Beruflich Dokumente

Kultur Dokumente

Corpo CD Classes of Shares Etc.

Hochgeladen von

Emer MartinCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Corpo CD Classes of Shares Etc.

Hochgeladen von

Emer MartinCopyright:

Verfügbare Formate

Republic Planters Bank vs. Agana Case Digest Republic Planters Bank vs.

Agana [GR 51765, 3 March 1997] Facts: On 18 September 1961, the Robes-Francisco Realty & Development Corporation (RFRDC) secured a loan from the Republic Planters Bank in the amount of P120,000.00. As part of the proceeds of the loan, preferred shares of stocks were issued to RFRDC through its officers then, Adalia F. Robes and one Carlos F. Robes. In other words, instead of giving the legal tender totaling to the full amount of the loan, which is P120,000.00, the Bank lent such amount partially in the form of money and partially in the form of stock certificates numbered 3204 and 3205, each for 400 shares with a par value of P10.00 per share, or for P4,000.00 each, for a total of P8,000.00. Said stock certificates were in the name of Adalia F. Robes and Carlos F. Robes, who subsequently, however, endorsed his shares in favor of Adalia F. Robes. Said certificates of stock bear the following terms and conditions: "The Preferred Stock shall have the following rights, preferences, qualifications and limitations, to wit: 1. Of the right to receive a quarterly dividend of 1%, cumulative and participating. xxx 2. That such preferred shares may be redeemed, by the system of drawing lots, at any time after 2 years from the date of issue at the option of the Corporation." On 31 January 1979, RFRDC and Robes proceeded against the Bank and filed a complaint anchored on their alleged rights to collect dividends under the preferred shares in question and to have the bank redeem the same under the terms and conditions of the stock certificates. The bank filed a Motion to Dismiss 3 private respondents' Complaint on the following grounds: (1) that the trial court had no jurisdiction over the subject-matter of the action; (2) that the action was unenforceable under substantive law; and (3) that the action was barred by the statute of limitations and/or laches. The bank's Motion to Dismiss was denied by the trial court in an order dated 16 March 1979. The bank then filed its Answer on 2 May 1979. Thereafter, the trial court gave the parties 10 days from 30 July 1979 to submit their respective memoranda after the submission of which the case would be deemed submitted for resolution. On 7 September 1979, the trial court rendered the decision in favor of RFRDC and Robes; ordering the bank to pay RFRDC and Robes the face value of the stock certificates as redemption price, plus 1% quarterly interest thereon until full payment. The bank filed the petition for certiorari with the Supreme Court, essentially on pure questions of law. Issue: 1. Whether the bank can be compelled to redeem the preferred shares issued to RFRDC and Robes. 2. Whether RFRDC and Robes are entitled to the payment of certain rate of interest on the stocks as a matter of right without necessity of a prior declaration of dividend. Held: 1. While the stock certificate does allow redemption, the option to do so was clearly vested in the bank. The redemption therefore is clearly the type known as "optional". Thus, except as otherwise provided in the stock certificate, the redemption rests entirely with the corporation and the stockholder is without right to either compel or refuse the redemption of its stock. Furthermore, the terms and conditions set forth therein use the word "may". It is a settled doctrine in statutory construction that the word "may" denotes discretion, and cannot be construed as having a mandatory effect. The redemption of said shares cannot be allowed. The Central Bank made a finding that the Bank has been suffering from chronic reserve deficiency, and that such finding resulted in a directive, issued on 31 January 1973 by then Gov. G. S. Licaros of the Central Bank, to the President and Acting Chairman of the Board of the bank prohibiting the latter from redeeming any preferred share, on the ground that said redemption would reduce the assets of the Bank to the prejudice of its depositors and creditors. Redemption of preferred shares was prohibited for a just and valid reason. The directive issued by the Central Bank Governor was obviously meant to preserve the status quo, and to prevent the financial ruin of a banking institution that would have resulted in adverse repercussions, not only to its depositors and creditors, but also to the banking industry as a whole. The directive, in limiting the exercise of a right granted by law to a corporate entity, may thus be considered as an exercise of police power. 2. Both Section 16 of the Corporation Law and Section 43 of the present Corporation Code prohibit the issuance of any stock dividend without the approval of stockholders, representing not less than two-thirds (2/3) of the outstanding capital stock at a regular or special meeting duly called for the purpose. These provisions underscore the fact that payment of dividends to a stockholder is not a matter of right but a matter of consensus. Furthermore, "interest bearing stocks", on which the corporation agrees absolutely to pay interest before dividends are paid to common stockholders, is legal only when construed as requiring payment of interest as dividends from net earnings or surplus only. In compelling the bank to redeem the shares and to pay the corresponding dividends, the Trial committed grave abuse of discretion amounting to lack or excess of jurisdiction in ignoring both the terms and conditions specified in the stock certificate, as well as the clear mandate of the law. COMMISSIONER OF INTERNAL REVENUE vs. MANNING L-28398 | Aug 6, 1975 | Petition for Review | Castro Petitioner: Commissioner of Internal Revenue Respondents: John Manning, W.D. McDonald, E.E. Simmons & CTA Quick Summary: Facts: Reese, the majority stockholder of Mantrasco, executed a trust agreement between him, Mantrasco, Ross, Selph, carrascoso & Janda law firm and the minority stockholders, Manning, McDonald and Simmons. Said agreement was entered into because of Reeses desire that Mantrasco and Mantrasocs 2 subsidiaries, Mantrasco Guam and Port Motors, to continue under the management of Manning, McDonald and Simmons upon his *Reese+ death. When Reese died, Mantrasco paid Reeses estate the value of his shares. When said purchase price has been fully paid, the 24,700 shares, which were declared as dividends, were proportionately distributed to Manning, McDonald and Simmons. Because of this, the BIR issued assessments on Manning,

