Beruflich Dokumente

Kultur Dokumente

Revision Accounting

Hochgeladen von

David Williams0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten1 SeiteWeek 6 time value of money Looked at a company - separation of ownership re owners (SHs) and managers. Week 7 coupon payments - Calculating PV of cash flows from coupons, and face value at maturity (2 separate streams of CFs) Week 8 Valuing securities - stocks bonds (Week 7) mature, stocks do not risk of debt vs. Equity Primary vs secondary market for stocks bond market characteristics: various e.g. IPOs, secondary sale of shares on

Originalbeschreibung:

Originaltitel

revision accounting

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenWeek 6 time value of money Looked at a company - separation of ownership re owners (SHs) and managers. Week 7 coupon payments - Calculating PV of cash flows from coupons, and face value at maturity (2 separate streams of CFs) Week 8 Valuing securities - stocks bonds (Week 7) mature, stocks do not risk of debt vs. Equity Primary vs secondary market for stocks bond market characteristics: various e.g. IPOs, secondary sale of shares on

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

18 Ansichten1 SeiteRevision Accounting

Hochgeladen von

David WilliamsWeek 6 time value of money Looked at a company - separation of ownership re owners (SHs) and managers. Week 7 coupon payments - Calculating PV of cash flows from coupons, and face value at maturity (2 separate streams of CFs) Week 8 Valuing securities - stocks bonds (Week 7) mature, stocks do not risk of debt vs. Equity Primary vs secondary market for stocks bond market characteristics: various e.g. IPOs, secondary sale of shares on

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

24/10/2013

Week 6 Time value of money

Looked at a company

separation of ownership re owners (SHs) and managers Types of funding: liability vs. equity (adv. vs. disadv.)

AFX9590 Accounting and Finance for International Managers

Revision: Weeks 6 - 9

Future value Present value Perpetuities

= + +

Annuities

Valuing securities - bonds

Coupon payments

Calculating PV of cash flows from coupons, and face value at maturity (2 separate streams of CFs)

Week 8 Valuing securities - stocks

Bonds (Week 7) mature, stocks do not Risk of debt vs. equity Primary vs secondary market for stocks Stock market characteristics: various e.g. IPOs, secondary sale of shares on stock market; Bid (buyers) ask (seller) Market measures: market capitalisation, EPS, P/E ratio, dividend yield Price and intrinsic value = PV of cash payoffs anticipated by the investor in stock

At each point in time securities with the same risk should offer the same return regardless of being a stock or bond

= +

Zero coupon bonds

No payments received before maturity

Types of bonds: Government, semi-government, corporate

Default rates on corporate bonds

Value of bonds: coupon rate vs. yield (important**) Holding period return calculations Yield curves Interest rates and inflation

Week 8 continued (Valuing stock)

Dividend discount model (no growth):

=

Week 9 Capital budgeting

Net present value How to choose between projects

Equivalent annual annuity for machines with different lives (EAA) Payback rule (how long to recover initial investments) IRR what would be the discount rate if NPV equals zero not useful for mutually exclusive projects. Can give conflicting accept/reject with NPV Profitability index (PI) NPV / initial investment Higher result better Incremental cash flows e.g. Sony playstation 4 release will impact Sony playstation 3 cash flows

Constant growth dividend discount model:

=

Non-constant growth: 3 step model

Work out PV expected dividends for set future period Estimate stock price at end of dividend period Take the future estimated stock price and bring it back to a PV and add in the PV of the dividend stream

Das könnte Ihnen auch gefallen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Ch11-Valuation of SecuritiesDokument94 SeitenCh11-Valuation of SecuritiesRaiHan AbeDinNoch keine Bewertungen

- Valuation of Financial Assets Stocks (Equity) : Business Finance 1Dokument23 SeitenValuation of Financial Assets Stocks (Equity) : Business Finance 1Fahad NaeemNoch keine Bewertungen

- Finance 301 Learning Objectives by Chapter Chapter 1: IntroductionDokument7 SeitenFinance 301 Learning Objectives by Chapter Chapter 1: Introductionhughng92Noch keine Bewertungen

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDokument118 SeitenInvestment Analysis and Portfolio Management: Lecture Presentation SoftwarekegnataNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument122 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownWhy you want to knowNoch keine Bewertungen

