Beruflich Dokumente

Kultur Dokumente

Follow The Magical Accounting Rules

Hochgeladen von

OchenilogbeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Follow The Magical Accounting Rules

Hochgeladen von

OchenilogbeCopyright:

Verfügbare Formate

Follow the Magical Accounting Rules

To make sure that financial statements are easy to understand, there is a set of rules and practices that is established, which is known as the generally accepted accounting principles (GAAP). This has been developed to provide a basic guideline for the rules of accounting because I think its fair to say that it can get confusing at times. There are a lot of variations to the meaning so here is the best answer. Its the generally accepted accounting rules and procedures that are necessary to define accounting practice. Basically its a set of theories that accountants come to accept, and there are always controversies with some methods between accountants like any other field of study. Accounting is a discipline that is always growing and changing so its a good idea to keep up to date with all of the trends that are going on. Since the management prepares the financial statements of a company it is possible that a financial statement can be altered to give a company a particular boost. So, thats why the companies that sell their ownership to the public needs to get their financial statements audited by a public certified accountant. A certified public accountant (CPA) are licensed through the sate for the same e act reason lawyers and doctors are, so they and protect the public by providing the highest !uality of professional service possible. The reason why "#As are used is because they have no connection with the company and are independent. They have $ero financing ties with the company. Some firms that employ a lot of certified public accountants include %eloitte & Touch http://www deloitte co!, '#() http://www us "p!g co!/inde# asp, and #ricewaterhouse"oopers http://www pwcglobal co!/ An accountant with no strings attached or is independent commonly performs an audit, which is evaluating a companies financial statements, product, accounting systems, and records. The main purpose of an audit is to make sure that the financial statements have been properly prepared according to the e cepted accounting rules. 'eep in mind* since accounting is not a precise science it has room for interpretation according to the )A##. +owever, that doesnt mean that the accountants report should contain substantial errors in the financial report, but more like that for the most report it is reliable for creditors to take a look at. An accountant can make a decision only when the financial statements conform to the guidelines of )AA#. In the past creditors, banks, and investors tend to favor an auditor when they are deciding to invest in a company or give loans, because of their independence. The individualistic audit is an e tremely crucial factor in the growth of financial markets internationally. Also, many organi$ations can directly or indirectly influence a )AA#. The ,inancial Accounting $tandards %oard (FA$%) http://www fasb org/ is the most critical body for the development and issuing of rules on accounting practice. The website I previously listed is e tremely critical and you can attend seminars online for no cost, and also stay up to date with the rules. This independent body issues the Statements of ,inancial Accounting Standards. -e t, the A!erican &nstitute of Certified Public Accountants (A&CPA) http://www aicpa org/inde# ht! is the official professional association for certified accountants. Its the largest "#A organi$ation that e ists in America and heavily influence accounting practices through its senior committees. The Securities and . change "ommission is the agency of the federal government that legally has the power to set and e ecute accounting practices for companies that sell security to the public, and it has a large impact on accounting practice. -e t, the go'ern!ental accounting

standard (GA$%) http://www gasb org/ is critical for accounting because its main /ob is to issue the standards for accounting to the local and state governments in the 0nited States. +owever, a lot of these organi$ations are focused on the rules in regulations in the 0nited States. There are a lot of businesses and accountants internationally so thats why the &nternational Accounting $tandard %oard http://www iasb org/ (&A$%) was formed. It was approved by more then 12 international agencies. The 0.S laws that analy$e the revenues for the cost of operating a business can also affect accounting practice. Its no !uestion that the ma/or provider for income for the government comes from income ta . The income ta rules are heavily applies by the &nternal Re'enue $er'ice (&R$) http://www irs go'/. Sometimes these rules actually cause a conflict with the accepted rules of accounting. A lot of businesses use accounting practices because its a re!uirement by ta law. Also, companies can use the rules of ta law to their advantage financially. Accounting also has laws of conduct for profession, and one e tremely important one is ethics. A nice website dealing with the issues of ethics is http://www ethics org/

It touches bases on !uestions that help determine if something is either right or wrong, and is based on moral decisions. (ost people are faced with several ethical issues each day and, and some ethical activities could be on the range of illegal. If a business decides to use false or misleading advertising, or to bribe customers into giving them testimonials for a specific product, then they could be acting in an unethical manner. The ethics of a company could also be a result of the employees so thats why its always a good idea to run a background check of who you are hiring, whether its online or offline. Professional ethics is the guidelines that apply to the conduct of individuals of a certain profession. Similar to the ethical actions of a company, the ethical actions of an individual is a decision. As being a member of an organi$ation, accountants have to take the responsibility not only to their customers and employers, but also to the general public to act in the greatest ethical way possible. Accountants are very good at following professional ethics because they are the second professional group as having the largest ethical standards, with clergy being the highest, no surprises about that one. It is important for individuals who decide to become an accountant to have the highest levels of professionalism as possible. To enforce that its prestigious members are following the rules, the AI"#A along with each state have adopted some codes of professional conduct that certified public accountants have to follow. Some simple rules are being responsible to the people that depend on the trust of accountants, such as creditors and investors. 3hen working with people the accountant must act with integrity which means that they are honest, and the individuals gain from the visit with the accountant. The accountant must display ob/ectivity which means that they are intellectually honest, and they must remain independent which means that they must avoid any relationship with the business or individual because it will damage the accountants principles.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Right To TravelDokument2 SeitenRight To TravelGETTO VOCAB100% (8)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Patrick Gray & John D. Cox - Shakespeare and Renaissance EthicsDokument322 SeitenPatrick Gray & John D. Cox - Shakespeare and Renaissance EthicsEveraldo TeixeiraNoch keine Bewertungen