McDonald and Simmons for deficiency income tax for 1958. Manning et al, opposed this assessment but the BIR still found them liable. Manning et al. appealed to the CTA, which absolved them from any liability. Held: The manifest intention of the parties to the trust agreement was, in sum and substance, to treat the 24,700 shares of Reese as absolutely outstanding shares of Reese's estate until they were fully paid. Such being the true nature of the 24,700 shares, their declaration as treasury stock dividend in 1958 was a complete nullity and plainly violative of public policy. A stock dividend, being one payable in capital stock, cannot be declared out of outstanding corporate stock, but only from retained earnings. A stock dividend always involves a transfer of surplus (or profit) to capital stock. A stock dividend is a conversion of surplus or undivided profits into capital stock, which is distributed to stockholders in lieu of a cash dividend. Facts: 1952 - Mantrasco had an authorized capital stock of P2.5M divided into 25,000 common shares. 24,700 of these shares are owned by Julius Reese while the rest, at 100 each, are owned by Manning, McDonald & Simmons. February 29, 1958 - a trust agreement was executed between Reese, Mantrasco, Ross, Selph, carrascoso & Janda law firm, Manning, McDonald and Simmons. Said agreement was entered into because of Reeses desire that Mantrasco and Mantrasocs 2 subsidiaries, Mantrasco Guam and Port Motors, to continue under the management of Manning, McDonald and Simmons upon his [Reese] death. October 19, 1954 - Reese died. However, the projected transfer of his shares in the name of Mantrasco could not be immediately effected for lack of sufficient funds to cover the initial payment on the shares. February 2, 1955 - after Mantrasco made a partial payment of Reese's shares, the certificate for the 24,700 shares in Reese's name was cancelled and a new certificate was issued in the name of Mantrasco. Also, new certificate was endorsed to the law firm of Ross, Selph, Carrascoso and Janda, as trustees for and in behalf of Mantrasco. December 22, 1958 - a resolution was passed during a special meeting of Mantrasco stockholders. November 25, 1963 - entire purchase price of Reese's interest in Mantrasco was finally paid in full by Mantrasco. May 4, 1964 - trust agreement was terminated and the trustees delivered to Mantrasco all the shares which they were holding in trust. September 14, 1962 - BIR ordered an examination of Mantrascos books. This examination disclosed that: 1. as of December 31, 1958 the 24,700 shares declared as dividends had been proportionately distributed to Manning, McDonald & Simmons, representing a total book value or acquisition cost of P7,973,660 2. Manning, McDonald & Simmons failed to declare the said stock dividends as part of their taxable income for the year 1958 Thus, BIR examiners concluded that the distribution of Reese's shares as stock dividends was in effect a distribution of the "asset or property of the corporation as may be gleaned from the payment of cash for the redemption of said stock and distributing the same as stock dividend." April 14, 1965 - Commissioner of Internal Revenue issued notices of assessment for deficiency income taxes to Manning, McDonald & Simmons for the year 1958. Manning, McDonald & Simmons opposed said assessments. BIR still held them liable for these assessments. Manning, McDonald & Simmons appealed to the CTA. CTA: absolved Manning, McDonald & Simmons from any liability on the ground that their respective 1/3 interest in Mantrasco remained the same before and after the declaration of stock dividends and only the number of shares held by each of them changed. Issues: 1. WON the shares are treasury shares [NO] 2. WON Manning, McDonald & Simmons should pay for deficiency income taxes [ YES] Ratio: 1. Treasury shares are stocks issued and fully paid for and re-acquired by the corporation either by purchase, donation, forfeiture or other means. Treasury shares are therefore issued shares, but being in the treasury they do not have the status of outstanding shares. Consequently, although a treasury share, not having been retired by the corporation reacquiring it, may be re-issued or sold again, such share, as long as it is held by the corporation as a treasury share, participates neither in dividends, because dividends cannot be declared by the corporation to itself, nor in the meetings of the corporation as voting stock, for otherwise equal distribution of voting powers among stockholders will be effectively lost and the directors will be able to perpetuate their control of the corporation, though it still represents a paid-for interest in the property of the corporation. In this case, such essential features of a treasury share are lacking in the former shares of Reese . The manifest intention of the parties to the trust agreement was, in sum and substance, to treat the 24,700 shares of Reese as absolutely outstanding shares of Reese's estate until they were fully paid . Such being the true nature of the 24,700 shares, their declaration as treasury stock dividend in 1958 was a complete nullity and plainly violative of public policy. A stock dividend, being one payable in capital stock, cannot be declared out of outstanding corporate stock, but only from retained earnings. Nature of a stock dividend A stock dividend always involves a transfer of surplus (or profit) to capital stock. A stock dividend is a conversion of surplus or undivided profits into capital stock, which is distributed to stockholders in lieu of a cash dividend. 2. The ultimate purpose which the parties to the trust agreement aimed to realize is to make Manning, McDonalds & Simmons the sole owners of Reeses interest in Mantrasco by utilizing the periodic earnings of Mantrasco and its subsidiaries to directly subsidize their purchase of said interests and by making it appear that they have not received any income from those firms when, in fact, by the formal declaration of non-existent stock dividends in the treasury they secured to themselves the means to turn around as full owners of Reeses shares.

