a oided.

3.!.!

Conditions to be satisfied To %ualify for )* and,or ** for a ',* in respect of an asset, the person ma8ing the claim must satisfy all the following conditions&

*. ;.

he was carrying on a #usiness during the #asis period( in respect of that asset, he has incurred 67 in that #asis period "to %ualify for )*$, or has incurred 67 in that #asis period and , or a pre ious #asis

-. >.

period "to %ualify for **$( that asset was in use for the purpose of the #usiness( and at the end of that #asis period, he was the owner of the asset and the asset was in use.

[ 3hese c n,!t! ns an, ther c ns!,erat! ns !n respect + the wnersh!p + the asset are ,!scusse, !n ,eta!l !n Pu0l!c Rul!ng ) . 1/2001 .]

3.3 !om6utation of ca6ital allo3ances for y/a 2000 (!-) ( subse7uent -/$

3.3.1

New assets The amount of ** is a percentage of the 67 incurred on the asset, calculated according to the rates prescri#ed in the new Rules. E'a(ple 1 * company "which has #een in #usiness for a num#er of years$ purchases a refrigerator for RB5,000 on 1!.02.!000 and uses it in its restaurant #usiness. !00 pieces of dinner plates are purchased for RB!,000 on 15.0<.!000 to replace some of the e+isting croc8ery that is chipped, crac8ed or discoloured "disposed of for RB!00$. The assets are included in the #alance sheet of the #usiness, for which accounts are prepared for the financial year ended 30.0:.!000. 4 r Y/A 2000 (CY)/ 5A an, AA can 0e cla!(e, as + ll ws &

Asset Refrigerator

QE 5,000

A !2"#$ 1,000

AA <00 [120]

%otal 1,<00

6Cap!tal all wances cann t 0e cla!(e, !n respect + the ,!nner plates as the e'pen,!ture + R72/000 !s n t regar,e, as QE8 h we-er/ !t can 0e ,e,ucte, + r ta' purp ses as c st + replace(ent + cr c9er.. 3he R7200 rece!-e, +r ( the ,!sp sal + the replace, cr c9er. !s t 0e !nclu,e, as gr ss !nc (e. 3hese a,:ust(ents sh ul, 0e (a,e !n the ta' c (putat! n.; E'a(ple 2 * #usinessman installs a telephone system "inclusi e of a fa+ machine$ in the office of his stationery retail #usiness, incurring e+penditure of RB2,000 on 30.0F.!000. * secondhand an is later ac%uired in Guly !000 for RB!5,000. The assets are included in the #alance sheet of the #usiness in the accounts prepared for the year ended 31.1!.!000. 4 r Y/A 2000 (CY)/ 5A an, AA can 0e cla!(e, as + ll ws &

Asset Telephone system Han

QE 2,000 !5,000

A !2"#$

AA

%otal 1,!00

?00 200 [100] 5,000

5,000 10,000 [!00]

3.3.!

Existing assets

*.

Assets + r wh!ch spec!al Rules / spec!al rates ha-e 0een appl!e, 5or assets ac%uired #efore the #asis period for ',* !000 "-'$ [i.e. in the #asis period for -/$ !000 "preceding year #asis$ and prior years of assessment] for which #oth )* and ** ha e #een allowed according to the spec!al rates under any of the spec!al Rules mentioned in paragraph 3.1.3 a#o e, the new Rules and the new rates are not to #e applied, and the rele ant special Rules and special rates must continue to #e applied for ',* !000 "-'$ and su#se%uent years of assessment until all the

remaining #alance of the 67 [i.e., the residual e+penditure or RE ] in respect of each asset has #een completely a#sor#ed. ;. Assets + r wh!ch the l, Rules r l, rates ha-e 0een appl!e, 5or assets ac%uired #efore the #asis period for ',* !000 "-'$ for which #oth )* and ** ha e #een allowed according to the e+isting rates i.e., the rates prescri#ed under the %ncome Tax (2ualifying Plant $nnual $llo3ances) Rules /08 [ <.). 15%/1"#& ] "as amended #y the %ncome Tax (2ualifying Plant $nnual $llo3ances) ($men5ment) Rules /80 [P.U. (A) 3%# / 1"&0] [hereinafter referred to as the l, rates and the l, Rules ], any one of the following 3 alternati e approaches may #e adopted& Alternati&e ': )ew rates appl!e, (all e'!st!ng assets) * person can apply the new rates to all e+isting assets for ',* !000 "-'$ and su#se%uent years of assessment until all the R7 in respect of each asset has #een completely a#sor#ed. E'a(ple 1 *n indi idual has the following assets&

