Beruflich Dokumente

Kultur Dokumente

Lydian Data Services Overview

Hochgeladen von

Patrick AdamsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lydian Data Services Overview

Hochgeladen von

Patrick AdamsCopyright:

Verfügbare Formate

D SE T SRCI R C ITPLT Y I VPER IM VE AM TO E RA AN ND D UCM ONFIDEN TIAL

SUMMARY OF BUSINESS PLAN FEBRUARY 2008

CONFIDENTIAL

Disclaimer

The sole purpose of this document is to assist the recipient in performing due diligence and deciding whether to proceed with a business agreement with LDS. Use of this document is governed by the terms of the previously executed Confidentiality Agreement, which strictly limits the use, circulation and copying of the information embodied herein. Any person in possession of this Document should familiarize himself with such Agreement before reading, circulating or using the Document. This Document may not be distributed, reproduced, or used without the express consent of LDS or for any purpose other than the evaluation of LDS by the person to whom this Document has been delivered or as otherwise provided in the Confidentiality Agreement.

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

Table of contents

1. 2. 3. Executive summary ........................................................................ 3 Business highlights LDS positioned for rapid growth ............................... 5 Industry segment overview ............................................................... 7

Industry environment Outsourced mortgage processing market overview Mortgage BPO market evolution 7 12 13

4.

Business overview .........................................................................16

Customers Mortgage processing platform overview Mortgage process outsourcing services Imaging services Business connectivity services Licensed software products 16 17 19 22 23 24

5. 6.

Business model overview ................................................................25 Technology platform ......................................................................27

Technology overview 27

7.

Management, employees, and facilities ...............................................35

Facilities and infrastructure 38

8. 9.

Competitive Differentiation .............................................................40 Financial Highlights .......................................................................41

Cash and Total Assets Shareholder Information Revenue 41 41 42

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

1. Executive summary

Lydian Data Services (LDS), headquartered in Boca Raton, Florida, was founded in August, 2000, and is a subsidiary of Lydian Trust Company (LTC), a privately-owned, diversified financial services company. LDS provides Business Process Outsourcing (BPO), seamless business connectivity, and transaction management solutions to mortgage originators, secondary market conduits and investors. LDS has the flexibility and proven track record to service a wide range of clients from top global financial institutions to smaller, niche players. LDS offers stand-alone or end-to-end loan processing services that streamline and safeguard the mortgage process. LDS provides a complete outsourcing package that includes LDSs personnel, business processes technology systems and industry partners. By choosing to outsource a full business process rather than just the labor component, the client frees itself from the burden and expense of developing industry-leading business processes and installing, maintaining and upgrading complex technology systems and interfaces. Attractive industry dynamics The U.S. mortgage industry is one of the largest and most robust financial markets in the world, with $14 trillion of debt outstanding as of 2Q 2007, driven by sound consumer demand over the short to long term. Financial institutions view the sector as fundamental, both from an offering and asset composition (low risk-weighted asset) standpoint. With decreasing home price appreciation and resulting credit quality issues, stable to decreasing interest rates, and capital market disruptions, all lenders have been affected. Industry players need to assess how they can profitably have a presence in mortgages in the context of this crisis, along with historical industry challenges including inherent inefficiencies, declining profit margins, fraud, and regulatory risk. Outsourcing the mortgage origination process to a leading provider, such as LDS, can address these issues by streamlining the exchange of information, improving controls, and reducing unit costs by more than 50%. Once the mortgage market stabilizes and originators look to expand their operations, outsourcing will be a much more appealing option than rebuilding staff and infrastructure internally. The mortgage BPO market offers a wide range of services that can span the entire life-cycle of a mortgage, from origination to account servicing and collections. Unique business model Many of LDSs competitors address only a piece of the mortgage value chain and typically offer labor-intensive solutions rather than a technology-centric approach. LDS has developed a highly efficient process and powerful technology platform that enable lenders to collaborate quickly and efficiently with all parties in a mortgage transaction, whether dealing with data or documentation services. LDSs BPO services and technologies increase automation and reduce risk and cycle time from when a loan is originated through to when it is boarded to servicing or sold in the secondary market. LDSs services address all stages of the mortgage value chain through both turn-key solutions as well as highly customized products and services. Turn-key fulfillment solutions are standardized products that leverage the entire range of LDSs services, including the use of both standard best practice processes and LDSs staff, on a common technology platform. LDSs custom solutions are designed to provide a high level of flexibility and seamless integration with clients existing mortgage business. Comprehensive and differentiated product set LDS offers four primary services to its clients:

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

Mortgage process outsourcing services: LDSs processing solutions offer financial services companies the ability to outsource retail and wholesale origination and correspondent acquisition fulfillment functions, from receipt of an application to servicing transfer. LDS also offers bulk loan acquisition and quality control auditing services that provide a quality certified standard review for closed loans for investors purchasing loan pools or for lenders who need to fulfill investor audit requirements. Imaging services: LDSs imaging solutions offer mortgage lenders, aggregators, and investors the ability to recognize automatically and digitize thousands of mortgage forms as well as to change characteristics of imaged loans such as stacking order, data format, and document grouping, and then automatically deliver virtual loan files to a specified destination. Business connectivity services: Business connectivity services is a new product suite that allows clients to assemble loosely coupled mortgage processing services from a variety of third-party vendors as well as from LDS BPO offerings. As the first offering in this product suite, InvestorExpress extracts data from the lender's loan origination system, transforms documents into an investor's preferred electronic loan delivery format, and securely transmits the information to one or more investors. Licensed software products: LDS packages, licenses and markets its technology as the Mortgage Connectivity Hub (MCH). The MCH provides system integration, automates processes across disparate applications, and enables real-time user access and reporting of enterprise data. It is the only mortgage industry specific software solution available that equips companies with a standards-based infrastructure solution that is designed as a service-oriented architecture (SOA) and that uses pre-built integration adapters for over 100 commercial off-the-shelf applications.

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

2. Business highlights LDS positioned for rapid growth

Large and untapped market opportunity The mortgage industry is massive, fragmented, and poised for long-term growth. $14 trillion of mortgage debt was outstanding as of 2Q 2007. There are a broad range of participants, from brokers and mortgage originators to aggregators who provide loans to wholesale lenders or secondary market investors. Financial institutions have adopted outsourcing in other segments of their businesses, but mortgage fulfillment still remains in-house for many firms. Accelerated adoption is expected in the near future as the lender cost structure is not well-suited for high operating leverage. Only 12% of financial institutions outsource their mortgage processing operations yet approximately 50% express interest in doing so. Mortgage fulfillment is expected to be the fastest growing financial services BPO segment. As major originators consolidate operations and accumulate market share, smaller companies increase outsourcing activities to stay competitive. Consolidation of the mortgage industry is expected to be similar to the activity seen in the credit card industry in the mid-1990s. However the sheer size and complexity of the mortgage market will provide significantly more opportunities for fully integrated BPOs. Market dislocation enhances LDSs positioning As mortgage originations contract, banks suffer incremental loss of profitability if they are unable to increase scale and/or cut costs. 2006 average profit per loan has decreased to $(50) from $1,272 in 2003. LDS offers up to a 66% reduction in unit costs and enables clients the flexibility of adjusting to reductions in origination volume. When the mortgage market stabilizes, it will be faster and less costly to outsource incremental volume than to rebuild internal capabilities. Mortgage lenders are subject to increased oversight by regulators and heightened demands for accountability by investors. Mortgage fraud costs exceeded $5 billion in 2006 and Suspicious Activity Reports have increased 2,052% between 1996 and 2006. Moodys has announced that it will look for additional third-party diligence over loans provided to originators and it will expect detailed reporting methods, including loanlevel information disclosure for investors. High fixed cost and volatile revenue structure of a mortgage processor is not suitable for a mortgage bank with high regulatory constraints and financial leverage. Quarterly single family origination volumes have ranged from a high of $3.8 trillion in 2003 to a projected $2.3 trillion 2007, a decrease of 40%.