Manning, McDonald & Simmons, using the trust instrument as a convenient technical device, bestowed unto themselves the full worth and value of Reese's corporate holdings with the use of the very earnings of the companies. Such package device, obviously not designed to carry out the usual stock dividend purpose of corporate expansion reinvestment but exclusively for expanding the capital base of Manning, McDonald & Simmons in Mantrasco, cannot be allowed to deflect their responsibilities toward our income tax laws. All these amounts are subject to income tax as being a flow of cash benefits to Manning, McDonald & Simmons . Commissioners assessment is erroneous Commissioner should not have assessed the income tax on the total acquisition cost of the alleged treasury stock dividends in 1 lump sum. The record shows that the earnings of Mantrasco over a period of years were used to gradually wipe out the holdings of Reese. Consequently, those earnings should be taxed for each of the corresponding years when payments were made to Reeses estate on account of his 24,700 shares. Dispositive: CTA judgment set aside. Case remanded to the CTA for further proceedings for the recomputation of the income tax liabilities of Manning, McDonald & Simmons.

Quasi-Reorganizatio Section 38. Power to increase or decrease capital stock; incur, create or increase bonded indebtedness. No corporation shall increase or decrease its capital stock or incur, create or increase any bonded indebtedness unless approved by a majority vote of the board of directors and, at a stockholders meeting duly called for the purpose, two -thirds (2/3) of the outstanding capital stock shall favor the increase or diminution of the capital stock, or the incurring, creating or increasing of any bonded indebtedness. Written notice of the proposed increase or diminution of the capital stock or of the incurring, creating, or increasing of any bonded indebtedness and of the time and place of the stockholders meeting at which the proposed increase or diminution of the capital stock or the incurring or increasing of any bonded indebtedness is to be considered, must be addressed to each stockholder at his place of residence as shown on the books of the corporation and deposited to the addressee in the post office with postage prepaid, or served personally. A certificate in duplicate must be signed by a majority of the directors of the corporation and countersigned by the chairman and the secretary of the stockholders meeting, setting forth: (1) That the requirements of this section have been complied with; (2) The amount of the increase or diminution of the capital stock; (3) If an increase of the capital stock, the amount of capital stock or number of shares of no-par stock thereof actually subscribed, the names, nationalities and residences of the persons subscribing, the amount of capital stock or number of no-par stock subscribed by each, and the amount paid by each on his subscription in cash or property, or the amount of capital stock or number of shares of no-par stock allotted to each stock-holder if such increase is for the purpose of making effective stock dividend therefor authorized; (4) Any bonded indebtedness to be incurred, created or increased; (5) The actual indebtedness of the corporation on the day of the meeting; (6) The amount of stock represented at the meeting; and (7) The vote authorizing the increase or diminution of the capital stock, or the incurring, creating or increasing of any bonded indebtedness. Any increase or decrease in the capital stock or the incurring, creating or increasing of any bonded indebtedness shall require prior approval of the Securities and Exchange Commission. One of the duplicate certificates shall be kept on file in the office of the corporation and the other shall be filed with the Securities and Exchange Commission and attached to the original articles of incorporation. From and after approval by the Securities and Exchange Commission and the issuance by the Commission of its certificate of filing, the capital stock shall stand increased or decreased and the incurring, creating or increasing of any bonded indebtedness authorized, as the certificate of filing may declare: Provided, That the Securities and Exchange Commission shall not accept for filing any certificate of increase of capital stock unless accompanied by the sworn statement of the treasurer of the corporation lawfully holding office at the time of the filing of the certificate, showing that at least twenty-five (25%) percent of such increased capital stock has been subscribed and that at least twenty-five (25%) percent of the amount subscribed has been paid either in actual cash to the corporation or that there has been transferred to the corporation property the valuation of which is equal to twenty-five (25%) percent of the subscription: Provided, further, That no decrease of the capital stock shall be approved by the Commission if its effect shall prejudice the rights of corporate creditors.

Non-stock corporations may incur or create bonded indebtedness, or increase the same, with the approval by a majority vote of the board of trustees and of at least two-thirds (2/3) of the members in a meeting duly called for the purpose. Bonds issued by a corporation shall be registered with the Securities and Exchange Commission, which shall have the authority to determine the sufficiency of the terms thereof. (17a) Definition of 'Stock Split' A corporate action in which a company divides its existing shares into multiple shares. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts, because the split did not add any real value. The most common split ratios are 2-for-1 or 3-for-1, which means that the stockholder will have two or three shares for every share held earlier. Also known as a "forward stock split." In the U.K., a stock split is referred to as a "scrip issue," "bonus issue," "capitalization issue" or "free issue." Definition of 'Capital Reduction' The process of decreasing a company's shareholder equity through share cancellations and share repurchases. The reduction of capital is done by companies for numerous reasons including increasing shareholder value and producing a more efficient capital structure. After a capital reduction, the number of shares in the company will decrease by the reduction amount. In some capital reductions, shareholders will receive a cash payment for shares cancelled - but, in other situations, there is minimal impact on shareholders. Don Andres Soriano (American), founder of A. Soriano Corp. (ASC) had a total shareholdings of 185,154 shares. Broken down, the shares comprise of 50,495 shares which were of original issue when the corporation was founded and 134,659 shares as stock dividend declarations. So in 1964 when Soriano died, half of the shares he held went to his wife as her conjugal share (wife s legitime) and the other half (92,577 shares, which is further broken down to 25,247.5 original issue shares and 82,752.5 st ock dividend shares) went to the estate. For sometime after his death, his estate still continued to receive stock dividends from ASC until it grew to at least 108,000 shares. In 1968, ASC through its Board issued a resolution for the redemption of shares fro m Sorianos estate purportedly for the planned Filipinization of ASC. Eventually, 108,000 shares were redeemed from the Soriano Estate. In 1973, a tax audit was conducted. Eventually, the Commissioner of Internal Revenue (CIR) issued an assessment against ASC for deficiency withholding tax-at-source. The CIR explained that when the redemption was made, the estate profited (because ASC would have to pay the estate to redeem), and so ASC would have withheld tax payments from the Soriano Estate yet it remitted no such withheld tax to the government. ASC averred that it is not duty bound to withhold tax from the estate because it redeemed the said shares for purposes of Filipinization of ASC and also to reduce its remittance abroad. ISSUE: Whether or not ASCs arguments are tenable. HELD: No. The reason behind the redemption is not material. The proceeds from a redemption is taxable and ASC is duty bound to withhold the tax at source. The Soriano Estate definitely profited from the redemption and such profit is taxable, and again, ASC had the duty to withhold the tax. There was a total of 108,000 shares redeemed from the estate. 25,247.5 of that was original issue from the capital of ASC. The rest (82,752.5) of the shares are deemed to have been from stock dividend shares. Sale of stock dividends is taxable. It is also to be noted that in the absence of evidence to the contrary, the Tax Code presumes that every distribution of corporate property, in whole or in part, is made out of corporate profits such as stock dividends. It cannot be argued that all the 108,000 shares were distributed from the capital of ASC and that the latter is merely redeeming them as such. The capital cannot be distributed in the form of redemption of stock dividends without violating the trust fund doctrine wherein the capital stock, property and other assets of the corporation are regarded as equity in trust for the payment of the corporate creditors. Once capital, it is always capital. That doctrine was intended for the protection of corporate creditors.

