Beruflich Dokumente

Kultur Dokumente

Limitations: Pillai's Institute of Management Studies and Research - New Panvel

Hochgeladen von

vishalbiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Limitations: Pillai's Institute of Management Studies and Research - New Panvel

Hochgeladen von

vishalbiCopyright:

Verfügbare Formate

LIMITATIONS Designing own and new financial products is very costly and time consuming for the bank.

Customers now-a-days prefer net banking to branch banking. The banks that are slow in introducing technology-based products, are finding it difficult to retain the customers who wish to opt for net banking..

A major disadvantage is monitoring and follows up of huge volume of loan accounts inducing banks to spend heavily in human resource department.

The volume of amount borrowed by a single customer is very low as compared to wholesale banking. This does not allow banks to exploit the advantage of earning huge profits from single customer as in case of wholesale banking.

Pillais Institute of Management Studies and Research New Panvel

Page 7

SUMMARY OF FINDINGS 90% of customers are happy with the bank timings & they opinioned that it is very good.

80% of respondents like the branch ambience & layout & find it friendly. 80% of respondents said branch was clean and well maintained.

Respondents were of view that Branch personnel had listened to them patiently and have been able to respond to their queries and clarifications.

74% of respondent responded that Branch personnel had been very helpful and courteous.

72% of respondents opinioned that branch personnel does Need Analyses & Risk Assessment of customer savings before recommending any investment option to them.

86% of respondent that branch personnel are aware of Product and Services and responded to your queries.

Pillais Institute of Management Studies and Research New Panvel

Page 8

SUGGESTIONS As 10% customer response is not good for the clarification of the queries response towards them so bank personnel should improve this issue because customer is a source through which business can be increase and satisfy customers is a source to create more customers, with reference to table no.4

As it is only 10% respondent said that sometime there was a error in the transaction happened so to avoid these kinds of errors should be avoided because it is unnecessarily results in wastage of time for both staff members and service rendered, reference to table no. 9

With reference to table no. 6, larger number of branch personnel should do Need Analyses & Risk Assessment before recommending any investment option to customer.

With reference to table no.7, more branch personnel should be aware of Product and Services and responded to customers queries.

With reference to table. 10, YES bank should look into the feedback provided by customer and takes necessary action wherever required.

With reference to table no. 12, bank should focus on Instant FD facility &Echeques as small 10% of customer likes this.

Pillais Institute of Management Studies and Research New Panvel 9

Page

Das könnte Ihnen auch gefallen

- The Successful Strategies from Customer Managment ExcellenceVon EverandThe Successful Strategies from Customer Managment ExcellenceNoch keine Bewertungen

- Capstone - Omkar - Retail BankingDokument95 SeitenCapstone - Omkar - Retail BankingOmkar VedpathakNoch keine Bewertungen

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDokument111 SeitenMBA Finance Project On Retail Banking With Special Reference To YES BANKOmkar Vedpathak75% (4)

- MBA Finance Project On Retail Banking With Special Reference To YES BANKDokument115 SeitenMBA Finance Project On Retail Banking With Special Reference To YES BANKManjeet Singh100% (2)

- Customer Satisfaction Regarding Products and Services Offered by Bank of BarodaDokument29 SeitenCustomer Satisfaction Regarding Products and Services Offered by Bank of BarodaAnonymous D5g37JjpGBNoch keine Bewertungen

- Chapter-4 (Research Methodology)Dokument48 SeitenChapter-4 (Research Methodology)ankit161019893980Noch keine Bewertungen

- Empirical study on banking operations and retail products of Axis BankDokument11 SeitenEmpirical study on banking operations and retail products of Axis BankDeepjyoti RoyNoch keine Bewertungen

- Customer Relationship Management in Banking Sector-A Case Study of PNBDokument27 SeitenCustomer Relationship Management in Banking Sector-A Case Study of PNBmanicoolgal4uNoch keine Bewertungen

- Naseer Prroject ReportDokument116 SeitenNaseer Prroject ReportnehaNoch keine Bewertungen

- Service Quality Analysis of SBIDokument38 SeitenService Quality Analysis of SBIAkhil BhatiaNoch keine Bewertungen