SUMMARY

Beyond outsourcing labor alone to outsourcing the combination of labor, process and technology LDS is at the forefront of the industry as a fully integrated BPO that can provide a total outsourced solution, enabling clients to outsource a full business process rather than just the labor component, freeing themselves from the burden of developing business processes and the expense installing, maintaining and upgrading unique complex technology systems and interfaces. LDS has the scale and breadth to be able to meet successfully the dynamic demands of an industry with continually shifting participants, systems, and regulations.

BUSINESS

PLAN

CONFIDENTIAL

Flexibility to meet the needs of a diverse client base LDS offers outsourced end-to-end mortgage fulfillment services or individual -la-carte services. LDSs services are flexible, allowing clients to start with a standardized implementation and then to customize and expand their integration with LDS systems and processes as their outsourcing strategy becomes increasingly sophisticated. LDS does not have the one-sizefits-all approach of many of its competitors, allowing it to eliminate a barrier to signing new clients. LDSs outsourced private label offerings seamlessly and discreetly integrate with systems and branding to minimize the impact on the end user of the transition to an outsourced solution. Scalable and repeatable process The LDS processes, built on defined best practices, is open, adaptable and easily integrated with a clients current systems, which reduces manual exception handling and inefficiencies associated with paper loan files. LDSs turn-key solutions can bring a client to market up to five times quicker than its competitors, often within 30 days versus competitors who can take up to six months or a year. LDS can scale efficiently as volumes fluctuate due to its ability to digitize and manipulate loan files and manage transactions with a robust workflow. LDS imaging technology can recognize thousands of documents and auto-classify the more than 70 most relevant document classes. LDS positioned to harness strong network effects By providing the backbone to a highly fragmented mortgage fulfillment industry, LDS can increase its value as it increases integration with market participants and third-party vendors. As LDS enables additional dynamic web services and connects additional clients onto the Lydian Exchange Network (the Network), it can derive revenue from both sides of processing transactions; third-party vendors pay to participate and clients pay for loan processing. LDS is at the forefront of industry change by designing and implementing best practices fulfillment processes at a time lenders are searching for risk reduction LDSs best practices were designed based on LDSs significant experience in closed loan due diligence and quality assurance and a deep understanding of the typical issues in the loan process that have ultimately created losses for lenders and investors

SUMMARY

LDSs best practices have been designed to mitigate risk, ensure process efficiency and loan quality and provide seamless connectivity and collaboration to all parties in the loan transaction. Lydians best practices fulfillment solution feature a host of leading industry business partners that are seamlessly integrated into the platform that cover a range of mortgage services including settlement services, point of sale technology, automated underwriting, loan documentation, compliance, fraud, mortgage insurance and loan servicers and investors

BUSINESS

PLAN

CONFIDENTIAL

3. Industry segment overview

Industry environment

The U.S. mortgage industry is one of the largest and most robust financial markets in the world, with $14 trillion of debt outstanding as of 2Q 20071, driven by sound consumer demand over the short to long term. Financial institutions view the sector as key, both from an offering and asset composition (low risk-weighted asset) standpoint. The current drop in mortgage originations (Exhibit 3.1) has exacerbated longstanding challenges in the mortgage industry. Lenders and investors are re-examining traditional business models around originating and investing in mortgages and embracing new opportunities such as Business Process Outsourcing (BPO) to increase efficiency and profitability and lower risk in one of the largest fixed income markets.

Exhibit 3.1 Quarterly single family originations vs. quarterly conforming 30-year fixed mortgage rates

1,200 1,100 1,000 Originations ($bn) 900 800 700 600 500 400 'Q1 'Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 5.00 6.00 6.50 Mortgage rate (%) Single family originations 30-year mortgage rate 7.00 7.50

5.50

2002

2003

2004

2005

2006

2007

Source: Mortgage Bankers Association, November 15, 2007 (origination and interest rate estimates for Q4 2007 MBA forecasts), Federal Home Loan and Mortgage Corporation

Complex and inefficient mortgage process Firms have long struggled with the complexity of the mortgage value chain, one of the most fragmented, expensive, and least automated processes in the financial services industry. The mortgage origination process has significant inefficiencies and potential for errors, including: Multiple parties and points of entry: Loan applications or closed loans can be submitted from a number of different sources, from a highly fragmented universe of brokers submitting loans on a wholesale basis to mortgage originators and aggregators who in turn provide closed loans on a loan by loan basis or in bulk pools to secondary market investors. Numerous and unique loan program types: There are hundreds of increasingly complex origination programs and product types that feed the origination process. Furthermore, lenders are continuously adjusting their products, updating guidelines and changing pricing attributes to be more competitive and to better control risk.

BUSINESS

PLAN

SUMMARY

Estimated mortgage debt outstanding as of Q2 2007 (Federal Reserve Bulletin, September, 2007).

CONFIDENTIAL

Paper loan file sharing: Each participant in the origination process needs access to loan file data, but many documents only exist in paper format. The process of transferring physical loan files among participants increases cost and lowers efficiency significantly. Additionally, when loans are marketed and sold in the secondary market, investors require access to loan data to perform analyses and due diligence. In many cases, information contained in different parts of the loan file is not consistent. This lack of data integrity significantly slows investors ability to close mortgage investments and increases the transaction risk associated with poor data and document quality. Distribution to, and use of, third-party services: Multiple third-party services, such as title verification, appraisal, and flood insurance, are required to fully underwrite a loan. Non-electronic data exchange by each of these parties creates the potential for delays, the risk of personal information being lost, and costly errors in transcription. Extensive document types required for closing: Due to the wide variety of loan programs and products offered, more then 100 different document types may be required to close a loan, ranging from underwriting and federal or legal disclosure documents to materials submitted by third-parties such as insurers and appraisal vendors. Attempts to standardize and automate the process have been hindered historically as many vendors, counterparties and states often use different versions of the same document type. Automating the process successfully requires an imaging system to recognize automatically thousands of distinct documents. Complex and changing regulatory environment The origination and acquisition of mortgage loans has always been subject a complex scheme of federal, state and local regulation. At each step of the process from application through servicing loans must be monitored continually to ensure that they are in line with disparate, complex and multi-jurisdictional laws and regulations that govern the industry. Many states and even local governments have unique regulatory requirements that need to be enforced and monitored in an evolving regulatory environment. The ability to identify up-to-date compliance requirements is important and reduces the risk of additional loan complications and resulting litigation. Compounding this already complex regulatory environment are the increased calls for regulators to respond to perceived predatory practices of certain lenders and growing defaults in various sectors of the mortgage market through passing new legislation that could affect how mortgages are originated and sold to investors, including: The House of Representatives has passed the Mortgage Reform and Anti-Predatory Lending Act, which establishes a national licensing and registration system for mortgage lenders, bans lenders from steering borrowers to loans that contain predatory characteristics or that the borrow cannot reasonably repay. It makes banks that securitize mortgages liable for violating lending laws. Sen. Chris Dodd, Chairman of the Senate Banking Committee, has declared that he will introduce a parallel bill in the Senate. Senator Barack Obama, a leading Democratic presidential candidate, recently proposed the Stop Fraud Act, which would provide a federal definition of mortgage fraud. In addition, it would create criminal penalties and increase law enforcement funding. Rating agencies have been widely criticized recently for their role in perpetuating creditquality issues in the mortgage market. All of the agencies have received subpoenas from various state Attorneys General regarding anti-competitive behavior, and the SEC has launched an investigation into how firms evaluated sub-prime Mortgage-Backed Securities (MBS) transactions. In addition, a new law may be introduced by Senate Banking