LINGAYEN GULF v. Baltazar(1953) 1) Baltazar subscribed to the Cs 600 shares (P100 par value per share) for a total P60,000. 2) Baltazar has an unpaid balance of P18,500. 3) BOD issued a call to 50% of all unpaid subscriptions. The BOD call was not published, although Baltazar received a notice of said call. 4) BOD also released Baltazar from paying his unpaid balance. 5) Since Baltazar ignored the call, C sued him for the balance. 6) Baltazars defense: a)Cs action was premature because there was no valid call (because no publication). b) he was released by the BOD c) claims from the C a reasonable compensation as president HELD: Call should not only be sent by letter but also published. Velasco is different because the C there became insolvent. The rule is notice of call for payment of unpaid subscribed stock must be published except when the C is insolvent, in w/c case, payment is immediately demandable. The release attempted in the Resolution 17 was not valid.

Notice of any call for the payment of unpaid subscription should be made not only personally but also by publication once a week, for four consecutive weeks in some newspapers. In a solvent corporation, there must be a published call for the payment of unpaid subscriptions before payment could be demanded. No cancellation or release from obligation can be valid without the consent of the stockholder. Chua Guan v. SAMAHANG MAGSASAKA INC. (1935) 1) Gonzalo H. Co Toco was the owner of 5,894 shares of the capital stock of the said corporation represented by nine certificates. 2) a debt 3) The said certificates of stock were delivered with the mortgage to the mortgagee, Chua Chiu. Gonzalo H. Co Toco, a resident of Manila, mortgaged said 5,894 shares to Chua Chiu to guarantee the payment of

4) The said mortgage was duly registered in the office of the register of deeds of Manila on June 23, 1931, and in the office of the said corporation on September 30, 1931. 5) Subsequently, Chua Chiu assigned all his right and interest in said mortgage to the plaintiff and the assignment was registered in the office of the register of deeds in the City of Manila on December 28, 1931, and in the office of the said corporation on January 4, 1932. 6) The debtor, Gonzalo H. Co Toco, having defaulted in the payment of said debt at maturity, the plaintiff foreclosed said mortgage and delivered the certificates of stock and copies of the mortgage and assignment to the sheriff in order to sell the said shares at public auction. 7) The sheriff auctioned said 5,894 shares of stock on December 22, 1932, and the plaintiff having been the highest bidder for the sum of P14,390, the sheriff executed in his favor a certificate of sale of said shares. 8) The plaintiff tendered the certificates of stock standing in the name of Gonzalo H. Co Toco to the proper officers of the corporation for cancellation and demanded that they issue new certificates in the name of the plaintiff. 9) plaintiff. 10) The prayer is that a writ of mandamus be issued requiring the defendants to transfer the said 5,894 shares of stock to the plaintiff by cancelling the old certificates and issuing new ones in their stead. 11) C Defense: The said officers (the individual defendants) refused and still refuse to issue said new shares in the name of the

that the defendants refuse to cancel the said certificates standing in the name of Gonzalo H. Co Toco on the books .of the corporation and to issue new ones in the name of the plaintiff because prior to the date when the plaintiff made his demand, to wit, February 4, 1933, nine attachments had been issued and served and noted on the books of the corporation against the shares of Gonzalo H. Co Toco and the plaintiff objected to having these attachments noted on the new certificates which he demanded. 12) It will be noted that the first eight of the said writs of attachment were served on the corporation and noted on its records before the corporation received notice from the mortgagee Chua Chiu of the mortgage of said shares dated June 18, 1931. 13) No question is raised as to the validity of said mortgage or of said writs of attachment and the sole question presented for decision is whether the said mortgage takes priority over the said writs of attachment. 14) ISSUE: Did the registration of said chattel mortgage in the registry of chattel mortgages in the office of the register of deeds of Manila, under date of July 23, 1931, give constructive notice to the said attaching creditors? HELD: appellant The attaching creditors are entitled to priority over the defectively registered mortgage of the

RATIO: The property in the shares maybe deemed to be situated in the province in which the corporation has its principal office or place of business. If this province is also the province of the owner's domicile, a single registration is sufficient. If not, the chattel mortgage should be registered both at the owner's domicile and in the province where the corporation has its principal office or place of business. In this sense the property mortgaged is not the certificate but the participation and share of the owner in the assets of the corporation.

