Beruflich Dokumente

Kultur Dokumente

Joint Stock Company

Hochgeladen von

bekza_159Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Joint Stock Company

Hochgeladen von

bekza_159Copyright:

Verfügbare Formate

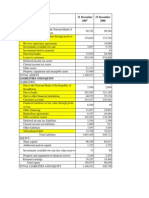

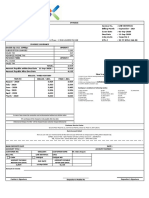

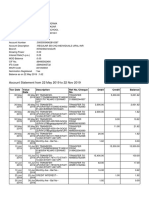

Alliance Bank Joint Stock Company is one of the leading banks in Kazakhstan, which has been successfully providing

the banking services for more than 19 years. Today Alliance Bank JSC is the seventh largest bank in terms of assets in Kazakhstan, developing as a universal financial institution in all business segments, primarily focusing on the retail market and SME lending. Joint Stock Company (JSC) Alliance Bank (the Bank) was incorporated in the Republic of Kazakhstan in 1999 under the name of Open Joint Stock Company (OJSC) Irtyshbusinessbank as a result of a merger of OJSC Semipalatinsk Municipal Joint Stock Bank and OJSC Irtyshbusinessbank. Its

branch network includes 19 branches and 108 cash offices in 51 cities and rural settlements of the Republic of Kazakhstan. Alliance Bank JSC is a subsidiary of Sovereign Wealth Fund Samruk Kazyna JSC. JSC Alliance Banks primary business is related to commercial banking activity, originating loans and guarantees, accepting deposits, exchanging foreign currencies, dealing with securities, transferring cash payments, as well as providing other banking services. ATFBank Joint Stock Company was established in June 1995 under the name of Almaty Merchant Bank CJSC. The Bank operates under a general banking license issued on September 2, 2005 by the Agency of the Republic of Kazakhstan on Regulation and Supervision of Financial Market and Financial Institutions, which also allows the Bank to conduct operations with precious metals and foreign currency operations. The Bank also possesses licenses for securities operations and custody services from the National Bank of the Republic of Kazakhstan granted on November 27, 2003. ATF Bank and subsidiary (the Group) provide retail, corporate banking and insurance services in Kazakhstan. The Bank accepts deposits from the public, extends credit, transfers payments in Kazakhstan and abroad, exchanges currencies and provides other banking services to its commercial and retail customers. The Bank has three subsidiaries and one associate. Financial crisis in Kazakhstan began in the second half of the 2007 due to problems in the mortgage market in the U.S. According to unofficial data, by the end of 2008 the debt of Kazakh banks to foreign creditors reached an astronomical sum more than $ 35 billion. Moreover, in the most difficult position in this situation were exactly "Alliance Bank" and ATF Bank, which not only took considerable funds abroad, but also invested in risky projects abroad, and actively made loans of purchasing real estate in the country. On October 2008, the anti-crisis plan was developed under which the government has allocated funds for the purchase from leading banks (Halyk Bank, Kazkommertsbank, BTA Bank and Alliance Bank) 25% of the voting shares. On February 2, 2009, The Government of the Republic of Kazakhstan reported on redemption of 76% of the shares of Alliance Bank. Unfortunately really buybacks did not take place until the end of 2009.

On April 13, 2009, JSC "Alliance Bank" applied to creditors with a proposal to restructure the debt. Experts regarded this statement as a technical default. On December 15, 2009 the head of the Alliance Bank reported that lenders have approved the restructuring plan of its obligations. As a result the bank's debt reduced by $ 1 billion from $ 4.5 billion After the restructuring of debts of JSC Alliance Bank was completed on April 2010, Sovereign Wealth Fund Samruk-Kazyna" acquired a controlling packet of shares of "Alliance Bank" and spend $ 856 million on its capitalization. In November 2007 - Bank Austria Creditanstalt (BA-CA), a division of UniCredit Group (UniCredit Group) for the commercial banking sector in Central and Eastern Europe, has acquired 91.8% of shares of JSC "ATF." (Over 2,117,000 U.S. dollars (about 1.452 million euros at the current exchange rate)) As KzRating has mentioned before, the quality of the loan portfolio (especially in the corporate sector) is often exaggerated by Kazakh banks in order to ensure sufficient profitability. The new owners of ATF bank (UniCredit Group) were the first to conduct a large-scale asset reclassification in 2008. March 15, 2013 UniCredit Bank Austria has signed the sale contract with KazNitrogenGaz related to the selling of 99.75% of Kazakhstan JSC "ATF."!