9etails of assets 67 'ear incur red 3ld rate =ew rate

(otor &an <5,000 1::<

)ffice e*uipment !!,000 1::F

+urniture 10,000 1::F

!00 !00

1!0 100

?0 100

3he cap!tal all wance c (putat! n sh ul, 0e as + ll ws*

4 QE Y/A 1""$ 5A AA RE Y/A 1""&

(otor &an 4 1:;000 4 4 4 4 4 4 4 4 4 4 4

)ffice e*uipment 4 22;000 4 2,200 !,F20 4 4 4 4 4 4 4 4 4 4 <,020 <;/00 4 4 !,F20 2;=20 4 !,F20 /;080 4

+urniture 4 4 !,000 ?00 4 4 4 4 4 4 4 4 4 0;000 4 4 !,?00 1;200 4 4 ?00 0;<00 4 ?00 :;000 4

5A 15,000 RE Y/A 1""" AA RE

AA 15,000 30,000 4 <:;000 4 4 4 15,000 4 =0;000

Y/A 2000 (prece,!ng .ear 0as!s) 4 4 AA RE Y/A 2000 (CY) AA 6new rates; RE Y/A 2001 AA RE 4 15,000 4 4 :;000 4 4 4 4 10= 4 4 4 4

!,F20 1;0<0 4 !,!00 <;8<0 4 !,!00 2;0<0

4 4 4 10= 4 4 4 4

?00 <;800 4 1,000 =;800 4 1,000 2;800

20= 15,000 4 4 4 4 Nil 4 4 4

E'a(ple 2 * company has the following assets&

9etails of assets 67 'ear incurre d 3ld rate =ew rate

(achinery 1?0,000 1::2

Air conditioners ?,000 1::F

+urniture 10,000 1::2

100 120

1!0 120

?0 100

3he cap!tal all wance c (putat! n sh ul, 0e as + ll ws*

4 QE Y/A 1""5 5A AA RE Y/A 1""# AA RE Y/A 1""$ 5A AA RE Y/A 1""& AA RE Y/A 1""" AA RE

(achinery 4 4 3F,000 1?,000 4 4 4 4 4 4 4 4 4 4 4 4 4 4 80;000 4 4 52,000 20;000 4 1?,000 08;000 4 4 1?,000 /0;000 4 1?,000 12;000 4 1?,000 :<;000

Air conditioners 4 4 4 4 4 4 4 4 4 1,F00 :F0 4 4 4 4 4 4 4 8;000 4 4 4 4 4 4 4 4 4 !,5F0 :;<<0 4 :F0 <;<80 4 :F0 =;:20

+urniture 4 4 !,000 ?00 4 4 4 4 4 4 4 4 4 4 4 4 4 4 0;000 4 4 !,?00 1;200 4 ?00 0;<00 4 4 ?00 :;000 4 ?00 <;800 4 ?00 <;000

Y/A 2000 (prece,!ng .ear 0as!s) 4 4 4 AA RE Y/A 2000 (CY) AA 6new rates; RE Y/A 2001 AA RE 4 4 4 1%= 4 4 4 4 1?,000 =0;000 4 !5,!00 0;800 4 I10,?00 Nil 4 4 4 1%= 4 4 4 4

:F0 2;:00 4 1,1!0 ;<<0 4 1,1!0 =20

4 4 4 10= 4 4 4 4

?00 =;200 4 1,000 2;200 4 1,000 ;200

> AA 25/200 restr!cte, t the a( unt + RE Alternati&e 2: ?l, rates appl!e, (all e'!st!ng assets $ * person can continue to apply the old rates for all e+isting assets for ',* !000 "-'$ and su#se%uent years of assessment until all the R7 in respect of each asset has #een completely a#sor#ed. E'a(ple 3 )f the company in E'a(ple 2 "paragraph 3.3.!.; a#o e$ had decided not to apply the new rates #ut to continue applying the old rates to all its e+isting assets to a oid complications, then the computation of capital allowances would ha e #een& 6C (putat! n + r Y/A 1""% t 2000 (prece,!ng .ear 0as!s)* as per E'a(ple 2 a0 -e;

