Beruflich Dokumente

Kultur Dokumente

Development of Islamic Banking in Malaysia

Hochgeladen von

Kame Hame HaaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Development of Islamic Banking in Malaysia

Hochgeladen von

Kame Hame HaaCopyright:

Verfügbare Formate

THE EFFECTIVENESS OF ISLAMIC BANKING IN MALAYSIA The first attempt to establish Islamic Banking was in 1950s start in rural

area of Pakistan. It was when the pious landowners deposit their funds without interest rewards. Credit then was advanced to other poorer landowners for agricultural improvement. Although it was no shortage of borrowers, for the depositors, it was once and for all effort. The depositors took considerable interest on how the money was loaned out. However in Malaysia development of Islamic Banking just began in 1963. In September 1963, Perbadanan Wang Simpanan Bakal-Bakal Haji was established. Perbadanan Wang Simpanan Bakal- Bakal Haji was set up as an institution for Muslim to save their money for Hajj expenses. Sis years later, in 1969, Perbadanan Wang Simpanan Bakal Bakal Haji merged with Pejabat Urusan Haji to form Lembaga Tabung Haji. Only in 1983, about 20 years after Perbadanan Wang Simpanan Bakal- Bakal Haji founded, the first Islamic Banking in Malaysia established with the formation of Bank Islam Malaysia Berhad (BIMB) under Islamic Banking Act 1983. Bank Islam is also become the first stand alone Islamic Bank in Malaysia. Stand alone Islamic Bank meaning that it is an independent financial institution that offers full range of Islamic compliant products and services from retail banking wealth and asset management, corporate banking advisory and capital market trading. There are many examples of stand alone Islamic Banking in this world such as Bank Syariah Mandiri, Bank Muamalat, Al-Rajhi Bank, Dubai Islamic Bank, Al Baraka Banking Group and Kuwait Finance House. In Malaysia, Islamic Banking is provided in dual banking environment. It is the first country in the world that has dual system of banking and finance. This means that Islamic Banking system operates in parallel with the conventional banking system. Since Islamic Banking does not prohibit participation by non-Muslims, its potential for further growth is tremendous. Bank Negara Malaysia Financial Sector Master Plan (FSMP) and MIFC initiatives help spur further the development of Islamic Banking. During the first 10 years of its establishment, Bank Islam Malaysia Berhad (BIMB) was the sole bank given an Islamic banking license to operate in the country. This was to allow Bank Islam to operate in a smooth manner without undue competition that might hinder the progress of Islamic Banking. In 1993, Bank Negara Malaysia set up the Skim Perbankan Tanpa Faedah which was later known as Islamic Banking Scheme (IBS) that allow conventional banks to offer Islamic Windows banking products. Islamic windows specialized set ups within conventional banks that offer Islamic compliant products and services. It generally targeted at affluent customer segments and institutional investor. These institution however are required to separate the funds and activities of Islamic banking transaction from the conventional banking business to ensure that there would not be any co-mingling of funds.

In 1994 Interbank Islamic Money Market was established. This introduced the Islamic Interbank cheque clearing system based on Mudharabah principles where the deficit of clearing account of one Islamic Banking Scheme will be funded by the surplus funds from other Islamic Banking Scheme bank or by Bank Negara Malaysia. In 1997, under Bank Negara Malaysia, National Shariah Advisory Council was set up. It is functioning as advisor to Bank Negara Malaysia. It advices Bank Negara Malaysia on Syariah aspects of the operations of these institutions, as well as on their product and services. In 1999, the second full fledge Islamic Bank arrived as new competitor of Bank Islam Malaysia Berhad named as Bank Muamalat. Bank Muamalat Malaysia Berhad (BMMB) commenced operation 1 October 1999 with a network of 40 branches. In 2001, Bank Negara Malaysia launch of the Financial Sector Masterplan which included a 10 years plan for the development of Islamic Banking and Takaful. Takaful got their first licensed operator as early as 1984. The Malaysian government then issues the Malaysian Government Sukuk the worlds first global sovereign Sukuk. Kumpulan Guthrie Berhad issued the world first global corporate Islamic bond. In year 2002, Islamic Banking and Finance Institute Malaysia was established as the industry owned training and research centre. Only in 2004, conventional banks allowed to establish Islamic subsidiaries and new banking licenses were issued to foreign Islamic Institution such as Kuwait Finance House, Asian Finance Bank and Al Rajhi Bank. However only in Aug 2005 they operate their operation in Malaysia. Today, almost all conventional banks operates Islamic banking window such as RHB Islamic Bank, AmIslamic Bank, OCBC Al Amin, HSBC Amanah and so on. International Currency Business Unit (ICBU) was established in September 2006. ICBU of Islamic bank allowed to conduct wide range of Islamic Banking business under the Islamic Banking Act 1983 with non-residents in international currencies other than Malaysian Ringgit (except currency of Israel). The income arising from the transactions of the ICBU is eligible for tax exemption accorded under the Income Tax Act 1967 for 10 years from the year assessment 2007. In 2009, Corporate Murabahah Master Agreement had launched in a move to boost the Islamic Market. Nowadays, Islamic banking in Malaysia is continuously tremendously well known in universe.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanDokument3 SeitenDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeNoch keine Bewertungen