Das könnte Ihnen auch gefallen

- Jensen and Meckling (1976)Dokument22 SeitenJensen and Meckling (1976)Taufik IsmailNoch keine Bewertungen

- Miller and Modigliani Theory ArticleDokument7 SeitenMiller and Modigliani Theory ArticleRenato WilsonNoch keine Bewertungen

- Master's Thesis Guidelines 2014Dokument19 SeitenMaster's Thesis Guidelines 2014bekza_159Noch keine Bewertungen

- The Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerDokument38 SeitenThe Cost of Capital, Corporate Finance and The Theory of Investment-Modigliani MillerArdi GunardiNoch keine Bewertungen

- Corporate Tax Planning and Debt Endogeneity: Case of American FirmsDokument12 SeitenCorporate Tax Planning and Debt Endogeneity: Case of American Firmsbekza_159Noch keine Bewertungen

- Jensen MecklingDokument71 SeitenJensen MecklingAllouisius Tanamera NarasetyaNoch keine Bewertungen

- Kazakhstan Institute of Management, Economics and Strategic Research FIN5206 Investment ManagementDokument23 SeitenKazakhstan Institute of Management, Economics and Strategic Research FIN5206 Investment Managementbekza_159Noch keine Bewertungen

- An Empirical Model of Capital Structure: Some New EvidenceDokument15 SeitenAn Empirical Model of Capital Structure: Some New Evidencebekza_159Noch keine Bewertungen

- Capital Structure, Equity Ownership and Firm Performance PDFDokument34 SeitenCapital Structure, Equity Ownership and Firm Performance PDFHop LuuNoch keine Bewertungen

- Kazakhstan Institute of ManagementDokument8 SeitenKazakhstan Institute of Managementbekza_159Noch keine Bewertungen

- They Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?Dokument5 SeitenThey Discussed Discounted Cash Flow (DCF) Methods. What Was One We Used in Class?bekza_159Noch keine Bewertungen

- Adv Corporate Finance Paper FinalDokument3 SeitenAdv Corporate Finance Paper Finalbekza_159Noch keine Bewertungen

- Financial Derivatives FinalDokument26 SeitenFinancial Derivatives Finalbekza_159Noch keine Bewertungen

- IntroductionDokument1 SeiteIntroductionbekza_159Noch keine Bewertungen

- Executive Summary Adv CorpDokument2 SeitenExecutive Summary Adv Corpbekza_159Noch keine Bewertungen

- Financial Derivatives FinalDokument37 SeitenFinancial Derivatives Finalbekza_159Noch keine Bewertungen

- Financial StatementDokument20 SeitenFinancial Statementbekza_159Noch keine Bewertungen

- Of Difference To The Brand in Order To Have A Competitive Advantage and That ConsumersDokument3 SeitenOf Difference To The Brand in Order To Have A Competitive Advantage and That Consumersbekza_159Noch keine Bewertungen

- Alliance BankDokument5 SeitenAlliance Bankbekza_159Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- House # 27, Block HH, Phase 4, Phase - 4 DHA LAHORE PUNJABDokument1 SeiteHouse # 27, Block HH, Phase 4, Phase - 4 DHA LAHORE PUNJABSidra AnjumNoch keine Bewertungen

- IndiaBanks GoldilocksWithAMinorBump20230310 PDFDokument26 SeitenIndiaBanks GoldilocksWithAMinorBump20230310 PDFchaingangriteshNoch keine Bewertungen

- Recording of Transactions Part II: Short Answer Type QuestionsDokument22 SeitenRecording of Transactions Part II: Short Answer Type Questionsshashi sinhaNoch keine Bewertungen