- Sessions 28, 29 and 30Dokument23 SeitenSessions 28, 29 and 30Deedra ColeNoch keine Bewertungen

- Benchmarking: Efficiency, and Financial Leverage in Achieving An ROE Figure. For Example, A FirmDokument8 SeitenBenchmarking: Efficiency, and Financial Leverage in Achieving An ROE Figure. For Example, A FirmDavidHooNoch keine Bewertungen

- Mutual Funds: Vishal Aggarwal MBA Class of 2007Dokument27 SeitenMutual Funds: Vishal Aggarwal MBA Class of 2007suruchibhasinNoch keine Bewertungen

- 92c8mutual FundsDokument19 Seiten92c8mutual FundsAfroz MalikNoch keine Bewertungen

- Balance Sheet Analysis ConceptsDokument34 SeitenBalance Sheet Analysis ConceptsPrathamesh Deo100% (1)

- ACFI1003 - Topic 8 Investors and The Share MarketDokument48 SeitenACFI1003 - Topic 8 Investors and The Share Marketshotboi69Noch keine Bewertungen

- Financial Accounting ppt02Dokument31 SeitenFinancial Accounting ppt02Bikanair BikanairNoch keine Bewertungen

- Valuation of P&M - 240920Dokument24 SeitenValuation of P&M - 240920MANNAVAN.T.NNoch keine Bewertungen

- Finanacial Statements: Balance Sheet & Profit and Loss AccountDokument26 SeitenFinanacial Statements: Balance Sheet & Profit and Loss AccountAshok SeerviNoch keine Bewertungen

- Session 2 Review of AccountingDokument39 SeitenSession 2 Review of AccountingMargaretta LiangNoch keine Bewertungen

- CF Unit 4Dokument37 SeitenCF Unit 4Saravanan ShanmugamNoch keine Bewertungen

- Part - 3 - Application1 - Equity ValuationDokument35 SeitenPart - 3 - Application1 - Equity Valuationts wNoch keine Bewertungen

- Finanacial Statements: Balance Sheet & Profit and Loss AccountDokument26 SeitenFinanacial Statements: Balance Sheet & Profit and Loss AccountRichard AustinNoch keine Bewertungen

- Chapter 6 - Bond Valuation and Interest RatesDokument113 SeitenChapter 6 - Bond Valuation and Interest RatesAnastasia Retno Pratiwi100% (1)

- CH 06Dokument73 SeitenCH 06Sarang AdgokarNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument118 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownseptaritaNoch keine Bewertungen

- FIN2004 Midterm Cheat Sheet PDFDokument4 SeitenFIN2004 Midterm Cheat Sheet PDFPeixuan Zhuang100% (1)

- (A) Introduction To Financial Management (B) Financial Reporting (C) Financial AnalysisDokument17 Seiten(A) Introduction To Financial Management (B) Financial Reporting (C) Financial Analysisazim919Noch keine Bewertungen

- Valuation Mergers and AcquisitionDokument41 SeitenValuation Mergers and AcquisitionSubrahmanya Sringeri100% (1)

- Stock and Their Valuation: Melziel A. Emba Far Eastern University - ManilaDokument40 SeitenStock and Their Valuation: Melziel A. Emba Far Eastern University - ManilaJOHN PAOLO EVORANoch keine Bewertungen

- 5910 Final RevisionDokument4 Seiten5910 Final RevisionFiona ShenNoch keine Bewertungen

- Working NotesDokument9 SeitenWorking NotesShekhar PanseNoch keine Bewertungen

- Financial Management 1Dokument63 SeitenFinancial Management 1geachew mihiretuNoch keine Bewertungen

- Cost of CapitalDokument42 SeitenCost of CapitalsonjoyNoch keine Bewertungen

- Asset Liability ManagementDokument32 SeitenAsset Liability ManagementAshish ShahNoch keine Bewertungen

- Corporate FinanceDokument16 SeitenCorporate FinanceBot RiverNoch keine Bewertungen

- Dividend Policy and Firm ValueDokument40 SeitenDividend Policy and Firm ValueDamilola iloriNoch keine Bewertungen

- BE300 Lecture 5Dokument31 SeitenBE300 Lecture 5Rafan AhmedNoch keine Bewertungen

