Beruflich Dokumente

Kultur Dokumente

2012 CPBI Form 2 Eqst

Hochgeladen von

Jojo Aboyme CorcillesOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2012 CPBI Form 2 Eqst

Hochgeladen von

Jojo Aboyme CorcillesCopyright:

Verfügbare Formate

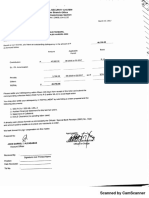

NATIONAL STATISTICS OFFICE

CPBI Form 2 NSCB Approval No. NSO-1223-02 Expires 24 January 2014

2012 CENSUS OF PHILIPPINE BUSINESS AND INDUSTRY

MINING AND QUARRYING MANUFACTURING

January December 2012

<<

type in this area the information printed on the address stub found on the cover of your CPBI questionnaire >>

Dear Sir/Madam: The National Statistics Office (NSO) is conducting the 2012 Census of Philippine Business and Industry (CPBI). The 2012 CPBI will provide key measures on the performance, structure and trends of businesses and industries that will be used for planning and policy formulation by the government and private sectors. This office is authorized to collect information from businesses and industries under the Commonwealth Act 591 (CA 591). The information collected shall be kept strictly confidential and shall not be used for purposes of taxation, investigation or regulation under Section 4 of CA 591. We appreciate your utmost cooperation by accomplishing this questionnaire and providing NSO with a copy of the 2012 Financial Statement of your establishment. You may also download the e-questionnaire or accomplish the questionnaire online with the web-based questionnaire at NSO website (http://www.census.gov.ph/itsd).

Thank you very much.

1

For inquiries, contact:

Telephone Number:

CARMELITA N. ERICTA Administrator

e-Mail Address:

or cpbi@census.gov.ph

FOR NSO USE ONLY FN IND QN QR PROV-MUN ECN BGY SZ LO EO

Page 2

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

GENERAL INSTRUCTIONS

Provide best estimates if exact figures are not available in your records. Indicate N.A. for items not applicable. Refer to the relevant explanatory notes and definitions provided in specific items when providing responses for each item. Include only Philippine-based activities, including imports and exports, of this establishment. Mark ( ) only one box, unless instructed otherwise.

GENERAL INFORMATION ABOUT THIS ESTABLISHMENT 1. Business and Registered Name in 2012, Company Website and Tax Identification Number (TIN)

A. Business Name: B. Registered Name: C. Business Address: D. Company Website: E. TIN:

2. Economic Activity or Business in 2012

Describe in detail the main and other activities of this establishment.

LN NO

A. Main Activity (Refers to the activity that contributes the

biggest or major portion of the gross income or revenue of this establishment.)

Do Not Fill (For NSO Use Only) 2009 PSIC

01

A.1. Major products/goods produced or sold or type of service rendered

Specify:

02

B. Secondary/Other Activities (Refer to activities carried

out by this establishment in addition to the main activity and in which the output, like that of the main activity, must be suitable for delivery outside this establishment.)

Do Not Fill (For NSO Use Only) 2009 PSIC

03

3. Year Started Operation

Indicate the year when this establishment started operation regardless of location in the Philippines.

4. Legal Organization in 2012

Mark ( ) the box corresponding to the best description of this establishment.

1 2 3 4

Single Proprietorship Partnership Government Corporation Stock Corporation

5 6 7

Non-stock, Non-profit Corporation Cooperative Others, specify:____________________

Continued on Page 3

Page 3

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

GENERAL INFORMATION ABOUT THIS ESTABLISHMENT (cont.) 5. Economic Organization in 2012

Mark ( ) the box corresponding to the best description of this establishment.

1 2 3

Single Establishment Branch only

Provide details of Main Office below

Establishment and main office

(both located in the same address and with branches elsewhere) Provide details of branches in Item 21

4 5

Main Office only

Provide details of branches in Item 21

Single Establishment is an establishment which has neither branch nor main office. It may have ancillary unit/s other than main office, located elsewhere. Branch is an establishment which has a separate main office located elsewhere. Main office is the unit which controls, supervises and directs one or more establishments of an enterprise. Ancillary unit is the unit that operates primarily or exclusively for a related establishment or group of related establishments or its parent establishment and provides services that supports those establishments.

