Beruflich Dokumente

Kultur Dokumente

Weekly Market Commentary 3-17-2014

Hochgeladen von

monarchadvisorygroupCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Weekly Market Commentary 3-17-2014

Hochgeladen von

monarchadvisorygroupCopyright:

Verfügbare Formate

LP L FINANCIAL R E S E AR C H

Weekly Market Commentary

March 17, 2014

March Madness in the Markets

Jeffrey Kleintop, CFA

Chief Market Strategist LPL Financial

Highlights

As the NCAA basketball tournament gets down to its own sweet sixteen while the rest of March plays out, it is a good time to reect on the sixteen competing drivers of the markets that may make for an exciting showdown in the weeks and months to come. There will likely be some upsets that result in volatility as these factors face off against each other.

With the exception of last years steady rise, March has been maddening for investors. In three of the past four years the S&P 500 raced higher in March only to reverse all of those gains in a pullback of about 10% that began in late March or April. It later took stocks at least ve months to climb back to the peaks of March. As the NCAA tournament gets down to its own sweet sixteen while the rest of March plays out, it is a good time to reect on the competing drivers of the markets that may make for an exciting showdown in the weeks and months to come.

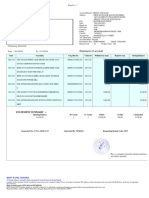

Stocks Sweet Sixteen

Sweet Sixteen Elite Eight Final Four CHAMPIONSHIP Final Four Elite Eight Sweet Sixteen Earnings Valuations

Employment Weather China Germany/Japan

Economy

Fundamentals

Cyclicals Defensives

Ukraine Russia Tapering EM

Margin Breadth

Policy

Sentiment

Money Flow Volatility

Source: LPL Financial Research 03/17/14

As we narrow down stocks sweet sixteen potential drivers again this year, the four regions of market-moving factors vying for investor attention are: economy, policy, fundamentals, and sentiment.

Member FINRA/SIPC Page 1 of 4

W E E KLY MARKE T CO MME N TAR Y

Economy

Employment vs. Weather Job growth and other indicators of economic growth slowed in recent months. We will learn in the coming weeks how much of that reected a genuine softening of economic activity versus just the impact of extreme winter weather across the United States in the form of snowfall and low temperatures. China vs. Germany/Japan What is the trajectory of global growth? The second largest economy in the world, China, appears to be slowing. However, the third and fourth largest economies, Germany and Japanwhich when combined are similar in size to Chinahave shown signs of accelerating growth. In the short term, Japan faces a scal drag due to a tax increase, but tremendous monetary stimulus should help to sustain growth over the remainder of the year.

Policy

Ukraine vs. Russia While a resolution to the Ukraine-Russia conict may be elusive, that has also been the case in other countries in recent years and did not keep stocks from moving on once the prospects for a broader military engagement faded. U.S. stock market sell-offs due to geopolitical events have led to quick reversals in recent years as seen with Egypt and Syria. Market participants have been trained to buy quickly on signs that a crisis is likely to be averted. What to watch: if unrest prompts Russian action in other parts of Ukraine or armed clashes begin to break out, the risk of a broader crisis rises. Tapering vs. Emerging Markets The soft global economy of the past ve years prompted the Federal Reserve (Fed) to pump money into the global nancial system, encouraging capital to ow into the emerging markets and allowing them to run unsustainable trade and budget decits. Now, as global growth is improving, we are seeing the Fed begin to taper its bond purchases, and that change is prompting some emerging markets to have to quickly adjust by devaluing their currencies and cutting spending dramatically. These consequences of tapering have created weakness in emerging markets that has spilled over into developed economy stock markets.

Fundamentals

Earnings vs. Valuations Earnings growth for S&P 500 companies is accelerating from the sluggish, low single-digit growth seen for much of 2013. However, 2013s run up in valuations leaves the market much more dependent upon that growth. The price-to-earnings ratio of the S&P 500 on the past four quarters earnings is now only about one point below the 1718 seen at the end of all prior bull markets since WWII (with the one exception of March 2000 when it was much higher).