- Chapter 3 Stock ValuationDokument51 SeitenChapter 3 Stock ValuationJon Loh Soon Weng50% (2)

- TVM, Valuation, Risk and ReturnDokument23 SeitenTVM, Valuation, Risk and ReturnSreenivasan PadmanabanNoch keine Bewertungen

- The Role of The Financial Manager: (Topic 1)Dokument19 SeitenThe Role of The Financial Manager: (Topic 1)Tarique AnwerNoch keine Bewertungen

- Fundamental Analysis SeminarDokument18 SeitenFundamental Analysis SeminarAndrew WangNoch keine Bewertungen

- Topic 1 - Investment BackgroundDokument40 SeitenTopic 1 - Investment BackgroundManh TranNoch keine Bewertungen

- Lecture 1 The Investment EnvironmentDokument43 SeitenLecture 1 The Investment Environmentnoobmaster 0206Noch keine Bewertungen

- Share ValuationDokument52 SeitenShare ValuationMinato UzumakiNoch keine Bewertungen

- Selection of Stocks Fundamental and Technical AnalysisDokument52 SeitenSelection of Stocks Fundamental and Technical AnalysisKartikyaNoch keine Bewertungen

- Investment and Portfolio Management: ACFN 3201Dokument16 SeitenInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNoch keine Bewertungen

- Corporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementDokument39 SeitenCorporate Financing Decision (MFIN 641) Mba V Term Kathmandu University School of ManagementSichen UpretyNoch keine Bewertungen

- Chapter 4: The Valuation of Long-Term Securities: - Study ObjectivesDokument5 SeitenChapter 4: The Valuation of Long-Term Securities: - Study ObjectivesUsman FazalNoch keine Bewertungen

- FN1024 Chapter 7 PDF RevDokument34 SeitenFN1024 Chapter 7 PDF Revduong duongNoch keine Bewertungen

- CF Unit 2Dokument30 SeitenCF Unit 2Saravanan ShanmugamNoch keine Bewertungen

- Week 11-12 - Stock Valuation - INF516 InvestmentsDokument66 SeitenWeek 11-12 - Stock Valuation - INF516 InvestmentshuguesNoch keine Bewertungen

- Law On Corporate Finance Module IDokument50 SeitenLaw On Corporate Finance Module ISrinibashNoch keine Bewertungen

- Ugc Net Mang Unit5Dokument74 SeitenUgc Net Mang Unit5santosh kumarNoch keine Bewertungen

- An Introduction To Equity ValuationDokument37 SeitenAn Introduction To Equity ValuationAamir Hamza MehediNoch keine Bewertungen

- Financial Management I: Session 3, 4 & 5Dokument26 SeitenFinancial Management I: Session 3, 4 & 5Harshit MaheshwariNoch keine Bewertungen

- Session 18Dokument38 SeitenSession 18MokshitNoch keine Bewertungen

- Finance FinalDokument16 SeitenFinance FinalHOO VI YINGNoch keine Bewertungen

- Sem in Finance-Notes To Final Exam Readings Part 2Dokument82 SeitenSem in Finance-Notes To Final Exam Readings Part 2hantrankha75Noch keine Bewertungen

- International Capital Market Case Study - Part 1. Basic Knowledge of Capital MarketDokument27 SeitenInternational Capital Market Case Study - Part 1. Basic Knowledge of Capital Marketmanojbhatia1220Noch keine Bewertungen

- Financial Theory and Corporate Policy: Fourth EditionDokument16 SeitenFinancial Theory and Corporate Policy: Fourth EditionK59 Lai Hoang SonNoch keine Bewertungen

- Adex 58K Special Topics in Finance: Valuation - Theory and PracticeDokument11 SeitenAdex 58K Special Topics in Finance: Valuation - Theory and PracticeKivanc GocNoch keine Bewertungen

- Financial Accounting and Reporting Study Guide NotesVon EverandFinancial Accounting and Reporting Study Guide NotesBewertung: 1 von 5 Sternen1/5 (1)

- CA IPCC Inter Income Tax Revision - Kalpesh Classes PDFDokument61 SeitenCA IPCC Inter Income Tax Revision - Kalpesh Classes PDFSandra MaloosNoch keine Bewertungen