Ancillary unit other than Main Office

Provide details of Main Office below

A. Registered Name of Main Office

_________________________________________________ _________________________________________________

Do Not Fill (For NSO Use Only) ECN

B. Address of Main Office

_________________________________________________ _________________________________________________

PROV MUN BGY

C. Contact Person in Main Office

(1) Name _________________________________ (2) Title/Designation ________________________ (3) Tel. No. _______________________________ (4) (5) Fax No.________________________ E-mail_________________________

6. Capital Participation as of December 31, 2012

Indicate the percent share of the stockholders by nationality.

Capital participation refers to the claims of foreign and/or local investors against capital/equity.

1 Filipino

______%

5 Chinese 6 German 7 Japanese 8 Korean

______% ______% ______% ______%

9 Malaysian 10 Singaporean 11 Taiwanese

______% ______% ______%

2 American ______% 3 Australian ______% 4 British ______%

12 Others, specify: ______________ ______%

Continued on Page 4

Page 4

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

EMPLOYMENT 7. Employment as of November 15, 2012

Paid employees are all full-time and part-time employees working in or for the establishment and receiving regular pay, as well as those working away from this establishment and paid by and under the control of this establishment.

INCLUDE:

Employees on sick or maternity leave Employees on paid vacation or holiday Employees on strike Directors of corporations working for pay Executives/managers and other officers of the same category Working owners receiving regular pay Apprentices and learners receiving regular pay Workers receiving compensation on sharing basis Persons hired only during peak seasons like planting, harvesting, and the like Any other employee receiving regular pay not reported above

EXCLUDE:

Directors paid solely for their attendance at meetings of Board of Directors Consultants Workers on indefinite leave Working owners who do not receive regular pay Homeworkers Workers receiving commissions only

Unpaid workers are working owners who do not receive regular pay, apprentices and learners without regular pay, and persons working for at least 1/3 of the working time normal to this establishment without regular pay. EXCLUDE:

Silent or inactive business partners

Type of Employment a. Paid Employees b. Unpaid Workers c. Total

(sum of a and b)

Male

(1)

Female

(2)

Total

(3)

LN NO 01 02 03

RESEARCH AND DEVELOPMENT (R&D) PERSONNEL 8. R&D Personnel as of November 15, 2012

Research and Development (R&D) refers to creative work undertaken as a systematic basis in order to increase the stock of knowledge, including knowledge of man, culture and society, and the use of this stock of knowledge to devise new applications. R&D personnel are all persons employed directly on R&D as well as those providing direct services such as R&D managers, administrators and clerical staff. R&D personnel are classified into three categories: researchers, technicians and auxiliary personnel.

Male

(1)

Female

(2)

Total

(3)

LN NO 01

R&D Personnel

PRODUCTION WORKERS AND HOURS WORKED 9. Number of Production Workers as of November 15, 2012

Production workers are workers directly engaged in the production process.

INCLUDE: Working foremen EXCLUDE: Apprentices and other learners receiving regular pay/not directly engaged in production process Managers, executives, administrative and technical personnel above foremen level Accounting and personnel staff Unpaid production workers

Male

(1)

Female

(2)

Total

(3)

LN NO 01

Production Workers

Continued on Page 5

Page 5

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

PRODUCTION WORKERS AND HOURS WORKED (cont.) 10. Total Hours Worked in 2012

Number of hours worked by production workers refers to the number of hours actually spent by production workers at work for the whole year of 2012.

INCLUDE:

Waiting time and overtime

EXCLUDE:

Time spent for paid sick leave and paid vacation leave

Male

(1)

Female

(2)

Total

(3)

LN NO 01

Hours Worked

INCOME AND EXPENSE ACCOUNT 11. Income in 2012

TYPE OF INCOME VALUE IN PESOS

(Omit centavos) LN NO 01 02

a. Sale of products/by-products (sum of 1 to 4) 1. Sales to domestic market

(Sale of products/by-products of this establishment to another establishment including, producer, wholesaler and retailer, of a different enterprise.)

2. Interplant transfers

(Shipment of products produced to other domestic plants or establishments belonging to the same enterprise as this establishment. These should be valued as though sold.)

03

3. Direct exports

(Products produced and shipped directly outside the country by this establishment.)

04 05 06 07 08 09 10 11 12 13 14 15 16 17 18

4. Sales to exporters

(Sale of products/by-products locally to exporters by this establishment.)

b. Sale of goods

(Income from goods sold in the same condition as purchased.)

c. Income from industrial service done for others

(sum of 1 and 2)

1. Contract and commission work done for others

(Income from outsourcing activities done on materials owned and controlled by another establishment.)