The P/E ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or prot earned by the rm per share. It is a nancial ratio used for valuation: a higher P/E ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower P/E ratio.

Cyclicals vs. Defensives After strong cyclical leadership last year from sectors up over 40% like consumer discretionary and industrials, defensives (such as the health care and utilities sectors) have been the strongest performers in 2014s volatile market. A return to cyclical leadership would be a sign of strength for the stock market.

Page 2 of 4

LPL Financial Member FINRA/SIPC

W E E KLY MARKE T CO MME N TAR Y

Sentiment

Margin vs. Breadth Is the market showing signs of a top? Margin debt has soared to all-time highs as data from the Fed show that individuals now have the same percentage (41%) of their nancial assets allocated to stocks as at the 2007 stock market peak (but well below the 53% in early 2000). However, margin debt and the S&P 500 have tended to move together, historically, as the stock markets rise to all-time highs have lifted margin balances and stock weightings. These would be more worrisome and point to a market top if, as the S&P 500 Index continued to climb indicators of the breadth of the advance in the market, or how broad the participation among all stocks is in the gains of the index, began to decline (measured by indicators like cumulative advance decline line or number of stocks hitting new 52-week highs). Money Flow vs. Volatility In the last several months individual investors have joined corporations and started buying funds that invest in U.S. stocks after many years of net selling, based on data from the Investment Company Institute (ICI). While investors tend to chase returns, and the one-, three-, and ve-year returns of the S&P 500 all currently reect double-digit gains, investors could be spooked out of additional buying by rising volatility. Last years steady gains for stocks encouraged buying, but a bumpier ride to gains in 2014 could curtail investors recent risk appetite. There are quite a few listed here, but these certainly are not all the factors that are inuencing the markets. The key message for investors in considering these factors is: do not be too condent in any particular outcome. It is a time to nibble at opportunities as they emerge; it is not a time to jump in with both feet, or for indiscriminate selling. Investing is not a game, but it is important also to remember that forecasting is not an exact science, and many factors can affect outcomes that are hard to predict. For example: Extreme Weather and Natural Disasters The extreme winter weather in the U.S. had an impact on the economy. A few years ago the Japanese earthquake had a sizable impact and natural disastersdespite tremendous advances in technologyare very hard to predict with any degree of accuracy. Geopolitics Geopolitical outcomes can also be hard to foresee as we look to Ukraine. For example, the outcome of the Arab Spring uprisings and the changes they have led to in countries including Syria and Egypt were hard to foresee. The markets rarely offer perfect clarity on their direction because they are driven by these factors as well as many others. Even this weeks NCAA March Madness can be seen as a reminder of how it can be notoriously hard to predict winners; historically, a teams ranking has meant nothing after getting down to the elite eight. There will likely be some upsets that result in volatility and pullbacks as these factors face off against each other. In the end, we expect positive fundamentals and economic growth to win out and a potentially rewarding year for investors. n

LPL Financial Member FINRA/SIPC Page 3 of 4

W E E KLY MARKE T CO MME N TAR Y

IMPORTANT DISCLOSURES The opinions voiced in this material are for general information only and are not intended to provide specic advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your nancial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested into directly. Unmanaged index returns do not reect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results. The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Stock and mutual fund investing involves risk including loss of principal. International and emerging market investing involves special risks such as currency uctuation and political instability and may not be suitable for all investors. The Investment Company Institute (ICI) is the national association of U.S. investment companies, including mutual funds, closed-end funds, exchange-traded funds (ETFs), and unit investment trusts (UITs). Members of ICI manage total assets of $11.18 trillion and serve nearly 90 million shareholders. INDEX DESCRIPTIONS The Standard & Poors 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

This research material has been prepared by LPL Financial. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an afliate of and makes no representation with respect to such entity.

Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Member FINRA/SIPC Page 4 of 4 RES 4537 0314 Tracking #1-255530 (Exp. 03/15)

Das könnte Ihnen auch gefallen

- Weekly Market Commentary 3/18/2013Dokument4 SeitenWeekly Market Commentary 3/18/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 3-19-2012Dokument4 SeitenWeekly Market Commentary 3-19-2012monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary May 2012Dokument6 SeitenLane Asset Management Stock Market Commentary May 2012Edward C LaneNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary May 2014Dokument7 SeitenLane Asset Management Stock Market Commentary May 2014Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 03302015Dokument5 SeitenWeekly Market Commentary 03302015dpbasicNoch keine Bewertungen

- Lane Asset Management Stock Market and Economic Commentary February 2016Dokument11 SeitenLane Asset Management Stock Market and Economic Commentary February 2016Edward C LaneNoch keine Bewertungen

- Stock Market Commentary For October 2014Dokument8 SeitenStock Market Commentary For October 2014Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 6-26-2012Dokument4 SeitenWeekly Market Commentary 6-26-2012monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 4/29/2013Dokument3 SeitenWeekly Market Commentary 4/29/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary June 2012Dokument6 SeitenLane Asset Management Stock Market Commentary June 2012Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 10-10-11Dokument3 SeitenWeekly Market Commentary 10-10-11monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 4/15/2013Dokument4 SeitenWeekly Market Commentary 4/15/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary September 2015Dokument10 SeitenLane Asset Management Stock Market Commentary September 2015Edward C LaneNoch keine Bewertungen

- Stock Market Commentary November 2014Dokument7 SeitenStock Market Commentary November 2014Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 1/28/2013Dokument3 SeitenWeekly Market Commentary 1/28/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market and Economic Commentary July 2012Dokument7 SeitenLane Asset Management Stock Market and Economic Commentary July 2012Edward C LaneNoch keine Bewertungen

- Lane Asset Management Market Commentary For Q3 2017Dokument15 SeitenLane Asset Management Market Commentary For Q3 2017Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 02-21-12Dokument2 SeitenWeekly Market Commentary 02-21-12monarchadvisorygroupNoch keine Bewertungen

- Mid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesDokument4 SeitenMid-Year Outlook 2014 Abridged: Investor's Almanac Field NotesJanet BarrNoch keine Bewertungen

- Bumps On The SlopeDokument2 SeitenBumps On The SlopeJanet BarrNoch keine Bewertungen

- Spring 2014 HCA Letter FinalDokument4 SeitenSpring 2014 HCA Letter FinalDivGrowthNoch keine Bewertungen

- Stock Market Commentary June 2016Dokument10 SeitenStock Market Commentary June 2016Edward C LaneNoch keine Bewertungen

- Strategy 0518Dokument30 SeitenStrategy 0518derek_2010Noch keine Bewertungen

- BlackRock Midyear Investment Outlook 2014Dokument8 SeitenBlackRock Midyear Investment Outlook 2014w24nyNoch keine Bewertungen

- Weekly Market Commentary 3-512-2012Dokument4 SeitenWeekly Market Commentary 3-512-2012monarchadvisorygroupNoch keine Bewertungen

- Deteriorating Financial Conditions Threaten To Escalate The European Debt CrisisDokument2 SeitenDeteriorating Financial Conditions Threaten To Escalate The European Debt CrisisKevin A. Lenox, CFANoch keine Bewertungen

- The Market Downturn Is Here, Now What?Dokument3 SeitenThe Market Downturn Is Here, Now What?dpbasicNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary March 2012Dokument6 SeitenLane Asset Management Stock Market Commentary March 2012Edward C LaneNoch keine Bewertungen

- Trading Range IntactDokument8 SeitenTrading Range IntactAnonymous Ht0MIJNoch keine Bewertungen