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

Committee Chairman and presidential candidate Christopher Dodd that will attempt to alleviate perceived conflicts of interest in the rating agency business model In November 2007, New York State Attorney General Andrew Cuomo sued First American Financial Corp. and its eAppraiseIT unit on charges of colluding with Washington Mutual to inflate artificially the values of homes to justify higher mortgages. As a part of its investigation, Attorney General Cuomo issued subpoenas to Fannie Mae and the Federal Home Loan Mortgage Corporation (Freddie Mac) requesting information on loans bought from various banks, including Washington Mutual. In addition to the federal initiatives, new state laws are expected to give the state regulators increased discretion over determining violation, as well as instituting increased licensing and disclosure requirements. Many states are passing new laws that increase the scope of predatory lending regulation, which primarily focuses on fees, to include suitability standards and underwriting guidelines. Due to the ambiguity surrounding these new regulatory initiatives and the sprawling regulatory landscape, lenders struggle to ensure compliance. The increase in bankruptcy filings by lenders has caused deep-pocketed investors, as assignees, to become potentially substitute targets for class action plaintiffs. Currently, there is no law requiring borrowers to attest to their respective mortgages suitability, resulting in no documentation to eliminate or limit liability. Instead, lenders and investors typically discover if a loan is unsuitable only when they are subject to legal action. Declining profit margins The mortgage industry has generally been slow to react to changes in market conditions. With increased competition over recent years, lenders accepted lower income per loan but attempted to maintain overall earnings growth by increasing volumes through tighter pricing and more lenient underwriting. Profitability of loan origination decreased every year between 2004 and 2006 as firms failed to successfully match declining revenues with high, fixed personnel and infrastructure costs. According to the Mortgage Bankers Association (MBA), the net loan production financial income was $1,272 per loan in 2003 but fell to a loss of ($50) per loan in 2006. The industry sought to cut costs significantly in 2007, but these reductions are unlikely to be significant enough to reverse this trend in margin compression.

BUSINESS

PLAN

SUMMARY

CONFIDENTIAL

Exhibit 3.2 Net loan financial income and cost to originate ($ / loan)

1,500 1,000 500 0 2002 -500 -1,000 (1,000) -1,500 (1,485) -2,000 (2,049) -2,500 (2,479) -3,000 (739) 2003 2004 2005 1,102 1,272 Net loan production financial income 657 258 (50) 2006 Cost to originate

Source: 2007 Mortgage Bankers Association Annual Cost Study (2006 data)

As margins tightened, most firms did not invest in improving their operationally efficiency, instead opting to maximize short-term results. This high-volume, low-margin strategy started to unravel once volumes began to fall significantly in 2006 and 2007. Most originators are now faced with both high fixed and variable costs and are increasingly seeking solutions such as BPO to lower expenses. Increasing costs of fraud Over the same period that profit margins have declined, the costs associated with mortgage fraud have increased dramatically. Losses attributed to mortgage fraud have been estimated to reach $4.2 billion for 2006. This figure does not take into account an additional estimated $1.2 billion spent on fraud prevention tools.2 Fraud has been increasing steadily over time due to a relatively lax oversight environment and enticingly lucrative returns, especially in areas with high home appreciation rates. In a 2006 report assembled by the United States Treasury, Suspicious Activity Reports (SARs) related to mortgage fraud increased 2,052% between 1996 and 2006 (Exhibit 3.3).3 This trend is also echoed by the 2006 FBI Mortgage Fraud Report which concludes that fraud has increased due to market pressures to increase the volume and velocity of origination as well as the greater prevalence of non-traditional loans.

PLAN

SUMMARY

BUSINESS

The Prieston Group, 2006 Data, February 16, 2007 and April 2, 2007. United States Treasury, Financial Crimes Enforcement Network, Mortgage Loan Fraud: An industry assessment based upon Suspicious Activity Report analysis, November 2006.

10

CONFIDENTIAL

Exhibit 3.3 Mortgage loan fraud reporting trend (number of SARs)

30,000 25,989 25,000 28,372

20,000

18,391

15,000 9,539 5,387

10,000 4,696

5,000 1,318 0 1996 1997 1,720

2,269

2,934

3,515

1998

1999

2000

2001

2002

2003

2004

2005

2006

Source: United States Treasury (2006 data estimated)

BasePoint Analytics, a fraud analytics company, analyzed more than 3 million loans and found that between 30 and 70 percent of early payment defaults (EPDs) are linked to significant misrepresentations in the original loan applications.4 According to the Federal National Mortgage Association (Fannie Mae), over 90% of misrepresentations fall into three areas: credit (39%), property (31%) and income (23%).5 This is further supported by Moodys analysis of defaults in its 2006 sub-prime portfolio, which concluded that stated documentation was one of the largest predictors of default. Lenders are discovering that their existing business processes and legacy technology systems are not designed to deal with the current volume or the variety and complexity of assets that they are required to assess for possible fraud. In addition, market pressures to decrease costs and accelerate the mortgage origination process make it increasingly difficult for lenders and investors to conduct the due diligence necessary to prevent fraud, especially in a business process that is frequently paper-based and labor intensive. Secondary market challenges The recent credit turmoil has prompted concern from investors, oversight authorities, and regulators about current origination and securitization processes. Lenient lending practices and misrepresentations by various parties in the origination process have contributed to unexpectedly high delinquency levels. Moodys, as one of the principal rating agencies that rates the quality of these assets, has recently called for reform in the industry and is currently soliciting feedback on its recommendations, including:6 Enhanced third-party reviews Moody's will now look for additional third-party oversight that reviews the accuracy of the information provided by borrowers, appraisers and brokers to originators.

PLAN

SUMMARY

BasePoint White Paper, New Early Payment Default-Links to Fraud and Impact on Mortgage Lenders and Investment Banks, p. 2, 2007. Federal National Mortgage Association, Fannie Mae Mortgage Fraud Update, September, 2007. Moody's Proposes Enhancements to Non-Prime RMBS Securitization, September 25, 2007.

BUSINESS

5 6

11

CONFIDENTIAL

Enhanced representations and warranties Originators should provide more uniform representations and warranties that the loan information provided to investors is accurate and that the loans included in the transaction were appropriate for the borrowers. Enhanced reporting Moody's recommends that loan level information both prior to closing and throughout the life of the transaction be provided to all transaction participants requesting it. Changes in the secondary mortgage market such as the recommendations put forward by Moodys will create substantial new burdens on lenders and investors. These changes will lead to higher costs for third-party oversight, increased liabilities for data accuracy representation, and additional infrastructure needs for providing loan level information to all transaction participants. In light of these new demands, lenders and investors are seeking solutions such as BPO as a means to audit larger loan samples, or the complete loan pool, and provide a means to obtain and share loan data.