2. Industrial repair, maintenance and installation work d. Income from non-industrial service done for others

(sum of 1 to 6)

1. Rent income from land 2. Rental income from buildings, warehouses and other structures 3. Rental income from machinery and transport equipment 4. Rental income from office equipment 5. Other rental income, specify: ______________________ 6. Other non-industrial service done for others (sum of a and b)

Specify:

a.) _______________________________________ b.) _______________________________________ e. Interest income

(INCLUDE: Interest on finance leases; Earnings on discounted bills; Interest from deposits in banks and other financial institutions; Interest/discounts on loans, deposits, financing, bonds, money market; etc.)

19

Continued on Page 6

Page 6

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

INCOME AND EXPENSE ACCOUNT (cont.) 11. Income in 2012

TYPE OF INCOME VALUE IN PESOS

(Omit centavos) LN NO 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34

f.

Dividend income

g. Commissions and fees earned h. Royalty income

(Income received for trademarks, patents or secrecy and concessions.)

i. j.

Franchise income

(Income received to distribute or sell a product or service.)

Delivery charges separately invoiced to customers

k. Other income (sum of 1 to 5) 1. Foreign exchange gains 2. Gain from sale of assets 3. Gain resulting from the change in the fair value of assets, inventories 4. Gain on sale of investment assets and marketable securities 5. Others (sum of a to c)

Specify:

a) _________________________________________ b) _________________________________________ c) _________________________________________ l. Total Income (sum of a to k)

VALUE IN PESOS

(Omit centavos)

12. Subsidies Received from the Government in 2012

Subsidies refer to special grants received from the government in the form of financial assistance or tax exemption or tax privilege to aid and develop an industry. INCLUDE:

Price support and price discount Interest rate subsidy Import subsidies Direct subsidies on export Subsidies resulting from multiple exchange rate Subsidies to public corporations and quasi-corporations Subsidies on products used domestically Subsidies on payroll or workforce Subsidies to reduce pollution

LN NO

01

13. Expense in 2012

TYPE OF EXPENSE VALUE IN PESOS

(Omit centavos) LN NO 01 02 03 04 05

a. Cost of products/by products sold (sum of 1 to 4 less 5) 1. Raw materials used (sum of a and b less c)

(INCLUDE: Raw materials and fuels that enter into the product.)

a) Raw materials inventories, beginning b) Raw materials purchased c) Raw materials inventories, ending

Continued on Page 7

Page 7

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

INCOME AND EXPENSE ACCOUNT (cont.) 13. Expense in 2012

TYPE OF EXPENSE VALUE IN PESOS

(Omit centavos) LN NO 06 07 08

2. Direct labor (sum of a to c) a) Gross salaries and wages and other benefits

(Refer to payments in cash or in kind prior to any deductions for employees contributions to SSS/GSIS, withholding tax, etc.)

b) Separation, retirement/terminal pay and gratuities, etc. c) Total employers contribution to SSS/GSIS, ECC, etc.

(INCLUDE: Employers contribution paid by this establishment to SSS/GSIS, Employees Compensation Commission (ECC), PhilHealth, PAG-IBIG, etc.)

09

3. Overhead Cost (sum of a to p) a) Materials and supplies

(INCLUDE: Blasting materials, containers, packing materials and other plant supplies.)

10 11 12 13 14 15 16 17 18 19 20 21 22 23

b) Fuels, lubricants, oils and greases c) Electricity d) Water e) Contract and commission work done by others f) Industrial repair, maintenance and installation work done by others g) Rent expense for land h) Rental expense for buildings, warehouses and other structures i) Rental expense for machinery and transport equipment j) Rental expense for office equipment k) Other rental expense, specify: _________________ l) Non-industrial service done by others with respect to production m) Taxes on products and other taxes on production

(sum of 1 and 2)

1) Taxes on products

(Taxes paid on products by producer or by the purchaser of the product. INCLUDE: Import tax, export tax, excise tax, value added tax, sales tax, gross receipts tax, etc.)

24

2) Other taxes on production

(Taxes paid by the producer due to production. INCLUDE: Business licenses, real estate tax, road tax, environmental tax, etc. EXCLUDE: Income tax.)

