Beruflich Dokumente

Kultur Dokumente

How To Capture Gains When Equity Markets Rise.... While Providing Protection When They Fall.

Hochgeladen von

aandpcapitalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How To Capture Gains When Equity Markets Rise.... While Providing Protection When They Fall.

Hochgeladen von

aandpcapitalCopyright:

Verfügbare Formate

Maximizing returns subject to assuring a minimum floor.

John OBrien Miguel Palacios Matthew Lockard Ajit Patankar Tapan Samaddar

Slide 2

The Challenge

How to capture gains when equity markets rise

Confidential

10/29/2013

Slide 3

The Challenge

...while getting protection when they fall ?

Confidential

10/29/2013

Slide 4

The current approach

The current approach involves allocating an investors assets between safe assets (typically bonds) and risky assets (typically equities).

Confidential

10/29/2013

Slide 5

Shortcomings of the current approach

There is no predefined limit to potential losses. Bond/Stock allocations are typically based on past

performance, from which future performance could diverge wildly.

If equities fall over a long period of time,

rebalancing to maintain a fixed bond/stock allocation will compound losses. than you can stay solvent.

Markets may crash and remain irrational longer

Confidential 10/29/2013

Slide 6

Introducing A&P

A&P Capital (Accumulate and Preserve) Strategy solves these existing problems.

A&P suits individuals saving for retirement, college, home purchases and other life events, who not only require capital appreciation but also require that loss of capital must be limited.

A&P is not a market beating strategy. Instead, A&P is an engineered, protective asset allocation strategy, focusing on maximizing long-term returns subject to maintaining a minimum floor.

10/29/2013

Confidential

Slide 7

A&P Essential Features

Uses available derivatives-based hedging to put a fixed floor under potential losses over a given period of time.

For example, a put position is purchased to protect the risky assets against declines of more than 10% over the next 18 months.

Periodically rebalances to lock in gains.

For example, if the portfolio gains 10% relative to its value when protection was purchased, the existing put position is liquidated and a new one, with a higher strike price, is purchased, thereby ratcheting up the net value of the protected assets

Doesnt need access to the actual account holding your assets.

Confidential

10/29/2013

Slide 8

How A&P works: Customers View

Step 1: Client chooses the minimum protection level and the protection duration for his/her assets: this determines the protection cost, from the 3x3 matrix below.

Protection Duration Minimum Asset Protection Level 1year 18months 2year 90% 3.1% 4.6% 6.5% 85% 2.6% 3.9% 5.7% 80% 1.7% 2.8% 3.7% Above data was correct at market close on 1/10/2014. The data changes dynamically with the Market conditions.

Protection Cost

Step 2: Client opens a new managed IRA / Roth IRA / Brokerage account with Charles Schwab and fund that account with only the following amount: Protection cost % from the table above X Amount of assets they want protected. Step 3: A&P will make the necessary transactions in the Client's account and separately monitor the account.

Confidential

10/29/2013

Slide 9

A&P Capital Strategy Simulation and Actual results.

Confidential

10/29/2013

A&P: Back-testing results, 1990-2013 (cost of protection included)

Slide 10

Confidential

10/29/2013

A&P: Back-testing results, 2000-2012 (cost of protection included)

Slide 11

Confidential

10/29/2013

Slide 12

A real-life application: 1987-1999, Merrill Lynch

Growth and Guarantee Fund ($250M AUM)

Growth and Guarantee Fund features:

Automatically rolled over every 18 months or

upon a 10% appreciation relative to NAV at prior rollover point. 10% between rollover points.

Used options to limit losses to a maximum of The guaranteed minimum NAV was further

backed by an Aetna-sponsored insurance policy (which never needed to be exercised).

10/29/2013

Confidential

Merrill Lynch Growth and Guarantee Fund was advised by current a A&P managing partner

Slide 13

A real-life application: 1987-1999, ML Growth and

Guarantee Fund ($250M AUM)

Growth & Guarantee Fund audited performance results, 1987-1997

Confidential

Merrill Lynch Growth and Guarantee Fund was advised by current a A&P managing partner

10/29/2013

Slide 14

A&P Capital Strategy About Us

Confidential

10/29/2013

Slide 15

Contact Us

Contact us to learn how A&P Strategies can bring LEIS and other innovative asset allocation strategies to your clients.

John OBrien, Managing Partner

John@AandPCapital.com 917-690-0117

Miguel Palacios, Senior Principal

Miguel@AandPCapital.com 510-717-6453

Tapan Samaddar, Senior Principal

Tapan@AandPCapital.com 408-480-3704

Confidential

10/29/2013

Slide 16

A&P Strategies Team Member Profiles

John OBrien, co-founder of A&P Strategies LLC, is the Executive Director of the Masters in Financial Engineering (MFE) program at UC Berkeley, Haas School of Business. He assisted in developing the MFE program, and became its first Executive Director in July 2000. Mr. OBrien is also an adjunct professor of finance at Haas, and created and teaches the MFE course in financial innovation. John was formerly a Managing Director of Credit Suisse Asset Management (CASM) where he created and managed the risk management function, the client service function and the e-commerce effort. Prior to CSAM, for fifteen years, Mr. OBrien was Chairman and CEO of Leland OBrien Rubinstein (LOR) Associates, and Chairman of the Capital Market Fund, and the S&P 500 SuperTrust the first exchange traded fund (ETF). LOR is credited with a series of financial market innovations and product offerings. Earlier, John co-founded Wilshire Associates (originally named O'Brien Associates), and co-developed the Wilshire 5000 common stock index (originally known as the O'Brien 5000). Mr. O'Brien was named among Fortune Magazine's "Businessmen of the Year" in 1987. John holds a S.B. in economics from MIT, and an M.S. in operations research from UCLA.