Outsourced mortgage processing market overview

In this challenging operational and financial environment, market participants will increasingly turn to BPOs for outsourcing all or part of the mortgage origination and acquisition process. Mortgage originators have reacted to the reduction in market volumes and rising costs by seeking ways to maintain profitability. Many in the industry realize cost reductions by reducing staffing levels and forcing productivity gains, as was recently demonstrated by major players such as Countrywide Financial, National City, Bear Stearns, Lehman Brothers and Morgan Stanley. This removes one of the traditional objections to outsourcing, the tangible and intangible costs associated with terminating employees. Once the mortgage market stabilizes and originators look to expand their operations, outsourcing will be a much more appealing option than rebuilding staff and infrastructure internally. In a survey of over 100 financial institutions, 50% were reported to be considering outsourcing mortgage processing whereas only 12% currently outsource at least a portion of this process (Exhibit 3.4).

Exhibit 3.4 Mortgage outsourcing is well-positioned for growth

55% outsourcing business function % of respondents considering

Mortgage processing Procurement CRM Finance & accounting Human resources

50%

45%

SUMMARY

40%

Card services

Check processing

35% 10% 12% 14% 16% 18% 20% 22% 24%

PLAN

Currently outsourc e this proc ess

Source: Datamonitor report, January 2007

BUSINESS

The acceptance of mortgage processing outsourcing is expected to be accelerated by the success that the financial services industry has experienced in other segments, such as card and check processing. In recent decades, consolidation in industries that benefit from scale

12

CONFIDENTIAL

has driven demand for outsourcing as smaller players attempt to compete with ever larger rivals. Parallels can be drawn between the credit card industry in the mid 1990s and the mortgage market today. By the end of 2006, outsourcing in the card services segment was over 60% higher than in the mortgage industry but based on the current dislocations in the mortgage market a similar adoption pattern is expected by the mortgage industry. Given these economic drivers, mortgage processing is expected to account for a third of the $1.7 billion in BPO revenue growth between 2006 and 2008 (Exhibit 3.5).

Exhibit 3.5 Financial services business process outsourcing services ($mm) Service Card issuing services Check processing Horizontal processes Mortgage processing Total 2005A $4,210 2,650 4,550 2,600 $14,010 2006A $4,440 2,700 4,810 2,730 $14,680 2007E $4,690 2,710 5,080 2,990 $15,470 2008E $4,960 2,710 5,380 3,290 $16,340 06 08 growth $520 10 570 560 $1,660 CAGR 5.6% 0.1% 5.8% 8.2% 5.3%

Source: Datamonitor report, January 2007

LDS is well positioned to capture increasing demand though a comprehensive suite of products, systems and services that directly address the issues that their clients face by increasing profitability, accuracy, and transparency of their mortgage-related processes.

Mortgage BPO market evolution

Lenders require scale and financial flexibility to be competitive It is expected that the winners in the marketplace will seek to minimize fixed costs and capital expenditures associated with building, operating, and maintaining a mortgage processing platform. Instead, these costs will be shifted to fully integrated BPOs who can aggregate volumes to build enough scale to make the required platform and employee development investments worthwhile. Additionally, in light of recent market gyrations, it is expected that lenders will see clearly the virtues of reducing operating leverage. A BPO with operating leverage but with scale in mortgage processing will be better equipped to handle the volatility of the mortgage market than a lender that already employs significant financial leverage and must meet continued regulatory and liquidity requirements to remain a going concern. Beyond outsourcing just labor to outsourcing labor, process and technology

SUMMARY

A lenders initial foray into outsourcing is often based on a strategy to reduce labor costs. The lender will engage a BPO to provide personnel who will duplicate the lenders existing business process and process work using the lenders existing technology systems. But labor cost is only one component of a successful outsourcing strategy. And many lenders find that while they can reduce labor costs through outsourcing, they are still burdened with the high costs associated with inefficient processes and complex, legacy technology systems. As a result, more lenders and investors are turning to fully integrated BPOs, such as LDS, which can provide not just outsourced labor but a total outsourced solution including business processes, technology systems and the management of key vendor partners. By choosing to outsource a full business process rather than just the labor component, the client frees itself

BUSINESS

PLAN

13

CONFIDENTIAL

from the constant expense and burden of developing industry leading business processes and installing, maintaining and upgrading complex technology systems and interfaces. The need for fully integrated BPO providers is especially important in the mortgage industry, where higher scrutiny, regulatory complexity, increasing fraud risk, competition, and volatile volumes demand decreased time to market, increased flexibility, improved controls, and financial adaptability. As the mortgage industry continues to evolve, the number of counterparties, third-party software packages and third-party services will continue to grow. Furthermore, the increase in regulatory fragmentation will add to the demands placed on the providers in this industry. With this increased complexity, very few market participants, with exception to the most technology-savvy lenders, will be able to successfully meet the demands of the industry and reach the scale required to compete in the mortgage lending business. Centralized technology platforms can reduce inefficiencies created by industry fragmentation and complexity Most mortgages must be processed by a highly fragmented and complex mortgage industry, which requires seamless and secure connections between applicants, brokers, investors and a myriad of third-party providers. A comprehensive and seamlessly integrated data and document hub solution that extracts and validates loan data in a standard format that links counterparties with disparate third-party software packages is the most efficient means to address industry fragmentation and complexity inherent in the origination process. Historically, lenders built systems in silos and integrated them on a point-to-point basis. Whereas quick short-term gains can be achieved with this integration methodology, in the long-term it is unsustainable given the complexity of the marketplace. Each system involved in the origination process requires an exponentially increasing number of connectors as the number of other systems with which it must communicate increases (2 x 2(N-1) connectors need to be built for N systems). The exorbitant cost of maintaining these types of systems will drive firms to substitute the associated labor-intensive processes for incremental capital expenditure spending on necessary and advanced technologies. In contrast to point-to-point integration, an enterprise service and data hub approach can extract data from paper-based or proprietary electronic formats and convert them to a common format that can be validated and shared with other systems. This design is far more scalable, flexible, and less costly since only one connector needs to be built and maintained for each data format to convert to a common format rather than requiring a connector for every combination of formats.

BUSINESS

PLAN

SUMMARY

14

CONFIDENTIAL

Exhibit 3.6 Service-oriented integrated data and document hub

Point-to-Point connections Simple to develop, but expensive to maintain and an exponential problem as 2 x 2(N-1) connections for N systems becomes prohibitively complex Enterprise Service & Data Hub approach Choreography of connections and processes across the Enterprise and allows leveraging of integrated Web Services

Service-oriented hubbed architecture

Source: LDS

The upfront costs and expertise required to build a data hub system in-house are higher than a point-to-point solution and can be prohibitively expensive for many lenders. LDS, however, has developed a common-language system that lenders can seamlessly implement to create a hub for their networks and inter-party communications. Alternatively, a lender can deploy its existing system in conjunction with LDSs BPO and transaction management services to enable seamless collaboration between the existing systems and distribution channels to LDSs services through the industry award-winning integrated data and document hub. Clients can leverage LDSs services and technology at a fraction of the cost that they would need to invest to develop, implement and maintain a comparable system in-house.

BUSINESS

PLAN

SUMMARY

15

CONFIDENTIAL

4. Business overview

LDS, headquartered in Boca Raton, Florida, began operations in August 2000 as a division of Lydian Private Bank. Following its rapid growth, LDS was organized as a separate subsidiary of LTC, a diversified financial services company, in January 2001. LDS is an industry leading provider of BPO, transaction management and seamless business connectivity solutions to the mortgage originators, secondary market conduits and investors. LDSs clients improve their existing operations efficiency and effectiveness by outsourcing, either fully or partially, their mortgage fulfillment processing and review functions using LDSs innovative solutions. In February 2006, LDS acquired WellFound Decade Corporation, an enterprise software provider with over 14 years of experience developing and deploying large-scale infrastructure for data integration, business processes and portals for the mortgage industry, and re-branded that business as Lydian Technology Group. By leveraging the tools and resources of LTG, LDS is able to integrate its products and services at various levels of its clients value chain and continually update the technology of its products.

