Beruflich Dokumente

Kultur Dokumente

Consumer Durable Industry in India

Hochgeladen von

shehzanamujawarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consumer Durable Industry in India

Hochgeladen von

shehzanamujawarCopyright:

Verfügbare Formate

Consumer durable industry in india

Swot Analysis

Vindhey Gaurav

School Of Management Studies

Motilal Nehru National Institute Of Technology

Consumer durable industry in india, Swot Analysis

Table of Contents Overview ....................................................................................................................3 Some Facts .................................................................................................................3 Introduction ................................................................................................................4 Sector Outlook ...........................................................................................................4 Swot Analysis ............................................................................................................7 Classification ..............................................................................................................8 Consumer Electronics ................................................................................................8 Demand Drivers in Consumer Electronics Sector .....................................................8 Challenges Facing the Consumer Electronics Industry .............................................9 Major Players in Consumer Electronics Industry ....................................................10 Scope ........................................................................................................................11 Current Scenario ......................................................................................................11 Future Scenario ........................................................................................................12 List of Companies ....................................................................................................13

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

Consumer durable industry in india, Swot Analysis

Overview

With the increase in income levels, easy availability of finance, increase in consumer awareness, and introduction of new models, the demand for consumer durables has increased significantly. Products like washing machines, air conditioners, microwave ovens, color televisions (CTVs) are no longer considered luxury items. However, there are still very few players in categories like vacuum cleaners, and dishwashers. Consumer durables sector is characterized by the emergence of MNCs, exchange offers, discounts, and intense competition. The market share of MNCs in consumer durables sector is 65%. MNC's major target is the growing middle class of India. MNCs offer superior technology to the consumers , whereas the Indian companies compete on the basis of firm grasp of the local market, their well-acknowledged brands, and hold over wide distribution network. However, the penetration level of the consumer durables is still low in India. An important factor behind low penetration is poor government spending on infrastructure. For example, the government spending is very less on electrification programs in rural areas. This factor discourages the consumer durables companies to market their products in rural areas.

Some Facts

1. Bargaining power of suppliers in consumer durables sector is limited due to threat of imports and intense competition. 2. Some of the entry barriers in consumer durables sector are distribution network, capital, and ability to hire purchases. 3. Demand is seasonal and cyclical.

brands.

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

4. Competition among players is on the basis of difference in prices and well-acknowledged

Consumer durable industry in india, Swot Analysis

Introduction

Before the liberalization of the Indian economy, only a few companies like Kelvinator, Godrej, Allwyn, and Voltas were the major players in the consumer durables market, accounting for no less than 90% of the market. Then, after the liberalization, foreign players like LG, Sony, Samsung, Whirlpool, Daewoo, Aiwa came into the picture. Today, these players control the major share of the consumer durables market.

Consumer durables market is expected to grow at 10-15% in 2007-2008. It is growing very fast because of rise in living standards, easy access to consumer finance, and wide range of choice, as many foreign players are entering in the market. On the flip side, the presence of a large number of players in the consumer durables market sometimes results in excess supply.

Sector Outlook

There has been strong competition between the major MNCs like Samsung, LG, and Sony. LG Electronics India Ltd. has announced its extension plan in 2006. The company is going to invest $250 million in India by 2011 and is planning to establish a manufacturing facility in Pune. TCL Corporation is also planning to establish a $22 million manufacturing facility in India. The Indian companies like Videocon Industries and Onida are also planning to expand. Videocon has acquired Electrolux brand in India. Also, with the acquisition of Thomson Displays by Videocon in Poland, China, and Mexico, the company is marking its international presence.

Page School Of Management Studies Motilal Nehru National Institute Of Technology

Consumer durable industry in india, Swot Analysis

According to isuppli Corporation (Applied Market Intelligence), country's fiscal policy has encouraged Indian consumer electronic industry. The reduction on import duty in the year 200809 has benefited many companies, such as Samsung, LG, and Sony. These companies import their premium end products from manufacturing facilities that are located outside India. Indian consumers are now replacing their existing appliances with frost-free refrigerators, split air conditioners, fully automatic washing machines, and color televisions (CTVs), which are boosting the sales in these categories. Some companies like Samsung Electronics Co. Ltd. and LG Electronics India Ltd. are now focusing on rural areas also. These companies are introducing gift schemes and providing easy finance to capture the consumer base in rural areas. Sector Financials 31/03/2007 Sales Sales Growth Gross Profit Margin Profit After Tax (PAT) PAT Growth Market Capitalization P/E Ratio Return on Capital Employed 13.9% (ROCE) 23.1% 6.9% 37,331m 10.7% 1,019m 1,787m 7.0 31/03/2008 30,100m -19.4% 6.6% 940m -4.3% 2,392m 7.6 In Rs 31/03/2009 43,096m 43.2% 4.3% -1,202m -209.5% 2,359m -7.9