4 RE Y/A 2000 (CY)

(achinery 4 4 =0;000 4

Airconditioners 4 4 2;:00 4

+urniture 4 4 =;200 4

AA 6 l, rates; RE Y/A 2001 AA RE

10= 4 4 4 4

1?,000 8;000 4 1?,000 Nil

12= 4 4 4 4

:F0 ;000 4 :F0 0<0

&= 4 4 4 4

?00 2;<00 4 ?00 ;000

J4

Alternati&e 3 > )ew rates appl!e, t s (e e'!st!ng assets an, l, rates appl!e, t thers * person can apply the new rates for some of his e+isting assets "for which the new rates are higher than the old rates$ and continue to apply the old rates for the rest of his e+isting assets "for which the old rates are higher than the new rates$ for ',* !000 "-'$ and su#se%uent years of assessment. E'a(ple % )f the indi idual in E'a(ple 1 "paragraph 3.3.!.; a#o e$ had decided to apply the new rates in respect of some assets and to continue applying the old rates in respect of others so as to ta8e ad antage of the higher rates in #oth instances, then the computation of capital allowances would ha e #een& 6C (putat! n + r Y/A 1""$ t 1"""* as per E'a(ple 1 a0 -e;

4 RE AA RE Y/A 2000 (CY) AA

(otor &an 4 4 4 4 20= 6 l,; =0;000 15,000 :;000 4 15,000 Y/A 2000 (prece,!ng .ear 0as!s)

)ffice e*uipment 4 4 4 4 12= 6 l,; !,F20 /;080 4 !,F20 1;0<0

+urniture 4 4 4 4 4 10= 6new; 1,000 :;000 4 ?00 <;800

RE Y/A 2001 AA RE Y/A 2002 AA RE

4 4 4 4 4 4 4

Nil 4 4 4 4 4 4

4 4 4 4 4 4 4

<;<00 4 !,F20 ;100 4 I1,<F0 Nil

4 4 4 4 4 4 4

=;800 4 1,000 2;800 4 1,000 ;800

> AA 2/#%0 restr!cte, t the a( unt + RE

2.0

%NT*RPR*T$T%"N 5or the purpose of this Ruling& 2. A*ssetA means plant or machinery used for the purpose of the #usiness on 1 which %ualifying plant e+penditure has #een incurred. 2. A1ersonA includes a company, a co4operati e society, a partnership, a clu#, ! an association, a /indu Eoint family, a trust, an estate under administration and an indi idual, #ut e+cludes a unit trust to which section F3* of the *ct applies. 2. A6ualifying plant e+penditureA [67] means capital e+penditure incurred 3 on the pro ision, construction or purchase of plant or machinery used for the purpose of a #usiness [other than assets that ha e an e+pected life span of not more than ! years "see paragraph 3.1.% a0 -e $]. 2. AResidual e+penditureA [R7] at any date in respect of an asset means the 2 una#sor#ed #alance of the %ualifying e+penditure [67], arri ed at #y deducting from the total 67 incurred #efore that date, the aggregate amount of&

2.2.1 2.2. ! 2.2.3

any initial allowance [)*] made for any ',*( any annual allowance [**] made for any ',* #efore that date( and any notional annual allowance "i.e., annual allowances that would ha e #een made if it had #een claimed or could ha e

#een claimed$ made or should ha e #een made #efore that date.

2. ATa+ computationA means the wor8ing sheets, statements, schedules, 5 calculations and other supporting documents forming the #asis upon which an income ta+ return is made that are re%uired to #e su#mitted together with the return or maintained #y the person ma8ing the return. 2. 9here a person incurs capital e+penditure under a hire purchase F agreement on the pro ision of plant or machinery for the purpose of a #usiness of his, the %ualifying plant e+penditure incurred #y him in the #asis period for a year of assessment is ta8en to #e the aggregate of the capital portion of the instalment payments and any down payment made #y him under that agreement in that period. (9ate of issue> 8 ?anuary 200 )