Customers

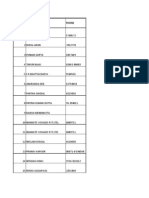

The scalability and efficiency of LDSs products and its position across clients mortgage processing value chain has allowed it to develop a client base that includes firms of various sizes, from major investment houses, including Deutsche Bank, HSBC, and Goldman Sachs, to smaller depositories and financial services firms, including Bayview Financial, Sovereign Bank, Union Bank of California, and Alaska USA Federal Credit Union. The breadth of LDSs product offerings within the mortgage value chain allows for LDS both to anticipate and meet its current clients needs as well as to grow its client base. LDS currently has 70 clients across its product range. Exhibit 4.1 below shows a list of selected clients.

Exhibit 4.1 Selected clients of LDS

BUSINESS

PLAN

SUMMARY

Source: Company

16

CONFIDENTIAL

LDS has been featured extensively in various national trade publications. This helps LDS both to expand its sales reach to new clients as well as to describe generally the types of advantages available to clients through BPO and advanced business connectivity.

Publicity summary 2007 YTD Publication name # of articles 9 8 7 Mortgage Line

Source: Company

Publication name

# of articles 3 3 3

Other publications

11

Mortgage processing platform overview

LDS has developed a highly efficient set of best practices fulfillment processes and a powerful technology platform that enables lenders to collaborate quickly and efficiently with all parties in a mortgage transaction, whether dealing with data or documentation services. LDSs BPO services and technologies increase automation and reduce risk and cycle time from when a loan is originated through when it is boarded to servicing or sold in the secondary market.

Exhibit 4.2 Strategic positioning

BUSINESS

PLAN

SUMMARY

17

CONFIDENTIAL

LDSs technology allows customers to take full advantage of their existing infrastructure investments and it facilitates easy collaboration with the LDS BPO platform. In collaboration with the MCH, LDS interfaces with virtually every major commercial off-the-shelf mortgage system in the industry, including point of sale systems (POS), loan origination systems (LOS), secondary marketing systems and loan servicing systems. Using the LDS technology, all parties to a loan transaction, including borrowers, brokers, lenders, and third-party business partners, can trade document files electronically, regardless of format. In addition, LDS enables clients to connect to key third-party service providers throughout the mortgage life-cycle and to deliver closed loans electronically to secondary market conduits and investors. LDSs model is a completely open architecture so that even lenders looking to collaborate with other fulfillment providers can do so via the Lydian Exchange Network.

Exhibit 4.3 LDS business model

Clients

Originators of loans

Sellers of loans

Buyers of loans

Electronic data feed

Paper documents

Imaged files

Interface

Lydian Portal Lydian MCH

Imaging

Lydian eFX

Intelligent workflow and routing

Retail and wholesale loan origination Correspondent Loan Acquisition Services

Services

Bulk acquisition services

Mortgage Process Outsourcing Services Imaging services

Licensed Software Products

Mortgage Connectivity Hub

Business connectivity services

Investor Express

Quality control auditing services

LDSs services address all stages of the mortgage value chain through both off-the-shelf, turn-key solutions as well as highly customized products and services.

SUMMARY

Turn-key solutions Turn-key fulfillment solutions are standardized plug and play products that leverage the entire range of LDSs services, including the use of both standard best practice processes and LDSs staff, on a common technology platform. For smaller clients with inconsistent loan volumes, the turn-key product enables them to outsource the loan fulfillment process at a lower price point. For larger clients that are eager to increase production, initial use of a turn-key solution enables them to ramp up quickly their outsourced origination and fulfillment businesses while working with LDS to design a custom fulfillment solution. Custom solutions

BUSINESS

PLAN

18

CONFIDENTIAL

LDSs custom solutions are designed to provide a high level of flexibility and seamless integration into clients existing mortgage business. LDSs custom solutions can be configured to fit the clients needs while maintaining the benefits of outsourcing and standardized best practices. The customization work is funded by the client and typically takes several months to implement.

Exhibit 4.4 below illustrates how LDSs product offerings relate to each stage of the mortgage value chain as well as the typical level of integration with clients processes and internal platforms. As LDS becomes more deeply embedded in its clients enterprise, it can offer more value and becomes more difficult to replace.

Exhibit 4.4 Product offerings

Retail & wholesale origination Correspondent fulfillment loan acquisition

Mortgage value chain

Lydian Service

Bulk loan acquisition

Quality control auditing

Imaging services

InvestorExpress Business connectivity services

Mortgage Connectivity Hub Licensed software products

Service offerings

Mortgage process outsourcing services

Imaging services

Marketing Application Registration Pre-underwriting Underwriting Closing Funding Post-closing Secondary marketing Servicing transfer Servicing Recovery Typical customers

Investment banks Mortgage Banks Depositories Brokers Investment banks GSEs Investors Investment banks GSEs Aggregators Aggregators Depositories Originators Investment banks Investment banks Investment banks Aggregators Aggregators Aggregators Depositories Depositories Depositories Originators Originators Originators Investors Investors Investors Settlement Services Settlement Services Settlement Services Risk vendors Risk vendors Risk vendors Tech vendors Tech vendors Tech vendors

Level of integration with client systems & processes

Lighter shading = less integrated Darker shading = more integrated

Mortgage process outsourcing services

SUMMARY

Retail and wholesale origination LDSs fulfillment services provide financial services companies of all sizes the ability to outsource their retail, and/or wholesale origination and fulfillment functions, from preregistration to secondary market investor delivery. LDS offers a wide range of service options, from relatively standardized processing solutions using the LDS turn-key processing platform and its best practices Standard Operating Procedures, to highly customized solutions that can seamlessly integrate into a lenders infrastructure. LDSs origination fulfillment solutions includes: Collaborative loan origination portal

BUSINESS

PLAN

19

CONFIDENTIAL

LDS provides customers with configurable private-labeled loan origination websites for both direct-to-consumer retail and broker wholesale businesses. These websites are seamlessly linked to LDSs web-based mortgage fulfillment system, allowing for 24/7 access to the status of a loan in the pipeline and collaboration among transaction participants. LDSs web-based origination platform also incorporates a document viewer so that the content of loan files can be viewed in a paperless environment. Furthermore, lenders who wish to use their own loan origination technology can seamlessly connect to LDSs system, thereby leveraging LDSs existing connectivity to 3rd party vendors, warehouse lenders, investors, servicers and custodians. Integrated document imaging and virtual loan workflow LDSs processing workflow for both retail and wholesale fulfillment is completely paperless. A virtual loan folder is created at the inception of origination process and all documents are either scanned as they enter the operation or up-loaded into the electronic loan folder. Through LDSs system, users can access LDSs Mortgage Document Center (MDC), which provides access to a virtual world of document management. With a rich set of advanced features, all parties authorized for a loan transaction are able to manage document classification, upload scanned, faxed, email and pdf documents, and print documents based on their defined security access. Furthermore, LDS stores all images based on the customers requirements. Comprehensive loan origination processes The BPO services provided by LDS for retail and wholesale origination include: Pre-registration processing Registration processing Pre-approval Fraud Underwriting Processing Pre-closing Compliance Closing Funding Post closing Investor Delivery Custodial services and servicing transfer

SUMMARY

LDS can also provide many of these services on an a la carte basis. For example, a client may want to outsource registration and processing to LDS while maintaining underwriting in house. Or a client may want to maintain all functions through funding in house and outsource post closing functions to LDS, either on a stand-alone basis or using LDSs electronic loan delivery platform, InvestorExpress. Correspondent loan acquisition Correspondent loan acquisition services are designed for clients acquiring loans on a loan by loan basis, where each loan must be reviewed individually and LDS must provide a seamless outsourced solution from lock through servicing transfer. (This is in contrast to a bulk review described below, where only a re-underwrite is performed on a sample of a loan pool.)