Monserrat v. Ceron (GR 37078, 27 September 1933) Facts: Petitioner, Monserrat, was president and manager of the Manila Yellow Taxicab Company Inc., and the owner of P1,200 common shares of stock of the company. He assigned the usufruct (right in a property owned by another for a limited time or until death) of half of his common shares of stock to Carlos Ceron (defendant). The assignment included the right to enjoy the profits from the shares, prohibiting Ceron from selling, mortgaging, encumbering, or exercising any act implying absolute ownership. Ceron mortgaged some of the shares of stock of Manila Yellow Taxicab, including the 600 common shares assigned to him by Monserrat to Eduardo Matute, President to Erma, Inc as payment of his debt. Matute was not informed of the document that contained Cerons rights and prohibitions with regard to the 60 0 common shares of stock from Monserrat. *Original case did not mention how the case was instituted in the CFI. The CFI Manila rendered judgment in favor of the plaintiff declaring the plaintiff the owner of the 600 shares of stock; and declaring the mortgage constituted on the ownership of the shares of stock null and void and without force and effect, although the mortgage on the usufruct enjoyed by the mortgage debtor Ceron in the said 600 shares of stock is hereby declared valid; with costs against the defendants. Erma Inc. and the Sheriff of Manila, the defendants therein, appealed from the decision. Issue & Ruling: Whether it is necessary to enter upon the books of the corporation a mortgage constituted on common shares of stock in order that such mortgage may be valid and may have force and effect as against third persons. o Section 35 of the Corporation Law provides the following: The capital stock of stock corporations shall be divided into shares for which certificates signed by the president or the vice-president, counter signed by the secretary or clerk and sealed with the seal of the corporation, shall be issued in accordance with the by-laws. Shares of stock so issued are personal property and may be transferred by delivery of the certificate indorsed by the owner or his attorney in fact or other person legally authorized to make the transfer. No transfer, however, shall be valid, except as between the parties, until the transfer is entered and noted upon the books of the corporation so as to show the names of the parties to the transaction, the date of the transfer the number of the certificate, and the number of shares transferred. o Section 35 of the Corporation Law does not require any entry except of transfers of shares of stock in order that such transfers may be valid as against third persons. o The word transfer is defined by the "Diccionario de la Academia de la Lengua Castellana" as the act and effect of transferring; and the verb as to assign or waive the right in, or absolute ownership of, a thing in favor of another, making him the owner thereof. o Section 3 of Act No. 1508, as amended by Act No. 2496, defines the phrase (chattel mortgage) as: a conditional sale of personal property as security for the payment of a debt the condition being that the sale shall be avoided upon the seller paying to the purchaser a sum of money or doing some other act named. If the condition is performed according to its terms the mortgage and sale immediately become void, and the mortgage is hereby divested of his title. o The chattel mortgage is not the transfer referred to in section 35 of Act No. 1459 commonly known as the Corporation law, which transfer should be entered and noted upon the books of a corporation in order to be valid, and which, means the absolute and unconditional conveyance of the title and ownership of a share of stock. o Inasmuch as a chattel mortgage of the aforesaid title is not a complete and absolute alienation of the dominion and ownership thereof, its entry and notation upon the books of the corporation is not necessary requisite to its validity. Whether or not the defendant entity, Erma, Inc., had knowledge of the document that states that the transfer of the 600 shares of common stocks from Monseratt to Ceron was only for the usufruct of the shares, and that Ceron bound himself not to alienate nor encumber them. o The evidence shows that when Matute went to the office of the Manila Yellow Taxicab Co., Inc., to examine the Stock and Transfer Book of the said corporation, for the purpose of ascertaining the actual status of Carlos G. Ceron's shares of stock, Matute found nothing but that the shares in question were recorded therein in the name of said Carlos G. Ceron, free from all liens and encumbrances. o The notation of liens and encumbrances was placed there only on May 5, 1931, the same date on which the 600 common shares were to have been sold at public auction, in view of Carlos G. Ceron's default in the payment of the loan secured by them. o Therefore, defendant entity Erma, Inc. as conditional purchaser of the 600 shares of stock, acquired, in good faith, Cerons right and title to the shares of stock. SC holds that: since section 35 of the Corporation Law does not require the notation upon the books of a corporation of transactions relating to its shares, except the transfer of possession and ownership thereof, as a necessary requisite to the validity of such transfer, the notation upon the aforesaid books of the corporation, of a chattel mortgage constituted on the shares of stock in question is not necessary to its validity.

Escano v Filipinas Mining Facts: The CFI of Manila ordered Salvosa to transfer and deliver to Escano 116 active shares and an undetermined number of shares in escrow of the Filipinas Mining Corp., and to pay P500 as damages. The escrow however was only to be transferred upon its release by the said Company. The sheriff garnished the shares of Salvosa in the Company, which the latter said was issued to the former. The sheriff thereafter sold the same at a public auction. There remained P490 pesos to be paid by Salvosa on the judgment award. As to the delivery and transfer of the escrow shares of Salvosa, it was contended that they could not have been the object of such transfer, as Salvosa said that the said shares were already sold to Bengzon, about a year before the judgment of

the CFI was rendered. It was also said that Bengzon thereafter sold the shares to Standard Investment. Filipinas Mining thereafter issued certificates of shares of stock to Standard Investment, despite the fact that the sales and transfers from Salvosa to Bengzon, Bengzon to Standard, were not recorded in the corporate books until 3 years after the said shares were attached by garnishment. Issue: Whether the issuance of the certificate of shares of stock by Filipinas Mining to Standard Investment was valid as against the attaching creditor of the said shares. rd Held: No. The transfer of the escrow shares could not affect 3 persons such as Escano, an attaching creditor. According rd to the Corporation Code, states that such transfer needs to be recorded in the corporate books to be effective as against 3 persons. This recording is required due to the following reasons: 1) it allows the corporation to know who the real owner of the shares is; 2) it gives the corporation a chance to object to such transfer in case of any claims it ma have on the stock to be transferred; and 3) to avoid fictitious and fraudulent transfers. There is no valid reason to treat unissued shares held in escrow differently from the issued shares insofar as their sale and transfer are concerned. In both cases, the corporation is entitled to know the actual owners of the shares and has the right to object to the transfer upon any valid ground. Also, the possibility of fictitious or fraudulent transfers exists in both cases. Thus, it would be illogical to not apply the registration requirement to transfers of unissued shares held in escrow.

