Beruflich Dokumente

Kultur Dokumente

Economic Outlook and Indicators - Banking Sector - January 2014

Hochgeladen von

Policy and Management Consulting GroupCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Economic Outlook and Indicators - Banking Sector - January 2014

Hochgeladen von

Policy and Management Consulting GroupCopyright:

Verfügbare Formate

Outlook and Indicators

www.pmcg-i.com

Issue #21

Economic

EEEEEBanking Sector - 2013

19.03.2014

In January 2014, the indicator of the volume of loans exceeds (21.6%) to the corresponding indicator in January 2013. The weighted average interest rate on loans decreased (1 percentage point) and equals 18.4%. In January 2014, the indicator of the volume of deposits exceeds(21.0%) to the corresponding indicator in January 2013. In the mentioned period, the weighted average interest rate on deposits decreased (2.4 percentage points) and equals 6.2%. In 2013, compared to 2012, the profit of the commercial banks increased by 255 mln.GEL and equals 389 mln.GEL.

Deposits and its growth rate

12000 10000 8000

mln.GEL

35% 30% 25% 20%

6000 15% 4000 2000 0

May May 2011 Jan 2012 Jan 2013 Jan May 2014 Jan March March March Oct Oct Apr Apr July July Apr Sept Sept July Sept Aug Nov Aug Nov Aug Oct Jun Jun Jun Nov Dec Dec Dec Feb Feb Feb

10% 5% 0%

Deposits in National Currency (left)

Deposits in Foreign Currency (left)

Deposits Growth Rate (compared to the previous year) (right)

In January 2014, the indicator of deposits exceeds (21%) the corresponding indicator in January 2013. Both, the indicators of the volume of deposits denominated in GEL (27.0%) as well as in foreign currency increased (17.6%). The share of deposits denominated in foreign currency (62.0%) still exceeds to the share of deposits denominated in GEL (38.0%), but it is 1.8 percentage points lower than the indicator of January 2013 (63.8%). This points to the increase of the level of larization, which on its turn is a significant determinant for the implementation of the effective Monetary Policy and its impact on the economy. In January 2014, the weighted average interest rate on deposits is 6.2%, which is 2.4 percentage points lower than the corresponding indicator in January 2013. Besides, the interest rate on National currency denominated deposits reduced by 2.6 percentage points and equals 8.8% and on foreign currency denominated deposits reduced by 2.4 percentage point and equals 5.3%.

Monthly Dynamics of loans to the National Economy

10000 9000 8000 7000

mln.GEL

In January 2014, the indicator of the loans to the national economy exceeds (21.6%) the corresponding indicator in January 2013. The share of the loans to both, individuals as well as to legal entities increased (31.8%; 13.8%). In this period, the highest shares of the loans to National economy are for Trade (45.1%), Industry (17.4%) and Construction (8.1%) sectors. The share of consumer loans in total loans to individuals is 38.2% and the share of the loans secured by the real estate in total loans to individuals is 44.1%. In January 2014, the weighted average interest rate on loans is 18.4%. This indicator is 1 percentage point lower than the indicator of January 2013. The interest rate on National currency denominated loans reduced by 1.5 percentage point and equals 21.0%. The interest rate on foreign currency denominated loans reduced by 2.4 percentage point and equals 12.9%.

Dynamics of NPLs and its share in total loans

1000 900 800 700

m ln.GEL

Deposits growth rate (%)

35% 30% 25% 20% 15% 10% 5% 0%

2011 Jan 2012 Jan 2013 Jan Jun Jun March March March July July Jun May May May Aug Aug July Sept Sept Aug Sept Feb Feb Dec Nov Nov Dec Feb Oct Oct Apr Apr Apr Oct

6000 5000 4000 3000 2000 1000 0

Loans of Legal Entities (left)

Loans of Individuals (left)

Growth rate of Loans (compared to the previous year) (right)

14% 12% 10% 8% 6% 4% 2% 0%

Share,%

600 500 400 300 200 100 0

The share of the non-performing loans in total loans is an important indicator for determining the quality of the loan portfolio. In January 2014, the volume of NPLs decreased (-3.9%). Thus, the share of NPLs in total loans (9.6%) decreased by 2.0 percentage point (7.6%). In January 2014, 50.0% of non-performing loans is covered by the special reserves.