BUSINESS

PLAN

20

CONFIDENTIAL

In all cases, LDS evaluates loans for credit, fraud, and compliance issues according to client criteria, works to resolve issues, such as missing documents or signatures, and amends loan files as necessary. During this process, clients are provided access to a website where they can view their loan pipeline, view loan details (e.g., document images, conditions, conversation logs), as well as utilize tools required for management reporting. Loan images and data are typically exchanged electronically depending on the level of integration with the client. LDS offers a wide range of service options, from relatively standardized products on the turn-key platform to highly customized solutions. The BPO services provided by LDS for correspondent loan acquisition include: Mortgage document and data management Underwriting review Fraud review Compliance review Management and clearing of conditions Issuance of trust receipt Funding / Issuance of purchase advice Data validation and final data file Investor Delivery Servicing transfer Bulk loan acquisition LDS provides bulk loan due diligence services for clients seeking to review a pool of loans, typically in connection with the clients evaluation of the loans for purchase. A bulk review normally includes LDS re-underwriting a sample of the loans (usually 10% to 25%) to ensure that such loans were originated in accordance with the sellers underwriting guidelines (both from a credit and compliance perspective). Clients also utilize LDSs bulk due diligence services to help them identify violations of representations and warranties concerning previously purchased loans so that they can put back such loans to the sellers. LDSs bulk due diligence services provided by LDS include: Cracking of preliminary bid tapes Loan file receive Data integrity review Underwriting review Appraisal review

SUMMARY

Fraud review Compliance review Reporting Quality control auditing Some federal agencies and investors, including HUD, Fannie Mae and Freddie Mac, require that 10% of all funded loans be reviewed each month; a number also require that reviews be performed by an independent third party not involved in the loan origination process. LDSs quality control auditing services are designed to evaluate procedural inadequacies with a lenders operations by reviewing all or a certain percentage of their monthly mortgage loan

BUSINESS

PLAN

21

CONFIDENTIAL

production. The goal of the service is to provide analysis and reporting to the lender that identifies issues with specific loans and procedural and systemic problems so that they may be corrected. This review also corrects and remedies issues on selected loans. LDSs quality control auditing services consists of the following services: Collateral and credit file receive Income, debt and employment review Credit review Appraisal review Closing document review Compliance & legal review Third-party re-verifications Reporting

Imaging services

The value of LDSs imaging platform is maximized in the context of mortgage processing, as LDSs loan conversion solution offers mortgage lenders, aggregators, and investors the ability to change imaged loan specifications such as stacking order, data format, and grouping. Furthermore, the flow of images from the point of origin to destination is completely automated throughout LDSs processing platform and can be customized for clients using LDSs imaging services as an application service provider. Physical loan files For paper or physical loan files, LDS is equipped to receive, prepare, scan, and enhance those physical loan files. LDSs product offering for paper loans includes: Conversion of paper files to images LDS receives paper loans and converts them into images. Initial classification & delivery Once a paper loan is converted to an electronic format, it is initially processed through the document classification system which can recognize over 3,000 distinct document formats. File destruction LDS provides file destruction services along with certificates of destruction. Electronic loan files Once LDS has converted a paper file to electronic format, or for those loan files that are provided to LDS already in an electronic format, LDS provides the following additional imaging services:

SUMMARY

Automated reception of images via EFX Imaged loans are delivered electronically to LDSs loan conversion system. Stacking order Imaged loans can be re-classified into approximately 200 document classes pertinent to the mortgage industry. Format transformation Format of the images can be changed to and from any of the following formats: TIFF, PNG, PDF, and JPG. Grouping and file naming Loan conversion system can change the grouping of images into separate files with a custom naming convention.

BUSINESS

PLAN

22

CONFIDENTIAL

Color, grey scale and black and white System allows for color, grey scale or black and white images as well as converting color images into black and white. Electronic storage Images are stored in LDSs highly available and highly scalable imaging platform. Automated delivery of images via EFX Images loans are delivered automatically from LDSs loan conversion system either back to the sender or to a pre-defined destination in the recipients preferred format. In addition, loans can be routed to LDS to provide add-on services such as data validation, appraisal review, or re-underwriting of the loan prior to delivery to the final destination(s).

Business connectivity services

InvestorExpress InvestorExpress enables mortgage sellers to submit electronically mortgage loan data and documents to potential investors, which drastically reduces funding and post-closing times and costs for both parties. InvestorExpress allows sellers to optimize the management of their warehouse lines and to achieve greater profitability by reducing negative warehouse interest expense and by increasing business capacity and operational efficiencies. Specifically, loans advertised on InvestorExpress are typically purchased within days of closing rather than the usual cycle time of two to four weeks. Sellers that use InvestorExpress can reduce the amount of internal secondary marketing and post closing personnel normally required for shipping and post closing functions. This innovative, packaged solution leverages components of LDSs MCH by providing sellers with the ability to use their existing LOS to show investors their selection of loans. MCH provides for the seamless extraction of all necessary data from the LOS and other data sources, if applicable, and then securely transmits the data to LDS. Prior to using InvestorExpress, sellers can request LDS to perform optional post closing and quality control services to ensure i) data quality between documents and the LOS data are comparable, ii) the loan file was properly closed, and iii) other quality control measures were conducted. Regardless, the loans can be immediately transformed into an investors electronic loan delivery format and securely transmitted. Images of the loan documents can also be shipped via InvestorExpress. InvestorExpress can electronically pair previously imaged files with the associated data file and can securely transmit them to LDS, where the image will be received, classified and transformed into the stacking order required by the Investor. Some key features of InvestorExpress include: Data extraction Extraction of data from one or more systems (usually loan origination systems) Security Secure transmission of data to LDS Pipeline view web application On-line application to help clients manage loan inventory, which includes pipeline view, loan detail view (initial findings, conditions, image view), loan and asset searches, reporting services, and ability to select loans sent to investors Multi-investor delivery Routing of data and images to one or more investors. LDS can also print and ship paper-based files to investors, if required

BUSINESS

PLAN

SUMMARY

23

CONFIDENTIAL

Licensed software products

Mortgage Connectivity Hub The MCH is the only software solution that equips companies with a ready-to-deploy, standards-based, infrastructure solution that connects numerous disparate systems in the mortgage process. With the MCH, businesses can achieve seamless communication among their own software solutions, as well as with outside service providers. This allows once costly and error-prone tasks to be completed automatically and without errors. The MCH is currently designed to work with over 100 ready-to-use adapters for the most widely used mortgage systems. These adapters are designed to improve data connectivity among systems as well as to accelerate the implementation of InvestorExpress. These adapters connect all types of third-party systems, including loan origination, servicing, point of sale, loan delivery and core banking systems, to the MCH, thus enabling each system to communicate with other connected systems and LDS (see the Technology platform section below for more details). Exhibit 4.5 shows selected fulfillment clients who also implemented the MCH.