Das könnte Ihnen auch gefallen

- Republic Planters Bank Vs AganaDokument2 SeitenRepublic Planters Bank Vs AganaHoven Macasinag100% (2)

- Republic Planters Bank vs. Agana Case DigestDokument12 SeitenRepublic Planters Bank vs. Agana Case DigestMichael CamacamNoch keine Bewertungen

- Cir Vs ManningDokument3 SeitenCir Vs ManningEKANG100% (1)

- 25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)Dokument11 Seiten25) Republic Planters Bank v. Agana, 269 SCRA 1 (1997)LucioJr AvergonzadoNoch keine Bewertungen

- Commissioner vs. ManningDokument2 SeitenCommissioner vs. Manningshinjha73100% (5)

- Cir Vs Manning Case DigestDokument2 SeitenCir Vs Manning Case DigestJesse Joe LagonNoch keine Bewertungen

- 172 CIR v. ManningDokument5 Seiten172 CIR v. ManningPio MathayNoch keine Bewertungen

- 129 Mackin vs. Nicollet HotelDokument3 Seiten129 Mackin vs. Nicollet HotelLoren Bea TulalianNoch keine Bewertungen

- Republic Vs Security CreditDokument8 SeitenRepublic Vs Security CreditSyElfredGNoch keine Bewertungen

- Pledge DigestDokument17 SeitenPledge DigestjNoch keine Bewertungen

- 2-Republic Planters Bank Vs AganaDokument3 Seiten2-Republic Planters Bank Vs Aganaeunice demaclidNoch keine Bewertungen

- 25 F.2d 783 (1928) MACKIN Et Al. v. NICOLLET HOTEL, Inc., Et AlDokument8 Seiten25 F.2d 783 (1928) MACKIN Et Al. v. NICOLLET HOTEL, Inc., Et AlClauds GadzzNoch keine Bewertungen

- Republic Planters Bank vs. Agana (1997)Dokument3 SeitenRepublic Planters Bank vs. Agana (1997)Maddie100% (1)

- Facts: On September 18, 1961, Private Respondent Corporation Secured A Loan From Petitioner in The AmountDokument10 SeitenFacts: On September 18, 1961, Private Respondent Corporation Secured A Loan From Petitioner in The AmountYvon BaguioNoch keine Bewertungen

- Cred Trans PinkyDokument4 SeitenCred Trans PinkyJiri Othello DinsayNoch keine Bewertungen

- Commissioner of Internal Revenue V. John L. Manning, W.D. Mcdonald, E.E. Simmons and The Court of Tax AppealsDokument3 SeitenCommissioner of Internal Revenue V. John L. Manning, W.D. Mcdonald, E.E. Simmons and The Court of Tax AppealsJorge AngNoch keine Bewertungen

- Cases in Corporation LawDokument76 SeitenCases in Corporation LawtinzkieNoch keine Bewertungen

- First Division: DecisionDokument5 SeitenFirst Division: DecisionKrisleen AbrenicaNoch keine Bewertungen

- 6 Case Republic Planters Bank Vs Agana Corporation LawDokument2 Seiten6 Case Republic Planters Bank Vs Agana Corporation LawYe Seul DvngrcNoch keine Bewertungen

- MBC Vs Teodoro FinalDokument3 SeitenMBC Vs Teodoro FinalKTNoch keine Bewertungen

- Rural Bank of Lipa City Vs CA Case DigestDokument5 SeitenRural Bank of Lipa City Vs CA Case DigestBerch Melendez100% (1)

- Mico Metals Vs CADokument27 SeitenMico Metals Vs CAEarl LarroderNoch keine Bewertungen

- GBL Cases 1-13gDokument94 SeitenGBL Cases 1-13gAyidar Luratsi NassahNoch keine Bewertungen

- Vires and Beyond The Powers of The Corporate Directors To AdoptDokument12 SeitenVires and Beyond The Powers of The Corporate Directors To AdoptHarry PeterNoch keine Bewertungen

- Vires and Beyond The Powers of The Corporate Directors To AdoptDokument3 SeitenVires and Beyond The Powers of The Corporate Directors To AdoptHarry PeterNoch keine Bewertungen

- Commr. v. Manning (06 August 1975)Dokument17 SeitenCommr. v. Manning (06 August 1975)KTNoch keine Bewertungen

- Fua Cun vs. Summers FulltextDokument3 SeitenFua Cun vs. Summers FulltextattymaryjoyordanezaNoch keine Bewertungen

- Gloucester Ice & Cold Storage Co. v. Commissioner of Internal Revenue, 298 F.2d 183, 1st Cir. (1962)Dokument4 SeitenGloucester Ice & Cold Storage Co. v. Commissioner of Internal Revenue, 298 F.2d 183, 1st Cir. (1962)Scribd Government DocsNoch keine Bewertungen

- G.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationDokument13 SeitenG.R. No. 96727 August 28, 1996 Rizal Surety & Insurance Company vs. Court of Appeals and Transocean Transport CorporationGodfrey Saint-OmerNoch keine Bewertungen

- CIR Vs Manning, GR L-28398, Aug. 6, 1975Dokument8 SeitenCIR Vs Manning, GR L-28398, Aug. 6, 1975Dario G. TorresNoch keine Bewertungen

- Fua Cun v. SummersDokument4 SeitenFua Cun v. SummersGale BabieraNoch keine Bewertungen