- Ulman Financial Fourth Quarter Newsletter - 2018-10Dokument8 SeitenUlman Financial Fourth Quarter Newsletter - 2018-10Clay Ulman, CFP®Noch keine Bewertungen

- Stock Market Commentary February 2015Dokument9 SeitenStock Market Commentary February 2015Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 04132015Dokument4 SeitenWeekly Market Commentary 04132015dpbasicNoch keine Bewertungen

- Weekly Market Commentary 7-10-2012Dokument3 SeitenWeekly Market Commentary 7-10-2012monarchadvisorygroupNoch keine Bewertungen

- Q3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyDokument5 SeitenQ3 - 2015 Commentary: 5.1% and 10.3%, RespectivelyJohn MathiasNoch keine Bewertungen

- Weekly Market Commentary 4-30-12Dokument4 SeitenWeekly Market Commentary 4-30-12monarchadvisorygroupNoch keine Bewertungen

- ZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Dokument85 SeitenZacksInvestmentResearchInc ZacksMarketStrategy Mar 05 2021Dylan AdrianNoch keine Bewertungen

- Weekly Market Commentary 12/9/2013Dokument3 SeitenWeekly Market Commentary 12/9/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 11/18/2013Dokument3 SeitenWeekly Market Commentary 11/18/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary November 2011Dokument8 SeitenLane Asset Management Stock Market Commentary November 2011Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 3/25/2013Dokument5 SeitenWeekly Market Commentary 3/25/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market and Economic February 2012Dokument6 SeitenLane Asset Management Stock Market and Economic February 2012Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 6/17/2013Dokument3 SeitenWeekly Market Commentary 6/17/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 5-21-2012Dokument2 SeitenWeekly Market Commentary 5-21-2012monarchadvisorygroupNoch keine Bewertungen

- Mason Hawkins 11q3letterDokument4 SeitenMason Hawkins 11q3letterrodrigoescobarn142Noch keine Bewertungen

- Weekly Market Commentary 5/28/2013Dokument2 SeitenWeekly Market Commentary 5/28/2013monarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary For January 2017Dokument9 SeitenLane Asset Management Stock Market Commentary For January 2017Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary 02232015Dokument4 SeitenWeekly Market Commentary 02232015dpbasicNoch keine Bewertungen

- Q1 2015 Market Review & Outlook: in BriefDokument3 SeitenQ1 2015 Market Review & Outlook: in Briefapi-284581037Noch keine Bewertungen

- Bar Cap 3Dokument11 SeitenBar Cap 3Aquila99999Noch keine Bewertungen

- March Madness: Update - Spring 2017Dokument3 SeitenMarch Madness: Update - Spring 2017Amin KhakianiNoch keine Bewertungen

- Weekly Market Commentary 06-27-2011Dokument2 SeitenWeekly Market Commentary 06-27-2011Jeremy A. MillerNoch keine Bewertungen

- LPL 2014 Mid-Year OutlookDokument15 SeitenLPL 2014 Mid-Year Outlookkbusch32Noch keine Bewertungen

- Weekly Market Commentary 4/8/2013Dokument4 SeitenWeekly Market Commentary 4/8/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary: Lies, Damn Lies, and ChartsDokument4 SeitenWeekly Market Commentary: Lies, Damn Lies, and ChartsmonarchadvisorygroupNoch keine Bewertungen

- Lane Asset Management Stock Market Commentary For October 2013Dokument9 SeitenLane Asset Management Stock Market Commentary For October 2013Edward C LaneNoch keine Bewertungen

- Weekly Market Commentary: Two and ADokument2 SeitenWeekly Market Commentary: Two and Aapi-234126528Noch keine Bewertungen

- 4Q 2015 Market CommentaryDokument3 Seiten4Q 2015 Market CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- SPEX Issue 17Dokument10 SeitenSPEX Issue 17SMU Political-Economics Exchange (SPEX)Noch keine Bewertungen