NPLs (left)

Share of NPLs in total loans (left)

Loans growth rate (%)

Outlook and Indicators

www.pmcg-i.com Issue #21

M19.03.2014

Economic

EEBanking Sector - 2013

250

The dynamic of the loans on agriculture, hotels and restaurants and financial intermediation

In January 2014, the indicator of loans on agriculture exceeds (167.3%) the corresponding indicator in January 2013. The volume of loans on hotels and restaurants and financial intermediation also increased significantly (129.3%; 467.7%). The increase of the loans to these sectors reflected on the growth of the mentioned sectors. According to the indicator of the first three quarters of real GDP 2013, agriculture increased by 9.0%, hotels and restaurants by 3.1% and financial intermediation by 7.6%.

200

150

mln.GEL

100

50

0

2011 Jan 2012 Jan 2013 Jan 2014 Jan Sept Sept March March March Sept Feb Feb July July Feb July Aug Aug Dec Dec Aug Jun Jun Jun May May May Nov Nov Nov Dec Oct Oct Apr Apr Apr Oct

Agriculture

Hotels and restaurants

Financial Intermediation

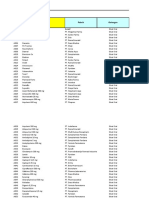

Financial Aggregates of the Commercial Banks' Activities

3000 2500 2000

mln.GEL

1500 1000 500 0 -500 2007 2008 Incomes 2009 2010 Expenses 2011 2012 Net Profit 2013

In 2013, compared to 2012, the profit of the commercial banks increased by 255 mln.GEL and achieved 389 mln. GEL. In 2013, the incomes of the commercial banks increased (13.1%, 281 mln.GEL). Non-Interest Income (Fees and Commissions, Net Gains/Losses from Currency Conversion Operations, Net Gains/Losses from Securities Trading, Other Non-Interest Income) and incomes from loans to households also increased significantly (23.3%, 149 mln. GEL; 20.9%, 148 mln.GEL). In 2013, the expenses of the commercial banks increased slightly (1.1%, 22 mln.GEL). In January 2014, the indicator of return on equity (ROE) is 15.1% and exceeds the corresponding indicator in January 2013 (6.4%).

Basic Economic Indicators

Nominal GDP in current prices (mln USD)

Per capita GDP (USD) GDP real growth, percent Consumer Price Index Foreign Direct Investment (USD) Unemployment Rate External Public Debt (mln USD) Poverty Level

III12

4156.1 924.1

7.50%

IV12

4367.6

2012

15 846.8 3 523.4 6.2% 99.1

I 13*

3487.6

II 13*

3958.4 882.8 1.5%

III 13*

4120.3 918.9 1.4%

IV 13*

2013

Contact Information

971.1

2.80%

777.8

2.40%

PMCG Research

99.5

195.4

-

181

911.6 15% 4357.1 9.7%

226.2

Tamar Jugheli

E-mail: research@pmcg.ge

www.pmcg-i.com E-mail: t.jugheli@pmcg.ge T: (+995) 2 921171

232.4

238.7

217.1

914.4

4202

Source:

National Statistics Office of Georgia, Ministry of Finance of Georgia, National Bank of Georgia