25

n) Depreciation for machineries and equipment used in production o) Amortization for intangible assets used in production p) Other overhead cost, specify: ___________________ 4. Finished products and work-in-progress inventories, beginning 5. Finished products and work-in-progress inventories, ending

Continued on Page 8

26 27 28 29 30

Page 8

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

INCOME AND EXPENSE ACCOUNT (cont.) 13. Expense in 2012

TYPE OF EXPENSE VALUE IN PESOS

(Omit centavos) LN NO 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55

forwarding, freight charges and

b. Cost of goods sold (sum of 1 and 2 less 3) 1. Goods for resale inventories, beginning 2. Goods purchased for resale

(Acquisition cost of goods purchased for resale without transformation or processing.)

3. Goods for resale inventories, ending c. Interest expense

(Interest paid for loans obtained from banks and other financial institutions.)

d. General administrative and other operating expenses

(sum of 1 to 18)

1. Indirect labor (sum of a to c) a) Gross salaries and wages and other benefits b) Separation, retirement/terminal pay and gratuities, etc. c) Total employers contribution to SSS/GSIS, ECC, etc. 2. Other materials and supplies

(INCLUDE: Office supplies, non-durable tools, working clothes and other supplies)

3. Other fuels, lubricants, oils and greases 4. Electricity 5. Water 6. Industrial service done by others (sum of a and b) a) Contract and commission work done by others b) Industrial repair, maintenance and installation work 7. Non-industrial service done by others (sum of a to i) a) Rent expense for land b) Rental expense for buildings, warehouses and other structures c) Rental expense for machinery and transport equipment d) Rental expense for office equipment e) Other rental expense, specify: ________________ f) Communication expense g) Insurance expense h) Transport service expense

(INCLUDE: Stevedoring, messengerial services fee)

56

i) Other non- industrial service done by others

(INCLUDE: Bank charges; Professional, business and other service fees; Storage and warehousing fees; Advertising and promotional expenses; Management fees; Janitorial and security services fee; etc.)

57

Continued on Page 9

Page 9

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

INCOME AND EXPENSE ACCOUNT (cont.) 13. Expense in 2012

TYPE OF EXPENSE VALUE IN PESOS

(Omit centavos) LN NO 58

patents or secrecy; and

8. Other taxes and licenses 9. Royalty fee

(Expense for trademarks, copyrights, concessions/leases of subsoil assets)

59

10. Franchise fee

(Expense made for license to make, distribute or sell a product or service)

60

11. Research and development (R&D) expense

(Amount spent on any systematic, scientific and creative work undertaken to increase the stock of knowledge and the use of this knowledge to create new or improved products, processes, services, and other applications.)

61

12. Environmental protection expense

(Amount spent for the prevention, reduction and elimination of pollution as well as any degradation of the environment such as environmental protection services like wastewater treatment, reforestation, etc.)

62

13. Other depreciation expense 14. Other amortization expense 15. Other expense (sum of a to c) a) Foreign exchange losses b) Charitable donations and grants c) Bad and doubtful debts

(Report net of bad debts recovered.)

63 64 65 66 67 68 69 70 71 72 73 74 75 76

d) Loss from sale of assets e) Loss resulting from the change in the fair value of assets, inventories f) Loss on sale of investment assets and marketable securities g) Others (sum of 1 to 3)

Specify:

1) ______________________________________ 2) ______________________________________ 3) ______________________________________ e. Total Expense (sum of a to d)

E-COMMERCE 14. Sales from e-Commerce Transactions in 2012

e-Commerce refers to the selling of products or services over electronic systems such as the Internet Protocol-based networks and other computer networks, Electronic Data Interchange (EDI) network, or other on-line system. EXCLUDE: Orders received via telephone, facsimile or e-mails

PERCENT TO TOTAL INCOME

LN NO

__________%

01

Continued on Page 10

Page 10

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

CAPITAL EXPENDITURES, SALES AND BOOK VALUE OF TANGIBLE FIXED ASSETS, INCLUDING LOSSES AND DAMAGES 15. Capital Expenditures, Sale and Book Value of Tangible Fixed Assets, including Losses and Damages in 2012