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

Consumer durable industry in india, Swot Analysis

Growth in 2009-10 Consumer Durables Air Conditioner Refrigerator Microwave Ovens Washing Machines Color Televisions (CTVs) Black & White Televisions Clock Watch VCDs Consumer Electronics (Overall) Growth 20-25% 5-10% 25% 5-10% 15-20% -20% 10% 10% 30% 9%

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

Consumer durable industry in india, Swot Analysis

Swot Analysis

Strengths

1. Presence of established distribution networks in both urban and rural areas 2. Presence of well-known brands 3. In recent years, organized sector has increased its share in the market vis a vis the unorganized sector.

Weaknesses

1. Demand is seasonal and is high during festive season 2. Demand is dependent on good monsoons 3. Poor government spending on infrastructure 4. Low purchasing power of consumers

Opportunities

1. In India, the penetration level of white goods is lower as compared to other developing countries. 2. Unexploited rural market 3. Rapid urbanization 4. Increase in income levels, i.e. increase in purchasing power of consumers 5. Easy availability of finance

Threats

1. Higher import duties on raw materials imposed in the Budget 2008-09 2. Cheap imports from Singapore, China and other Asian countries

Page School Of Management Studies Motilal Nehru National Institute Of Technology

Consumer durable industry in india, Swot Analysis

Classification

Consumer durables Sector can be classified as follows: 1. Consumer Electronics includes VCD/DVD, home theatre, music players, color televisions (CTVs), cameras, camcorders, portable audio, Hi-Fi, etc. 2. White Goods include dishwashers, air conditioners, water heaters, washing machines, refrigerators, vacuum cleaners, kitchen appliances, non-kitchen appliances, microwaves, built-in appliances, tumble dryer, personal care products, etc. 3. Moulded Luggage includes plastics. 4. Clocks and Watches 5. Mobile Phones

Consumer Electronics

Consumer electronics are the products that are used everyday by the consumers. Consumer electronics include the products that come under the category of office products, communications, and entertainment.

Classification of Consumer Electronics Goods :-

Consumer electronics can be classified into personal computers, telephones, calculators, playback, digital video disk (DVD), video compact disc (VCD), video home systems (VHS), home theatre, music players, color televisions (CTVs), cameras, camcorders, portable audio, HiFi, etc.

Demand Drivers in Consumer Electronics Sector :-

Increase in disposable income, changing tastes of consumers, increase in nuclear families, increasing number of workingwomen, growth in per capita income, greater variety of choices,

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

growth in entertainment sectors, increasing consumerism, etc.

Consumer durable industry in india, Swot Analysis

Indian Consumer Electronics Export

Growth

In India, the demand of video products, such as color televisions (CTVs), VCD/DVD players, and set-top boxes account for 90% of the consumer electronic market. Easy availability of finance is an important factor driving growth for consumer electronics market. Some companies are also taking advantage of this factor by teaming up with banks to offer attractive loan schemes to consumers. According to isuppli projects (India market intelligent service), consumer electronics industry in India is growing at a compounded annual growth rate (CAGR) of 11%.

Challenges Facing the Consumer Electronics Industry

With the increase in price wars due to the entry of new players in the market and increase in manufacturing capacity by some original manufacturers, the profitability and margins of the companies are adversely affected. Poor distribution network in semi-urban and rural areas. Low awareness of consumer electronics products in rural India. Presence of gray market in consumer electronics products, especially in DVD player, music players. Companies need to increase focus on product differentiation to address various segmental specific needs.

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

Consumer durable industry in india, Swot Analysis

With the increase in access to Internet information, and availability of wide range of choices, consumers have become quite smart. They want the product that is easy-to-handle, good in quality and low in price. Most importantly, consumers want some guarantee for the product that they are buying. They look for the product that can be used for many years. The role of electronic companies doesn't end on the sale of the product, but continues till the end of guarantee period.

Major Players in Consumer Electronics Industry

The major players in the sub-categories of consumer electronics are: Personal Computers Samsung, Wipro, HP, Compaq, Dell VCD/DVDs Sony, Panasonic, Pioneer, Toshiba Hi-Fi/Music Systems Samsung, Sony India, Thompson, BPL Sanyo Technologies, Videocon Industries, Mirc Electronics, Philips India, Baron International, Eastern Micro Electronics, Matsushita Television and Audio Ltd Video Projectors Phil Systems, Keltron Projectors, Birla 3M, Samrat Video Vision Colour Television LG Electronics, Philips, Sony; Sansui, Samsung, BPL, Videocon, Onida, Aiwa, Akai, Thompson, Panasonic Cameras/Camcorders Sony, Canon, Olympus, Fuji film, Nikon