*projected

-2-

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Navigating The EU Integration ProcessDokument1 SeiteNavigating The EU Integration ProcessPolicy and Management Consulting GroupNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Media Announcement - Sharing Experience of Public-Private Dialogue in EU Integration Process For Moldova and GeorgiaDokument2 SeitenMedia Announcement - Sharing Experience of Public-Private Dialogue in EU Integration Process For Moldova and GeorgiaPolicy and Management Consulting GroupNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Press ReleaseDokument1 SeitePress ReleasePolicy and Management Consulting GroupNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Economic Outlook and Indicators - Tax Revenues - January - August 2013Dokument2 SeitenEconomic Outlook and Indicators - Tax Revenues - January - August 2013Policy and Management Consulting GroupNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Economic Outlook and Indicators - Tax Revenues - July 2013Dokument2 SeitenEconomic Outlook and Indicators - Tax Revenues - July 2013Policy and Management Consulting GroupNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Low Voltage Fixed and Automatic Power Factor Correction SystemsDokument6 SeitenLow Voltage Fixed and Automatic Power Factor Correction Systemszabiruddin786Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Women and International Human Rights Law PDFDokument67 SeitenWomen and International Human Rights Law PDFakilasriNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Trane Air Cooled Scroll Chillers Installation Operation MaintenanceDokument276 SeitenTrane Air Cooled Scroll Chillers Installation Operation MaintenanceBay Mưa100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Indirect Current Control of LCL Based Shunt Active Power FilterDokument10 SeitenIndirect Current Control of LCL Based Shunt Active Power FilterArsham5033Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- ReferensiDokument4 SeitenReferensiyusri polimengoNoch keine Bewertungen

- Cisco - Level 45Dokument1 SeiteCisco - Level 45vithash shanNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Installation Manual: 1.2 External Dimensions and Part NamesDokument2 SeitenInstallation Manual: 1.2 External Dimensions and Part NamesSameh MohamedNoch keine Bewertungen

- Factors That Contribute To Successful BakingDokument8 SeitenFactors That Contribute To Successful BakingErrol San Juan100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Dynamic Stretching - Stability - Strength.570239Dokument2 SeitenDynamic Stretching - Stability - Strength.570239Sylvia GraceNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Meng Mammogram JulDokument4 SeitenMeng Mammogram JulLivia MillNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Soft Tissue SarcomaDokument19 SeitenSoft Tissue SarcomaEkvanDanangNoch keine Bewertungen

- Data Obat VMedisDokument53 SeitenData Obat VMedismica faradillaNoch keine Bewertungen

- Research Activity #2Dokument2 SeitenResearch Activity #2Shania GualbertoNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- MINUZA Laptop Scheme Programs ThyDokument9 SeitenMINUZA Laptop Scheme Programs Thyanualithe kamalizaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- T W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaDokument6 SeitenT W H O Q L (Whoqol) - Bref: Skrócona Wersja Ankiety Oceniającej Jakość ŻyciaPiotrNoch keine Bewertungen

- ZL Ap381Dokument10 SeitenZL Ap381micyNoch keine Bewertungen

- PYMS Is A Reliable Malnutrition Screening ToolsDokument8 SeitenPYMS Is A Reliable Malnutrition Screening ToolsRika LedyNoch keine Bewertungen

- Plastic Omnium 2015 RegistrationDokument208 SeitenPlastic Omnium 2015 Registrationgsravan_23Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- OBESITY - Cayce Health DatabaseDokument4 SeitenOBESITY - Cayce Health Databasewcwjr55Noch keine Bewertungen

- Cuts of BeefDokument4 SeitenCuts of BeefChristopher EnriquezNoch keine Bewertungen

- BlahDokument8 SeitenBlahkwood84100% (1)

- 3 14 Revision Guide Organic SynthesisDokument6 Seiten3 14 Revision Guide Organic SynthesisCin D NgNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Boli Vertebro MedulareDokument12 SeitenBoli Vertebro MedulareHalit DianaNoch keine Bewertungen

- Marketing ProjectDokument82 SeitenMarketing ProjectSumit GuptaNoch keine Bewertungen

- Solar Powered Water Pumping System PDFDokument46 SeitenSolar Powered Water Pumping System PDFVijay Nishad100% (1)

- Wire Rope Inspection ProgramDokument2 SeitenWire Rope Inspection Programسيد جابر البعاجNoch keine Bewertungen

- Additional Activity 3 InsciDokument3 SeitenAdditional Activity 3 InsciZophia Bianca BaguioNoch keine Bewertungen

- Exam Questions: Exam Title: Chapter MEK 8Dokument4 SeitenExam Questions: Exam Title: Chapter MEK 8vishnu sharmaNoch keine Bewertungen

- Internationalresidential Code 2009 Edition Fuel Gas SectionDokument49 SeitenInternationalresidential Code 2009 Edition Fuel Gas SectionZarex BorjaNoch keine Bewertungen

- CatalogDokument12 SeitenCatalogjonz afashNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)