- Corpo 2 J.R.S. Business Corp. vs. Imperial Insurance, Inc., 11 SCRA 634, No. L-19891 July 31, 1964Dokument9 SeitenCorpo 2 J.R.S. Business Corp. vs. Imperial Insurance, Inc., 11 SCRA 634, No. L-19891 July 31, 1964Claudia LapazNoch keine Bewertungen

- JRS V Imperial InsuranceDokument5 SeitenJRS V Imperial InsuranceYoo Si JinNoch keine Bewertungen

- Petitioner Vs VS: Third DivisionDokument10 SeitenPetitioner Vs VS: Third DivisionJillandroNoch keine Bewertungen

- 5 Lee Chua Siok Suy Vs CADokument17 Seiten5 Lee Chua Siok Suy Vs CAcertiorari19Noch keine Bewertungen

- 072&091-Republic Planters Bank vs. Agana 269 Scra 1Dokument5 Seiten072&091-Republic Planters Bank vs. Agana 269 Scra 1wewNoch keine Bewertungen

- PDF 6 Case Republic Planters Bank Vs Agana Corporation LawDokument2 SeitenPDF 6 Case Republic Planters Bank Vs Agana Corporation LawPatatas SayoteNoch keine Bewertungen

- Tax - Gross IncomeDokument5 SeitenTax - Gross IncomeCamille Benjamin RemorozaNoch keine Bewertungen

- J.R.S. Business Corp. v. Imperial InsuranceDokument5 SeitenJ.R.S. Business Corp. v. Imperial Insurancesensya na pogi langNoch keine Bewertungen

- Violation of Banking LawDokument10 SeitenViolation of Banking LawGlenn S. GarciaNoch keine Bewertungen

- Case-Digests - CorpoDokument5 SeitenCase-Digests - Corpolaw.school20240000Noch keine Bewertungen

- Narra Nickel Mining Vs RedmontDokument7 SeitenNarra Nickel Mining Vs RedmontEj TuringanNoch keine Bewertungen

- GR 51765 Rep Planters Bank Vs Enrique AganaDokument4 SeitenGR 51765 Rep Planters Bank Vs Enrique AganaNesrene Emy LlenoNoch keine Bewertungen

- Corpo Case CompendiumDokument423 SeitenCorpo Case CompendiumCorinthNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument6 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- United States v. Lester Genser and Lawrence Forman, 582 F.2d 292, 3rd Cir. (1978)Dokument28 SeitenUnited States v. Lester Genser and Lawrence Forman, 582 F.2d 292, 3rd Cir. (1978)Scribd Government DocsNoch keine Bewertungen

- Petitioner, Present:: Coastal Pacific Trading, Inc.Dokument38 SeitenPetitioner, Present:: Coastal Pacific Trading, Inc.NFNLNoch keine Bewertungen

- Korbly v. Springfield Institution For Sav., 245 U.S. 330 (1917)Dokument6 SeitenKorbly v. Springfield Institution For Sav., 245 U.S. 330 (1917)Scribd Government DocsNoch keine Bewertungen

- Jones v. SEC, 4th Cir. (1997)Dokument20 SeitenJones v. SEC, 4th Cir. (1997)Scribd Government DocsNoch keine Bewertungen

- First American National Bank v. Fidelity & Deposit Company of Maryland, 5 F.3d 982, 1st Cir. (1993)Dokument6 SeitenFirst American National Bank v. Fidelity & Deposit Company of Maryland, 5 F.3d 982, 1st Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals Third CircuitDokument11 SeitenUnited States Court of Appeals Third CircuitScribd Government DocsNoch keine Bewertungen

- 8commissioner V Manning - Capitalization, Treasury SharesDokument2 Seiten8commissioner V Manning - Capitalization, Treasury SharesIanNoch keine Bewertungen

- Lee VS CaDokument3 SeitenLee VS CaReggie LlantoNoch keine Bewertungen

- Republic Planters Bank v. Agana, 269 SCRA 1Dokument6 SeitenRepublic Planters Bank v. Agana, 269 SCRA 1Danica Godornes100% (1)

- Commissioner Vs Manning Case DigestDokument2 SeitenCommissioner Vs Manning Case DigestEKANGNoch keine Bewertungen

- REPUBLIC PLANTERS BANK Vs HON. AGANADokument2 SeitenREPUBLIC PLANTERS BANK Vs HON. AGANAJoannaNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument17 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- 122253-2006-Coastal Pacific Trading Inc. v. Southern20180406-1159-Jglc63Dokument18 Seiten122253-2006-Coastal Pacific Trading Inc. v. Southern20180406-1159-Jglc63Christian VillarNoch keine Bewertungen

- In The Matter of The Trimble Company, A Corporation. William J. McMinn Samuel A. Robinson, Joseph A. Warren, JR., and R. J. Mitchell, Creditors, 339 F.2d 838, 3rd Cir. (1964)Dokument9 SeitenIn The Matter of The Trimble Company, A Corporation. William J. McMinn Samuel A. Robinson, Joseph A. Warren, JR., and R. J. Mitchell, Creditors, 339 F.2d 838, 3rd Cir. (1964)Scribd Government DocsNoch keine Bewertungen

- COUNTER-AFFIDAVIT (Karen Joy Henderin)Dokument4 SeitenCOUNTER-AFFIDAVIT (Karen Joy Henderin)Emer MartinNoch keine Bewertungen

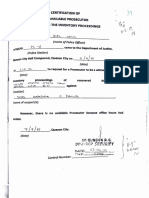

- Certification of No Available Doj RepresentativeDokument1 SeiteCertification of No Available Doj RepresentativeEmer MartinNoch keine Bewertungen

- COUNTER-AFFIDAVIT (Andres Apo)Dokument2 SeitenCOUNTER-AFFIDAVIT (Andres Apo)Emer MartinNoch keine Bewertungen