- Project Report HDFC BANKDokument14 SeitenProject Report HDFC BANKShubham AgarwalNoch keine Bewertungen

- A Dissertation ON Retail BankingDokument160 SeitenA Dissertation ON Retail Bankinghello2gauravNoch keine Bewertungen

- Internship Report On Transcom DigitalDokument129 SeitenInternship Report On Transcom DigitalFarzana Sharmin80% (5)

- Case StudyDokument5 SeitenCase Studyjharlaloo0% (1)

- Sbi-Bank - Effectiveness of Customer Relationship Management Programme in State Bank of IndiaDokument71 SeitenSbi-Bank - Effectiveness of Customer Relationship Management Programme in State Bank of IndiaVrinda Priya60% (5)

- Needs Assessment Cycle FinalDokument6 SeitenNeeds Assessment Cycle Finalapi-337437414Noch keine Bewertungen

- A Dissertation Report OnDokument111 SeitenA Dissertation Report OnshashankNoch keine Bewertungen

- Customer Satisfaction Report on Maruti Suzuki SkyDokument52 SeitenCustomer Satisfaction Report on Maruti Suzuki Skywww_kewalsingh73Noch keine Bewertungen

- Assessment On Factor That Affect Customer Satisfaction in Case of NIB International Bank S.C Adama BranchDokument15 SeitenAssessment On Factor That Affect Customer Satisfaction in Case of NIB International Bank S.C Adama BranchBereket K.ChubetaNoch keine Bewertungen

- "Retail Ba: A Project ReportDokument93 Seiten"Retail Ba: A Project ReportGurpreet SinghNoch keine Bewertungen

- Presentation1 Customer SatisfactionDokument22 SeitenPresentation1 Customer SatisfactionAnjali Angel100% (2)

- Chapter 5Dokument4 SeitenChapter 5Okorie Chinedu PNoch keine Bewertungen

- Financial Services & Self-Service Sites: Industry GuideDokument17 SeitenFinancial Services & Self-Service Sites: Industry Guideperlh1973Noch keine Bewertungen

- Case Study On Recent Trend of eDokument2 SeitenCase Study On Recent Trend of eNishaNoch keine Bewertungen

- Analysis Customer Relationship HDFC BankDokument79 SeitenAnalysis Customer Relationship HDFC BankitsmecoolnsmartNoch keine Bewertungen

- HDFC BankDokument79 SeitenHDFC BankAnkit YadavNoch keine Bewertungen

- Retail Banking Customer Satisfaction SurveyDokument2 SeitenRetail Banking Customer Satisfaction SurveyMonikaNoch keine Bewertungen

- Critical Evaluation of Marketing Strategies of SBI.: Chapter No. 06Dokument30 SeitenCritical Evaluation of Marketing Strategies of SBI.: Chapter No. 06SarinNoch keine Bewertungen

- Case StudyDokument5 SeitenCase StudyNeri NeriNoch keine Bewertungen

- NBP Chapter 8 AnalysisDokument7 SeitenNBP Chapter 8 AnalysisMaliha HassanNoch keine Bewertungen

- Conclusions and Suggestions.: Chapter No. 07Dokument35 SeitenConclusions and Suggestions.: Chapter No. 07SarinNoch keine Bewertungen

- A Survey On Customers Satisfaction of The Ntel Marketing and Services PVT LTD PuneDokument39 SeitenA Survey On Customers Satisfaction of The Ntel Marketing and Services PVT LTD PuneKunal KoreNoch keine Bewertungen

- Brac Bank Call Center ServiceDokument5 SeitenBrac Bank Call Center ServiceShånghatik Sangeet KhisaNoch keine Bewertungen

- Project ProposalDokument10 SeitenProject ProposalOkorie Chinedu PNoch keine Bewertungen

- Dissertation On Customer SatisfactionDokument4 SeitenDissertation On Customer SatisfactionPaySomeoneToWriteMyPaperGilbert100% (1)

- AnirudhDokument81 SeitenAnirudhbalki123Noch keine Bewertungen

- Thesis On Customer Satisfaction in BanksDokument7 SeitenThesis On Customer Satisfaction in Banksfjn786xp100% (2)