Tangible Fixed Assets refer to physical assets (tangible) acquired and for use of this establishment and expected to have a productive life of more than one year. These include land, buildings, other structures, land improvements, transport equipment, machinery and equipment, sub-soil assets and other fixed assets. EXCLUDE: INCLUDE: Tangible fixed assets received from other establishments belonging to the Financing cost same enterprise as this establishment should be valued as though purchased. Delivery charges and installation costs, taxes and other necessary fees (import duties, registration fees, etc.). Capital expenditures for tangible fixed assets refer to the full value of fixed assets acquired in 2012 whether or not full payments have been made. Sale of tangible fixed assets refers to the actual amount received/realized (not book value) from the sale of fixed assets during the year including the value of fixed assets transferred to other establishments of the same enterprise. Losses and damages refer to the decrease in the book value of tangible fixed assets due to theft, major catastrophe, and other accidental destructions. Book value refers to the initial or acquisition cost of tangible fixed assets less accumulated depreciation charges. Also include in Book Value as of December 31 the capital expenditures for the corresponding tangible fixed assets.

VALUE IN PESOS (Omit centavos) TYPE OF TANGIBLE FIXED ASSETS

CAPITAL EXPENDITURES FOR TANGIBLE FIXED ASSETS

TOTAL (1)

PERCENT

Directly Imported

SALE OF TANGIBLE FIXED ASSETS (3)

LOSSES AND DAMAGES (4)

BOOK VALUE AS OF DECEMBER 31, 2012 (5)

LN NO

(2)

a. Land b. Buildings, other structures and land improvements

(INCLUDE: Leasehold improvements, major repairs, renovations and additions.)

01

02

c. Transport equipment

(INCLUDE: Aircrafts, ships/vessels, trains, buses, cars, trucks and other transport equipment.)

03

d. Machinery and equipment

(sum of 1 and 2)

04

1. ICT machinery and equipment

(INCLUDE: Computer and peripherals, telecommunications equipment and apparatus.)

05

2. Other machinery and equipment

(INCLUDE: Power plants; Electronic machinery and equipment, other than telecommunications; and Furniture and fixtures.)

06

e. Sub-soil assets- for Mining

establishments only

(INCLUDE: Coal, oil and natural gas reserves; and metallic/non-metallic reserves.)

07

f.

Valuables

(INCLUDE: Precious stones and metals, paintings, sculptures, antiques, etc.)

08

g. Other tangible fixed assets not included above, specify:

___________________________

09

h. Total (sum of a to g)

Continued on Page 11

10

Page 11

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

CAPITAL EXPENDITURES FOR ALL TANGIBLE FIXED ASSETS BY MODE OF ACQUISITION 16. Capital Expenditures for All Tangible Fixed Assets by Mode of Acquisition in 2012

Report the full value of all tangible fixed assets acquired in 2012 by mode of acquisition. Total in this item should be equal to the Total reported in Item 15 column 1.

New tangible fixed assets refer to brand new tangible fixed assets acquired during the year, including directly/newly imported tangible fixed assets. Directly/newly imported tangible fixed assets are considered new whether or not they were used before they were imported. Major alterations and improvements on tangible fixed assets are done to increase the performance or capacity of existing tangible fixed assets or to significantly extend their expected service lives. Used tangible fixed assets refer to those that have been previously used within the country. Tangible fixed assets produced on own account refer to the physical assets produced by the establishment for its own use. It should be valued as the cost of all work put in place including overhead cost.

MODE OF ACQUISITION

VALUE IN PESOS

(Omit centavos)

LN NO 01 02 03 04 05

a. New tangible fixed assets b. Major alterations and improvements on tangible fixed assets c. Land and used tangible fixed assets d. Tangible fixed assets produced on own account e. Total (sum of a to d)

CAPITAL EXPENDITURES AND BOOK VALUE FOR INTANGIBLE ASSETS 17. Capital Expenditures for Intangible Assets in 2012

Report the full value of all intangible fixed assets acquired in 2012 and book value as of December 31, 2012.

VALUE IN PESOS (Omit centavos) TYPE OF INTANGIBLE ASSETS

CAPITAL EXPENDITURES

(1)

BOOK VALUE AS OF DECEMBER 31, 2012

(2)

LN NO

a. Intangible non-produced assets

(INCLUDE: Purchased goodwill; Patents; Trademarks; Franchises; Licenses; Processes; and Copyrights; Concessions; Leases and other transferable contract.)

01

b. Computer software and databases

(INCLUDE: Computer programs; Systems and applications software purchased; Computer software developed in-house; Computer databases purchased; and Computer databases developed in-house.)

02

c. Mineral exploration for Mining establishments only

(Expenditure incurred by the mining establishment to acquire new mineral reserve.)