- Further White Estate Lawsuit Negotiation CorrespondenceDokument16 SeitenFurther White Estate Lawsuit Negotiation CorrespondenceDanielBabylone100% (1)

- MGP7708 - Shadizar - City of WickednessDokument182 SeitenMGP7708 - Shadizar - City of WickednessSingham123100% (7)

- The Roots of The Filipino People: The EpilogueDokument16 SeitenThe Roots of The Filipino People: The EpilogueSteve B. Salonga100% (1)

- Homeopathic Materia Medica Vol 1Dokument259 SeitenHomeopathic Materia Medica Vol 1LotusGuy Hans100% (3)

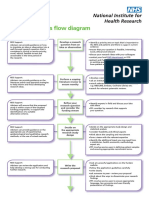

- Research Process Flow Chart A4 WebDokument2 SeitenResearch Process Flow Chart A4 WebEma FatimahNoch keine Bewertungen

- Keogh ComplaintDokument5 SeitenKeogh ComplaintWIS Digital News StaffNoch keine Bewertungen

- Book Review The Wealth of NationDokument2 SeitenBook Review The Wealth of NationFaizan Shaikh100% (1)

- Jurisprudence Notes - Nature and Scope of JurisprudenceDokument11 SeitenJurisprudence Notes - Nature and Scope of JurisprudenceMoniruzzaman Juror100% (4)

- Key Term COGNITIVE THEORY AND THERAPYDokument24 SeitenKey Term COGNITIVE THEORY AND THERAPYAimar SyazniNoch keine Bewertungen

- C.F. Sharp Crew Management, Inc. v. Espanol, Jr. (2007)Dokument18 SeitenC.F. Sharp Crew Management, Inc. v. Espanol, Jr. (2007)Kriszan ManiponNoch keine Bewertungen

- Ramos vs. Court of Appeals: in Cases Where The Res Ipsa Loquitur Is Applicable, The Court Is Permitted ToDokument4 SeitenRamos vs. Court of Appeals: in Cases Where The Res Ipsa Loquitur Is Applicable, The Court Is Permitted ToCourtney TirolNoch keine Bewertungen

- Atlantic Council and Burisma Sign Cooperation AgreementDokument3 SeitenAtlantic Council and Burisma Sign Cooperation AgreementDSU Deep State UnveiledNoch keine Bewertungen

- Caraan Vs CA (G.R. No. 140752)Dokument12 SeitenCaraan Vs CA (G.R. No. 140752)MaryNoch keine Bewertungen

- Stanford Encyclopedia of Philosophy: Virtue EthicsDokument22 SeitenStanford Encyclopedia of Philosophy: Virtue EthicsCarlos SchoofNoch keine Bewertungen

- Shahnama 09 FirduoftDokument426 SeitenShahnama 09 FirduoftScott KennedyNoch keine Bewertungen

- b00105047 Posthuman Essay 2010Dokument14 Seitenb00105047 Posthuman Essay 2010Scott Brazil0% (1)

- Building Partnership and Linkages: Youth Formation DivisionDokument35 SeitenBuilding Partnership and Linkages: Youth Formation DivisionLeven Mart LacunaNoch keine Bewertungen

- NOSTALGIA - Grandma's Fridge Is Cool - Hemetsberger Kittiner e MullerDokument24 SeitenNOSTALGIA - Grandma's Fridge Is Cool - Hemetsberger Kittiner e MullerJúlia HernandezNoch keine Bewertungen

- Business Ethics: Felix M. Del Rosario, Cpa, MbaDokument38 SeitenBusiness Ethics: Felix M. Del Rosario, Cpa, Mbafelix madayag del rosarioNoch keine Bewertungen

- A Poem For Cotton PickersDokument4 SeitenA Poem For Cotton Pickersapi-447987846Noch keine Bewertungen

- Online Training of Trainers' (Tot) /walkthrough of Modules ScheduleDokument5 SeitenOnline Training of Trainers' (Tot) /walkthrough of Modules ScheduleJames Domini Lopez LabianoNoch keine Bewertungen

- Matthew 6Dokument32 SeitenMatthew 6Maui Severino LicarosNoch keine Bewertungen

- COMPARATIVE PUBLIC LAW and Research Methedology Assignment PDFDokument2 SeitenCOMPARATIVE PUBLIC LAW and Research Methedology Assignment PDFKARTHIK A0% (1)

- Sadness Quotes - TourDokument10 SeitenSadness Quotes - TourSanjay KattelNoch keine Bewertungen

- Warriors Dont CryDokument5 SeitenWarriors Dont Cryapi-252730671Noch keine Bewertungen

- CASE STUDY 2 - Group 8Dokument1 SeiteCASE STUDY 2 - Group 8Jhia TorreonNoch keine Bewertungen

- wp1 5Dokument5 Seitenwp1 5api-599286347Noch keine Bewertungen

- Vs Indsoc 04 Better SocietyDokument2 SeitenVs Indsoc 04 Better Societyapi-377276404Noch keine Bewertungen