Exhibit 4.5 Selected MCH users

BUSINESS

PLAN

SUMMARY

24

CONFIDENTIAL

5. Business model overview

LDS has developed highly efficient business processes and a powerful technology platform that increase automation and reduce risk and cycle time and risk from loan origination through secondary market sale. The technology platform also enables LDS to collaborate quickly and efficiently with all parties in a mortgage transaction. The mortgage lifecycle, from the origination of the loan to its sale on the secondary market or its absorption into a lenders own servicing portfolio, is laden with complexity and fragmentation, brought on by a myriad of disparate systems, processes and third-party vendors. LDS has built a business network model that provides seamless access to value-added services; these services compress the lifecycle of the mortgage by automating key functions, which ensures loan quality and mitigates risk throughout the process. LDSs model goes beyond the traditional vision of outsourcing, i.e., instead of simply focusing on labor outsourcing, LDS delivers full end-to-end BPO solutions comprising people, process and platform with seamless connectivity to key parties. LDSs business model and day-to-day operational decisions are guided by its corporate vision and mission statements: Vision Statement: Become the primary business connectivity and fulfillment solutions provider for the mortgage industry by providing innovative solutions that change the way mortgage transactions are priced, processed and delivered. Mission Statement: Increase the efficiency and effectiveness of the mortgage market by consistently providing quality transaction processing and information management solutions to originators, aggregators and secondary market investors. This will be accomplished through a strong sales and service culture, leading domain expertise, innovative technology and the ability to connect seamlessly key participants in the mortgage market. LDS delivers value beyond the traditional outsourcing relationship through its strong foundation in business process and advanced technology, including: Developing an automated technology that serves as key middleware for communication between a lenders internal systems and LDS. MCHs software installed at the lenders location enables seamless collaboration with a lenders existing information systems. Library of over 100 integration adapters requires limited set-up time and enables connectivity with virtually every major commercial off-the-shelf mortgage lending application, including point-of-sale, loan origination, product and pricing, secondary marketing and servicing systems. LDS technology removes the integration challenge as a major barrier in the outsourcing paradigm.

SUMMARY

Providing real-time business collaboration through a powerful centralized communication hub. Seamless communication between a lenders systems and LDSs applications enables realtime collaboration with LDSs services. LDS enables connectivity to automated third-party settlement services including those that provide analysis of compliance, fraud, identity and income verification. LDS delivers loan data and documents electronically in the native formats required by key secondary market investors, including Fannie Mae and Freddie Mac, which improves funding

BUSINESS

PLAN

25

CONFIDENTIAL

times, reduces negative warehouse interest expense and increases business capacity and operational efficiency. LDS delivers loans electronically to the lenders servicing platform, whether in-house or externally, thus improving borrower satisfaction and eliminating the cost and risk of manual loan boarding efforts. Setting the industry standard for automated best practices within the business process to ensure sophistication, mitigating risk to lenders of all sizes, and giving greater confidence to secondary market investors. Implementation of best practices creates a standard business process that moves key verifications and audits traditionally done on the back-end of the process to the front-end, which results in the elimination of post-closing expenditures and assures secondary market investors of loan quality. Compliance checks throughout the origination process ensure that loans maintain at least the minimum standard set by the client, even as key elements of the loan are modified throughout the process. Automated fraud detection and identity verification through connectivity with key partners greatly reduces the risk of loss by preventing mortgage fraud and by assessing risk on every transaction. Electronic connectivity to Fannie Mae and Freddie Mac provides efficient and streamlined access to automated underwriting processes for conforming loans. Automated program and product eligibility test and expert underwriting sophistication both in technology and dedicated personnel for all types of loan products, including conforming, Alt-A, Alt-B and subprime products. Converting physical loan files to digital format to ensure greater economies, efficiency and collaboration between all parties. Expert imaging, automatic document classification and data extraction technologies ensure greater efficiency by eliminating paper documentation and the manual steps that slow down processing and reduce data integrity. Automatic classification and data extraction enable data to be taken from documents and compared with data from clients and LDSs systems, automating the processing, quality control and post closing processes. Proprietary enterprise document viewer, which allows for collaboration among lenders, investors and third-party providers, increases efficiency by enhancing communication and tracking all activity associated with a loan file.

BUSINESS

PLAN

SUMMARY

26

CONFIDENTIAL

6. Technology platform

Technology overview

LDS has implemented industry-leading technologies and standards throughout its technology and service platform. The combination of innovative technologies, industry best practices, and sound operating controls has enabled LDS to build a technology platform with the industries only truly integrated document and data hub that seamlessly interconnects best-in-breed transaction processing applications. These applications handle every function of LDSs BPO and transaction management platform, including mortgage web portals, document imaging, imaging classification and data extraction, retail, wholesale, and correspondent fulfillment, and closed loan due diligence and quality control audits.

Exhibit 6.1 Technology platform

SUMMARY

Clients who use the MCH can take full advantage of their existing investments in technological infrastructure can easily collaborate with LDSs BPO services. The seamless interaction with LDS allows clients to process loans more efficiently and to reduce cycle time; it also eliminates many of the typical frictions associated with business process outsourcing such as shipping paper documents that need to be re-entered into processing systems. The MCH interfaces with virtually every major commercial off-the-shelf mortgage system in the industry, including point of sale systems, loan origination systems, secondary marketing systems and loan servicing systems. LDS enables all parties that are active in a loan transaction, including borrowers, brokers, lenders, and third-party business partners, to trade document files electronically, regardless of format.

BUSINESS

PLAN

LDSs suite of mortgage processing and transaction management applications includes:

27

CONFIDENTIAL

Electronic File Exchange (EFX) EFX is an integrated solution for the delivery, receipt, and pass-through processing of image files in and out of LDS. In addition to being able to accept and process inbound images and their associated metadata, EFX delivers loan data, images and associated metadata in any output method (client-defined format, channel, protocol). EFX handles non-image files in addition to exchanging image files between LDS and its business partners. Mortgage Website System (MWS) MWS is a web portal that gives clients and their customers the ability to upload data tapes, edit loan data and conditions, perform lock and lock maintenance, manage closed loan pipelines and take action on re-pricing scenarios securely. This application is integrated with the Mortgage Document Center so that users can view imaged loan files. In a custom fulfillment solution, the web portal would typically be private labeled to the clients specifications.

BUSINESS

PLAN

SUMMARY

28

CONFIDENTIAL

Mortgage Document Center (MDC) MDC is a solution for managing, analyzing, and distributing large volumes of imaged loan files. MDC allows users to navigate virtual loan files with a user-friendly interface and allows clients and their customers to review the same file simultaneously. Users can move documents and pages from one document class to another as well as create files in other formats, such as Adobe PDF, and reorder pages.

BUSINESS

PLAN

SUMMARY

29

CONFIDENTIAL

Mortgage Processing System (MPS) MPS is a workflow-oriented system that supports a range of retail and wholesale loan origination and correspondent/flow loan acquisition fulfillment activities and manages virtual loan files through the Mortgage Document Center. Additionally, MPS is integrated with a broad array of third-party providers. By leveraging LDSs connectivity to these providers and integration with MDS, MPS provides an end-to-end mortgage processing platform that handles loans from origination through closed loan review and document delivery.

BUSINESS

PLAN

SUMMARY

30

CONFIDENTIAL

Mortgage Due Diligence and Quality Control System (MDS) MDS is a workflow-oriented system that supports closed loan due diligence and quality control audits. MDS can be deployed on-site at an originators facility or it can be seamlessly connected to LDSs internal network where it can access virtual loan files, using the MDC, as well as access a suite of third-party vendors such as Interthinks, Hanson, Core Logic and Lexus Nexus.