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

10

Consumer durable industry in india, Swot Analysis

Scope

In terms of Purchasing Power Parity (PPP), India is the 4th largest economy in the world and is expected to overtake Japan in the near future to become the 3rd largest. Indian consumer goods market is expected to reach $400 billion by 2010. India has the youngest population amongst the major countries. There are a lot of young people in India in different income categories. Nearly two- thirds of its population is below the age of 35, and nearly 50 % is below 25. There are 56 million people in middle class, who are earning US$ 4,400- US$ 21,800 a year. And there are 6 million rich households in India. The upper-middle and high-income households in urban areas are expected to grow to 38.2 million in 2007 as against 14.6 million in 2000. Rural sector offers huge scope for consumer durables industry, as it accounts for 70% of the Indian population. Rural areas have the penetration level of only 2% and 0.5% for refrigerators and washing machines respectively. The urban market and the rural market are growing at the annual rates of 7%-10%and 25% respectively. The rural market is growing faster than the urban market. The urban market has now largely become a product replacement market. The bottom line is that Indian market is changing rapidly and is showing unprecedented business opportunity.

Current Scenario

The consumer durables market in India is valued at US $ 4.5 billions currently. In 2006, microwave ovens and air conditioners registered a growth of about 25%. Frost-free refrigerators have registered significant growth as many urban families are replacing their old refrigerators. Refrigerator sales amounted to 4.2 millions in 2006, whereas the production of the refrigerators went up by 17% as compared to the preceding year. Washing machines, which have always seen poor growth, have seen reasonable growth in 2006. More and more Indians are now buying

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

11

Consumer durable industry in india, Swot Analysis

electrical appliances due to change in electricity scenario. The penetration level of color televisions (CTVs) is expected to increase 3 times by 2010 According to National Council for Applied Economic Research (NCAER), Indian consumer class is growing at a fast rate. This in turn is benefiting the consumer durables manufacturers.

Future Scenario

With easy availability of finance, emergence of double-income families, fall in prices due to increased competition, government support, growth of media, availability of disposable incomes, improvements in technology, reduction in customs duty, rise in temperatures, growth in consumer base of rural sector, the consumer durables industry is growing at a fast pace. Given these factors, a good growth is projected in the future, too. The penetration level of consumer durables is very low in India, as compared with other countries. This translates into vast unrealized potential. For example, in case of color televisions (CTVs), the penetration level of various countries is: India Brazil China US France Japan 24% 11% 98% 333% 235% 250%

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

12

Consumer durable industry in india, Swot Analysis

Demand and Penetration Level of White Goods in India 1995-1996 Demand 3.43 million 149 per 1,000 Penetration level households households households 2005-2006 8.72 million 319 per 1,000 2009-2010 13.14 million 451 per 1,000

In a study conducted by Frost & Sullivan and commissioned by India Semiconductor Association (ISA), the demand for Electronic Appliances is projected to grow exponentially at a compounded annual growth rate (CAGR) of 30%. In billions

List of Companies

Some of the companies in consumer durables sector are: 1. AIWA 2. Akai India 3. BenQ Corporation 4. Blue Star Ltd.

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

13

Consumer durable industry in india, Swot Analysis

5. Bose Corporation 6. BPL 7. Canon India 8. Carrier Aircon Ltd. 9. Daewoo India 10. Electrolux-Kelvinator 11. Godrej 12. Haier India 13. Hitachi Ltd. 14. Khaitan India Ltd. 15. LG Electronics India Ltd. 16. MIRC Electronics Ltd. 17. Mitsubishi Electronic Corporation 18. Nokia India 19. Onida 20. Pace Micro Technology 21. Panasonic 22. Philips India 23. Samsung India 24. Samtel 25. Sansui India 26. Siemens 27. Sony India 28. Thomson Ltd. 29. Titan Industries

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

14

Consumer durable industry in india, Swot Analysis

30. Toshiba Corporation 31. Videocon Industries 32. Whirlpool Appliances

The top 10 players in consumer durables sector are:

Nokia India LG Electronics India Ltd. Philips India Titan Industries Samsung India Electronics Whirlpool Appliances Siemens Sony India Videocon Industries Blue star

