Beruflich Dokumente

Kultur Dokumente

2013 Regulation Update-Text

Hochgeladen von

coolvassCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2013 Regulation Update-Text

Hochgeladen von

coolvassCopyright:

Verfügbare Formate

Becker CPA Review

Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition Date Page and Item Number Errata/Clarifications

The text shows the following at Item i: Flexible Spending Arrangements Stems (FSAS) R1-20 Item i. A Flexible Spending Arrangement Stems from a Section 125 employee flexible This text should read as follows: Flexible Spending Arrangements (FSAs) A Flexible Spending Arrangement stems from a Section 125 employee flexible

1/4/13

1/4/13

R1-20 Item i.(1)

The annual limit for employee pre-tax deposits to their flexible spending account is $2,500 for 2013. (It was $5,000 in 2012.)

Page R1-25, Item E: Payments Pursuant to a Divorce Additional Information

1/7/13

R1-25 Item E.

Additional information is provided and can be deemed Item E.4 in your textbooks.

Click here for a detailed explanation.

2/7/13

R1-62 Examples

An additional Example #5 of like-kind exchanges has been provided to show realized gain with boot paid. Place click here to view the example.

R2, page 35, Item 1, please add Item g. Adoption Credit. R2-35 Item 1 4/11/13 and R2-42 Item F.5 As of 2012, the Adoption Credit is available as a credit, but is non-refundable. (It was refundable in 2010 and 2011.) Under Item 2, g, note that the Adoption Credit is refundable for 2010 and 2011, rather than 2010 and forward. R2, page 42, Item F.5. Note the adoption credit is refundable for 2010 and 2011. For 2012, it is available but not refundable.

Becker CPA Review

Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition (b) Of course, there are exceptions to the rule, and these exceptions (notice and consent requirements) will keep the excess benefits from being included in income, if the taxpayer qualifies. The exceptions will apply if certain notice and consent requirements are met, and only if the insured is a United States citizen or resident. Further, the insured must have been: (1) and R3-22 Life Insurance Proceeds (Under Items Not Includible in "Taxable Income") (2) an employee of the policyholder during the 12-month period before the insureds death, or a director or other highly compensated employee at the time the contract was issued. Proceeds paid to a member of the insureds family, a designated beneficiary, a trust for the beneficiary, or an estate of the insured are also not included if the notice and consent requirements are met.

R3-6 Item .1.b. (2)(b)

1/7/13

In addition to annual reporting and record retention requirements, the notice and consent requirements that must be satisfied in order to make the benefits non-taxable include: (1) written notification to the employee that the company plans to insure the life of the employee, (2) disclosure to the employee of the maximum face amount of insurance, (3) written consent of the employee being insured that this policy may be continued even if the employee terminates employment, and (4) written notification to the employee of the policyholder that will be the beneficiary of the proceeds payable upon the death of the employee.

1/30/13

R3-31 Item VI.A.1.

The paragraph heading is Long-term Capital Gain Treatment. Note: The lower capital gains rates indicated here do not apply to C corporations. All capital gains of a C corporation are taxed at ordinary income rates.

Becker CPA Review

Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition As indicated in item VI.C.2, the rule for Section 1250 recapture requires only the difference between the accelerated depreciation taken on the real estate (typically those assets placed into service before 1987) and what straight-line depreciation would have been if it had been taken on the asset instead. This rule has the effect of the overall gain being taxed at 25%, as indicated in item VI.C.3. [Phase-out provisions may apply in some cases, all of which are beyond the scope of the CPA exam.] A few students have inquired of the special rules regarding Section 1250 additional recapture for corporations. While this topic has historically not been tested on the CPA exam, we are providing the information in this update to address the issue. R3-32 Item 3. Per Internal Revenue Code section 291, for corporations, in the case of section 1250 property which is disposed of during the taxable year, 20 percent of the excess (if any) of (a) the amount which would be treated as ordinary income if such property was section 1245 property, over (b) the amount treated as ordinary income under section 1250 (determined without regard to this paragraph), shall be treated as gain which is ordinary income under section 1250 and shall be recognized notwithstanding any other provision of this title. Effectively, the calculation above means that the TOTAL amount of the taxable recapture as ordinary income for a corporation subject to the provisions of Section 1250 is equal to the amount of the ordinary income under the general Section 1250 rules (see above) plus 20% of the straight-line depreciation that was not recaptured under the general rules. As always, the total depreciation recaptured is limited to the recognized gain.

1/7/13

Under heading "Included Costs": The three lines under this heading should be replaced with the following, providing a separate description for organizational expenditures and start-up costs. 2/7/13 R4-14 Item 6.b. b. Allowable organizational expenditures and include fees paid for legal services in drafting the partnership agreement, fees paid for accounting services, and fees paid for partnership filings. Start-up costs include the following costs incurred prior to the opening of the business: training costs, advertising costs, and testing costs.

IRS Tax Return Preparer Program R4-45 Item 10.d. In 2011, the IRS began requiring all tax return preparers who prepare and file tax returns for a fee to pass an exam, pay an annual fee, and complete 15 hours of continuing education each year. Attorneys, CPAs and Enrolled Agents were exempt from the new regulation. In January of 2013, a federal court overturned this ruling, and the IRS is appealing. For the time being, the tax return preparer program is no longer required. If the situation changes, we will post additional information.

