Beruflich Dokumente

Kultur Dokumente

Exam Paper April 2013

Hochgeladen von

Alexandra DincaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exam Paper April 2013

Hochgeladen von

Alexandra DincaCopyright:

Verfügbare Formate

INSTITUTE AND FACULTY OF ACTUARIES

EXAMINATION

27 September 2013 (pm)

Subject CT5 Contingencies Core Technical

Time allowed: Three hours INSTRUCTIONS TO THE CANDIDATE 1. 2. 3. 4. 5. Enter all the candidate and examination details as requested on the front of your answer booklet. You must not start writing your answers in the booklet until instructed to do so by the supervisor. Mark allocations are shown in brackets. Attempt all 14 questions, beginning your answer to each question on a separate sheet. Candidates should show calculations where this is appropriate. Graph paper is NOT required for this paper. AT THE END OF THE EXAMINATION Hand in BOTH your answer booklet, with any additional booklets firmly attached, and this question paper.

In addition to this paper you should have available the 2002 edition of the Formulae and Tables and your own electronic calculator from the approved list.

CT5 S2013

Institute and Faculty of Actuaries

11

Calculate: (a) (b) (c) Basis: Mortality Interest PFA92C20 4% per annum [2]

10 q63 (2) ��63 a

s55:10

12

Define temporary initial selection, giving a distinct example of the process.

[2]

13

A whole life assurance policy was issued to a life aged x exact for a sum assured of S payable at the end of year of death. A premium of P is payable annually in advance until death. The following expense assumptions were used to derive the gross premium payable on the policy: Initial commission Initial expenses a% of the annual premium B

Renewal commission c% of each annual premium excluding the first Renewal expenses Claim expenses D per annum at the start of the second and subsequent policy years e% of the sum assured

Let t Vx represent the gross premium reserve on this policy at duration t. Write down an equation linking the gross premium reserve at the beginning and the end of: (a) (b) the first policy year the t th policy year where t > 1 [3]

14

Calculate Basis: Mortality

2.25 p90.25

using the method of Uniform Distribution of Deaths.

AM92

[3]

CT5 S20132

15

A three-year unit-linked endowment assurance policy is sold to a male life aged 40 exact. The profit signature for this policy, calculated using AM92 Select mortality and making no allowance for surrenders, is: (209.80, 253.55, 109.85) It is now assumed for the cash flows for this policy that 15% of all policies in force at the end of the first policy year are surrendered at that time. The surrender value payable at that time is the bid value of units at the end of the policy year less a surrender penalty of 500. There are no other changes to the policy. (a) (b) Calculate the revised profit signature in the first policy year. Comment on the impact on the profit signature in the second and third policy years. [4]

16

A life aged 75 exact purchases a ten-year temporary annuity of an initial amount of 1,200 per annum. This annuity increases on each policy anniversary by 100 per annum, the last increase being at the beginning of the tenth policy year. All annuity payments are annual in advance. Calculate the expected present value of the annuity benefits. Basis: Mortality Interest Expenses AM92 Ultimate 6% per annum Nil [4]

17

Calculate ( IA)20 (the present value of a whole life assurance issued to a life aged 20 exact payable immediately on death where the benefit paid on death at time t is t) using the following basis: Basis: Mortality x = 0.03 for x<40 inclusive and 0.04 for x 40 Force of interest 5% per annum [6]

18

Show, using the random variable approach, that the expected present value of an annuity of 1 per annum payable annually in arrears to a life now aged x, deferred for n [7] years is equal to ax ax:n .

CT5 S20133

PLEASE TURN OVER

19

The following statistics have been provided in relation to a particular country and one of its regions: Age band 1835 3650 5170 (i) Calculate: (a) (b) (c) (d) (ii) the mortality rates for each age band both for Region A and Country the crude mortality rate for each of Region A and Country the directly standardised mortality rate for Region A by reference to the Country the standardised mortality ratio for Region A by reference to the Country [5] Region A Population Number exposed of Deaths 25,000 50,000 70,000 25 80 170 Country Population Number exposed of Deaths 500,000 125,000 110,000 1,000 375 500

Comment on the results.