BUSINESS

PLAN

SUMMARY

31

CONFIDENTIAL

Mortgage Compliance System (MCS) MCS is a workflow-oriented system that supports the automated review of federal, state and local mortgage compliance regulations, including: State and local high cost and predatory Issues arising out of borrowers rights to lending laws rescind Federal Truth-in-Lending Act (including Real Estate Settlement Procedures Act Section 32/HOEPA) (RESPA) Annual Percentage Rate and finance Closing documents disclosures charge disclosure

BUSINESS

PLAN

SUMMARY

32

CONFIDENTIAL

Lydian Universal Rules Engine (LURE) LURE is LDSs expert business rules engine which serves as a key component in the automation of various processes and system functionality. LURE enables LDS to automate key decision-making tasks in business processes where the typical logic is too complex and/or volatile to be included in the application logic or external workflow technology. Examples of these tasks include regulatory compliance, mortgage product pricing and eligibility rules. LURE provides users with the ability to manage changes in their business environments by introducing new rules or modifying existing rules through a set of configurable maintenance screens.

Mortgage Connectivity Hub The MCH is the first and only SOA-based integration platform built on the formal and defacto standards of the mortgage industry, including MISMO, FNMA DO/DU, and FHMC LP. A service-oriented architecture is ideally suited for implementing the future-proof IT architecture, as it is an enabler for just-in-time integration and interoperability of legacy applications. At the core of the MCH is a single object model that uses MISMO data standards as the common language for system integration, process automation, business rule enforcement, user application development, enterprise reporting, and business connectivity. This single object model is represented consistently with normalized XML data, SQL tables, and Java business objects, which allow application developers, system integrators, database administrators, business analysts, and web designers across the company to leverage the other MCH components for a future-proof architecture. Users of the MCH have reduced the effort and costs associated with integrating disparate systems by up to 80%. New clients can significantly jump start their projects by leveraging the MCHs library of pre-built integration adapters and modifying them to meet their needs.

BUSINESS

PLAN

SUMMARY

33

CONFIDENTIAL

Whether utilized internally within LDSs technology platform or licensed to clients as a stand alone business connectivity solution, the MCH equips companies with a cost-effective, service-oriented architecture with pre-built integration adapters to hundreds of financial services applications. It allows companies to leverage best-of-breed technologies by making it easy to add, update or remove applications without system-wide repercussions.

BUSINESS

PLAN

SUMMARY

34

CONFIDENTIAL

7. Management, employees, and facilities

Management team LDS is led by a best-in-class management team with over 125 years of collective experience in the financial services industry. Exhibit 7.1 provides more detail on the LDS management team.

Exhibit 7.1 Management team Name William M. Decker Stephen C. Wilhoit Corey M. Davis Brian Fitzpatrick Peter Stewart Clayton Greenfield Greg Bergman Don Turner Jeffrey T. Osheka Position Chief Executive Officer President Executive Vice President, Sales President, Lydian Technology Group EVP, Product Management and Marketing Sr. Vice President, Finance Executive Vice President of Operations Executive Vice President of Technology Senior Vice President of Technology, Chief Technology Officer, Chief Security Officer Senior Vice President of Technology Sales and Business Development, Lydian Technology Group Years of industry experience 22 21 17 18 13 15 18 15 21

William M. Decker 561-630-2211 Chief Executive Officer Mr. Decker is a Co-Founder of Lydian Trust Company and the Founder of Lydian Data Services. He has 22 years experience in the financial services industry with experience managing all aspects of a regulated financial institution. Prior to Co-Founding Lydian Data Services, Mr. Decker served as Chairman, President and Chief Executive Officer of Enterprise National Bank of Palm Beach, and held senior positions in fixed income portfolio management, fixed income and derivative trading strategies with regional banks including Barnett Bank and Wachovia. Mr. Decker is a graduate of the University of Denver and is a Chartered Financial Analyst. Stephen C. Wilhoit 561-630-2169 President Mr. Wilhoit is a Co-Founder of Lydian Trust Company and serves as President of Lydian Data Services. Mr. Wilhoit has over 21 years of experience in the financial services industry including expertise in the operations, finance, legal, and regulatory areas of depository institutions. Prior to co-founding Lydian Trust Company, he held executive management positions with Ocwen Financial Corporation. Mr. Wilhoit is a graduate of the University of Virginia with a Bachelor of Science Degree in Chemical Engineering and Wake Forest University School of Law. Corey M. Davis 561-237-4770 Executive Vice President of Sales Mr. Davis is responsible for directing the sales efforts for the company. He has over 17 years of sales management experience in the mortgage industry that includes senior positions at Fidelity National Financial where he managed the national sales efforts for the real estate and mortgage group. Mr. Davis was also the Director of Field Sales with MGIC, and a Regional Sales

BUSINESS

PLAN

SUMMARY

35

CONFIDENTIAL

Manager with North American Mortgage Company. Mr. Davis is a graduate of the University of Maryland with a Bachelor of Science degree in Business Management. Brian Fitzpatrick 904-208-6212 President of Lydian Technology Group & EVP Product Management and Marketing Mr. Fitzpatrick is President of LTG and responsible for all aspects of its day-to-day operations. Additionally, Mr. Fitzpatrick is responsible for the company's product direction, product marketing and corporate communications. He brings 18 years experience in the financial services and mortgage banking industries that includes senior positions at GHR Systems and Electronic Data Systems Corporation (EDS). Mr. Fitzpatrick has been a speaker for numerous mortgage industry panels and conferences and has authored articles and white papers for a variety of mortgage and related financial services trade publications. Peter Stewart 561-237-3905 Senior Vice President of Finance Mr. Stewart is responsible for all finance, accounting, and control functions for the company and has over 13 years of financial management experience in the business process outsourcing industry that includes management positions at Automatic Data Processing and its PEO subsidiary, ADP TotalSource. He is a graduate of the Stern School of Business at New York University and is a Certified Public Accountant. Clayton Greenfield 561-922-4567 Executive Vice President of Operations Mr. Greenfield is responsible for outsource operations for the company, including wholesale and retail origination, quality control auditing services and correspondent loan acquisition services and bulk due diligence. Mr. Greenfield has over 15 years of experience in the mortgage industry and has held positions in sales, secondary marketing, underwriting and operations, including senior positions with Delta Funding and Fidelity Mortgage. He is a graduate of State University of New York College at Oswego with a Bachelor of Science degree in Business Administration. Greg Bergman 561-922-4664 Executive Vice President of Technology Mr. Bergman is responsible for directing technology operations and future architectural design platforms for the company. He brings over 18 years of information technology and software design experience in the banking, financial, and mortgage industry, and has held positions at Blockbuster and Digital Software Services. While the CIO of VirtualBank, he was instrumental in building the technology infrastructure for the banking and mortgage platforms, as well as developing the Internet banking system. In his current role, he is responsible for aligning business strategies with software development and architecture to support the goals of the company.

SUMMARY

Don Turner 561-237-3914 Senior Vice President of Technology, Chief Technology Officer, Chief Security Officer Mr. Turner is responsible for directing Technology Advancement and Operations for the company, including Product Delivery and Professional Services, Software Development, Software Quality Assurance, Corporate Security, and Operating Controls Compliance (SAS-70, GLBA). He has over 15 years of professional experience that includes management positions in the Financial Services, Healthcare/Pharmaceutical, and Government Services/Intelligence industries. Mr. Turner served as a member of the Technical Advisory Board for Cisco Systems and was the Technology Committee Co-Chairman for the Massachusetts Biotechnology Council. He attended Worcester Polytechnic Institute, where he pursued undergraduate degrees in Thermal Physics and Mathematics.

BUSINESS

PLAN

36

CONFIDENTIAL