1/30/13

Becker CPA Review

Regulation Course Textbook and Lecture Errata/Clarifications 2013 Exam Edition R4, page 60, Item 3. Required Disclosure of Tax Preparer 4/11/13 R4-60 Item 3 Change this section to read: The tax preparer should inform the taxpayer of the penalty risks with respect to the tax effects (tax return position) of a transaction. The courts will not uphold (sustain) the imposition of the penalty if the transaction, at a minimum, meets the more-likelythan-not standard.

Note: The tax portion of the Regulation exam focuses primarily on principles and concepts, and not on year-specific amounts, thresholds and phase-outs. New tax law is not testable until six months after the date passed by Congress. Therefore, the American Taxpayer Relief Act passed on January 1, 2013 is not testable on the CPA Exam until July 1, 2013.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Factor Affecting Digital Payment Kiran GajjarDokument12 SeitenFactor Affecting Digital Payment Kiran GajjarKRIANNoch keine Bewertungen

- Ngorongoro Conservation Area camping and entry quotesDokument40 SeitenNgorongoro Conservation Area camping and entry quotesEZEKIELNoch keine Bewertungen

- IFRS-Deferred Tax Balance Sheet ApproachDokument8 SeitenIFRS-Deferred Tax Balance Sheet ApproachJitendra JawalekarNoch keine Bewertungen

- Introduction to GST Chapter 1: Constitutional Framework and Defects in Indirect TaxesDokument5 SeitenIntroduction to GST Chapter 1: Constitutional Framework and Defects in Indirect TaxesAniket SharmaNoch keine Bewertungen

- CH 10. Money Its Functions and PropertiesDokument12 SeitenCH 10. Money Its Functions and PropertiesMr RamNoch keine Bewertungen

- DxwebDokument4 SeitenDxwebjustinagtrfde100Noch keine Bewertungen

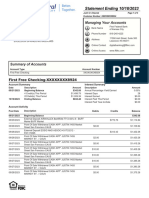

- Customer: Address:: Abudallah Ahmed Salim AididDokument1 SeiteCustomer: Address:: Abudallah Ahmed Salim AididعبداللهNoch keine Bewertungen

- Cashless Society: Presented By: Arsalan ArifDokument24 SeitenCashless Society: Presented By: Arsalan ArifArsalan ArifNoch keine Bewertungen

- Bir Ruling 103-10 - Cod and NodDokument5 SeitenBir Ruling 103-10 - Cod and NodJerwin DaveNoch keine Bewertungen

- Price US$400: Bay Beach ResortDokument2 SeitenPrice US$400: Bay Beach Resortgau shresNoch keine Bewertungen

- A YHjwmr LFL 4 CWQ YuDokument15 SeitenA YHjwmr LFL 4 CWQ YuLaba MeherNoch keine Bewertungen

- Toshiba Information EquipmentDokument2 SeitenToshiba Information EquipmentGuile Gabriel AlogNoch keine Bewertungen

- Acct Statement - XX6440 - 28032023Dokument16 SeitenAcct Statement - XX6440 - 28032023Maran PrabakaranNoch keine Bewertungen

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDokument1 SeiteSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaNoch keine Bewertungen

- AccountStatement01-10-2022 To 27-12-2022Dokument26 SeitenAccountStatement01-10-2022 To 27-12-2022Amit KumarNoch keine Bewertungen

- My File NameDokument1 SeiteMy File NameDimple QueenNoch keine Bewertungen

- Taxguru - in-TaxGuru Consultancy Amp Online Publication LLPDokument7 SeitenTaxguru - in-TaxGuru Consultancy Amp Online Publication LLPsamratsom1947Noch keine Bewertungen

- 1770 EnglishDokument6 Seiten1770 Englishhafiedzs sNoch keine Bewertungen

- Ops Amw FRM D en SalesTaxAdjustmentForm AllStatesExceptWA2013Dokument6 SeitenOps Amw FRM D en SalesTaxAdjustmentForm AllStatesExceptWA2013Ma'at MutamuntatNoch keine Bewertungen

- Akansha ChourasiaDokument1 SeiteAkansha Chourasiaakanksha skyNoch keine Bewertungen

- FirstEnergy Solutions Bruce Mansfield Unit 1 Leases Shariah Law Prepaid RentDokument27 SeitenFirstEnergy Solutions Bruce Mansfield Unit 1 Leases Shariah Law Prepaid RentTimothy ToyNoch keine Bewertungen

- Tax QuizDokument48 SeitenTax QuizJaneNoch keine Bewertungen

- Chandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, GampahaDokument1 SeiteChandra Jayasir I P A Domestic Gampaha 05-09-083 GMA1037 071 537 Gonigahalanda Watta, Ranweli Place, Gampahasasanka123asiri123Noch keine Bewertungen

- Assessment of Individual's Income Tax in India: January 2018Dokument4 SeitenAssessment of Individual's Income Tax in India: January 2018Jai VermaNoch keine Bewertungen

- Bill Feb 23 1Dokument2 SeitenBill Feb 23 1Irfan JillaniNoch keine Bewertungen

- Book IRCTC Retiring Room TicketDokument2 SeitenBook IRCTC Retiring Room TicketAkshay RachakondaNoch keine Bewertungen

- 20-UCO-359 UCO2502 Record NoteDokument51 Seiten20-UCO-359 UCO2502 Record NoteKaushik SNoch keine Bewertungen

- Synopsis of Project GSTDokument4 SeitenSynopsis of Project GSTamarjeet singhNoch keine Bewertungen

- YatraDokument1 SeiteYatraANANTHAKRISHNANRRNoch keine Bewertungen

- NR PropertiesDokument30 SeitenNR PropertiesHari Harul VullangiNoch keine Bewertungen