School Of Management Studies Motilal Nehru National Institute Of Technology

Page

15

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Project Report On Value Added Tax VATDokument77 SeitenProject Report On Value Added Tax VATshehzanamujawarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- University of Mumbai: A Study On Comparative Analysis of Pepsico and Coco-ColaDokument5 SeitenUniversity of Mumbai: A Study On Comparative Analysis of Pepsico and Coco-ColashehzanamujawarNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- United India Insurance Company LimitedDokument38 SeitenUnited India Insurance Company Limitedshehzanamujawar100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- "Project On Marketing Strategies For Insurance": Bachelor of Commerce (Banking & Insurance) Semester VI (2011-2012)Dokument8 Seiten"Project On Marketing Strategies For Insurance": Bachelor of Commerce (Banking & Insurance) Semester VI (2011-2012)shehzanamujawarNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Venture Capital Venture Capital (VC) IsDokument1 SeiteVenture Capital Venture Capital (VC) IsshehzanamujawarNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Group Assignment - Management Control Systems - Birch Paper CompanyDokument6 SeitenGroup Assignment - Management Control Systems - Birch Paper CompanyNatya NindyagitayaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- 104-Me 1443017742071Dokument82 Seiten104-Me 1443017742071Hardik SharmaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Ann Star Fashion ShopDokument17 SeitenAnn Star Fashion ShopShruti MandalNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Brand ManagementDokument46 SeitenBrand ManagementPayal AroraNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Howard Sheth and Nicosia ModelsDokument4 SeitenHoward Sheth and Nicosia ModelskkNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Hul PPT FinalDokument11 SeitenHul PPT Finaldhiraj_sonawane_1Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- OneDrive For BusinessDokument25 SeitenOneDrive For BusinessIvanSilvaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Branding Strategies of FMCG Companies - A Case Study: Mohammed AfreenDokument9 SeitenBranding Strategies of FMCG Companies - A Case Study: Mohammed AfreenAmbuj JoshiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Rice ECO501 LecturesDokument172 SeitenRice ECO501 LecturesIu ManNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Chapter 2 Airline EconomicsDokument5 SeitenChapter 2 Airline Economicsdagger21Noch keine Bewertungen

- The Making of Chik ShampooDokument3 SeitenThe Making of Chik ShampooGaurav AroraNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Case Study On Carbury Dairy Milk ChoclateDokument3 SeitenCase Study On Carbury Dairy Milk ChoclateDivesh VithalNoch keine Bewertungen

- 07 Catalogs and Master DataDokument26 Seiten07 Catalogs and Master DataJayaRam KothaNoch keine Bewertungen

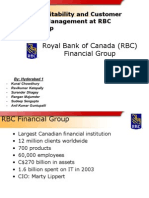

- RBC Case StudyDokument20 SeitenRBC Case StudyRangan Majumder100% (2)

- Certificado Ts 16949Dokument2 SeitenCertificado Ts 16949Stanic24Noch keine Bewertungen

- $70 My Mobile Broadband Plus 100GB: Plan IDDokument2 Seiten$70 My Mobile Broadband Plus 100GB: Plan IDJohn OhNoch keine Bewertungen

- Case Study 1Dokument1 SeiteCase Study 1Hazel Jane A. PATOSANoch keine Bewertungen

- Chapter 15: Public RelationsDokument10 SeitenChapter 15: Public RelationsAzizSafianNoch keine Bewertungen

- Assignment - Importance of Quality Management in Mauritius30.09.2015Dokument11 SeitenAssignment - Importance of Quality Management in Mauritius30.09.2015NaDiaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Introductory Micro Economics-Class-XII PDFDokument18 SeitenIntroductory Micro Economics-Class-XII PDFVickram Jain100% (1)

- Intangibility Perishability Heterogeneity Simultaneous Production and Consumption IntangibilityDokument2 SeitenIntangibility Perishability Heterogeneity Simultaneous Production and Consumption IntangibilitymaddymahekNoch keine Bewertungen

- Limited-Service Restaurants in IndonesiaDokument16 SeitenLimited-Service Restaurants in IndonesiaDionysius OlivianoNoch keine Bewertungen

- Samgyupsal ThesisDokument50 SeitenSamgyupsal ThesisSvnshine Tan57% (23)

- Practice 2Dokument9 SeitenPractice 2Nguyễn Quỳnh TrâmNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Case Study On Brand WagonR FINALDokument6 SeitenCase Study On Brand WagonR FINALDheeraj BharadwajNoch keine Bewertungen

- SL No Candidate Name DOB (Mm/dd/yy) Campus Basic Qualification MBA Specialisation MajorDokument9 SeitenSL No Candidate Name DOB (Mm/dd/yy) Campus Basic Qualification MBA Specialisation MajorSonali GroverNoch keine Bewertungen

- HMT Vs Titan NewDokument55 SeitenHMT Vs Titan NewEvelyn SparksNoch keine Bewertungen

- Bullwhip EffectDokument2 SeitenBullwhip EffectItisha JainNoch keine Bewertungen

- Market TownDokument35 SeitenMarket TownDavid BellNoch keine Bewertungen

- Mac 123Dokument6 SeitenMac 123Dave TurnipseedNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)