[2] [Total 7]

20

The following is an extract of a decrement table assumed for a funeral plan, showing deaths (d) and withdrawals (w): Age x 85 86 87 (al)x 10,000 6,300 4,200

d (ad)x w (ad)x

1,400 1,000

2,300 1,100

It has been established that the independent rates of decrement of withdrawal are now only 50% of those assumed in the table above for the ages of 85 and 86. The underlying independent mortality rates are unchanged. Construct a revised decrement table to reflect this change.

[7]

CT5 S20134

21

A pension scheme provides a lump sum benefit on death in service of three times salary in the 12 months before death. Normal retirement age is 65 exact. (i) Calculate the expected cashflow between ages 40 and 41 in respect of the death benefit for a life now aged 35 exact with salary in the previous 12 months of 25,000. [3]

Basis: Pension scheme tables in the Formulae and Tables for Examinations (ii) (a) (b) Give a formula for the expected present value of the death benefit. Hence express this value using commutation factors.

[5] [Total 8]

22

At the beginning of 2004, a life insurance company issued a number of 20-year special endowment assurance policies to male lives then aged 40 exact. Each policy provides a death benefit of 75,000 payable at the end of year of death and a maturity benefit of 150,000. Premiums on each policy are payable annually in advance for the term of the policy, ceasing on earlier death. (i) Calculate the annual gross premium for each policy using the following premium basis: Mortality Interest Initial commission Initial expenses Renewal expenses [4]

AM92 Select 4% per annum 25% of the first annual premium 400 45 per annum at the start of the second and subsequent policy years

(ii)

Determine the gross premium reserve for each policy in force at the end of the eighth policy year and for each policy in force at the end of the ninth policy year, using the same basis as above. [6]

At the beginning of 2012, there were 625 policies in force. Actual experience for this portfolio of business during 2012 was as follows: Number of deaths 3 Interest earned 4.5% Expense incurred per policy in force at beginning of policy year 45 (iii) Derive, using the recursive relationship between the opening and closing reserves, the profit/loss from this portfolio of business in 2012 separately from: mortality interest expenses CT5 S20135

[4] [Total 14]

PLEASE TURN OVER

23

A life insurance company issues a 15-year increasing term assurance policy to a life aged 50 exact. The death benefit on the policy, payable immediately on death, is given by the formula: 10,000 [6+t] t = 0, 1, 2, ......, 14 where t denotes the curtate duration in years since the inception of the policy. Level premiums on the policy are payable monthly in advance for the term of the policy, ceasing on death if earlier. (i) Calculate the monthly premium for the policy using the following premium basis: Mortality Interest Expenses Initial Renewal Commission Initial Renewal Claim Inflation AM92 Select 6% per annum 225 65 per annum inflating at 1.92308% per annum, at the start of the second and subsequent policy years 30% of the total premium payable in the first policy year 4% of the second and subsequent monthly premiums 275 on termination, inflating at 1.92308% per annum For renewal and claim expenses, the amounts quoted are at outset, and the increases due to inflation start immediately. [8] (ii) (iii) Calculate the gross prospective reserve for the policy at the end of the 14th policy year using the elements of the premium basis that are relevant. [3] Write down an expression for the gross future loss random variable at the end of the 14th policy year, again using the elements of the premium basis that are relevant. [4] [Total 15]

CT5 S20136

24

A life insurance company issues a four-year with profits endowment assurance policy for a basic sum assured of 25,000 to a life aged 56 exact. Level premiums are payable annually in advance throughout the term of the policy. Compound reversionary bonuses are added to the policy at the start of each year, including the first. The basic sum assured (together with any bonuses attaching) is payable at maturity or at the end of year of death, if earlier. (i) Show that the annual premium is approximately 6,483 using the following premium basis: Mortality Interest Initial expenses AM92 Select 6% per annum 100 plus 25% of the first premium (all incurred on policy commencement)