- Objective.: Research Design and MethodologyDokument47 SeitenObjective.: Research Design and MethodologySalman BabaNoch keine Bewertungen

- Banking ServicesDokument27 SeitenBanking ServicesChintan JainNoch keine Bewertungen

- Marketing Anylytics - Final Business ProjectDokument18 SeitenMarketing Anylytics - Final Business ProjectMUHAMMAD ARSHADNoch keine Bewertungen

- Thesis Topics On Customer SatisfactionDokument8 SeitenThesis Topics On Customer Satisfactionfjmzktm7100% (2)

- Mba Dissertation Customer SatisfactionDokument5 SeitenMba Dissertation Customer SatisfactionBuyACollegePaperOnlineSingapore100% (1)

- Research Report On Loans and Advance SystemDokument16 SeitenResearch Report On Loans and Advance SystemRavi DhudiyaNoch keine Bewertungen

- Case 9 ROLDokument5 SeitenCase 9 ROLAilene Tsui Alferez PaciaNoch keine Bewertungen

- 15 SummaryDokument29 Seiten15 SummaryNekta PinchaNoch keine Bewertungen

- Analysis of Customer Relationship Management in HDFC BANKDokument13 SeitenAnalysis of Customer Relationship Management in HDFC BANKManeesh SharmaNoch keine Bewertungen

- Maintaining The Customer Experience-2008 PDFDokument5 SeitenMaintaining The Customer Experience-2008 PDFAndra LazarNoch keine Bewertungen

- Chapter 4Dokument11 SeitenChapter 4Arun SurendranNoch keine Bewertungen

- Summer Training Report On Citi BankDokument18 SeitenSummer Training Report On Citi BankPriyanshu KumarNoch keine Bewertungen

- ZA FSI Rebuilding Relationship Bank Study 160810Dokument20 SeitenZA FSI Rebuilding Relationship Bank Study 160810Subhasini Selvaraj SNoch keine Bewertungen

- AlemDokument19 SeitenAlemKALID MUNIRNoch keine Bewertungen

- Chapter-Iv: Introduction and BenefitDokument19 SeitenChapter-Iv: Introduction and BenefitTabi AlamNoch keine Bewertungen

- Presentation ON Internship at Nabil Bank: Chhitiz Shrestha Bba-Bi 7 Semester Ace Institute of ManagementDokument26 SeitenPresentation ON Internship at Nabil Bank: Chhitiz Shrestha Bba-Bi 7 Semester Ace Institute of ManagementChhitiz ShresthaNoch keine Bewertungen

- Analytics in CRM Labs WhitepaperDokument34 SeitenAnalytics in CRM Labs WhitepaperParag ShettyNoch keine Bewertungen

- Customer Relationship Marketing: Relationship build business ... how do you relate to your target audience?Von EverandCustomer Relationship Marketing: Relationship build business ... how do you relate to your target audience?Noch keine Bewertungen

- Customer Experience 3.0: High-Profit Strategies in the Age of Techno ServiceVon EverandCustomer Experience 3.0: High-Profit Strategies in the Age of Techno ServiceBewertung: 5 von 5 Sternen5/5 (1)

- Exceptional Customer Service- Retaining your Customers for Life!Von EverandExceptional Customer Service- Retaining your Customers for Life!Noch keine Bewertungen

- The Customer Success Professional's Handbook: How to Thrive in One of the World's Fastest Growing Careers--While Driving Growth For Your CompanyVon EverandThe Customer Success Professional's Handbook: How to Thrive in One of the World's Fastest Growing Careers--While Driving Growth For Your CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Tata Abh BH Hai BataDokument2 SeitenTata Abh BH Hai BatavishalbiNoch keine Bewertungen

- Tata BataDokument2 SeitenTata BatavishalbiNoch keine Bewertungen

- UdaipurDokument1 SeiteUdaipurvishalbiNoch keine Bewertungen

- Regulation: Legal Environment - GeneralDokument2 SeitenRegulation: Legal Environment - GeneralvishalbiNoch keine Bewertungen