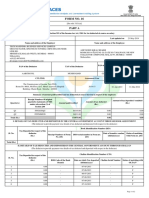

- Form No. 16: Part ADokument2 SeitenForm No. 16: Part AasifNoch keine Bewertungen

- Peralta v. QuimpoDokument1 SeitePeralta v. QuimpoMigz DimayacyacNoch keine Bewertungen

- General AnnuityDokument22 SeitenGeneral AnnuityJomel RositaNoch keine Bewertungen

- Coal Mines Pension SchemeDokument15 SeitenCoal Mines Pension SchemeK_Hrusheekesh__2697100% (1)

- Reliance Jio Infocomm Limited Annual ReportDokument34 SeitenReliance Jio Infocomm Limited Annual Reportrohit0000000Noch keine Bewertungen

- Winter 2014, CISC101, Assignment 1Dokument2 SeitenWinter 2014, CISC101, Assignment 1qingmui100% (1)

- Venture Capital AssignmentDokument10 SeitenVenture Capital Assignmentraveena_jethaniNoch keine Bewertungen

- Homework Chapter 12Dokument28 SeitenHomework Chapter 12Trung Kiên NguyễnNoch keine Bewertungen

- RICH vs. PALOMADokument4 SeitenRICH vs. PALOMAMervin ManaloNoch keine Bewertungen

- June PayslipDokument1 SeiteJune PayslipObineni MadhusudhanNoch keine Bewertungen

- Functions of RbiDokument4 SeitenFunctions of RbiMunish PathaniaNoch keine Bewertungen

- 001 - PPT On BLRC Report1Dokument51 Seiten001 - PPT On BLRC Report1Ganesan RamanNoch keine Bewertungen

- Modern Institute of Technology & Research Centre Alwar (Raj.)Dokument21 SeitenModern Institute of Technology & Research Centre Alwar (Raj.)Pushpendra KumarNoch keine Bewertungen

- NRDA NOC Received For A FileDokument2 SeitenNRDA NOC Received For A FileMuktesh SwamyNoch keine Bewertungen

- Financial Ratio Analysis of HealthsouthDokument11 SeitenFinancial Ratio Analysis of Healthsouthfarha tabassumNoch keine Bewertungen

- A Study of Financial Performance: A Comparative Analysis of Axis and ICICI BankDokument9 SeitenA Study of Financial Performance: A Comparative Analysis of Axis and ICICI BankUsman KulkarniNoch keine Bewertungen

- Eco ProjectDokument14 SeitenEco ProjectBhumika MistryNoch keine Bewertungen

- Cotract Costing Project TopicDokument17 SeitenCotract Costing Project TopicShravani Shrav100% (1)

- PAS 36 Impairment of AssetsDokument3 SeitenPAS 36 Impairment of AssetsRia GayleNoch keine Bewertungen

- Income Tax PlainingDokument57 SeitenIncome Tax PlainingrohitNoch keine Bewertungen

- CH 11Dokument34 SeitenCH 11PetersonNoch keine Bewertungen

- CONDOMINIUM NOTES Atty. DomingoDokument2 SeitenCONDOMINIUM NOTES Atty. Domingothalia alfaroNoch keine Bewertungen

- Ch02 Mini CaseDokument5 SeitenCh02 Mini CaseJosé Augusto BernabéNoch keine Bewertungen

- Trial BalanceDokument15 SeitenTrial BalanceMercy NamboNoch keine Bewertungen

- Upwork FinancialDokument19 SeitenUpwork FinancialVvb SatyanarayanaNoch keine Bewertungen

- Financing Current AssetsDokument9 SeitenFinancing Current Assetspbelim100% (1)

- Intrebari Model Test Engleza ID, Anul II, CIG, FEAA, IASI PDFDokument6 SeitenIntrebari Model Test Engleza ID, Anul II, CIG, FEAA, IASI PDFGabriela LunguNoch keine Bewertungen

- Section 4 - Joint and Solidary ObligationsDokument10 SeitenSection 4 - Joint and Solidary ObligationsExequielCamisaCrusperoNoch keine Bewertungen

- Fundamental Concepts and Tools of Business FinanceDokument19 SeitenFundamental Concepts and Tools of Business FinanceMafe Marquez91% (11)