03

d. Entertainment, literary and artistic originals

(INCLUDE: Original films, sound recordings, manuscripts, tapes, models, etc., on which drama performances, radio and television programming, musical performances, sporting events, literary and artistic output, etc., are recorded.)

04

e. Other intangible assets

(INCLUDE: Other produced intangible asset not included above.)

05 06

f. Total (sum of a to e)

Continued on Page 12

Page 12

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

TOTAL ASSETS 18. Total Assets as of December 31, 2012

Report the total assets of this establishment as of December 31, 2012 Total Assets are resources including land owned and/or controlled by the establishment as a result of past transactions and events from which future economic benefits are expected to flow to the enterprise.

VALUE IN PESOS

(Omit centavos)

LN NO

01

CAPACITY UTILIZATION 19. Average Capacity Utilization Rate of this Establishment in 2012

Capacity utilization is the ratio of total output to the maximum rated capacity of this establishment.

Mark ( ) the appropriate box corresponding to the capacity utilization of this establishment in 2012. 1 2 Below 50% 50% - 59% 3 4 60% - 69% 70% - 79% 5 6 80% - 89% 90% - 100%

INVENTORIES 20. Inventories in 2012

Inventories refer to stocks of goods owned by or under the control of the establishment as of a fixed date, regardless of where the stocks are located. Stocks of raw materials, fuels and supplies should be valued at current replacement cost in purchaser prices at the indicated dates. Finished products, work-in-progress and goods for resale should be valued at producer prices. Replacement Cost is the cost of an item in terms of its present price rather than its original price. Finished products refer to the value of goods manufactured by this establishment that are ready for sale/shipment. Work-in-progress refers to value of all materials which have been partially processed by the establishment but which are not usually sold or turned over to other establishments without further processing.

VALUE IN PESOS (Omit centavos) TYPE OF INVENTORIES As of January 1, 2012

(1)

As of December 31, 2012

(2)

LN NO

a. Finished products b. Work-in-progress c. Raw materials d. Other materials and supplies

(INCLUDE: Blasting materials, containers, packing materials, plant supplies, office supplies, nondurable tools and spare parts, working clothes, etc.)

01 02 03

04

e. Fuel, lubricants, oils and greases f. Goods for resale g. Others, specify: __________________ h. Total (sum of a to g)

Continued on Page 13

05 06 07 08

Page 13

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

21. Branches, Divisions, Plants Owned or Controlled (for Main Office)

List name, address and total employment as of November 15, 2012 and year started operation of branches, divisions, plants, or other establishments that this establishment owns or controls.

TOTAL YEAR EMPLOYMENT STARTED as of November 15, OPERATION 2012

NAME OF BRANCH/DIVISION/PLANT

ADDRESS

Do Not Fill (For NSO Use Only) PROV/MUN/BGY ECN (4)

(1) 1

(2)

(3)

10

Please use additional sheets, if necessary.

22. Remarks

Continued on Page 14

Page 14

PLEASE ENTER ON THE APPROPRIATE SPACE OR BOX THE DATA REQUESTED.

23. Certification

I hereby certify that this report for the period _____________ to ____________ has been completed as accurately as the records of this establishment allow and with the best estimates in some instances. Name__________________________________ Title/Designation_________________________ Signature_________________________ Date_____________________________

24. Contact Person

Person to be contacted for queries regarding this form: Name_____________________________________________________ Title/Designation _____________________________ Tel. No. ______________Fax No.____________ Address _____________________________

____________________________________________

Email Address________________________

THANK YOU FOR ACCOMPLISHING THIS FORM!