Das könnte Ihnen auch gefallen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- d15 Hybrid P2int ADokument13 Seitend15 Hybrid P2int AKelly Tan Xue LingNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- j15 P7int Q CleanDokument7 Seitenj15 P7int Q CleanvictorpasauNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- D14 P7int QP PDFDokument7 SeitenD14 P7int QP PDFAdriana LazicNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- P7int 2011 Dec ADokument18 SeitenP7int 2011 Dec AMohammed AlamoodiNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Youtube VideoDokument1 SeiteYoutube VideoKelly Tan Xue LingNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Wht-Sec 109f-PR1 - 2010Dokument16 SeitenWht-Sec 109f-PR1 - 2010Kelly Tan Xue LingNoch keine Bewertungen

- Ab Int Sept 2018Dokument68 SeitenAb Int Sept 2018Kelly Tan Xue LingNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- AB INT Nov 2018Dokument68 SeitenAB INT Nov 2018Kelly Tan Xue LingNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Withholding TaxDokument1 SeiteWithholding TaxKelly Tan Xue LingNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Exam Technique For P7 - ACCA Qualification - Students - ACCA GlobalDokument3 SeitenExam Technique For P7 - ACCA Qualification - Students - ACCA GlobalKelly Tan Xue LingNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Garmin Malaysia - Authorized Garmin DistributorDokument5 SeitenGarmin Malaysia - Authorized Garmin DistributorKelly Tan Xue LingNoch keine Bewertungen

- Audit and Assurance Case Study Questions - ACCA Qualification - Students - ACCA Global PDFDokument4 SeitenAudit and Assurance Case Study Questions - ACCA Qualification - Students - ACCA Global PDFKelly Tan Xue LingNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Examinable Documents September 2016 To June 2017Dokument5 SeitenExaminable Documents September 2016 To June 2017Kelly Tan Xue LingNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Acca p4 Adavanced Financial ManagementDokument6 SeitenAcca p4 Adavanced Financial ManagementKelly Tan Xue LingNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Audit and Assurance Case Study Questions - ACCA Qualification - Students - ACCA GlobalDokument4 SeitenAudit and Assurance Case Study Questions - ACCA Qualification - Students - ACCA GlobalKelly Tan Xue LingNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- P4 Becke Mock 2015Dokument13 SeitenP4 Becke Mock 2015Kelly Tan Xue LingNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Exam Technique - ACCA Qualification - Students - ACCA Global-2Dokument4 SeitenExam Technique - ACCA Qualification - Students - ACCA Global-2Kelly Tan Xue LingNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Entertainment - PR 4 2015-bjjbDokument18 SeitenEntertainment - PR 4 2015-bjjbKelly Tan Xue LingNoch keine Bewertungen

- BL ObserverDokument25 SeitenBL ObserverKelly Tan Xue LingNoch keine Bewertungen

- Guide On Advertising Services (Revised As at 20 May 2015)Dokument22 SeitenGuide On Advertising Services (Revised As at 20 May 2015)Kelly Tan Xue LingNoch keine Bewertungen

- 101 Lessons I Learnt From Richard Branson PDFDokument109 Seiten101 Lessons I Learnt From Richard Branson PDFBexha80% (5)

- 1Dokument1 Seite1Kelly Tan Xue LingNoch keine Bewertungen

- Guide On Advertising Services (Revised As at 20 May 2015)Dokument22 SeitenGuide On Advertising Services (Revised As at 20 May 2015)Kelly Tan Xue LingNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- CollateralDokument1 SeiteCollateralKelly Tan Xue LingNoch keine Bewertungen

- Framework For Tax InvestigationDokument18 SeitenFramework For Tax InvestigationKelly Tan Xue LingNoch keine Bewertungen

- BL ObserverDokument25 SeitenBL ObserverKelly Tan Xue LingNoch keine Bewertungen

- BPP Learning Media - The #1 Platinum Approved Study ProviderDokument4 SeitenBPP Learning Media - The #1 Platinum Approved Study ProviderKelly Tan Xue LingNoch keine Bewertungen

- NPVDokument40 SeitenNPVKelly Tan Xue LingNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Sa Dec13 BDokument21 SeitenSa Dec13 BKelly Tan Xue LingNoch keine Bewertungen

- Fabm1 q3 Mod4 Typesofmajoraccounts FinalDokument25 SeitenFabm1 q3 Mod4 Typesofmajoraccounts FinalClifford FloresNoch keine Bewertungen