- DhumDokument2 SeitenDhumvishalbiNoch keine Bewertungen

- Across Down: Schemes, Shares, Property, Etc. - Card?" Bought and SoldDokument3 SeitenAcross Down: Schemes, Shares, Property, Etc. - Card?" Bought and SoldvishalbiNoch keine Bewertungen

- Insider Trading Is The Trading of A: Public Company Stock Securities Bonds Stock OptionsDokument2 SeitenInsider Trading Is The Trading of A: Public Company Stock Securities Bonds Stock OptionsvishalbiNoch keine Bewertungen

- Tata Motors Limited (Formerly TELCO, Short For Tata Engineering and Locomotive Company) Is AnDokument1 SeiteTata Motors Limited (Formerly TELCO, Short For Tata Engineering and Locomotive Company) Is AnvishalbiNoch keine Bewertungen

- Limitations: Pillai's Institute of Management Studies and Research - New PanvelDokument4 SeitenLimitations: Pillai's Institute of Management Studies and Research - New PanvelvishalbiNoch keine Bewertungen

- Facebook: The world's largest social networkDokument1 SeiteFacebook: The world's largest social networkvishalbiNoch keine Bewertungen

- Facebook: The world's largest social networkDokument1 SeiteFacebook: The world's largest social networkvishalbiNoch keine Bewertungen

- Retail Banking in India Project ReportDokument62 SeitenRetail Banking in India Project ReportMann SainiNoch keine Bewertungen

- Creditors Board of Directors ExecutivesDokument1 SeiteCreditors Board of Directors ExecutivesvishalbiNoch keine Bewertungen

- Principles of Corporate Governance: Cadbury Report Sarbanes-Oxley ActDokument1 SeitePrinciples of Corporate Governance: Cadbury Report Sarbanes-Oxley ActvishalbiNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentvishalbiNoch keine Bewertungen

- Whatsapp AhackDokument2 SeitenWhatsapp AhackvishalbiNoch keine Bewertungen

- Whtsapp DealDokument3 SeitenWhtsapp DealvishalbiNoch keine Bewertungen

- Stakeholders: Corporate Governance Refers To The System by Which Corporations Are Directed and Controlled. TheDokument1 SeiteStakeholders: Corporate Governance Refers To The System by Which Corporations Are Directed and Controlled. ThevishalbiNoch keine Bewertungen

- Acconting StandarsDokument4 SeitenAcconting StandarsvishalbiNoch keine Bewertungen

- Corporate GovernanaceDokument10 SeitenCorporate GovernanacevishalbiNoch keine Bewertungen

- Peo TpdsDokument119 SeitenPeo TpdsvishalbiNoch keine Bewertungen

- CrosswordsDokument2 SeitenCrosswordsvishalbiNoch keine Bewertungen

- Accounting Standards As14newDokument18 SeitenAccounting Standards As14newapi-3705877Noch keine Bewertungen

- Price Sensitive InfoDokument1 SeitePrice Sensitive InfovishalbiNoch keine Bewertungen

- State of EconomyDokument8 SeitenState of EconomyvishalbiNoch keine Bewertungen

- Goods Services Financial Capital Financial TransfersDokument2 SeitenGoods Services Financial Capital Financial TransfersvishalbiNoch keine Bewertungen

- AccountingDokument3 SeitenAccountingvishalbiNoch keine Bewertungen

- Amalgamation Pooling of Interest MethodDokument16 SeitenAmalgamation Pooling of Interest Methodvairamuthu2000Noch keine Bewertungen

- New Microsoft Office Word DocumentDokument1 SeiteNew Microsoft Office Word DocumentvishalbiNoch keine Bewertungen

- Manual Google SitesDokument28 SeitenManual Google SitesAntonio DelgadoNoch keine Bewertungen

- Salary CalculatorDokument19 SeitenSalary Calculatorvirag_shahsNoch keine Bewertungen

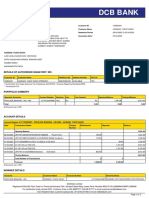

- DCB Bank: Statement of AccountDokument2 SeitenDCB Bank: Statement of AccounthasnainNoch keine Bewertungen