- Court Report PDFDokument5 SeitenCourt Report PDFAinnabila RosdiNoch keine Bewertungen

- Corpo 3Dokument93 SeitenCorpo 3Emer MartinNoch keine Bewertungen

- Steps For Driver's License Renewal, Just Make Sure You Bring Your Old Driver'sDokument1 SeiteSteps For Driver's License Renewal, Just Make Sure You Bring Your Old Driver'sEmer MartinNoch keine Bewertungen

- 19 SCRA 962 - Business Organization - Corporation Law - Piercing The Veil of Corporate Fiction - Fraud CaseDokument2 Seiten19 SCRA 962 - Business Organization - Corporation Law - Piercing The Veil of Corporate Fiction - Fraud CaseEmer MartinNoch keine Bewertungen

- Rednotes Legal FormsDokument26 SeitenRednotes Legal FormsEmer MartinNoch keine Bewertungen

- Pale Canon 14-22Dokument24 SeitenPale Canon 14-22Emer MartinNoch keine Bewertungen

- Kho VS CaDokument2 SeitenKho VS CaEmer MartinNoch keine Bewertungen

- Section 14Dokument5 SeitenSection 14Emer MartinNoch keine Bewertungen

- Sample Memorandum of AgreementDokument4 SeitenSample Memorandum of AgreementEmer Martin100% (1)

- Fractional ProgrammingDokument53 SeitenFractional Programmingjc224Noch keine Bewertungen

- SEC VAL AssignmentDokument2 SeitenSEC VAL Assignmentharsh7mmNoch keine Bewertungen

- Example Business Plan For MicrofinanceDokument38 SeitenExample Business Plan For MicrofinanceRh2223db83% (12)

- Bcel 2019Q1Dokument1 SeiteBcel 2019Q1Dương NguyễnNoch keine Bewertungen

- General Insurance UwDokument90 SeitenGeneral Insurance UwsushantducatiNoch keine Bewertungen

- July 15, 2015Dokument12 SeitenJuly 15, 2015The Delphos HeraldNoch keine Bewertungen

- Cash Flows and Accrual Accounting in Predicting Future Cash FlowsDokument210 SeitenCash Flows and Accrual Accounting in Predicting Future Cash Flows129935Noch keine Bewertungen

- Session 5-3: Thailand Case Study by Kraiyos PatrawartDokument30 SeitenSession 5-3: Thailand Case Study by Kraiyos PatrawartADBI Events100% (1)

- Impairment of Assets by The ICAIDokument59 SeitenImpairment of Assets by The ICAIHeena KhandelwalNoch keine Bewertungen

- Cash Flow Analysis 1Dokument61 SeitenCash Flow Analysis 1Chhaya ThakorNoch keine Bewertungen

- Chapter 5Dokument17 SeitenChapter 5Sarah AzoreNoch keine Bewertungen

- AshokaDokument16 SeitenAshokaManjesh KumarNoch keine Bewertungen

- Analysis of Askari Bank Organization StructureDokument12 SeitenAnalysis of Askari Bank Organization StructureUser100% (2)

- Resume - Jagriti Kalia 1Dokument2 SeitenResume - Jagriti Kalia 1Anurag SinghNoch keine Bewertungen

- 2130 Ds Machinery HealthAnaDokument14 Seiten2130 Ds Machinery HealthAnajose rubenNoch keine Bewertungen

- 1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Dokument12 Seiten1) SEBI Issue of Capital and Disclosure Requirements (ICDR) Regulations 2009Shasha GuptaNoch keine Bewertungen

- 2021 Catalonia BioRegion ReportDokument40 Seiten2021 Catalonia BioRegion ReportDaniel FusterNoch keine Bewertungen

- ECT Readers GuideDokument85 SeitenECT Readers GuideMaame Akua Adu BoaheneNoch keine Bewertungen

- Argentina StandaloneDokument3 SeitenArgentina StandaloneBAE NegociosNoch keine Bewertungen

- FS250 EN Col95 FV LTRDokument318 SeitenFS250 EN Col95 FV LTRロドリゲスマルセロNoch keine Bewertungen

- Chapter 14 - PERFORMANCE MEASUREMENT, BALANCED SCORECARDS, AND PERFORMANCE REWARDSDokument20 SeitenChapter 14 - PERFORMANCE MEASUREMENT, BALANCED SCORECARDS, AND PERFORMANCE REWARDSGRACE ANN BERGONIONoch keine Bewertungen

- Derivatives and Risk ManagementDokument17 SeitenDerivatives and Risk ManagementDeepak guptaNoch keine Bewertungen

- Allied Bank App FormDokument2 SeitenAllied Bank App FormChristian LarkinNoch keine Bewertungen

- Discount Rate or Hurdle Rate Module 7 (Class 24)Dokument18 SeitenDiscount Rate or Hurdle Rate Module 7 (Class 24)Vineet Agarwal100% (1)

- 226-Article Text-601-1-10-20210702Dokument12 Seiten226-Article Text-601-1-10-20210702Leni NopriyantiNoch keine Bewertungen

- Indraprastha Gas Limited - SWOT AnalysisDokument27 SeitenIndraprastha Gas Limited - SWOT Analysissujaysarkar850% (1)

- 2019.Q4 Goehring & Rozencwajg Market Commentary PDFDokument24 Seiten2019.Q4 Goehring & Rozencwajg Market Commentary PDFv0idinspaceNoch keine Bewertungen

- Techniques of ControlDokument18 SeitenTechniques of ControlAyush GoelNoch keine Bewertungen

- Q & A - Test 1 Acc106 - 114Dokument8 SeitenQ & A - Test 1 Acc106 - 114Jamilah EdwardNoch keine Bewertungen

- CEO List LahoreDokument2 SeitenCEO List Lahorehelping handNoch keine Bewertungen