25. Processing Information: Do Not Fill (For NSO Use Only)

Activity Distributed by Collected by Name Signature

Number of items with Errors

Date / / / / / / / / /

Field Edited by / / Verified by CO /

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Rental - Terms and Conditions May2014Dokument13 SeitenRental - Terms and Conditions May2014Jojo Aboyme CorcillesNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- 001 Tacr 01 PDFDokument293 Seiten001 Tacr 01 PDFJojo Aboyme CorcillesNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- DictDokument5 SeitenDictJojo Aboyme CorcillesNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- RA - 10173-Data - Privacy - Act - of - 2012 IRR - v.072716 PDFDokument40 SeitenRA - 10173-Data - Privacy - Act - of - 2012 IRR - v.072716 PDFbioenergyNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- APECO Aerial ShotsDokument33 SeitenAPECO Aerial ShotsJojo Aboyme CorcillesNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 2017-09-20 - PC Express - Laptop and Desktop Price List PDFDokument12 Seiten2017-09-20 - PC Express - Laptop and Desktop Price List PDFJojo Aboyme CorcillesNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Dpa Irr PDFDokument49 SeitenDpa Irr PDFHelena HerreraNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Agrifish EditedDokument24 SeitenAgrifish EditedJojo Aboyme CorcillesNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- 2015-4 Romallosa (Briquetting of Biomass and Urban Waste Using A Household Briquette Molder) PDFDokument17 Seiten2015-4 Romallosa (Briquetting of Biomass and Urban Waste Using A Household Briquette Molder) PDFJojo Aboyme CorcillesNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Rosters of PAE - Need Information PDFDokument1 SeiteRosters of PAE - Need Information PDFJojo Aboyme CorcillesNoch keine Bewertungen

- 2017-10-21 - PC Express - Suggested Retail Price ListDokument2 Seiten2017-10-21 - PC Express - Suggested Retail Price ListJojo Aboyme CorcillesNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- SSS Soa For PNAI (84578) PDFDokument2 SeitenSSS Soa For PNAI (84578) PDFJojo Aboyme CorcillesNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- ENCA Organic Farming Report 2015projdoc PDFDokument1 SeiteENCA Organic Farming Report 2015projdoc PDFJojo Aboyme CorcillesNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- EY Philippines Tax Bulletin December 2015Dokument24 SeitenEY Philippines Tax Bulletin December 2015Jojo Aboyme CorcillesNoch keine Bewertungen

- Laws On Bases Conversion 040313 Final PDFDokument263 SeitenLaws On Bases Conversion 040313 Final PDFJojo Aboyme Corcilles100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- 2014TRANSCOAccomplishmentReportCorrected PDFDokument13 Seiten2014TRANSCOAccomplishmentReportCorrected PDFJojo Aboyme CorcillesNoch keine Bewertungen

- DILG Memo Circular 2012-128 - Additional Guidelines On AE Institutionalization PDFDokument7 SeitenDILG Memo Circular 2012-128 - Additional Guidelines On AE Institutionalization PDFj8m8l8Noch keine Bewertungen

- EDD.1.I.006 - Agro-Industrial Economic Zone PDFDokument1 SeiteEDD.1.I.006 - Agro-Industrial Economic Zone PDFJojo Aboyme CorcillesNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- ph04 PDFDokument38 Seitenph04 PDFJojo Aboyme CorcillesNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- K To 12 Bread and Pastry Learning ModuleDokument117 SeitenK To 12 Bread and Pastry Learning Modulegiareysie80% (90)

- Ecotourism PEZA IncentivesDokument8 SeitenEcotourism PEZA IncentivesJojo Aboyme CorcillesNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Consumer Guide SteelbarsDokument2 SeitenConsumer Guide SteelbarsJojo Aboyme CorcillesNoch keine Bewertungen

- Aggreko Temperature and Moisture Control Flyer - Global VersionDokument3 SeitenAggreko Temperature and Moisture Control Flyer - Global VersionJojo Aboyme CorcillesNoch keine Bewertungen

- PH Auto Industry Sales Report 2014Dokument15 SeitenPH Auto Industry Sales Report 2014Jojo Aboyme CorcillesNoch keine Bewertungen

- Consumer Guide CementDokument2 SeitenConsumer Guide CementJojo Aboyme CorcillesNoch keine Bewertungen

- Aggreko ChillerDokument2 SeitenAggreko ChillerJojo Aboyme CorcillesNoch keine Bewertungen

- Aggreko Containerised Power Flyer - Global VersionDokument2 SeitenAggreko Containerised Power Flyer - Global VersionJojo Aboyme CorcillesNoch keine Bewertungen

- LWT Mud Cat TraxxDokument2 SeitenLWT Mud Cat TraxxJojo Aboyme CorcillesNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Kline Booking Procedure WebsiteDokument2 SeitenKline Booking Procedure WebsiteJojo Aboyme CorcillesNoch keine Bewertungen

- Tokyo Stock ExchangeDokument13 SeitenTokyo Stock Exchangekarthik vvsNoch keine Bewertungen

- Toms Vsa PrinciplesDokument4 SeitenToms Vsa Principlesharishgarud100% (1)

- AMFI Question and AnswersDokument51 SeitenAMFI Question and AnswersDhanraj Chauhan100% (1)