- The Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsVon EverandThe Sector Strategist: Using New Asset Allocation Techniques to Reduce Risk and Improve Investment ReturnsBewertung: 4 von 5 Sternen4/5 (1)

- Outlook 2014. Investor's AlmanacDokument8 SeitenOutlook 2014. Investor's AlmanacmonarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary: Get Ready For Market Storm AngelDokument3 SeitenWeekly Market Commentary: Get Ready For Market Storm AngelmonarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary: Lies, Damn Lies, and ChartsDokument4 SeitenWeekly Market Commentary: Lies, Damn Lies, and ChartsmonarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 11/18/2013Dokument4 SeitenThe Monarch Report 11/18/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 11/18/2013Dokument3 SeitenWeekly Market Commentary 11/18/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary: Taper, No Taper, or Somewhere in Between?Dokument5 SeitenWeekly Economic Commentary: Taper, No Taper, or Somewhere in Between?monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 12/9/2013Dokument3 SeitenWeekly Market Commentary 12/9/2013monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 10/28/2013Dokument4 SeitenThe Monarch Report 10/28/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary: The One Big RiskDokument4 SeitenWeekly Market Commentary: The One Big Riskapi-234126528Noch keine Bewertungen

- Weekly Market Commentary 10/21/2013Dokument3 SeitenWeekly Market Commentary 10/21/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 11/112013Dokument5 SeitenWeekly Economic Commentary 11/112013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 9/16/2013Dokument6 SeitenWeekly Economic Commentary 9/16/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 9/30/2013Dokument4 SeitenWeekly Economic Commentary 9/30/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 10/21/2013Dokument4 SeitenWeekly Economic Commentary 10/21/2013monarchadvisorygroupNoch keine Bewertungen

- Don't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MDokument4 SeitenDon't Forget To R.S.V.P. For Our Kevin Elko Event at Cabana On October 8 at 6:00 P.MmonarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 7/29/2013Dokument5 SeitenWeekly Economic Commentary 7/29/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Forecast - Sept. 23rdDokument5 SeitenWeekly Economic Forecast - Sept. 23rdambassadorwmNoch keine Bewertungen

- Weekly Economic Commentary 9/3/2013Dokument6 SeitenWeekly Economic Commentary 9/3/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 6/11/2013Dokument3 SeitenWeekly Market Commentary 6/11/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 9/3/2013Dokument3 SeitenWeekly Market Commentary 9/3/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 8/26/2013Dokument5 SeitenWeekly Economic Commentary 8/26/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 6/3/2013Dokument6 SeitenWeekly Economic Commentary 6/3/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 6/17/2013Dokument3 SeitenWeekly Market Commentary 6/17/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 8/12/2013Dokument4 SeitenWeekly Market Commentary 8/12/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 7/1/2013Dokument4 SeitenWeekly Market Commentary 7/1/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 6/24/2013Dokument4 SeitenWeekly Market Commentary 6/24/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Economic Commentary 6/10/2013Dokument5 SeitenWeekly Economic Commentary 6/10/2013monarchadvisorygroupNoch keine Bewertungen

- Weekly Market Commentary 6/3/2013Dokument4 SeitenWeekly Market Commentary 6/3/2013monarchadvisorygroupNoch keine Bewertungen

- The Monarch Report 6/10/2013Dokument4 SeitenThe Monarch Report 6/10/2013monarchadvisorygroupNoch keine Bewertungen

- UBL Chapter 1 IntroductionDokument88 SeitenUBL Chapter 1 IntroductionMasudur Rahman0% (1)

- 130565353X 540322Dokument19 Seiten130565353X 540322blackghostNoch keine Bewertungen

- Financial Report On Pioneer CementDokument62 SeitenFinancial Report On Pioneer Cementl080082Noch keine Bewertungen

- Jay Abraham - Stealth MarketingDokument246 SeitenJay Abraham - Stealth Marketingg_anagno50% (10)