- Customer Satisfaction Key to Banking SuccessDokument40 SeitenCustomer Satisfaction Key to Banking Successnavdeep2309Noch keine Bewertungen

- Chap012 Solution Manual Financial Institutions Management A Risk Management ApprDokument12 SeitenChap012 Solution Manual Financial Institutions Management A Risk Management ApprПита ДаминNoch keine Bewertungen

- The History of Banking Kerim CatovicDokument10 SeitenThe History of Banking Kerim CatovicsolacevillarealNoch keine Bewertungen

- 4-Tier Structure For Urban Cooperative BanksDokument6 Seiten4-Tier Structure For Urban Cooperative BanksNavneet BhandariNoch keine Bewertungen

- Sebi Sensex Nifty Bse NseDokument47 SeitenSebi Sensex Nifty Bse NseKushal WaliaNoch keine Bewertungen

- Project On Kotak Mahindra BankDokument34 SeitenProject On Kotak Mahindra BankMcbc Promax Ultrahd100% (1)

- CBSE Class 11 Accountancy Sample Paper SA1 2015Dokument4 SeitenCBSE Class 11 Accountancy Sample Paper SA1 2015Ritikesh GuptaNoch keine Bewertungen

- Jll-Capital Markets BrochureDokument12 SeitenJll-Capital Markets BrochurechloeheNoch keine Bewertungen

- QuestionnaireDokument5 SeitenQuestionnaireharpalchudasama1100% (10)

- BoG On Revision On The Suspension of DividendsDokument2 SeitenBoG On Revision On The Suspension of DividendsJoseph Appiah-DolphyneNoch keine Bewertungen

- Test 1Dokument83 SeitenTest 1Cam WolfeNoch keine Bewertungen

- Annexure - 2 COS 38 Joint Hindu Family LetterDokument2 SeitenAnnexure - 2 COS 38 Joint Hindu Family LetterRahul Kumar50% (2)

- Financial Analysis of HDFC BankDokument48 SeitenFinancial Analysis of HDFC BankAbhay JainNoch keine Bewertungen

- Atm Using FingerprintDokument5 SeitenAtm Using FingerprintShivaNoch keine Bewertungen

- Cardiff Cash Management V2.0Dokument108 SeitenCardiff Cash Management V2.0elsa7er2000Noch keine Bewertungen

- Money and CreditDokument7 SeitenMoney and CreditSunil Sharma100% (1)

- Pedersen - Wall Street Primer (2009)Dokument262 SeitenPedersen - Wall Street Primer (2009)Cosmin VintilăNoch keine Bewertungen

- Standing Instructions FormatDokument5 SeitenStanding Instructions FormatTaufik Mansuron100% (1)

- Tratado - Cap. 15Dokument15 SeitenTratado - Cap. 15Cinthia de SouzaNoch keine Bewertungen

- Description: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Dokument3 SeitenDescription: 1. Question Details Jmodd7 5.4.001.cmi. (1639656)Suvaid KcNoch keine Bewertungen

- RecoveriesDokument45 SeitenRecoveriesSona ElvisNoch keine Bewertungen

- OPPT: Individual UCC DEMAND BANK UNFREEZE TemplateDokument4 SeitenOPPT: Individual UCC DEMAND BANK UNFREEZE TemplateAmerican Kabuki100% (3)

- Annual Report 2011Dokument56 SeitenAnnual Report 2011Mark EpersonNoch keine Bewertungen

- Solved in The Documentary Movie Expelled No Intelligence Allowed TherDokument1 SeiteSolved in The Documentary Movie Expelled No Intelligence Allowed TherAnbu jaromiaNoch keine Bewertungen

- Module 2 Math of InvestmentDokument17 SeitenModule 2 Math of InvestmentvlythevergreenNoch keine Bewertungen

- PressenTatIon of UBL (Loan)Dokument15 SeitenPressenTatIon of UBL (Loan)Adeel ShahNoch keine Bewertungen

- Summary of FBI's Financial Investigation of 9/11 HijackersDokument20 SeitenSummary of FBI's Financial Investigation of 9/11 Hijackers9/11 Document Archive100% (1)