- Limited Companies and MultinationalsDokument3 SeitenLimited Companies and MultinationalsKazi Rafsan NoorNoch keine Bewertungen

- 4 HR 5 EMA SystemDokument10 Seiten4 HR 5 EMA SystemBaljeet Singh100% (1)

- My Trading Plan: Volatility Trading Equity TradingDokument10 SeitenMy Trading Plan: Volatility Trading Equity Tradingdnyanesh_patil25100% (2)

- Relationships Among Inflation, Interest Rates, and Exchange RatesDokument2 SeitenRelationships Among Inflation, Interest Rates, and Exchange RatesPradip KadelNoch keine Bewertungen

- A Post Factor Analysis of Financial RatiosDokument13 SeitenA Post Factor Analysis of Financial Ratiosbanhi.guhaNoch keine Bewertungen

- Soal Chapter 18 Performance EvaluationDokument2 SeitenSoal Chapter 18 Performance EvaluationfauziyahNoch keine Bewertungen

- 9 Sebi, S M (P #1-C) : Hare Arket IllarDokument19 Seiten9 Sebi, S M (P #1-C) : Hare Arket IllarVCITYNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Dharmesh ProjectDokument92 SeitenDharmesh Projectsheeta05047335Noch keine Bewertungen

- Interest Rate FuturesDokument73 SeitenInterest Rate Futuresvijaykumar4Noch keine Bewertungen

- Reliance Equity Opportunities FundDokument1 SeiteReliance Equity Opportunities FundbhaveshlibNoch keine Bewertungen

- Sapm - 2 MarksDokument17 SeitenSapm - 2 MarksA Senthilkumar100% (3)

- LECTUREDokument12 SeitenLECTURECriszia MaeNoch keine Bewertungen

- Merrill Finch IncDokument7 SeitenMerrill Finch IncAnaRoqueniNoch keine Bewertungen

- RBADokument128 SeitenRBACa Mehal DoshiNoch keine Bewertungen

- C Project-2-2Dokument44 SeitenC Project-2-2Rajesh Kumar roulNoch keine Bewertungen

- 2013 Group Results Press Release enDokument7 Seiten2013 Group Results Press Release enronalzdinNoch keine Bewertungen

- Ashok LeylandDokument12 SeitenAshok LeylandvenkatmatsNoch keine Bewertungen

- CFA3 (2011) SS13 Alternative InvestmentsDokument5 SeitenCFA3 (2011) SS13 Alternative InvestmentsErcem ErkulNoch keine Bewertungen

- Bitcoin Intrinsic Value - Wedbush Report - December 2013Dokument7 SeitenBitcoin Intrinsic Value - Wedbush Report - December 2013igzolt100% (3)

- Sensex: How Sensex Is CalculatedDokument5 SeitenSensex: How Sensex Is CalculatedSatish K SinghNoch keine Bewertungen

- Daily Treasury Report0424 ENGDokument3 SeitenDaily Treasury Report0424 ENGBiliguudei AmarsaikhanNoch keine Bewertungen

- Ch06 P14 Build A ModelDokument6 SeitenCh06 P14 Build A ModelKhurram KhanNoch keine Bewertungen

- Study of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementDokument45 SeitenStudy of Financial Derivatives (Futures & Options) : A Project Report On Functional ManagementmaheshNoch keine Bewertungen

- The Simplest For Ex PipsDokument18 SeitenThe Simplest For Ex PipsManojkumar NairNoch keine Bewertungen

- Private Equity New Investment ProcessDokument5 SeitenPrivate Equity New Investment ProcessJack Jacinto100% (2)

- Oecd PDFDokument11 SeitenOecd PDFtanushree sNoch keine Bewertungen

- Bloomberg Confidential / Not For Distribution: Mnemonic Exchange Product In/out Current Fee Currency NotesDokument21 SeitenBloomberg Confidential / Not For Distribution: Mnemonic Exchange Product In/out Current Fee Currency Notessanjay guravNoch keine Bewertungen

- University of Chicago Press Fall 2009 Distributed TitlesVon EverandUniversity of Chicago Press Fall 2009 Distributed TitlesBewertung: 1 von 5 Sternen1/5 (1)

- University of Chicago Press Fall 2009 CatalogueVon EverandUniversity of Chicago Press Fall 2009 CatalogueBewertung: 5 von 5 Sternen5/5 (1)