- Affidavit of Good Faith Chattel Mortgage PDFDokument1 SeiteAffidavit of Good Faith Chattel Mortgage PDFArianneParalisanNoch keine Bewertungen

- Case Digests - CreditTransDokument14 SeitenCase Digests - CreditTransMaria Fiona Duran MerquitaNoch keine Bewertungen

- SBT Ifsc DetailsDokument125 SeitenSBT Ifsc DetailsRohitNoch keine Bewertungen

- Punjab National BankDokument4 SeitenPunjab National Bankhell_quit1Noch keine Bewertungen

- Conveyancing AssignmentDokument6 SeitenConveyancing AssignmentDON ODUOR OTIENONoch keine Bewertungen

- ACCTG 21 CHAPTER 1 OkDokument82 SeitenACCTG 21 CHAPTER 1 OkBukhani MacabanganNoch keine Bewertungen

- Cash & Cash EquivalentDokument3 SeitenCash & Cash Equivalentdeborah grace sagarioNoch keine Bewertungen

- Problems Present ValueDokument3 SeitenProblems Present ValueZariah GtNoch keine Bewertungen

- Ttransaction HistoryDokument1 SeiteTtransaction Historyاحمد الثقفيNoch keine Bewertungen

- Guidelines Regarding Payment Procedures of Tuition & Other FeesDokument1 SeiteGuidelines Regarding Payment Procedures of Tuition & Other FeesAshiqur RahmanNoch keine Bewertungen

- Opening of Bank AccountDokument2 SeitenOpening of Bank AccountGanesh medisettiNoch keine Bewertungen

- Banking Structure in IndiaDokument49 SeitenBanking Structure in IndiaAjay RapelliNoch keine Bewertungen

- State Bank Collect PPT For Educational InstitutionsDokument17 SeitenState Bank Collect PPT For Educational Institutionssrinivasa annamayya100% (1)

- Price Rs. 1,364: Booking ConfirmationDokument2 SeitenPrice Rs. 1,364: Booking ConfirmationAnand aashishNoch keine Bewertungen

- Swift An OverviewDokument137 SeitenSwift An OverviewSudhir KochharNoch keine Bewertungen

- Table of Contents - v02Dokument13 SeitenTable of Contents - v02Jake Floyd G. FabianNoch keine Bewertungen

- Case Study On DHPLDokument7 SeitenCase Study On DHPLUtkarsh PandeyNoch keine Bewertungen

- Chapter12 Managing and Pricing Deposit ServicesDokument26 SeitenChapter12 Managing and Pricing Deposit ServicesTừ Lê Lan HươngNoch keine Bewertungen

- Kyc Detail Commonwealth BankDokument5 SeitenKyc Detail Commonwealth BankLorin WagnerNoch keine Bewertungen

- AnnuityDokument10 SeitenAnnuityJiru Kun0% (1)

- Aacmac Gold Coast 2020: Australasian Acupuncture & Chinese Medicine Annual ConferenceDokument3 SeitenAacmac Gold Coast 2020: Australasian Acupuncture & Chinese Medicine Annual ConferenceaswadiibrahimNoch keine Bewertungen

- Practices of Banking and Insurance (Coh433) - 1509906777991Dokument2 SeitenPractices of Banking and Insurance (Coh433) - 1509906777991Gautam RathNoch keine Bewertungen

- Proposed Loan Terms: Congratulations Dominic Szathmari JR and Mirela SzathmariDokument2 SeitenProposed Loan Terms: Congratulations Dominic Szathmari JR and Mirela SzathmariMirela SzathmariNoch keine Bewertungen

- Bhim Baroda Pay (Upi)Dokument5 SeitenBhim Baroda Pay (Upi)Rajkot academyNoch keine Bewertungen

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDokument2 SeitenOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNoch keine Bewertungen

- SBI Nov PDFDokument5 SeitenSBI Nov PDFbinduNoch keine Bewertungen

- 31 RRC ME Dubai - Course Booking Form v1.03 1908Dokument3 Seiten31 RRC ME Dubai - Course Booking Form v1.03 1908Khlalid SHahNoch keine Bewertungen