Confidential

10/29/2013

Slide 17

A&P Strategies Team Member Profiles

In addition, we have an exceptional team focused on Strategy, Research and Product Development.

Confidential

10/29/2013

Slide 18

Thank You

www.AandPCapital.com

Confidential

10/29/2013

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Student Partners Program (SPP) ChecklistDokument4 SeitenStudent Partners Program (SPP) ChecklistSoney ArjunNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Shaking Tables Around The WorldDokument15 SeitenShaking Tables Around The Worlddjani_ip100% (1)

- Jaen Public Market Efficiency Plan - FinalDokument126 SeitenJaen Public Market Efficiency Plan - FinalBebot Bolisay100% (2)

- The MYTHS WE LIVE by - Late Senator Lorenzo TanadaDokument12 SeitenThe MYTHS WE LIVE by - Late Senator Lorenzo TanadaBert M DronaNoch keine Bewertungen

- Keegan02 The Global Economic EnvironmentDokument17 SeitenKeegan02 The Global Economic Environmentaekram faisalNoch keine Bewertungen

- National Mineral Policy Guide for Sustainable GrowthDokument18 SeitenNational Mineral Policy Guide for Sustainable GrowthIas PrelimsNoch keine Bewertungen

- What is Economics? - The study of production, distribution and consumption /TITLEDokument37 SeitenWhat is Economics? - The study of production, distribution and consumption /TITLEparthNoch keine Bewertungen

- 26 Structured RepoDokument4 Seiten26 Structured RepoJasvinder JosenNoch keine Bewertungen

- Local Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoDokument2 SeitenLocal Educator Begins New Career With Launch of Spaulding Decon Franchise in FriscoPR.comNoch keine Bewertungen

- DR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Dokument21 SeitenDR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Detlef LoyNoch keine Bewertungen

- Biblioteca Ingenieria Petrolera 2015Dokument54 SeitenBiblioteca Ingenieria Petrolera 2015margaritaNoch keine Bewertungen

- John Ashton Arizona Speech 2013Dokument6 SeitenJohn Ashton Arizona Speech 2013climatehomescribdNoch keine Bewertungen

- 790 Pi SpeedxDokument1 Seite790 Pi SpeedxtaniyaNoch keine Bewertungen

- HDFC Fact SheetDokument1 SeiteHDFC Fact SheetAdityaNoch keine Bewertungen

- What Is Social EntrepreneurshipDokument3 SeitenWhat Is Social EntrepreneurshipshanumanuranuNoch keine Bewertungen

- Companies From Deal CurryDokument5 SeitenCompanies From Deal CurryHemantNoch keine Bewertungen

- By: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosDokument9 SeitenBy: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosRhea Antonette DiazNoch keine Bewertungen

- SIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaDokument17 SeitenSIP Project Presentation Brand Promotion of Moolchand Medcity Through Value Added Service (VAS) Program and Medical Camp Nitin SharmaNitin SharmaNoch keine Bewertungen

- Geoweb Channel OverviewDokument8 SeitenGeoweb Channel OverviewJonathan CanturinNoch keine Bewertungen

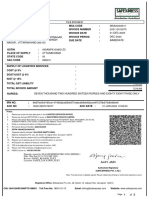

- Tax invoice for ceiling fanDokument1 SeiteTax invoice for ceiling fansanjuNoch keine Bewertungen

- IntroductionDokument3 SeitenIntroductionHîmäñshû ThãkráñNoch keine Bewertungen

- Company Scrip Code: 533033Dokument17 SeitenCompany Scrip Code: 533033Lazy SoldierNoch keine Bewertungen

- HNIDokument5 SeitenHNIAmrita MishraNoch keine Bewertungen

- Accounting equation problems and solutionsDokument2 SeitenAccounting equation problems and solutionsSenthil ArasuNoch keine Bewertungen

- Nluj Deal Mediation Competition 3.0: March 4 - 6, 2022Dokument4 SeitenNluj Deal Mediation Competition 3.0: March 4 - 6, 2022Sidhant KampaniNoch keine Bewertungen

- Credit 243112012575 12 2023Dokument2 SeitenCredit 243112012575 12 2023bhawesh joshiNoch keine Bewertungen

- Global Trends AssignmentDokument9 SeitenGlobal Trends Assignmentjan yeabuki100% (2)

- Liquidity Preference TheoryDokument5 SeitenLiquidity Preference TheoryAaquib AhmadNoch keine Bewertungen

- Example Accounting Ledgers ACC406Dokument5 SeitenExample Accounting Ledgers ACC406AinaAteerahNoch keine Bewertungen

- Chevron Attestation PDFDokument2 SeitenChevron Attestation PDFedgarmerchanNoch keine Bewertungen