- Pandit Automotive Pvt. Ltd.Dokument6 SeitenPandit Automotive Pvt. Ltd.JudicialNoch keine Bewertungen

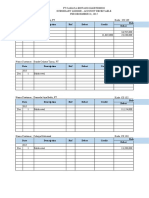

- Latihan Soal PT CahayaDokument20 SeitenLatihan Soal PT CahayaAisyah Sakinah PutriNoch keine Bewertungen

- 4 P'sDokument49 Seiten4 P'sankitpnani50% (2)

- Introduction - IEC Standards and Their Application V1 PDFDokument11 SeitenIntroduction - IEC Standards and Their Application V1 PDFdavidjovisNoch keine Bewertungen

- DX210WDokument13 SeitenDX210WScanner Camiones CáceresNoch keine Bewertungen

- IAS 41 - AgricultureDokument26 SeitenIAS 41 - AgriculturePriya DarshiniNoch keine Bewertungen

- Seller Commission AgreementDokument2 SeitenSeller Commission AgreementDavid Pylyp67% (3)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDokument148 SeitenHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerNoch keine Bewertungen

- July 07THDokument16 SeitenJuly 07THYashwanth yashuNoch keine Bewertungen

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperDokument15 SeitenThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoNoch keine Bewertungen

- Ahmed BashaDokument1 SeiteAhmed BashaYASHNoch keine Bewertungen

- Fiscal Deficit UPSCDokument3 SeitenFiscal Deficit UPSCSubbareddyNoch keine Bewertungen

- Calander of Events 18 3 2020-21Dokument67 SeitenCalander of Events 18 3 2020-21Ekta Tractor Agency KhetasaraiNoch keine Bewertungen

- Letter InsuranceDokument2 SeitenLetter InsuranceNicco AcaylarNoch keine Bewertungen

- BS 6206-1981 PDFDokument24 SeitenBS 6206-1981 PDFwepverro100% (2)

- Water Recycling PurposesDokument14 SeitenWater Recycling PurposesSiti Shahirah Binti SuhailiNoch keine Bewertungen

- Cfa - Technical Analysis ExplainedDokument32 SeitenCfa - Technical Analysis Explainedshare757592% (13)

- Literature ReviewDokument14 SeitenLiterature ReviewNamdev Upadhyay100% (1)

- Business Cycle Indicators HandbookDokument158 SeitenBusiness Cycle Indicators HandbookAnna Kasimatis100% (1)

- Scheme For CBCS Curriculum For B. A Pass CourseDokument18 SeitenScheme For CBCS Curriculum For B. A Pass CourseSumanNoch keine Bewertungen

- Accra Resilience Strategy DocumentDokument63 SeitenAccra Resilience Strategy DocumentKweku Zurek100% (1)

- JK Fenner (India) LimitedDokument55 SeitenJK Fenner (India) LimitedvenothNoch keine Bewertungen

- Production Planning & Control: The Management of OperationsDokument8 SeitenProduction Planning & Control: The Management of OperationsMarco Antonio CuetoNoch keine Bewertungen

- DuPont Analysis On JNJDokument7 SeitenDuPont Analysis On JNJviettuan91Noch keine Bewertungen

- Factors Affecting SME'sDokument63 SeitenFactors Affecting SME'sMubeen Shaikh50% (2)

- Quijano ST., San Juan, San Ildefonso, BulacanDokument2 SeitenQuijano ST., San Juan, San Ildefonso, BulacanJoice Dela CruzNoch keine Bewertungen

- NaftaDokument18 SeitenNaftaShabla MohamedNoch keine Bewertungen

- The Global Interstate System Pt. 3Dokument4 SeitenThe Global Interstate System Pt. 3Mia AstilloNoch keine Bewertungen

- Business Economics - Question BankDokument4 SeitenBusiness Economics - Question BankKinnari SinghNoch keine Bewertungen