- FM QuizDokument3 SeitenFM QuizSheila Mae AramanNoch keine Bewertungen

- The Application and Impacts of Operation Research Methodologies On Financial MarketsDokument6 SeitenThe Application and Impacts of Operation Research Methodologies On Financial MarketsAnonymous lAfk9gNPNoch keine Bewertungen

- VITTA Global Asset MGMT 02.06.2017 PDFDokument20 SeitenVITTA Global Asset MGMT 02.06.2017 PDFTejpal Singh RathoreNoch keine Bewertungen

- Cgweek 2010Dokument13 SeitenCgweek 2010jef7georgeNoch keine Bewertungen

- Repo Vs Reverse RepoDokument9 SeitenRepo Vs Reverse RepoRajesh GuptaNoch keine Bewertungen

- Elements of Accountancy TermDokument12 SeitenElements of Accountancy TermSwaapnil ShindeNoch keine Bewertungen

- Capital Adequacy Analysis of Top Bangladeshi BanksDokument10 SeitenCapital Adequacy Analysis of Top Bangladeshi BanksFaysal KhanNoch keine Bewertungen

- Regression Analysis: Case Study 1: Dr. Kempthorne September 23, 2013Dokument22 SeitenRegression Analysis: Case Study 1: Dr. Kempthorne September 23, 2013Esaú CMNoch keine Bewertungen

- Notes To Margin of SafetyDokument19 SeitenNotes To Margin of SafetyTshi21100% (10)

- 1542438436593Dokument1 Seite1542438436593kushalNoch keine Bewertungen

- Hidden Financial RiskDokument50 SeitenHidden Financial RiskgandhunkNoch keine Bewertungen

- DETARRIFICATIONDokument5 SeitenDETARRIFICATIONanshushah_144850168Noch keine Bewertungen

- IHCL SUBSIDIARY Annual Report 2009 10Dokument348 SeitenIHCL SUBSIDIARY Annual Report 2009 10raman86_netNoch keine Bewertungen

- Test Business English Banking VocabularyDokument10 SeitenTest Business English Banking VocabularyTijana Doberšek Ex Živković100% (2)

- What Is MoneyDokument9 SeitenWhat Is Moneymariya0% (1)

- Industry & Distribution Business Strategy: Hiroyuki UgawaDokument22 SeitenIndustry & Distribution Business Strategy: Hiroyuki UgawacarlammartinsNoch keine Bewertungen

- Business Case - Whitegloves Janitorial ServiceDokument6 SeitenBusiness Case - Whitegloves Janitorial ServiceKimberly Rose MallariNoch keine Bewertungen

- Ifrs 1Dokument10 SeitenIfrs 1Imron SeptiadiNoch keine Bewertungen

- Effect of Taxation On Small BusinessDokument37 SeitenEffect of Taxation On Small BusinessBhanu pratap singh100% (1)

- LBO Sensitivity Tables BeforeDokument37 SeitenLBO Sensitivity Tables BeforeMamadouB100% (2)

- Estate and Trusts - Taxation 1Dokument5 SeitenEstate and Trusts - Taxation 1Ronald Nepomuceno LavaresNoch keine Bewertungen

- Justin Sayne Leather's Insanity Male Performance Brand Gains Solid Financial and Operational PartnersDokument2 SeitenJustin Sayne Leather's Insanity Male Performance Brand Gains Solid Financial and Operational PartnersPR.comNoch keine Bewertungen

- MesopotamiaDokument5 SeitenMesopotamiaAthulPaiNoch keine Bewertungen

- Barclays On Debt CeilingDokument13 SeitenBarclays On Debt CeilingafonteveNoch keine Bewertungen

- MGT401 Final Term 7 Solved Past PapersDokument71 SeitenMGT401 Final Term 7 Solved Past Paperssweety67% (3)

- Capital Account ConvertabilityDokument3 SeitenCapital Account Convertabilitydisha_11_89Noch keine Bewertungen