Renewal expenses 2.5% of the second and subsequent premiums plus 40 at the start of the second and subsequent policy years Bonus rates A compound reversionary bonus will be declared each year at a rate of 1.92308% per annum [5] (ii) The insurance company holds net premium reserves using a rate of interest of 4% per annum and AM92 Ultimate mortality. Calculate the expected profit margin on this policy using the following profit test basis:

Mortality Interest earned on funds Initial expenses Renewal expenses Bonus rates Risk discount rate

80% AM92 Select 7.5% per annum as per premium basis as per premium basis as per premium basis 9.5% per annum [13] [Total 18]

END OF PAPER

CT5 S20137

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- ch19 3Dokument40 Seitench19 3BobNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Calc 1141 2Dokument27 SeitenCalc 1141 2BobNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

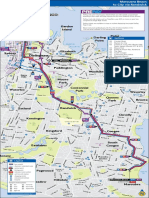

- 376 - 377 Bus MapDokument1 Seite376 - 377 Bus MapBobNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Global Financial Crisis: - An Actuarial PerspectiveDokument3 SeitenThe Global Financial Crisis: - An Actuarial PerspectiveBobNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 376 - 377 Bus Time TableDokument19 Seiten376 - 377 Bus Time TableBobNoch keine Bewertungen

- ch4 5Dokument37 Seitench4 5BobNoch keine Bewertungen

- Is Insurance A Luxury?Dokument3 SeitenIs Insurance A Luxury?BobNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- International: 2020 VisionDokument5 SeitenInternational: 2020 VisionBobNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hapter Xercise OlutionsDokument5 SeitenHapter Xercise OlutionsBobNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Takaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthDokument3 SeitenTakaful: An Islamic Alternative To Conventional Insurance Sees Phenomenal GrowthBobNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Institute of Actuaries of India: Professional Conduct Standards (Referred To As PCS)Dokument9 SeitenInstitute of Actuaries of India: Professional Conduct Standards (Referred To As PCS)BobNoch keine Bewertungen

- The Uk Actuarial Profession The Actuaries' Code: ApplicationDokument3 SeitenThe Uk Actuarial Profession The Actuaries' Code: ApplicationBobNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Pension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleDokument43 SeitenPension Benefit Design: Flexibility and The Integration of Insurance Over The Life CycleBobNoch keine Bewertungen

- Signs of Ageing: HealthcareDokument2 SeitenSigns of Ageing: HealthcareBobNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Draft Standards For The Development of Spreadsheets: 1 Spreadsheets Can Be AssetsDokument5 SeitenDraft Standards For The Development of Spreadsheets: 1 Spreadsheets Can Be AssetsBobNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Code of Conduct For Candidates: Effective December 1, 2008Dokument2 SeitenCode of Conduct For Candidates: Effective December 1, 2008BobNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Chapter 3: Professionalism Exercise Sample Solutions Exercise 3.1Dokument6 SeitenChapter 3: Professionalism Exercise Sample Solutions Exercise 3.1BobNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Code of Professional Conduct November 2009: IndexDokument10 SeitenCode of Professional Conduct November 2009: IndexBobNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Rules of Professional ConductDokument9 SeitenRules of Professional ConductBobNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Code of Professional Conduct: Section 5Dokument4 SeitenCode of Professional Conduct: Section 5BobNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Chapter 2 Exercises and Solutions: Exercise 2.1Dokument3 SeitenChapter 2 Exercises and Solutions: Exercise 2.1BobNoch keine Bewertungen

- Expert Input: On The Current Financial CrisisDokument7 SeitenExpert Input: On The Current Financial CrisisBobNoch keine Bewertungen

- Doors Of: December 2009/january 2010Dokument6 SeitenDoors Of: December 2009/january 2010BobNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)