- Courier C129303 R6 TDK0 CADokument15 SeitenCourier C129303 R6 TDK0 CARohan SmithNoch keine Bewertungen

- ALI Financial Statements (2021)Dokument26 SeitenALI Financial Statements (2021)Lorey Joy IdongNoch keine Bewertungen

- Caso HertzDokument31 SeitenCaso HertzIsabel Cristina Davila VillaNoch keine Bewertungen

- Quiz Conso FSDokument3 SeitenQuiz Conso FSMark Joshua SalongaNoch keine Bewertungen

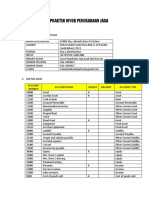

- Soal Praktek Myob Perusahaan JasaDokument4 SeitenSoal Praktek Myob Perusahaan Jasahani ramadiyantiNoch keine Bewertungen

- Chapter 2 JournalizingDokument21 SeitenChapter 2 Journalizingkakao100% (1)

- Afm AssignmentDokument6 SeitenAfm AssignmentShweta BhardwajNoch keine Bewertungen

- Accounting For Partnership and CorporationDokument19 SeitenAccounting For Partnership and CorporationJoelyn Grace MontajesNoch keine Bewertungen

- Unit 4: Auditing: What Does An Auditor Do?Dokument50 SeitenUnit 4: Auditing: What Does An Auditor Do?LisantikaNoch keine Bewertungen

- ACC 101 Chapter 4 - Part 1 (Closing Entires)Dokument5 SeitenACC 101 Chapter 4 - Part 1 (Closing Entires)Qais KhaledNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FABM-2 LAS Quarter 3Dokument84 SeitenFABM-2 LAS Quarter 3Rudelyn AlcantaraNoch keine Bewertungen

- Week15 - Fundamentals of AccountingDokument5 SeitenWeek15 - Fundamentals of AccountingShiene MedrianoNoch keine Bewertungen

- Comprehensive Assessment 1 and 2Dokument3 SeitenComprehensive Assessment 1 and 2Kurt NicolasNoch keine Bewertungen

- Las 4Dokument8 SeitenLas 4Venus Abarico Banque-AbenionNoch keine Bewertungen

- Mgt101 Solved Mcqs Another FileDokument10 SeitenMgt101 Solved Mcqs Another Filemalik50% (2)

- IFRS Diploma Answers 2015Dokument7 SeitenIFRS Diploma Answers 2015Soňa SlovákováNoch keine Bewertungen

- Ifrs Unit 3Dokument15 SeitenIfrs Unit 3Deven LadNoch keine Bewertungen

- Equity Method Investment CalculationDokument8 SeitenEquity Method Investment CalculationjvNoch keine Bewertungen

- Pe Illustrative Financial StatementDokument42 SeitenPe Illustrative Financial StatementRobert ManjoNoch keine Bewertungen

- Excel Pinakafinal Na Balance HihiDokument14 SeitenExcel Pinakafinal Na Balance HihiBrex Malaluan GaladoNoch keine Bewertungen

- Q2 2019 PDFDokument166 SeitenQ2 2019 PDFCheri PutriNoch keine Bewertungen

- Handouts ACCOUNTING-2Dokument39 SeitenHandouts ACCOUNTING-2Marc John IlanoNoch keine Bewertungen

- Ey Leases A Summary of Ifrs 16Dokument28 SeitenEy Leases A Summary of Ifrs 16Wedi TassewNoch keine Bewertungen

- 8.7.1 Allowance MethodDokument5 Seiten8.7.1 Allowance MethodAkkamaNoch keine Bewertungen

- Chapter 8Dokument8 SeitenChapter 8Kurt dela Torre100% (1)

- Screenshot 2022-10-06 at 9.42.46 AMDokument20 SeitenScreenshot 2022-10-06 at 9.42.46 AMUzer BagwanNoch keine Bewertungen

- Red Hat Bookkeeping Presentation 2015Dokument42 SeitenRed Hat Bookkeeping Presentation 2015nxjhdjs gdeiwqntbgd2c gve2s23Noch keine Bewertungen

- Group 8 ACTIVITYDokument3 SeitenGroup 8 ACTIVITYRoldan, Juan Miguel S.Noch keine Bewertungen

- Eliminating EntriesDokument81 SeitenEliminating EntriesRose CastilloNoch keine Bewertungen